meme coin

Wallstreetbets gets hacked, $2.2m worth of meme coins stolen

Published

5 months agoon

By

admin

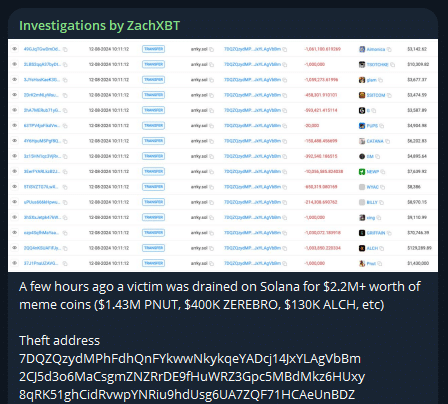

A security breach on X resulted in the theft of over $2.2 million worth of meme coins on Solana.

Blockchain investigator ZachXBT revealed the attack exploited a vulnerability in X’s mobile platform, leading to losses across multiple tokens in what appears to be a sophisticated phishing operation against Wallstreetbets.

The attack resulted in the theft of multiple tokens, with the major losses including $1.43 million in PNUT, $400,000 in ZEREBRO, and $130,000 in ALCH tokens.

According to ZachXBT’s Telegram announcement, the attackers exploited a previously identified bug in X’s mobile platform. This allowed them to add passkeys to compromised accounts—a vulnerability that remained invisible to original account owners and wasn’t being properly addressed by platform support.

The vulnerability affects the platform’s mobile interface, allowing attackers to maintain persistent access even after apparent account recovery attempts.

Wallstreetbets regains access to the account

Wallstreetbets has since regained control of their account. He also confirmed that the unauthorized tweets containing malicious links had been posted during the compromise.

The account holder revealed they had been battling unauthorized access attempts for approximately one month. The user is also working in conjunction with X’s security team to resolve the continuous security issues.

URGENT: I just deleted the following tweet which was NOT written by me. As you my or may not know I’ve dealing with fraudsters hacking my account for a month. I will NEVER ask you to click a sketchy link and certainly NEVER tell you to buy something (except maybe $XRP). pic.twitter.com/4hB8gaC1Pn

— wallstreetbets (@wallstreetbets) December 8, 2024

In a direct message to the attackers, Wallstreetbets issued a stern warning, claiming knowledge of their identities despite their use of VPN services to mask their activities.

“Hiding your logins to my account with a VPN is a laughably weak way to cover your tracks,” the account stated. Wallstreetbets suggested possible legal consequences for the criminal activity.

The account holder has also reached out to potentially affected users, requesting them to share details of any losses through direct messages. This information is intended to be forwarded to authorities as part of ongoing investigations into the security breach.

Wallstreetbets wasn’t the only major breach on Sunday. Cardano’s X account was also hacked, with details of a phony U.S. Securities and Exchange Commission lawsuit posted before being taken down.

Source link

You may like

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Markets

POPCAT eyes breakout moment after months of pressure below major level

Published

3 days agoon

April 25, 2025By

admin

POPCAT is showing early signs of life as it presses against a level it hasn’t cleared in over two months. But can this altcoin finally shift momentum and kickstart a fresh trend?

POPCAT (POPCAT) is currently trading at a region that has historically acted as a price ceiling, the $0.39 level. This zone has suppressed price action for over 78 days, with each attempt at reclaiming it quickly being rejected. However, the current push appears more constructive, as the price grinds back into this level with strength. That said, a breakout alone isn’t confirmation, rather price acceptance and a structure retest are still necessary before any sustained upside can be considered likely.

Key technical points

- The $0.39 region is a historical resistance level that has not been held above for more than two months.

- Current price structure shows an attempt to reclaim this level with strength after a prolonged consolidation beneath.

- A successful breakout and bullish retest could quickly drive price action toward higher targets near $0.70 and $0.95.

The $0.39 resistance was last broken down with conviction and has held as a ceiling since, suppressing upside momentum and leading to a prolonged accumulation range. This made the level significant not just technically but also from a psychological perspective for both bulls and bears. Now, POPCAT is pushing back into this area with improved market intent, hinting at a possible deviation and reclaim structure.

This structure resembles a classic deviation setup, where the market fails to sustain a breakdown and flips resistance into support. In this case, what we want to see next is acceptance above the $0.39 mark — not just a wick or intraday spike. Multiple candle closures above the level, followed by a successful bullish retest, would be the key confirmation traders should watch for.

If such a move plays out, the next major resistance levels to monitor are $0.70 and then $0.95. These align with prior distribution zones and could be tested quickly if momentum builds. Volume confirmation will also be crucial, a low-volume breakout would be treated with caution, whereas a strong influx will lend credence to the structural shift.

What to expect in the coming price action

POPCAT remains in a technically bullish posture as long as it holds the $0.39 area once (and if) it’s broken. Watch for a confirmed breakout and retest , this would signal true acceptance and raise the probability of a continuation play. A failure to hold above this region, however, may result in another rejection and range-bound chop, delaying any further breakout attempts.

For now, the price is at a decision point, and how it behaves over the coming days will determine whether this is just another fade or the start of a much larger rally.

Source link

Markets

Pepe eyes higher low formation after local rejection — is a 35% rally on the table?

Published

6 days agoon

April 22, 2025By

admin

Pepe is encountering resistance, but this rejection could mark the beginning of a bullish continuation setup. Traders are watching for a potential higher low that may set the stage for a strong rotation to the upside.

Pepe price action (PEPE) is currently facing a local resistance zone, one that is not necessarily bearish in nature but could act as a springboard for a bullish continuation. The region being tested aligns with the 0.618 Fibonacci retracement and the value area high from the local range, making it a strong candidate for a healthy rejection. Rather than expecting a sharp reversal, this scenario points to a potential retrace that would form a higher low — a classic bullish continuation signal if confirmed by follow-through.

Key points

- Pepe is testing a local resistance area around the 0.618 Fib and value area high.

- A rejection could lead to a sweep of swing low liquidity near the point of control.

- Bullish structure remains intact if a higher low forms and price reclaims support.

Should this rejection play out, price action is expected to rotate down toward the point of control region, which also aligns with the VWAP support level, creating strong technical confluence. Liquidity has been building beneath the current range since last Wednesday, and a sweep of that liquidity would be in line with a swing failure pattern (SFP). If price takes out that swing low but quickly closes back above it, this would confirm a higher low structure on the local timeframe — a strong bullish signal that sets the stage for a rally toward the recent swing high.

Such a move could result in a 35% upside push, provided broader market conditions remain favorable. It’s worth emphasizing that this pattern relies heavily on a supportive macro environment, particularly strength in majors like Bitcoin and Ethereum. If those assets continue trending upward, Pepe is likely to follow with a bullish reaction from support. However, if that point of control fails to hold and VWAP support breaks down, then the scenario shifts toward lower levels being tested again, possibly invalidating the higher low thesis.

For now, the market dynamics are still leaning toward bullish continuation. Price structure remains intact, and the reaction around this technical region will be pivotal. The presence of confluence — including the 0.618 Fibonacci, value area low, and point of control — makes this a strong candidate for a base before the next leg higher. If this setup fails, then it simply confirms another lower high and the likelihood of a lower low. But the current structure and liquidity profile suggest a bounce is more probable.

What to expect in the coming price action

As long as Pepe finds support around the point of control and the VWAP confluence, the structure favors the formation of a higher low. If confirmed, traders can anticipate a move back toward the swing high, offering a potential 35% upside. However, failure to hold this region will flip the bias bearish and open the door for further downside.

Source link

meme coin

Dogecoin supporters are 72% long — do they know something we don’t?

Published

1 week agoon

April 20, 2025By

admin

Dogecoin is stirring intrigue at $0.1560, with a slight 0.32% daily uptick, a 3.20% weekly dip, and a 10.45% monthly drop, holding a $23.23 billion market cap.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

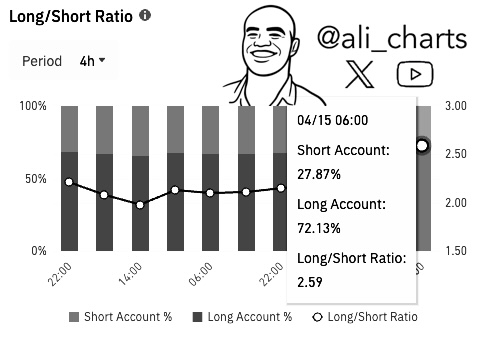

A crypto analyst, Ali, reveals that a striking 72.13% of Binance users are long on Dogecoin (DOGE) futures, dwarfing the 27.87% short positions, while Surf flags a volatile chart pattern.

As this bullish bias unfolds, altcoins like Minotaurus (MTAUR) ride the market’s hum. Are DOGE supporters onto a breakout, or is their optimism a setup for a shakeout?

A Lopsided Bullish Bet

Ali’s highlights a 2.59 long/short ratio for DOGE on Binance over a 4-hour span, with 72.13% of users holding long positions versus 27.87% short. The Coinglass chart illustrates this skew vividly: stacked bars show long positions (dark gray) towering over shorts (light gray) across the period, with a white line tracking the ratio’s climb above 1.0.

At 06:00, the ratio hit 2.59, meaning longs outnumber shorts by over 2.5 to 1. This heavy bullish tilt suggests people expect a near-term price surge, possibly toward $0.21-$0.29, as Ali’s past posts hinted.

Yet, such an imbalance risks volatility, liquidations could amplify a drop, making their confidence a double-edged sword.

Surf’s Chart: Volatility on the Horizon

Surf’s analysis points to a broadening formation on DOGE’s weekly chart, spanning mid-2021 to April 2025, where each candlestick represents a week. Diverging trendlines, upward-sloping lows, and downward-sloping highs connect widening price swings, signaling growing indecision. Higher highs near $0.22 and lower lows around $0.13 define the pattern.

Broadening formations often precede reversals after trends, with breakouts dictating direction. A push above the upper trendline could spark a rally to $0.29 or beyond, aligning with the 72% long bias.

However, a break below $0.13 risks a slide to $0.06. Surf’s chart suggests people’s bullishness faces a critical test, with volatility looming.

Minotaurus: Tapping Altcoin Energy

As DOGE supporters lean hard into longs, Minotaurus (MTAUR) gains ground in Web3 gaming. Its strategy-based maze game uses MTAUR tokens to unlock features and power-ups, resonating with Gen Z’s gaming culture in a $15 billion market.

Influencers are spotlighting its community focus, echoing DOGE’s grassroots appeal. If DOGE’s bullish bet ignites an altcoin wave, MTAUR’s utility could draw eyes, amplifying market excitement. Hurry up and buy Minotaurus here.

Final Thoughts: Are Dogecoin Supporters Ahead of the Curve?

The 72.13% long positions and expanding formation suggest a DOGE breakout, supported by whale activity, with 800 million tokens gathered, anticipating ETF prospects. However, the imbalanced ratio could face a correction if support around $0.13 weakens. Minotaurus’ ascent highlights the potential of altcoins, indicating that their optimism may spread.

Regardless of being insightful or overly scrutinized, DOGE’s $0.1560 position serves as a critical juncture — either a breakout or a breakdown is imminent.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje