Altcoin

XRP hits new all-time high gears to extend bullish streak

Published

2 months agoon

By

admin

XRP gained 42% in the past week, after rallying close to 1% on Friday. The altcoin hit a new all-time high, with the 24-hour trade volume leaving Ethereum (ETH) to bite the dust on Thursday. The token could extend its streak in the coming days following President-elect Donald Trump’s inauguration.

XRP could extend rally alongside Bitcoin

XRP rallied over 40% in the past week. Bitcoin (BTC), the largest cryptocurrency recovered from its flashcrash under $90,000 and made a comeback above $104,000 on Friday. The native token of the XRPLedger is rallying alongside the top crypto.

Trump’s upcoming inauguration is one of the leading catalysts, alongside optimism on crypto regulation, pro-crypto policy and a new approach by financial regulatory agencies in the U.S.

XRP could gain further, entering price discovery next week.

XRP trades at $3.26 at the time of publication.

On-chain indicators support gains

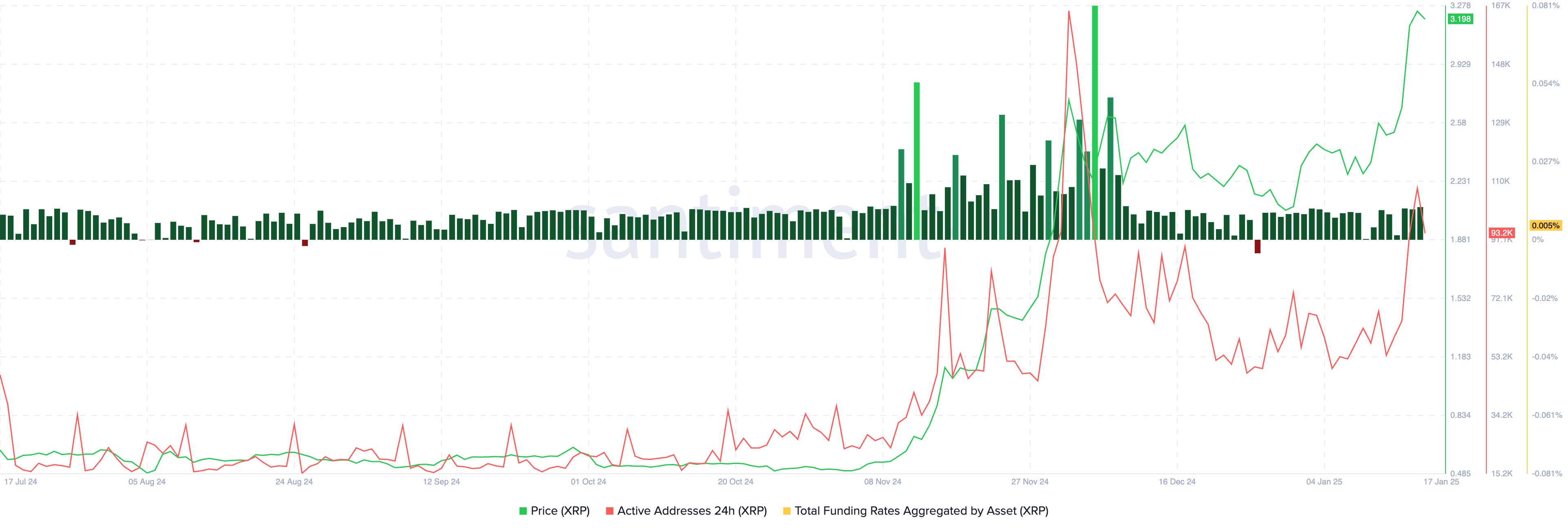

XRP’s on-chain indicators support a bullish thesis for the altcoin. The total funding rate metric is positive, greater than one throughout January 2025. The count of active addresses recorded a large spike on Thursday, Jan. 16.

The on-chain indicators on Santiment are conducive to further gains in XRP in the coming week.

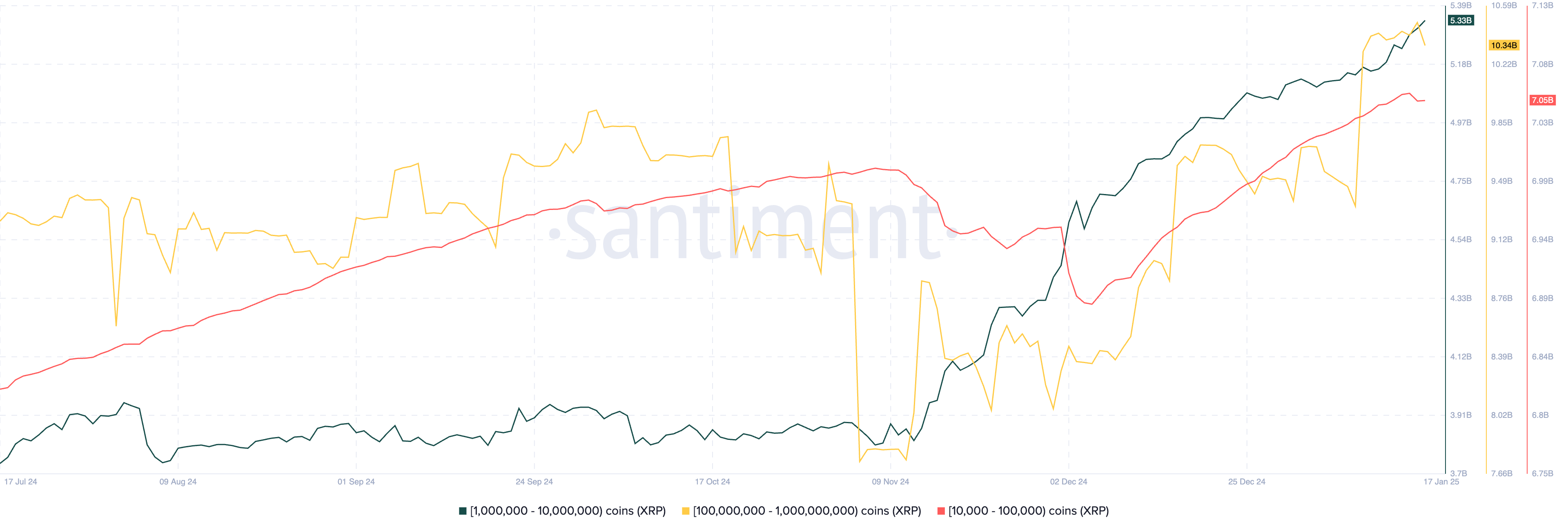

The supply distribution metric on Santiment shows an increase in XRP token supply held by wallets that own 10,000 to 100,000, 1 million to 10 million and 100 million and above XRP tokens. The three classes of holders have accumulated the altcoin, even as the price climbs. This is indicative of a likely XRP price increase in the future.

Market movers and Ripple lawsuit

Monday’s inauguration is the largest market mover in crypto. But RippleNet’s rising adoption among institutions, the developments in RLUSD stablecoin and the SEC’s lawsuit against Ripple are the three key market movers influencing the altcoin’s price.

Even as the U.S. financial regulator filed an appeal against Ripple on Jan. 15, the altcoin continued its rally undeterred. The July 2023 ruling by Judge Analisa Torres that classified secondary sales of XRP as non-securities is being challenged and the SEC is seeking to have those retail sales classified as unregistered securities sales.

Ryan Lee, chief analyst at Bitget Research, told crypto.news in an exclusive interview:

“XRP’s surge can be attributed to favorable outcomes in Ripple’s SEC lawsuit and a more crypto-friendly political climate in the US. If regulatory uncertainties are resolved, the influx of institutional investors could further solidify XRP’s position in the crypto market.”

It remains to be seen whether the Trump administration will support pro-crypto regulation and whether it influences the outcome of lawsuits against firms like Ripple Labs.

Technical analysis and XRP price forecast

XRP is hovering close to its all-time high at $3.40. At the time of writing, XRP traded at $3.2385. A 22% price rally could push XRP into price discovery, at the 141.4% Fibonacci retracement level of the climb from the $1.9054 low to the $3.4000 peak.

The technical indicators, RSI and MACD support a bullish thesis for XRP. MACD flashes consecutive green histogram bars. Traders need to keep their eyes peeled as RSI signals that the token is currently overbought or overvalued, as it reads 83.

In the event of a correction, XRP could find support at the 50% Fibonacci retracement level at $2.6977.

James Toledano, COO at Unity Wallet, told crypto.news in an exclusive interview:

“Given that XRP was stuck at around $0.50 for literally 3 years, its recent breakout momentum reflects new levels of investor optimism around regulatory clarity and the potential approval of an XRP ETF in the following months. If the XRP ETF gets approved, it will have the potential to open the floodgates of capital inflow, meaning it could reach new heights in 2025.”

Toledano warns XRP holders to be wary as altcoins take volatility to the next level in the current market cycle.

He said:

“Altcoin ETFs have genuine potential to attract capital, especially if supported by innovation-friendly policies with the new incoming U.S. administration. But, their success may be less consistent compared to Bitcoin ETFs due to the seemingly episodic nature of interest in altcoins.

Just take a look at fluctuations in Bitcoin’s price this week. The factors are multifaceted; we could say it’s Trump, seasonality, geopolitics, macroeconomics and sentiment all blended together. To play devil’s advocate, we humans are pattern seekers but sometimes there are hidden drivers and the cause and effects are not always linked.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Altcoin

XRP Must Close Above This Level For Bullish Breakout: Analyst

Published

2 hours agoon

March 16, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has struggled to gain momentum, with its price caught in a downtrend since the beginning of March. Although XRP has managed to push up in the past five days after reaching a low of $1.93 on March 11, it has yet to fully recoup its losses in the first week of the month.

Related Reading

The altcoin’s long-term prospects are still on bullish speculation, but its short-term price action has frustrated traders looking for signs of a breakout. Amid this stagnation, crypto analyst Egrag Crypto has outlined specific price levels that could determine whether XRP finally reverses its course.

Analyst Identifies $2.65 As Key Level Before XRP Can Challenge $3.00

Egrag Crypto, a long-time bullish advocate for XRP, recently took to social media platform X to outline key price levels that could determine the cryptocurrency’s next significant move. He identified $2.65 as the first critical threshold the coin must reclaim to sustain meaningful bullish momentum. However, the analyst expressed concern over XRP’s repeated tests of lower boundaries, which is in reference to the recent bottom at $1.93.

According to the analyst, the frequent retests of this support level are a double-edged sword. While multiple touches on resistance can eventually trigger a breakout, repeated tests of support weaken its integrity, increasing the likelihood of a breakdown. He likened this pattern to knocking on a door that would eventually open or break. He highlighted six instances of XRP retesting this zone since December 2024 on a 12-hour candlestick chart, warning that prolonged weakness could pave the way for further downside.

For the crypto to escape this cycle and shift into bullish territory, Egrag emphasized the importance of a strong close above $3.00, not just a brief move past it. This level has served as the upper resistance trendline for the past two weeks and has been a barrier to any sustained uptrend. Failure to break and hold above $3.00 could cause continued correction in the short term and keep XRP trapped in its current range.

However, the analyst believes XRP’s chances of reaching $3.00, considering the current price action, are slim without securing a close above $2.65.

Image From X: EGRAG CRYPTO

What’s Next For XRP After $3?

March has been particularly bearish for XRP, with sellers maintaining control as it failed to reclaim lost ground. However, if XRP bulls manage to close above $3 before the end of the month, it will open up the door for the resumption of a price rally. With this in mind, Egrag set an initial target of $4.80, placing XRP at new all-time highs.

Related Reading

Interestingly, this target is modest compared to the analyst’s more ambitious long-term projections. Egrag has previously predicted that XRP could surge to $110 in the long term. At the time of writing, XRP is trading at $2.37 and is still 26.5% away from reaching $3.

Featured image from Crypto Logos, chart from TradingView

Source link

Altcoin

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Published

10 hours agoon

March 16, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After dropping to less than $2 last March 11th, Ripple’s XRP springs back to life and it’s currently trading between $2.30 and $2.40. And with the US Securities and Exchange Commission vs Ripple case nearing its resolution, the market can expect more price volatility for this digital asset.

Related Reading

Within this context, market analyst Ali Martinez boldly claims that Ripple’s native coin still have the legs to hit a two-digit figure this cycle, using an extensive symmetrical triangle formation as a solid basis.

Martinez’s view runs opposite the bearish statements from other commentators. XRP has been on a slide lately, affected by the broader crypto fall, dipping by around 25% from its $3.40 high achieved mid-January.

XRP Gradually Builds Its Symmetrical Triangle

Like most cryptos, XRP continues to have a highly volatile market performance. The token attempted a recovery early this month but met resistance, leading to a steep decline on March 11th. Interestingly, a few commentators remain bullish on the altcoin, including Martinez, who sees the token on track to reach $15.

This is why $XRP can still reach $15! pic.twitter.com/vkIiR0rnpU

— Ali (@ali_charts) March 14, 2025

In his latest commentary, shared via a Twitter/X posting, Martinez highlighted the seven-year symmetrical triangle formed by this asset, which dates back to January 2018, when it dropped from its $3.80 high.

Even before Martinez shared this observation, several commentators reported the triangle’s formation, suggesting that a breakout could lead to a price run.

The Ascending Trendline

According to Martinez, XRP formed its lower highs in January 2018, extending the descending trendline on top. As the crypto witnessed higher lows during this time frame, it extended its ascending trendline below, creating a symmetrical triangle.

Interestingly, XRP exited the symmetrical triangle structure following the November US elections. Ripple’s native token surged by 280% for the month, marking the biggest 30-day increase for the asset in seven years.

Along with surprising traders, this breakout inspired fresh hope among XRP enthusiasts. While some experts noted that past breakouts do not automatically ensure continuous rallies, many saw this spike as evidence of possible long-term strength.

Still, the dramatic price fluctuation sparked conversations on XRP’s future, particularly in light of further government changes and more general market movements.

Ripple’s XRP is currently trading at $2.37, which is 2% up in the last seven days.

Related Reading

XRP Currently Retesting A Breakout

After two months of upside, Ripple’s XRP is on a downturn, reflecting the broader crypto market sentiment. According to Martinez, XRP’s price is currently retesting the triangle chart breakout. He also suggested that even if XRP slips below $2, it’s still on track for a breakout, as long as it stays above $1. Armed with the charts, Martinez believes that XRP hitting $15 is not a far-out idea.

Featured image from StormGain, chart from TradingView

Source link

Altcoin

Is XRP About to Shock the Market? Analyst Says $110 Is Possible

Published

3 days agoon

March 14, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ripple’s XRP, one of the top-performing cryptos last year, is trading between $2.15 and $2.30. The token’s current price is a far cry from its 52-week high of $3.38 last January 17th, which was spurred by the industry’s excitement over US President Donald Trump’s reelection.

Related Reading

Although XRP joins the downtrend of the broader crypto market, a few commentators and analysts expect that Ripple is due for a major rally. According to crypto analyst Egrag Crypto, Ripple’s XRP is set for another price run after it compares the asset’s current Elliot Wave structure with its 2017 fractals.

XRP Continues To Weather The Storm

Egrag Crypto’s latest price analysis and projection for XRP come as the altcoin and the broader crypto market slump. The Ripple’s coin is holding steady above the critical $2 price support, which suggests it follows the broad five-wave Elliott Wave chart. Traditionally, assets replicating the Elliott Wave structure often incur significant price action.

#XRP = Thread (1/7) #XRP: Double Digits This Cycle, Triple Digits Next!

The thread below about #XRP was shared in the Subscribers section on February 12, 2025.

We’ve built together the Full Elliot Wave Count to assess our next Targets:

Take an in-depth look at it!

… pic.twitter.com/NKv00Y5MZD

— EGRAG CRYPTO (@egragcrypto) March 12, 2025

Based on Egrag’s assessment, XRP is currently in the second wave of the Elliot Wave structure, which is traditionally defined by high price volatility and corrections.

Traders And Investors Must Watch Out For The Larger Wave Structure

In a Twitter/X post, Egrag explained that XRP is in its corrective wave two and is primed for a price run to double digits or even over $100.

The analysts elaborated that a Wave 2 often retraces a part of Wave 1, usually matching 50%, 76% or even 85.4% of the initial movement. Ripple’s XRP, he shares, is solidifying its hold in the correction phase.

The asset faces bearish pressure, and the market can expect a double bottom soon before it moves into its Wave 3. EGRAG warns that Wave 3 is the most aggressive part of the cycle, with more volatility.

Can XRP Hit $100 Or More?

Previously, XRP’s Wave 1 pattern submitted a huge 733% increase in price. And by using the Elliot Wave extension formula, the popular analyst projects that XRP’s Wave 3 can extend by 1.618x the gain of the first wave. Using this calculation, Egrag offers a potential surge of 1,185x, translating to XRP’s price range between $22 to $24.

Once XRP hits the peak of Wave 3, the fourth wave and a price correction follows. For this wage, the retracement level ranges between 14% to 38.2% of Wave 3. If this happens, Egrag predicts that XRP’s price can drop to $8.

Related Reading

Wave 5 of the Elliot Wave follows, where price can be predicted using three methods. First, if XRP’s price grows between 1.236% and 1.618%, the asset’s price can hit between $32 and $48. Second, if Wave 5 replicates Wave 1, the price can be between $60 and $70. Third, if there’s a 61.8% extension of the movements of Waves 1 and 3, then there’s a chance that XRP’s price can hit $100.

Featured image from Medium, chart from TradingView

Source link

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Here’s why the Toncoin price surge may be short-lived

Wells Fargo Sues JPMorgan Chase Over Soured $481,000,000 Loan, Says US Bank Aware Seller Had Inflated Income: Report

BTC Rebounds Ahead of FOMC, Macro Heat Over?

Solana Meme Coin Sent New JellyJelly App Off to a Sweet Start, Founder Says

Toncoin open interest soars 67% after Pavel Durov departs France

Coinbase (COIN) Stock Decline Can’t Stop Highly Leveraged Long ETF Rollouts

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x