256855931724870038

Published

3 months agoon

By

admin

You may like

Will Pi Network Price Reach $100 in This Bull Market?

Axie Infinity developer cuts 21% workforce: report

Chill Guy Meme Coin Pumps Another 50% as Creator Fights Back

Super Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

AI predicts one altcoin set to outperform XRP and Solana in 2025

BTC and Major Altcoins Pullback, SAND Soars 60%

Pi Network

Will Pi Network Price Reach $100 in This Bull Market?

Published

23 mins agoon

November 25, 2024By

admin

Pi Network has erased some of the gains made last week as the recent rally in the crypto industry took a breather. Still, there are chances that the Pi coin will resume its rebound, and potentially hit $100 ahead of the mainnet launch.

Pi Network Price Prepares For the Mainnet Launch

The Pi Network IoU price will be on the spotlight after the recent successful PiFest event and the upcoming ending of the KYC verification of pioneers.

In a recent statement, Pi’s developers said that over 27,000 sellers registered in the Map of Pi during the recent PiFest event. Map of Pi is a dApp in its ecosystem that enables sellers accepting the Pi coin to register themselves.

These numbers mean that the coin is getting popular among sellers, a move that could make it a better cryptocurrency compared to Bitcoin in terms of shopping. It also means that the developers have achieved one of the three conditions that needs to happen ahead of the mainnet launch. This condition calls for the network to have an ecosystem that will give the Pi coin utility.

The other condition is that the developer needs to complete the KYC verification of all miners, a process that has accelerated in the past few months. The grace period of this process will complete on November 30.

Additionally, with cryptocurrencies being in a strong bull run, the third condition of a friendly environment has been met. Therefore, there is a likelihood that the Pi mainnet launch will happen as soon as in December.

Pi Coin Analysis: Will It Hit $100?

The Pi Coin IoU, which is not associated with the Pi project, jumped to $100 in October as anticipation of the mainnet launch. It then suffered a harsh reversal and bottomed at $44.95 on November 12. This decline was notable because its lower side was slightly above the 100-day moving average, which explains why the coin has bounced back.

Pi Network’s rebound also happened a few weeks after it formed a golden cross as the 200-day and 50-day moving averages crossed each other.

The current retreat happened after the coin rose to the extreme overshoot of the Murrey Math Lines. Therefore, with the rising expectation of an upcoming mainnet launch, there are chances that the Pi coin price will bounce back, and potentially retest the important resistance at $100. A break above that level will raise the odds of the coin rising to the year-to-date high of $122.05.

On the flip side, a drop below the top of the trading range at $56.25 will invalidate the bullish view, and raise the odds of it falling to $45, its lowest level this month.

Frequently Asked Questions (FAQs)

There are chances that the coin will bounce back ahead of the mainnet launch, which is expected to happen in December this year. If this happens, the coin may retest the key resistance at $100, its highest point last month.

No. Pi coin is not associated with the real project and is not an indicator of what will happen when the mainnet launch happens.

It is unlikely that the Pi Coin will do well after the mainnet launch as evidenced by the recent crashes of Hamster Kombat and Notcoin.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Axie Infinity

Axie Infinity developer cuts 21% workforce: report

Published

2 hours agoon

November 25, 2024By

admin

Axie Infinity creator Sky Mavis lays off 50 employees as part of broader efforts to adapt post-hack and market shifts.

Sky Mavis, the developer of the blockchain-based game Axie Infinity, said it will lay off 21% of its staff — or roughly 50 employees — as part of efforts to streamline operations and focus on core products, TechInAsia has learned.

The firm’s co-founder Nguyen Thanh Trung emphasized in an X post that the decision was not driven by financial pressures, reassuring that the decision is a “strategic move that allows for a sharper focus and positioning Sky Mavis for hypergrowth in 2025 and beyond.”

“The decision to part ways with talented team members was not made lightly and does not reflect their contributions to Sky Mavis. […] In order to better focus on these products and have the agility needed to open Ronin in Q1, we have made the tough decision to let go of 21% of our workforce.

Nguyen Thanh Trung

Trung also shared that Sky Mavis would not pursue new directions, stating, “rather than trying to build products for all users, we are doubling down on what makes Sky Mavis truly exceptional.” As a result, the game developer will focus on the Ronin wallet and expanding the Ronin Network “for more builders.” Following the news, the price of the Axie Infinity (AXS) token plunged 3.78%.

Founded in 2018, Sky Mavis operates a play-to-earn model where players purchase monsters as well as earn non-fungible tokens and in-game currency. In 2022, North Korea-affiliated hackers launched a multi-level social engineering attack on the company, leading to a $600 million loss. In response, Sky Mavis shifted to a free-to-play model.

Source link

Coins

Chill Guy Meme Coin Pumps Another 50% as Creator Fights Back

Published

3 hours agoon

November 25, 2024By

admin

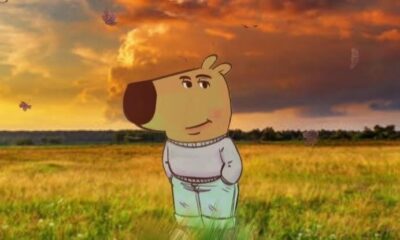

From TikTok trends to crypto wallets, the “Chill Guy” meme has become an internet phenomenon, turning a laid-back cartoon dog into the face of a million-dollar market cap crypto.

Since its November 15 launch, the Chill Guy meme coin ($CHILLGUY) ballooned from a $10 million market cap to over $461 million, driven by the widespread popularity of the Chill Guy character—a relaxed anthropomorphic dog in a grey sweater, blue jeans, and red sneakers.

The Solana-based meme coin has increased in value by 50% over the last 24 hours alone, trading just shy of $0.50, per CoinGecko data. The token’s rise reflects the ongoing craze around meme coins, which continue to defy market norms with their volatile yet lucrative returns.

CHILLGUY features an anthropomorphic brown dog sporting a grey sweater, rolled-up jeans, and red sneakers, captivating audiences with its laid-back demeanor and has become a cultural phenomenon.

Frequently paired with humorous captions on platforms like TikTok, the character embodies a carefree attitude, resonating particularly with Gen Z audiences.

However, the coin’s ascent has not been without controversy. Behind the meme coin’s success lies growing tension as the meme’s creator, Philip Banks, pushes back against what he calls unauthorized exploitation of his work.

“Just putting it out there, Chill Guy has been copyrighted. Like, legally. I’ll be issuing takedowns on for-profit related things over the next few days,” Banks tweeted last week.

While Banks clarified that casual use by brands or individuals isn’t his target—“I just ask for credit. Or Xboxes.”—he noted unauthorized merchandise and shitcoins are crossing the line.

Despite these concerns, early adopters of CHILLGUY have seen massive returns, with one trader turning a $1,000 investment into over $1 million within days.

It isn’t the first time meme coins have demonstrated their ability to convert internet phenomena into financial windfalls.

Recently, the Peanut the Squirrel (PNUT) token—inspired by the viral story of Peanut, a pet squirrel euthanized by New York authorities—reached a $1 billion market cap within two weeks, while the First Convicted Raccoon (FRED) coin climbed 383% in a day.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Will Pi Network Price Reach $100 in This Bull Market?

Axie Infinity developer cuts 21% workforce: report

Chill Guy Meme Coin Pumps Another 50% as Creator Fights Back

Super Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

AI predicts one altcoin set to outperform XRP and Solana in 2025

BTC and Major Altcoins Pullback, SAND Soars 60%

Трамп обирає менеджера прокрипто-хедж-фонду Скотта Бессента на посаду міністра фінансів

Trump calls up crypto pals, Senator says sell gold for Bitcoin | Weekly Recap

Where to Invest in November End?

XRP Price Hits 3-Year High At $1.6

Australia seeking advice on crypto taxation to OECD

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: