Gary Gensler

18 GOP AGs sue SEC as Gensler hints resignation

Published

5 months agoon

By

admin

Donald Trump’s promise of a U.S. SEC without Gary Gensler may be realized ahead of schedule amid state lawsuits and resignation chatter.

Wall Street’s top cop-on-the-beat has been accused of “unconstitutional overreach” and “unfair persecution” of the $3 trillion cryptocurrency industry, according to a lawsuit signed by 18 Republican Attorneys Generals.

The lawsuit alleges that the United States Securities and Exchange Commission and its commissioners, led by chair Gary Gensler, overstepped their jurisdiction and disregarded state economic autonomy.

JUST IN:

18 US states are suing the SEC for unconstitutional overreach and unfair persecution of the crypto industry under Gary Gensler — Fox Business’s Eleanor Terrett pic.twitter.com/wZ40bQL5Ch

— Bitcoin Magazine (@BitcoinMagazine) November 14, 2024

Litigation from GOP AGs and states has added to the existing scrutiny of Gensler’s SEC career. Top lawmakers have opened an investigation into the SEC’s hiring practices amid suspicions of politically biased recruitment, which has spurred the inquiry.

Several members of Congress have called for his resignation, and Donald Trump has promised the digital asset industry that he would dismiss Gensler.

Is Gary Gensler retiring?

Social media is buzzing with speculation that Gensler might be on his way out as SEC Chairman. His comments in a note on Nov. 14, calling his time at the SEC “a great honor” and praising his colleagues for their dedication, have fueled rumors of a possible imminent retirement.

The SEC is a remarkable agency. The staff and Commission are deeply mission-driven, focused on protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation.

Gary Gensler, SEC chair

He added that it’s been a privilege to serve with the SEC “doing the people’s work and ensuring that our capital markets remain the best in the world.”

A firm stance on crypto regulation has marked Gensler’s tenure at the securities regulator. Blockchain industry players increasingly anticipate changes in leadership and policy enforcement from the SEC after years of grappling with Gensler’s regulatory approach.

The SEC has ongoing court cases against firms like Coinbase and Ripple (XRP). As such, Gensler’s potential departure has become a focal point for speculation on how regulatory policies might shift under new leadership.

Source link

You may like

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

crypto

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

Published

3 weeks agoon

March 26, 2025By

admin

The new Chair of the U.S. Securities and Exchange Commission (SEC) reportedly has a crypto portfolio worth millions of dollars.

According to a new report from Fortune, an ethics disclosure reveals that Paul Atkins – President Donald Trump’s nominee to be the next SEC Chair – holds about $6 million in crypto-related investments, including $1 million worth of equity in two crypto firms and $5 million in crypto investment funds.

Atkins, who previously served as the SEC’s Chair between 2002 and 2008 under then-President George W. Bush, held a board seat on Securitize – a tokenization firm backed by asset management giant BlackRock – and owned between $250,000 and $500,000 worth of call options in the company, according to the report.

He also held between $250,000 and $500,000 in equity in crypto bank Anchorage Digital and between $1 million and $5 million worth of staked crypto on Off the Chain Capital, an investment fund of which he is a limited partner.

In the ethics agreement, Atkins agreed to divest his holdings after his confirmation, which is slated for Thursday.

According to Bloomberg, Atkins and his spouse have a net worth of at least $327 million.

Under the helm of its previous Chair, Gary Gensler, the SEC waged war on the digital assets industry by accusing several high-profile crypto firms, including Ripple Labs, Binance, Coinbase, and Consensys, of violating securities laws. Gensler also deemed many crypto assets, including smart contract platforms Ethereum (ETH) and Solana (SOL), as securities that fell under the agency’s regulatory jurisdiction.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

In 2024, meme coins became one of the most traded and discussed aspects of the cryptocurrency sector. Critics argue they give the industry a bad image. Others enjoy the gambling thrills and, at times, mind-boggling returns. If and when the U.S. government steps in to regulate this controversial industry, what will the outcome look like?

When the crypto sector earned the moniker “Wild West,” meme coins were to blame. Thousands of new tokens are created daily via platforms like Pump.Fun. Investors — a mix of retail traders, crypto insiders, influencers, and sometimes institutional players — all hope to get an unlikely jackpot.

Meme coin opponents also blame the space for being a distraction from the higher-quality projects across the crypto sector. For example, the pre-inauguration launch of the Official Trump (TRUMP) token exemplifies this trend.

“The crypto sector put someone in power whose first act is to emphasize and take advantage of the opportunity for grift within crypto,” Angela Walch, a crypto researcher, told Time. “And that’s just embarrassing.”

The meshing of meme coins and politics isn’t exclusive to the U.S. In Argentina, President Javier Milei promoted the Libra token, which rose to $4.50 before plummeting in value.

As Lyn Alden, the founder of Lyn Alden Investment Strategy, put it in January: “The same bearish [traditional finance] accounts that dismissed bitcoin due to mostly unrelated ICOs, DeFi, and NFTs, will now dismiss it due to meme coins.”

Having watched this space since 2017, I see a lot of the same patterns.

The same bearish tradfi accounts that dismissed bitcoin due to mostly unrelated ICOs, DeFi, and NFTs, will now dismiss it due to meme coins.

When they could just buy it and beat their own portfolios.

— Lyn Alden (@LynAldenContact) January 20, 2025

Democrats speak up

Feb. 27 was marked with two important events in the meme coins space. First, the U.S. Securities and Exchange Commission (SEC) said that the securities regulations will not adhere to meme coins.

Second, the MEME Act proposal from Democrats aims to block American officials from launching their own meme coins, as Trump did before the inauguration. Are these events conflicting, and are meme coins so problematic? Let’s break it down.

The Official Trump token launch was controversial. Some saw it as a bold signal from the then-president-elect that he was ready to embrace crypto. However, many in the crypto community booed the move as a blatant “grift” considering the price dropped in value within just a few days.

The New York Times names $2 billion collectively lost by over 800,000 people who invested in the Trump coin.

Another important point of criticism was that the Official Trump token could line Trump’s pockets. Foreign political actors may bribe him effortlessly by buying TRUMP tokens in bulk (Trump signed an executive order freezing enforcement of the Foreign Corrupt Practices Act).

Various Democratic representatives are speaking up. California Democrat Rep. Sam Liccardo introduced the bill aimed to stop U.S. officials from creating tokens. Liccardo stressed that Trump’s meme coin “raises concerns about transparency, insider trading, and improper foreign influence.”

The bill, which is going to be named Modern Emoluments and Malfeasance Enforcement, or MEME Act, exists now only as a draft. The act is set to block the POTUS, Congress members, and other top officials and members of their families from launching cryptocurrencies.

More than that, the bill will block them from issuing or sponsoring both securities and commodities. The profits generated by Trump via the Official Trump token must be disgorged.

Although Liccardo doesn’t think that the Republican-controlled House of Representatives will support the bill now, he believes it can happen later when “the cult of Trump” will start to degrade and more Republicans will turn against him. The same week, it became known that the Trump family is going to create a branded metaverse that will include the NFT marketplace.

Was Gensler’s SEC too easy on meme coins?

Critics of the Biden-era crypto policies share a viewpoint that the Gary Gensler-led SEC deliberately ignored harmful meme coins while hunting down legitimate crypto brands like Ripple and Coinbase.

This theory suggests that the governmental agencies didn’t go after the thriving meme coin market as it served as a boogeyman to turn people against cryptocurrencies per se. People were investing in meme coins and losing money. It was creating a favorable background for the SEC and served as a good excuse to suppress legitimate crypto projects.

Is The SEC to Blame For the Rise of Meme Coins?

Former CFTC Chairman Chris Giancarlo shares his thoughts on the rise of Meme coins. He highlights that under Gary Gensler’s tenure he attacked good projects which forced the market towards meme coins.

Watch the full interview… https://t.co/mNTR9LWfjg pic.twitter.com/QKL5gJzBbn

— Tony Edward (Thinking Crypto Podcast) (@ThinkingCrypto1) February 16, 2025

SEC stays away, but warns of volatility

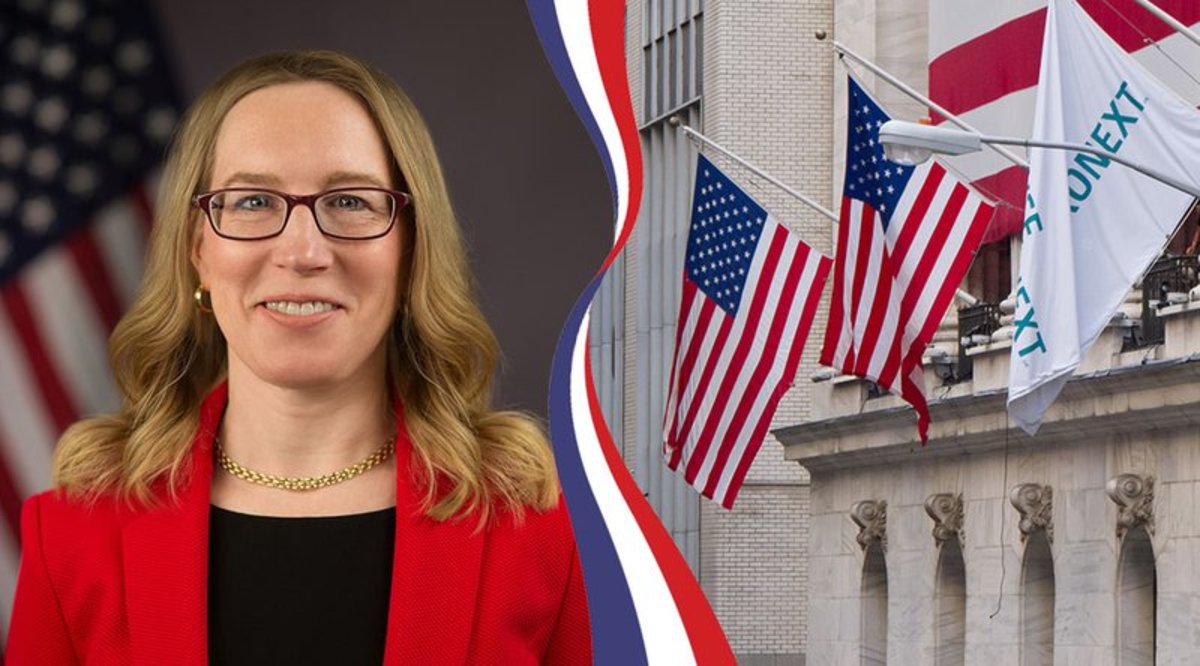

While the Gensler-era SEC was criticized for constant equalization of cryptocurrencies to unregistered securities, effectively outlawing them, the crypto-friendly Hester Peirce-era SEC refused to step it when over $2 billion were siphoned away from over 810,000 wallets holding Official Trump.

Peirce indicated that the SEC is not responsible for dealing with meme coins, since they’re not classified as securities.

On Feb. 27, the SEC clarified its stance by ruling that meme coins are not securities and more akin to collectibles. Therefore, it cannot be regulated by the SEC and people launching meme coins don’t have to register them as securities.

The statement warns about the significant market price volatility of meme coins, noting that this disclaimer is usually present in the descriptions of meme coins. This ruling gives the green light to create even more meme coins in the future.

Although the new SEC continues to stay away from regulating the meme coin space, there are signs of crisis in the sector. One of the main hubs of the 2024 meme coin revolution was Pump.Fun, a Solana-based launchpad that acts an Imgflip (a platform known for creating memes and GIFs) for crypto.

The tokens created on Pump.Fun are down 80%. Some attribute this decline to the controversial Libra coin downfall. However, the tariff war affecting the BTC price may be another mighty factor.

Meme coins are often compared to events like an ICO boom or an NFT boom, meaning that the dust will settle and the market will be recalibrated.

Vitalik Buterin said that the downsides of the ICO era were addressed via the DeFi solutions. The meme coin market can mature too.

There is perhaps an analogy with weed here.

Ten years ago, to many weed represented freedom, and rebellion against sclerotic old order that denied self-sovereignty over our bodies. Then, weed became legalized, and “official”.

On that day, I remember my personal interest in weed…

— vitalik.eth (@VitalikButerin) January 23, 2025

Source link

business

SEC Rescinds SAB 121, Permitting Banks to Custody Bitcoin

Published

3 months agoon

January 25, 2025By

admin

In a landmark decision, the U.S. Securities and Exchange Commission (SEC) has officially rescinded Staff Accounting Bulletin (SAB) No. 121, a controversial rule that had long hindered banks from offering bitcoin and crypto custody services. This move, announced on Thursday, signals a significant shift in the SEC’s approach to regulating bitcoin and crypto and paves the way for greater financial integration.

BREAKING:

SEC OFFICIALLY RESCINDS SAB 121, WHICH PREVENTED BANKS FROM CUSTODYING #BITCOIN pic.twitter.com/VCnggkCGmL

— Bitcoin Magazine (@BitcoinMagazine) January 23, 2025

Introduced in March 2022 under former SEC Chair Gary Gensler, SAB 121 required institutions holding bitcoin and crypto assets for customers to record those holdings as liabilities on their balance sheets. This accounting standard created significant operational and financial burdens for banks and custodians, effectively discouraging them from providing bitcoin-related services. The rule was widely criticized by the crypto industry and lawmakers, with SEC Commissioner Hester Peirce famously calling it a “pernicious weed” in April 2023.

“Bye, bye SAB 121! It’s not been fun,” Peirce wrote in a post on X (formerly Twitter) on Thursday, following the SEC’s issuance of Staff Accounting Bulletin No. 122, which formally rescinds the guidance.

The SEC’s move to rescind SAB 121 comes just days after Gensler’s resignation and marks the start of a new era under Republican leadership. Acting SEC Chair Mark Uyeda, who assumed the role on Monday, quickly announced the formation of a crypto task force led by Peirce to craft clearer and more practical regulatory frameworks for the industry.

“To date, the SEC has relied primarily on enforcement actions to regulate crypto retroactively and reactively, often adopting novel and untested legal interpretations along the way,” the agency acknowledged in a statement on Tuesday.

With the removal of SAB 121, major banks are now expected to move swiftly to integrate bitcoin and crypto custody services into their offerings. This is a significant milestone in the financialization of bitcoin, bringing it closer to mainstream adoption.

Source link

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x