bear market

Trump’s tariffs send Bitcoin and crypto market tumbling

Published

3 months agoon

By

admin

After President Donald Trump targeted China, Mexico, and Canada with long-threatened import taxes, the crypto market fell on Feb. 1 in a risk-off action. Bitcoin’s price fell by 5%, which has rippled its way into altcoins.

Effective Feb. 1, the U.S. will impose tariffs of 25% on imports from Canada and Mexico and 10% on Chinese goods, adding further complexity to the current trade wars.

As a result, over the past 24 hours ending on Feb. 3, Bitcoin (BTC) has experienced a notable decline amid a market-wide sell-off. The cryptocurrency fell by over 5%, reaching a low of approximately $91,200 before rebounding to around $94,000 as of this writing.

Despite this recovery, BTC remains roughly 13% below its all-time high of $109,000, and trading volume has surged by more than 200%, suggesting considerable selling pressure or market panic.

Additionally, the overall global crypto market cap has dropped nearly 12% during the same period, settling at about $3.15 trillion.

It’s worth noting that following President Donald Trump’s inauguration on Jan. 20, Bitcoin and other altcoins saw a significant price increase. However, since that peak, recent developments—including new tariff policies—have contributed to a drastic decline in market sentiment and asset values.

Given Bitcoin’s recent price crash, it has had a cascading effect on altcoins. In the last 24 hours, Ethereum (ETH) has fallen by nearly 20%, Ripple (XRP) by 22%, Solana (SOL) by 8%, and Binance Coin (BNB) by over 15%.

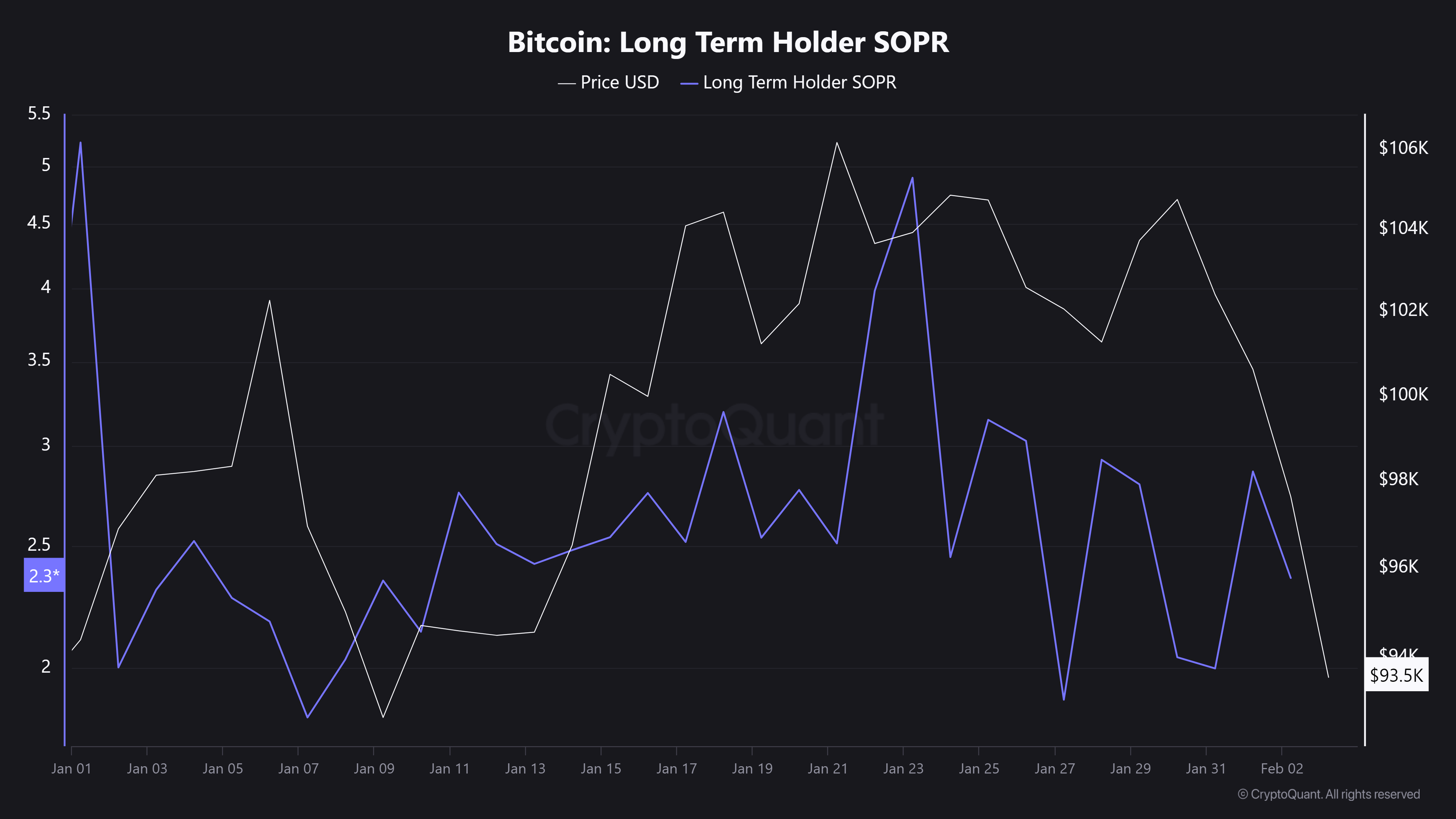

Rising trading volume alongside price dips often signals strong selling pressure or market panic, as more traders offload their assets. This pattern suggests that long-term investors are now selling their coins at lower profits than their purchase price—or even at a loss year-to-date—as illustrated by the Bitcoin: Long Term Holder SOPR chart.

Such behavior often indicates capitulation among long-term holders, a phenomenon common during bearish market trends and corrections. Experts, including BitMEX CEO Arthur Hayes, have even warned that a “financial crisis” may be on the horizon.

60% of American plebes don’t have $1k of emergency funds. The Fed is “worried” about inflation. So Trump decides to hike energy prices via tariffs? He ain’t a fool, maybe he is trying to trigger a mini financial crisis? It’s def in the maybe column. pic.twitter.com/VEiI9qZZqC

— Arthur Hayes (@CryptoHayes) February 2, 2025

Source link

You may like

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Although some believe that crypto PR and communications efforts should slow down when the markets are cooling off, it couldn’t be further from the truth. Sure, during crypto winters, product development teams huddle together to work on building their solutions—and that’s great—but these are also the ideal times for brand building.

Indeed, when the market is going through a crypto slowdown, the strategic brands are seizing the opportunity to strengthen credibility while everyone else is hibernating. And when the market inevitably heats up, this strategy will position such players ahead of the competition.

Now, not all might agree with this point of view, arguing that pushing PR during a downturn is tone-deaf. Others might see slow market communications as unnecessary noise when product development should be the only priority. But visibility isn’t vanity—it’s strategy, and it’s easier to get noticed in calmer markets.

Slower news, hungrier journalists

As the movements in the crypto market slow down, so does everything else that relates to it, including newsrooms. In other words, journalists have more space (and patience) for stories that go beyond mere price action. There are no big stories of exploding digital assets. Bitcoin (BTC) is nowhere near reaching a new all-time high, and altcoins are taking the cue from the industry’s number one, sleeping it off themselves.

Thus, when the hype and the noise in the crypto sphere die down, media outlets are on the lookout for stories worth telling. In such moments, true innovation and strong projects get their chance to shine and get real editorial interest, instead of getting lost among drama-driven headlines.

Small news can be perceived as newsworthy in a bear market

Here’s a secret—during a bull run, not even a $10 million funding round might turn heads. It’s just too common when there’s money flowing everywhere across the board. To illustrate, an insider source at a crypto media powerhouse once said that their “funding news coverage threshold is a minimum of $10 million, with exceptions.”

This might sound counterintuitive at first, but in a more bearish market sentiment, that same outlet might just be interested in a mere $5 million, or even a $1.4 million seed round, like the one recently raised by crypto payment hub Lyzi to expand its Tezos-based service.

In other words, Lyzi has just told the world that it’s there and constantly working on building its product. Arguably, in a period of market pessimism, it would be one hell of a smart and well-timed PR move, and the best part—the likes of CoinDesk might pick it up.

Pick up the mic when no one else is talking

Providing expert commentary when the industry goes silent becomes even more valuable. Journalists still seek third-party sources and insights, and this is your chance to establish yourself as an authoritative figure in the sector, to whom journalists will come back when the bull market returns.

This means that when it’s all quiet on the crypto front and a journalist comes knocking at your door, be ready. Hiring a good PR firm that will lead you, shape your story, and provide the stage is certainly the right move, but it’s up to you to step up with confidence and claim the spotlight.

Execution still matters

With this in mind, don’t mindlessly drop news just for the sake of it. Be strategic about timing, like holidays, conferences, and other major events that might overshadow your news, as well as the tone—this isn’t the time to brag but display resilience and value.

Also, use the time of market bearishness to build your reputation and flesh out your digital footprint through earned media placements in trusted crypto outlets. Potential users, partners, and investors will look you up online, so make sure they have good things to read about you—that’s your PR working in the background.

The real bottom line

All things considered, crypto PR in times of market stagnation and bearish sentiment is not so much about creating hype as it is about demonstrating real substance. It’s about crafting a narrative that portrays you as the crypto player who can weather the blizzard, better positioning your brand.

So, the next time you’re considering staying silent during a crypto downturn, think again. You might miss out on the best PR opportunities of the cycle, as at this time, you could get more attention than usual.

Don’t wait for the bull to charge—make your mark when the field is clear.

Afik Rechler

Afik Rechler is the co-founder and co-CEO of Chainstory, a results-driven crypto PR agency. He specializes in crypto communications and search-driven content marketing. Afik has been in the crypto industry since late 2016, helping blockchain businesses meet their marketing and communications goals.

Source link

bear market

Hints of Long-Term Crypto Bear Market Showing Up, According to Coinbase Analyst

Published

1 week agoon

April 17, 2025By

admin

A top Coinbase researcher says signs of a long-term crypto bear market are starting to emerge.

David Duong, the global head of research at Coinbase, says in a new analysis that the 200-day moving average (MA) indicates bearishness for Bitcoin (BTC) and the Coinbase 50 Index (COIN50), which tracks the performance of the 50 largest digital assets by market cap.

“As Bitcoin’s role as a ‘store of value’ continues to grow, we think a holistic evaluation of crypto’s aggregate market activity will be needed to better define bull and bear markets for the asset class, particularly as we’re likely to see increasingly diverse behavior in its expanding sectors.

Nevertheless, both BTC and the COIN50 index have recently broken below their respective 200-day MAs, which signals potential bearish long-term trends in the overall market. This is consistent with the fall in the total crypto market cap and decline in venture capital funding for this space, hallmarks of a potential crypto winter rising.”

The analyst says if a crypto bear market does set in, a bullish reversal could start taking shape sometime between July and September.

“Thus, we think this warrants taking a defensive stance on risk for the time being, though we still believe that crypto prices may be able to find their floor in mid-to-late 2Q25 – setting up a better 3Q25.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

Why Isn’t XRP Skyrocketing? Expert Explains The Hidden Forces

Published

3 weeks agoon

April 9, 2025By

adminXRP prices dipped below $2 for the first time since December 2024 on Monday, even after a number of positive developments for the cryptocurrency.

The decline is surprising to many investors who had hoped recent good news would send its value higher. Market analyst Vincent Van Code attributes this underperformance to underlying economic issues and not with XRP itself.

Trump Tariffs Are Blamed For Crypto Market Decline

Van Code attributes the recent decline in cryptocurrencies to the tariffs imposed by US President Donald Trump on other nations.

The tariff situation is just a power play to utilize economic pressure to get better negotiating terms, said Van Code. He expects these trade tensions to be short-term and perhaps pave the way for the market to rebound in the near future.

Current #XRP prices are not aligned with recent @Ripple market announcenets, SEC case conclusion news, XRP US stockpile.

Do you think this is becuase XRP is not performing well?

I DONT! This is a global market downturn. Impacts across multiple markets, multiple countries, and…

— Vincent Van Code (@vincent_vancode) April 9, 2025

XRP Fundamentals Strong

Even after falling to $1.64 on April 7, XRP has shown a rebound by increasing to $1.82—a 10% increase. Van Code pointed out that Ripple and XRP’s fundamental strengths have not changed. They’re a hundred times better than a year ago when the SEC lawsuit was at its peak, he said.

The SEC-Ripple case resolution, potential inclusion in US digital asset reserves, and Ripple’s Hidden Road acquisition were all considered positive developments for the cryptocurrency.

Investment Strategy During Market Uncertainty

Van Code described his approach to today’s market condition, showing he buys such assets like XRP when sentiment is low but fundamentals remain in place.

He looks at weekly charts for larger decisions and uses hourly charts for intraday action. The market commentator termed XRP the “Fight Club” of cryptos because of its ability to withstand market action and stress.

Future Growth Drivers For XRP

Going forward, Van Code identified three key drivers to XRP adoption: regulation, corporate usage, and solid partnerships. He warned investors to avoid being influenced by short-term price fluctuations due to outside influences such as the tariff scenario.

The analyst said that he would only be jittery if XRP was the sole cryptocurrency that is dropping in value. He also stated that the current decline is part of a larger market trend and not particular to XRP.

The cryptocurrency market still responds to economic policy as investors look for indications that the tariff issue is resolved. Most XRP supporters are optimistic that as soon as these external pressures are gone, the price will more accurately reflect the good news surrounding Ripple and its currency.

Featured image from Unsplash, chart from TradingView

Source link

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Solaxy, BTC bull token, and Pepeto gaining momentum as leading 2025 presale tokens

Australian Radio Station Used AI DJ For Months Before Being Discovered

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals