Video

Xmas Altcoin Rally Insights by BNM Agent I

Published

4 months agoon

By

admin

AI breaks it down from our post https://blocknewsmedia.com/heres-what-could-trigger-christmas-rally-for-altcoins-according-to-glassnode-co-founders/

The co-founders of the crypto analytics firm Glassnode are outlining two key conditions that could spark altcoin rallies just in time for Christmas.

Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, tell their 63,300 followers that altcoins could be on the verge of outperforming Bitcoin (BTC) in the next two weeks.

The Glassnode co-founders are looking at the Bitcoin Dominance (BTC.D) chart, which tracks the percentage of the total crypto market cap that belongs to Bitcoin. The duo shares a chart suggesting that BTC.D has flipped bearish, opening the doors for altcoins to rise faster in value than Bitcoin.

“Bitcoin dominance has been rejected at the upward trendline – is this the setup for a Christmas rally in altcoins?

For this to happen:

Bitcoin needs to consolidate above $100,000. A period of sideways movement could allow altcoins to gear up for a breakout.

The second half of December and year-end could bring fireworks to the altcoin market. Are you ready?”

At time of writing, BTC.D is hovering at 56.94%, still below the duo’s trendline.

Looking at Bitcoin itself, Negentropic says BTC has so far failed to launch a massive surge above $100,000 due to the selling pressure coming from long-term holders, entities that have held their BTC stacks for more than 155 days.

The Glassnode executives believe that long-term holders are almost out of coins to unload, putting Bitcoin in a position to ascend at the start of 2025.

“Long-Term Holders Selling Pressure Continues.

Key Insight: Long-Term Holders (LTHs) have hit their lowest holdings of the year, marking the largest outflow in 2024.

Triggers: Back-to-back liquidations contributed to significant selling, alongside the year-end profit-taking season.

Looking Ahead: The start of the new year may signal the end of this selling streak, setting the stage for a potential shift in market dynamics.

How will this trend affect Bitcoin in the end of 2024?”

At time of writing, Bitcoin is trading for $101,893.

source

You may like

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

With all the current bearish sentiment and macroeconomic uncertainty swirling around both Bitcoin and the broader global economy, it might come as a surprise to see miners as bullish as ever. In this article, we’ll unpack the data that suggests Bitcoin miners are not just staying the course, they’re accelerating, doubling down at a time when many are pulling back. What exactly do they know that the broader market might be missing?

For a more in-depth look into this topic, check out a recent YouTube video here:

Why Bitcoin Miners Are Doubling Down Right Now

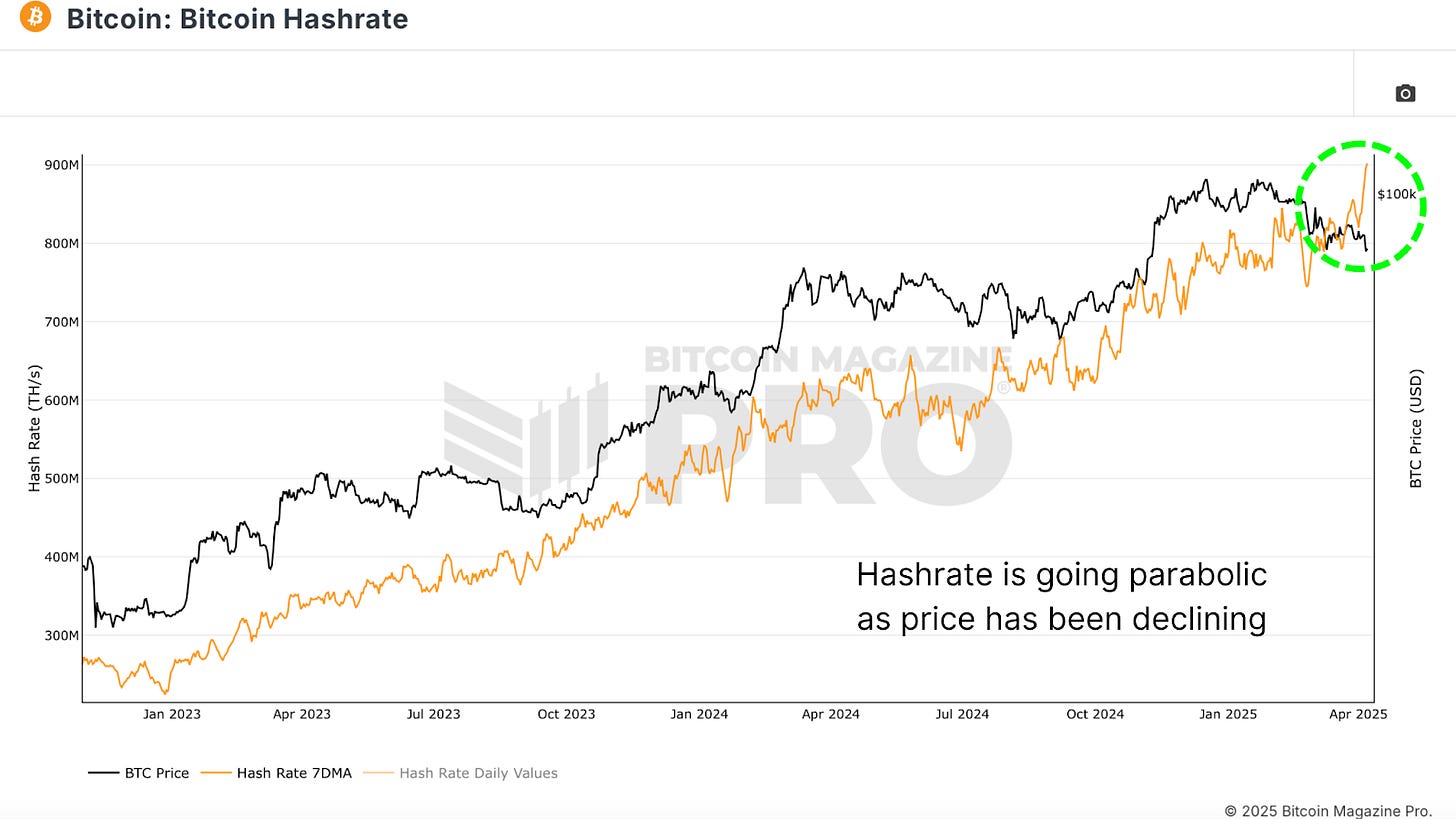

Bitcoin Hash Rate Going Parabolic

Despite Bitcoin’s recent price underperformance, the Bitcoin Hashrate has been going absolutely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish price action. Typically, hash rate is tightly correlated with BTC price; when price drops sharply or remains stagnant, hash rate tends to plateau or decline due to economic pressure on miners.

Yet now, in the face of heightened global tariffs, economic slowdown, and a consolidating BTC price, hash rate is accelerating. Historically, this level of divergence between hash rate and price has been rare and often significant.

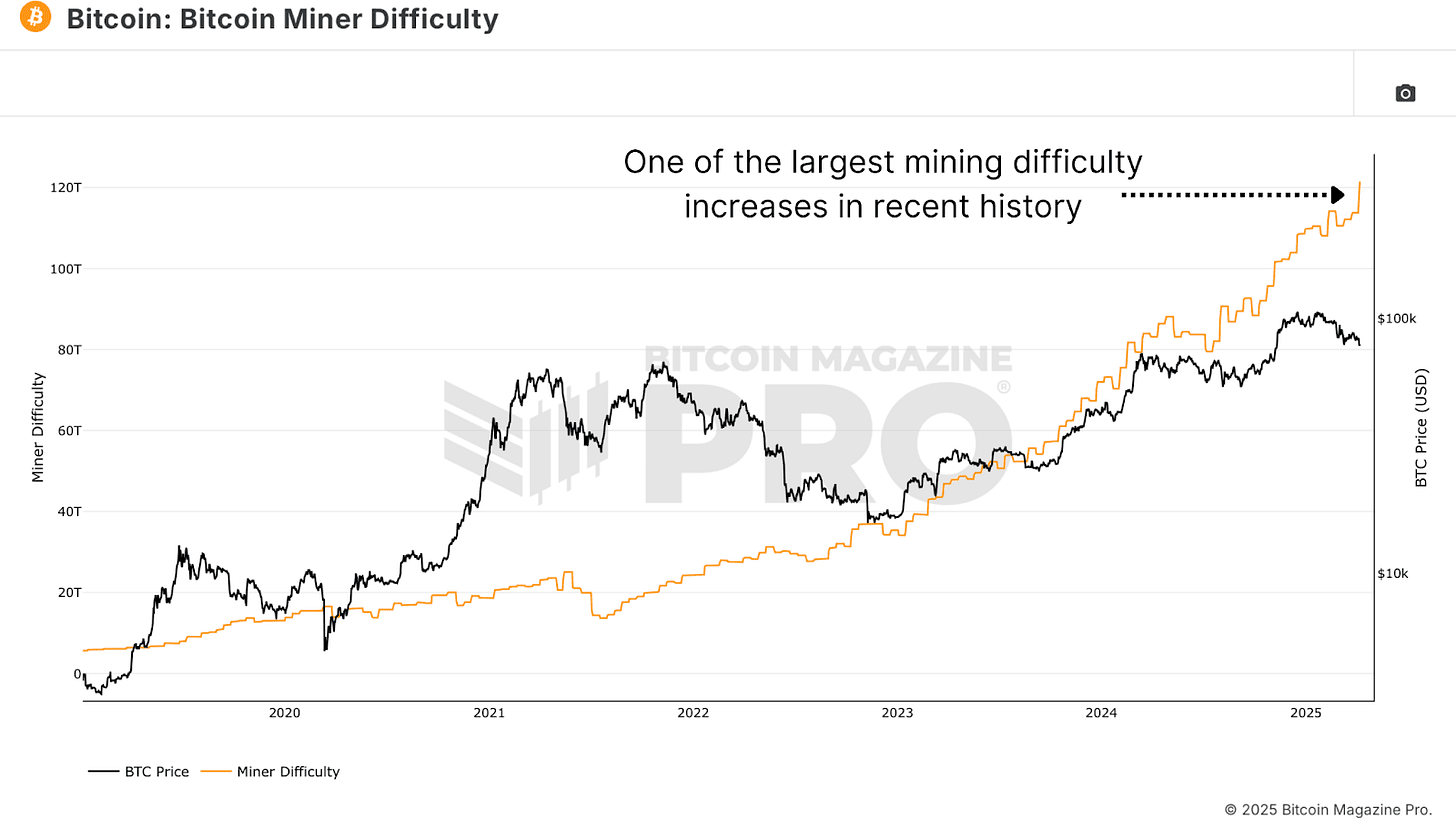

Bitcoin Miner Difficulty, a close cousin to hash rate, just saw one of its largest single adjustments upward in history. This metric, which auto-adjusts to keep Bitcoin’s block timing consistent, only increases when more computational power floods the network. A difficulty spike of this magnitude, especially when paired with poor price performance, is nearly unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC price does not appear to support the decision in the short term.

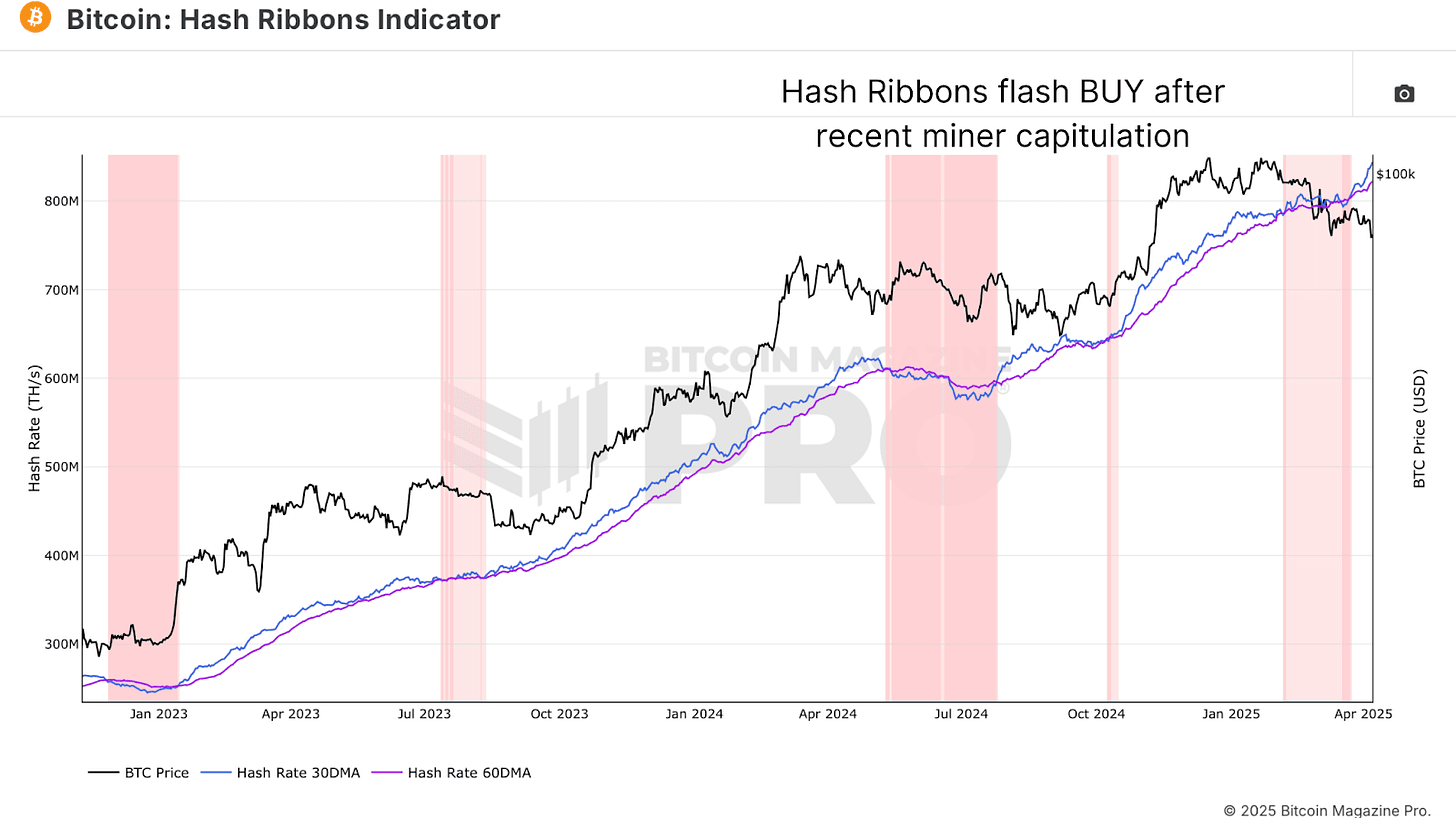

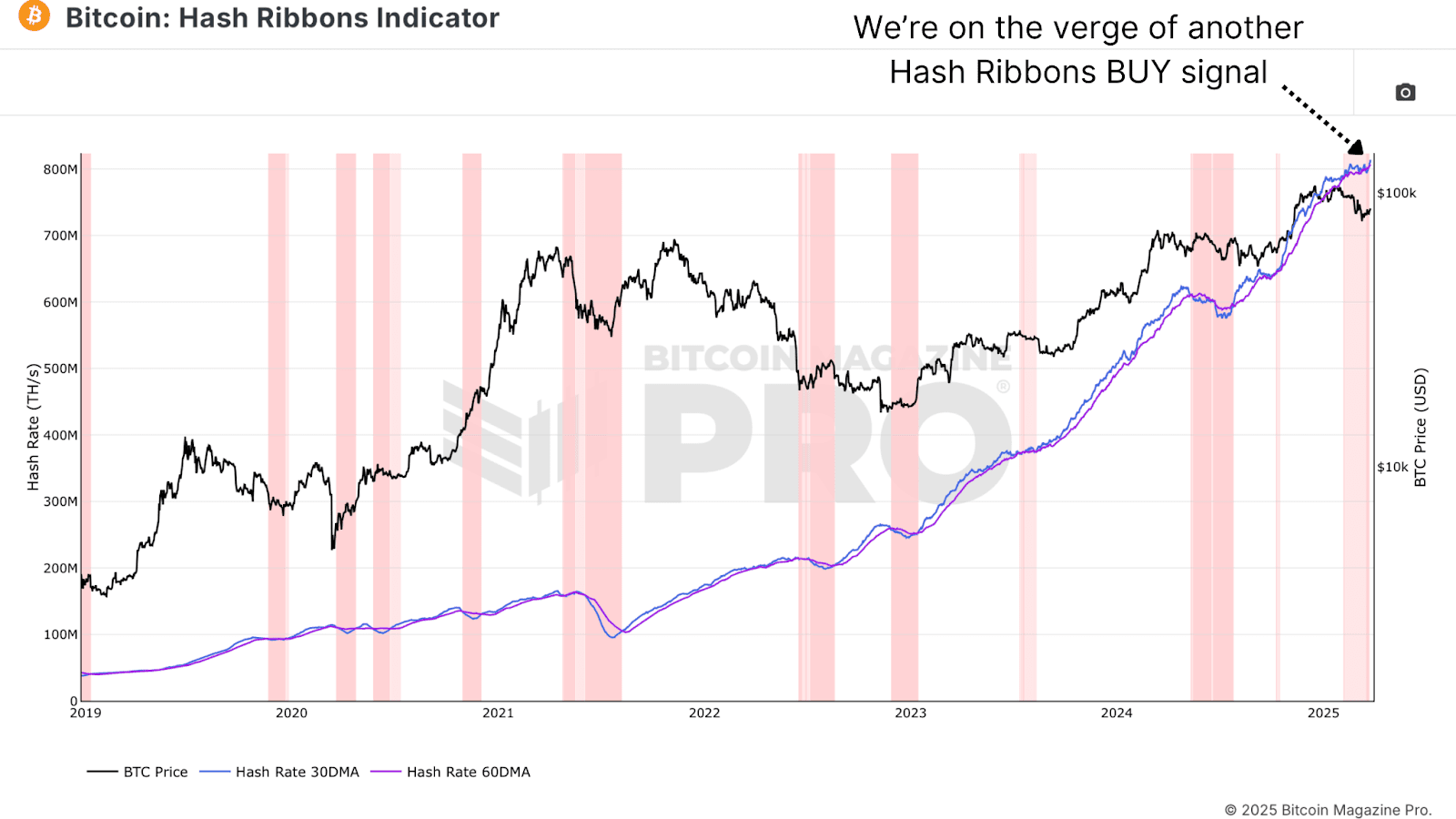

Adding further intrigue, the Hash Ribbons Indicator, a blend of short and long-term hash rate moving averages, recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) crosses back above the 60-day (purple line), it signals the end of miner capitulation and the beginning of renewed miner strength. Visually, the background of the chart shifts from red to white when this crossover occurs. This has often marked powerful inflection points for BTC price.

What’s striking this time around is how aggressively the 30-day moving average is surging away from the 60-day. This is not just a modest recovery, it’s a statement from miners that they are betting heavily on the future.

The Tariff Factor

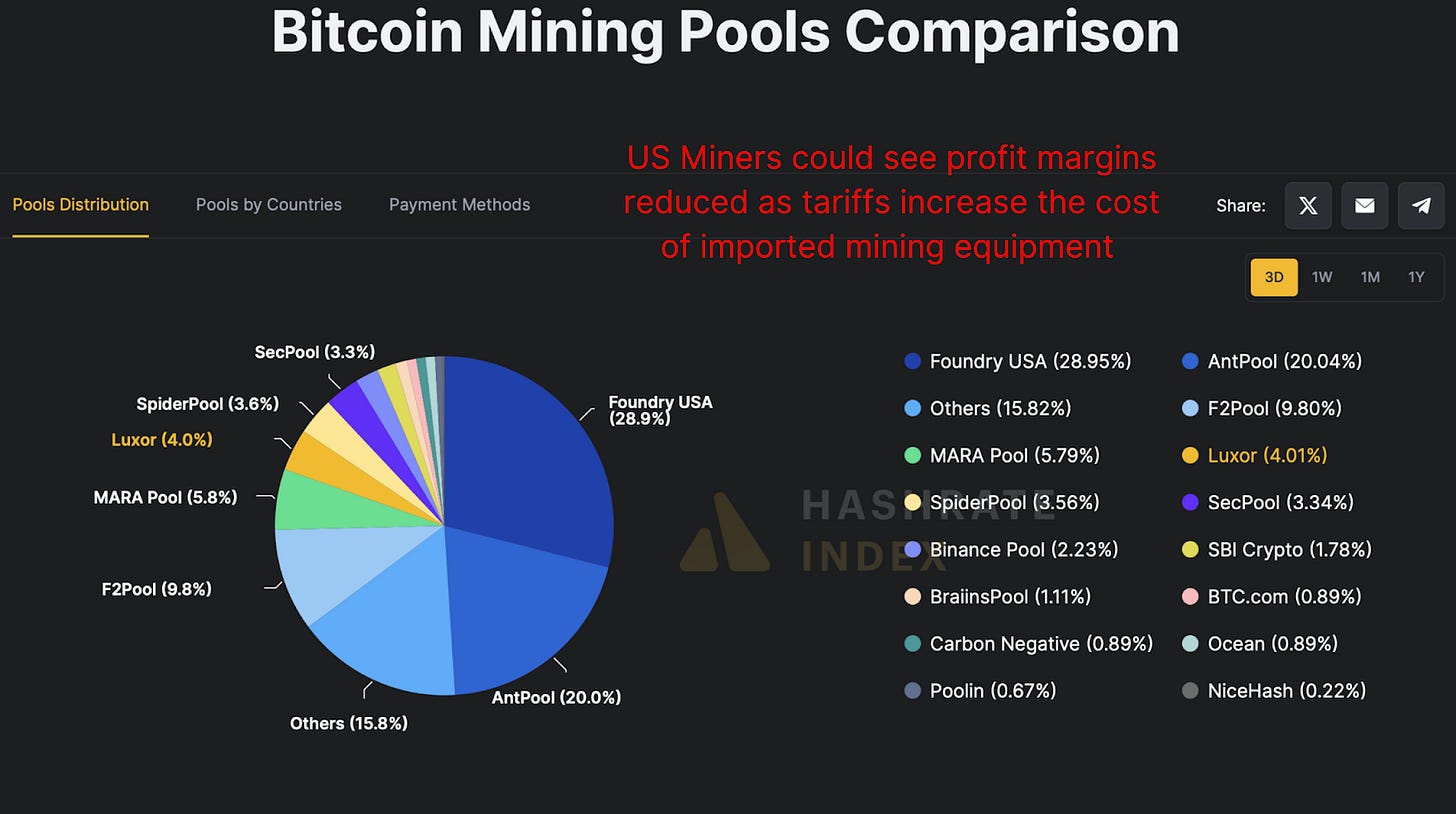

So, what’s fueling this miner frenzy? One plausible explanation is that miners, especially U.S.-based ones, are trying to front-run the impact of looming tariffs. Bitmain, the dominant producer of mining equipment, is now in the crosshairs of trade policies that could see equipment prices surge by 30–50%, potentially to even over 100%!

Given that over 40% of Bitcoin’s hash rate is controlled by U.S.-based pools like Foundry USA, Mara Pool, and Luxor, any cost increase would drastically reduce profit margins. Miners may be aggressively scaling now while hardware is still (relatively) cheap and available.

Bitcoin Miners Keep Mining

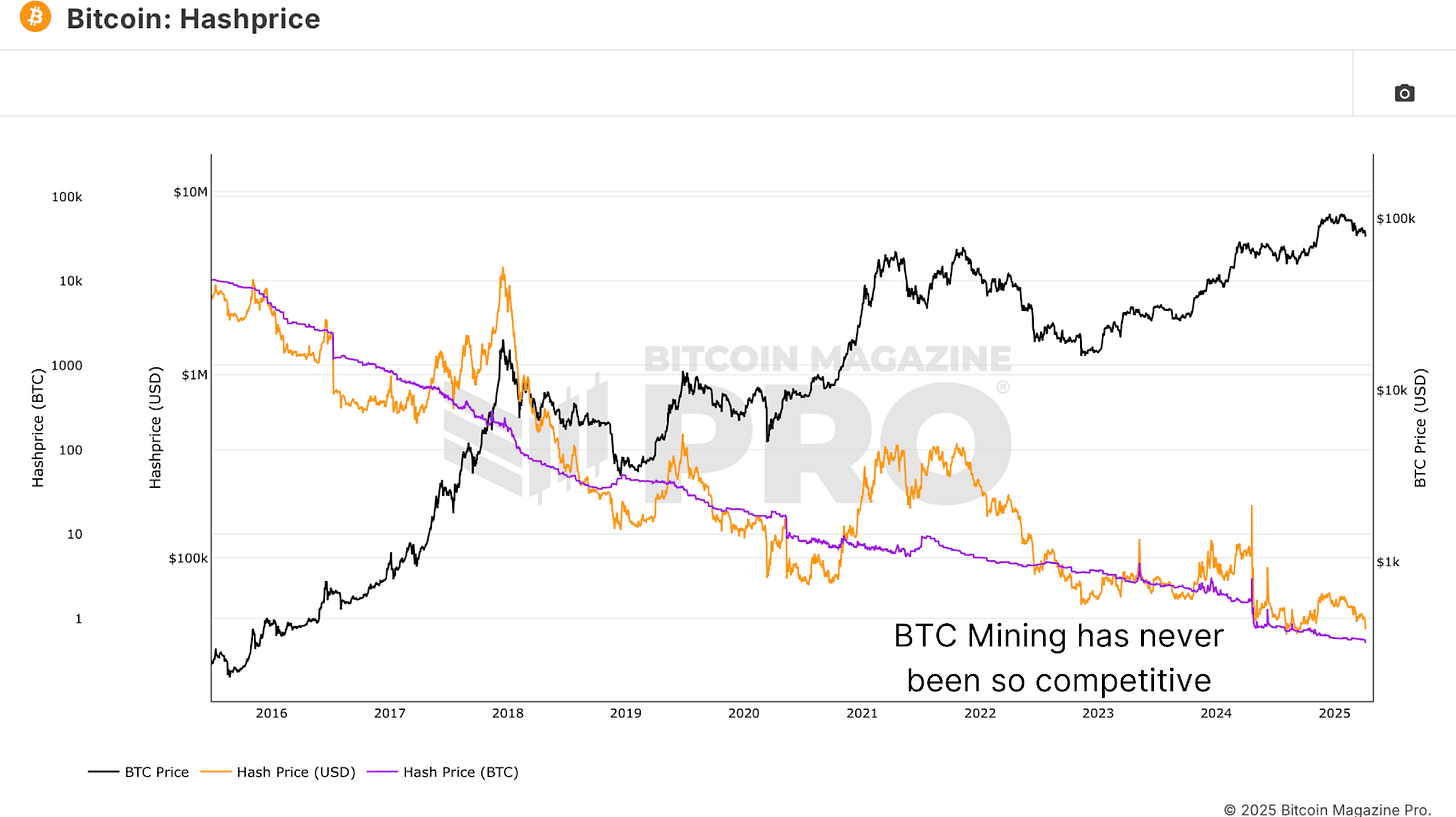

Hashprice, the BTC-denominated revenue per terahash of computational power, is at historical lows. In other words, it’s never been less profitable in BTC terms to operate a Bitcoin miner on a per-terahash basis. Typically, we see hash price increase toward the tail-end of bear markets, as competition fades and weaker players exit the space.

But that’s not happening here. Despite terrible profitability, miners are not only staying online, they’re deploying more hash power. This could imply one of two things; either miners are racing against deteriorating margins to front-load BTC accumulation, or, more optimistically, they have strong conviction in Bitcoin’s future profitability and are buying the dip aggressively.

Bitcoin Miners Conclusion

So, what’s really happening? Either miners are desperately front-running hardware costs, or, more likely, they’re signaling one of the strongest collective votes of confidence in the future of Bitcoin we’ve seen in recent memory. We’ll continue tracking these metrics in future updates to see whether this miner conviction is proven right.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bessent

Why The Bond Market Matters More Than Ever For U.S. Foreign Policy

Published

5 days agoon

April 13, 2025By

admin

Scott Bessent’s Bond Strategy: The U.S. Ten-Year, Foreign Policy & the New Monetary Order

Experts from the Bitcoin Policy Institute unpack why the 10-year Treasury yield is central to Donald Trump’s policy ambitions and U.S. Treasury Secretary Scott Bessent’s economic strategy.

Featuring Bitcoin Policy Institute Executive Director Matthew Pines, Head of Policy Zack Shapiro and Growth Associate Zack Cohen.

They explore how bond market dynamics affect U.S. interest payments, trade policy, and the feasibility of industrial onshoring. As America confronts growing debt burdens and fiscal constraints, understanding the yield curve becomes critical for navigating the future of U.S. monetary policy and Bitcoin’s role within it.

From Episode #1 of The Bitcoin Policy Hour: “Wargaming the Mar-a-Lago Accord: Tariffs, Bitcoin and Stablecoins“.

Source link

Following a sharp multi-week selloff that dragged Bitcoin from above $100,000 to below $80,000, the recent price bounce has traders debating whether the Bitcoin bull market is truly back on track or if this is merely a bear market rally before the next macro leg higher.

Bitcoin’s Local Bottom or Bull Market Pause?

Bitcoin’s latest correction was deep enough to rattle confidence, but shallow enough to maintain macro trend structure. Price seems to have set a local bottom between $76K–$77K, and several reliable metrics are beginning to solidify the local lows and point towards further upside.

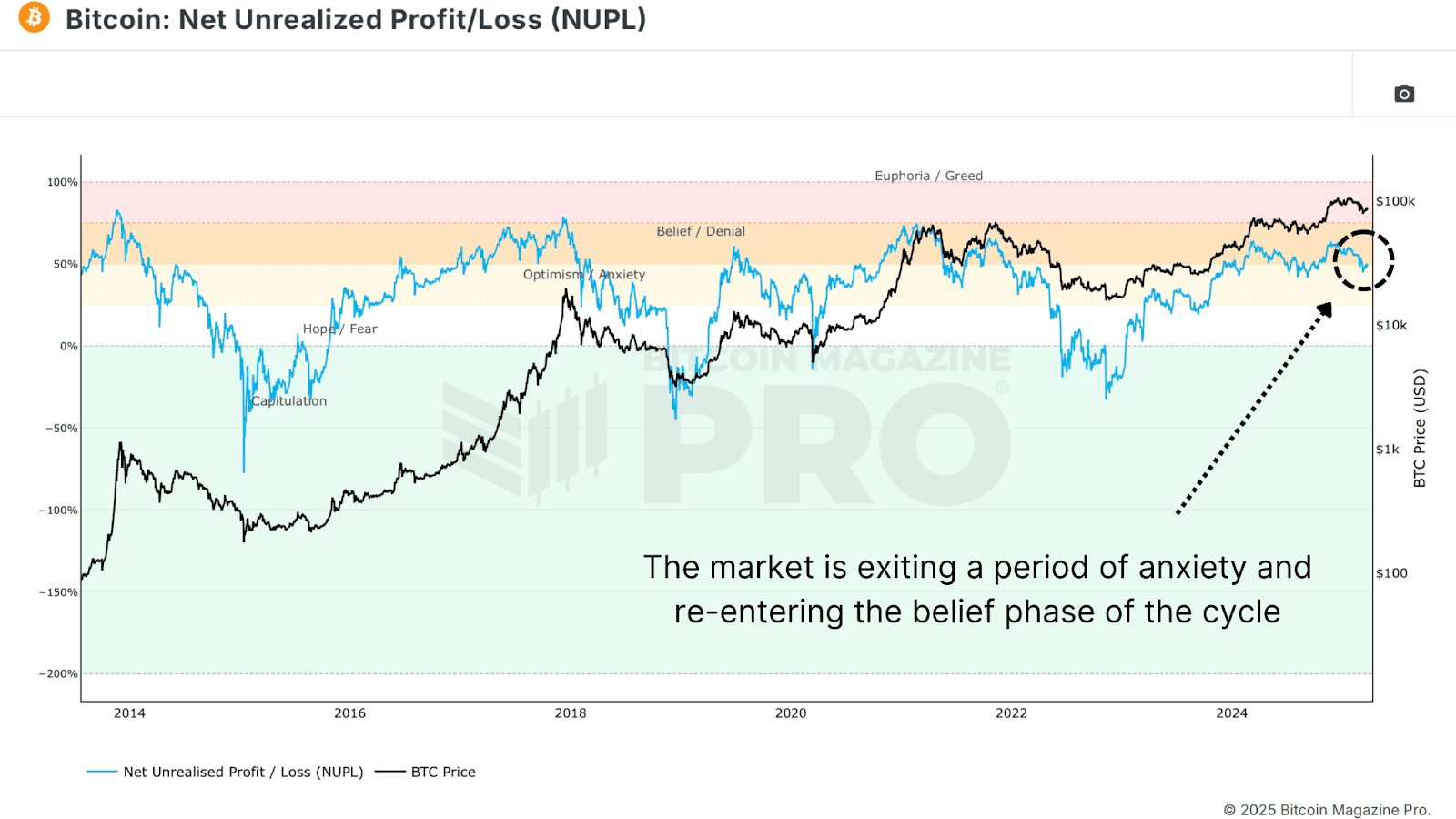

The Net Unrealized Profit and Loss (NUPL) is one of the most reliable sentiment gauges across Bitcoin cycles. As price fell, NUPL dropped into “Anxiety” territory, but following the rebound, NUPL has now reclaimed the “Belief” zone, a critical sentiment transition historically seen at macro higher lows.

The Value Days Destroyed (VDD) Multiple weighs BTC spending by both coin age and transaction size, and compares the data to a previous yearly average, giving insight into long term holder behavior. Current readings have reset to low levels, suggesting that large, aged coins are not being moved. This is a clear signal of conviction from smart money. Similar dynamics preceded major price rallies in both the 2016/17 and 2020/21 bull cycles.

Bitcoin Long-Term Holders Boost Bull Market

We’re also now seeing the Long Term Holder Supply beginning to climb. After profit-taking above $100K, long-term participants are now re-accumulating at lower levels. Historically, these phases of accumulation have set the foundation for supply squeezes and subsequent parabolic price action.

Bitcoin Hash Ribbons Signal Bull Market Cross

The Hash Ribbons Indicator has just completed a bullish crossover, where the short-term hash rate trend moves above the longer-term average. This signal has historically aligned with bottoms and trend reversals. Given that miner behavior tends to reflect profitability expectations, this cross suggests miners are now confident in higher prices ahead.

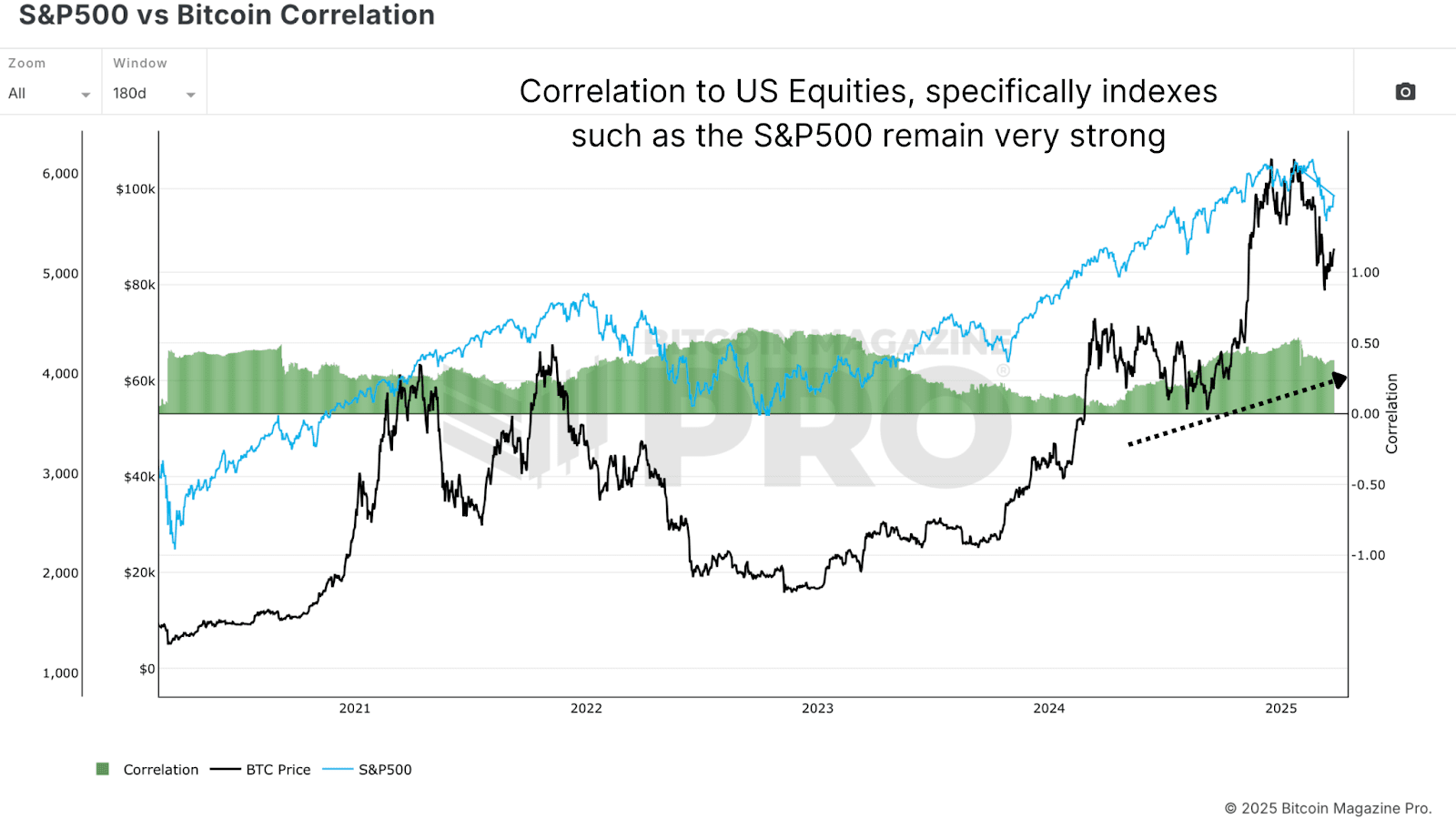

Bitcoin Bull Market Tied to Stocks

Despite bullish on-chain data, Bitcoin remains closely tied to macro liquidity trends and equity markets, particularly the S&P 500. As long as that correlation holds, BTC will be partially at the mercy of global monetary policy, risk sentiment, and liquidity flows. While rate cut expectations have helped risk assets bounce, any sharp reversal could cause renewed choppiness for Bitcoin.

Bitcoin Bull Market Outlook

From a data-driven perspective, Bitcoin looks increasingly well-positioned for a sustained continuation of its bull cycle. On-chain metrics paint a compelling picture of resilience for the Bitcoin bull market. The Net Unrealized Profit and Loss (NUPL) has shifted from “Anxiety” during the dip to the “Belief” zone after the rebound—a transition often seen at macro higher lows. Similarly, the Value Days Destroyed (VDD) Multiple has reset to levels signaling conviction among long-term holders, echoing patterns before Bitcoin’s rallies in 2016/17 and 2020/21. These metrics point to structural strength, bolstered by long-term holders aggressively accumulating supply below $80,000.

Further supporting this, the Hash Ribbons indicator’s recent bullish crossover reflects growing miner confidence in Bitcoin’s profitability, a reliable sign of trend reversals historically. This accumulation phase suggests the Bitcoin bull market may be gearing up for a supply squeeze, a dynamic that has fueled parabolic moves before. The data collectively highlights resilience, not weakness, as long-term holders seize the dip as an opportunity. Yet, this strength hinges on more than just on-chain signals—external factors will play a critical role in what comes next.

However, macro conditions still warrant caution, as the Bitcoin bull market doesn’t operate in isolation. Bull markets take time to build momentum, often needing steady accumulation and favorable conditions to ignite the next leg higher. While the local bottom between $76K–$77K seems to hold, the path forward won’t likely feature vertical candles of peak euphoria yet. Bitcoin’s tie to the S&P 500 and global liquidity trends means volatility could emerge from shifts in monetary policy or risk sentiment.

For example, while rate cut expectations have lifted risk assets, an abrupt reversal—perhaps from inflation spikes or geopolitical shocks—could test Bitcoin’s stability. Thus, even with on-chain data signaling a robust setup, the next phase of the Bitcoin bull market will likely unfold in measured steps. Traders anticipating a return to six-figure prices will need patience as the market builds its foundation.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals