Bitcoin price

Will Trump Announce Zero Tax Gains in Today’s Crypto Summit Talk?

Published

2 days agoon

By

admin

Cryptocurrencies price are up as traders anticipate pro-crypto remarks from US President Trump today, March 20. Bitcoin price rose to a two-week high of $87,000 before retreating to trade at around $85,250 at press time. XRP led the gains among the top ten altcoins with a 7% rise while Ethereum briefly reclaimed $2,000 before reversing to $1,990. As the crypto summit draws near will Trump’s announcements drive more gains for crypto prices?

Will Trump Announce Zero Tax Gains During Crypto Summit?

Speculation is rife that Trump could make a major announcement at the Blockworks Digital Assets Summit happening in New York. Crypto analyst JackTheRippler opined that the President will announce zero capital gains on USA crypto coins. Walter Bloomberg also noted that Trump would make a “major update” to his crypto strategy.

If Trump imposes zero tax gains on cryptocurrencies, it will boost retail and institutional interest, causing massive price gains. This policy would also make the US a major crypto hub.

Trump’s attendance at this Summit will also mark the first time that a sitting US President is attending a crypto conference. This is fuelling excitement among crypto investors, with Bitcoin price likely to hit $90,000.

The Executive Director of the President’s Working Group on Digital Assets, Bo Hines, was among the speakers at the crypto summit earlier this week. In his remarks, he noted,

“We are looking forward to working with our partners at Treasury, and the Secretary of Commerce in order to find those budget-neutral ways in which we can acquire more [Bitcoin]… We need as much as we can get.”

If Trump provides clarity on how the US will acquire Bitcoin and announces a zero crypto tax policy for US-based coins, cryptocurrencies price will rebound and likely reclaim the $3 trillion market cap.

Cryptocurrencies Price Prediction After Trump Speech

Cryptocurrencies price could rebound after the summit as Trump’s pro-crypto remarks have always been met with a brief relief rally. For instance, earlier this month, BTC rose from around $85,000 to $93,000 within hours after Trump signed an executive order for a crypto reserve.

However, with the market expectations already high, failure to make a major announcement could cause a resumption of bearish trends. This could push Bitcoin below $80,000 while Ethereum price may lose support at $1,800.

Nevertheless, the total market cap shows that the market has been on a gradual rebound over the past week. If Trump’s remarks signal a bullish breakout, TOTAL could target its 100-day SMA of $3.18 trillion.

If analysts are right and Trump withdraws capital gains on US crypto coins, altcoins like XRP and Cardano are likely to record a parabolic rally. This could see XRP price hit $3 within hours while the Cardano price forecast hints at a rally past $1.

Therefore, it is likely that cryptocurrencies price will post gains after Trump’s speech during the Digital Assets Summit. However, this rally may be short-lived if traders rush to book profits.

Frequently Asked Questions (FAQs)

Cryptocurrencies price will likely see a relief rally if President Trump makes pro-crypto remarks at the crypto summit.

Speculation is rife that President Trump will announce zero capital gains tax on US-based crypto coins. This could drive massive gains for altcoins like XRP and Cardano.

If President Trump provides clarity on how the US government will acquire Bitcoin for the crypto reserve, it could drive a rally to $100,000.

muthoni

Muthoni Mary is a seasoned crypto market analyst and writer with over three years of experience dissecting blockchain trends, price movements, and market dynamics. With a sharp eye for technical analysis and an in-depth understanding of on-chain metrics, she delivers insightful, data-driven content that helps investors navigate the fast-paced world of digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Bitcoin

Bitcoin Long-Term Holder Net Position Turns Green For The First Time In 2025

Published

2 days agoon

March 20, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

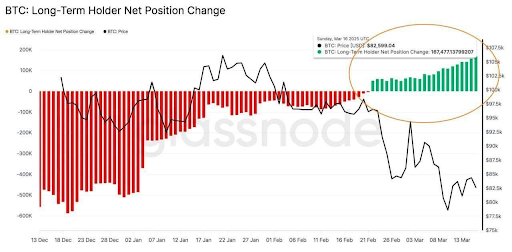

Bitcoin’s long-term holders have resumed accumulation in what is a notable shift in investor sentiment despite the turbulence that has gripped the market in recent weeks. Particularly, data from on-chain analytics platform Glassnode shows that the “BTC: Long-term holder net position change” metric has flipped positive for the first time this year. This suggests that long-term Bitcoin investors are capitalizing on market conditions to add significant amounts of BTC to their holdings.

Long-Term Holders Add 167,000 BTC Amid March Crash

Earlier this month, Bitcoin’s price plunged from above $90,000 to around $80,000 during a rapid sell-off. This price stunned many traders and triggered a continuous wave of liquidations among short-term investors. Yet despite this steep correction, long-term holders treated the sub-$90,000 levels as a buying opportunity rather than a reason to capitulate.

Related Reading

In other words, coins are moving into wallets that haven’t spent their BTC in a long time, which is a notable reversal after starting 2025 with a negative net position change. This marks the first net accumulation by these “HODLers” in 2025. Glassnode’s Long-Term Holder Net Position Change metric, which had been in the red, flipped “green” as long-term investors aggressively accumulated through the downturn.

On-chain data shows that this flip to green has seen long-term holders increase their net Bitcoin holdings by more than 167,000 BTC in the past month. This notable influx is valued at nearly $14 billion. In short, the cohort of seasoned holders began scooping up cheap BTC while short-term sentiment was at its bleakest.

Is A Bitcoin Price Recovery Brewing?

The timing of this flip from red selloff to green accumulation among long-term holders is striking, considering what the Bitcoin price went through in the past two weeks. This data suggests that a large part of the Bitcoin crash was caused by panic-selling among short-term holders. This behavior aligns with past market cycles between August and September 2024, where long-term holders accumulated aggressively during a price dip.

Related Reading

Interestingly, Glassnode’s long-term holder metric isn’t the only one pointing to positive Bitcoin sentiment among large holders. After weeks of uncertainty, Bitcoin exchange-traded funds (ETFs) have started seeing net inflows again. On March 17, spot Bitcoin ETFs collectively drew in about $274.6 million, the largest single-day inflow in 28 days and a clear signal of renewed investor interest.

The very next day brought another wave of fresh capital, with roughly $209 million pouring into Bitcoin funds on March 18. In fact, this three-day streak represents the first sustained run of positive inflows since February 18, a period during which Bitcoin funds have experienced consecutive days of outflows.

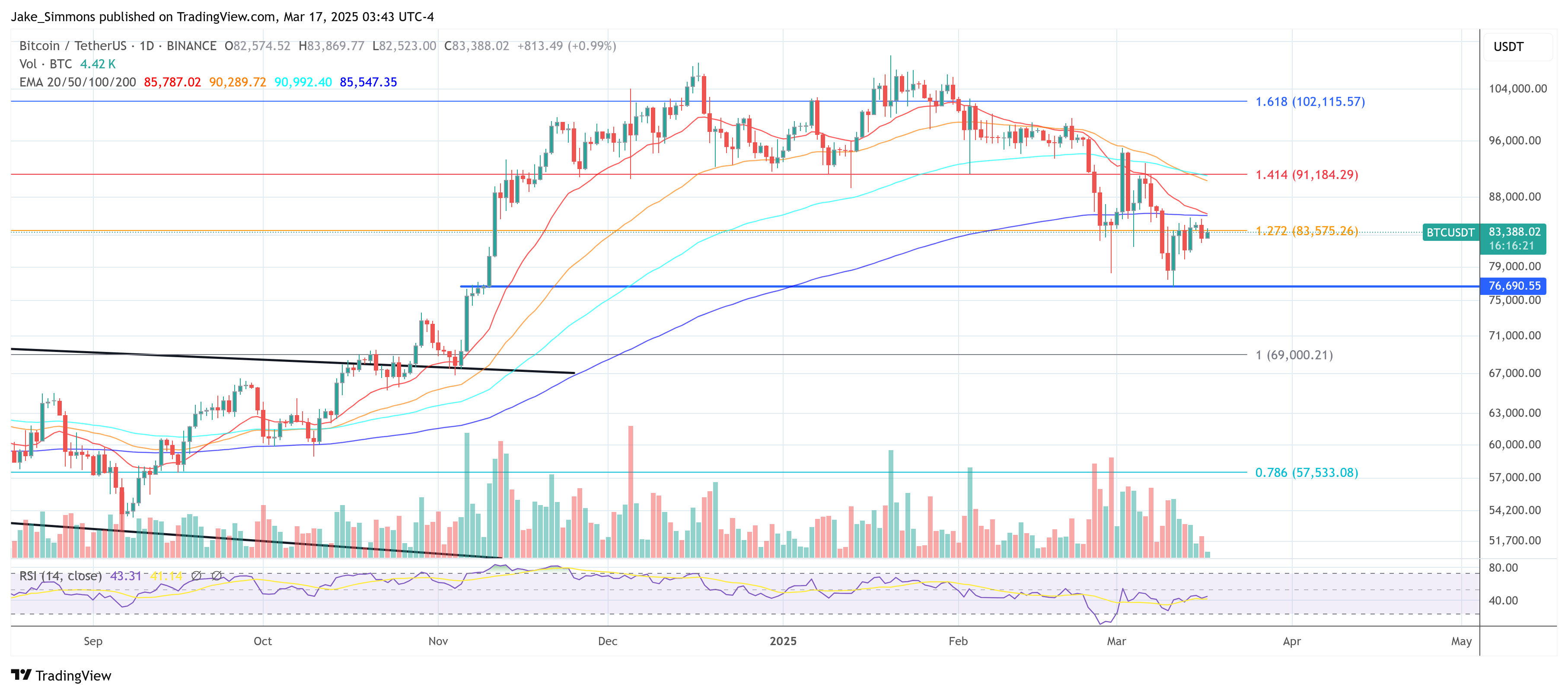

At the time of writing, Bitcoin is trading at $83,500.

Featured image from Unsplash, chart from Tradingview.com

Source link

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

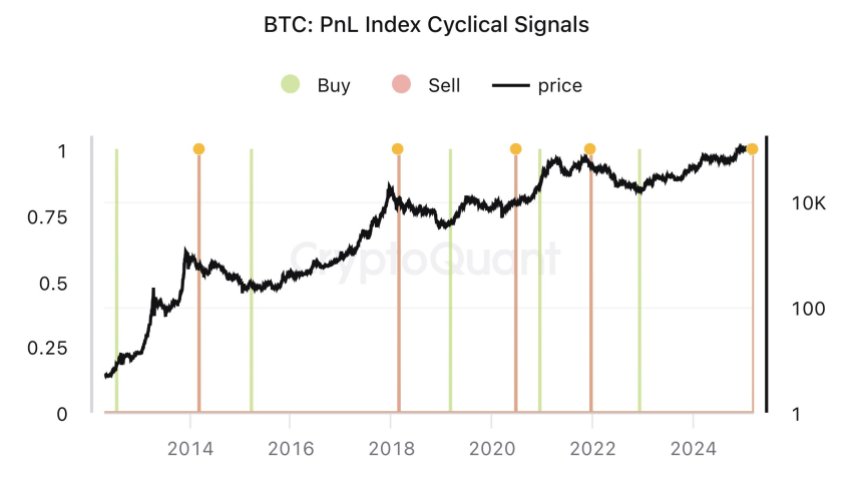

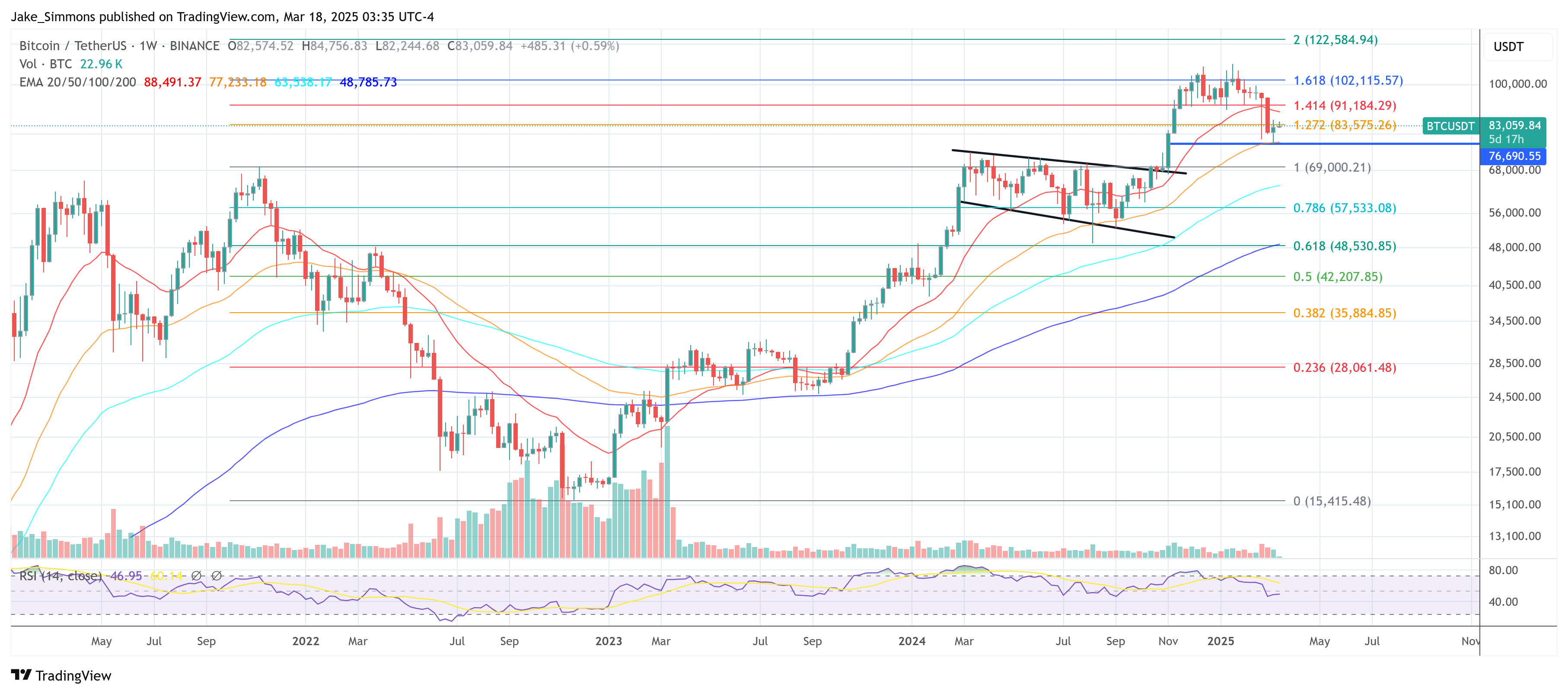

CryptoQuant CEO Ki Young Ju announced today that Bitcoin’s bull cycle “is over” and warned investors to brace for “6–12 months of bearish or sideways price action.” This development comes after the on-chain analytics veteran had previously urged caution but maintained a measured outlook on the market as recently as two weeks ago.

Is The Bitcoin Bull Run Over?

In a post shared today via X, Ki stated:“Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action.”

Related Reading

Along with the comment, the CEO highlighted the Bitcoin PnL Index Cyclical Signals—an index that aggregates multiple on-chain metrics, such as MVRV, SOPR, and NUPL, to pinpoint market tops, bottoms, and cyclical turning points in Bitcoin’s price. According to Ki, this indicator has historically offered reliable buy and sell signals.

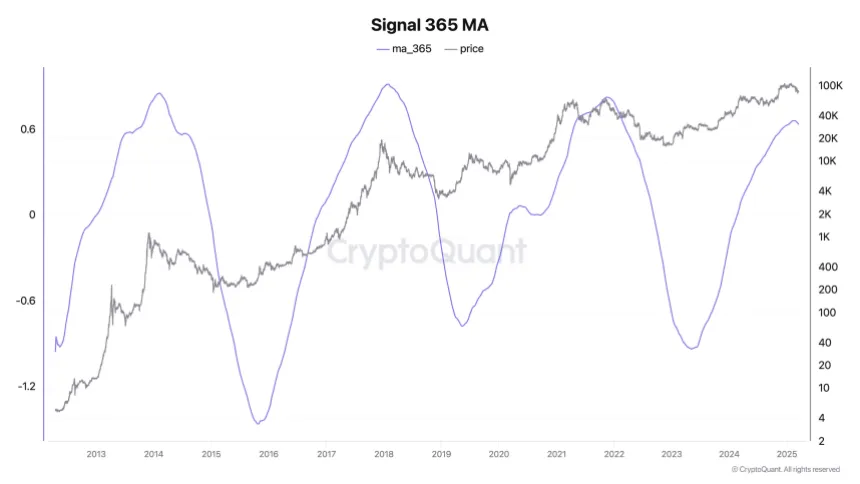

He further explained how an automated alert, previously sent to his subscribers, combined these metrics into a 365-day moving average. Once the trend in this 1-year moving average changes, it often signals a significant market inflection point. As proof, Ki also shared a chart: “This alert applies PCA to on-chain indicators like MVRV, SOPR, and NUPL to compute a 365-day moving average. This signal identifies inflection points where the trend of the 1-year moving average changes.”

Ki pointed to drying liquidity and fresh selling pressure by “new whales” who, he said, are unloading Bitcoin at lower prices. Notably, he revealed that CryptoQuant users who subscribed to his alerts received this signal before today’s public announcement. “With fresh liquidity drying up, new whales are selling Bitcoin at lower prices. Cryptoquant users who subscribed to my alerts received this signal a few days ago. I assume they’ve already adjusted their positions, so I’m posting this now.”

Related Reading

This latest declaration contrasts remarks from just four days ago, on March 14, when Ki struck a more cautious tone, stating: “Bitcoin demand seems stuck, but it’s too early to call it a bear market.”

At that time, he shared a chart of the Bitcoin Apparent Demand (30-day sum) indicator, which had turned slightly negative—an early signal that demand might be tapering off. Although Ki pointed out that demand could still rebound (as it has in past sideways phases), he acknowledged the possibility of Bitcoin teetering on the edge of a bear market.

The pivot in sentiment is especially notable given Ki’s stance from two weeks ago. In that earlier post, he opined that the “bull cycle is still intact,” crediting strong fundamentals and growing mining capacity: “There’s no significant on-chain activity, and key indicators are neutral, suggesting the bull cycle is still intact. Fundamentals remain strong, with more mining rigs coming online.”

However, he also cautioned that the market could turn if sentiment did not improve, particularly in the United States. With today’s announcement, the warning has evidently crystallized. Reflecting on the potential downside scenario, Ki said at the time: “If the cycle ends here, it’s an outcome no one wanted—not old whales, mining companies, TradFi, or even Trump. (FYI, the market doesn’t care about retail.)”

At press time, BTC traded at $83,059.

Featured image created with DALL.E, chart from TradingView.com

Source link

Bitcoin

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Published

5 days agoon

March 17, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a new publication titled The Mustard Seed, Joe Burnett—Director of Market Research at Unchained—outlines a thesis that envisions Bitcoin reaching $10 million per coin by 2035. This inaugural quarterly letter takes the long view, focusing on “time arbitrage” as it surveys where Bitcoin, technology, and human civilization could stand a decade from now.

Burnett’s argument revolves around two principal transformations that, he contends, are setting the stage for an unprecedented migration of global capital into Bitcoin: (1) the “Great Flow of Capital” into an asset with absolute scarcity, and (2) the “Acceleration of Deflationary Technology” as AI and robotics reshape entire industries.

A Long-Term Perspective On Bitcoin

Most economic commentary zooms in on the next earnings report or the immediate price volatility. In contrast, The Mustard Seed announces its mission clearly: “Unlike most financial commentary that fixates on the next quarter or next year, this letter takes the long view—identifying profound shifts before they become consensus.”

At the core of Burnett’s outlook is the observation that the global financial system—comprising roughly $900 trillion in total assets—faces ongoing risks of “dilution or devaluation.” Bonds, currencies, equities, gold, and real estate each have expansionary or inflationary components that erode their store-of-value function:

- Gold ($20 trillion): Mined at approximately 2% annually, increasing supply and slowly diluting its scarcity.

- Real Estate ($300 trillion): Expands at around 2.4% per year due to new development.

- Equities ($110 trillion): Company profits are constantly eroded by competition and market saturation, contributing to devaluation risk.

- Fixed Income & Fiat ($230 trillion): Structurally subject to inflation, which reduces purchasing power over time.

Burnett describes this phenomenon as capital “searching for a lower potential energy state,” likening the process to water cascading down a waterfall. In his view, all pre-Bitcoin asset classes were effectively “open bounties” for dilution or devaluation. Wealth managers could distribute capital among real estate, bonds, gold, or stocks, but each category carried a mechanism by which its real value could erode.

Related Reading

Enter Bitcoin, with its 21-million-coin hard cap. Burnett sees this digital asset as the first monetary instrument incapable of being diluted or devalued from within. Supply is fixed; demand, if it grows, can directly translate into price appreciation. He cites Michael Saylor’s “waterfall analogy”: “Capital naturally seeks the lowest potential energy state—just as water flows downhill. Before bitcoin, wealth had no true escape from dilution or devaluation. Wealth stored in every asset class acted as a market bounty, incentivizing dilution or devaluation.”

As soon as Bitcoin became widely recognized, says Burnett, the game changed for capital allocation. Much like discovering an untapped reservoir far below existing water basins, the global wealth supply found a new outlet—one that cannot be augmented or diluted.

To illustrate Bitcoin’s unique supply dynamics, The Mustard Seed draws a parallel with the halving cycle. In 2009, miners received 50 BTC per block—akin to Niagara Falls at full force. As of today, the reward dropped to 3.125 BTC, reminiscent of halving the Falls’ flow repeatedly until it is significantly reduced. In 2065, Bitcoin’s newly minted supply will be negligible compared to its total volume, mirroring a waterfall reduced to a trickle.

Though Burnett concedes that attempts to quantify Bitcoin’s global adoption rely on uncertain assumptions, he references two models: the Power Law Model which projects $1.8 million per BTC by 2035 and Michael Saylor’s Bitcoin model which suggests $2.1 million per BTC by 2035.

He counters that these projections might be “too conservative” because they often assume diminishing returns. In a world of accelerating technological adoption—and a growing realization of Bitcoin’s properties—price targets could overshoot these models significantly.

The Acceleration Of Deflationary Technology

A second major catalyst for Bitcoin’s upside potential, per The Mustard Seed, is the deflationary wave brought on by AI, automation, and robotics. These innovations rapidly increase productivity, lower costs, and make goods and services more abundant. By 2035, Burnett believes global costs in several key sectors could undergo dramatic reductions.

Adidas’ “Speedfactories” cut sneaker production from months to days. The scaling of 3D printing and AI-driven assembly lines could slash manufacturing costs by 10x. 3D-printed homes already go up 50x faster at far lower costs. Advanced supply-chain automation, combined with AI logistics, could make quality housing 10x cheaper. Autonomous ride-hailing can potentially reduce fares by 90% by removing labor costs and improving efficiency.

Burnett underscores that, under a fiat system, natural deflation is often “artificially suppressed.” Monetary policies—like persistent inflation and stimulus—inflate prices, masking technology’s real impact on lowering costs.

Bitcoin, on the other hand, would let deflation “run its course,” increasing purchasing power for holders as goods become more affordable. In his words: “A person holding 0.1 BTC today (~$10,000) could see its purchasing power increase 100x or more by 2035 as goods and services become exponentially cheaper.”

To illustrate how supply growth erodes a store of value over time, Burnett revisits gold’s performance since 1970. Gold’s nominal price from $36 per ounce to roughly $2,900 per ounce in 2025 appears substantial, but that price gain was continuously diluted by the annual 2% increase in gold’s overall supply. Over five decades, the global stock of gold almost tripled.

If gold’s supply had been static, its price would have hit $8,618 per ounce by 2025, according to Burnett’s calculations. This supply constraint would have bolstered gold’s scarcity, possibly pushing demand and price even higher than $8,618.

Related Reading

Bitcoin, by contrast, incorporates precisely the fixed supply condition that gold never had. Any new demand will not spur additional coin issuance and thus should drive the price upward more directly.

Burnett’s forecast for a $10 million Bitcoin by 2035 would imply a total market cap of $200 trillion. While that figure sounds colossal, he points out that it represents only about 11% of global wealth—assuming global wealth continues to expand at a ~7% annual rate. From this vantage point, allocating around 11% of the world’s assets into what The Mustard Seed calls “the best long-term store of value asset” might not be far-fetched. “Every past store of value has perpetually expanded in supply to meet demand. Bitcoin is the first that cannot.”

A key piece of the puzzle is the security budget for Bitcoin: miner revenue. By 2035, Bitcoin’s block subsidy will be down to 0.78125 BTC per block. At $10 million per coin, miners could earn $411 billion in aggregate revenue each year. Since miners sell the Bitcoin they earn to cover costs, the market would have to absorb $411 billion of newly mined BTC annually.

Burnett draws a parallel with the global wine market, which was valued at $385 billion in 2023 and is projected to reach $528 billion by 2030. If a “mundane” sector like wine can sustain that level of consumer demand, an industry securing the world’s leading digital store of value reaching similar scale, he argues, is well within reason.

Despite public perception that Bitcoin is becoming mainstream, Burnett highlights an underreported metric: “The number of people worldwide with $100,000 or more in bitcoin is only 400,000… that’s 0.005% of the global population—just 5 in 100,000 people.”

Meanwhile, studies might show around 39% of Americans have some level of “direct or indirect” Bitcoin exposure, but this figure includes any fractional ownership—such as holding shares of Bitcoin-related equities or ETFs through mutual funds and pension plans. Real, substantial adoption remains niche. “If Bitcoin is the best long-term savings technology, we would expect anyone with substantial savings to hold a substantial amount of bitcoin. Yet today, virtually no one does.”

Burnett emphasizes that the road to $10 million does not require Bitcoin to supplant all money worldwide—only to “absorb a meaningful percentage of global wealth.” The strategy for forward-looking investors, he contends, is simple but non-trivial: ignore short-term noise, focus on the multi-year horizon, and act before global awareness of Bitcoin’s properties becomes universal. “Those who can see past the short-term volatility and focus on the bigger picture will recognize bitcoin as the most asymmetric and overlooked bet in global markets.”

In other words, it is about “front-running the capital migration” while Bitcoin’s user base is still comparatively minuscule and the vast majority of traditional wealth remains in legacy assets.

At press time, BTC traded at $83,388.

Featured image created with DALL.E, chart from TradingView.com

Source link

The SEC Resets Its Crypto Relationship

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Tether eyeing ‘Big Four’ firm for reserve audit: CEO

Solo Bitcoin Miner Hits the Jackpot, Scoring $266K Reward

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: