24/7 Cryptocurrency News

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Published

5 months agoon

By

admin

The crypto market enters a crucial week, with a flurry of key events like the US PCE inflation, FOMC Minutes, and Q3 GDP (first revision) data, among others, scheduled. In addition, the crypto market expiry has also fueled concerns among the market participants. For context, the investors are awaiting the impact of these events, as the broader market noted a massive rally in recent days.

US PCE Inflation & FOMC Minutes In Focus

The crypto market awaits a flurry of key economic events this week, including US PCE, FOMC, and others, with speculations soaring over the potential impact on asset prices. Notably, the week will start with Consumer confidence data and US FOMC for November scheduled on Tuesday, November 26. This would provide further cues on the Fed’s potential stance with their monetary policy plans, which usually affect the investors’ sentiment.

In addition, the minutes will also be closely watched, as recent reports showed that the US Federal Reserve said that it won’t be focusing on the 2% inflation target ahead. Besides, with Donald Trump’s election victory and Elon Musk’s focus on cutting Federal spending, investors will keep close track of the central bank’s minutes this week.

Following that, the market participants will await the US GDP figures for the third quarter. The first revision of the economic figure is scheduled for Wednesday, November 27, which will provide cues on the US economic health. This is also likely to impact the sentiment of the broader financial sector, let alone the crypto market.

Meanwhile, investors will be closely watching the inflation figures, especially after recent data indicates prices are soaring. The US PCE inflation, set for Wednesday, is expected to come in at 0.2% in October, unchanged from the previous month’s figure. On the other hand, the YoY PCE figure is expected to accelerate at 2.3%, as compared to 2.1% noted in the prior month.

In addition, the Core PCE inflation figures, which exclude the energy and food prices, are expected to show a 2.8% surge, up from the 2.7% noted in September. However, the monthly figure is expected to remain unchanged at 0.3%.

Will Crypto Expiry Impact The Ongoing Rally?

Bitcoin and other top altcoins have noted robust rallies recently, with optimism hovering in the market after Donald Trump’s election win. However, some market experts anticipate the upcoming crypto expiry to impact the market sentiment.

According to Deribit data, $9.13 billion in Bitcoin options is set to expire on November 29, with a put/call ratio of 0.80. The max pain price is $77,000. On the other hand, $1.24 billion Ethereum is also set to expire on the same date, with a put/call ratio of 0.77 and a max pain price of $2,800.

This crypto expiry, worth more than $10 billion, is likely to spark volatility in the market, impacting investors’ sentiments. In addition, many top experts including Peter Brandt hint towards a potential Bitcoin selloff ahead, while remaining optimistic about the crypto’s long-term trajectory.

Having said that, the market will keep close track of the US PCE inflation figures, FOMC minutes, and other macroeconomic events. In addition, the crypto expiry is also expected to impact the traders’ sentiment, especially amid the ongoing rally in the market.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

24/7 Cryptocurrency News

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

Published

2 hours agoon

April 16, 2025By

adminIn the latest development in the long-running XRP lawsuit, the US Court of Appeals has granted Ripple and the SEC’s joint motion to suspend their respective appeals. This will give both parties time to finalize the settlement in the long-running legal battle.

XRP Lawsuit: Court Grants Ripple & SEC’s Joint Motion

As revealed in a court document, the US Court of Appeals has granted Ripple and the US Securities and Exchange Commission’s (SEC) joint motion to hold the appeal in abeyance. The court has further directed the Commission to file a status report within 60 days of this order.

This court order consequently suspends the ongoing appeal and cross-appeal filed by the SEC and Ripple, respectively. As CoinGape reported, both parties had filed the joint motion to suspend the appeals in light of them reaching a settlement.

The SEC and Ripple argued that holding the appeal in abeyance will help conserve judicial and party resources while they both continue to pursue a negotiated resolution of this matter.

In March, Ripple agreed to drop its cross-appeal against the SEC following the latter’s decision to drop its appeal in the long-running XRP lawsuit. However, the matter is yet to be finalized as both parties revealed in the filing that they need additional time to obtain the Commission approval for their agreement-in-principle.

Once approved, both parties will still need to get an indicative ruling from the District Court. As part of the agreement, Ripple and the SEC had agreed that the former would only pay $50 million out of the $125 million penalty that Judge Analisa Torres awarded against the crypto firm. The Commission also agreed to request that Judge Torres lift the standard injunction that it imposed on Ripple.

Possible Reason For The Delay?

It remains unclear why the Commission has yet to approve the agreement in the XRP lawsuit. However, a possible reason could be that the SEC is holding out for Paul Atkins to assume office.

As CoinGape reported, the US Senate has confirmed Atkins as the next SEC Chair. The next step is for US President Donald Trump to sign off on the confirmation and swear him in as Gary Gensler’s successor.

Once the Commission approves the agreement, Ripple and the SEC will ask Judge Torres for relief from her earlier judgment. Once that happens, the Court of Appeals can strike out the appeal and remand the case to the District court for a full ruling on the agreement.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ripple Whale Moves $63M As XRP Tops List for Spot ETF Approval

Published

1 day agoon

April 15, 2025By

admin

A large Ripple whale has moved 29,532,534 XRP, valued at $63.81 million, from an unknown wallet to Coinbase. This Ripple whale transfer comes at a time when XRP is making waves in the cryptocurrency market, positioning itself as one of the top candidates for a U.S. spot ETF approval.

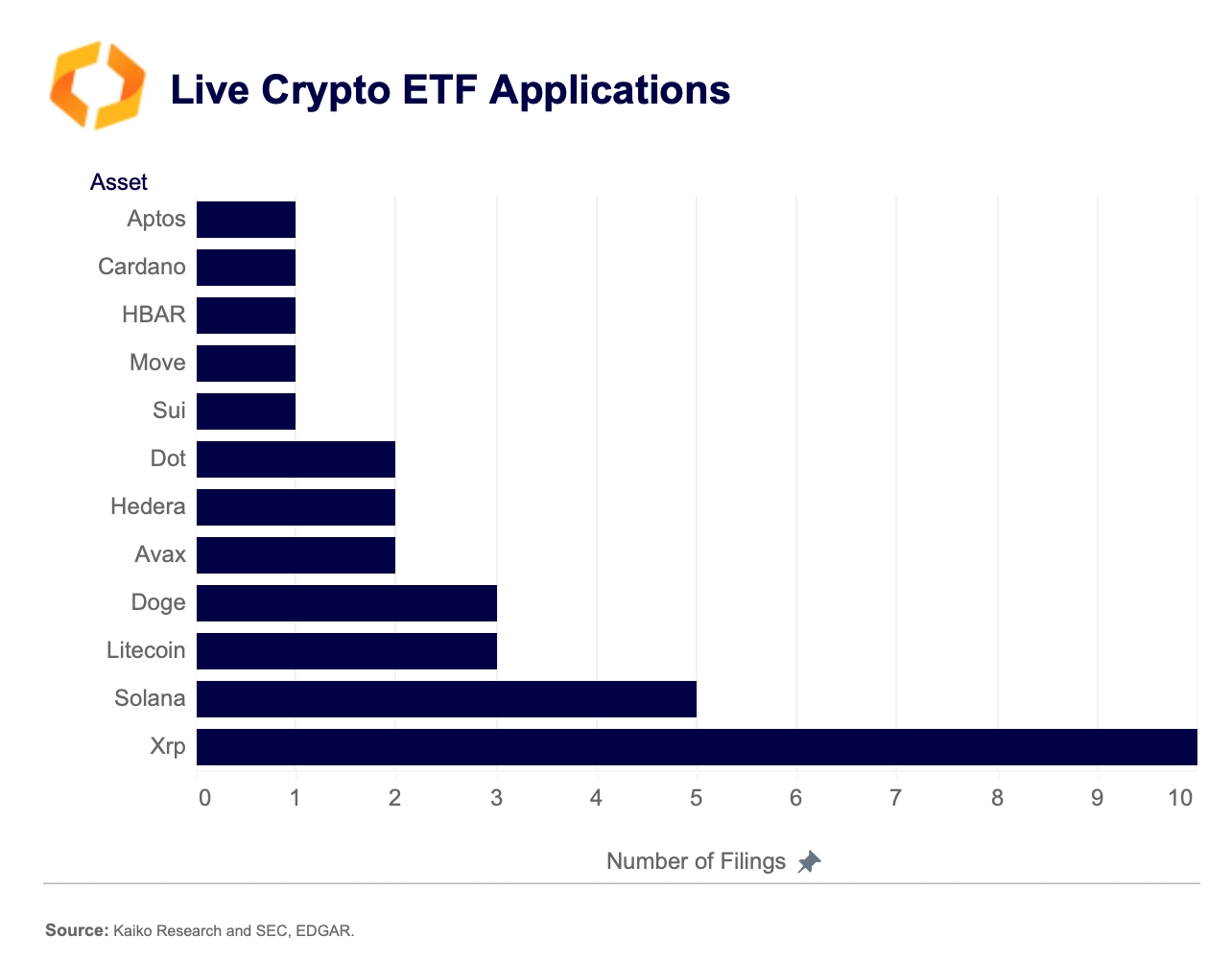

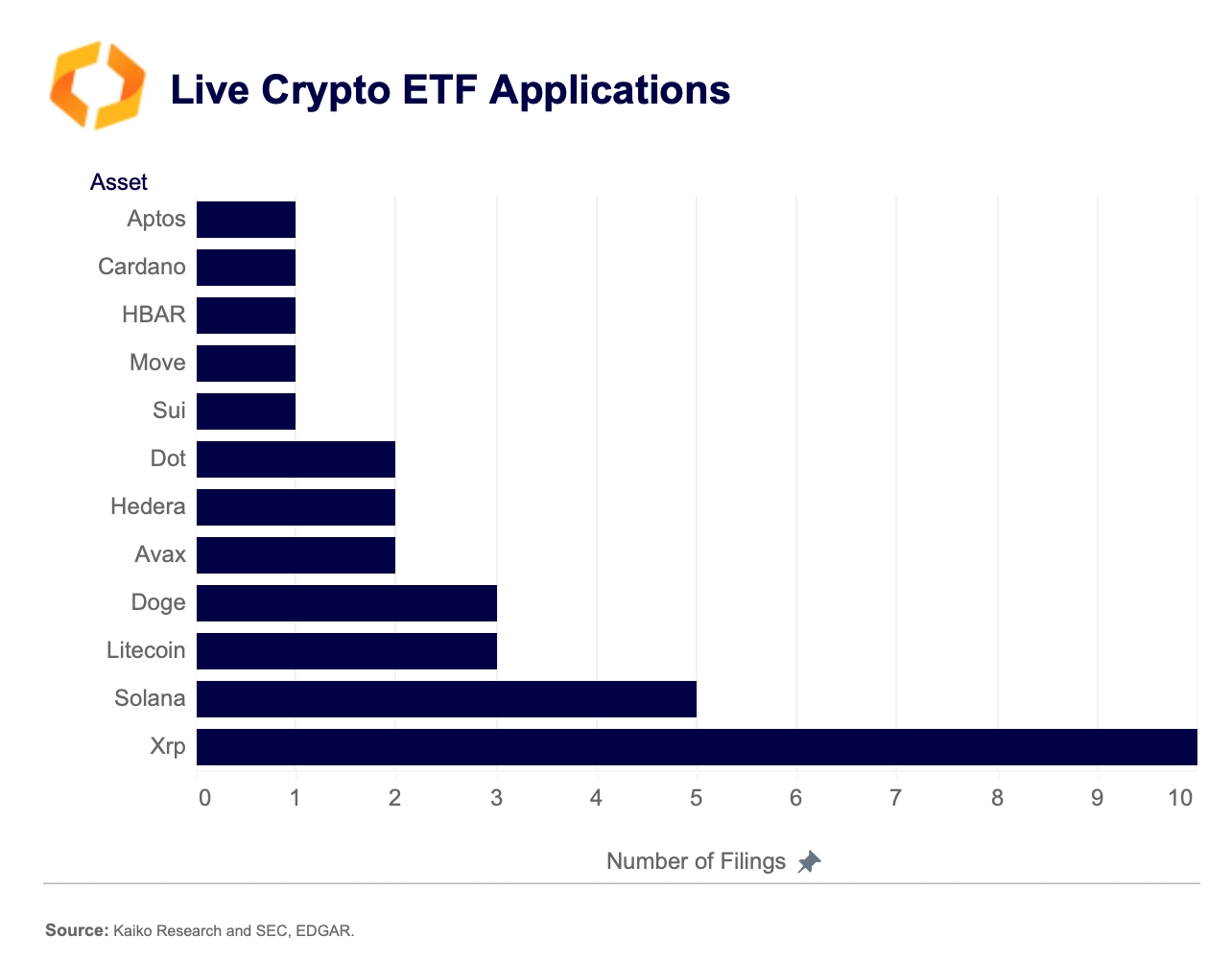

XRP’s increasing liquidity and recent developments have placed it in direct competition with Solana (SOL) for ETF approval, with analysts predicting XRP may secure approval sooner than its rivals.

XRP’s Growing Liquidity Boosts ETF Prospects

XRP has shown a marked improvement in liquidity over the past few months, positioning itself as a strong contender for a U.S. spot ETF. A study of market depth done by Kaiko Indices shows that XRP and Solana have the deepest 1% market depth on vetted exchanges. XRP’s liquidity has increased since late 2024, outperforming that of Solana and even risen to two times that of Cardano’s ADA.

Several events have enhanced XRP’s liquidity, such as Teucrium’s launching of a 2x XRP ETF in the recent past. This leveraged product tracks European ETPs and swap agreements, offering double the daily returns of XRP.

On the launch date, it traded above $5 million, becoming the best-performing fund for the Teucrium Fund Company. Such momentum brings XRP the vital support for its objective to establish a place in the approval process for the U.S. spot ETF.

Despite the absence of a robust futures market, as seen in BTC, XRP has gradually made an increased impression in the US spot market. This triggered the token’s market share to go to the highest level since the SEC lawsuit in 2021, which triggered multiple delistings.

In this regard, Solana’s market share has decreased to 16% from the 25-30% recorded in 2022. According to analysts, XRP continues to trade significantly in the spot market, which could pave the way for approval soon.

Ripple’s Push for ETF Approval

The SEC has approved various filings for XRP spot ETFs, with a key deadline for Grayscale’s amendment scheduled for May 22. Additional good news came from the regulatory channel, confirming Paul Atkins as the new SEC Chair. Since several deadlines are set for the ETFs in the cryptocurrency market, Atkins’ leadership could determine the fate of XRP and other assets.

XRP’s situation differs from Bitcoin’s, as it lacks a robust futures market, making the cryptocurrency’s regulatory landscape more complex. However, rising liquidity and introducing the 2x XRP ETF have shifted the narrative firmly towards Ripple’s token. Therefore, the steps taken by the SEC in reaction to Grayscale’s filing will set the direction through which XRP may or may not get approval.

Despite this, according to data from Polymarket, there is a 74% chance that XRP will be approved for a spot ETF by December 31, 2025. However, there is still cautious optimism in the option market for XRP.

Data from Deribit reveals an abundance of bear call options, indicating that traders mainly hedge against further downside. This is partly due to worries from the broader market, such as macroeconomic issues that may affect crypto assets, like the Trump tariffs.

XRP Price Trend Amid Ripple Whale Moves

Looking at the technical analysis of the XRP price, there are indications of purely bullish opportunities. According to crypto analyst TheDefilink, XRP price is presently trading above key support levels on the daily charts, and as signified by the Ichimoku Cloud, the trend remains bullish.

In addition, large token transfers mean that Ripple whales are active on the market. The latest 29 million XRP transferred to Coinbase, alongside the 70 million XRP transfer between two unknown wallets, also depicts interest in XRP.

Additionally, the tightening of XRP’s Exponential Moving Averages (EMAs) suggests a potential golden cross could be forming, a pattern often associated with upward price movements.

According to the analyst, XRP price resistance levels are $2.23 and $2.50, with support levels at $1.96 and $1.61. A successful move above the $2.23 resistance could further energize the bullish sentiment surrounding XRP, aligning with a recent CoinGape XRP price analysis.

However, failure to hold the $1.96 support level might lead to a shift in market sentiment, potentially triggering a bearish correction in the short term.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Here’s Why a Massive Ethereum Price Rally is Next

Published

1 day agoon

April 15, 2025By

admin

Despite being the second biggest cryptocurrency, Ethereum has witnessed the worst quarterly price performance of 5 years in Q1 2025. With continuous bears’ dominance and macroeconomic events putting downward pressure on the altcoin, it is down significantly. However, that might change as the ETH price chart shows a bullish sign.

Ethereum Price Up for Rally As Buying Signal Flashes

Ethereum’s downtrend resulted in the token’s crashing to a low of $1,400 earlier in the month. Experts have attributed this fall to investors’ bearish sentiments and the overall crypto market crash. However, the Ethereum price drop against Bitcoin to its lowest in years indicates underlying performance issues.

While the selling sentiments remain, a buy signal has formed in the ETH price chart, presenting the possibility of a rebound. According to the crypto analyst Ali Martinez’s X post, the TD sequential indicator is presenting Setup 9, i.e., an indicator of trend reversal.

ETH may be gearing up for a major rebound, with the TD Sequential flashing a buy signal on the weekly chart!

The “9” is historically proven to mark the end of the bearish trend and present buying opportunities. Moreover, the smaller body size of the candle suggests weakening selling pressure and traders opting to buy.

Besides, no major resistance near the chart exists, so a smooth uptrend can form unless any major macroeconomic event interferes.

Symmetrical Triangle Formation Supports Ethereum Price’s Bullish Outlook

With a 3% recovery over the week, Ethereum currently trades at $1,639.91 with a market capitalization of $197.88B. Although the recovery is slow, the token moves in a symmetrical triangle formation, simultaneously opening the possibility of an uptrend or a downtrend.

If the ETH price moves up, it could rally to $1,900, but a downside move could result in a crash to $1,380. Although uncertainty remains amid Trump’s tariff trade war, the long-term bullish Ethereum price prediction is sustained.

Considering the same, a crypto whale has just opened a $12.6M ETH Long with 5x leverage, influencing investors’ sentiments.

Frequently Asked Questions (FAQs)

Persistent berish investor sentiments, broader crypto market crash, and macroeconomic events drive the poor performance of Ethereum.

After a 3% recovery during the week, Ethereum currently trades at $1,639.91 but could hit $1,900 with the confirmation of bullish momentum.

The ETH price chart shows that investors’ buying interest is rising and selling sentiments are declining. Even whales are placing long leverage, showcasing rising confidence in the altcoin.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market. As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: