Altcoin

XRP and TRON could rally even as BTC under $100k

Published

4 months agoon

By

admin

Ripple and TRON posted over 50% weekly gains and the two altcoins could continue their climb in the altcoin season. As Bitcoin slips under the $100,000 level, it dragged altcoins down with a market-wide correction on Friday.

XRP (XRP) and TRON (TRX) could recover and extend the rally next week, according to on-chain and technical indicators.

Bitcoin erases recent gains, slips under $100,000

Bitcoin’s rally to a new all-time high above the $100,000 milestone, at $104,088 was fueled by consistent institutional capital inflows to Spot BTC ETFs, and pro-crypto developments in the U.S (BTC).

The largest cryptocurrency pulled back shortly after, down nearly 6% from its all-time high. Altcoins reacted to the development, and a market-wide correction followed. Most alts in the top 20 erased between 1 and 5% of their value within a 24-hour period.

Analysts at Crypto Finance, a part of the Deutsche Börse Group, believe that the catalyst for the surge in BTC was Fed Chair Jerome Powell’s remarks at the DealBook Summit, where he compared bitcoin to gold rather than the US dollar.

XRP and TRON could extend rally as altcoin season persists

The altcoin season index at Blockchain center signals that it is “altcoin month.” Altcoin season persists as 75% of the top 50 altcoins continue to outperform Bitcoin over a 90-day time period. The indicator reads 86 on a scale of 0 to 100.

XRP and TRON gained nearly 50% on the weekly timeframe, per TradingView data. The two altcoins could extend their gains as the altcoin season persists.

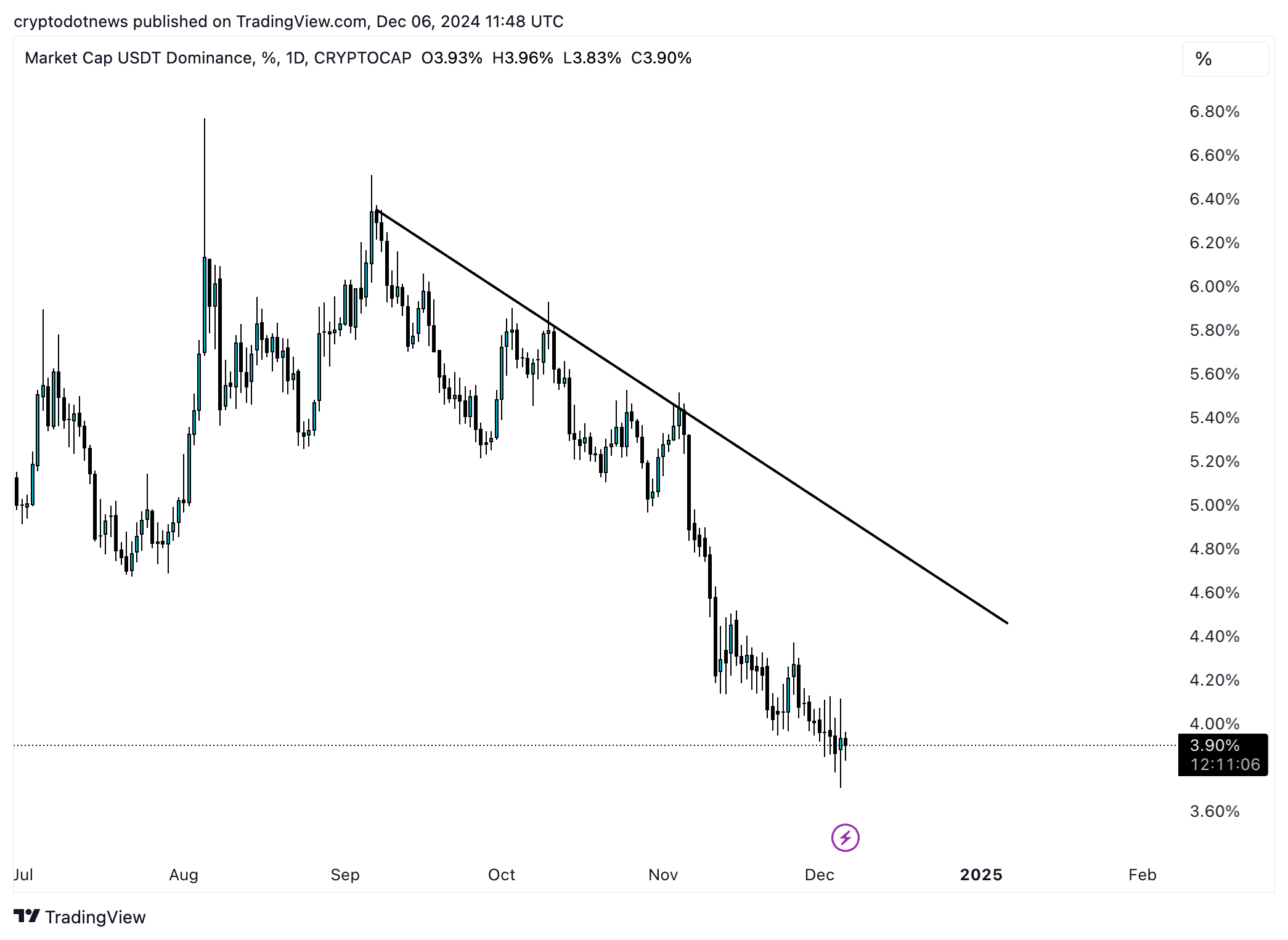

Tether (USDT) dominance is at 3.91%, meaning traders are likely rotating their capital from stablecoins to cryptocurrencies and altcoins. USDT dominance has been in a downward trend since September 2024.

Traders need to watch the USDT dominance chart closely for signs of a trend reversal or consolidation. If USDT dominance starts climbing again, it could signal a surge in profit-taking or capital flowing out of Bitcoin and altcoins.

On-chain and technical analysis

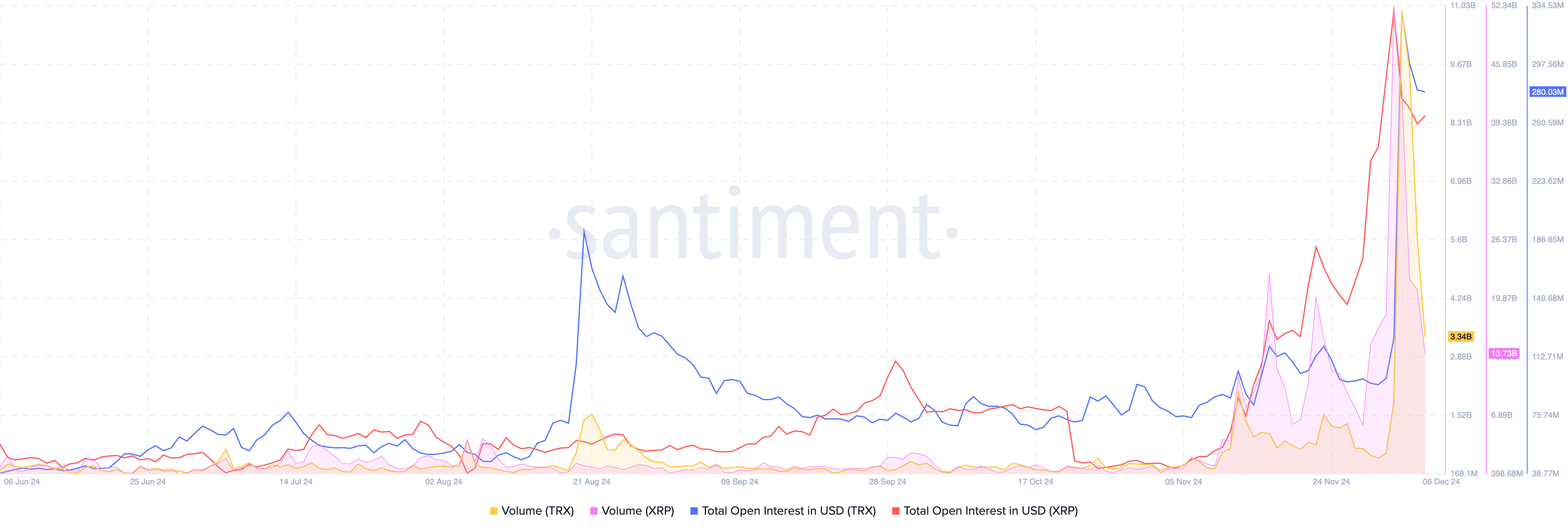

The total open interest in both XRP and TRON was noted to spike earlier this week. Open interest tracks the active positions in the token across derivatives exchanges. A spike in the metric was followed by above-average open interest as of Friday, December 6, per Santiment data.

The volume in both altcoins is above average, with positive spikes in early December, as seen in the Santiment chart below. This shows demand and relevance among traders on crypto exchange platforms.

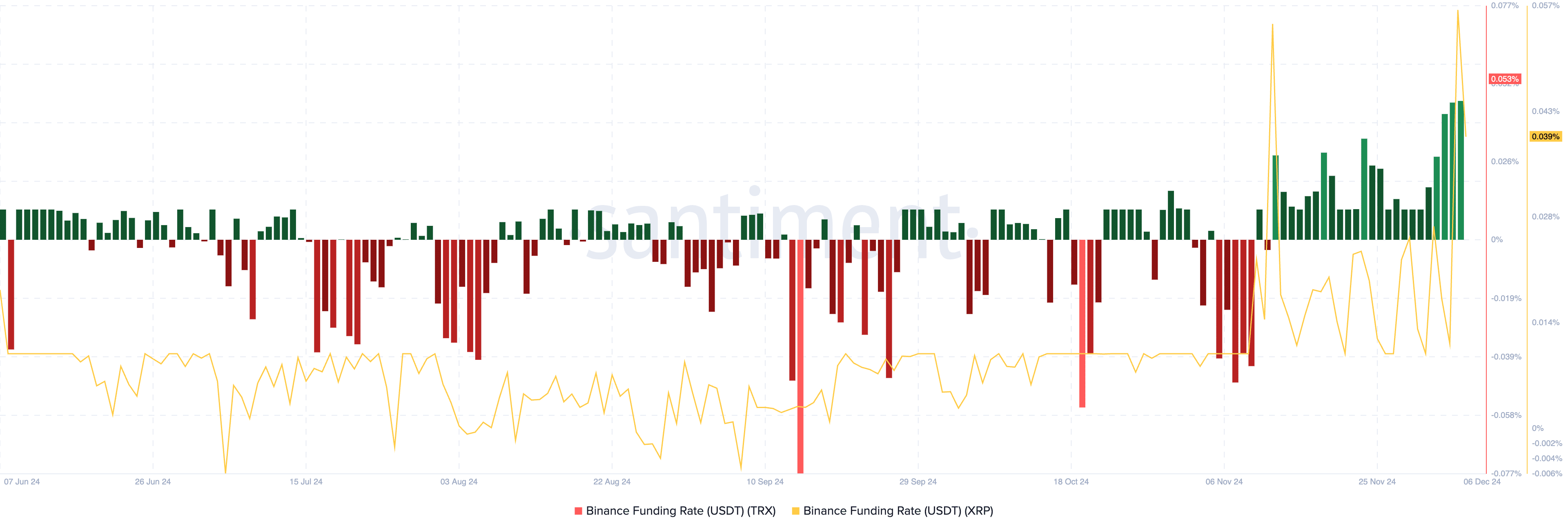

For both altcoins, the funding rate has been positive since November 12. A positive funding rate is indicative of bullish market sentiment among XRP and TRON traders on derivatives exchanges.

XRP and TRON price forecast

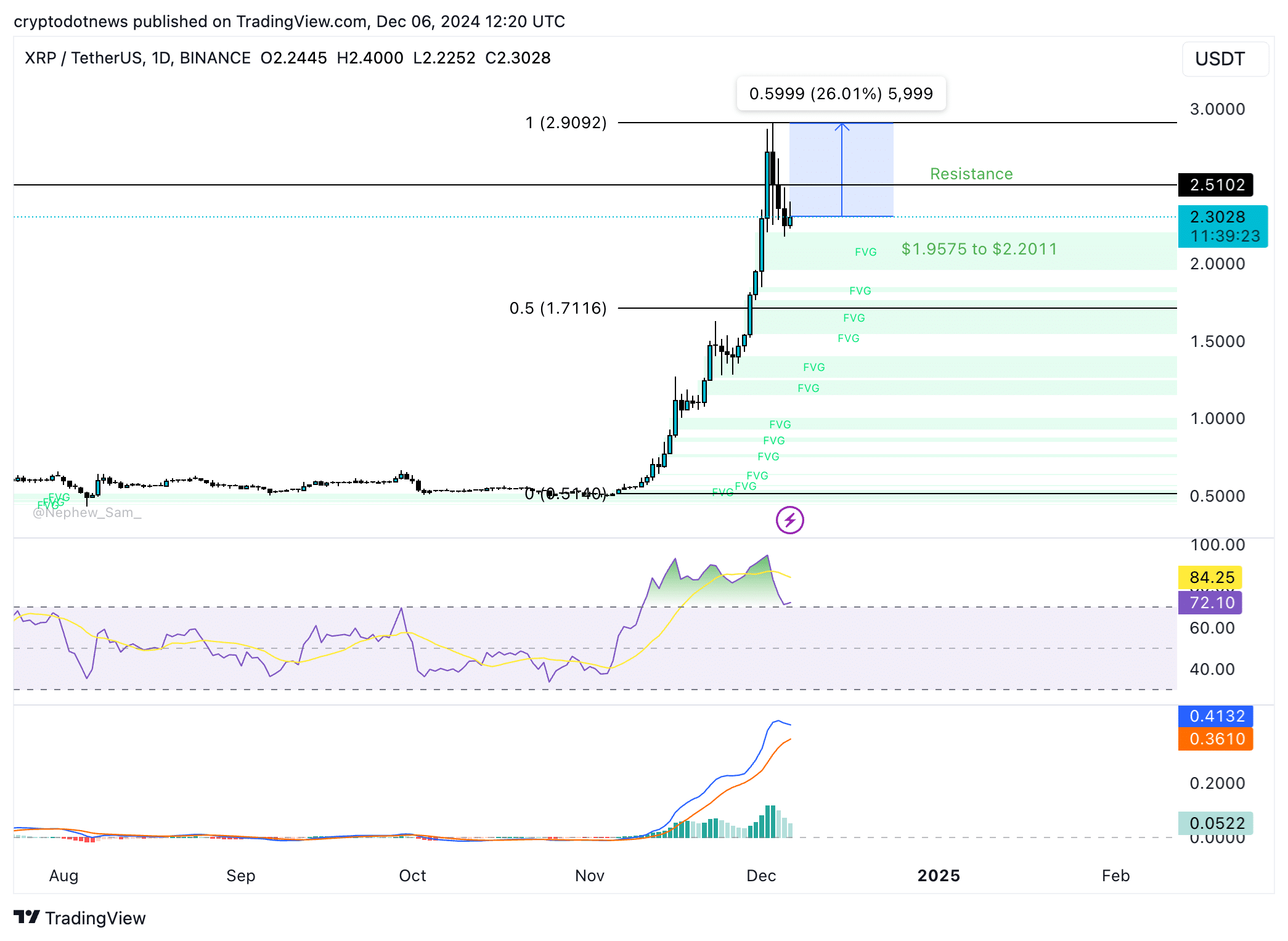

XRP trades at $2.3028 early on Friday. The altcoin’s technical indicators, Relative strength index and moving average convergence divergence are supportive of gains in XRP price.

XRP faces resistance at $2.5102, and the target is the December 2024 peak of $2.9092. A correction could send XRP to collect liquidity in the imbalance zone between $1.9575 and $2.2011.

Once the inefficiency is filled, XRP could attempt to regain lost ground and target a 26% price rally to the target.

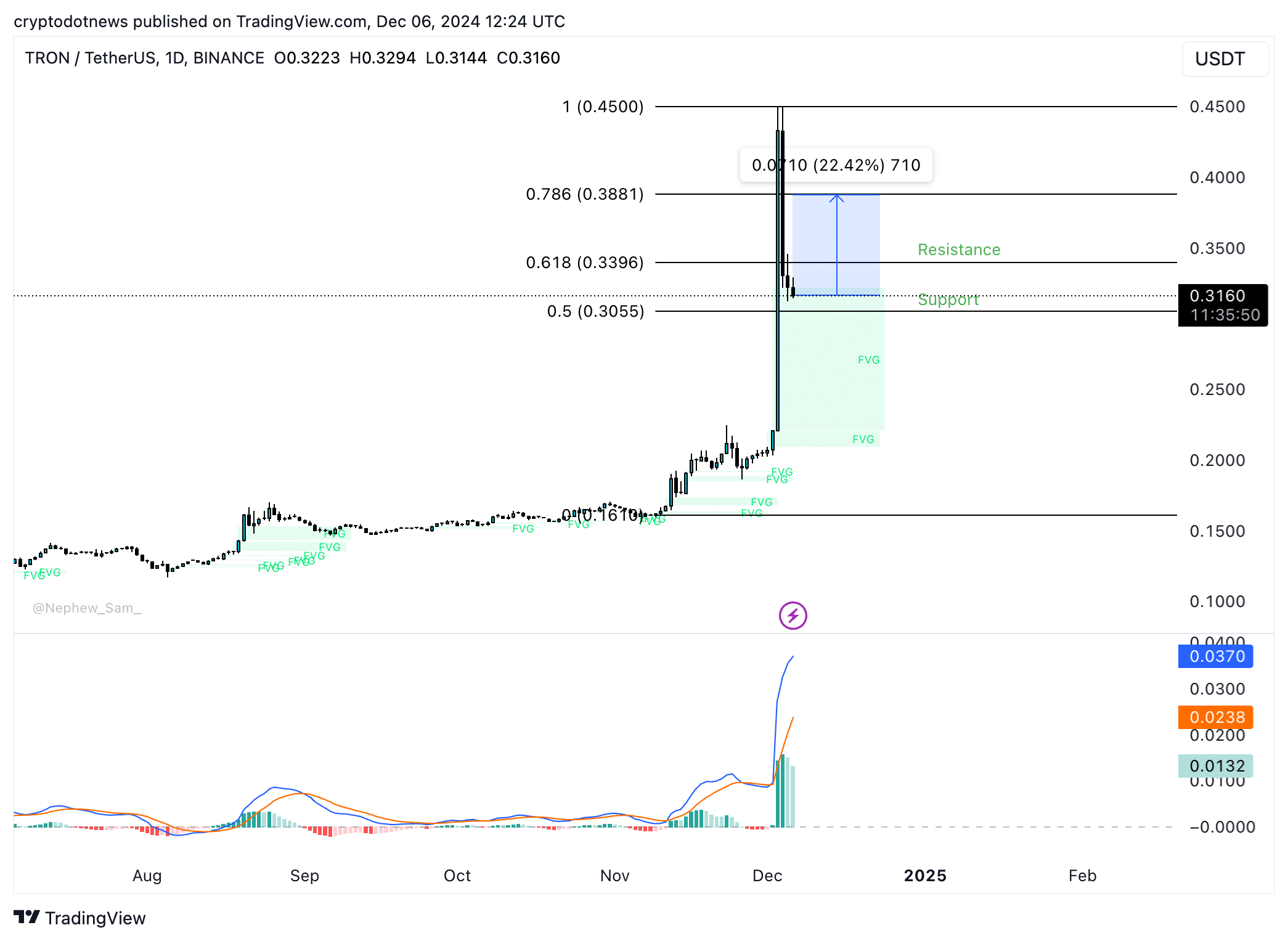

TRON trades close to support at $0.3160 on Friday. The closest support is $0.3055, the 50% Fibonacci retracement of the rally from the November 9 low to the December 4 peak of $0.4500.

TRON could rally 22.42% and target the 78.6% Fib retracement at $0.3881. The altcoin faces resistance at $0.3396, the 61.8% Fib retracement level, as seen on the daily price chart.

The momentum indicator, MACD supports a thesis of gains in TRON as it flashes green histogram bars above the neutral line.

Strategic considerations

Bitcoin’s price trend is key, and traders need to watch BTC closely for an impulsive correction. A steep decline could usher a pullback in altcoins; therefore, sidelined buyers and traders adding to their long position need to watch BTC price.

XRP and TRON both have observed a decline in their open interest across derivatives exchanges in the past 24 hours, per Coinglass data. This is likely a reaction to Bitcoin’s decline under the $100,000 level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

Trader Says Altcoin That’s Ripped 222% in a Month Still Has Room To Run, Updates Outlook on SOL-Based Memecoin

Boosting growth in the tokenized credit market

As Bitcoin Mining Companies Slump, Tether Loads Up on Bitdeer

Can XRP Price Hit $20? Federal Reserve Hints US Banks Can Use XRP

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

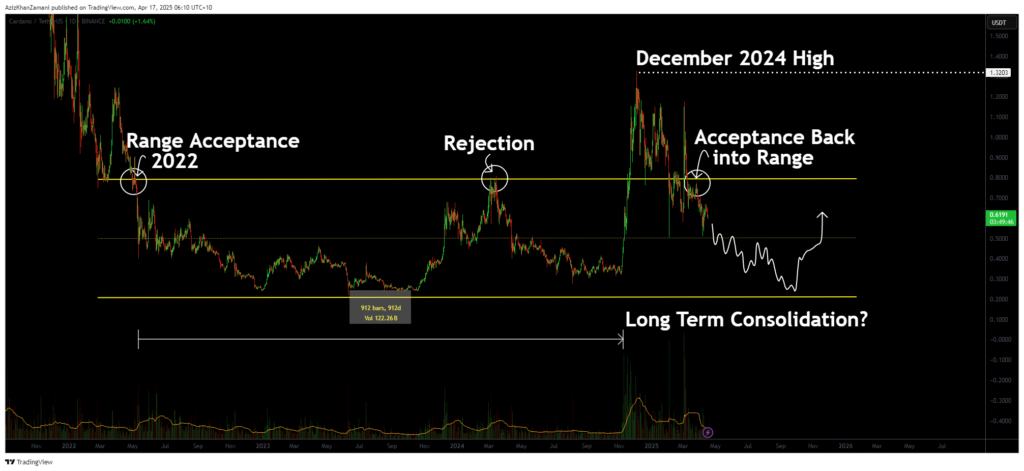

Cardano (ADA) has shown major structural developments as it re-enters a multi-year trading range. The recent price action suggests acceptance back within this long-term structure, with indicators pointing toward a potential move to the lower support region.

Cardano (ADA) has re-entered a significant trading range that has contained its price action for over three years. After a breakout in late 2024 that lacked volume strength, the asset has failed to sustain its highs and is now showing signs of weakness. For traders, this shift back into the range carries major implications for ADA’s medium- to long-term price trajectory.

Key points covered

- ADA has closed multiple candles back within a multi-year trading range, signaling true acceptance

- The 2024 breakout lacked volume confirmation, indicating a potential climactic top

- A move towards the lower support region is increasingly likely as ADA seeks true market value

After more than 912 days of trading within a well-defined range since 2022, ADA finally broke out in December 2024, setting a new high. However, this breakout lacked the critical component of follow-through volume. A sharp drop in volume immediately after the breakout signaled weakening momentum, suggesting a climactic top rather than a sustainable bullish trend.

Price action has since fallen back below the range high and closed multiple candles beneath it, a clear sign of acceptance back within the range. This is significant from a structural standpoint. Rather than consolidating above and building new support, ADA is now signaling a potential return to its value zone, likely toward the lower bound of the long-term range.

The volume profile reinforces this theory. The expansion to the December highs was not matched by sustained buyer interest. Instead, volume sharply tapered off, indicating that the breakout may have been speculative and not backed by conviction. In such cases, price often returns to equilibrium levels to reassess fair market value.

What to expect in the coming price action

With ADA now firmly back inside the long-term range, a slow grind toward the lower support region is increasingly probable. Traders should exercise patience, avoiding premature entries until there is either a confirmed trend reversal or a test of the lower boundary. The real opportunity may lie in ADA’s eventual consolidation and structure near the bottom of this historical range.

Source link

Altcoin

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Published

5 days agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana appears to be gearing up for a major technical breakout, with recent price action building up an interesting chart formation. A familiar bullish pattern has formed, and if validated, it could drive the price to a level not seen in recent weeks. This new development was highlighted by popular analyst Titan of Crypto on social media platform X.

Pattern Breakout Sets $143 In Sight

Like every other large market-cap cryptocurrency, Solana has experienced an extended period of price crashes since late February. In the case of Solana, this price crash has been drawing out since January, when it reached an all-time high of $293 during the euphoria surrounding the Official Trump meme coin. Since then, Solana has corrected massively, even reaching a low of $97 on April 7.

Related Reading

The price action before and after this $97 low has created an interesting formation on the 4-hour candlestick timeframe chart. As crypto analyst Titan of Crypto noted, this formation is enough to send Solana back up to $143.

At the heart of the latest bullish outlook is a clearly defined inverse head and shoulders structure, which is known for its reliability in signaling a reversal from a downtrend to a bullish breakout. The left shoulder of the pattern began forming in early April as Solana attempted to rebound from sub-$110 levels. The subsequent drop to the $96 bottom on April 7 formed the head of the structure. From there, a recovery started as buyers cautiously stepped back in, giving rise to the right shoulder.

The breakout of the neckline resistance has taken place in the past 24 hours. With this in mind, Titan of Crypto predicted that $143 becomes the next logical destination based on the measured move from the head to the neckline.

Image From X: Titan of Crypto

Momentum Strengthens With Structure Confirmation

Looking at the chart shared by the analyst, the momentum behind Solana’s price movement appears to be gaining strength. Trading volume is an important metric in evaluating the strength of a breakout, and the volume accompanying the recent breakout above the neckline seemingly confirms it.

Particularly, Solana has seen a 5.3% increase in its price during the past 24 hours, with trading volume surging by 3.76% within this timeframe to $4.21 billion.

Although it is common to see a throwback or minor consolidation just above the neckline, the projected path suggests continued upside as long as price action holds above that key breakout zone.

Related Reading

At the time of writing, Solana is trading at $129, 10% away from reaching this inverse head-and-shoulder target. A move to $143 would not only represent a meaningful recovery from April’s lows but could also improve the confidence in Solana’s price trajectory moving into Q2. The next outlook is what happens after it reaches this target of $143, which will depend on the general market sentiment.

Featured image from The Information, chart from TradingView

Source link

Altcoin

Is It Time For Altcoin Season? Bitcoin Dominance Rises To Major Rejection Zone

Published

6 days agoon

April 12, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

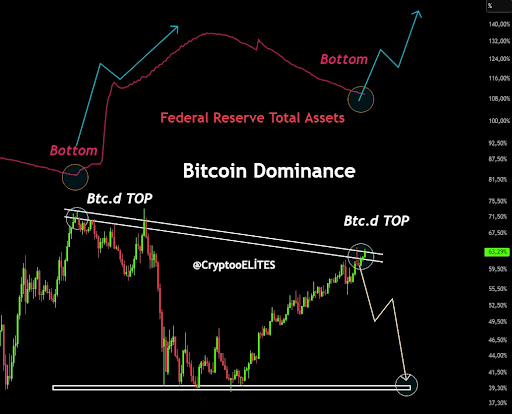

Crypto analyst El Crypto has raised the possibility of an altcoin season happening soon. The analyst alluded to Bitcoin’s dominance rising to a major rejection zone, which could be bullish for altcoins.

Altcoin Season May Be Imminent As Dominance Hits Major Rejection Zone

In an X post, El Crypto suggested that the altcoin season may be imminent as Bitcoin’s dominance hits a major resistance zone. He revealed that BTC’s dominance again touched a zone that has led to rejection every time in the last one and a half years. He added that the Stochastic Relative Strength Index (RSI) is also in the overbought area, while a bearish cross has now happened again.

Related Reading

Based on this, the analyst remarked that the market looks to be in for some fun, hinting at an altcoin season. Crypto analyst CryptoElites also affirmed that Bitcoin’s dominance has reached its peak. He further affirmed that next up is a massive altcoin rally, which will usher in the alt season.

In another X post, the crypto analyst alluded to the USDT and USDC dominance ratio. He claimed that the market was at a critical trend reaction point right now. CryptoElites then mentioned that if the stablecoins’ dominance breaks down, then the altcoin season will officially begin.

Crypto analyst Kevin Capital also looked to provide a bullish outlook towards the altcoin season. In an X post, he highlighted the global liquidity index overlaid with the Dogecoin price. In line with this, he remarked that it might be time for market participants to start paying attention to this.

So far, altcoins have been mirroring Bitcoin’s price action, suffering a similar downtrend amid the trade war. However, if the altcoin season were to kick into full gear, these altcoins could easily decouple from the flagship crypto and outperform. Ethereum is known to lead this altcoin season, but that may not be the case this time, as ETH has underperformed throughout this cycle.

Still Bitcoin Season For Now

Blockchain Center data shows that it is still Bitcoin season for now, as the flagship crypto continues to outperform most altcoins. In the past 90 days, only seven out of the top 50 coins have outperformed the flagship crypto. These coins include Mantra, GateToken, Monero, LEO, Tron, and FastToken.

Related Reading

For it to be altcoin season, 75% of the top 50 coins would need to outperform Bitcoin over the last 90 days. Although almost all coins have witnessed declines within this timeframe, BTC has suffered a 22% drop, which is less than what these altcoins have seen during this period.

At the time of writing, the Bitcoin price is trading at around $80,900, down over 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from iStock, chart from Tradingview.com

Source link

Trader Says Altcoin That’s Ripped 222% in a Month Still Has Room To Run, Updates Outlook on SOL-Based Memecoin

Boosting growth in the tokenized credit market

As Bitcoin Mining Companies Slump, Tether Loads Up on Bitdeer

Can XRP Price Hit $20? Federal Reserve Hints US Banks Can Use XRP

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals