Markets

XRP meme coin PHNIX pumps 50%; UFD shows a similar pump

Published

3 months agoon

By

admin

As the overall crypto market struggles to reclaim a bullish stance, XRP meme coin PHNIX has pumped over 50%.

In the last 24 hours, while Bitcoin (BTC) and Ethereum (ETH) have shown clear signs of struggle to reclaim a bullish stance, a few lesser-known coins have pumped double digits.

One of the top gainers, as per CoinGecko’s list, is Phoenix (PHNIX). PHNIX is an XRP (XRP) meme coin that has pumped from a 24-hour range of $0.00004662 to as high as $0.0000698.

Crypto analyst Gordon recently tweeted that meme coins on the XRP chain are exploding. He especially pointed out that PHNIX printed a massive God candle after a week of consolidation. Gordon also highlighted that it looks ready for its next rally.

MEMECOINS ON THE $XRP CHAIN ARE EXPLODING!$XRP is rising like a phoenix from the ashes, and its flagship meme, $PHNIX, just printed a massive god candle after a week of consolidation. It now looks ready for its next rally.

The most recognised mascot of the third-largest…

— Gordon (@AltcoinGordon) January 12, 2025

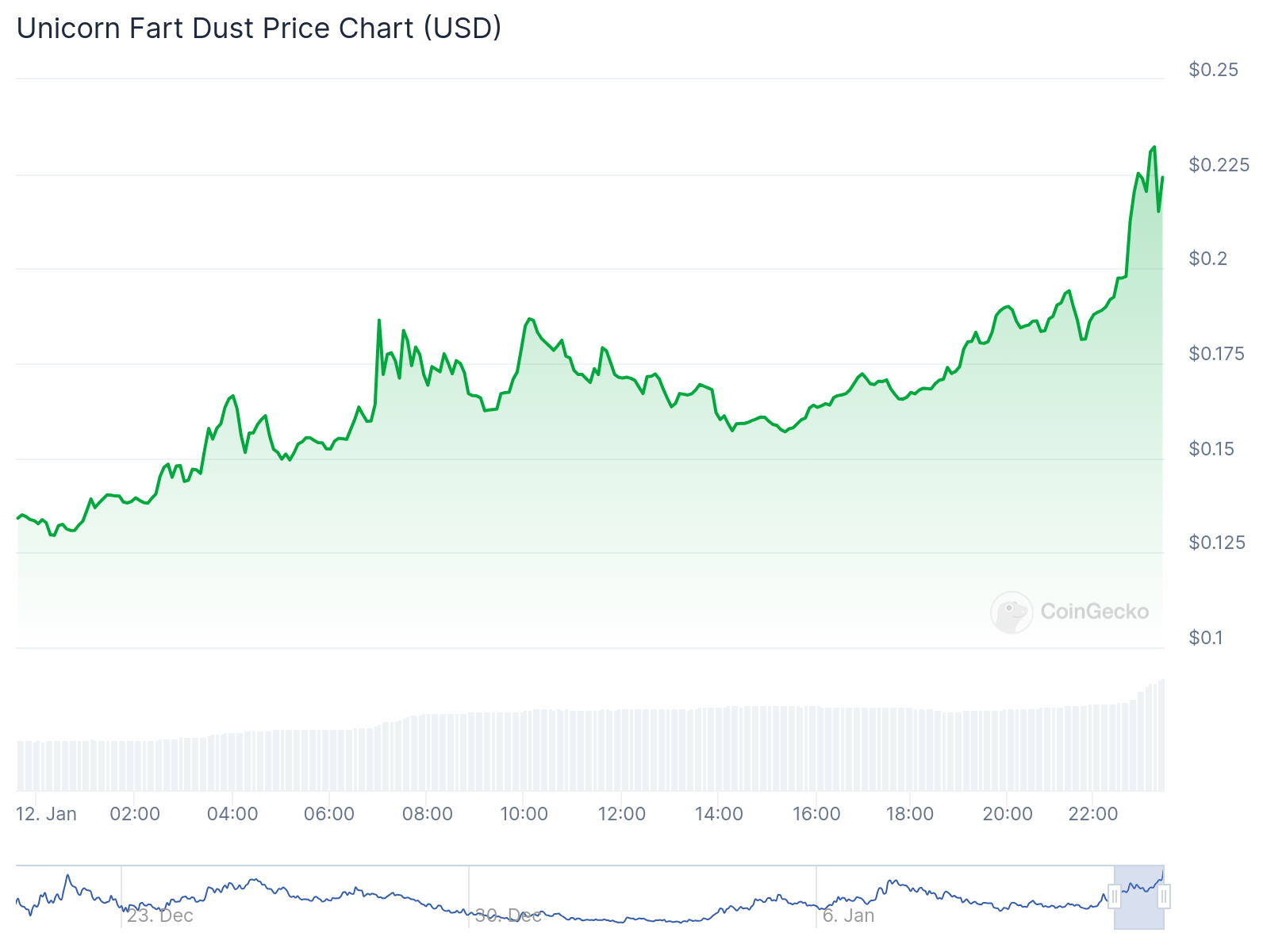

The second coin with almost a 70% pump is Unicorn Fart Dust (UFD). The UFD price has shot up close to 100% in the last seven days and is trading at $0.2274 at press time.

The meme coin was started by a 56-year-old YouTuber called Basement Ron, who creates videos about gold, silver, and now UFD. While the exact reason for the price surge is unclear, the coin has also bagged partnerships with companies like MoonPay.

Why is @MoonPay sponsoring Basement Ron?

I have never received so many texts and DMs so I wanted to answer publicly!

Ron’s journey, which he alludes to below, is something we all are incredibly proud of at MoonPay as we look to onboard the masses to crypto.

Ron is not… https://t.co/nPp0KAy6As

— Keith A. Grossman (@KeithGrossman) January 11, 2025

When we narrow it down to the top gainers of the top 300 coins by market cap, Theta Network (THETA) has spiked close to 14% from a 24-hour low of $0.06857 to as high as $0.09682 before retracing to its current price of $0.07854.

As per CoinMarketCap data, the global crypto market cap stands at $3.33 trillion, with a 1% surge in the last 24 hours. Alternative data also shows that the crypto Fear and Greed Index is now at 62, indicating greed. Greed usually indicates that the market is due for a correction.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

Published

1 hour agoon

April 27, 2025By

admin

April has been a month of extreme volatility and tumultuous times for traders.

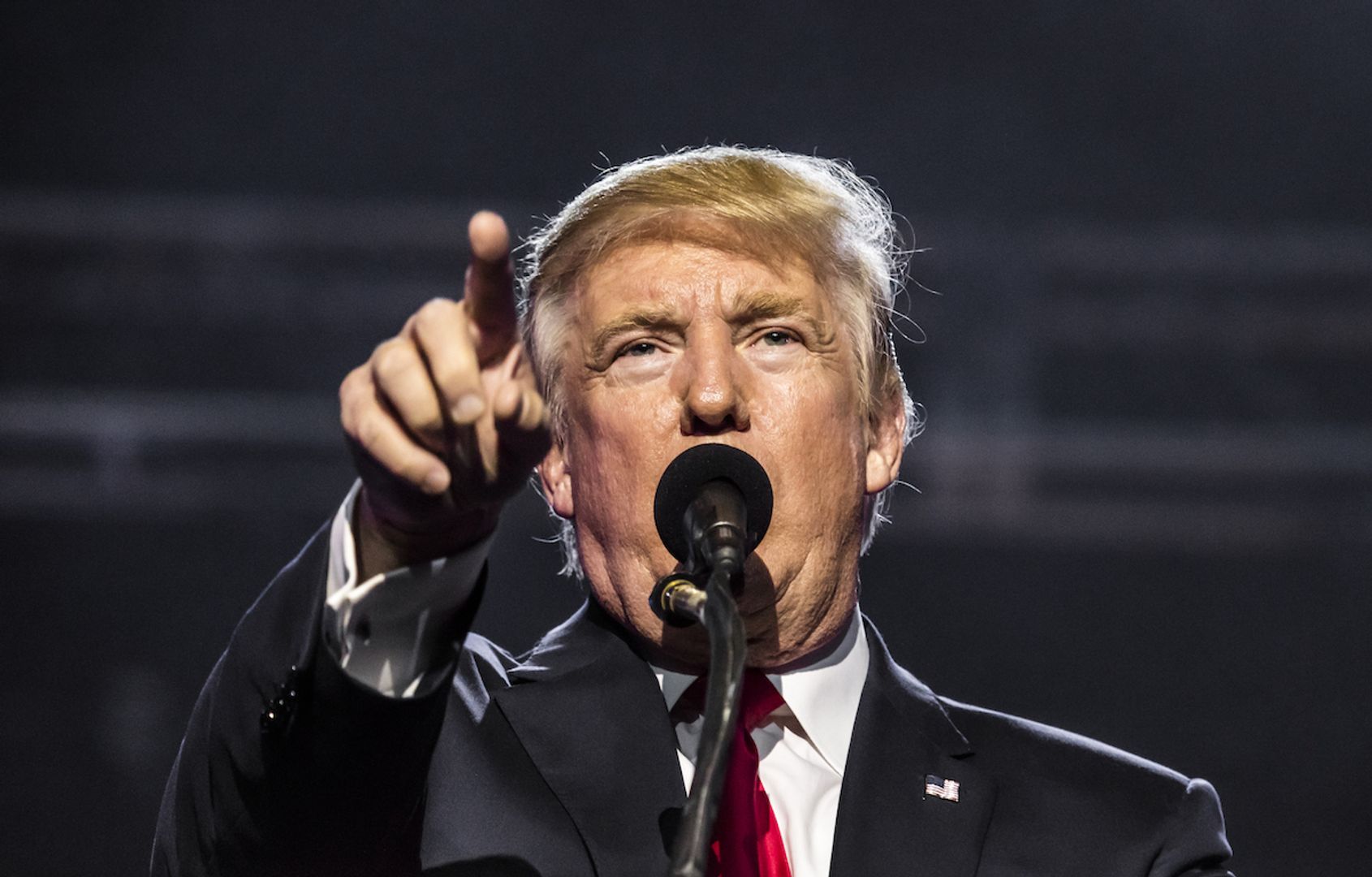

From conflicting headlines about President Donald Trump’s tariffs against other nations to total confusion about which assets to seek shelter in, it has been one for the record books.

Amid all the confusion, when traditional “haven assets” failed to act as safe places to park money, one bright spot emerged that might have surprised some market participants: bitcoin.

“Historically, cash (the US dollar), bonds (US Treasuries), the Swiss Franc, and gold have fulfilled that role [safe haven], with bitcoin edging in on some of that territory,” said NYDIG Research in a note.

NYDIG’s data showed that while gold and Swiss Franc had been consistent safe-haven winners, since ‘Liberation Day’—when President Trump announced sweeping tariff hikes on April 2, kicking off extreme volatility in the market—bitcoin has been added to the list.

“Bitcoin has acted less like a liquid levered version of levered US equity beta and more like the non-sovereign issued store of value that it is,” NYDIG wrote.

Zooming out, it seems that as the “sell America” trade gains momentum, investors are taking notice of bitcoin and the original promise of the biggest cryptocurrency.

“Though the connection is still tentative, bitcoin appears to be fulfilling its original promise as a non-sovereign store of value, designed to thrive in times like these,” NYDIG added.

Read more: Gold and Bonds’ Safe Haven Allure May be Fading With Bitcoin Emergence

Source link

Markets

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Published

7 hours agoon

April 27, 2025By

admin

In brief

- Bitcoin’s quadrennial halving happened one year ago, cutting block rewards for miners in half.

- Bitcoin usually soars one year after the event happens, due to slowing issuance of new coins.

- Yes, BTC has jumped to a new high—but the percentage growth pales in comparison to past cycles.

It’s been one year since Bitcoin had its quadrennial halving event, which usually sends the price soaring.

But while it’s true that Bitcoin rose to an all-time high in the months following the latest halving in April 2024, the percentage spike has not been nearly as sizable as in past cycles.

Data provider Kaiko told Decrypt that though the biggest coin’s price is indeed up, macroeconomic factors have hindered it from making the same kind of gains.

In the report, Kaiko said that at recent levels, the increases represented the “weakest post-halving performance on record in terms of percentage growth.”

Following a surge over the past week, Bitcoin was around $95,000 on Friday, up about 49% since the halving. Past percentage increases have reached well into the three or four figures during the same timespan.

“One of the main changes [with this Bitcoin cycle] is the current macro regime—interest rates have never been this high,” Kaiko Senior Analyst Dessislava Aubert told Decrypt, adding that “the current period of high uncertainty” has hurt the coin’s performance.

Bitcoin has typically performed well in a low-interest rate environment, along with other risk-on assets like stocks. But those have swooned amid investor fears that U.S. President Donald Trump’s trade war, dramatic cost-cutting, and other macroeconomic uncertainties would send prices higher and stunt growth.

Bitcoin soared to a peak price of just under $109,000 on January 20, the day of Trump’s inauguration, as crypto markets expected the new administration’s policies to help the industry.

The halving takes place every four years and slashes block rewards for miners—the power-hungry operations that process transactions on the network—in half. With fewer digital coins entering circulation, investors and industry observers generally expect the asset to surge.

Case in point: Before Bitcoin’s first halving in 2012, it was priced at $12.35. One year later, the price of the coin stood at $964, a nearly 8,000% gain.

At the next halving on July 9, 2016, Bitcoin was trading hands for $663. Fast-forward to 2017 and it had shot up in value and was priced at $2,500—a 277% increase.

And at the previous halving, which took place on May 11, 2020, BTC was valued at $8,500. A bull run followed the next year, and Bitcoin skyrocketed to an all-time high price above $69,000, a 762% rise.

The last halving cut miners’ rewards from 6.25 BTC to 3.125 BTC for each block they process. But Bitcoin’s price is barely 50% higher than it was last year.

That has confounded experts, who previously told Decrypt that the halving—along with the historic approval of spot Bitcoin ETFs last January—would lead to a phenomenal run for the leading cryptocurrency. While it has indeed surged and put up substantial dollar gains, the scale of the spike has underwhelmed industry observers.

Retail investors aren’t the only ones who are disappointed. The extraordinarily tough mining industry is also suffering, with a lower BTC price meaning that businesses are being forced to sell off coins more so than before to cover operational costs.

Curtis Harris, Compass Mining’s senior director of growth, noted that increased mining difficulty—fierce competition for smaller rewards—is making it harder for businesses to survive in the industry.

“Unlike previous cycles, the April 2024 halving hasn’t delivered the explosive price growth many miners expected,” he told Decrypt, adding also that “the bigger economic picture” was also making it tough for the space.

Trump’s election win in November and his subsequent inauguration led to a new all-time high price for Bitcoin. But the asset has since plunged and only partially recovered amid investor angst about his erratic policies on trade tariffs and the economy.

“These raise the cost of borrowing, make miners more cautious, and slow down investment in new mining operations,” he added.

But Compass Mining Chief Mining Officer Shanon Squires told Decrypt that miners could have foreseen that the rally would be less lively than past post-halving ones.

“Most have a stable profit if they are optimizing operating expenses and running a good business,” Squires said. “Anyone who built their mining farm expecting $1 million Bitcoin today wasn’t paying attention.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Donald Trump

Trump Memecoin’s 85% Weekly Surge Defies Democrats’ Call for Impeachment, Massive Unlocks

Published

18 hours agoon

April 26, 2025By

admin

TRUMP, the memecoin tied to U.S. President Donald Trump, is up about 16% in the last 24 hours, even as Democratic lawmakers cite the president’s involvement with the token as potential grounds for impeachment and after a massive unlock earlier in the month.

At a town hall on Friday, Sen. Jon Ossoff (D-Ga.) pointed to the crypto project offering its top holders an invitation to a dinner event with President Trump, calling it a clear case of selling access to the presidency, NBC News reports.

“When the sitting president of the United States is selling access for what are effectively payments directly to him. There is no question that that rises to the level of an impeachable offense,” Ossify said.

U.S. Senators Adam Schiff (D-Calif.) and Elizabeth Warren (D-Mass.) also sent a letter on April 25 to the U.S. Office of Government Ethics asking for an investigation to determine if President Trump violated federal ethics rules by inviting top investors.

Read more: Dinner With the U.S. President? All You Need Is $420 Worth of TRUMP

The allegations stem from an announcement that a private dinner will be held on May 22, where the top 220 TRUMP memecoin holders can meet with the U.S. President.

Still, the TRUMP token has kept on rising. The memecoin surged over 70% after the event was announced and has already been up 85% over the last seven days.

The rise came even after the token saw a massive $320 million unlock earlier this month, significantly inflating its circulating supply. In less than three months, TRUMP token is set to endure an additional unlock of 25.1% of its current circulating supply, at the time of writing, worth nearly $780 million.

Despite the recent rise, the token is still down more than 77% from its all-time high above $70, which it saw shortly after launch. Its subsequent price plunge led to an estimated $2 billion of investor losses.

Read more: TRUMP Token Pops 12% After U.S. President Calls It ‘The Greatest of Them All’

Source link

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Solaxy, BTC bull token, and Pepeto gaining momentum as leading 2025 presale tokens

Australian Radio Station Used AI DJ For Months Before Being Discovered

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals