Crypto scam

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Published

5 months agoon

By

admin

A new scam is targeting cryptocurrency investors, with the bad actors masquerading as business “professors.”

According to a warning issued by the Washington State Department of Financial Institutions (DFI), the scheme starts with advertisements on social media platforms like Facebook, offering a lucrative investment opportunity.

When users click the link in the ad, they are redirected to a “Letter from the Professor” or “Letter from the Dean” on a website designed by scammers. To establish credibility, the scammers then claim to be associated with an “Academy,” “Business School,” or “Wealth Institute.”

Those interested are invited to a WhatsApp or Telegram group managed by individuals with titles such as professor, advisor, or assistant. The groups also include other members posing as investors, which the DFI says may be bots or part of the scheme.

In these groups, users are then offered daily trading signals and investment tips, claiming that these will result in huge returns.

The victims are introduced to a website that facilitates cryptocurrency trading and are encouraged to make investments using the information provided by the group.

The real scam plays out when the scammers offer the victims high-dollar loans or lines of credit to meet the capital requirements to participate in some of their offerings.

These bogus loans are processed informally on the messaging platforms. To make the process seem legitimate, investors are often asked to provide financial information, such as credit scores, and to sign fake loan documents.

If a victim isn’t interested in the loan offer, the “assistants” borrow cryptocurrency funds on their behalf and deposit the funds into the victim’s trading account. A screenshot is provided as proof of the transaction.

However, the DFI found these transactions to be fake as they have no record on blockchain explorers.

Victims are told they can repay the loan using profits made on the platform. However, when trying to do so, the victim’s accounts are frozen, and they are asked to repay the loan from their own pockets.

Scammers also threaten victims with legal action if they deny repayment.

“DFI has yet to receive a report where an investor was able to withdraw their funds by paying the loan back,” the announcement said.

The DFI also reported a scam using the same tactics, where a victim was duped of $300,000. The complaint was about the “Excellence and Innovation Fortune Business School,” which claimed to be a financial institution but was instead a front for the ICHCOIN cryptocurrency scam.

These sorts of scams, in which the bad actors disguise themselves as professionals, have become quite prevalent in the cryptocurrency space.

Regulators in the United Kingdom recently warned the public about an email scheme with scammers posing as lawyers. These fake advocates demanded cryptocurrency payments from victims by alleging that they owned videos that could harm their reputation.

Source link

You may like

‘Very Promising Start’: Top Analyst Says Ethereum Headed Higher Against Bitcoin – Here Are His Targets

5 hidden gems to watch as the market gears up for 10,000% surge

BTC Monthly Chart Reveals Bull Market Target

AI bot transfers $50k in crypto after user manipulates fund handling

Perpetual DEX Hyperliquid to Launch Native Token Following Bullish October

Ethereum Foundation Invests Millions Into zkVM, What’s Happening?

24/7 Cryptocurrency News

Pro Gamer Linked to $3.5M Meme Coin Scam: ZachXBT

Published

23 hours agoon

November 28, 2024By

admin

The crypto market has become the center of attention, with the Bitcoin price aiming at the $100k mark. However, another incident is also gaining investors’ attention these days. A famous crypto investigator, ZachXBT made a major crypto scam finding, linking a pro gamer to a $3.5M meme coin scam. More importantly, these scams were also linked to major celebrity social media account hacks, scam promotions, and much more.

At one point, the crypto industry had earned a name for itself among the biggest finance entities, with $3.31T in global market capitalization. However, the rising crypto scams, theft, and laundering are concerning. Even Changpeng Zhao showed disappointment in memecoin and the rising scams.

ZachXBT Unveils $3.5M MemeCoin Scam and the Culprit

In 2024, the crypto market faced many wallet hacks, rug pull scams, and many other concerning scams. However, celebrity account hacks and the promotion of cryptocurrency-related scams were the most frequent.

Considering the rising case, a popular crypto investigator, ZachXBT, analyzed nine celebrity account hacks and the involved meme coins. He concluded that there is a connection between all these hacks. More importantly, he claimed that a pro-Fortnite gamer known by the name Serpent is the mastermind behind this.

ZachXBT linked this pro gamer in the $3.5M meme coin scam, confirming that he used multiple Pump.Fun memecoin and pump and dump tactics to make millions. Surprisingly, the biggest connection was the Serpent’s ERROR project wallet, which interacted with every social media hacker’s wallets directly or indirectly.

1/ An investigation into how the threat actor Serpent went from a pro Fortnite player to helping steal $3.5M via meme coin scams launched from 9+ account compromises on X & IG and gambling the proceeds away at online casinos. https://t.co/zR6QtuQW8a pic.twitter.com/Y8ovnEnQgj

— ZachXBT (@zachxbt) November 27, 2024

Serpent is known as a pro gamer and blockchain security analyst. He is even the founder of the Sentinel, which is a threat mitigation system but new reports link him with the scam, making it a big controversy. More importantly, he scammed $3.5M and gambled them away in online casinos. The controversy grew as Serpent deleted many of his X posts right after ZachXBT’s claims.

Breaking Down The Serpent’s Crypto Scam

In a detailed X post, ZachXBT revealed his finding to the crypto community, which explained the memecoin scams of more than $3.5M after the scammer compromised various celebrity social media accounts. It includes the account hacks of McDonald’s, Usher, Kabosu Owner, Andy Ayrey, Wiz Khalifa, SPX 6900, etc X (Twitter) and Instagram.

McDonald’s Instagram hack was among the first hacks of the year, where the scammer promoted a memecoin called GRIMACE and earned more than $690k with the pump and dump tactics. This happened on August 21, and the person shifted the funds to two main crypto wallets. The crypto scammer transferred 101.5 SOL to two addresses on September 3 and deployed the SCHRADER token. Interestingly, this token was promoted during the Actor Dean Norris X account hack.

Further, on September 6, the scammer processed Mcdonald’s ATO to a casino deposit address with the beginning address as B2fw. This same account transferred 110 Sol to two new wallet addresses on September 12 and sniped the meme coins which was used during the Usher crypto hack. The same B2fw wallet transferred 4868 SOL to casino deposit address ECb5v, which is connected to Andy Ayrey and the Enoshima Aquarium hack on October 15. Within the same day, 84 SOLs were transferred to ECb5v.

Even the popular AI bot Truth Terminal owner’s X account got hacked on October 29, which stayed compromised for days. In that period, 6 memecoins were promoted on his account. All these involved a common 3GVUs wallet, and the same wallet transferred 169 SOL to Ecb5vs on October 30. However, this is just the mid, the list goes on for others.

Bottom Line

Meme-themed cryptocurrencies gained investors attention in 2024, where many offered heavy gains, mainly the Solana memecoins. As a result, millions of Solana-based meme tokens were launched this year on Pump. Fun, but many were misused for crypto scams. With his recent investigation, ZachXBT has revealed the person behind the $3.5M meme coins scam. The scams also involved hacking celebrity accounts and promoting tokens to boost their price and dumping them all. This way, the scammer or alleged pro-Fortnite gamer Serpent made heavy returns, but others were left with losses.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Crypto scam

Meme Coins Die — Bloggers’ Advertising is Ineffective

Published

3 days agoon

November 26, 2024By

admin

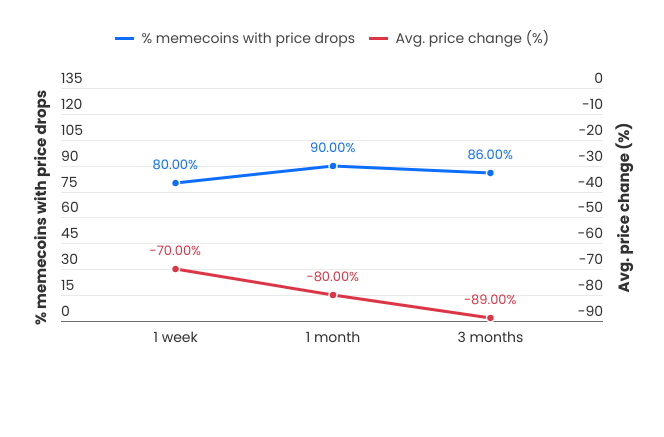

The vast majority of meme coins promoted by influencers in X end up “dead” — their value drops by 90% or more within three months.

The attention surrounding meme coins has led many famous X personalities to promote these tokens as a quick way to make money. However, the research by CoinWire shows the unpleasant reality: most meme coins have no value, and many investors face heavy losses.

“Our research reveals a sobering truth: most of these meme coins are, in fact, dead, and the majority of investors end up with significant losses.”

CoinWire report

To understand the meme coin situation, the experts analyzed data from over 1,500 tokens endorsed by 377 influential X users. They selected 377 of them with at least 10,000 followers who frequently promote meme coins. They then compiled a list of 1,567 meme coins that were promoted over the past three months.

Using Dune Analytics, experts collected information on the price when they were first promoted, the current price, and the price after one week, one month, and three months. A meme coin is considered dead if its current value has fallen by 90% or more compared to the initial promotion.

“76% of Twitter influencers have promoted meme coins that are now dead. Two out of three meme coins they promote are worthless. This means that many influencer-driven promotions essentially set up investors for failure.”

CoinWire report

The real effectiveness of meme coin promotion

The actual situation with meme coins differs significantly from influencers’ positive picture.

Stats show that these projects rarely meet their expectations: after a week, 80% of meme coins promoted by influencers lose 70% of their value.

After a month, about 90% of these tokens lost about 80% in value, and after three months, 86% of them fell in price by 10 times. As analysts note, this trend indicates significant instability and volatility of meme coins backed by influential individuals. In addition, most investors end up facing serious losses, often just a few weeks after investing.

Achieving high returns is almost impossible

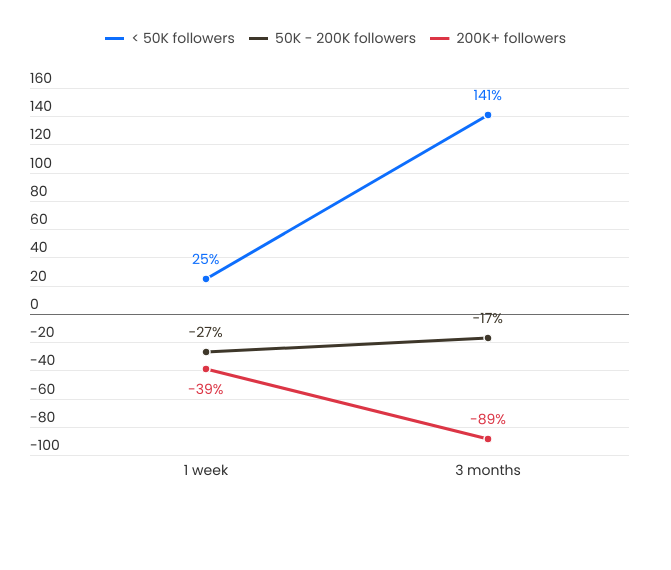

One main factor that makes meme coins attractive is their potential to generate significant returns.

However, in reality, this almost never happens. Only 1% of influencers successfully promoted meme coins. Furthermore, only 3% of meme coins promoted by influencers ever achieved such a significant increase.

Interestingly, the more followers an influencer has, the worse the performance of the meme coins they promote. Influencers with over 200,000 followers tend to perform the worst, with their meme coin promotions losing 39% of their investment within a week and 89% of their investment within three months.

In contrast to more prominent influencers, those with fewer than 50,000 followers perform better, with 25% of their revenue positive within a week and a 141% increase within three months. This may indicate that smaller influencers are more sincere in their promotional approaches, while larger ones often prioritize financial gain over the quality of the projects they support.

As for influencer earnings from meme coin promotions, analysts used TweetHunter’s X earnings calculator to estimate the potential profit from a sponsored tweet.

While investors often lose money, influencers benefit from promoting meme coins. They earn an average of $399 for each promotional tweet that attracts about 15,000 views. In this way, influencers promote even the most dubious tokens in the hopes of making a high profit.

Influencer promotion is mostly harmful

The data highlights a disturbing reality: meme coin promotion by influencers is mostly doing more harm than good for ordinary investors. 76% of influencers promote tokens without activity, and the probability of getting the desired 10x return is extremely low.

“Investors need to be cautious, questioning the true value behind these promotions and avoiding decisions driven by social media hype alone.”

CoinWire report

A CoinWire study shows that X meme coin hype is good for influencers but almost always disastrous for investors. Most of these tokens quickly lose their value. The chances of serious profits for investors who believe the buzz are minimal.

Source link

Crypto scam

Crypto traders doxx 13 year-old-boy who rugged two pump.fun tokens

Published

1 week agoon

November 20, 2024By

admin

A 13-year-old boy got doxxed by crypto traders after pulling the rug on a pump.fun token he named Gen Z Quant. Traders doxxed his whole family and turned them into pump.fun tokens.

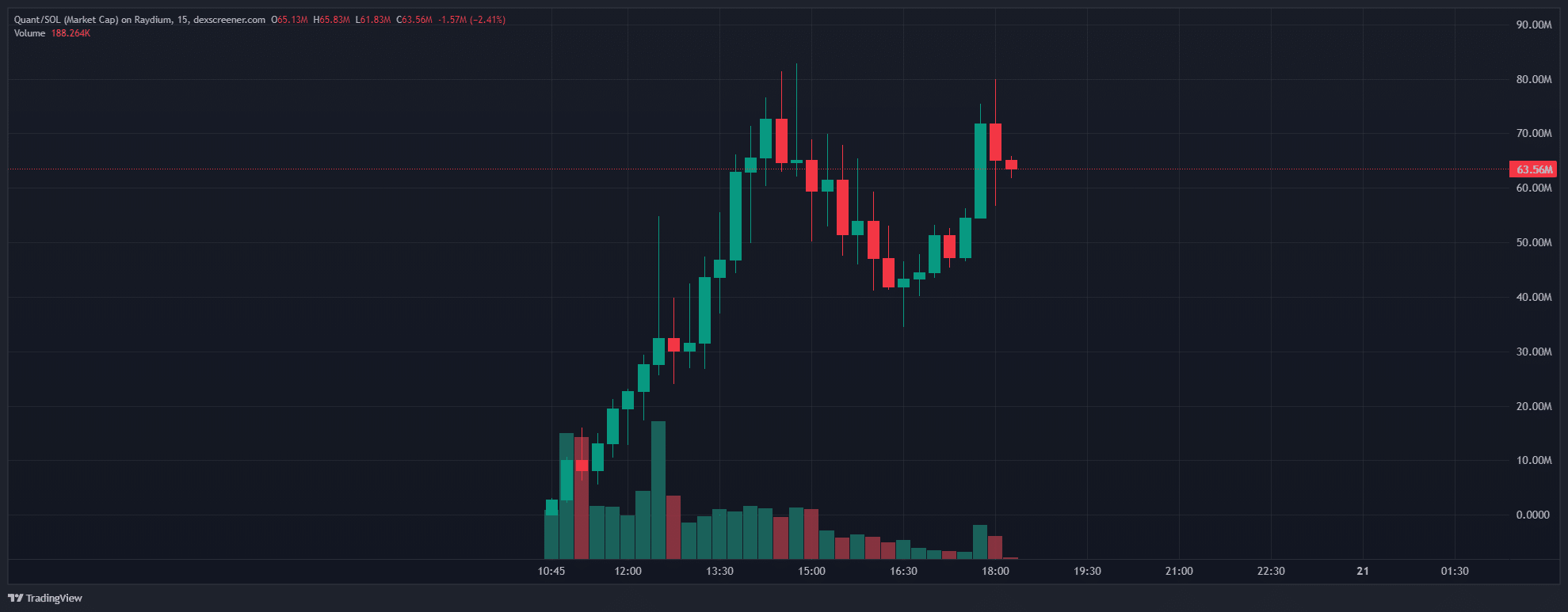

A 13-year-old boy has been caught in the middle of one of the most random rug-pulls the crypto community has ever witnessed. On Nov. 20, the unnamed boy launched a token on pump.fun under the ticker QUANT and watched as the price go up by 260% mere minutes after launching.

Not even an hour later, the boy dumps all his QUANT tokens, effectively pulling the rug from under traders who had bought the token minutes before. The boy made a profit of $30,000 by inflating the price and selling all his tokens.

As if that was not enough, he went online and flipped the middle finger at the traders who had been burned by QUANT’s rug-pull. He then went on to do the same thing by launching another token of the same name, which he later dumped for another $12,000 in profit.

Not long after, more experienced traders took over and brought the token’s market cap up to $70 million. The Gen Z Quant token he launched as an elaborate troll is currently trading at $0.05571 according to DEX Screener. It has soared to nearly 50% in the past six hours but is gradually going down hill by 13% in the past hour.

Although the boy has managed to turn his initial $30,000 token into a $2.4 million token, the crypto community was not going to let his misdemeanor slide.

Traders began doxxing the boy’s family and locating his school, tracking their social media accounts and complaining about the funds they lost thanks to the boy’s rug pull. Soon enough, developers began launching new pump.fun tokens named after the boy’s family members with their profile pictures revealed to accompany them.

Pump.fun tokens with the ticker QUANT DAD, QUANT SIS and QUANT MOM have already been circulating the markets, as well as tokens accompanied by a picture of the boy’s whole family and their pet dog with the ticker CABAL.

“Kid put his bloodline on the line,” one user pointed out.

“Then the community cto’d it to $135 million. He could’ve had 1.2 million. Then they doxxed his name, address and sschool. The community is roothless,” said a user on X.

One trader dubbed the boy “the future of finance,” while another reminded the community that this boy represents a messed up generation that has been “optimized to do that to people.”

Source link

‘Very Promising Start’: Top Analyst Says Ethereum Headed Higher Against Bitcoin – Here Are His Targets

5 hidden gems to watch as the market gears up for 10,000% surge

BTC Monthly Chart Reveals Bull Market Target

AI bot transfers $50k in crypto after user manipulates fund handling

Perpetual DEX Hyperliquid to Launch Native Token Following Bullish October

Ethereum Foundation Invests Millions Into zkVM, What’s Happening?

Cardano’s Hoskinson believe Bitcoin will surpass $250,000

BTC AT $97K, XRP Rises 7%, ALGO Surges 23%

Why Financial Advisors Must Adapt to Crypto or Risk Losing High-Net-Worth Clients

Major Bitcoin miners spent $3.6 billion on infrastructure

John Deaton Calls For Probe Into Operation Chokepoint 2.0

Solana whales back this new crypto as analysts predict 5,000% surge

Swiss Canton Bern Passes Bill To Probe Impact of Bitcoin Mining

Swiss lawmakers to study Bitcoin for power grid upgrade

Bitcoin Could Reach up to $500,000 Within 24 Months, Says Cardano Founder Charles Hoskinson – Here’s Why

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: