Bitcoin Magazine Pro

Why Smart Investors Buy Bitcoin Not Real Estate

Published

2 months agoon

By

admin

In today’s dynamic economic landscape, seasoned investors are reevaluating their portfolios and considering the potential of Bitcoin as an alternative to traditional assets like real estate. With a finite supply and transformative growth potential, Bitcoin presents a compelling case for forward-thinking investment strategies.

Real Estate: The Illusion of Stability

Real estate has long been regarded as a safe haven for preserving wealth. However, the housing market is not immune to systemic risks such as interest rate hikes, government intervention, and economic downturns. Moreover, property investments often require significant maintenance costs, taxes, and liquidity sacrifices.

Bitcoin, in contrast, offers unparalleled portability, resistance to confiscation, and immunity from local economic or geopolitical disruptions. Unlike property, Bitcoin has no maintenance costs or physical constraints.

The Rise of Bitcoin as a Store of Value

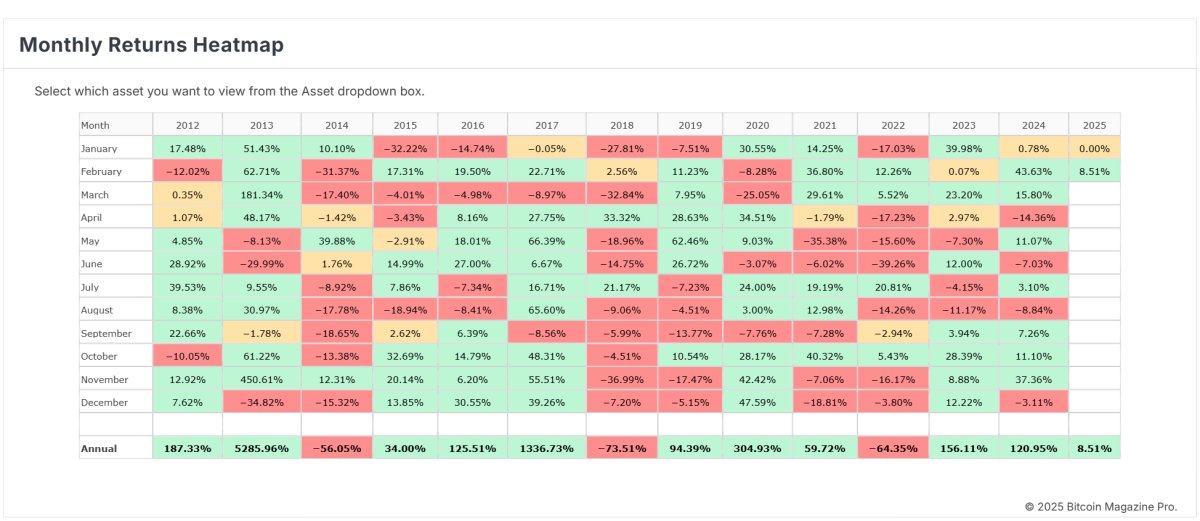

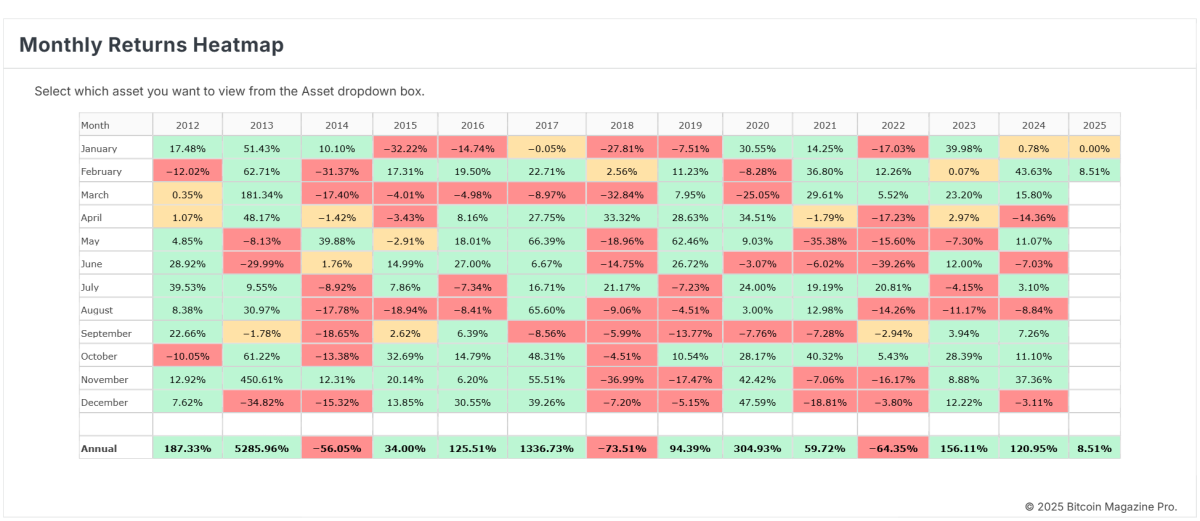

Bitcoin’s limited supply of 21 million coins establishes it as “digital gold” for the 21st century. Over the past decade, Bitcoin has consistently outperformed other asset classes, delivering exponential returns despite volatility.

In comparison, real estate’s appreciation is often tied to inflation and government monetary policy, which can diminish its true value over time. Bitcoin, on the other hand, operates on a deflationary model, ensuring scarcity and preserving purchasing power.

Liquidity and Accessibility

Real estate investments often require lengthy transactions, high fees, and significant regulatory hurdles. Selling a property can take months, tying up capital and reducing agility. Bitcoin, however, offers instant liquidity and can be traded 24/7 on global exchanges. This accessibility empowers investors to move their wealth seamlessly across borders.

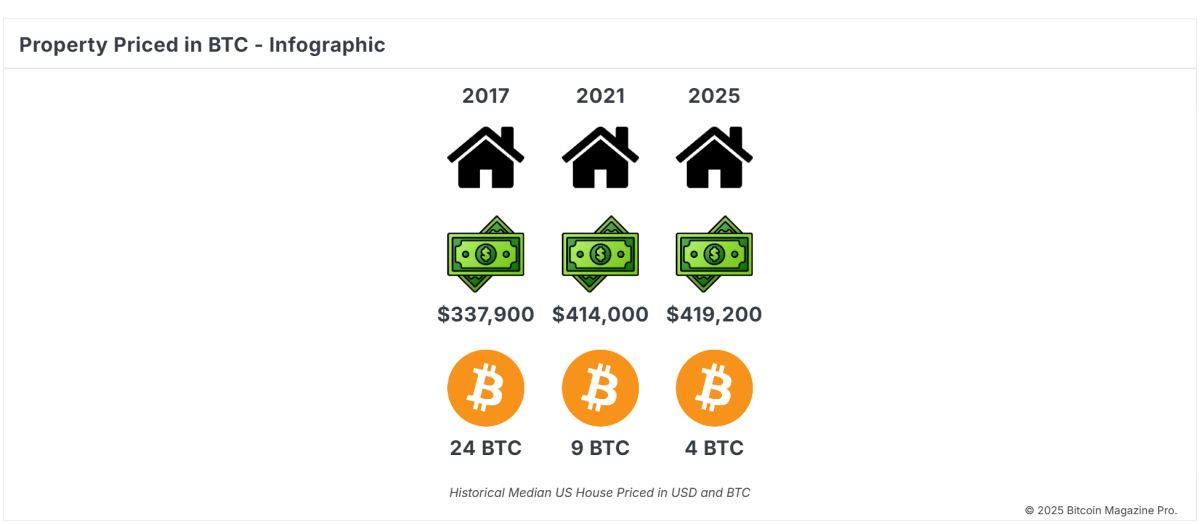

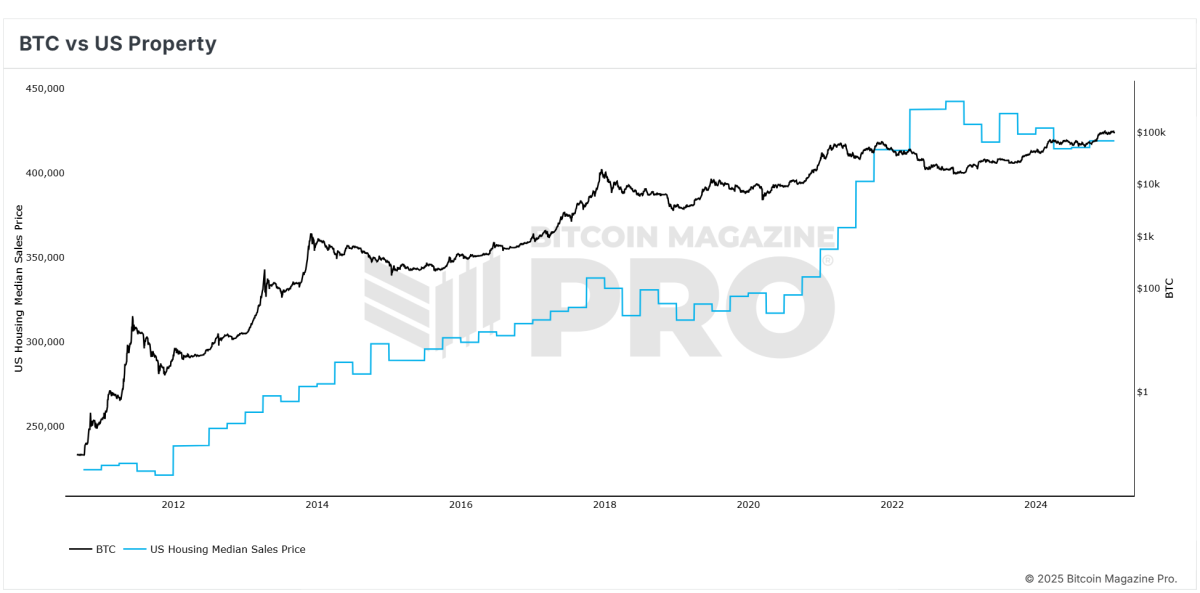

The data underscores Bitcoin’s ability to preserve and grow wealth more effectively than traditional property investments.

Hedging Against Inflation

Real estate prices often mirror inflationary trends but fail to outpace them significantly. Bitcoin, designed as a hedge against fiat currency devaluation, has demonstrated its resilience in inflationary periods. As central banks continue to print money at unprecedented rates, Bitcoin’s finite supply ensures its value is protected from monetary debasement.

Flexibility for Modern Investors

Today’s investors prioritize flexibility and global access. Real estate is a localized, illiquid asset that limits mobility. Bitcoin, by contrast, is borderless and allows for decentralized ownership without reliance on traditional financial systems. This feature is especially attractive to younger, tech-savvy investors who value freedom and control.

A Bold Vision for the Future

Bitcoin is more than just a speculative asset; it’s a financial revolution. By embracing Bitcoin, smart investors position themselves at the forefront of this paradigm shift. As Bitcoin adoption grows, its value proposition becomes increasingly clear: a robust, deflationary asset designed for the modern economy.

Conclusion

While real estate has historically been a cornerstone of investment portfolios, Bitcoin offers a transformative alternative that aligns with the demands of a rapidly evolving global economy. For those seeking to preserve wealth, hedge against inflation, and capitalize on groundbreaking technology, Bitcoin is the asset of choice. The question is no longer “Why Bitcoin?” but rather “Why not Bitcoin?”

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

You may like

Why Is Pi Coin Price Down Another 12% Today?

XRP Price Struggles at Key Resistance—Can Bulls Force a Breakout?

Bitcoin, Ethereum to end Q1 in the red, ‘vertical swing up’ unlikely

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

GameStop Approves Adding Bitcoin To Treasury Reserves

Cboe Exchange Submits Filing to List Fidelity Solana ETF

Bitcoin

Is Bitcoin Price Performance In 2025 Repeating 2017 Bull Cycle?

Published

3 days agoon

March 23, 2025By

admin

After reaching an all-time high above $100,000, the Bitcoin price has entered a multi-week downtrend. This correction has naturally raised questions about whether Bitcoin is still aligned with the 2017 bull cycle. Here we’ll analyze the data to assess how closely Bitcoin’s current price action correlates with previous bull markets, and what we can expect next for BTC.

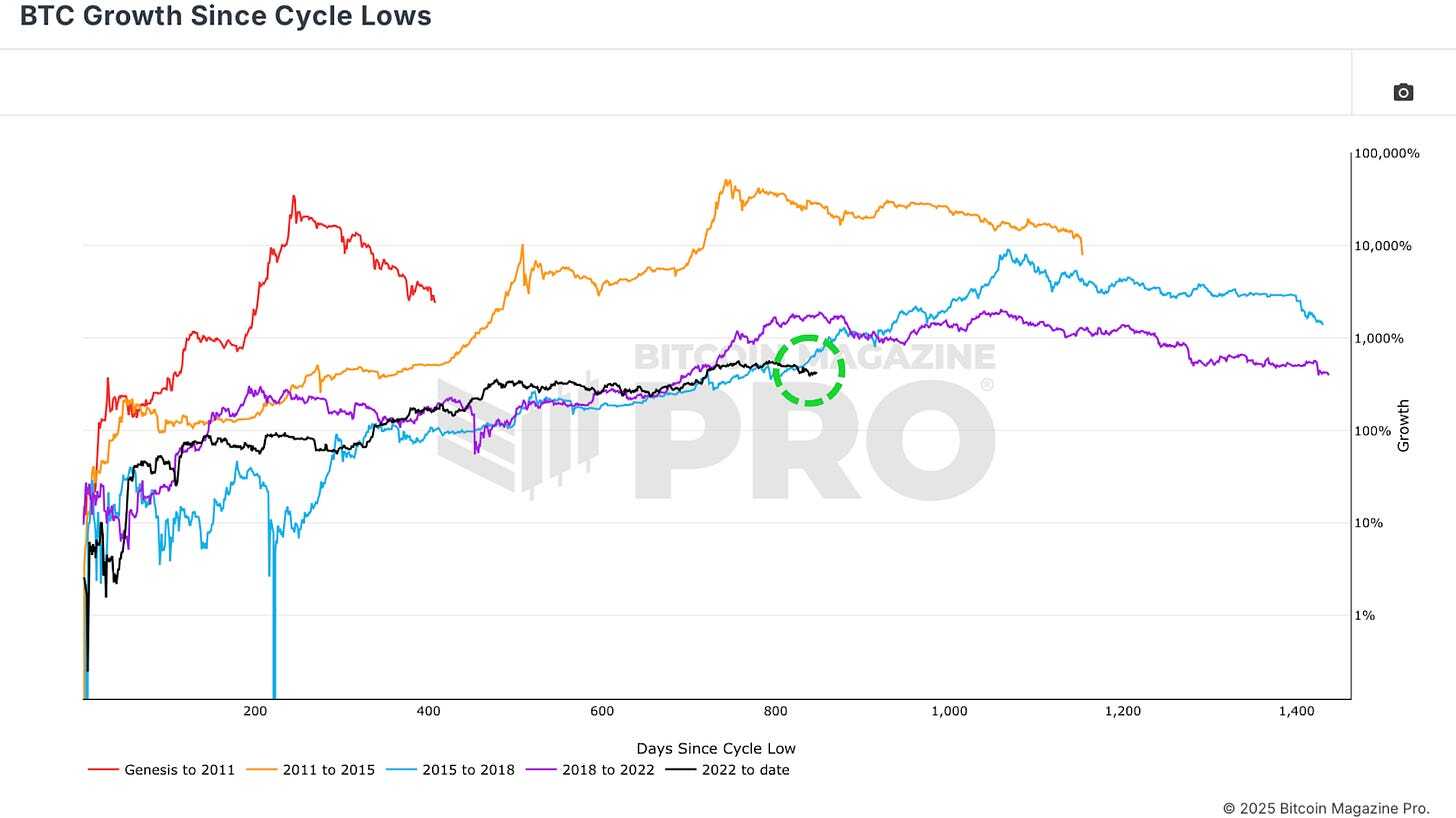

Bitcoin Price Trends in 2025 vs. 2017 Bull Cycle

Bitcoin’s price trajectory since the cycle lows set during the 2022 bear market has shown remarkable similarities to the 2015–2017 cycle, the bull market that culminated in Bitcoin reaching $20,000 in December 2017. However, Bitcoin’s recent downtrend marks the first major divergence from the 2017 pattern. If Bitcoin were still tracking the 2017 cycle, it should have been rallying to new all-time highs over the past month, instead, Bitcoin has been moving sideways and declining, suggesting that the correlation may be weakening.

Despite the recent divergence, the historical correlation between Bitcoin’s current cycle and the 2017 cycle remains surprisingly high. The correlation between the current cycle and the 2015–2017 cycle was around 92% earlier this year. The recent price divergence has reduced the correlation slightly to 91%, still an extremely high figure for financial markets.

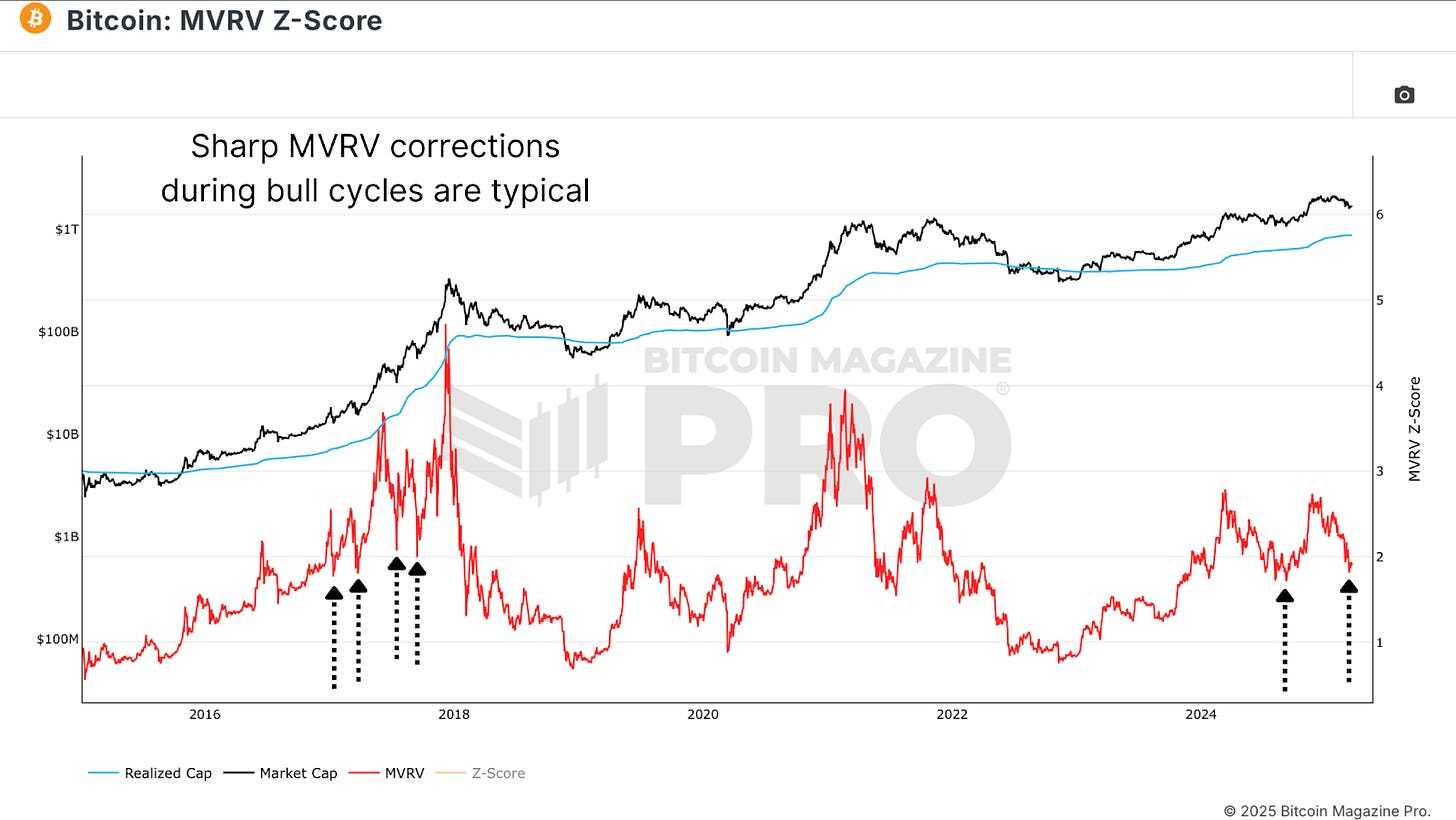

How Bitcoin Market Behavior Echoes 2017 Cycle Patterns

The MVRV Ratio is a key indicator of investor behavior. It measures the relationship between Bitcoin’s current market price and the average cost basis of all BTC held on the network. When the MVRV ratio rises sharply, it indicates that investors are sitting on significant unrealized profits, a condition that often precedes market tops. When the ratio declines toward the realized price, it signals that Bitcoin is trading close to the average acquisition price of investors, often marking a bottoming phase.

The recent decline in the MVRV ratio reflects Bitcoin’s correction from all-time highs, however, the MVRV ratio remains structurally similar to the 2017 cycle with an early bull market rally, followed by multiple sharp corrections, and as such, the correlation remains at 80%.

Bitcoin Price Correlation with 2017 Bull Cycle Data

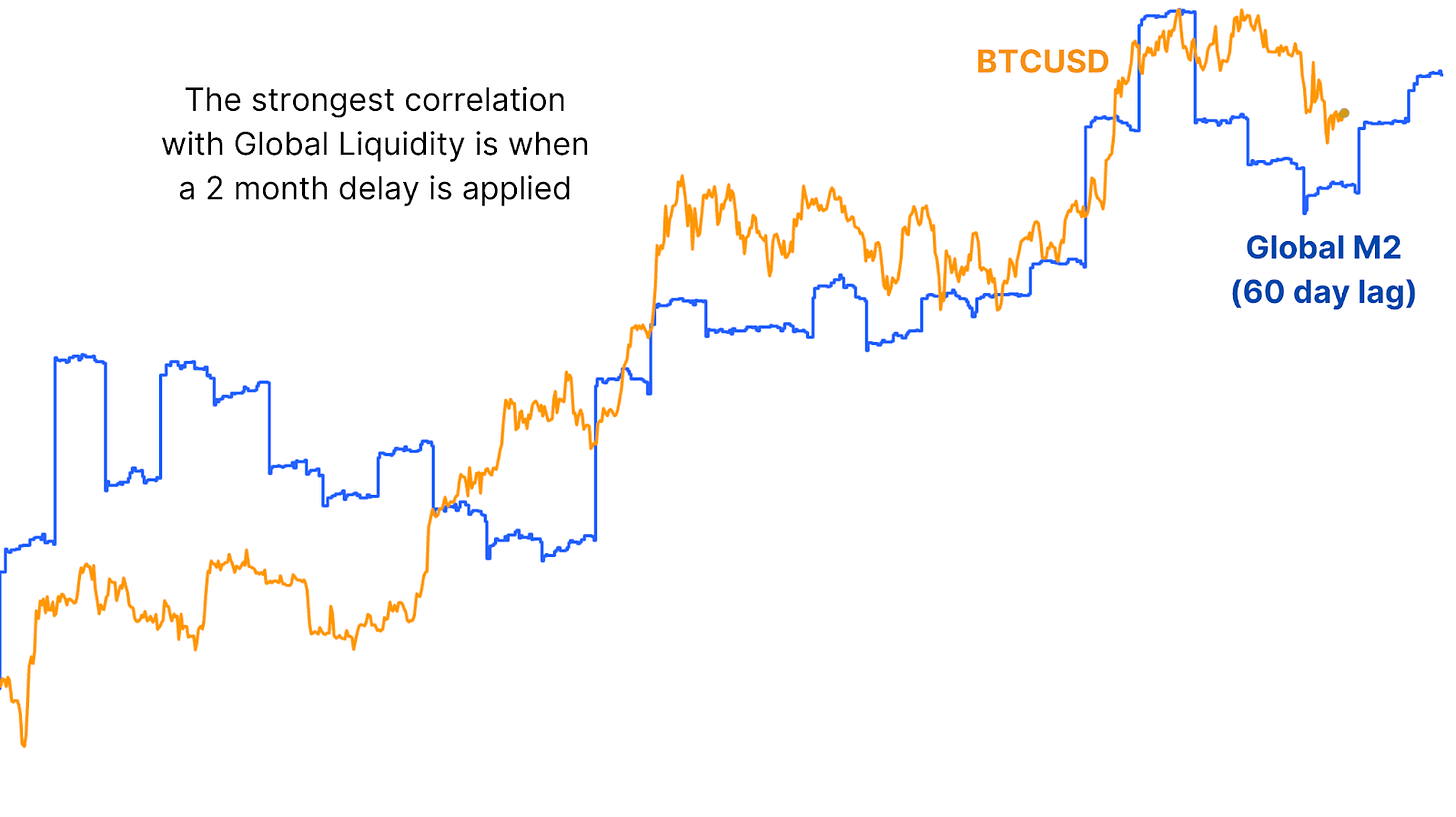

One possible explanation for the recent divergence is the influence of data lag. For example, Bitcoin’s price action has shown a strong correlation with Global Liquidity, the total supply of money in major economies; however, historical analysis shows that changes in liquidity often take around 2 months to reflect in Bitcoin’s price action.

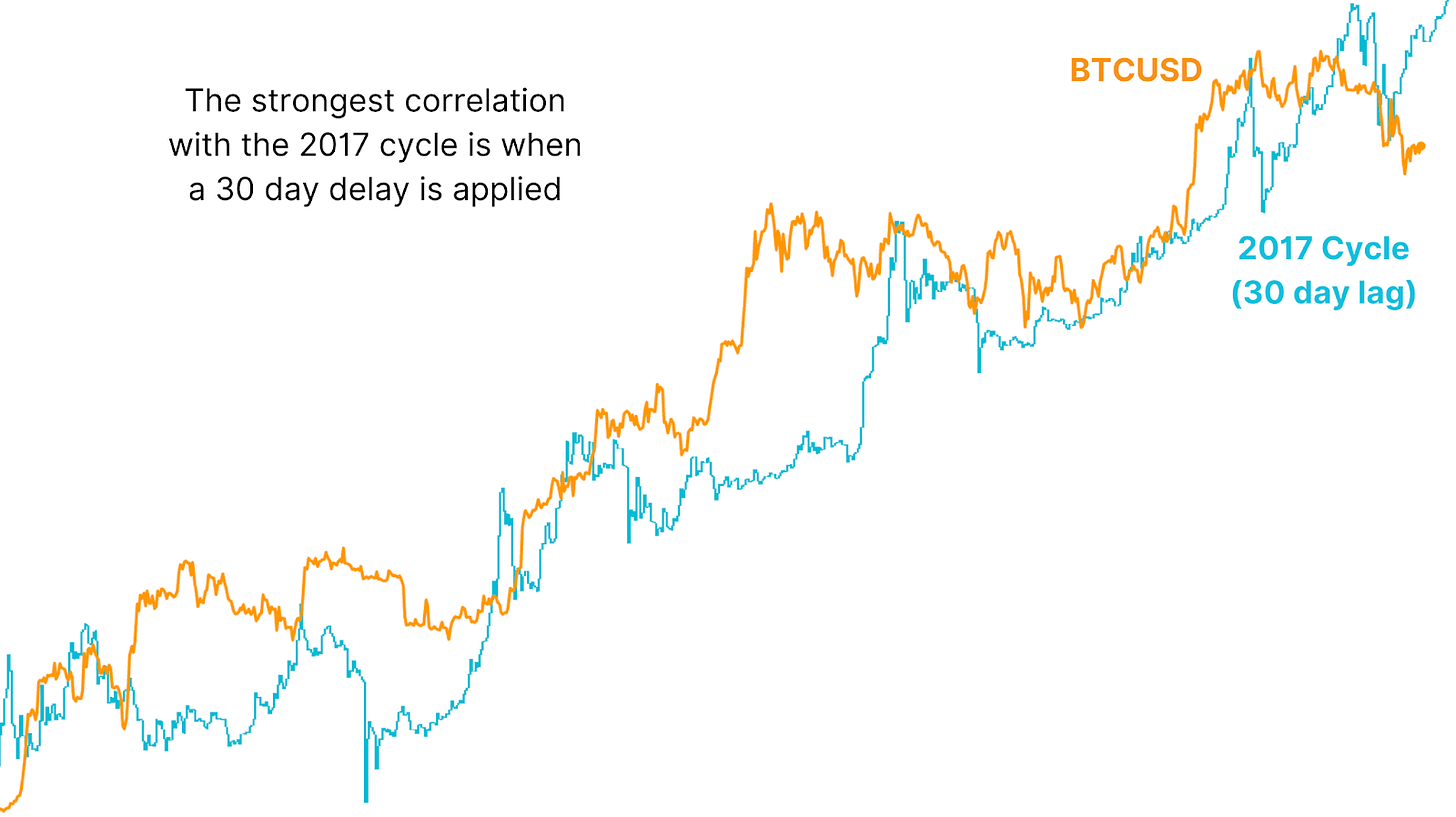

By applying a 30-day lag to Bitcoin’s price action relative to the 2017 cycle, the correlation increases to 93%, which would be the highest recorded correlation between the two cycles. The lag-adjusted pattern suggests that Bitcoin could soon resume the 2017 trajectory, implying that a major rally could be on the horizon.

What 2017 Bull Cycle Signals Mean for Bitcoin Price Today

History may not repeat itself, but it often rhymes. Bitcoin’s current cycle may not deliver 2017-style exponential gains, but the underlying market psychology remains strikingly similar. If Bitcoin resumes its correlation with the lagging 2017 cycle, the historical precedent suggests that Bitcoin could soon recover from the current correction, and a sharp upward move could follow.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin ETF

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Published

6 days agoon

March 19, 2025By

admin

Bitcoin’s market structure is evolving, and its once-predictable four-year cycles may no longer hold the same relevance. In a recent conversation with Matt Crosby, lead analyst at Bitcoin Magazine Pro, Mitchell Askew, Head Analyst at Blockware Solutions, shared his perspective on how Bitcoin ETFs, mining advancements, and institutional adoption are reshaping the asset’s price behavior.

According to Askew, Bitcoin’s historical pattern of parabolic price increases followed by steep drawdowns is changing as institutional investors enter the market. At the same time, the mining industry is becoming more efficient and stable, creating new dynamics that affect Bitcoin’s supply and price trends.

Bitcoin’s Market Cycles Are Fading

Askew suggests that Bitcoin may no longer experience the extreme cycles of past bull and bear markets. Historically, halving events reduced miner rewards, triggered supply shocks, and fueled rapid price increases, often followed by corrections of 70% or more. However, the increasing presence of institutional investors is leading to a more structured, macro-driven market.

He explains that Spot Bitcoin ETFs and corporate treasury allocations are bringing consistent demand into Bitcoin, reducing the likelihood of extreme boom-and-bust price movements. Unlike retail traders, who tend to buy in euphoria and panic-sell during downturns, institutions are more likely to sell into strength and accumulate Bitcoin on dips.

Askew also notes that since Bitcoin ETFs launched in January 2024, price movements have become more measured, with longer consolidation periods before continued growth. This suggests Bitcoin is beginning to behave more like a traditional financial asset, rather than a speculative high-volatility market.

The Role of Bitcoin Mining in Price Stability

As a mining analyst at Blockware Solutions, Askew provides insight into how Bitcoin mining dynamics influence price trends. He notes that while many assume a rising hash rate is always bullish, the reality is more complex.

In the short term, increasing hash rate can be bearish, as it leads to higher competition among miners and more Bitcoin being sold to cover electricity costs. However, over the long term, a rising hash rate reflects greater investment in Bitcoin infrastructure and network security.

Another key observation from Askew is that Bitcoin’s hash rate growth lags behind price growth by 3-12 months. When Bitcoin’s price rises sharply, mining profitability increases, prompting more capital to flow into mining infrastructure. However, deploying new mining rigs and setting up facilities takes time, leading to a delayed impact on hash rate expansion.

Why Mining Profitability Is Stabilizing

Askew also highlights that mining hardware efficiency is reaching a plateau, which has significant implications for miners and Bitcoin’s supply structure.

If you’re thinking about Bitcoin mining, you MUST watch this clip.

There’s a trend developing in mining hardware that will bode extremely well for miners:

– Longer machine lifespans

– Slowing hashrate growth

– Increased lag between price growth and hashrate growthBitcoin… pic.twitter.com/H0ZjsCm7Rc

— Mitchell

(@MitchellHODL) March 19, 2025

In Bitcoin’s early years, new mining machines offered dramatic efficiency improvements, forcing miners to upgrade hardware every 1-2 years to remain competitive. Today, however, new models are only about 10% more efficient than the previous generation. As a result, mining rigs can now remain profitable for 4-8 years, reducing the pressure on miners to continuously reinvest in new equipment.

Electricity costs remain the biggest factor in mining profitability, and Askew explains that miners are increasingly seeking low-cost power sources to maintain long-term sustainability. Many companies, including Blockware Solutions, operate in rural U.S. locations with stable energy prices, ensuring better profitability even during market downturns.

Could the U.S. Government Start Accumulating Bitcoin?

Another important discussion point raised by Askew is the potential for a U.S. Strategic Bitcoin Reserve (SBR). Some policymakers have proposed that the U.S. government accumulate Bitcoin in the same way it holds gold reserves, recognizing its potential as a global store of value.

Askew explains that if such a reserve were implemented, it could create a massive supply shock, pushing Bitcoin’s price significantly higher. However, he cautions that government action is slow and would likely involve gradual accumulation rather than sudden large-scale purchases.

Even if implemented over several years, such a program could further reinforce Bitcoin’s long-term bullish trajectory by removing available supply from the market.

Bitcoin Price Predictions & Long-Term Outlook

Based on current trends, Askew remains bullish on Bitcoin’s long-term price trajectory, though he believes the market’s behavior is shifting toward more gradual, sustained growth rather than extreme speculative cycles.

- Base Case: $150K – $200K

- Bull Case: $250K+

- Base Case: $500K – $1M

- Bull Case: Bitcoin flips gold’s $20T market cap → $1M+ per BTC

Askew sees several key factors driving Bitcoin’s price over the next decade, including:

He emphasizes that as Bitcoin’s market structure matures, it may become less susceptible to sharp price swings, making it a more attractive long-term asset for institutions.

Conclusion: A More Mature Bitcoin Market

According to Askew, Bitcoin is undergoing a structural shift that will shape its price trends for years to come. With institutional investors reducing market volatility, mining innovations improving efficiency, and potential government adoption, Bitcoin’s market behavior is beginning to resemble that of gold or other long-term financial assets.

While dramatic parabolic runs may become less frequent, Bitcoin’s long-term trajectory appears stronger and more sustainable than ever. Askew’s perspective reinforces the idea that Bitcoin is no longer just a speculative asset—it is evolving into a key financial instrument with increasing global adoption.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

Published

2 weeks agoon

March 15, 2025By

admin

Bitcoin has been struggling with lower lows in recent weeks, leaving many investors questioning whether the asset is on the brink of a major bear cycle. However, a rare data point tied to the US Dollar Strength Index (DXY) suggests that a significant shift in market dynamics may be imminent. This bitcoin buy signal, which has only appeared three times in BTC’s history, could point to a bullish reversal despite the current bearish sentiment.

For a more in-depth look into this topic, check out a recent YouTube video here:

Bitcoin: This Had Only Ever Happened 3x Before

BTC vs DXY Inverse Relationship

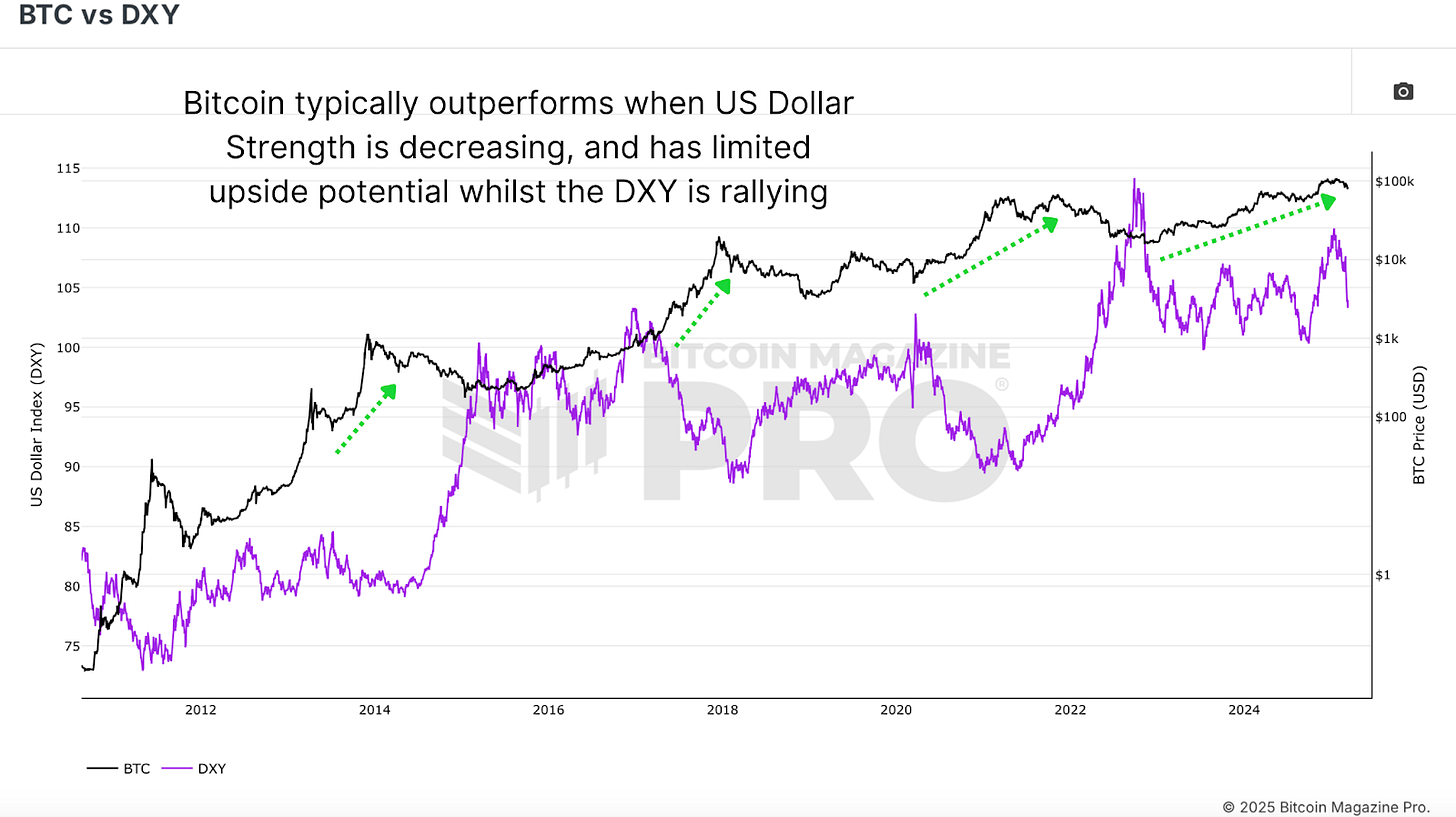

Bitcoin’s price action has long been inversely correlated with the US Dollar Strength Index (DXY). Historically, when the DXY strengthens, BTC tends to struggle, while a declining DXY often creates favorable macroeconomic conditions for Bitcoin price appreciation.

Despite this historically bullish influence, Bitcoin’s price has continued to retreat, recently dropping from over $100,000 to below $80,000. However, past occurrences of this rare DXY retracement suggest that a delayed but meaningful BTC rebound could still be in play.

Bitcoin Buy Signal Historic Occurrences

Currently, the DXY has been in a sharp decline, a decrease of over 3.4% within a single week, a rate of change that has only been observed three times in Bitcoin’s entire trading history.

To understand the potential impact of this DXY signal, let’s examine the three prior instances when this sharp decline in the US dollar strength index occurred:

- 2015 Post-Bear Market Bottom

The first occurrence was after BTC’s price had bottomed out in 2015. Following a period of sideways consolidation, BTC’s price experienced a significant upward surge, gaining over 200% within months.

The second instance occurred in early 2020, following the sharp market collapse triggered by the COVID-19 pandemic. Similar to the 2015 case, BTC initially experienced choppy price action before a rapid upward trend emerged, culminating in a multi-month rally.

- 2022 Bear Market Recovery

The most recent instance happened at the end of the 2022 bear market. After an initial period of price stabilization, BTC followed with a sustained recovery, climbing to substantially higher prices and kicking off the current bull cycle over the following months.

In each case, the sharp decline in the DXY was followed by a consolidation phase before BTC embarked on a significant bullish run. Overlaying the price action of these three instances onto our current price action we get an idea of how things could play out in the near future.

Equity Markets Correlation

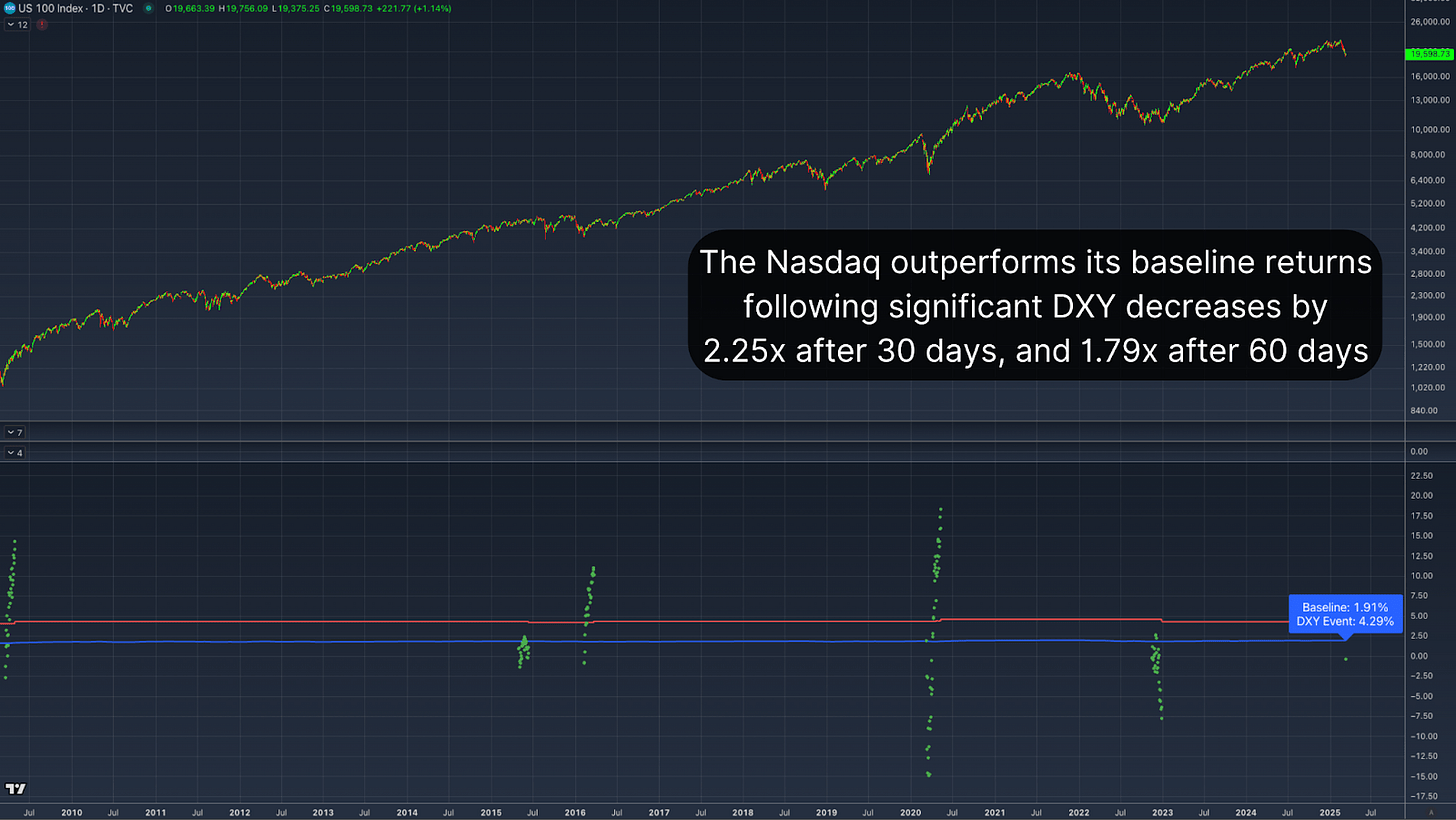

Interestingly, this pattern isn’t limited to Bitcoin. A similar relationship can be observed in traditional markets, particularly in the Nasdaq and the S&P 500. When the DXY retraces sharply, equity markets have historically outperformed their baseline returns.

The all-time average 30-day return for the Nasdaq following a similar DXY decline stands at 4.29%, well above the standard 30-day return of 1.91%. Extending the window to 60 days, the Nasdaq’s average return increases to nearly 7%, nearly doubling the typical performance of 3.88%. This correlation suggests that Bitcoin’s performance following a sharp DXY retracement aligns with historical broader market trends, reinforcing the argument for a delayed but inevitable positive response.

Conclusion

The current decline in the US Dollar Strength Index represents a rare and historically bullish Bitcoin buy signal. Although BTC’s immediate price action remains weak, historical precedents suggest that a period of consolidation will likely be followed by a significant rally. Especially when reinforced by observing the same response in indexes such as the Nasdaq and S&P 500, the broader macroeconomic environment is setting up favorably for BTC.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Why Is Pi Coin Price Down Another 12% Today?

XRP Price Struggles at Key Resistance—Can Bulls Force a Breakout?

Bitcoin, Ethereum to end Q1 in the red, ‘vertical swing up’ unlikely

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

GameStop Approves Adding Bitcoin To Treasury Reserves

Cboe Exchange Submits Filing to List Fidelity Solana ETF

How Strategy is Redefining Corporate Leverage?

Tokenized Treasuries Hit $5B Milestone as Fidelity Investments Touts RWA Potential as Collateral

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Dogecoin Price Mirroring This 2017 Pattern Suggests That A Rise To $4 Could Happen

SEC closes investigation into Immutable nearly 5 months after Wells notice

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

BlackRock Launches Bitcoin ETP In Europe

Crypto holds on to Gains, US may reverse Biden BTC sales, Tesla leads bounce

Cardano price could surge to $2 as whale purchases rise

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x