ETH

Will Ethereum Price Fail $3,000 Breakout as Whale Selling Prolongs?

Published

4 months agoon

By

admin

The crypto market entered November on a slightly bearish note as Bitcoin plunged below $70,000. Some analysts believe this downturn is a temporary selling pressure ahead of the U.S. presidential election. However, ongoing ETH whale selling casts doubt on Ethereum price recovery, raising concerns about a potential failure to break through the $3,000 level.

Currently, the ETH price trades at $2,459 with an intraday loss of 1.38%. According to Coingecko, Ethereum’s market cap is at $297.4 Billion, and the 24-hour trading volume is at 12.34 Billion.

Will Whale Selling Prevent Ethereum Price from $3,000 Breakout?

According to onchain data highlighted by EmberCN, a crypto whale that withdrew 96,638.9 ETH from Coinbase at $1,567 in September 2022 resurfaced after 40 days. Earlier today, this large holder transferred 15,000 ETH ( worth approximately $36.7M) to the crypto exchange Kraken.

Over the past eight months, the associated wallet has transferred a total of 85,000 ETH (worth around $251.04M) to Kraken, realizing a profit of up to $117.81M. However, the whale still holds 11,638.9 ETH ($28.55M), indicating the risk of further selling.

Moreover, a Cosmos Network wallet (0xE8…57d3) transferred 3,500 ETH, valued at around $8.72 million, to Coinbase Prime at 0:50 UTC+8 today. According to Arkham intelligence data, this wallet still holds a substantial 20,087 ETH worth about $49.85 million, acquired from its ICO allocation in 2017.

Typical whale/institution selling coincides with major market tops and is often a precursor of a fresh correction trendline. This selling pressure hints that the Ethereum price could witness a stalled recovery momentum and may struggle to break the $3,000 level.

ETH Chart Signals Potential 12% Drop Before Major Support Retest

Over the past three months, the Ethereum price prediction has showcased a sideways trend resonating strictly between the $2800 and $2150 levels. The daily chart showing price swings on either side indicates a lack of conviction from buyers and sellers.

Amid the market uncertainty and overhead supply, the ETH price plunged from $2,722 to $2,470 in the last four days, registering a 9.1% drop. If the large holders’ selling continues, the Ether price could plunge another 12% down to seek support at $2,150.

A bearish alignment between the crucial daily EMAs (20, 30, 100, and 200) signals the possibility of prolonged correction.

On the contrary note, if the upcoming U.S. election renews the bullish momentum in the crypto market, the Ethereum price could rebound from $2400. The aforementioned level coinciding with a long-coming support trendline could drive the ETH price to break the $2,800 range barrier.

Frequently Asked Questions (FAQs)

Ongoing ETH whale selling has increased market pressure, casting doubt on Ethereum’s price recovery

Continued whale selling could lead to prolonged price consolidation and a potential drop in ETH price by up to 12%, to hit $2,150.

If the upcoming U.S. election reignites bullish momentum in the crypto market, ETH could rebound from the $2,400 level and break $3000 barrier.

Sahil Mahadik

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

VanEck Registers AVAX ETF in Delaware

Why is Ethereum (ETH) price down today?

Key Support Level At $74,000 Determines Bitcoin Bull Or Bear Future

Deutsche Boerse-backed Clearstream to offer custody for Bitcoin, Ethereum

Analyst Who Nailed End of 2021 Bull Market Says Bitcoin May Have Seen Worst of Correction – Here’s Why

Crypto & Stock Market Crash as US Recession Odds Hit 40%

Altcoin

Monthly Close Below This Level Could Be Catastrophic

Published

1 day agoon

March 10, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has struggled to gain momentum, remaining stuck below critical resistance for over a year. Despite multiple attempts, the second-largest cryptocurrency by market capitalization has been unable to break through key technical levels since the beginning of this year.

Related Reading

Ethereum’s price action over the past two weeks has shown more weakness. An interesting analysis from analyst Tony “The Bull” Severino shows that the cryptocurrency recently failed to break above a resistance indicator and is now at risk of more catastrophic price drops.

Ethereum Fails To Breach Long-Term Resistance

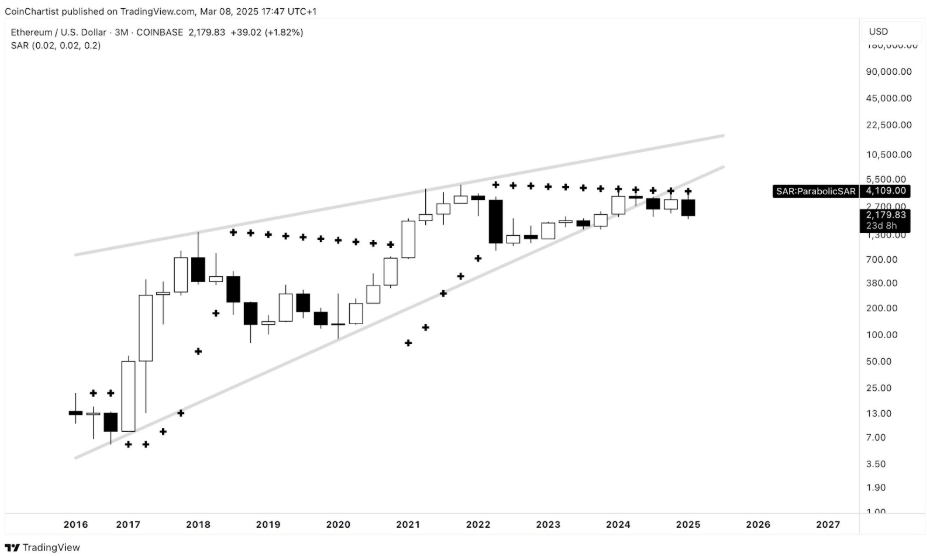

Tony “The Bull” Severino, in a technical analysis shared on social media platform X, highlighted Ethereum’s persistent failure to overcome major resistance levels. He pointed out that Ethereum has been unable to tag the quarterly (three-month) Parabolic SAR despite more than a year of attempts. This indicator, often used to determine the direction of an asset’s trend, shows that Ethereum is locked in a prolonged struggle against resistance on a larger downtrend.

“This feels like it sends a message — resistance won’t be broken,” the analyst said.

Image From X: Tony “The Bull” Severino

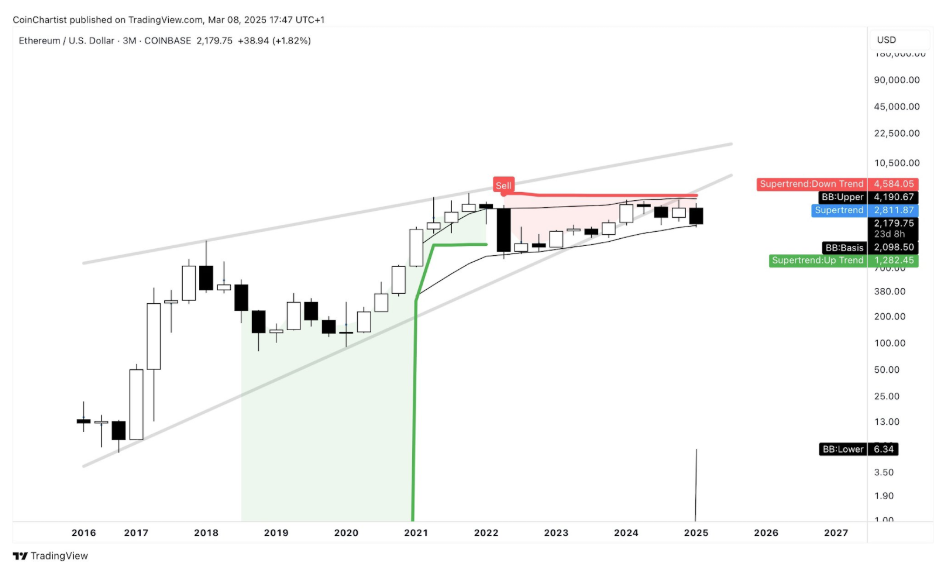

Adding to the failure to break resistance, Tony Severino also noted in another analysis that Ethereum has repeatedly faced rejection from the quarterly (3M) SuperTrend dynamic resistance, further solidifying the case that buyers have been unable to regain control.

Image From X: Tony “The Bull” Severino

A Monthly Close Below $2,100 Could Be Catastrophic

Ethereum’s inability to sustain key price levels has been a dominant theme in the past six months. Interestingly, this inability was shown further in the past two weeks. After failing to hold above $2,800, the cryptocurrency has seen a steady drop, losing multiple support zones along the way.

Currently, Ethereum is trading below $2,200, edging dangerously close to breaking below the crucial $2,100 threshold. A drop beneath this level is particularly concerning, not just because it signifies the loss of yet another psychological support but because technical indicators suggest that a monthly close below $2,100 could have severe consequences.

One of the most significant warning signs comes from the quarterly Bollinger Bands indicator, which has tracked Ethereum’s price action since February 2022. According to this indicator, Ethereum has remained within a defined range, with the upper Bollinger Band currently positioned at $4,190 and the lower band at $2,098. The worrying part is that a monthly close below $2,100 would effectively translate to breaking beneath the lower Bollinger Band and removing a long-standing support level.

Image From X: Tony “The Bull” Severino

Related Reading

At the time of writing, Ethereum is trading at $2,178, having gained 2.2% in the past 24 hours after starting the day at $2,120. Ethereum’s sentiment is now at its lowest level this year. The next few weeks will be crucial to see if Ethereum can reclaim lost ground and prevent a monthly close below $2,100.

Featured image from Tech Magazine, chart from TradingView

Source link

ETH

BlackRock ETF’s $11M Sell-off and US Inflation Triggers to Drive Next ETH Big Move

Published

2 days agoon

March 10, 2025By

admin

Ethereum price dived below $2,000 on March 9, mirroring the broader market downtrend. Institutional investors are offloading ETH, increasing downside risks.

Ethereum Price Dives Below $2,000 as US NFP Tilts Markets Bearish

Ethereum (ETH) experienced significant losses over the weekend as the highly anticipated White House Summit failed to lift market sentiment. Instead, the latest US Non-Farm Payroll (NFP) report dominated investor outlook, highlighting rising unemployment and increasing inflation pressures.

As a result, ETH price tumbled below the psychological $2,000 level, trading as low as $1,998 on Binance on March 9, marking an 8% daily decline. The drop exceeded Bitcoin’s 4% losses within the same timeframe, signaling stronger bearish momentum within ETH spot markets.

The selling pressure has been exacerbated by mounting fears of further Federal Reserve tightening in response to rising inflation metrics. With investors now eyeing the next Consumer Price Index (CPI) report, ETH price could struggle to gain meaningful traction unless macroeconomic conditions shift favorably.

BlackRock ETF Led Outflows with $11 Million Sell-off After US NFP Data

Amid rising unemployment and inflation triggers, institutional investors are reallocating capital away from crypto markets toward fixed-income securities, driving bond yields higher across global markets. This shift in investor sentiment has translated into substantial outflows from Ethereum ETFs.

According to on-chain analytics provider SosoValue, Ethereum ETFs recorded $23 million in outflows on Friday, the same day the US NFP report was released. Among the largest liquidations, BlackRock’s iShares Ethereum ETF saw an $11 million capital flight, the highest single-day outflow among Ethereum-focused funds.

The rapid outflows in Ethereum ETFs suggest that institutional investors are repositioning their portfolios in anticipation of further downside in crypto markets. If Ethereum ETF outflows continue into the coming week, ETH price could struggle to mount a sustained recovery.

Ethereum Price Forecast: Death Cross Pattern Signals Deeper Decline Toward $1,850

Ethereum price forecast signals have taken a decisive bearish turn, with ETH plunging 8.3% on March 9 to test support near $2,000. The daily chart reveals a concerning technical setup, as ETH struggles below key moving averages, with a confirmed Death Cross between short-term EMAs signaling prolonged downside risks.

If Ethereum closes below the critical $2,000 level, selling pressure could accelerate, targeting the next major support at $1,850, where historical demand has previously stabilized declines.

The Bollinger Bands show ETH trading at the lower band, suggesting it is in oversold territory. However, the absence of a significant bullish reaction underscores weak buying momentum. The MACD histogram remains in deep negative territory, with its signal line widening against the MACD line—affirming that bearish momentum is strengthening rather than reversing. While a relief bounce cannot be ruled out, any recovery toward $2,250 or $2,433 would likely face intense resistance as sidelined sellers look to re-enter.

The heightened leverage in derivatives markets could amplify price swings. If ETH loses $2,000 decisively, long liquidations may accelerate a cascade effect, making $1,850 the next crucial test for bulls. Conversely, a close above $2,200 could shift sentiment toward a bullish retracement.

Ethereum Price Outlook: Key Levels to Watch This Week

For Ethereum to break its bearish grip, ETF inflows must show signs of stabilization, particularly from major asset managers like BlackRock. If institutional demand returns, ETH could attempt to reclaim the $2,100 level and challenge the $2,250 resistance zone.

On the flip side, if macroeconomic headwinds persist and ETF outflows accelerate, Ethereum risks dropping below $1,950, potentially testing lower support at $1,850. With US CPI data and Federal Reserve commentary on the horizon, traders should remain cautious, as Ethereum’s price action could see heightened volatility in response to broader market shifts.

Overall, Ethereum remains vulnerable to further downside unless it reclaims key resistance levels and sees a resurgence in institutional demand.

Frequently Asked Questions (FAQs)

Ethereum fell due to rising inflation concerns, ETF outflows, and macroeconomic uncertainty following the US Non-Farm Payroll (NFP) report.

If ETH closes below $2,000, the next major support is at $1,850, where historical buying activity has previously stabilized declines. 3. Can Ethereum recover above $2,200 soon? A rebound is possible if ETF inflows return and macroeconomic sentiment improves, but resistance at $2,250 could limit upside momentum.

A rebound is possible if ETF inflows return and macroeconomic sentiment improves, but resistance at $2,250 could limit upside momentum.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ADA

CZ Weighs In On Altcoins Performance As Crypto Market Retraces

Published

3 days agoon

March 8, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Binance co-founder Changpeng Zhao has suggested that the highly anticipated Altseason isn’t here yet as most altcoins continue bleeding, while some market watchers consider the worst might be over soon.

Related Reading

CZ Says There’s No Altseason Yet

On Friday, Changpeng Zhao, also known as CZ, responded to an X user asking when the Altseason will happen. The Binance founder pointed out the price tracking and market data website CoinMarketCap (CMC), which recently added an “Altcoin Season Index.”

CZ highlighted that “of the top 100 altcoins,” very few have outperformed Bitcoin (BTC) in the past three months, suggesting that the Altseason won’t happen yet.

As the website states, the CMC Altcoin Season Index page “provides real-time insights into whether the cryptocurrency market is currently in Altcoin Season,” based on the performance of the top 100 altcoins against the flagship crypto over the past 90 days.

Under this metric, an Altseason is in if 75% of the top 100 altcoins outperform BTC during the established period. To CZ, “This is a tough ranking system,” as he considers that 50 would be a good score for Altcoins.

The CMC index page shows a score of 14/100, with only 14 altcoins outperforming BTC since early December. Some of the tokens in this list include Monero (XRM), Hyperliquid (HYPE), Pi (PI), Mantra (OM), Berachain (BERA), and the official Trump memecoin (TRUMP).

Leading cryptocurrencies of 2024, like SUI and Solana (SOL), show 37% to 41% price decreases in the past 90 days. Meanwhile, memecoin sensations like dogwifhat (WIF), PEPE, FLOKI, and BONK have bled between 70% and 80% during this period.

Analyst Michaël van de Poppe also noted that altcoins have had an overall negative performance on higher timeframes despite some recent price rallies. “Massive green day on some Altcoins, they are up 2%! Then, you zoom out, and you zoom out, and you zoom out,” he asserted.

Altcoins Bottom Could Be Near

Altcoin Sherpa stated that altcoins were in “about the same or worse” positions during the Summer 2024 retrace, pointing out that “things were also pretty bleak overall and then we saw some strong bounces in August.” However, he noted that, unlike last year, the market doesn’t have a “Trump Pump coming.”

Recently, some of the top cryptocurrencies saw a significant price increase after US President Donald Trump announced a strategic reserve that would include SOL, XRP, Cardano (ADA), Ethereum (ETH), and BTC.

Nonetheless, after the March 6 executive order establishing a Strategic Bitcoin Reserve and a “Digital Asset Stockpile,” the White House AI and Crypto Czar, David Sacks, clarified that the previously named altcoins were used as references for the most valuable tokens in the market.

Sherpa considers that the market’s bottom is close, but “we still also probably have the chop period to get through” before any substantial recovery.

On the contrary, some industry figures have also commented on altcoins’ overall performance this cycle, suggesting that the Altseason already started but will be different from previous cycles.

Related Reading

Recently, CryptoQuant’s founder and CEO, Ki Young Ju, stated that the Altseason had begun. He affirmed there will not be a direct Bitcoin-to-altcoins rotation this cycle, as BTC dominance isn’t the key metric that defines it.

To the CEO, trading volume is the metric that defines it this time. Ju also pointed out that this will be a very selective and challenging altseason, with only a few altcoins with strong narratives expected to thrive.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

VanEck Registers AVAX ETF in Delaware

Why is Ethereum (ETH) price down today?

Key Support Level At $74,000 Determines Bitcoin Bull Or Bear Future

Deutsche Boerse-backed Clearstream to offer custody for Bitcoin, Ethereum

Analyst Who Nailed End of 2021 Bull Market Says Bitcoin May Have Seen Worst of Correction – Here’s Why

Crypto & Stock Market Crash as US Recession Odds Hit 40%

ChatGPT Maker OpenAI Inks $12B Deal With CoreWeave Ahead of Planned IPO

Mt. Gox makes second $900M+ move in a week as Bitcoin taps $76K

Bitcoin’s Downtrend Continues, But Analyst Predicts $180K Target—Is It Possible?

Why is Bitcoin price down 30% from its all time high?

Market Cap of Top Five Stablecoins Surges to New All-Time High of $204,700,000,000, According to Analyst

3 Top Factors That Can Fuel Massive Bitcoin Price Rebound

Rex Shares, Osprey Seek Movement ETF Approval as Ethereum Layer-2 Mainnet Launches

4 things must happen before Ethereum can reclaim $2,600

Recent SEC Guidance On Memecoins Suggests Broader Policy Change

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: