coinbase

US Judge Deems SEC’s Order To Deny Coinbase Rulemaking Petition ‘Arbitrary and Capricious’

Published

2 months agoon

By

admin

A judge just ordered the U.S. Securities and Exchange Commission (SEC) to craft a more thorough response to a petition from Coinbase.

In July 2022, the top US crypto exchange filed a petition with the SEC to create a new regulatory framework for digital assets, but the regulator rejected the proposal with a single-paragraph notice in December 2023, saying that it disagreed with the idea that securities laws do not apply to the crypto industry.

The SEC also argued that it had other regulatory priorities and discretion over the “timing and priorities of its regulatory agenda.”

Coinbase, unsatisfied with the response, petitioned a court to review the SEC’s decision. The exchange also asked the court to order the SEC to institute a rulemaking proceeding on digital assets.

In a new ruling filed this week, Circuit Judge Thomas L. Ambro declined to order the SEC to make new rules for digital assets. He did, however, tell the SEC to expand on its response to Coinbase’s petition.

“The SEC’s order was arbitrary and capricious because it was conclusory and insufficiently reasoned. We thus grant Coinbase’s petition in part. The remedy is not at this stage to order the SEC to institute rulemaking proceedings but to remand to the agency for a sufficiently reasoned disposition of Coinbase’s petition.”

Paul Grewal, Coinbase’s chief legal officer, praised the ruling and likened it to a football referee being required to explain a penalty flag.

“You can’t just throw the yellow flag and penalize. You have to lay out the why and what happens next: offsides, number 85, 10-yard penalty, repeat first down.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Elizabeth Warren Calls Stablecoin Bill a Trump and Musk ‘Grift’

Crypto scammers nabbed in India for $700k fraud posing as a Japanese exchange

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

Bitcoin

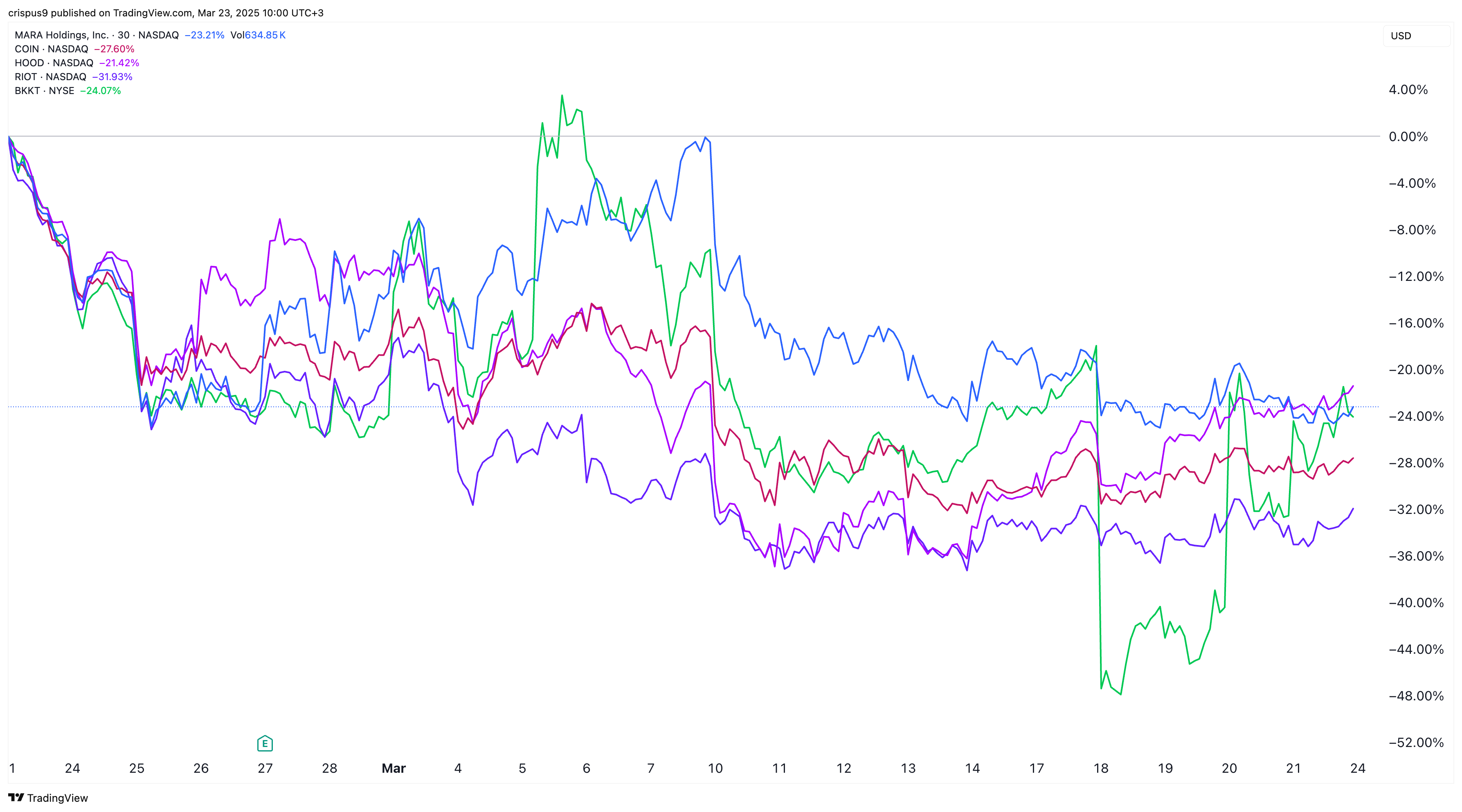

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Published

4 days agoon

March 23, 2025By

admin

Crypto stocks are caught in a brutal free fall, mirroring the market-wide slump in Bitcoin and altcoins.

Coinbase, the biggest crypto exchange in the U.S., has crashed from nearly $350 per share in November to $190. This decline has brought its market cap from $86 billion to $48 billion—a $38 billion wipe out.

Michael Saylor’s Strategy, has also shed billions of dollars in value. Its market cap dipped from a high of $106 billion last year to $79 billion today. The company, formerly known as MicroStrategy, has continued to accumulate Bitcoin and now holds 499,226 Bitcoins in its balance sheet.

Robinhood stock crashed from $66.85 earlier this year to $45, erasing $18 billion in value. While Robinhood is known for providing retail trading, it has become a major player in the crypto market. It hopes to play a bigger role in the sector when it completes its BitStamp acquisition later this year.

Bitcoin (BTC) mining stocks have also plunged as the struggling BTC price hurts margins. Mara Holdings, formerly known as Marathon Digital, has lost over $4.6 billion in valuation. Other similar companies like Riot Blockchain, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf have also shed billions in valuation.

Bitcoin, altcoin prices plummet

These crypto stocks have dropped because of the ongoing decline of Bitcoin and other altcoins. According to CoinMarketCap, the market cap of all cryptocurrencies has dropped from over $3.7 trillion in 2024 to $2.7 trillion today.

Bitcoin has dropped from $109,300 in January to $85,000 at last check. Most altcoins have done worse. For example, Solana meme coins have shed over $18 billion in value as their combined market cap sank.

Crypto prices and crypto stocks have dropped despite the Trump administration’s pledge to be highly supportive of the sector via initiatives like a Strategic Bitcoin Reserve.

The Securities and Exchange Commission has also enacted some friendly policies and ended most of the lawsuits in the industry. It has ended lawsuits brought on companies like Coinbase, Ripple Labs, and Kraken.

Whether these crypto stocks bounce back remains to be seen. Crypto analysts have a mixed outlook on the industry. Some observers expect Bitcoin’s price to recover, with Standard Chartered predicting it will hit $500,000 over time.

Ki Young Ju, CryptoQuant’s founder, estimates that the crypto bull run has ended, noting that all indicators were bearish.

Source link

coinbase

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Published

5 days agoon

March 22, 2025By

admin

My parents once dismissed Bitcoin as “made-up internet money”, yet they are increasingly asking me how to gain exposure to the digital currency. The launch this week of a 2x long Coinbase ETF is the latest example of how Wall Street recognizes demand from traditional equity investors.

Owning crypto outright is out of the question for my parents and is likely the case for many others. But, investors are hungry for exposure from Wall Street. In 2022 I recommended buying the first ever Bitcoin ETF (Purpose Bitcoin ETF) and in mid-2024 I suggested buying shares of Robinhood.

Both turned out to be very profitable trades, although the Bitcoin ETF certainly had its ups and downs (more downs than ups for a while).

With the rise of spot Bitcoin and other altcoin ETFs, digital assets are making a bigger push into the financial mainstream. Indeed, the tides are shifting. Even cautious investors, like my parents whose risk tolerance is lower as they are both retired, are warming up to the idea of owning more exposure to crypto.

That’s why I was intrigued by the launch of the Leverage Shares 2X Long Coinbase ETF (Ticker: COIG), which began trading on Nasdaq this week. Issued by Themes ETFs, COIG offers double the daily performance of Coinbase stock (COIN), one of the most prominent names in the U.S. crypto infrastructure.

It’s not a direct bet on the performance of any one crypto or the industry as a whole. Rather it is a way to express conviction in Coinbase as the go-to exchange for both retail and institutional crypto investors. The logic is sound: Coinbase generates higher revenue when more people are investing and trading in cryptos.

Leveraged ETFs like COIG aren’t your typical long-term investments. They’re designed for traders who want to amplify short-term market moves, whether it’s to seize a rally, hedge an existing position, or simply bet on momentum.

As is the case with all leveraged ETF, these aren’t “set it and forget it” tools. Investors who don’t understand how daily resets and compounding can impact returns will be frustrated to lose money even if the underlying asset inches higher.

To get a better understanding of how COIG works, why Themes ETFs launched it now, and what’s coming next, I spoke with Paul Marino, Chief Revenue Officer at Themes ETFs.

Below is a transcript of our interview:

The COIG ETF launch coincides with the recent downturn in both crypto and equity markets. What makes you confident that now is the right time to launch a 2X long Coinbase ETF (stock is down 25% ytd). Are you seeing any specific market trends or shifts in investor demand that reinforces now is the right time to launch?

Our long term view on Bitcoin and cryptocurrency is bullish and we believe that Coinbase will benefit as one of the world’s largest and most secure crypto platform. COIN trades with significant interest and volume and the decision to launch COIG was not an attempt to time the upside in the market, but rather to provide a way for retail and professional traders, a way gain leverage in the form of a daily liquid ETF wrapper.

How should a leveraged product like COIG fit into an investor’s broader portfolio? What should traders expect during periods of rapid price movements (either up or down) in Coinbase stock and how should it be balanced with core long-term holdings?

If an investor is active and looking to add leverage to Coinbase exposure, COIG is an easy way to do that without margin requirements or using options. The goal is to provide 200% the daily performance of COIN. Because of the daily reset of leveraged ETFs we do not recommend holding them for long periods of time,but instead use it tactically in anticipation of big moves or to hedge short positions.

While Coinbase stock would benefit from increased crypto adoption, the movement doesn’t always correlate with Bitcoin price. How should investors think about the correlation between COIG and broader crypto market trends?

As crypto adoption increases in the US and around the world, COIN should stand to benefit as one of the worlds premier platforms. We don’t think about it as a 1-to-1 correlation with Bitcoin, but we do believe as the Bitcoin tide rises, it will lift all crypto boats. And again, we believe the long term trend for crypto and Coinbase are positive.

Leveraged ETFs sound all fun and games but many investors don’t understand the math behind it. Due to daily compounding, a 2X fund would lose value if the underlying stock stays roughly flat. What key risks should investors understand before trading COIG (or any 2X fund)

There is risk in every investment and we recommend all investors understand the instruments and underlying securities they invest in before they begin trading. Simply put you are getting more upside opportunity based on the leverage factor, but equally risking more to the downside if the underlying stock goes down. We don’t recommend a “set and forget” type of approach with these instruments. And because of the daily reset, a trader could potentially lose capital in a choppy or flat market.

The prospectus notes that these funds are intended for “knowledgeable investors.” Can you explain what qualifies someone as being “knowledgeable”?

We believe its important for all investors and traders to understand what they invest in and what the risks are.

We are seeing increasing institutional adoption of crypto with many investors (i.e even my parents) planning or have already boosted their crypto allocations. Many prefer using more familiar vehicles like equities and ETFs over holding crypto directly. How is this trend influencing the crypto ETF landscape and do you consider your COIG product to be a ‘competitor’ to crypto investments?

COIG is a levered ETF, and the underlying security happens to be tied to crypto. It is not a “crypto” investment in the same way that a spot bitcoin ETF is or the same hold the actual coins It is simply a way to gain 2x exposure to Coinbase, up or down, in a daily liquid ETF wrapper. And COIN base is a proxy for crypto and BTC.

How is Themes ETFs positioning itself and differentiating its products in the leveraged ETF space. I see the expense ratio stands at 0.75% which is one of the lowest-cost ETFs of its kind. What other advantages does Themes offer, be it structure or strategy that would convince investors to choose COIG over other alternatives?

The experience of the management team and the low fee is a major differentiator and we are starting to see daily volumes and flows increase and more traders realize there is a reliable alternative at a better cost.

What can you tell us about Themes ETFs future crypto roadmap and product pipeline? Are there other themes/sectors within the crypto universe you are looking to introduce?

The ETF market is very fluid and we are always looking to provide innovative and first to market products that traders and investors want. We do have plans for more crypto related products that we will be announcing in the near future.

Source link

coinbase

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Published

5 days agoon

March 22, 2025By

admin

Animal spirits in the crypto industry continue to be evident amid the eased regulatory stance of the Trump administration, with leading U.S. spot exchange Coinbase (COIN) in advanced acquisition talks with leading global derivatives exchange Deribit, reports Bloomberg.

According to the story, the companies have notified Dubai regulators (where Deribit is licensed) about the discussions.

Bloomberg earlier this year — alongside rumors that Kraken was discussing an acquisition of Deribit — reported Deribit could be valued in the area of $4 billion to $5 billion.

Mostly known for its spot trading business, Coinbase (COIN) would be making a big push into the highly profitable crypto derivatives market with a purchase of Deribit, which saw trading volume in 2024 of nearly $1.2 trillion — almost double that of the year prior.

Earlier this week, another U.S. crypto exchange — Kraken — boosted its derivatives business with a $1.5 billion deal to purchase Ninja Trader.

Source link

Elizabeth Warren Calls Stablecoin Bill a Trump and Musk ‘Grift’

Crypto scammers nabbed in India for $700k fraud posing as a Japanese exchange

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

‘Chart Is Still Broken’ – Crypto Analyst Predicts Sustained Downtrend for Altcoins Until This Takes Place

GameStop Announces $1.3 Billion Fundraising Plan To Purchase Bitcoin

Wyoming Governor Backs Away From State’s Failed Bitcoin Reserve Push

Priced at $0.20, this Solana competitor could be the next crypto to 20x

Why Are We Still Under the SEC’s Gun?

Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x