Coins

Yen Surge, Soaring Bond Yields Could Threaten Bitcoin as BOJ Weighs Policy Shift

Published

2 weeks agoon

By

admin

A rallying yen and the highest Japanese bond yields in 30 years are sending warning signals across global markets, and Bitcoin may not be spared.

This week, Japan’s 30-year bond yield jumped to 2.345%, its highest level since 1994, while the yen rallied to around 153 against the U.S. dollar.

Goldman Sachs analysts led by former Bank of Japan (BOJ) chief economist Akira Otani believe that the bank may be nearing a policy pivot amid the yen’s rally.

If the yen strengthens further toward 130/USD, the central bank could pause rate hikes and slash its inflation outlook for 2026. A weaker yen past 160, meanwhile, could force tighter policy, the analysts said in a Monday report.

Either way, global markets are watching closely, and crypto may be one of the first to feel the heat.

“Major shift” for risk assets

Bitcoin, which thrives in environments of excess liquidity, faces the risk of capital rotation as Japanese yields rise.

Higher fixed-income returns and tightening policy typically draw institutional money away from speculative assets, especially those like Bitcoin that rely heavily on liquidity conditions.

“The macroeconomic trends in Japan, signaled by the current surge in the 30-year bond yield, signal a major shift coming for risk assets,” said Agne Linge, Head of Growth at decentralized bank WeFi told Decrypt.

Beyond institutional rotation, Linge warned of a more structural consequence, “The yen carry trade thrives when investors borrow yen at a cheaper rate… With bond yield soaring, the need to take the yen to invest in other assets is limited.

Other analysts say Bitcoin’s recent stability, trading near $85,600, may not hold if Japan tightens further.

Aravanan Pandian, CEO and Founder of crypto exchage KoinBX, told Decrypt that the BOJ’s historically loose policy has been a key pillar of global risk appetite. That may be changing.

“If the BOJ ends or drastically tightens its yield curve control (YCC), there might be a significant repatriation of capital, particularly from crypto assets,” he said. “Historically, risk-off sentiment is indicated by a stronger yen, which tends to lower speculative exposure across portfolios.”

Yield curve control (YCC) is a policy tool where the central bank targets specific long-term interest rates by buying or selling government bonds.

Pandian also said that a Japanese policy shift could ripple far beyond crypto, and could “trigger a wider rethinking of central bank autonomy and global debt sustainability,” he said.

Still, not everyone sees doom for digital assets. The Federal Reserve is facing mounting pressure to cut rates amid cooling CPI and PPI growth, potentially offsetting Japan’s hawkish tone.

While speaking with Decrypt, Marcin Kazmierczak, co-founder and COO of modular oracle RedStone, pointed to historical precedent from 2016, when the Bank of Japan last pivoted to tightening, as a comparable moment, “Bitcoin initially dropped 15% before rebounding strongly within six months,” he said.

A temporary blip?

While Goldman Sachs analysts have warned that a stronger yen could lead to capital flight from digital assets, Kazmierczak argued that the crypto market is far more robust than in previous cycles.

“Bitcoin’s 21-million-coin supply cap continues to position it uniquely against these shifting monetary policies,” he added, suggesting that the current downturn may be “temporary rather than structural.”

While Japan’s policy path is in focus, U.S. economic signals also weighed on sentiment. Bitcoin saw an uptick on Monday, as investors digested rising inflation expectations and recession risks.

A Fed survey showed consumers expect 3.6% inflation over the next year, with 44% anticipating higher unemployment, marking the highest anxiety levels since April 2020.

As of now, Bitcoin is trading at around $85,210, up 0.6% over the past 24 hours, and 8.2% rise in the past week, per data from CoinGecko.

Predictors on MYRIAD, the decentralized prediction market launched by Decrypt’s parent company DASTAN, appeared cautiously optimistic Tuesday, with 55% expecting Bitcoin to hold $85,000 through Wednesday.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

Coins

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

Published

2 hours agoon

April 28, 2025By

admin

Privacy blockchain Monero (XMR) jumped 51% on Monday—and on-chain investigators pointed to hackers laundering $330 million in stolen Bitcoin as the likely culprit.

Early on Monday, on-chain sleuth ZachXBT highlighted a “suspicious transfer” made from a “potential victim” of 3,520 BTC (worth approximately $333 million). Soon after, the funds were swapped to XMR via multiple exchanges. ZachXBT believes this was “theft” due to the high fees paid and the suspicious activity once the funds had been moved.

Nine hours ago a suspicious transfer was made from a potential victim for 3520 BTC ($330.7M)

Theft address

bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55gShortly after the funds began to be laundered via 6+ instant exchanges and was swapped for XMR causing the XMR price to spike…

— ZachXBT (@zachxbt) April 28, 2025

The investigator later added that it is “highly probable” the attack didn’t originate from North Korea and that the victim was a longtime Bitcoin holder.

In response, XMR jumped 51% to a price of $347.72 in seven hours, before retracing. At time of publication, Monero is priced at $264.18, up 15.3% on the day, according to CoinGecko.

Monero and privacy

Monero is the biggest privacy coin with a $5.3 trillion market cap, ranking as the 27th largest cryptocurrency by market capitalization.

Where regular blockchains, like Bitcoin and Ethereum, allow users to view every transaction that has happened on the network—enabling the tracking of funds through wallets—Monero uses a variety of technologies to obfuscate wallet addresses and transactions. As a result, it has become a popular network for malicious actors to hide their tracks on.

In 2020, the IRS offered $625,000 to firms aiming to “crack” Monero’s privacy, subsequently inking deals with blockchain tracing firm Chainalysis and data forensics analysis firm Integra FEC.

There have been cases of criminal Monero users being convicted, despite the network’s stringent privacy.

Last summer, British dark web drug dealer Jack Edward Finney was convicted and his Monero tokens seized. However, the seizure wasn’t due to the police cracking the network, but because Finney transferred the funds to the investigator as part of a confiscation order. UK officials later sold the tokens in what was described by prosecutors as the first UK Monero cryptocurrency payout.

In January 2024, it was reported by local Finnish media that Finland’s National Bureau of Investigation (KRP) had successfully tracked transcations made using Monero. However, a former member of the MAGIC Monero Fund committee, Csilla Brimer, told Decrypt that this wasn’t the whole truth. Instead, she said, investigations were likely able to trace some transcations because of poor operational security from the user.

“If you’re not careful with your operational security and you keep switching between Bitcoin and Monero, you might leak some information,” Brimer told Decrypt. “Regulators might use this slip-up to claim they can track Monero.”

“Monero is very solid at guarding your transaction details, but it can’t save you from slip-ups in your own security habits,” she added.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

Cathie Wood’s Ark Invest Makes Boldly Bullish Bitcoin Price Prediction

Published

2 days agoon

April 26, 2025By

admin

In brief

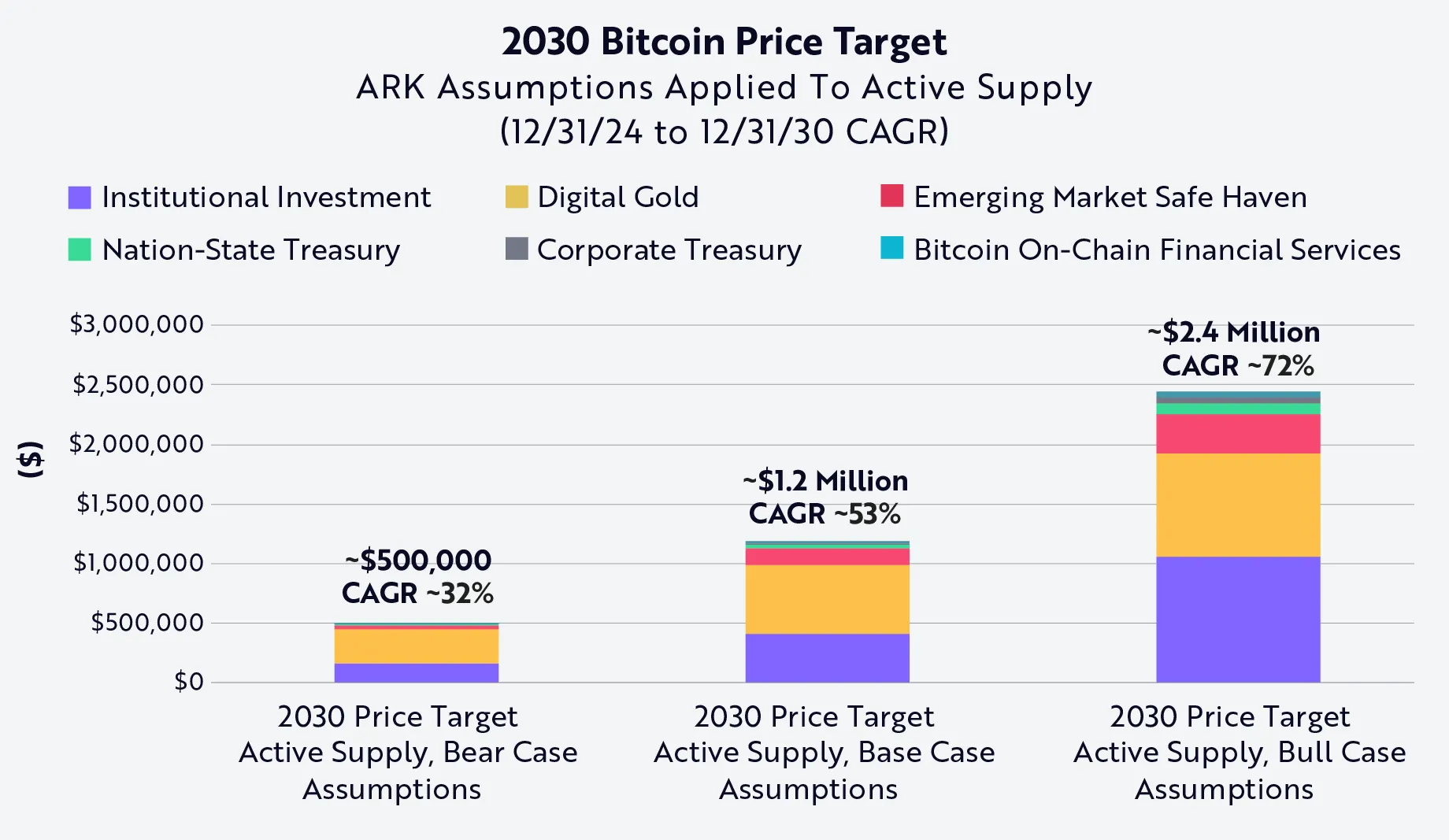

- Ark Invest predicts that Bitcoin could hit a price of as much as $2.4 million per coin by 2030.

- At worst, the firm predicts a bear case of around $500,000 in the next five years.

Prominent technology investor Cathie Wood’s Ark Invest released an updated Bitcoin price target, outlining a path for the top cryptocurrency to reach a price of as much as $2.4 million per coin by 2030.

Released on Thursday, the latest report levels up Ark’s previous price predictions from its annual Big Ideas report, which used total addressable markets (TAM) and penetration rate assumptions to determine a price prediction for Bitcoin.

Now, the firm combined its previous predictions with experimental modeling that considers Bitcoin’s “active” supply—which discounts lost or long-held coins.

“Bitcoin’s network liveliness has remained near ~60% since early 2018. In our view, that magnitude of liveliness suggests that ~40% of supply is ‘vaulted,’” the report reads. “On that basis, we arrive at the following price targets, which are roughly 40% higher than our base model, which does not account for Bitcoin active supply and network liveliness”

When accounting for active supply, Ark Invest predicts a bear case—or the most negative view—of around $500,000 per BTC. The bull case? A Bitcoin price of $2.4 million per coin.

Contributing to its potential growth, the report highlights the major inputs for its TAM and penetration rate data, which include its standing as a “digital gold,” institutional investment in spot ETFs, emerging market investors seeking a safe haven asset, and corporate treasuries continuing to diversify with Bitcoin.

Ark is not the only Bitcoin proponent to suggest a price appreciation above $1 million per coin. In September Strategy Chairman and co-founder Michael Saylor predicted the leading crypto asset would reach $13 million per coin over the next 21 years. In January, Coinbase CEO Brian Armstrong said he thinks it will reach the “multiple millions price range” as well.

Bitcoin topped $95,000 for the first time in two months earlier Friday, but still remains down from its all-time peak price of nearly $109,000 set in January.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

ZKsync Hacker Accepts Bounty, Returns Nearly $5M in Stolen Crypto

Published

4 days agoon

April 24, 2025By

admin

In brief

- A Hacker has returned nearly $5 million to ZKsync after accepting a 10% bounty under a safe harbor deal.

- The funds were originally stolen by exploiting a compromised airdrop contract.

- The incident adds to $1.67B in crypto losses in Q1 2025, with Ethereum hit hardest.

A hacker who drained nearly $5 million from Ethereum scaling protocol ZKsync’s airdrop contract has returned the stolen funds within the project’s 72-hour deadline, closing the chapter on the recent exploit.

“We’re pleased to share that the hacker has cooperated and returned the funds within the safe harbor deadline,” ZKsync posted on X, formerly Twitter. “The case is now considered resolved.”

The recovered assets, consisting of over 44.6 million ZK tokens and nearly 1,800 ETH, are now under the custody of the ZKsync Security Council, which will determine the next steps via governance.

The deal follows an exploit that took place earlier this week, targeting a “compromised key” behind the ZK token airdrop contract, which allowed the attacker to mint new tokens and reroute unclaimed funds.

The attacker then transferred the funds across both Ethereum and ZKsync’s own Layer 2 network.

“All user funds are safe and have never been at risk,” ZKsync said in a Tuesday post. “The ZKsync protocol and ZK token contract remained secure.”

The protocol responded later by issuing an on-chain message offering the attacker a 10% bounty if 90% of the funds were returned within 72 hours.

If the offer was ignored, ZKsync warned the hacker that the case would be escalated to law enforcement to pursue a “full criminal investigation.”

The ZK token’s price briefly plunged to $0.04 after the exploit but has since stabilized near $0.05, down 2.6% over the last 24 hours, according to CoinGecko data.

Following the return of the stolen funds, ZKsync said that a final investigation report is in the works and will be published once complete.

Hackers abound

The incident is the latest in a string of attacks plaguing the crypto sector this year. According to blockchain security firm Immunefi, nearly $1.6 billion in crypto has already been stolen in the first two months of the year.

A separate report from blockchain security firm CertiK paints an equally concerning picture, noting that the first quarter of the year saw a loss of $1.67 billion due to hacks, scams, and exploits, already accounting for over two-thirds of all stolen funds in 2024.

Much of this total was driven by the catastrophic Bybit exploit, which alone resulted in $1.45 billion in losses and has raised industry-wide concerns about centralized exchange security practices.

Private key compromises continued to dominate as a critical threat vector, responsible for $142.3 million in losses across just 15 incidents.

Alarmingly, only 0.38% of stolen funds were recovered this quarter, down from over 42% in the previous quarter. In February alone, not a single dollar was returned, the report said.

Meanwhile, Ethereum remained the most targeted, suffering nearly $1.54 billion in theft across 98 incidents.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines