crypto liquidations

$295m liquidated as Bitcoin, Ethereum downtrend continues

Published

4 months agoon

By

admin

Crypto investors suffered the biggest liquidation in over a week as Bitcoin and most altcoins continued their downtrend.

Bitcoin and altcoins liquidations rise

Data compiled by CoinGlass shows that total liquidations on Friday, Sep. 6, jumped to over $221 million, up from $72 million a day earlier. It was the biggest jump since Aug. 27 when liquidations soared to $281 million.

- Bitcoin (BTC), the biggest cryptocurrency, led the liquidations with over $114 million;

- Ethereum (ETH), $72 million worth and

- Solana (SOL), $14 million.

Bitcoin and other cryptocurrencies dropped as investors dumped risky assets and moved to safe havens. The tech-heavy Nasdaq 100 index dropped by over 500 points while the small-cap Russell 2000 index crashed by over 1.96%.

This decline happened after the U.S. published mixed jobs reports, signaling that the Federal Reserve will deliver a 0.25% cut instead of the expected 0.50%. The numbers showed that the unemployment rate fell slightly to 4.2% while wage growth bounced back.

Especially after the excitement of a month ago, when analysts and economists suddenly jacked up their probability of an economic recession, this morning’s (August) US jobs report comes as a relief… that is unless you were absolutely convinced that the Federal Reserve would cut…

— Mohamed A. El-Erian (@elerianm) September 6, 2024

There is a risk that Bitcoin and other altcoins may continue falling in the coming weeks. For one, a sense of fear is spreading in the market as the fear and greed index has fallen to the fear area of 30. In most periods, cryptocurrencies retreat when investors are fearful.

Bitcoin and Ethereum are also seeing weak institutional demand as their ETFs have continued their outflows. Data shows that Bitcoin ETFs have shed assets in the past eight consecutive days while Ether funds have shed over $568 million since inception.

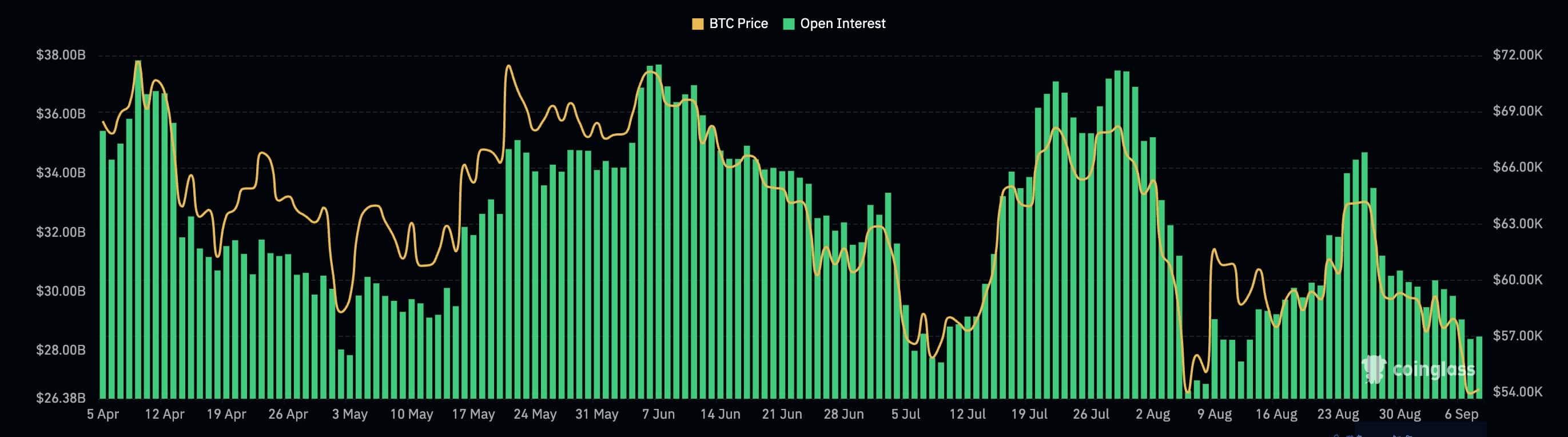

Additional data shows that the futures open interest continued falling and is hovering at its lowest point in over a month. Bitcoin’s open interest dropped to $28.4 billion, down from the year-to-date high of over $37 billion.

Bitcoin price has weak technicals

Bitcoin Death Cross?

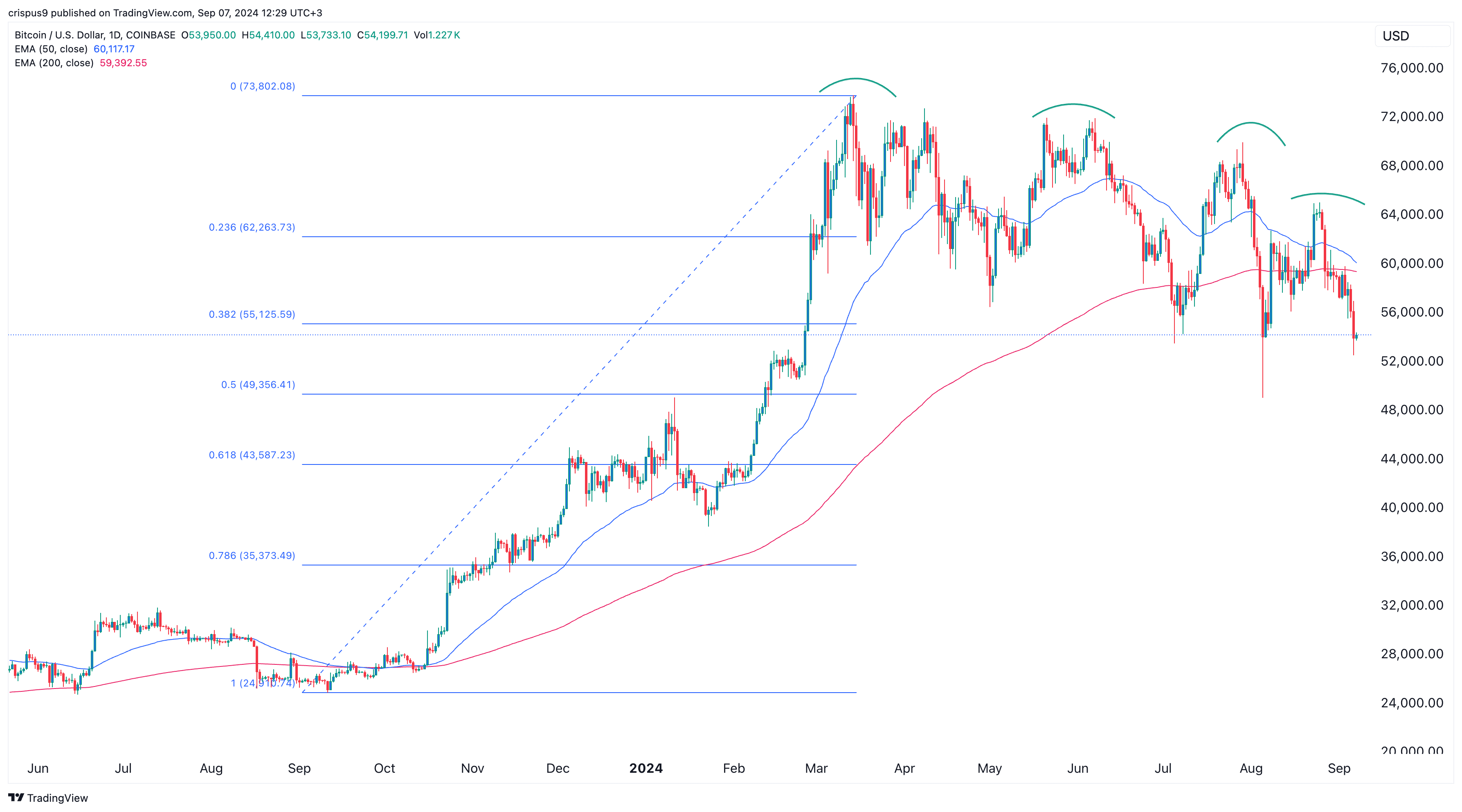

Technically, there is a risk that Bitcoin is about to form a death cross pattern as the spread between the 200-day and 50-day Exponential Moving Averages is narrowing.

The last time Bitcoin formed a death cross was in 2022. The event led to a 65% crash.

Bitcoin has also moved below the 38.2% Fibonacci Retracement point, meaning that it could drop to the 50% level of $49,000, its lowest level last month. A drop below that point will lead to more downside. Other altcoins tend to crash when BTC is not doing well.

Source link

You may like

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Bitcoin

Ethereum, Solana touch key levels as Bitcoin spikes

Published

5 months agoon

July 20, 2024By

admin

Bitcoin has jumped above $66,000, reaching its highest level since mid-June when prices hovered above $67,000.

The price of Bitcoin (BTC) is currently 4.7% up in the past 24 hours as buyers hover around $66,670. Meanwhile, Ethereum (ETH) has climbed above $3,500 and Solana (SOL) is trading above $170 – with gains of 3% and 8% respectively.

Other altcoins are also trading positive, with BNB (BNB) up 4.9%, Dogecoin (DOGE) 4.5% and Cardano (ADA), 3%.

Bitcoin rises amid global IT outage

The bounce in Bitcoin’s price came as chatter continued around the benchmark cryptocurrency’s potential inclusion as a strategic national reserve for the US.

Key to Bitcoin’s surge to intraday highs above $66,800 was the chaos accompanying a major IT outage on Friday, with airlines grounded and banks, media, and other global companies disrupted.

The outage followed a software update by cybersecurity giant CrowdStrike.

As the widespread cyber outages spotlighted Bitcoin’s strengths, the market seemed to take cues for a fresh rebound. The space also witnessed a huge surge in spot ETF volume.

Shorts feel pain as Bitcoin price surges

Meanwhile, the surge in prices had shorts obliterated. The past hour, as at 14:24 ET on Friday, has for instance seen over $6 million BTC shorts liquidated – compared to just $79,700 in long positions.

Data shows liquidations in the past four hours have seen bearish bitcoin bets worth over $12 million liquidated compared to around $1.6 million longs.

In the broader market, over $30 million shorts have been liquidated in the past four hours. This outpaces long liquidations by a wide margin as only $5.3 million in long positions have been rekt in this period.

On Thursday, analysts at Santiment had noted a surge in short positions in the bitcoin market, with BTC price hovering below $63k. Liquidations mounted as BTC price rose to above $66,800.

Source link

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential