Altcoin

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Published

4 months agoon

By

admin

Meme coins ranked among the most popular crypto narratives of 2024, creating a divide between crypto tokens. Bitcoin stands out among top crypto tokens with 125% year-to-date gains, and the meme coin category, or the “other tokens”, hit a key milestone, crossing a market capitalization of $100 billion.

Dogecoin (DOGE), Shiba Inu (SHIB) and Pepe (PEPE), the top three meme coins, have erased between 11% and 13% of their value in the past week. Bitcoin consolidates close to $95,000, nearly 12% below its all-time high of $108,353.

Bitcoin vs meme coins, most popular narrative of 2024

Meme coins captured the attention of most crypto traders and emerged as a popular narrative this year. A CoinGecko report updated on Monday notes that the meme coin narrative captured a combined 30.67% of global investor interest.

The report highlights that almost a third of crypto narrative interest this year was focused on speculative gains from meme coins. Traders placed a lower emphasis on fundamentals and turned their attention and capital towards dog and cat-related meme coins, pop culture references and internet personality-themed meme tokens.

Meme coins have enjoyed a 6% year-on-year increase in interest from crypto market participants. While Bitcoin garnered institutional attention and capital allocation following the approval of Spot BTC ETFs in the US, four meme coin-based trends ranked among the top 20 narratives in crypto.

Solana (SOL), Base, Artificial intelligence and cat-themed meme coins garnered between 14% and 8% of interest among crypto narratives.

With meme coins cementing their place as a trending token category and trending this cycle, catalysts like institutional allocation and ETF approval could pave the way for further gains for holders.

Base, Solana, XRP memes dominate over blue-chip memes in speculative gains

In the first week of December, XRP-based meme coins yielded gains for holders amidst rising relevance and demand for the XRP Ledger and its native token XRP. Similarly, Solana and Base-based meme coins have secured a rank in the top 20 cryptocurrency narratives of the year, dominating the popularity of blue-chip meme coins.

Dogecoin, SHIB and PEPE are typically considered blue-chip memes, with a market capitalization between $7 and $46 billion, as seen on CoinGecko. The top 3 tokens in the meme coin category observed a spike in active addresses and activity from traders within the first two weeks of December.

In the last seven days, the top 3 tokens have erased double-digit value, according to CoinGecko data. Several other meme tokens have accumulated double-digit losses, barring Pudgy Penguins (PENGU).

Institutional meme coin holdings tripled this year

The wave of meme coin adoption drove institutions to tripe their holdings in the category. From February to March 2024, institutional investors’ spot holdings of memecoins climbed from $62.5 million to $204.8 million.

This marks a 226% surge, a significant spike in interest in the memecoin market, according to Bybit’s report on institutional investment in meme coins.

In the Bybit report, Eugene Cheung, Head of Institutions of Bybit, is quoted as saying:

“Our report ‘Beyond the Hype’ shows that institutional and retail investors are actively leveraging the opportunities presented by the memecoin market. The strategic agility of institutions and the dynamic management by retail investors reflect a sophisticated engagement with these assets. We invite everyone to delve into the full report to understand these important dynamics better.”

Dogecoin ETF likely in 2025?

Rising institutional adoption has raised questions about the likelihood of approval from the U.S. financial regulator, the Securities and Exchange Commission, for meme coin ETFs. Nate Geraci, President of ETFStore expressed shock that an issuer has yet to file for a Dogecoin ETF, both in and outside of the U.S.

Geraci believes the only possible downside of such a filing would be that it would mark a futile attempt and end up as a marketing expense for an issuer. The President of the ETFStore commented on the “DOGE” ticker since it is the ticker for the largest meme coin and would likely hold the highest relevance and demand among issuers in the future,

Shocked an ETF issuer hasn’t filed for Dogecoin ETF yet…

What’s the downside?

Worst case, it’s a marketing expense.

Wonder which issuer is sitting on the “DOGE” ticker.

— Nate Geraci (@NateGeraci) December 23, 2024

As the SEC greenlights the Bitcoin-Ethereum hybrid ETF, DOGE traders have hopes for a Dogecoin ETF approval in 2025.

Bitcoin and meme coin divide runs deep

Ruslan Lienkha, Chief of markets at YouHodler told Crypto.news in an exclusive interview:

“Dogecoin’s recent performance appears primarily speculative, driven by its association with Elon Musk, rather than any underlying fundamentals, as it still lacks substantial real-world use cases. However, a potential utility could develop in the future.”

Lienkha comments on what divides Dogecoin and similar meme coins from Bitcoin. While Bitcoin has gained acceptance as “digital gold” and hedge against the devaluation of a fiat currency, Dogecoin and the like are considered speculative tokens.

The Bitcoin and meme coin divide runs deep and could influence the approval of a meme coin ETF, further investment from institutional investors and retail participation in the category in the second leg of the bull market.

Typically, a drawdown in Bitcoin ushers a steeper and market-wide correction, wiping recent gains from meme coins and hitting the market capitalization of the category negatively. The correlation with Bitcoin could continue to drag down meme coins, and in every instance, the largest crypto crashes or reacts to a market-moving event during this cycle.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Altcoin

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Published

20 minutes agoon

April 28, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price is eyeing a surge of 20% as it looks to reach a major resistance zone at $2.50, providing a bullish outlook for the altcoin. This projection comes amid XRP’s pullback to retest the breakout zone, with a confirmation of this breakout likely to lead to new highs.

XRP Price Eyes 20% Surge To $2.51

In a TradingView post, crypto analyst Liam indicated that the XRP price could soon rally to the key resistance level at $2.15803. The analyst highlighted $2.29387 and $2.40995 as the other key resistance levels for the altcoin. Meanwhile, he mentioned that $2.18880 and $2.08373 are the key support zones to keep an eye on.

Related Reading

Liam also commented on the current XRP price action and what needs to happen for the altcoin to reach this $2.51 target. He noted that the altcoin recently broke above a key consolidation range but is now pulling back to retest the breakout zone. If the support between $2.18880 and $2.08373 holds, then the altcoin could initiate a strong bullish rally towards the resistance zones, with $2.51803 as the major target.

The crypto analyst advised market participants to closely monitor price action around the retest zone. He claimed that a strong bullish rejection from support could offer a high-probability long opportunity toward the higher targets.

The XRP price currently boasts a bullish outlook, with the broader crypto market witnessing a reversal from recent lows. XRP’s fundamentals also support a price. CME Group recently announced plans to launch XRP futures contracts in May, while ProShares Trust XRP ETF could launch soon, which would also provide institutional investors with exposure to the fourth-largest crypto by market cap.

$2.24 Is Also A Major Resistance To Keep An Eye On

Crypto analyst CasiTrades suggested that $2.24 is another major resistance level to keep an eye on for the XRP price. She noted that this level has been a key focus for weeks. XRP recently broke above this level as it surged to $2.27 but faced strong rejection, and is now looking to retest $2.24 as resistance.

Related Reading

CasiTrades asserted that price remains vulnerable to deeper support until it can reclaim and close above $2.24. On the bullish side, the analyst claimed that this is a critical area that needs to be respected to keep bullish momentum intact. Crypto analyst Dark Defender assured that XRP will continue to climb to the top. His accompanying chart showed that the altcoin could reach as high as $8 in this market cycle.

At the time of writing, the XRP price is trading at around $2.28, up over 5% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pixabay, chart from Tradingview.com

Source link

Altcoin

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Published

16 hours agoon

April 27, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin’s price is entering a new bullish phase after months of decline. Technical analysis of the daily candlestick timeframe chart shows that the popular meme cryptocurrency is flashing a trend reversal, hinting at a significant shift from bearish to bullish momentum.

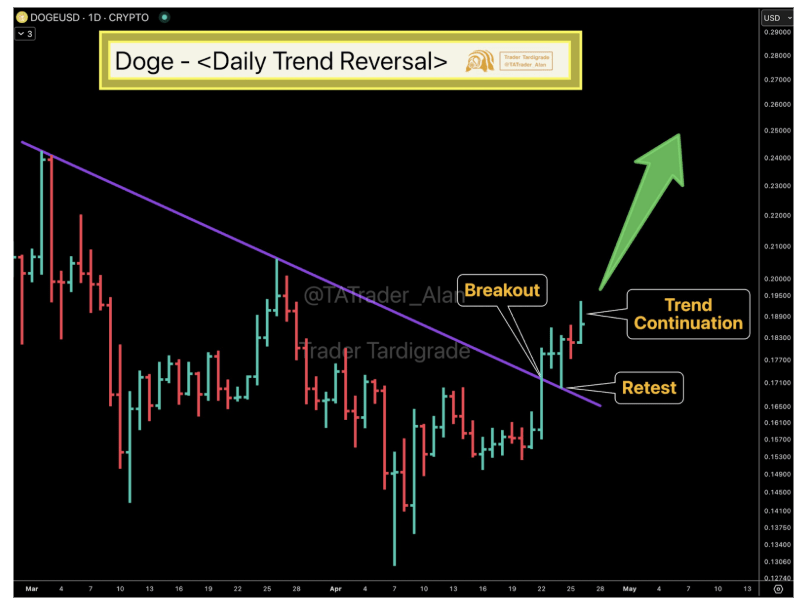

Analyst Flags Daily Trend Reversal On Dogecoin Chart

A prominent crypto analyst known as Trader Tardigrade has highlighted a confirmed trend reversal for Dogecoin. In a post on X (formerly Twitter) this week, he pointed out that DOGE’s daily chart has flipped from a downtrend to an uptrend. This claim is reinforced by a technical analysis of Dogecoin’s price action.

Related Reading

Dogecoin’s price recently broke above a descending trendline that had defined its downtrend for several weeks. This breakout occurred on April 22, when Dogecoin closed above $0.165 on the daily candlestick timeframe. This breakout was the first step indicating the coin was escaping its bearish trajectory.

Shortly after breaching the downward sloping resistance line, Dogecoin’s price pulled back between April 23 and April 24 to retest the same trendline, but this time from above. Importantly, the former resistance trendline held strong as a new support level during the retest. Following that successful test, Dogecoin resumed its upward climb, marking the continuation of the new uptrend.

This pattern of breakout, retest, continuation is a classic technical confirmation of a trend reversal. The successful retest of this trendline gives more confidence that the bullish shift is real and not a false signal.

Image From X: Trader Tardigrade

Bullish Target: $0.25 By Early May

With the daily trend now pointing upward, the focus is now on how far this new uptrend could carry Dogecoin. According to Trader Tardigrade’s analysis, Dogecoin could continue climbing in the coming days, potentially crossing the quarter-dollar mark very soon. As indicated on the chart he shared by Trader Tardigrade, the next Dogecoin price target is around $0.25 by the first week of May.

If achieved, a rise to $0.25 would be a significant milestone, considering Dogecoin has been stuck in a downtrend for over 10 weeks. As such, a break to $0.25 would mark Dogecoin’s highest price since late February and a robust recovery from its recent lows around the $0.14 to $0.15 range. Such a move would also represent roughly a 51% gain from the breakout level of $0.165.

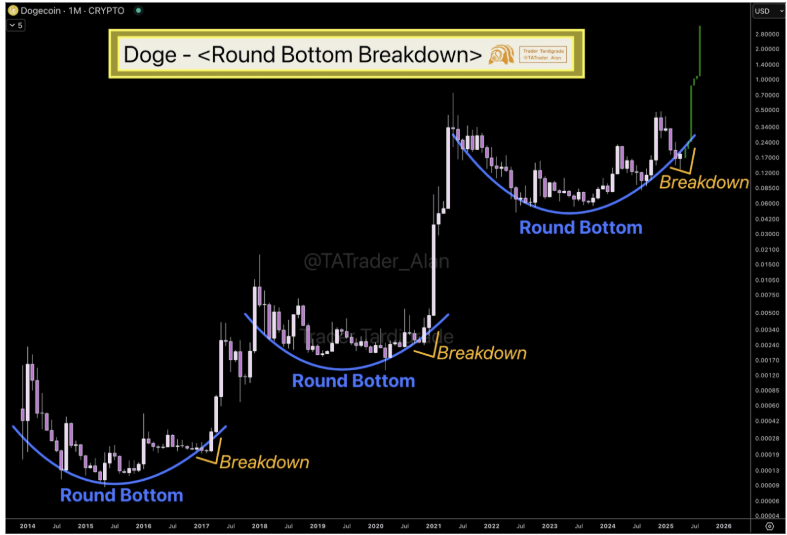

However, $0.25 is only the target in the short term. In a separate analysis, Trader Tardigrade pointed to Dogecoin’s long-term chart, highlighting a round bottom formation. The accompanying chart shows that in previous cycles, Dogecoin’s price formed a rounded bottom before entering explosive upward trends. This repeated pattern, now visible again on the monthly timeframe, signals that Dogecoin may be on the verge of another significant breakout. The long-term price target in this case is $2.8.

Image From X: Trader Tardigrade

Related Reading

At the time of writing, Dogecoin is trading at $0.18.

Featured image from Unsplash, chart from TradingView

Source link

Altcoin

TAO price action shifts hints at 200% rally potential, but one key confirmation remains

Published

3 days agoon

April 25, 2025By

admin

TAO has recently shown signs of breaking free from its extended bearish market structure with a decisive impulse move. While this shift is promising, if a higher low is established at a key confluence zone, TAO could be setting up for a potential 200% rally toward the previous range high.

Over the past several weeks, Bittensor (TAO) has been locked in a steady downtrend, consistently printing lower highs and lower lows. That pattern may now be changing. The recent impulsive move broke above a significant lower high, marking the first real break in TAO’s bearish structure. Now, price is hovering around a high-probability zone for continuation—provided buyers can confirm a valid higher low.

Key technical points

- TAO Breaks Bearish Market Structure: TAO has broken the most recent lower high, signaling a potential shift in trend for the first time since the range high.

- Testing the 0.618 Fibonacci and VWAP: Price is now testing the golden Fibonacci level, which aligns with the VWAP drawn from the top of the current downtrend, forming a crucial area of technical confluence.

- Point of Control (POC) as a Pivot Zone: If TAO confirms a higher low at this zone, where POC, VWAP, and 0.618 Fib all intersect, it increases the probability of a strong bullish impulse.

From a technical perspective, this current zone of interaction is highly significant for TAO. The confluence of key indicators, specifically the point of control, 0.618 Fibonacci level, and anchored VWAP, creates a strong area of interest. If buyers defend this level and TAO forms a higher low, the setup for a Wave 3 bullish impulse becomes far more likely. This would target the previous range high, equating to a projected 200% rally from the current zone.

Zooming out to the macro structure, TAO remains inside a large sideways range. The recent bounce from the range low shows clear signs of buyer activity, indicating demand at lower levels.

Should TAO begin consolidating above this confluence zone, form a bullish market structure, and show strong volume profile support, the odds of a full range rotation increase sharply.

What to expect in the coming price action

TAO is at a critical inflection point. If the higher low confirms at this confluence zone, the bullish case strengthens dramatically. A successful retest could spark a powerful continuation move, offering one of the clearest 200% setups in the current market structure.

Source link

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines