BRC-20

What Are BRC-20 Tokens? An Introduction

Published

2 months agoon

By

admin

Introduction

BRC-20 tokens are an experimental and inefficient token standard designed for creating fungible tokens on the Bitcoin blockchain. Inspired by Ethereum’s ERC-20 tokens, BRC-20 tokens leverage the Bitcoin Ordinals protocol to inscribe data onto individual satoshis, making them transferable and tradable.

Origins of BRC-20 Tokens

The BRC-20 token standard was introduced by a pseudonymous developer named Domo in March 2023. This development came shortly after the launch of the Bitcoin Ordinals protocol in January 2023 by Casey Rodarmor, which allowed users to inscribe data onto individual satoshis, enabling the creation of NFTs on the Bitcoin blockchain. The first BRC-20 token deployed was “ordi,” which quickly gained popularity and led to the creation of numerous other BRC-20 tokens.

The introduction of BRC-20 tokens aimed to bring the flexibility of fungible tokens to the Bitcoin network, similar to how ERC-20 tokens expanded the Ethereum ecosystem. However, BRC-20 tokens differ significantly from their Ethereum counterparts in terms of functionality and implementation.

How BRC-20 Tokens Work

BRC-20 tokens use the Ordinals protocol to inscribe JSON data onto satoshis. This data defines the token’s properties and functions, such as deployment, minting, and transfer. Unlike ERC-20 tokens on Ethereum, BRC-20 tokens do not use smart contracts, making their functionality more limited. However, their simplicity allows for easier asset tokenization on the Bitcoin network.

Deployment and Minting: The process begins with deploying a token by inscribing its properties onto a satoshi. Once deployed, tokens can be minted in specified quantities and transferred between users through Bitcoin transactions. The JSON data includes details such as the token’s name, maximum supply, and minting conditions.

Token Transfer: Transferring BRC-20 tokens involves creating a new inscription that specifies the transfer details. This inscription is then included in a Bitcoin transaction, making the transfer immutable and verifiable on the blockchain.

Pros and Cons

Pros:

- Simplicity: The absence of smart contracts simplifies the creation and transfer of tokens, making it accessible to a broader range of users.

- Security: Leveraging Bitcoin’s robust security features ensures a high level of trust and immutability.

Cons:

- Lack of Smart Contracts: The inability to use smart contracts restricts the functionality and potential use cases of BRC-20 tokens.

- Network Dependency: BRC-20 tokens are subject to Bitcoin’s prioritization of security and decentralization over transaction speed, which can result in higher fees during periods of high demand.

- Network Congestion: The popularity and poor design of these tokens led to increased transaction fees and network congestion, particularly at the time of launch as promotion and popularity are at peak levels. As popularity decreased, so did the congestion.

- Limited Interoperability: Being tailored specifically for the Bitcoin network, BRC-20 tokens are unable to interact with other blockchain ecosystems.

Practical Applications and Examples

Decentralized Application Tokens: A developer creates a new token for a decentralized application (dApp). By etching the token’s details into a Bitcoin transaction using the Ordinals protocol, the developer can manage the token directly on the Bitcoin blockchain without needing additional layers or complex smart contracts. This token can then be used within the dApp for various functions, such as access control, rewards, or governance.

Tokenized Assets: If an enterprise wants to tokenize its assets, such as shares or real estate, on the Bitcoin blockchain, with BRC-20 tokens, the company can inscribe tokens representing these assets, allowing for secure and transparent ownership transfer. This can simplify the process of buying, selling, or transferring ownership of these assets while leveraging Bitcoin’s robust security.

Loyalty Points System: A business could implement a loyalty points system using BRC-20 tokens. By creating and managing loyalty points as tokens, customers can earn, transfer, and redeem points directly on the Bitcoin blockchain. This ensures transparency and security, reducing the risk of fraud and increasing customer trust.

Community Tokens: A community group can decide to create its own token to facilitate various activities and rewards within the community. Using BRC-20 tokens, the group can inscribe tokens that members can use for participation in events, voting on community decisions, or rewarding contributions. This fosters a sense of ownership and engagement among community members.

BRC-20 tokens are often marketed as solutions for a range of applications as described above, from decentralized apps to tokenized assets, but in practice, they frequently attract speculative trading and gambling. While they utilize Bitcoin’s secure network, their primary use has quickly become creating and trading meme tokens and low-value digital assets. This mirrors a broader trend in the crypto world, where the promise of solving real-world problems is often overshadowed by a focus on short-term gains and speculative investments. The true value of Bitcoin lies in its security, decentralization, and role as sound money, which is often overlooked in the rush to exploit the latest token trends.

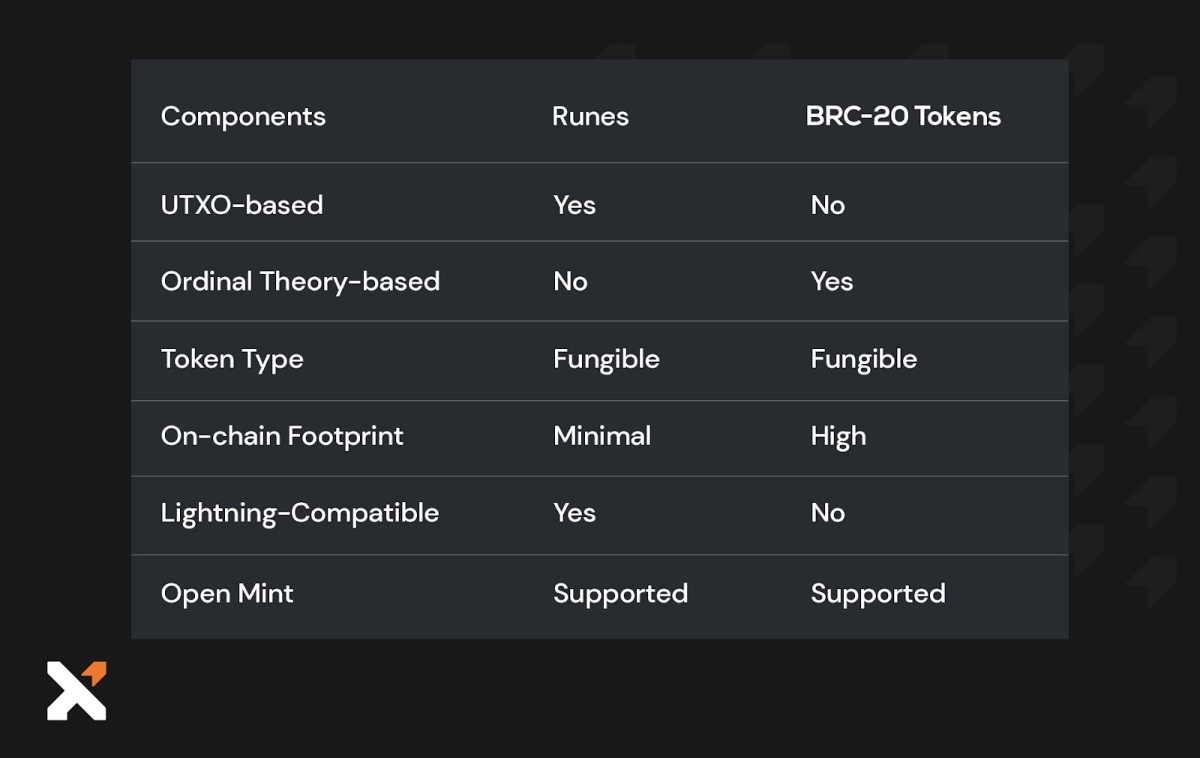

Runes Protocol: A Newer and More Efficient Solution

The Runes protocol, introduced by Casey Rodarmor, presents a more efficient and scalable alternative to BRC-20 tokens. By utilizing Bitcoin’s UTXO model and the OP_RETURN opcode, Runes manage to avoid the creation of unspendable UTXOs, thereby reducing network congestion and enhancing performance. Unlike BRC-20, which relies on JSON inscriptions that can bloat the network, Runes offer a streamlined process for token creation and transfer, integrating seamlessly with the Lightning Network and supporting a variety of wallet types. This makes Runes a superior choice for developers looking to create and manage tokens on the Bitcoin blockchain with greater efficiency and flexibility.

Source link

You may like

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Best In Slot

BRC-2.0 Bitcoin Tokens Could Outshine Runes

Published

3 months agoon

January 24, 2025By

admin

In a recent announcement, Best in Slot, the infrastructure company powering some of the most popular Bitcoin applications and wallets like Xverse and Liquidium, revealed that BRC-20s are getting an upgrade.

Dubbed BRC2.0, it’s expected to go live on Bitcoin Testnet in Q1 of 2025, with the aim to bring “smart contracts” to BRC-20s, enabling them to compete with Bitcoin sidechain designs.

In short, the “BRC20 Programmable Module” is designed to “unlock infinite new use cases for native assets on Bitcoin—including seamless DeFi, RWAs, DAOs, stablecoins, and more—without relying on multisig bridges or L2s.”

After many years in the space, we can all agree that we’ve heard promises like this before. However, metaprotocols have one distinguishable advantage: they are fully on-chain, rather than relying on entirely separate chains with new trust assumptions. Sure, metaprotocols may not be the best approach to decentralizing the token economy on Bitcoin, but they’re a start.

Runes suffered from overwhelmingly high expectations before their launch, and this is an opportunity for BRCs to make a comeback. No matter your stance on tokens on Bitcoin, competition between different standards will ultimately bring more efficiency and reduce on-chain bloat—something we can all agree is desirable.

The real question is this: for regular Bitcoiners who use Bitcoin purely as a monetary network, do we really need to go through this again? On-chain congestion, useless pump-and-dump schemes, skyrocketing fees…

My answer is: absolutely!

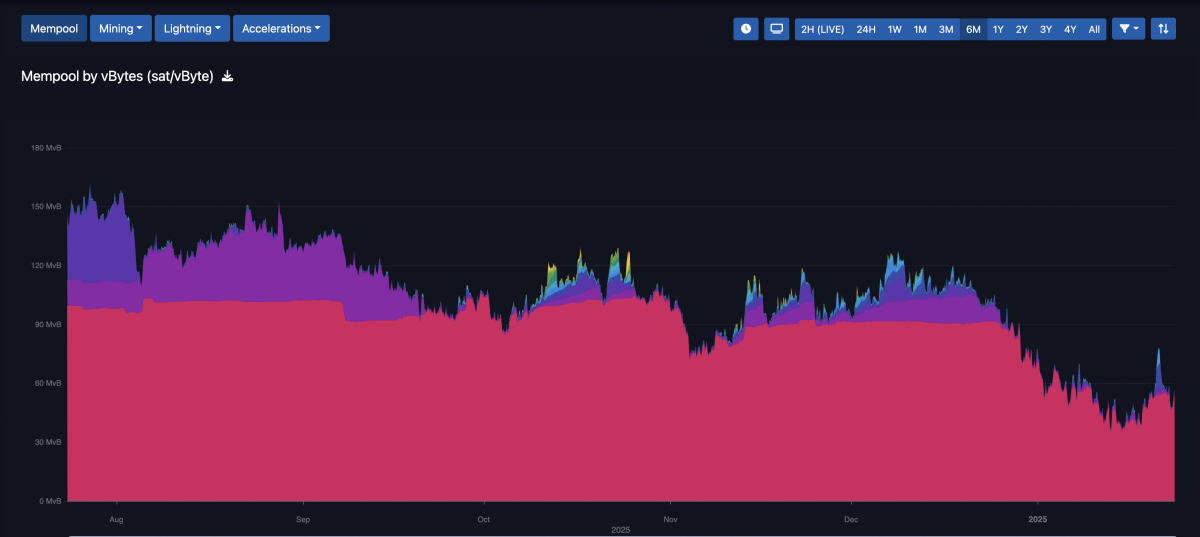

The mempool has been “dead” for the better part of the last six months.

First, as Bitcoiners, we’re supposed to support free markets. Having additional fee-paying users is literally the best possible outcome for Bitcoin’s survival. Miners have just gone through another halving, and keeping mining profitable is the only way to prevent centralization in the hands of subsidized actors (whether governments or financial markets—yes, miners issuing unlimited loans to buy machines will not last forever).

For context, according to CoinDesk, Solana’s validators experienced a record influx of over 100,000 SOL, worth nearly $25.8 million, in fees and tips due to intense trading activity of the TRUMP and MELANIA tokens.

Second, the Pandora’s box has already been opened. Tokens on Bitcoin are here to stay. If users desire additional programmability, who has the authority to stop it? (Aside from pro-censorship thinkbois, of course.)

As Bitcoin’s ecosystem evolves, the introduction of the BRC-20 upgrade presents a compelling case for why it might eclipse the Runes token standard. Here are several reasons why:

- The primary allure of BRC2.0 lies in its promise to enhance efficiency. With smart contract functionality, BRC-2.0 tokens could handle complex operations directly on the Bitcoin blockchain, potentially reducing the need for additional layers or sidechains. This could lead to more compact transactions, reducing on-chain bloat, a problem Runes have been criticized for due to their initial hype and subsequent congestion. This efficiency could be a game-changer for Bitcoin’s scalability, offering a streamlined approach to tokenization without altering the core protocol’s security or decentralization.

- BRC2.0 is designed to integrate with existing Bitcoin infrastructure. Thanks to collaborations with the likes of the Layer 1 Foundation, it could improve user experience and interoperability. Unlike Runes, which faced challenges in user adoption due to complex minting processes and bad UX, BRC2.0 aims to provide a more user-friendly interface for token creation and interaction. This could lead to broader acceptance and use, making Bitcoin a more attractive platform for developers and users alike.

My default position on anything new related to Bitcoin is always caution. We’ll have to wait for the actual specifics of this new protocol to be disclosed, but I’m excited about the prospect of more efficient DeFi use cases on Bitcoin—not on lesser chains.

If you’re still skeptical, I’ll leave you with this question: If tokens on Bitcoin are inevitable, what is worse?

- Metaprotocols using Bitcoin’s block space in exchange for fees, without changing the network’s rules?

- Or Bitcoiners bridging their hard-earned Bitcoin to centralized, competing chains to access the same token markets?

As a Bitcoin Maxi, I want all the fees. I want all the users. Bitcoin Maxis should be FEE REVENUE Maxis, as long as the core ethos of the underlying network remains unchanged (looking at feline enjoyyyyers).

My TL;DR:

- Wait and see what BRC2.0 has to offer. Will it truly become programmable in a way that’s secure enough for Bitcoiners to trust?

- Runes may become irrelevant if BRCs stage a real comeback, especially with better UX.

- Let the miners rejoice with degen fees.

- Tokens on Bitcoin without changing the rules are better than tokens on Bitcoin that require new opcodes or altered rules.

- Grateful for all the gigabrain devs building on Bitcoin apps instead of vaporware chains.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Articles I write may discuss topics or companies that are part of my firm’s investment portfolio (UTXO Management). The views expressed are solely my own and do not represent the opinions of my employer or its affiliates. I’m receiving no financial compensation for these takes. Readers should not consider this content as financial advice or an endorsement of any particular company or investment. Always do your own research before making financial decisions.

Source link

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Bybit shuts down four more Web3 services after axing NFT marketplace

Aptos To Continue Moving In ‘No Man’s Land’ – Can It Reclaim $5?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals