bnb

XRP Overtakes BNB To Become Fifth-Largest Crypto by Market Cap Following 298% Rally in November

Published

5 months agoon

By

admin

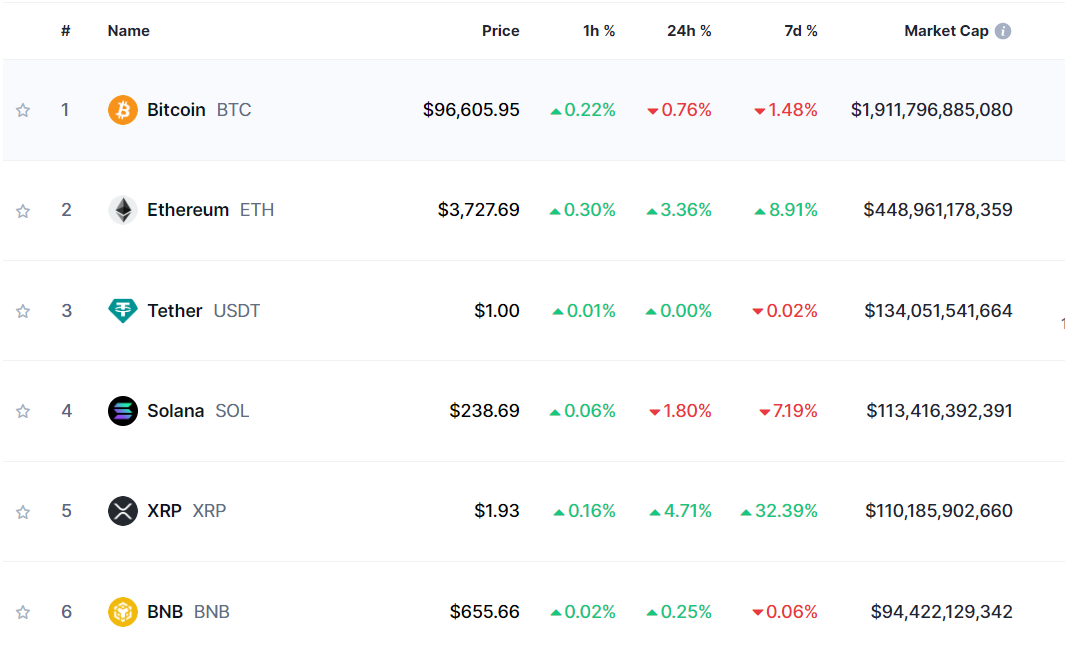

Cross-border payments solution XRP is now the fifth-largest crypto by market capitalization after rallying by nearly 300% in just one month.

Data from CoinMarketCap shows that XRP’s market cap is now hovering at around $110 billion, well above BNB’s valuation of $94.422 billion.

BNB, the native asset of the Binance ecosystem, was the fourth-largest crypto asset at the start of last month while XRP was ranked seventh. But XRP furiously rallied from $0.491 on November 1st to $1.957 on November 30th, printing staggering gains of 298% in as little as 30 days.

XRP is now closing in on Solana (SOL). The layer-1 altcoin and Ethereum (ETH) rival is currently the fourth-largest crypto asset valued at $113.416 billion.

About six years ago, XRP stood as the second-largest crypto by market cap just behind Bitcoin (BTC). But things went downhill for the payments altcoin after the U.S. Securities and Exchange Commission (SEC) sued Ripple in December of 2020, alleging that the firm has been selling XRP as an unregistered security for years.

In July 2023, XRP exploded after Judge Analisa Torres ruled Ripple’s automated, open market sales of XRP are not securities. Judge Torres also tossed out the SEC’s allegations that Ripple executives Brad Garlinghouse and Chris Larsen personally conducted an unregistered securities offering by selling XRP.

At time of writing, XRP is trading for $1.94.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/MiniStocker/WhiteBarbie

Source link

You may like

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Binance Coin

BNB Price Approaches a Key Level—Can It Clear the Hurdle?

Published

2 months agoon

February 20, 2025By

admin

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Source link

Binance coin price analysis

BNB Price Eyes $700 Amid Crypto Market Surge

Published

3 months agoon

January 30, 2025By

admin

Binance coin (BNB) price consolidated below $675 on Thursday having received a 1.8% boost as US Fed rate pause decision boosted markets sentiment. How far can the bulls extend the BNB price rebound phase?

Binance Coin (BNB) BNB tops $670 as Crypto market rebounds

Binance Coin (BNB) remained below $675 on Thursday as the broader crypto market reacted positively to the US Federal Reserve’s decision to pause interest rate hikes. This development bolstered investor confidence, driving inflows into risk assets and lifting market sentiment.

Over the past 24 hours, the global cryptocurrency market capitalization increased by 1.1%, amounting to nearly $30 billion in fresh capital, per Coingecko data.

At press time, BNB price traded at $672, reflecting a modest 1.8% gain on the day. The exchange token has benefited from rising market volumes, a trend that historically signals higher demand for trading-related assets.

However, despite the favorable macroeconomic backdrop, BNB’s price remains constrained by key resistance levels, leaving traders cautious about the next major move.

Rising Volatility Favors BNB’s Upside Potential

BNB has consistently outperformed many altcoins due to its integral role within the Binance ecosystem. The recent expansion of Binance’s services, coupled with increasing spot and derivatives trading activity, has added to the token’s bullish fundamentals. More so, with exchange tokens generally exhibiting strong correlation with market liquidity cycles, BNB appears well-positioned to capitalize on the recent shift in market sentiment after latest Fed rate pause.

Santiment chart above shows how BNB 1-Week Price Volatility Score has increased considerably in the last 2 days, moving from 0.009 on January 26 to hit 0.02 at press time on January 30.

Generally, rising price volatility signals intense market interest. Albeit with alternating imbalance between demand and supply, often driving up, rising volatility often drives up economic value created on a blockchain network.

This is further emphasized as historical trends in the chart shows how price breakouts for BNB were often precede by spikes in volatiltity. In essence BNB’s current consolidation phase may set the stage for a push above $675.

BNB Price Forecast; Bulls back in Control if $690 Resistance Caves

Binance Coin (BNB) is showing a consolidative price action near $671.51, trading within a tight range as the market digests recent macroeconomic developments.

The falling wedge pattern previously formed has already played out, leading to a breakout, but the price remains below key resistance at $689.47. Bollinger Bands suggest compressed volatility, often preceding a significant move, with the upper band aligning with the $720.98 target.

If bulls manage to push the price above $689.47, a breakout rally toward $720.98 could materialize, in line with the wedge’s projected target.

On the bearish side, the presence of multiple rejection wicks near the 20-day moving average and upper Bollinger Band suggests a lack of sustained momentum.

If BNB fails to reclaim the $689.47 level, it risks slipping toward the lower Bollinger Band at $657.96, which acts as immediate support. The Accumulation/Distribution Line (ADL) shows a steady uptrend, indicating underlying buying interest, which slightly favors the bullish case.

However, a breakdown below $657.96 could invalidate this outlook, exposing BNB to further declines toward the $625 region.

Frequently Asked Questions (FAQs)

It’s possible if BNB breaches the $690 resistance level. The technical indicators, including a falling wedge pattern and positive DMI, suggest bullish momentum could push BNB towards $720.92. How Has the US Fed Decision Impacted BNB? The US Fed’s pause on interest rate hikes has boosted market sentiment, leading to a 1.1% increase in crypto market capitalization. This has positively impacted BNB, which traded at $672 with a 1.8% daily gain. What Role Does Market Volatility Play in BNB’s Price Movement? Rising volatility often signals increased market interest and can drive up economic value on a blockchain network.

BNB’s price is driven by Binance ecosystem growth, market liquidity, and macroeconomic factors like Fed rate decisions.

If BNB doesn’t surpass $690, it may retrace to $672.57 support, depending on buying pressure and overall market sentiment.

ibrahim

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Binance Coin

BNB Price Rebound Possible: Can It Climb Back to $720?

Published

3 months agoon

January 9, 2025By

admin

BNB price is consolidating above the $675 support zone. The price is consolidating and might aim for a fresh increase above the $700 resistance.

- BNB price is struggling to settle above the $700 pivot zone.

- The price is now trading below $700 and the 100-hourly simple moving average.

- There was a break above a connecting bearish trend line with resistance at $695 on the hourly chart of the BNB/USD pair (data source from Binance).

- The pair must stay above the $680 level to start another increase in the near term.

BNB Price Holds Support

After a downside correction, BNB price found support at $675. It is now recovering losses like Ethereum and Bitcoin. There was a move above the $685 level.

The price was able to recover above the 23.6% Fib retracement level of the downward move from the $745 swing high to the $674 low. There was also a break above a connecting bearish trend line with resistance at $695 on the hourly chart of the BNB/USD pair.

The price is now trading below $700 and the 100-hourly simple moving average. If there is a fresh increase, the price could face resistance near the $700 level. The next resistance sits near the $710 level or the 50% Fib retracement level of the downward move from the $745 swing high to the $674 low.

A clear move above the $710 zone could send the price higher. In the stated case, BNB price could test $725. A close above the $725 resistance might set the pace for a larger move toward the $740 resistance. Any more gains might call for a test of the $750 level in the near term.

Another Dip?

If BNB fails to clear the $710 resistance, it could start another decline. Initial support on the downside is near the $685 level. The next major support is near the $675 level.

The main support sits at $650. If there is a downside break below the $650 support, the price could drop toward the $642 support. Any more losses could initiate a larger decline toward the $625 level.

Technical Indicators

Hourly MACD – The MACD for BNB/USD is losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level.

Major Support Levels – $685 and $675.

Major Resistance Levels – $700 and $710.

Source link

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: