Bitcoin

Will Bitcoin ETFs Surpass 1 Million BTC Before 2025?

Published

4 months agoon

By

admin

As Bitcoin continues to mature, one of the most telling indicators of its longevity and integration into the broader financial ecosystem is the rapid growth of Bitcoin Exchange-Traded Funds (ETFs). These products—offering mainstream, regulated exposure to Bitcoin—have garnered substantial inflows from both institutional and retail investors since their inception. According to data aggregated by Bitcoin Magazine Pro’s Cumulative Bitcoin ETF Flows Chart, Bitcoin ETFs have already accumulated more than 936,830 BTC, raising the question: Will these holdings surpass 1 million BTC before 2025?

The #Bitcoin ETFs have already accumulated 936,830 #BTC!

Will this surpass 1,000,000 BTC before 2025?

Let me know

pic.twitter.com/UojJpJlC4P

— Bitcoin Magazine Pro (@BitcoinMagPro) December 16, 2024

The Significance of the 1 Million BTC Mark

Crossing the 1 million BTC threshold would be more than a symbolic milestone. It would indicate profound market maturity and long-term confidence in Bitcoin as a credible, institutional-grade asset. Such a large amount of Bitcoin locked up in ETFs effectively tightens supply in the open market, setting the stage for what could be a powerful catalyst for upward price pressure. As fewer coins remain available on exchanges, the market’s long-term equilibrium shifts—potentially raising Bitcoin’s floor price and reducing downside volatility.

The Trend Is Your Friend: Record-Breaking Inflows

The momentum is undeniable. November 2024 saw record inflows into Bitcoin ETFs, surpassing $6.562 billion—over $1 billion more than the previous month’s figures. This wave of capital inflow dwarfs the rate of new Bitcoin creation. In November alone, just 13,500 BTC were mined, while more than 75,000 BTC flowed into ETFs—5.58 times the monthly supply. Such an imbalance underscores the scarcity dynamics now in play. When demand vastly outpaces supply, the natural market response is upward price pressure.

A Chart of Insatiable Demand

In a landmark moment, BlackRock’s Bitcoin ETF recently outpaced the company’s own iShares Gold Trust in total fund assets. This moment was captured visually in the November issue of The Bitcoin Report, revealing a clear shift in investor preference. For decades, gold sat atop the throne of “safe haven” assets. Today, Bitcoin’s emerging role as “digital gold” is validated by ever-growing institutional allocations. The appetite for Bitcoin-backed ETF products has become relentless, as both seasoned investors and new entrants acknowledge Bitcoin’s potential to serve as a cornerstone in diversified portfolios.

Long-Term Holding and Supply Shock

One key characteristic of Bitcoin ETF inflows is the long-term nature of these investments. Institutional buyers and long-term allocators are less likely to trade frequently. Instead, they acquire Bitcoin through ETFs and hold it for extended periods—years, if not decades. As this pattern continues, the Bitcoin held in ETFs becomes essentially removed from circulation. The result is a steady drip of supply leaving exchanges, pushing the market toward a potential supply shock.

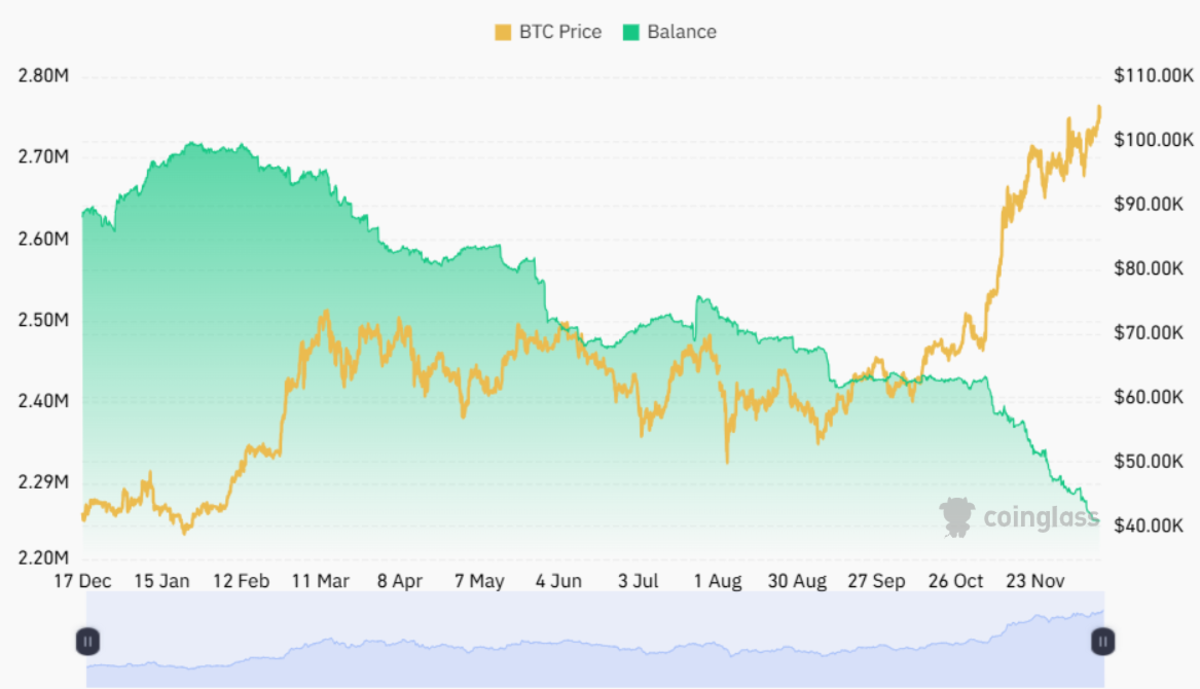

This trend is clearly illustrated by the latest data from Coinglass. Only about 2.25 million BTC currently remain on exchanges, highlighting a persistent decline in readily available supply. The chart below shows a divergence where Bitcoin’s price appreciation continues upward, while the exchange balances head down—an irrefutable signal of scarcity dynamics at work.

A Perfect Bitcoin Bull Storm and the March Toward $1 Million

These evolving dynamics have already propelled Bitcoin beyond the $100,000 milestone, and such achievements could soon feel like distant memories. As the market rationalizes a potential journey towards $1 million per BTC, what once seemed like a lofty dream now appears increasingly feasible. The “multiplier effect” in market psychology and price modeling suggests that once a large buyer comes into play, the ripple effects can cause explosive price surges. With ETFs continually accumulating, each major purchase may ignite a cascade of follow-on buying as investors fear missing out on the next leg up.

Incoming Trump Administration, the Bitcoin Act, and a U.S. Strategic Reserve

If current trends weren’t bullish enough, a new and potentially transformative scenario is brewing on the geopolitical stage. Incoming President-elect Donald Trump in 2025 has expressed support for the “Bitcoin Act,” a proposed bill directing the Treasury to establish a Strategic Bitcoin Reserve. The plan involves selling part of the U.S. government’s gold reserves to acquire 1 million BTC—about 5% of all currently available Bitcoin—and hold it for 20 years. Such a move would signal a seismic shift in U.S. monetary policy, placing Bitcoin on par with (or even ahead of) gold as a cornerstone of national wealth storage.

With ETFs already driving scarcity, a U.S. governmental move to secure a large strategic Bitcoin reserve would magnify these effects. Consider that only 2.25 million BTC are available on exchanges today. Should the United States aim to acquire nearly half of that in a relatively short timeframe, the supply-demand imbalances would become extraordinary. This scenario could unleash a hyper-bullish mania, pushing Bitcoin’s price into previously unthinkable territory. At that point, even $1 million per BTC might be viewed as rational, a natural extension of the asset’s role in global finance and national strategic reserves.

Conclusion: A Confluence of Bullish Forces

From near-term ETF inflows surpassing new issuance fivefold, to longer-term structural shifts like a potential U.S. Bitcoin reserve, the fundamentals are stacking in Bitcoin’s favor. The growing scarcity, combined with the multiplier effect of large buyers entering the market, sets the stage for exponential price appreciation. What was once considered unrealistic—a Bitcoin price of $1 million—now sits within the realm of possibility, underscored by tangible data and powerful economic forces at play.

The journey from today’s levels to a new era of Bitcoin price discovery involves more than just speculation. It’s supported by a tightening supply, unyielding demand, rising institutional acceptance, and even the potential imprimatur of the world’s largest economy. Against this backdrop, surpassing 1 million BTC in ETF holdings before 2025 may be just the beginning of a much larger story—one that could reshape global finance and reimagine the very concept of a reserve asset.

For the latest insights on Bitcoin ETF data, monthly inflows, and evolving market dynamics, explore Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

You may like

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

Bitcoin

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

Published

5 hours agoon

April 27, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

It was quite the coincidence that the cryptocurrency market jolted back to life after Easter Sunday, with Bitcoin leading the way with more than a double-digit gain. While the price of BTC continues to hold above the critical $94,000 level, the premier cryptocurrency seems to be losing some momentum.

Unsurprisingly, investors appear to be increasingly confident in the promise of this recent rally, as significant amounts of BTC continue to make their way off major centralized exchanges over the past few days. Here’s how much investors have moved in the past few days.

Over 35,000 BTC Move Out Of Coinbase And Binance

In a Quicktake post on the CryptoQuant platform, crypto analyst João Wedson revealed that Binance, the world’s largest cryptocurrency exchange by trading volume, has seen increased activity over the past few days. The exchange netflow data shows that huge amounts of Bitcoin have been withdrawn from the platform in recent days.

Related Reading

According to CryptoQuant data, a total of 27,750 BTC (worth $2.63 billion at current price) was moved out of Binance on Friday, April 25. This latest round of withdrawals represents the third-largest net outflow in the centralized exchange’s history.

The movement of significant crypto amounts from exchanges, which offer services like selling to non-custodial wallets, suggests a potential shift in investor sentiment and strategy. Large exchange outflows often signal increased confidence of holders in the long-term potential of an asset.

Wedson noted that the recent outflows do not guarantee a price rally for Bitcoin, but they do signal strong institutional activity, which is often a precursor for major volatility. Citing China’s crypto ban in 2021, the crypto analyst highlighted how massive exchange outflows didn’t prevent the dump.

At the same time, Wedson mentioned that the continuous Bitcoin outflows over several days, like during the FTX collapse, preceded a price bottom and the eventual market recovery. Ultimately, the online pundit hinted at paying close attention to the overall trend of the exchange netflow rather than a single-day activity.

Similarly, more than 7,000 BTC (worth approximately $66.5 million) have made their way out of the Coinbase exchange. According to the CryptoQuant analyst Amr Taha, this negative exchange netflow could be an indicator of increased institutional activity, as Coinbase is known as the primary crypto vendor for US-based institutions.

Taha said:

These large outflows typically suggest accumulation by institutions or large investors, potentially signaling bullish sentiment.

The analyst outlined that if the dwindling exchange reserves correlate with an increased spot demand or ETF inflows, a supply squeeze could be on the horizon, potentially pushing the price to the upside.

Bitcoin Price At A Glance

As of this writing, the price of BTC sits just beneath $95,200, reflecting an almost 2% increase in the past 24 hours.

Related Reading

Featured image from iStock, chart from TradingView

Source link

Bitcoin

Bitcoin Perpetual Swaps Signal Short Bias Amid Price Rebound – Details

Published

13 hours agoon

April 26, 2025By

admin

The Bitcoin market saw another rebound in the past week as prices leaped by over 12% to hit a local peak of $95,600. Amid the ongoing market euphoria, prominent blockchain analytics company Glassnode has shared some important developments in the Bitcoin derivative markets.

Bitcoin Short Bets Rise Despite Price Rally, Setting Stage For Volatility

Despite a bullish trading week, derivative traders are approaching the Bitcoin market with skepticism, as evidenced by a build-up of leveraged short positions.

In a recent X post on April 25, Glassnode reported that Open Interest (OI) in Bitcoin perpetual swaps climbed to 218,000 BTC, marking a 15.6% increase from early March. In line with market activity, this rise in Open Interest aligns with increased leverage, introducing the potential for market volatility via liquidations or stop-outs.

Generally, a rise in Open Interest amidst a price rally is expected to signal long-term market confidence. However, Glassnode’s findings have revealed an opposite scenario. Despite Bitcoin’s bullish strides in the past week, short market positions appear to be dominating the perpetual futures markets.

This concerning development is indicated by a decline in the average funding rate, which has now slipped into negative territory to sit around -0.023%. The perpetual funding rate is a periodic payment between long and short traders aimed at keeping the contract price in line with the underlying spot price.

A negative funding rate indicates short traders pay long traders as Bitcoin’s perpetual contract price is trading below the spot price. This is caused by a higher number of short positions as traders are largely bearish about Bitcoin, even despite recent gains.

Furthermore, the 7-day moving average (7DMA) of long-side funding premiums has dropped to $88,000 per hour, reinforcing this short-dominant sentiment. This downtrend indicates a waning demand for long positions, as traders exhibit a short bias.

However, Glassnode presents a bullish note stating that the present combination of rising leverage and short positions paves the way for a potential short squeeze, where an unexpected upward price move forces short-sellers to close their positions, thereby driving prices even higher.

Bitcoin Price Overview

At the time of writing, Bitcoin trades at $94,629 following a 1.01% retracement from its local peak price on April 25. Despite creeping developments in the perpetual futures market, the BTC market remains highly bullish, indicated by gains of 1.02%, 11.12%, and 8.32% in the last one, seven, and thirty days, respectively. With a market cap of $1.88 trillion, the premier cryptocurrency ranks as the largest digital asset and fifth-largest asset in the world.

Related Reading: Ethereum To Hit $5k Before Its 10th Birthday, Justin Sun Says

Source link

bank

Ruya Becomes First Islamic Bank To Offer Bitcoin And Virtual Asset Investments

Published

13 hours agoon

April 26, 2025By

admin

In a landmark development for Islamic finance and digital banking, ruya (رويا), the UAE’s digital-first Islamic bank, has become the first Islamic bank globally to offer customers direct access to virtual asset investments, including Bitcoin, through its mobile app, according to an announcement.

The new service is made possible through a strategic partnership with Fuze, a licensed leader in virtual asset infrastructure. Together, ruya and Fuze aim to provide a secure and ethical entry point into the digital economy, with services that are fully Shari’ah-compliant and aligned with the principles of Islamic finance.

“At ruya, we are committed to transforming the financial landscape in the UAE by offering forward-thinking services while staying true to our mission of ethical Islamic banking,” said Christoph Koster, CEO of ruya. “By integrating virtual assets into our investment platform, we aim to empower our customers to participate in the digital economy sustainably and responsibly. We can also assure our customers that the virtual assets we are offering on our ruya investment platform are Shari’ah-compliant, providing much-needed certainty.”

The launch comes at a time of rapid growth in the UAE’s virtual asset sector. In the year ending June 2024, the country received more than $30 billion in virtual assets, marking a 42% year-on-year increase, significantly outpacing the regional average of 11.7%, according to the announcement. The move underscores the UAE’s emergence as a major hub for digital finance in the MENA region.

“Partnering with ruya is a big step towards making virtual assets a seamless part of everyday banking,” said Mohammed Ali Yusuf (Mo Ali Yusuf), Co-Founder and CEO of Fuze. “Together, we’re combining Fuze’s cutting-edge infrastructure with ruya’s commitment to ethical Islamic banking.”

Unlike other platforms that encourage speculative crypto trading, ruya’s offering is embedded within a curated investment framework designed to support long-term financial growth, the company stated in the announcement. It will focus on transparency, fairness, and ethical investing—core tenets of Islamic finance.

To ensure accessibility and informed decision-making, ruya is also offering support through community centers and hybrid call centers, where customers can receive expert guidance on virtual asset investing.

Source link

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Solaxy, BTC bull token, and Pepeto gaining momentum as leading 2025 presale tokens

Australian Radio Station Used AI DJ For Months Before Being Discovered

5 Cardano Rivals to Watch as Founder Predicts Ethereum Will Die by 2040

Trump Memecoin’s 85% Weekly Surge Defies Democrats’ Call for Impeachment, Massive Unlocks

Solana’s Loopscale pauses lending after $5.8M hack

Bitcoin Perpetual Swaps Signal Short Bias Amid Price Rebound – Details

Ruya Becomes First Islamic Bank To Offer Bitcoin And Virtual Asset Investments

‘I Expect Huge Benefits from This Market Innovation’: New SEC Chair Signals Crypto Policy Shift in New Speech

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals