Law and Order

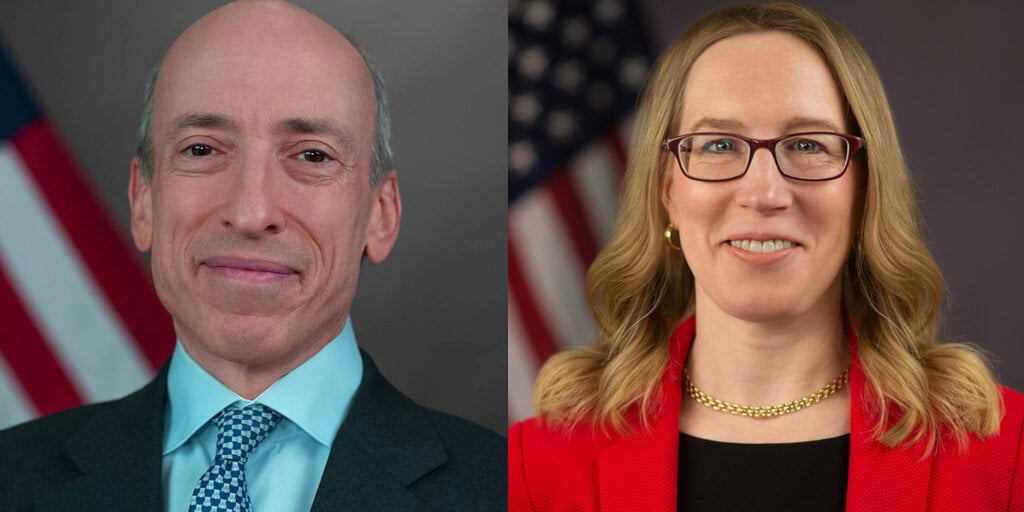

Who is Most Likely to Replace Gary Gensler After Trump Win?

Published

6 months agoon

By

admin

Will he be sacked? Or will he quit? Either way, crypto industry antagonist Gary Gensler’s days as Securities and Exchange Commission Chair are likely to be numbered.

President-elect Donald Trump is poised to hammer home one of his most popular crypto promises made earlier this year. At least, that’s what many in the industry are hoping for.

“I will fire Gary Gensler on day one,” Trump declared at a Bitcoin conference in July, prompting thunderous applause from thousands in Nashville. “The day I take the oath of office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over.”

Regardless of the fact that Trump’s words cut against Supreme Court precedent—as Decrypt has reported, a president can’t fire an SEC chair without cause—the names of several potential Gensler replacements are making the rounds ahead of Trump’s inauguration on January 20.

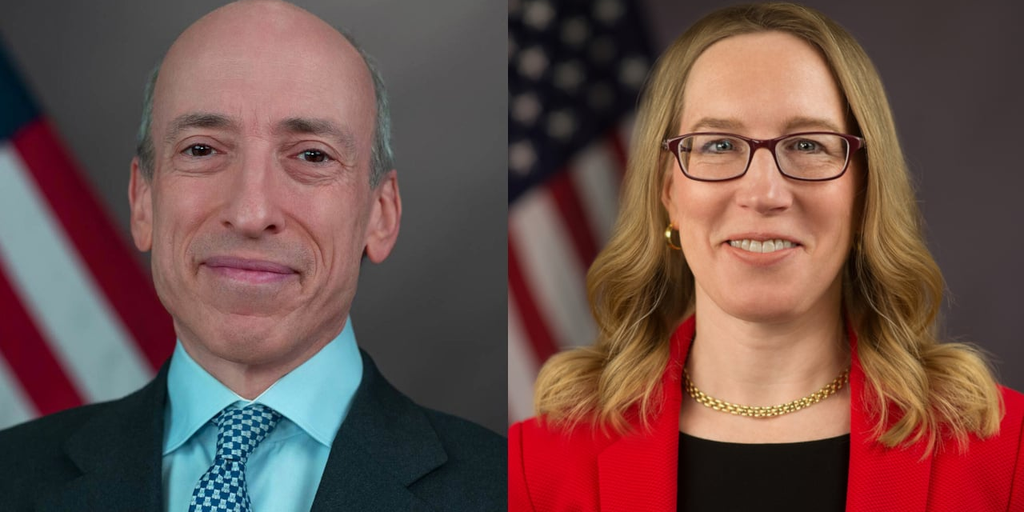

That list includes Hester Peirce and Mark Uyeda, both SEC commissioners; Dan Gallagher, Robinhood’s chief counsel; former chairman of the U.S. Commodity Futures Trading Commission, Chris Giancarlo; and former Binance.US CEO Brian Brooks.

Appointed by President Joe Biden, Gensler’s term as chair doesn’t end until 2026—with 18 months of wiggle room following his expiration date.

Still, SEC chairs have historically resigned when an opposing political party assumes control of the White House. Even so, Gensler, a Democrat, could be immediately demoted from chair to commissioner by Trump, leaving someone else to take up the mantle.

John Stark, an ardent crypto skeptic who once served as an SEC enforcement attorney, made the case for Peirce on Thursday.

“Most of the time, they just resign because they know that a new chair is going to be appointed,” Stark said. “The president will then immediately appoint someone to be acting chair, and that will usually be the senior member of that party.”

Nicknamed “Crypto Mom” for her support of the industry, Peirce has disagreed with the SEC’s penchant for suing crypto companies since she was appointed in 2018. Dissenting against an NFT-focused enforcement action in September, she derided the SEC’s approach as “misguided and overreaching,” creating many needless cases.

Of the SEC’s five current commissioners, three belong to the Democratic Party, including Gensler. Meanwhile, Peirce’s Republican colleague, Uyeda, who was appointed in 2022, is also being pitched as a potential contender.

“I’d give decent odds to Uyeda,” Jake Chervinsky, chief legal officer at Variant Fund, said in a tweet on Wednesday, adding that he thinks Peirce doesn’t want the job. He caveated, however, “I expect Trump may prefer to bring in someone new of his own.”

Peirce did not immediately respond to a request for comment from Decrypt.

With Trump’s transition team co-chaired by Cantor Fitzgerald Chairman and CEO Howard Lutnick, an outside pick to lead the SEC appears possible Fitzgerald views Wall Street as ripe for top cabinet positions, POLITICO reported Wednesday.

Robinhood’s Chief Legal Officer Gallagher would be a “natural choice,” according to one former SEC official who spoke with POLITICO.

Formerly serving as an SEC commissioner from 2011 to 2015, Gallagher testified before Congress earlier this year about digital asset regulation and a lack of “regulatory clarity at the federal level.”

After injecting over $119 million into federal elections this year, some leaders of digital asset firms are making calls of their own for Gensler’s replacement. Ripple Labs CEO Brad Garlinghouse encouraged Trump to appoint Gallagher as SEC chair on Wednesday, as well as Brooks or Giancarlo.

“They’d be massive upgrades in rebuilding the rule of law (and reputation) at the SEC,” Garlinghouse said. “Fire Gensler. Day 1, no delays.”

Nicknamed “Crypto Dad” for his commitment to digital assets as chairman of the U.S. Commodity Futures Trading Commission (CFTC) from 2017 to 2019, Giancarlo now works as senior counsel and co-chair of Willkie’s Digital Works practice.

While Giancarlo led the CFTC, bitcoin futures became approved on the Chicago Mercantile Exchange. At the same time, he cultivated a “Do No Harm” approach to the digital assets industry, according to the conservative law group Federalist Society.

Brooks—who hasn’t yet earned a paternalistic moniker from the digital assets industry—most notably served as acting comptroller of the currency. Leading the independent arm of the U.S. Treasury Department, he was responsible for chartering, regulating, and supervising national banks.

From 2018 to 2020, Brooks served as chief legal officer for the crypto exchange Coinbase. After departing Washington, he also served as CEO of Binance.US, leaving the American company after four months due to “differences over strategic direction.”

Notably, Coinbase and Binance.US—alongside Binance and the exchange’s co-founder and former CEO Changpeng Zhao—face ongoing SEC lawsuits, which allege both firms breached its regulatory rules.

But with a Trump-led change in SEC leadership, former SEC official Stark said a shift in the agency’s stance would almost be certain.

“Does this mean that the SEC’s war on crypto is over?” he asked on Thursday. “I would say ‘absolutely,’ with a resounding ‘yes.’”

Edited by Sebastian Sinclair and Josh Quittner

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Law and Order

Why Alabama’s Securities Commissioner Dropped Its Case Against Coinbase

Published

1 day agoon

April 26, 2025By

admin

Alabama’s Securities Commission this week dropped its enforcement action against crypto exchange Coinbase for its staking program—an apparent sign that regulators are letting up on digital assets companies as the federal government continues its pro-crypto pivot under President Trump.

But Commissioner Amanda Senn told Decrypt the regulator is still as committed as ever to promoting “market stability and integrity”—and it won’t hesitate to bring enforcement actions against Coinbase or any other firm, if necessary.

“We merely recognized that we may be able to accomplish what we want without the time and expense of litigation,” Senn said. “Had we been further down the road [in our action against Coinbase], we may have proceeded.”

Crypto out of the crosshairs?

Alabama is one of 10 states that banded together in June 2023 to bring a spate of enforcement actions against Coinbase, alleging the crypto exchange had violated securities laws by failing to properly register its staking services.

But now, as policymakers and federal regulators ratchet back their oversight of the digital asset industry under pro-crypto President Donald Trump, that unity has largely crumbled.

Five of the states—Illinois, Kentucky, South Carolina, Vermont, and Alabama—have dropped their enforcement actions against Coinbase over the past few weeks, while regulators in five other states are resisting pressure from Coinbase to do the same, according to a report from political news outlet Punchbowl.

Five holdouts are still electing to waste taxpayer resources on lawsuits, and four of those have banned staking with @coinbase, depriving consumers of the right to earn on their platform of choice. 2/3

— paulgrewal.eth (@iampaulgrewal) April 23, 2025

“We’re halfway there: Alabama just dropped its enforcement action against Coinbase,” the firm’s lead legal counsel Paul Grewal said Wednesday in a social media post, adding that the states’ actions were “misguided” and claiming that the “holdouts are still electing to waste taxpayer resources.”

However, Senn told Decrypt that she and her colleagues “don’t believe litigation is a waste of time”—and their call to drop an enforcement action against the firm “should not be taken by anyone that we will not litigate if an appropriate regulatory scheme [for the cryptocurrency industry] is not adopted” in the U.S.

Alabama rescinded its enforcement action against Coinbase to “allow time” for policymakers to create a legislative framework for the cryptocurrency industry—a move that could save investor shareholder and taxpayer dollars, Senn explained.

“By all accounts, a regulatory framework appears imminent, so it made sense for us to table our litigation posture and allow time for our policymakers to continue their good work,” Senn said.

Experts expect a market structure bill to pass in the latter half of this year, despite recent rumblings of disagreements between crypto-industry power players over what that legislation should entail.

Senn noted that lawmakers and federal regulators are holding multiple hearings and bimonthly roundtable discussions on crypto-focused legislative efforts and regulations.

“They’re pretty aggressive in their agenda,” she said, speaking of the pace at which lawmakers have moved to advance crypto-focused policy efforts.

Rethinking enforcement

However, mounting momentum for legislative reform on Capitol Hill is just one reason for which the Alabama Securities Commission dropped its action against Coinbase.

When the Commission decided to drop its enforcement action, it was still in the early stages of that process and was engaging in talks with Coinbase’s team, according to Senn.

“There were examinations of procedures but we were not in active discovery,” she explained.

That’s because—unlike some states that issued cease and desist orders to Coinbase—Alabama issued a show-cause order, a kind of enforcement action that acts more as a “vehicle for discussions” than a directive for a firm to completely halt its operations in a particular jurisdiction.

“Some states have already expended significant resources toward litigation and were much further down the road,” Senn explained. “Each jurisdiction should make its own decision about how it should proceed.”

Asked why Alabama opted to issue a show-cause instead of immediately ordering Coinbase to stop its activities in its jurisdiction, Senn said: “I consider [Coinbase] part of the financial sector—it’s a dollar in, a dollar out… but I appreciate that this is new technology, and a different transmission process and rather unique business model.”

“Now if we had issued a cease and desist, then the conversation would have been entirely different,” she added.

Senn stressed that Alabama’s choice to withdraw its enforcement action against Coinbase doesn’t mean the agency will hesitate to go after firms that break the rules or threaten to harm consumers.

Regulators in the Yellowhammer State are “still combating fraud” and protecting consumers, according to Senn, who referenced the infamous Mt. Gox Bitcoin exchange that faced hacks and shut down in 2014, leaving users with massive losses.

“Mt. Gox is still very much on our minds,” she said.

Edited by Andrew Hayward

Editor’s note: This story was updated to clarify one of Commissioner Senn’s comments.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

Federal Reserve Withdraws Crypto Rules for Banks, Ending ‘Choke Point’ Practices

Published

3 days agoon

April 25, 2025By

admin

The Federal Reserve said Thursday evening it will no longer obligate member banks to provide advanced notice of crypto and stablecoin-related ventures, and will instead monitor engagement with digital assets like it would any other banking activities.

The announcement comes weeks after parallel moves by the FDIC and Office of the Comptroller of the Currency, two other key federal banking regulators. Those agencies similarly clarified that banks are legally permitted to engage in crypto-related activities and no longer required to receive explicit permission from regulators to do so.

In January 2023, in the wake of FTX’s historic collapse, the three aforementioned agencies jointly issued guidance strongly discouraging American member banks from engaging with crypto, and ordering them to provide notice of any such intention.

“[T]he agencies believe that issuing or holding as principal crypto-assets that are issued, stored, or transferred on an open, public, and/or decentralized network, or similar system is highly likely to be inconsistent with safe and sound banking practices,” the joint statement said at the time.

That letter is now also rescinded, per today’s announcement.

In the months and years following the institution of said crypto-skeptical banking policies, numerous industry leaders claimed they and their businesses were denied traditional banking services based on their association with the crypto industry alone. Since retaking office, President Donald Trump has made undoing this alleged anti-crypto banking discrimination, dubbed “Operation Chokepoint 2.0,” a top priority.

Tonight, the Federal Reserve officially joined the FDIC and OCC in making a formal shift away from such Biden-era digital asset policies.

In crypto circles, though, some anxiety persisted until today that the Fed would resist making this pivot. The Fed board currently consists of four Democrats and three Republicans, and Fed chair Jerome Powell has shown himself in recent weeks to be willing to act independently of the president’s wishes.

One crypto banking advocate who requested anonymity in order to speak candidly told Decrypt they had worried the Fed’s Democratic majority, along with Powell, would drag its feet in rescinding Biden-era crypto policies, or potentially resist the move altogether. Today’s announcement shows the central bank is “moving in the right direction,” they said.

Today’s announcement stops short, though, of officially changing the Fed’s policies when it comes to granting crypto-focused banks master accounts, which grant Fed members access to the central bank’s services. Master accounts are crucial for a bank to meaningfully serve customers nationwide. For years, the Fed has resisted granting any such accounts to crypto-focused banks like Custodia and Kraken Financial.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

SEC Sues Crypto Executive Over Alleged $198 Million Scheme

Published

4 days agoon

April 23, 2025By

admin

In brief

- SEC accuses PGI Global CEO of running a $198M crypto Ponzi scheme.

- Investors were sold unregistered securities disguised as AI trading packages.

- Case marks SEC’s first crypto action under new Chair Paul Atkins.

On Tuesday, the U.S. Securities and Exchange Commission formally charged PGI Global CEO Ramil Palafox for allegedly running a $198 million crypto-based Ponzi scheme five years ago, accusing him of duping investors with false promises of AI-driven trading and guaranteed returns.

More than $57 million of those funds in fiat and Bitcoin were misappropriated for Palafox’s personal use and to benefit his close associates, the SEC alleged in a statement.

The case against Palafox, filed in the U.S. District Court for the Eastern District of Virginia, is the SEC’s first crypto-related enforcement action under new Chair Paul Atkins, who was sworn in just a day earlier.

Palafox ran PGI Global, short for Praetorian Group International, as a front for unregistered securities sales cloaked in crypto industry buzzwords, according to the SEC’s complaint.

From January 2020 to October 2021, Palafox marketed “membership packages” that allegedly guaranteed returns of up to 200% via a supposed AI-driven crypto and forex trading platform.

Formally known as PGI Global UK Ltd, the crypto trading firm was shut down by the U.K. High Court in September 2022 for operating a fraudulent investment scheme.

Between July 2020 and February 2021, PGI Global collected approximately £612,425 (US$815,000) from investors.

However, when the promised returns failed to materialize, investors were unable to withdraw their funds.

Palafox, based in the U.S., did not cooperate with the investigation. The U.S. Department of Justice and the U.S. Department of the Treasury seized the company’s website after a warrant was issued by the U.S. District Court for the Eastern District of Virginia.

“PGI Global never had an ‘Auto Trading’ platform and was conducting little to no trading of any kind on investors’ behalf,” the court filing reads.

Instead, investor funds were allegedly used to sustain a Ponzi-like system of payouts and to finance Palafox’s extravagant lifestyle, which includes a $1.7 million home in Las Vegas, multiple Lamborghinis, and $1.18 million in Cartier jewelry.

The complaint outlines how Palafox reportedly faked crypto activity through circular transactions and manipulated dashboards to falsely show returns and keep investors hooked.

“His false claims of crypto industry expertise and a supposed AI-powered auto-trading platform were just masking an international securities fraud,” Laura D’Allaird, chief of the SEC’s Cyber Unit, said in the statement.

The SEC also claims Palafox transferred assets in anticipation of the scheme’s collapse.

The complaint names four relief defendants, including Palafox’s wife, mother, and brother-in-law, and seeks the return of assets and funds they received, such as a $320,000 mortgage payoff, a Range Rover, and luxury goods from Louis Vuitton and Hermès.

The agency is also asking the court to impose a permanent ban on Palafox’s participation in crypto or MLM-related securities offerings, along with civil penalties and the full disgorgement of funds, while federal prosecutors have also indicted him in a related criminal case out of Virginia.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje