DeFi

Uniswap price rises as crypto experts see it hitting $50

Published

6 months agoon

By

admin

Uniswap’s price has rallied, crossing a crucial resistance level, with many crypto experts predicting further gains ahead.

Uniswap (UNI) token surged to $19.44, its highest level since December 2021, as crypto momentum continued to strengthen.

This rally coincides with robust inflows across decentralized exchange (DEX) networks. Data indicates that DEX platforms handled over $372 billion worth of tokens in November, marking the largest monthly increase on record.

Uniswap alone processed $30.86 billion in volume over the last seven days, solidifying its position as the industry leader. Its volume significantly exceeded that of competitors like Raydium and PancakeSwap combined. Over its lifetime, Uniswap has facilitated over 465 million trades worth more than $2.36 trillion.

Uniswap’s price is also gaining momentum as traders anticipate the launch of UniChain, the platform’s independent Layer-2 chain. UniChain aims to enable seamless cross-chain trading on a single platform. Currently in the testnet phase, UniChain is set to launch early next year.

At the same time, there are rising odds that the Trump administration will abandon the case brought against Uniswap by the Securities and Exchange Commission. The SEC alleged that the company provided securities on its platform without registration.

Uniswap price analysis

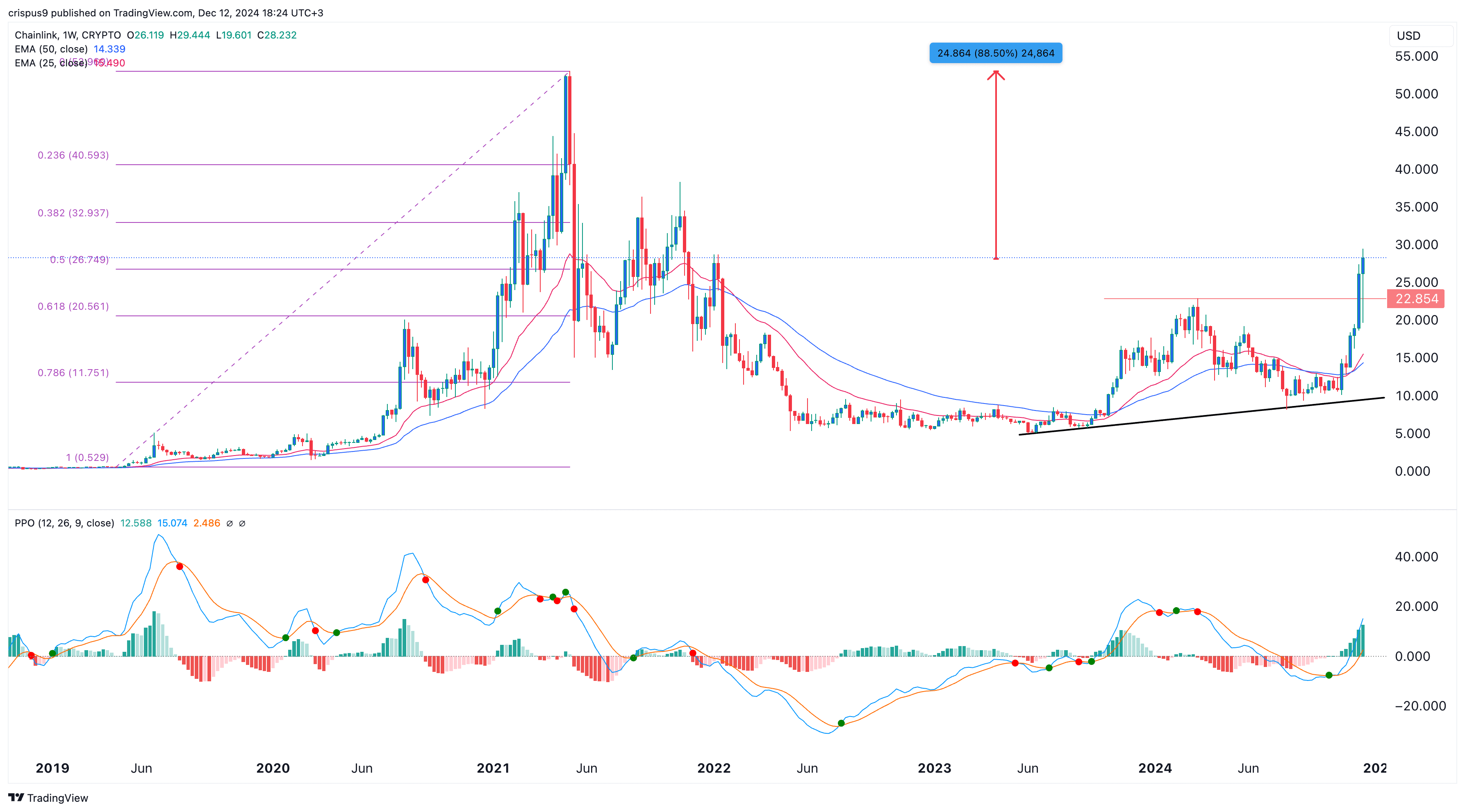

The weekly chart reveals that UNI has formed a slanted triple-bottom pattern, a bullish reversal indicator. The price has broken above the pattern’s neckline at $17.13, suggesting that bulls are firmly in control.

UNI is also approaching the 38.2% Fibonacci Retracement level at $19.23. Furthermore, it has moved above the 50-week moving average, while the MACD indicator and Relative Strength Index are both trending upwards.

The path of least resistance for UNI appears bullish, with a long-term target of $50, representing approximately a 180% increase from the current level. This aligns with predictions from analysts like Crypto Tigers predict.

For this to happen, Uniswap price will need to rise above the 50% retracement point at $24 and its all-time high of $45.

Source link

You may like

Dems Say They’re Blocked From Info on Verge of Crypto Market Structure Bill Hearings

Dow gains 214 points, markets end higher as strong labor data eases tariff concerns

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

cryptocurrency

Here’s why Sophon crypto rallied over 40% today

Published

14 hours agoon

June 3, 2025By

admin

SOPH, the native token of the entertainment-focused Layer 2 network Sophon, saw a strong rally today after getting listed on South Korea’s major crypto exchange, Bithumb.

According to data from CoinGecko, Sophon (SOPH), the native token of the entertainment-focused Layer 2 network Sophon rallied as high as 445 ot an intraday high of $0.072 on June 3 Asian time while its market cap shot up to $138.5 million.

SOPH rallied in a high-volume trading environment, with data showing its daily trading volume surged by 236% over the past 24 hours. As of now, the altcoin has a circulating supply of 2 billion tokens out of a total supply of 10 billion SOPH tokens.

The key driver behind today’s gains appears to be its listing on Bithumb, which went live on June 2. As one of the largest and most influential exchanges in South Korea, a Bithumb listing often sparks major hype, bringing in a flood of new investors looking to ride the momentum.

However, that’s not the only catalyst. Recent updates from the team revealed that Sophon is partnering with NFT launchpad Mintify to launch exclusive NFT collections, further expanding its Web3 entertainment ecosystem.

On top of that, the team has announced a $4 million developer grant to build new applications and use cases on the Sophon network, which could drive long-term utility for SOPH.

Together, these updates have amplified market optimism.

Sophon completed its token generation event on May 28, airdropping 900 million fully unlocked SOPH tokens, 600 million to L1 farmers, and 300 million to early users. Despite today’s strong performance, some profit-taking could occur in the short term as early airdrop receivers may look to lock in gains.

As reported earlier by crypto.news, Huma Finance’s native token, HUMA, dropped by more than 45% shortly after its own launch across multiple major exchanges.

That said, SOPH may be better positioned to avoid a similar outcome. It already boasts listings on major platforms including Binance, Upbit, OKX, Gate.io, KuCoin, and Bitget, offering wide exposure and deep liquidity. This broad access could help stabilize prices even if the initial hype tapers off.

Source link

Cardano

Cardano support crumbles as whales hit the sell button

Published

2 days agoon

June 1, 2025By

admin

Cardano price has slipped in the past few weeks, and the sell-off may continue after it dropped below key support levels and as whales started to capitulate.

Cardano (ADA) price dropped for five consecutive days, reaching a low of $0.65, its lowest level since May 8. It has dropped by over 21% from its highest point in May and by 50% from its November 2024 high.

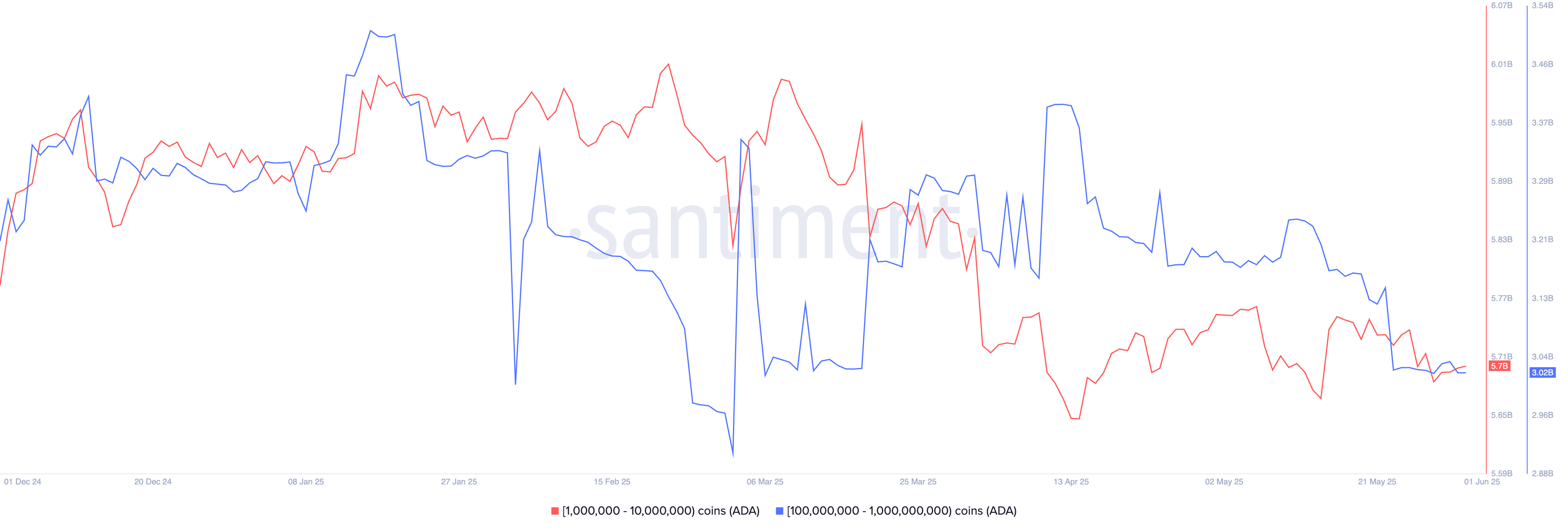

On-chain data shows that Cardano’s investors have started to capitulate. According to Santiment, the number of ADA holders has dropped to 4.49 million, down from 4.55 million at the highest point in May.

More data shows that whales have continued to sell their coins, sign that they expect its price to continue falling. Whales holding between 100 million and 1 billion coins hold 3.02 billion coins today, down from a high of 3.4 billion in April.

Similarly, those holding between 1 million and 10 million have reduced their holdings to 5.7 billion from the year-to-date high of 6 billion. These sales happened as the number of ADA tokens in profit dropped to 22.69 billion from 27 billion in April.

Cardano, once touted as a viable alternative to Ethereum, has continued to underperform across all areas. Its total value locked in decentralized finance has dropped to $391 million, while its cumulative DEX transactions stand at $4 billion.

In contrast, Unichain has a TVL of over $702 million, and its DEX volume has jumped to over $14 billion, a few months after its launch.

Cardano is now pegging its growth to its integration with Bitcoin (BTC), a move it expects will boost its TVL by billions. The argument is that incorporating Bitcoin will enable BTC holders to stake their holdings and earn rewards. However, this technology already exists, and Bitcoin staking platforms like SolvProtocol and Lombard Finance hold billions in assets.

Cardano price technical analysis

The daily chart shows that the ADA price has crashed in the past few days. This sell-off continued after it formed a double-top pattern at $0.839. It has now moved below this pattern’s neckline at $0.710, confirming its bearish bias.

Cardano has also plunged below the 50-day and 200-day moving averages, and is at risk of forming a death cross.

Therefore, the coin will likely continue falling as sellers target the psychological point at $0.50, down by 25% below the current level.

Cardano audit

Cardano also finds itself on the receiving end of damning allegations made by non-fungible token artist Masato Alexander.

Founder Charles Hoskinson, Alexander alleges, misappropriated $619 million in ADA tokens. Hoskinson denied the allegations.

An audit is currently in the works to debunk the claims, he said. If the audit clears the project of these accusations, investors’ confidence could be restored, triggering a strong rebound in Cardano. However, if the findings raise further concerns, ADA may continue in its recent downtrend.

The allegations center on a 318 million ADA transfer during the 2021 Allegra hard fork.

Hoskinson, one of the co-founders of Ethereum, launched the project in 2015. The Cardano blockchain officially went live on Sept. 29, 2017.

Hoskinson founded the Cardano protocol through IOHK, or Input Output Hong Kong, a blockchain research and engineering company he co-founded with Jeremy Wood. The project was named after Gerolamo Cardano, a 16th-century Italian mathematician, and its native cryptocurrency, ADA, was named after Ada Lovelace, a 19th-century mathematician often credited as the first computer programmer.

Source link

Aave

AAVE price slides 15% but buyers scoop the dip amid tokenized yield market boom

Published

5 days agoon

May 30, 2025By

admin

AAVE price slid more than 15% in four days but buyers quickly scooped the dip, setting up a potential 20% leg up as Pendle’s booming tokenized yield markets drive renewed interest in the Aave protocol.

Aave (AAVE) price dipped over 15% in just four days, from $283 peak on May 27 to $240 intraday low today. However, buyers rushed to scoop the dip, driving AAVE price above $254 intraday peak though it has since retraced slightly to $251.

The rebound comes amid a period of heightened activity on the Aave protocol, particularly related to the growth of tokenized yield markets in collaboration with Pendle (PENDL) and Ethena (ENA).

On May 27, support for three new collateral types—eUSDe, July-maturity PT-USDe, and August-maturity PT-eUSDe—was added to Aave, bringing an aggregate initial market size of approximately $700 million. The following day, on May 28, Pendle launched two of these markets with supply caps of $100 million for PT-eUSDe and $40 million for PT-USDe. Both caps were fully filled within hours, prompting Pendle to raise the limits on May 29 to $200 million and $80 million, respectively. These higher caps were again filled rapidly, reflecting strong demand for tokenized yield instruments on Aave.

Caps raised for PT-eUSDe (Aug 2025) and PT-USDe (July 2025) – and once again, they filled within hours.

Pendle PTs up to $1.32B in total supply now on @Aave

pic.twitter.com/gw6OJWCrCW

— Pendle (@pendle_fi) May 29, 2025

PT-USDe and PT-eUSDe are principal tokens that represent a fixed-yield claim on underlying assets locked within the Pendle protocol. These tokens enable users to trade and monetize future yield by separating the principal and yield components of their assets. To be clear, Ethena’s PTs were added to Aave a month ago, but the support for new collateral types eUSDe, July PT-USDe, and Aug PT-eUSDe were added to Aave on May 27.

While these PT tokens don’t directly affect the price of AAVE, they show growing use and demand for Aave’s DeFi platform, which could help the token’s value in the long run. As more users supply assets to trade these principal tokens, Aave’s TVL increases. As of May 20, Aave accounted for 20% of all TVL in the DeFi sector, according to data shared by the protocol. Growth in TVL can eventually benefit AAVE holders for its role in governance and generally as greater adoption tends to boost network value and investor confidence.

Meanwhile, AAVE price is potentially eyeing a 12%+ move from the current level of $251 as it targets resistance at $283, with the recent dip likely serving as a healthy bull retracement and a higher low within the broader uptrend.

Once $283 immediate resistance is cleared, the next major level to watch is the psychological $300 mark, which also acted as strong support during December rallies, which would represent a nearly 20% increase from the current price.

Source link

Dems Say They’re Blocked From Info on Verge of Crypto Market Structure Bill Hearings

Dow gains 214 points, markets end higher as strong labor data eases tariff concerns

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

MARA Hits Record-High Bitcoin Production in May

Retail investors no longer FOMO into BTC, altcoins

AVAX Rises 3.8% on Strong Volume, Breaking Key Resistance Levels

K33 begins Bitcoin buying with 10 BTC purchase for treasury strategy

Why $107,500 And $103,500 Are The Levels To Watch

Pakistan Proposes New Crypto Regulations

Japanese Bitcoin Hoarder Metplanet Adds $115,600,000 Worth of BTC As Stock Surpasses 263% Gains on the Year

Bitcoin traders anticipate decline, watch $100K

Ethereum Foundation Restructures R&D Division, Plans ‘Rethink’ on Design and Development

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Pi Network coin to $10? 4 catalysts that may make it possible

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Blockchain groups challenge new broker reporting rule

Xmas Altcoin Rally Insights by BNM Agent I

Trending

24/7 Cryptocurrency News7 months ago

24/7 Cryptocurrency News7 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Markets3 months ago

Markets3 months agoPi Network coin to $10? 4 catalysts that may make it possible

Ripple Price3 months ago

Ripple Price3 months ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin7 months ago

Bitcoin7 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion7 months ago

Opinion7 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin4 months ago

Bitcoin4 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines