News

WazirX hack victims to receive aid from new CoinSwitch fund

Published

2 months agoon

By

admin

CoinSwitch has announced a $70 million recovery program, “CoinSwitch Cares,” aimed at helping WazirX users recover losses from a July 2024 cyberattack.

The two-year initiative, seeks to restore confidence in India’s crypto ecosystem by providing financial relief to affected individuals.

Announcing #CoinSwitchCares – a ₹600 Crore recovery fund for WazirX users.

CoinSwitch Cares is a ₹600 crore recovery program to help WazirX users who lost money due to the alleged cyber attack of July 2024. With this two-year program, we want to help affected users recoup… pic.twitter.com/Ql0TG25ztu

— CoinSwitch: India’s Simplest Crypto App

(@CoinSwitch) January 7, 2025

The program offers WazirX users a chance to estimate their losses, recover a portion of their funds, and earn additional rewards.

To participate, users must complete four steps: calculate their losses using CoinSwitch’s provided tool, register on the platform and complete the Know Your Customer process, deposit funds from any source, and transfer recovered funds from WazirX to maximize benefits.

Participants can earn up to 10% of the funds they deposit through the program over two years. Additionally, CoinSwitch will redistribute trading revenue from the initiative based on victims’ proportionate losses.

Additionally, users can refer other affected WazirX customers and earn up to 5% of deposited funds as a referral reward.

WazirX hack in 2024

For context, cryptocurrency exchanges like WazirX allow users to trade digital assets such as Bitcoin (BTC) or Ethereum (ETH). However, they can also be targets for cyberattacks, which can lead to significant financial losses.

The WazirX cryptocurrency exchange was hacked in July 2024, leading to the theft of over $2 million in user funds. The attackers exploited a vulnerability in the platform’s smart contract system to siphon assets. WazirX temporarily halted operations and assured users that an investigation was underway to recover the stolen funds.

CoinSwitch, another crypto platform, is stepping in to provide financial relief and rebuild trust within the community.

Source link

You may like

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

A Saint Patrick’s Day Price History

Altcoins

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Published

7 hours agoon

March 17, 2025By

admin

A man linked to the launch of two collapsed memecoins has reportedly gone ahead with another project despite a potential Interpol Red Notice with his name on it.

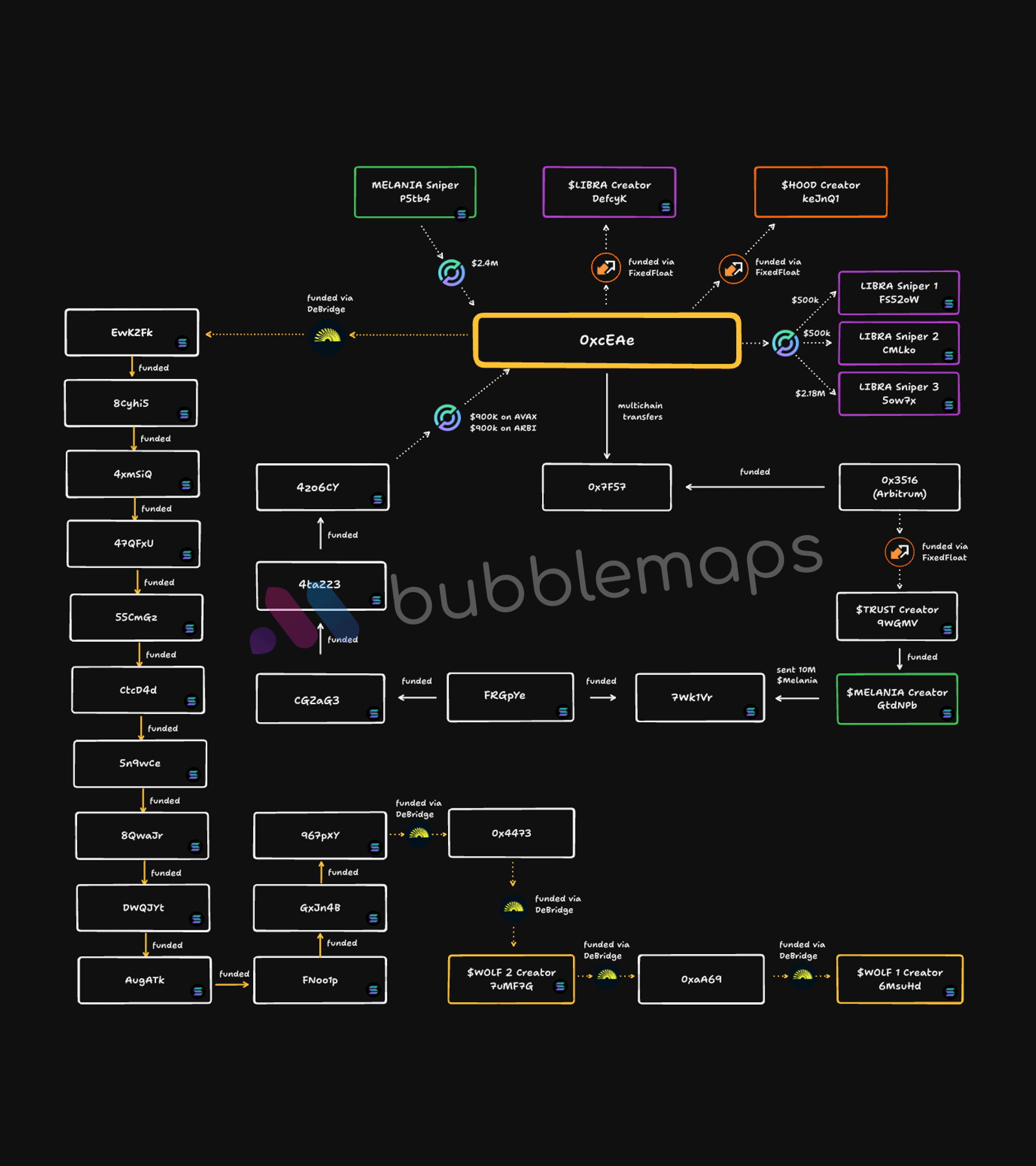

Blockchain analytics firm Bubblemaps reports that Hayden Davis was involved in launching WOLF, a coin inspired by the Wolf of Wall Street, the hit film based on former stockbroker Jordan Belfort.

Davis admitted to being behind the launch of LIBRA, a memecoin initially backed by Argentinian president Javier Milei. He was also copped for his involvement in the launch of MELANIA, a coin based on US First Lady Melania Trump. Both coins collapsed over 92% very shortly after their launch and have not recovered.

Shortly after the launch of LIBRA, Milei disavowed the memecoin, claiming he did not understand what he was getting himself into.

According to Forbes, Argentinian prosecutor Gregorio Dalbón has asked for a judge to arrange for an Interpol arrest warrant on Davis for his role in LIBRA.

Says Dalbón,

“I’m here to request the immediate detention of Hayden Mark Davis, a citizen of the United States, who is accused of being one of the principal actors behind the launch of the cryptocurrency LIBRA…

The possibility that Davis will abandon his country of residence or hide to avoid answering for his alleged acts appears to be aggravated by the economic resources he possesses, which he can use to move or remain in hiding, hindering our investigation.”

Despite the threat of being arrested, Bubblemaps says that one wallet that sniped the launch and collapse of WOLF behaved exactly the same as a wallet involved in a previous pump and dump allegedly linked to Davis.

“Starting with the WOLF creator 6MsuHd, we followed funding transfers back across 17 addresses and five cross-chain transfers.

All led to a single address: OxcEAe

The same one owned by Hayden Davis!

Why would Hayden do this?

Maybe he thought no one would trace it back to him.

He funded these wallets months before LIBRA and WOLF launched, moving money through 17 addresses and two chains.”

At time of writing, WOLF is trading for $0.00047, down nearly 99% from its all-time high of $0.0429 recorded on March 8th, according to DEX Screener.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Canadian Bitcoin miner Bitfarms has finalized the acquisition of Stronghold Digital Mining, marking the largest-ever merger between two publicly listed Bitcoin mining companies.

According to a press release published on March 17, Bitfarms has completed the all-stock acquisition of Stronghold Digital Mining. The merger was approved on Feb. 28, with 99.6% of votes cast voting in favor, representing about 54.5% of Stronghold’s outstanding shares.

Bitfarms acquired Stronghold through a stock-for-stock merger, with Stronghold shareholders receiving 2.52 Bitfarms shares for each Stronghold share they owned. Nearly 60 million Bitfarms shares and over 10.5 million warrants were issued as part of the deal. Stronghold’s stock was removed from Nasdaq and stopped trading.

Bitfarms’ stock opened higher Monday morning but lost any buying momentum and was trading lower by around 1% during the early afternoon session.

Details of the acquisition

With Stronghold now fully integrated into Bitfarms, the mining giant has expanded its energy capacity to 623 megawatts — including existing power generation and grid import capacity in Pennsylvania.

Additionally, Bitfarms now manages nearly 1 more Exahash of computing power, bringing its total to 18 Exahash. A previous agreement where Stronghold hosted miners for others is now being used for Bitfarms’ direct mining operations.

Bitfarms also sees potential to convert two Stronghold power sites into large-scale AI and computing hubs, with plans to partner with industry players to develop these facilities.

“With Stronghold’s portfolio of power assets, combined with our operational expertise and balance sheet strength, we are well positioned to create long-term value for our shareholders by executing on our US strategy and developing an HPC/AI business geared for scale, ” said Ben Gagnon, Chief Executive Officer of Bitfarms.

In addition to increasing its power assets, the acquisition has boosted Bitfarms’ share of the North American energy market from 6% to 80%.

Source link

Bitcoin

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

Published

13 hours agoon

March 17, 2025By

admin

A whale that has been dormant for 1.5 years has deposited 300 BTC to crypto brokerage FalconX alongside 1,050 BTC to two other wallets.

According to data on SpotOnChain, an anonymous whale with $85.7 million in Bitcoin (BTC) holdings just sent 300 BTC through digital asset broker FalconX. At current market prices, the transaction is worth around $25.1 million in BTC.

In addition to FalconX, the whale also sent 1,050 BTC, equal to around $87.2 million, to two fairly new wallets. At press time, the address still holds around $12.55 million worth of Bitcoin, or equal to 150,000 BTC.

The last transaction recorded on-chain from the whale occurred on Aug. 18, 2023 when it received 1,500 BTC from market marker Cumberland at a price of $26,353, worth $39.5 million at the time. This means that the address has been dormant for nearly two years.

According to data from crypto.news, Bitcoin has gone down by 0.44%. BTC is currently trading hands at $83,613. Bitcoin has been on a turbulent path in the past month, going down by more than 14%.

In the past day, Bitcoin reached a peak price of $84,693 before falling further to a $82,061 low and maintaining its value at around $83,000. In fact, BTC’s dive to the $84,000 threshold fills the CME price gap, which sets the stage for another potential price climb.

A CME gap is the disparity between the closing price of Bitcoin on the Chicago Mercantile Exchange or CME and its opening price when trading resumes. It is often used as an indicator for corrections after a sharp drop in the market. The CME gap is often referred as a “magnet” for Bitcoin prices.

Bitcoin’s recent price drop filling the CME gap and the notable BTC whale movements could suggest increased market activity is on the horizon. Traders are already anticipating the next market moves that could very well influence Bitcoin’s price trajectory and overall market sentiment.

Source link

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

A Saint Patrick’s Day Price History

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Bitfarms stock dips despite $110m acquisition

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

Bitcoin Flashing Bullish Reversal Signal Amid Waning Sell-Pressure, According to Crypto Strategist

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x