Bitcoin

Why $99,800 Is An Important Resistance To Break

Published

4 months agoon

By

admin

The Bitcoin price is approaching the $100,000 level again after experiencing significant declines these past weeks. A crypto analyst has pointed out that the critical resistance level at $99,800 is crucial for Bitcoin’s next move. If the pioneer cryptocurrency can break through this level, it could trigger a significant breakout, potentially propelling Bitcoin past the $100,000 mark.

Related Reading

Bitcoin Price Faces Resistance At $99,800

Prominent crypto analyst Ali Martinez has shared a chart showing an In/Out of the Money Around Price (IOMAP) analysis of the distribution of Bitcoin wallets based on their purchase price. According to the analyst, the Bitcoin price is facing extreme resistance between the $97,500 and $99,800 price levels as it tries to breach $100,000 again.

Martinez noted that around this price range, approximately 923,890 wallet addresses had purchased over 1.19 million BTC. This price zone acts as an important resistance level because many Bitcoin holders may look to sell and break even, potentially exerting selling pressure.

In the IOMAP chart shared by Martinez, the green dots that signal ‘In the Money’ represent price levels below the current Bitcoin price, where wallet holders are in profit because they bought BTC at a lower value. On the other hand, the red dots that represent ‘Out of the Money’ show price levels of Bitcoin’s present value, where wallet holders are at a loss because they bought BTC at a higher price.

Lastly, the white dot indicates ‘At the Money’ and represents the current price of Bitcoin at an average of $98,676, where some crypto wallets see neither profit nor loss.

Below Bitcoin’s current price, the chart shows strong buying zones, which could provide strong support if the pioneer cryptocurrency experiences a potential pullback. Martinez has forecasted that breaking through the critical resistance range between $97,500 and $99,800 would signal the start of a bullish rally for Bitcoin, potentially leading it to a new all-time high.

Currently, the Bitcoin price is trading at $98,652, steadily rising to return to previous highs above $100,000. To a new all-time high, Bitcoin will have to surge by over 7%, surpassing its present ATH above $104,000.

Related Reading

Bitcoin’s Biggest Gains To Come After Christmas

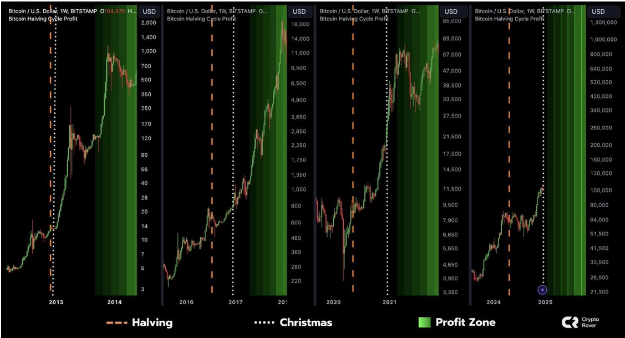

A popular crypto analyst identified as the ‘Crypto Rover’ has expressed optimism about Bitcoin’s near-term price potential this Q4. According to the analyst, Bitcoin has historically experienced its most significant gains right after Christmas during the halving years.

The analyst shared a price chart showing Bitcoin’s market performance during each halving cycle. In the 2012 halving year, Bitcoin started a significant price rally, which extended into the following year. The same bullish trend occurred in the next halving years in 2016 and 2020, with Bitcoin hitting exponential price highs.

Based on this historical trend, Crypto Rover projects that Bitcoin could witness a similar bullish surge before the end of 2024, with the rally potentially continuing into 2025.

Featured image from Bloomberg Images, chart from TradingView

Source link

You may like

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

accumulation

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

Published

4 hours agoon

April 18, 2025By

admin

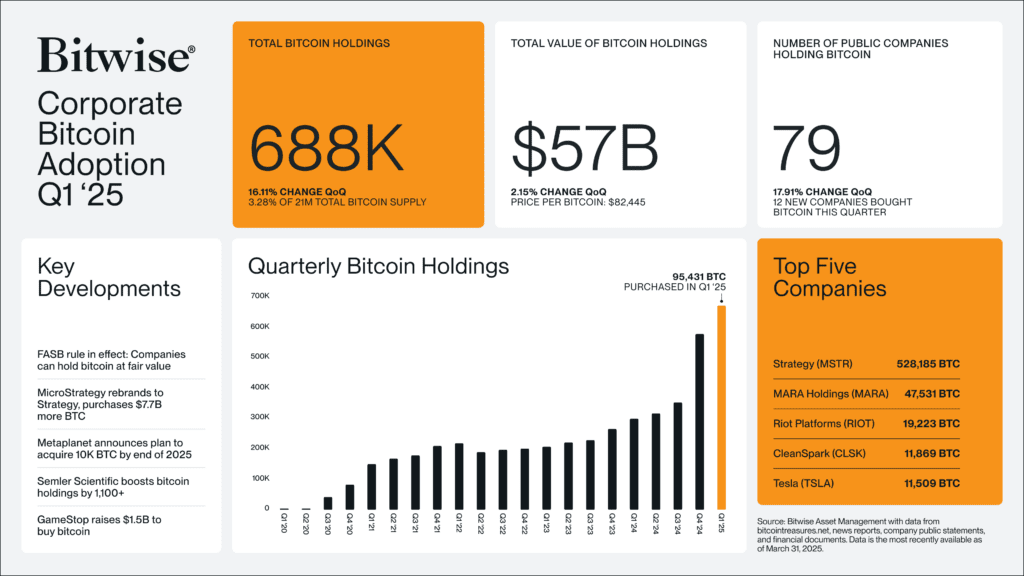

Public Companies Now Hold Over 688K BTC, Signaling Record Institutional Bitcoin Adoption

Bitcoin adoption by public companies has reached an all-time high, according to a new report from Bitwise. In Q1 2025, publicly traded firms now hold a combined over 688,000 BTC, up 16.11% quarter over quarter, representing 3.28% of Bitcoin’s fixed 21 million supply.

This corporate treasure trove is valued at over $57 billion, based on a Bitcoin price of $82,445, reflecting a 2.15% increase in total value from the previous quarter. The number of public companies with Bitcoin on their balance sheets has also grown to 79, a 17.91% quarterly increase, with 12 new companies joining the list.

Bitwise attributes the uptick in adoption to several key developments, most notably the Financial Accounting Standards Board (FASB) rule allowing companies to report Bitcoin at fair market value. This accounting shift has eliminated a major friction point for CFOs and boards, paving the way for more companies to easily adopt BTC as a reserve asset.

MicroStrategy—now rebranded as Strategy—continues to lead the charge, purchasing $7.7 billion worth of Bitcoin in Q1 and increasing its total holdings to 531,644 BTC after an additional buy of 3,459 BTC worth $285.8 million earlier this week.

Other notable top Bitcoin holders include MARA Holdings (47,531 BTC), Riot Platforms (19,223 BTC), CleanSpark (11,869 BTC), and Tesla (11,509 BTC).

Japanese firm Metaplanet announced plans to acquire 10,000 BTC by the end of 2025, while Semler Scientific added 1,100+ BTC to its balance sheet and filed this week to raise $500 million to buy more. “We have reached a settlement in principle, EXCITED TO BUY MORE BTC!” posted Chairman Eric Semler on X. In a recent interview with Bitcoin Magazine, he added: “We own a lot of #Bitcoin and that Bitcoin appreciates. What matters most is that we create shareholder value… We’re early in accumulating Bitcoin, and we’re gonna continue to do that.”

Meanwhile, GameStop is holding $1.5 billion in newly raised funds under the codename Project Rocket to invest in Bitcoin, adding to its $4.75 billion cash reserves. Though they have yet to deploy the funds, their participation may further fuel corporate demand in coming quarters.

With 95,431 BTC purchased in Q1 alone, the report suggests this momentum is only building.

Source link

Bitcoin

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Published

10 hours agoon

April 17, 2025By

admin

Bitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

Markets dipped on Wednesday after hawkish comments from Powell, who criticized Trump’s tariffs policy, saying that it would likely result in a slowing economy and rising prices — what economists call “stagflation.” In his remarks, Powell made clear his larger focus for now would be on prices, suggesting tighter Fed policy than otherwise thought.

Trump — who nominated the former investment banker and lawyer as Fed chair during his first term (Powell was given a second four-year term by President Biden) — has expressed his displeasure with Powell since retaking the White House. Powell, though, who is set to remain atop the central bank until May 2026, has repeatedly stated his determination to finish his term and suggested the president has no standing to fire him.

On Thursday, the WSJ reported that Trump has been privately discussing firing Powell for months, according to people familiar with the matter. Former Fed Governor Kevin Warsh is reportedly waiting in the wings as Powell’s replacement, but Warsh has lobbied the president not to move against the Fed chair, according to the story.

Joining Warsh in that warning is Treasury Secretary Scott Bessent, who said the move could roil already shaky U.S. markets as the central bank is supposed to be independent from political influences.

Odds of Trump removing Powell this year on the blockchain-based prediction market Polymarket rose to 19%, the highest reading since the contract’s late January launch.

Trump’s comments came on the back of the European Central Bank (ECB) cutting key interest rates for the seventh consecutive occasion on Thursday as it warned of a deteriorating growth outlook.

More pressure on markets came from the latest Philadelphia Fed manufacturing index, published Thursday morning, which showed a nosedive in activity this month, sinking to its lowest level (-26.4) in two years. Meanwhile, the prices paid index climbed to its highest reading since July 2022, adding to concerns about the Trump administration’s large-scale tariff policy pushing the U.S. economy into stagflation.

The S&P 500 and tech-heavy Nasdaq stock indexes traded mostly flat during the day.

A look at the crypto market showed BTC and Ethereum’s ETH up 0.8% over the past 24 hours. Most assets in the CoinDesk 20 Index traded higher during the day, with bitcoin cash (BCH), NEAR and AAVE leading gains.

How bitcoin traders position amid heightened fear on Wall Street ?

Bitcoin has stabilized between $83k and $86k with traders chasing bullish bets while still seeking downside protection.

On Deribit, traders are actively chasing calls at the 90k to $100k strikes expiring in May and June, the exchange said in a market update Thursday. The demand for calls indicates expectations for a continued price rally.

Some of these bullish bets have been funded by premiums collected by selling put options.

At the same time, there has been renewed interest in buying put options at $80k expiring this month, representing preparations for potential price declines. Buying a put option is akin to purchasing insurance against price slides.

The diverse two-way flow comes as the VIX, Wall Street’s fear gauge measuring the 30-day implied volatility, still remains well above its 50-day average, despite the pullback from recent highs above 50.

The VIX is warning that the macro situation is still unraveling rather than resolving, the exchange said on X.

Source link

Bitcoin

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

Published

12 hours agoon

April 17, 2025By

admin

Recently, Project Eleven (a quantum computing research group) announced a 1 bitcoin reward for the first team able to complete a challenge to demonstrate breaking a ECC (elliptic curve cryptograph) key using Shor’s algorithm on a quantum computer.

The deadline for this challenge is April 5th, 2026, meaning in order to qualify for the prize a team must demonstrate breaking a key pair it must be done before that deadline.

This is frankly a completely absurd and meaningless prize for a number of reasons, the first of which is the deadline of just under a year from today. Even highly optimistic projections about the progress of quantum computing put the timeline of practically achieving such a goal at more like 5-10 years. Expecting a workable proof of concept demonstration that actually breaks a keypair in a single year is pretty laughable at face value, even if you do view quantum computing as a material threat in the short term.

Next is the factor of economic incentives. A single bitcoin is currently worth approximately $80,000. That is frankly not a lot of money in the grand scheme of things. Especially when it comes to the application of a cutting edge technology like quantum computing that can perform an entire class of computation exponentially faster than a classical computer. Imagine how much more valuable things could be done with a working quantum computer.

You could eavesdrop on internet connections regardless of TLS, breaking secure connections to banks, equity brokerages, private corporate networks not using post-quantum cryptography. You could break every private messenger application on the planet, you could decrypt any PGP encrypted message sent over email that you knew the public key for. You could break the entire DNS system’s certificate authority hierarchy, allowing you to impersonate any server in the world a user tries to connect to.

All of these things have immeasurable value beyond just a mere $84,000. Why on Earth would someone with a working quantum computer publicly reveal that fact to claim a single bitcoin when they could take advantage of all these other things they would be capable of doing?

Okay, let’s sweep all of those possibilities aside and pretend the entire world magically migrates to post-quantum cryptography aside from Bitcoin. It still makes no sense to try to publicly claim this prize if you have a functional quantum computer.

Let’s assume you have a barely performant enough quantum computer, that it takes a decent amount of time to crack a single key. How many bare public keys are there securing 50 BTC outputs from the first mining epoch? THOUSANDS of them. Why on Earth would you crack one, and then go tell everyone publicly to claim a single bitcoin? You would just try to crack as many of those early coinbase rewards as possible before people detected you.

Finally, the timetable on its own is just absurd. Quantum computers currently are not even capable of factoring prime numbers that people can do themselves in their heads mentally. In a single year the technology is going to jump from that to cracking Bitcoin keys? That’s absurd.

So what the hell is the point of this prize except some publicity stunt? It’s utterly meaningless as a serious bounty to function as a canary in the coalmine for us, no matter how concerned or unconcerned you are with the timeframes of quantum computers as a threat.

This bounty is a joke.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals