Apple

$10 Weekly Bitcoin DCA Yields 202% Return, Outshines Traditional Assets Over 5 Years

Published

4 months agoon

By

admin

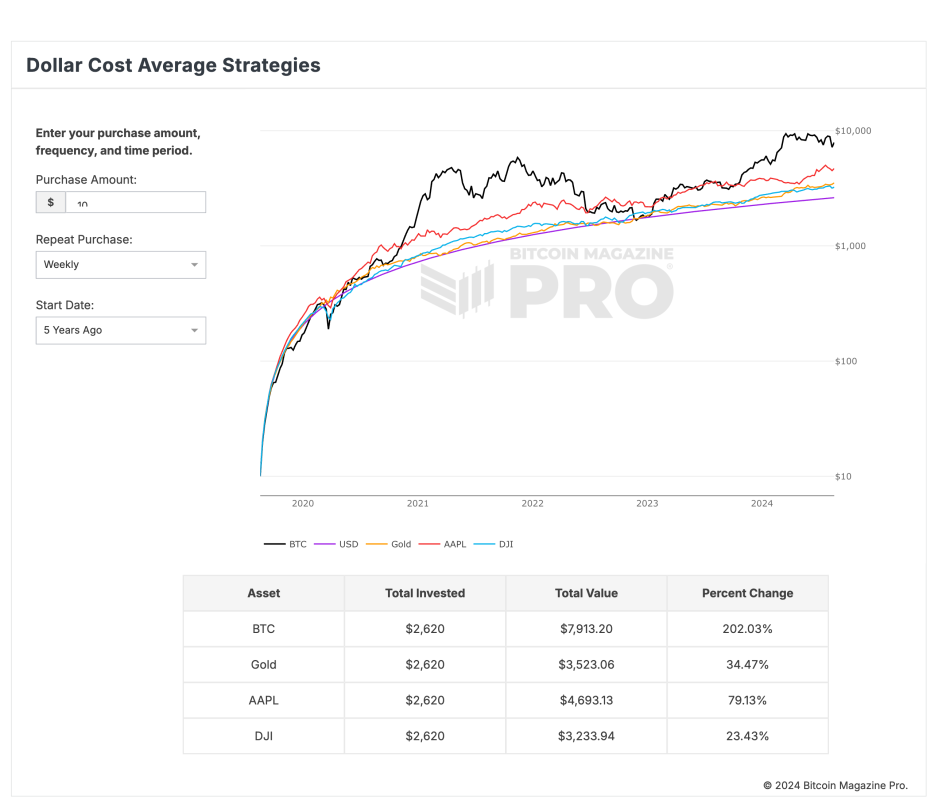

A recent analysis from Bitcoin Magazine Pro showcases the power of dollar-cost averaging (DCA) in Bitcoin compared to traditional assets like gold, Apple stock, and the Dow Jones Industrial Average (DJI). The data reveals that consistently investing $10 weekly into Bitcoin over the last five years would have grown a total investment of $2,620 into $7,913.20, reflecting a remarkable 202.03% return.

In contrast, the same $10 weekly investment in gold yielded a return of 34.47%, growing the initial $2,620 to $3,523.06. Apple stock also performed well, with a 79.13% return, turning the $2,620 investment into $4,693.13. Meanwhile, the Dow Jones provided the least return, with a 23.43% increase, growing the investment to $3,233.94.

This data underscores Bitcoin’s potential to be one of the best assets, if not the best asset, for investors to incorporate into their long-term investment strategies. The principle behind dollar-cost averaging—regularly investing a fixed amount of money regardless of price fluctuations—has proven particularly effective with Bitcoin, allowing investors to accumulate wealth over time.

Saving $10 a week into Bitcoin through Dollar Cost Averaging (DCA) offers an affordable and accessible way for newcomers to start investing in Bitcoin. This strategy is especially appealing for those who may be hesitant to invest large sums upfront or are still learning about the volatile nature of the Bitcoin market. By investing a small, fixed amount regularly, individuals can gradually build their Bitcoin holdings, reducing the impact of market fluctuations and making it easier to adopt a long-term investment mindset. This approach allows for consistent growth over time, without the pressure of trying to time the market perfectly.

The Dollar Cost Average Strategies tool from Bitcoin Magazine Pro allows users to explore various investment strategies, optimizing their Bitcoin investments across different time horizons. The tool compares Bitcoin’s performance against other assets like the US dollar, gold, Apple stock, and the Dow Jones, illustrating Bitcoin’s potential as a superior store of value in a well-rounded investment portfolio.

For more detailed information, insights, and to sign up to access Bitcoin Magazine Pro’s data and analytics, visit the official website here.

Source link

You may like

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

Apple

Billionaire Warren Buffett Abruptly Pours $563,000,000 Into Three Assets After Ditching Apple, Bank of America

Published

1 day agoon

December 21, 2024By

admin

Billionaire Warren Buffett just poured more than half a billion dollars into three assets.

After dumping huge positions in Apple and Bank of America and hoarding $325 billion in cash, new SEC filings show the Berkshire Hathaway chairman and CEO has bought $405 million of Occidental Petroleum (OXY).

Occidental Petroleum is a global energy company involved in oil and gas exploration and production, with further ventures in chemicals and low-carbon initiatives.

OXY is down 21% since the start of the 2024, dropping from $60.05 to $47.13 at time of publishing.

Meanwhile, Buffett has also purchased $113 million in Sirius XM Holdings (SIRI) and $45 million in VeriSign (VRSN).

Sirius XM offers satellite and streaming radio services across North America, with its stock down 57% since the start of 2024, from $54.90 to $23.08.

VeriSign is a global provider of domain name registry services and internet security solutions, with shares down 1.35% year-to-date, from $201.56 to $198.84.

Buffett completed purchases of the three companies last week and was required to report the buys immediately because Berkshire now owns more than 10% of each company.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Apple

Deepfake Tim Cook promotes crypto scam during Apple event

Published

3 months agoon

September 10, 2024By

admin

More than 350,000 people watched a video of Apple CEO Tim Cook promoting a cryptocurrency scam, only to realize later that it was a deepfake generated using artificial intelligence.

Sep. 9 was a big day for tech giant Apple, as millions of people across the globe waited for the “Glowtime” event that would introduce the new iPhone. Scammers used this opportunity to run multiple live streams that promoted the typical double-your cryptocurrency scam.

Now deleted, one of the streams garnered over 355,000 people at one point where an AI-altered old Tim Cook interview was used to mislead people to send various cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) to a wallet address controlled by the scammers.

During the live stream, an AI-generated voice mimicking Cook described the fradulent scheme as an “ideal opportunity for beginners to participate and familiarize themselves with the world of cryptocurrencies.”

Another live stream was broadcast on a YouTube account with the verification checkmark and was named Apple US, to impersonate the tech titan’s official channel. Meanwhile, some other streams were live from accounts that were completely unrelated to anything tech.

All of the videos featured a QR code which when scanned would redirect users to a malicious website designed to trick users. At the time of writing one of the scam websites was still live and the home page featured several wallet addresses for various cryptocurrencies like BTC, ETH, DOGE, and USDT.

To make it more convincing, the website also featured a fake transaction history which was automatically updated to make it look like people were actually transferring their funds.

As several users started reporting the scam live streams, YouTube support acknowledged the incident and urged users to report the videos using YouTube’s reporting tool. The videos have since been removed from the platform.

Scammers continue to misuse YouTube

YouTube has been a hunting ground for deepfake scammers as previously seen on multiple occasions. Tesla and SpaceX CEO Elon Musk was impersonated during the April 8 solar eclipse as fraudsters pushed a similar scam across multiple YouTube channels rebranded to look like SpaceX.

YouTube has yet to comment officially on the platform’s misuse, but the platform faced legal action back in 2020 when Apple co-founder Steve Wozniak, along with 17 other victims, sued YouTube, demanding the removal of scams that impersonated them to promote fake Bitcoin giveaways.

According to a June 2024 report from Bitget, deepfake scams surged 245% this year, and have led to roughly $80 billion in losses. This alarming trend has spurred regulators to act, with a new bill proposing that AI providers, like OpenAI, require users to include origin information in all AI-generated content to enhance transparency and accountability.

Source link

24/7 Cryptocurrency News

OpenAI’s Apple Investment & US Govt Deal Fuel AI Dominance Talks

Published

4 months agoon

August 29, 2024By

admin

AI News: Apple is reportedly in discussions to invest in OpenAI as part of a new fundraising round that would value the AI company at over $100 billion. This move comes as Sam Altman’s firm, OpenAI, pledges to work with the U.S. AI Safety Institute, sparking discussions about potential dominance in the U.S. AI landscape.

AI News: Apple Considers Investment in Sam Altman’s Firm

According to a report by The Wall Street Journal, Apple is in talks to invest in OpenAI, the developer behind ChatGPT. The proposed investment would be part of a larger fundraising effort that could value the ChatGOT developer at over $100 billion. The specific amount Apple might invest remains undisclosed, but this move marks a significant step in Apple’s strategy to integrate AI more deeply into its products and services.

Apple’s potential investment in Sam Altman’s firm is part of a broader strategy to integrate advanced AI technologies into its ecosystem. With the upcoming release of iOS 18, iPadOS 18, and macOS Sequoia, Apple users will gain access to ChatGPT’s capabilities without needing to create an account, enhancing the user experience while maintaining privacy.

This integration, as a result, is expected to make Apple devices more competitive by offering powerful AI tools directly within its software platforms.

OpenAI’s Collaboration with the U.S. AI Safety Institute

In parallel with its potential partnership with Apple, the firm has announced its collaboration with the U.S. AI Safety Institute. This federal body, part of the Commerce Department’s National Institute of Standards and Technology (NIST), aims to assess and mitigate risks associated with AI technologies.

As a result, OpenAI’s agreement to provide early access to its next major generative AI model for safety testing is seen as an effort to address growing concerns about AI safety and regulation.

This AI news comes after criticism of the firms’ perceived shift away from safety-focused research. Earlier this year, the firm disbanded a team dedicated to developing controls to prevent superintelligent AI systems from going rogue.

The move, consequently, led to the resignation of key safety researchers, raising questions about the company’s commitment to responsible AI development. By working with the U.S. AI Safety Institute, the artificial intelligence firm appears to be reaffirming its dedication to AI safety, even as it continues to push the boundaries of AI technology.

we are happy to have reached an agreement with the US AI Safety Institute for pre-release testing of our future models.

for many reasons, we think it’s important that this happens at the national level. US needs to continue to lead!

— Sam Altman (@sama) August 29, 2024

Consequently, the combined developments of Apple’s investment talks and OpenAI’s partnership with the U.S. AI Safety Institute have fueled speculation about the firms potential dominance in the U.S. Artificial intelligence landscape.

With Apple’s backing, Sam Altman’s firm could gain substantial financial and technological resources, further solidifying its position as a leading player in Artificial intelligence. Additionally, the firm’s involvement with the U.S. government’s AI safety initiatives may give it a significant influence over the future direction of AI regulation and development in the United States.

Kelvin Munene Murithi

Kelvin is a distinguished writer specializing in crypto and finance, backed by a Bachelor’s in Actuarial Science. Recognized for incisive analysis and insightful content, he has an adept command of English and excels at thorough research and timely delivery.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

Filecoin, Monero, and Lunex dominate smart investor portfolios

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

How Low Will Ethereum Price Go By The End of December?

Analyst says buying this altcoin at $0.15 could be as profitable as buying ETH at $0.66

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: