Cardano

Why Cardano Price Jumped 17% After Breaking Resistance

Published

5 months agoon

By

admin

Cardano (ADA) price has emerged as a top performer in the latest crypto market surge, recording over 17% growth within 24 hours. This significant price increase aligns with gains seen across various cryptocurrencies, reflecting renewed interest and positive momentum in the crypto space. With ADA breaking key resistance levels, the altcoin shows potential for continued upward movement, signaling a favorable outlook in the evolving digital currency landscape.

Cardano Price Surges 17% After Breaking Key Resistance Level

The latest ADA price has surged 17% in the last 24 hours, reaching $0.4236 and hitting a four-month high. This jump followed a broader market rally, with Cardano rebounding over 23% in the past week after breaking through a multi-month downtrend. The crypto market gained momentum after Donald Trump’s victory in the 2024 U.S. presidential election, fueling optimism across digital assets.

Bitcoin, leading the charge, set a new all-time high of $76,943 on November 7, while Ethereum also rose above $2,900. Cardano’s strong performance highlights renewed investor interest, pushing it past key resistance levels and outperforming other top crypto markets in recent gains.

Address Activity and Whale Transactions Fueling the Surge

Data reveals that Cardano has hit notable milestones during this surge. A record-breaking 37,892 unique ADA addresses engaged in transfers in a single day, marking the highest address activity since early September.

Furthermore, substantial transactions of $100,000 or more reached 697 on the same day, indicating intensified activity from large investors, or “whales,” the highest count since early September.

The latest rally has pushed Cardano above the $0.43 mark for the first time since July, a promising sign for ADA enthusiasts. This sustained increase in address activity and whale transactions suggests heightened market confidence, with potential FOMO building among retail investors. As Cardano rides this bullish wave, the community watches closely to see if the momentum will continue.

Cardano has been one of the notable surprise altcoins taking flight during this crypto-wide pump. Now up over +25% in the past 3 days, we may be seeing some retail FOMO coming soon. This has been a long time coming for the patient ADA community. pic.twitter.com/Ph2ZFFKnIU

— Santiment (@santimentfeed) November 8, 2024

Analyst Eyes 100% Upside for ADA Price

Crypto analyst recently hinted at a promising potential for an ADA price surge. According to his analysis, ADA could witness a 100% upward movement, suggesting a major breakout is on the horizon. The analyst highlights a prolonged period of price consolidation, with ADA forming a consistent descending trendline.

Breaking this trendline could pave the way for significant gains, possibly doubling ADA’s current value. Technical indicators hint at a shift in momentum, adding weight to the analyst’s forecast. The volume profile also shows increased buying interest, indicating rising investor confidence.

#ADA: Watch out, 100% move possible. #Cardano pic.twitter.com/79qUqfAxnV

— Mind Trader (@mindandtrading) November 8, 2024

Cardano’s recent breakout, record address activity, and rising interest from major investors create a strong case for its growth. The top coin could maintain its momentum with favorable market conditions and potentially approach $1 soon.

Frequently Asked Questions (FAQs)

Cardano surged after breaking resistance and amid a crypto market rally.

Increased whale activity, high address engagement, and breaking resistance fueled it.

It indicates rising user engagement, which boosts confidence and interest in ADA.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Altcoins

Ethereum Price Suffers 77% Crash Against Bitcoin, On-Chain Deep Dive Reveals Reasons Why

Published

3 days agoon

April 13, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Despite rolling out a large number of upgrades and innovations, the Ethereum price continues to lag behind Bitcoin (BTC) by a wide margin. Reports reveal that ETH has suffered a staggering 77% price crash against BTC — a decline likely fueled by a mix of technical, macro, and sentiment-driven factors. Notably, On-chain analytics platform, Santiment has now pinpointed and broken down the key reasons behind these price struggles.

Ethereum Price Nosedives Against Bitcoin

On April 11, Santiment released a detailed report on Ethereum, highlighting its almost four-year underperformance and the reasons behind it. Ethereum, once revered as the cryptocurrency most likely to dethrone Bitcoin, has recently suffered a brutal price decline when measured directly against BTC.

Related Reading

According to Santiment’s on-chain data, Ethereum has crashed by approximately 77% against Bitcoin since December 2021. While the dollar value of ETH hasn’t completely collapsed, especially compared to other altcoins, the long-term BTC/ETH ratio still paints a gruesome picture for Ethereum holders.

Notably, Ethereum has also failed to recover anywhere near its November 2021 all-time high of $4,760. In contrast, Bitcoin has surged ahead, reclaiming much of its market dominance and outpacing ETH across almost every timeframe.

This disparity has led many traders and former maximalists to compare ETH to a “shitcoin.” Even worse, various mid to low-cap altcoins have already outperformed Ethereum over the short, mid, and long-term timeframes, causing further embarrassment for the world’s second-largest cryptocurrency by market capitalization. Based on Santiment’s report, the ETH/BTC price ratio chart alone is enough to trigger doubt and uncertainty among long-term holders.

Behind The Scenes Of Ethereum Price Struggles

Beyond price action and market volatility, Santiment reveals that there are fundamental reasons for Ethereum’s sluggish performance over the years. Some of the major criticisms that analysts and traders have pinpointed include technical, sentimental, and regulatory issues.

Related Reading

Ironically, Ethereum’s Layer 2 solutions are one of the key drivers of its underperformance. L2 solutions like Arbitrum, Optimism, and zkSync are reportedly cannibalizing activity on the mainnet, taking investments from ETH while spreading investor attention thin.

Secondly, Ethereum seems to struggle with complex roadmaps and communication, which has led to investor confusion. Major updates like The Merge and Shanghai have been difficult for investors to comprehend, making ETH feel less accessible than BTC.

Thirdly, users remain frustrated by Ethereum’s relatively high gas fees and the slow rollout of key upgrades. This has pushed them toward more affordable and faster alternatives, significantly reducing adoption.

Another primary reason for Ethereum’s crash against Bitcoin is ongoing regulatory concerns. Unlike Bitcoin, which has a more established legal precedent, Ethereum faces constant uncertainty about whether it could be labeled a security.

Other points include ETH’s lack of investment appeal. While Bitcoin maintains the title as a stable digital gold, Ethereum appears to be caught in between, having no clear or attractive investment narrative. Moreover, newer blockchains like Solana and Cardano are also attracting a significant number of users with cheaper and faster solutions, ultimately pulling investments away from ETH.

The final reason Santiment has identified for Ethereum’s long-term price descent is rising selling pressure. Post-upgrade withdrawals of stakes ETHs have created steady sell-side pressure, limiting growth and momentum compared to Bitcoin.

Featured image from Unsplash, chart from Tradingview.com

Source link

Altcoin

Ethereum, Solana And Cardano Trend After Crypto Crash

Published

2 weeks agoon

April 6, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

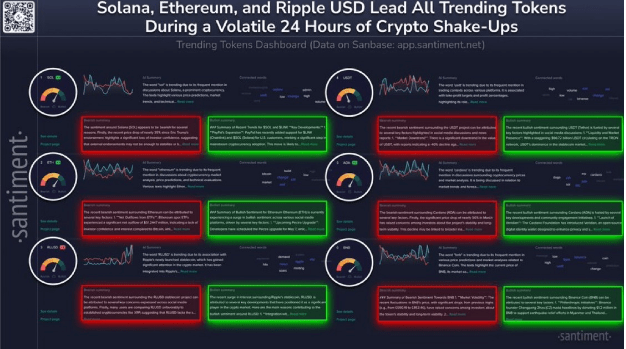

Despite the recent crypto crash that sent most digital assets tumbling, Ethereum (ETH), Solana (SOL) and Cardano (ADA) have managed to hold their ground. According to latest reports, these three cryptocurrencies are now leading the charts as the most trending coins in the market after the crash.

Related Reading

Santiment Unveils Top Trending Cryptos

The crypto market took a significant hit after fears of new tariffs implemented by United States President Donald Trump rattled investors and sent digital assets plunging across the board. However, while US stock markets closed, signs of recovery began to emerge across specific cryptocurrencies, with Ethereum, Solana, and Cardano leading the post-crash chatter.

According to an X (formerly Twitter) post by Santiment, a market intelligence platform, Solana is now back in the headlines as market analysts closely watch its price action following its crash.

The popular meme coin is seeing an increased level of speculative predictions, market trends, and technical chart breakdowns. As a result, SOL is recapturing the attention of retail and institutional investors. There’s also been notable activity within the Solana network as anticipation for a price rebound or breakout keeps spreading.

Ethereum is also trending in the crypto market, not just for its prolonged price slump and reaction to the crypto crash, but its ongoing transition to Ethereum 2.0 — a key upgrade focused on scalability and energy efficiency.

Santiment notes that analysts are highlighting Ethereum’s network performance during the market stress, showcasing an increase in discussions about the cryptocurrency’s market analysis. There have also been increased price predictions, technical evaluations, and talks about the cryptocurrency’s scalability and adoption.

Just like Solana and Ethereum, Cardano is seeing renewed attention as traders assess the cryptocurrency’s position in the broader market. There has been an influx of mentions surrounding Cardano’s market trends, with users speculating on its future price action and potential investments. Forecasts for the ADA price also range widely, with social media buzz and speculative posts fueling the cryptocurrency’s presence on trending charts.

While not as widely discussed as ETH, SOL, and ADA, Binance Coin (BNB) has also been showing up in technical forecasts. Santiment reveals that analysts are tracking BNB’s trading ranges and potential price movements, making it a focal point for investors and traders.

Related Reading

Stablecoins Join List Of Trending Assets

In addition to the altcoins above, Santiment has disclosed that stablecoins have also joined the list of top trending assets. While Ethereum, Solana, and Cardano experienced major declines after the crypto crash, stablecoins, as their names imply, remained stable against the dollar.

Ripple’s newly launched stablecoin RLUSD is trending due to its association with the crypto payments company, which gained significant attention following the completion of its legal battle with the US Securities and Exchange Commission. The stablecoin has been integrated into Ripple’s payment system, improving cross-border transactions and attracting institutional interest.

There has also been a significant increase in adoption and trading volume, with crypto exchange Kraken reporting an 87% surge in the latter and a $10 billion growth in the former.

Featured image from Gemini Imagen, chart from TradingView

Source link

24/7 Cryptocurrency News

Cardano Price Can Clinch $1 As It Eyes Bounce From New Support Zone

Published

2 weeks agoon

April 4, 2025By

admin

While predictions for Cardano to $1 may seem like a far cry, a cryptocurrency expert has injected new life into the claims. Cardano’s price is headed below 50 cents in search of a new support zone that can serve as a springboard to reach new highs.

Cardano Price Can Still Clinch $1 Despite Price Slump

Market technician Jonathan Carter in an analysis on X predicts that Cardano’s price can reclaim the $1 price point in the coming months. According to Carter, the recent ADA correction will not be a hindrance for Cardano’s price to reach $1.

ADA has lost a jarring 13% over the last week and trades at $0.64 in an unremarkable week for the cryptocurrency. On the daily charts, prices have generally moved sideways, underscoring a lack of investor enthusiasm.

For Carter, Cardano’s recent decline has seen it fail to stay above the $0.65 support level. The analyst opined that a downtrend is the offing for the Cardano price that could see a new support zone of $0.59. Carter says the new $0.59 support zone will hurl Cardano price to reach $1.

“Despite the long correction, the price still has a chance to bounce off this support and rise towards $1,” said Carter. “Otherwise, we will fall to the lower border of the broadening wedge.”

While some investors are eyeing an ADA bounce to $0.70, a plausible play will be a slump below $0.60 before the start of a rally.

A Slew Of Positives For ADA

Despite the pervading negative sentiment around ADA price, the cryptocurrency has a wave of positive fundamentals going for it. Cardano price spiked following Charles Hoskinson’s confirmation of Ripple’s RLUSD on ADA.

Furthermore, Charles Hoskinson reveals that Cardano will play a major role in Bitcoin decentralized finance (DeFi) application. In more positive technicals, Cardano price is forming a cyclical pattern from 2024 that can send prices to astronomical proportions in May.

While the prediction pegged prices at $2.5, optimists say ADA price to $10 is not a crazy hypothesis. The report cites present solid fundamentals and ADA’s over 1,000% spike to set its all-time high back in 2021 as pointers for the seismic rally to $10.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

The Inverse Of Clown World”

Bitcoin Indicator Flashing Bullish for First Time in 18 Weeks, Says Analyst Who Called May 2021 Crypto Collapse

3iQ and Figment to launch North America’s first Solana staking ETF

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: