Price analysis

3 Catalysts Driving Solana Price To $200 This Week

Published

4 months agoon

By

admin

Solana price has seen a notable surge over the past week, rising by nearly 20% as traders and investors react to a series of positive developments within the Solana ecosystem. Solana’s price trend showcases a notable upward trend over the week.

Beginning on July 17, the cryptocurrency’s value steadily increased from approximately $160, demonstrating significant growth and reaching a peak close to $185 around July 22.

This upward trend signifies a robust market response, possibly influenced by external market factors or developments within the SOL network. Following this peak, there appears to be a slight retraction in price, stabilizing around $175.

Solana, a layer 1 blockchain network, has slightly declined over the past 24 hours. However, SOL is still hovering above the $170 support level amidst volatile trading conditions. At the time of writing, the SOL price is trading at $176, reflecting a downturn of about 2% during the U.S. time zone.

According to CoinMarketCap data, despite the current dip, Solana maintains a robust market cap of approximately $81 billion, positioning it as the fifth-largest cryptocurrency by market cap. This performance is part of a broader context of significant trading volume, recorded at around $2.8 billion within the same period.

Solana Price Rises on Whale Transfers

Solana price has surged, fueled by significant whale transfers. Whale transfers refer to large cryptocurrency transactions often carried out by high-net-worth individuals or entities known as “whales.” These major players hold substantial amounts of cryptocurrency and can influence market dynamics merely by the scale of their trades.

When whales move their holdings, especially on platforms like Solana, it can increase volatility and prices as market participants react to these large inflows or outflows. The perception that whales are accumulating or distributing assets can trigger a cascade of trading activities driven by smaller investors following their lead.

🚨 124,819 #SOL (22,352,764 USD) transferred from unknown wallet to #Binancehttps://t.co/rVFKI05sjC

— Whale Alert (@whale_alert) July 22, 2024

SOL witnessed a significant transaction today, as 124,819 SOL (valued at approximately 22,352,764 USD) was transferred from an unknown wallet to the cryptocurrency exchange Binance.

2. Solana ETF Speculation Boosts Market Sentiment

Solana price prediction points to rising momentum amidst growing speculation that it could follow in Ethereum’s footsteps with the approval of its exchange-traded fund (ETF). This possibility is buoyed by Ethereum’s recent success in securing an ETF, which has been a significant boon to its valuation and investor appeal.

Furthermore, the blockchain’s rising fundamentals amplify the anticipation surrounding a Solana ETF. With its high throughput and low transaction costs, Solana continues to attract a broad spectrum of decentralized applications (dApps), which contribute to its ecosystem’s growth.

3. Open Interest and TVL Indicate Bullish Trends

A surge in open interest and Total Value Locked (TVL) on Solana indicates growing investor confidence and engagement within the ecosystem. The recent spike in open interest reflects heightened demand for Solana-based derivatives, which often serves as a forward-looking indicator of bullish sentiment among traders.

This surge in open interest and increased trading volume suggests that more investors are positioning themselves for a potential uptick in SOL price. According to Coinglass data, the rise in TVL, which has soared by over 25% in the past month to $5.248 billion, further underscores this trend.

The daily technical indicators for Solana (SOL) reveal significant market movements and trends. The Relative Strength Index (RSI) is at 64.79, indicating that Solana is approaching the overbought zone but still has room for potential upward movement.

The Moving Average Convergence Divergence (MACD) indicator further supports this bullish trend, with the MACD line at 9.07, crossing above the signal line at 5.18. This crossover typically signals a buying opportunity and suggests that the bullish trend may continue.

Frequently Asked Questions (FAQs)

Solana’s strong market momentum and positive developments could drive it to new all-time highs.

The surge is driven by significant whale transfers, ETF speculation, and increasing Total Value Locked (TVL).

Current market trends and technical indicators suggest bullish sentiment, making Solana a strong investment.

Related Articles

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Swiss lawmakers to study Bitcoin for power grid upgrade

Bitcoin Could Reach up to $500,000 Within 24 Months, Says Cardano Founder Charles Hoskinson – Here’s Why

Why Is The Worldcoin Price Up 20% Today, Rally To Continue?

Bybit x Block Scholes report

How High Can Shiba Inu Price Climb If Bitcoin Hits $100,000?

Need Gift-Buying Advice for That Special Someone? Our AI SantaBot is Here to Help

Price analysis

XLM Price Kickstarts Parabolic Rally to $1 After Recent Breakout

Published

11 hours agoon

November 28, 2024By

admin

XLM price has been on a steep ascent since mid-November. However, that momentum was briefly interrupted over the weekend as the wider crypto market followed Bitcoin’s downward cue. Nonetheless, the market returned to the upside on Wednesday, with Stellar breaking out of a bullish flag pattern. We discuss why this could be a pathway to the $1 mark.

XLM Price Triggers Parabolic Rally to $1

Consolidation phases typically follow exponential price gains like the one recently seen on Stellar price. The brief period of profit-taking is what forms the “flag.” In a market rally, a breakout from the flag pattern signals a return to the previous upward trajectory. In the case of XLM, the breakout happened on Wednesday, and a successive price gain on Thursday added credence to the bullish continuation pattern.

To get the price target in a bullish flag pattern, we measure the “flagpole,” which is the distance from the lows of the upward move to the highs at the flag’s formation point. We then use the same measurement to extrapolate to the upper target, starting from the flag’s lower trendline. Applying this method on the four-hour XLM price prediction chart below signals that the price could go as high as $1.11

Besides the technical outlook’s leaning toward the upside, a number of on-chain metrics also signal bullish control of the market, as discussed below.

Rising Open Interest Signals Increased Demand for XLM

Open Interest measures the value of options or futures contracts that are yet to expire, or investors are yet to exercise/close. In XLM’s case, the value of Open Interest in perpetual contracts rose by 3.2% in the 24 hours preceding this writing, as seen on the graphic below. That signals that more investors are predicting that the value of XLM will continue to rise in the coming days. This sentiment adds support to the coin’s demand side.

A Sharp Spike in XLM DeFi TVL Highlights Growing Adoption

According to recent DeFiLlama data, the Total Value Locked (TVL) in the Stellar chain DeFi ecosystem rose sharply by 63.5% in the last seven days to $56.18 million. That augurs well for XLM price as it points to increased utility in financial transactions.

Stellar Price’s Bullish Momentum Targets $0.50 Support

The RSI indicator reading is at 53, signaling a stronger upside potential. The next key barrier for XLM price is at $0.50, which is a psychological level. A break above that level will confirm the bullish bias. The coin has its immediate support at $0.48, the lower mark of the recent consolidation.

A break below that level will invalidate the upside thesis and potentially open up the path to test $0.40, near the last breakout zone before the parabolic.

Frequently Asked Questions (FAQs)

A bullish flag is a continuation pattern that comes after a brief consolidation period such as one seen on XLM price recently. We use the flagpole to measure the upper price target. A breakout from this pattern suggests that the price will likely continue soaring.

Rising Total Value Locked (TVL) highlights growing adoption of XLM in the DeFi ecosystem. With increased utility comes increased demand.

Rising Open Interest means investors are not in a hurry to exercise/close their perpetual contracts. That shows they are confident of the asset’s growth prospects, which signals growing demand.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

meme coin

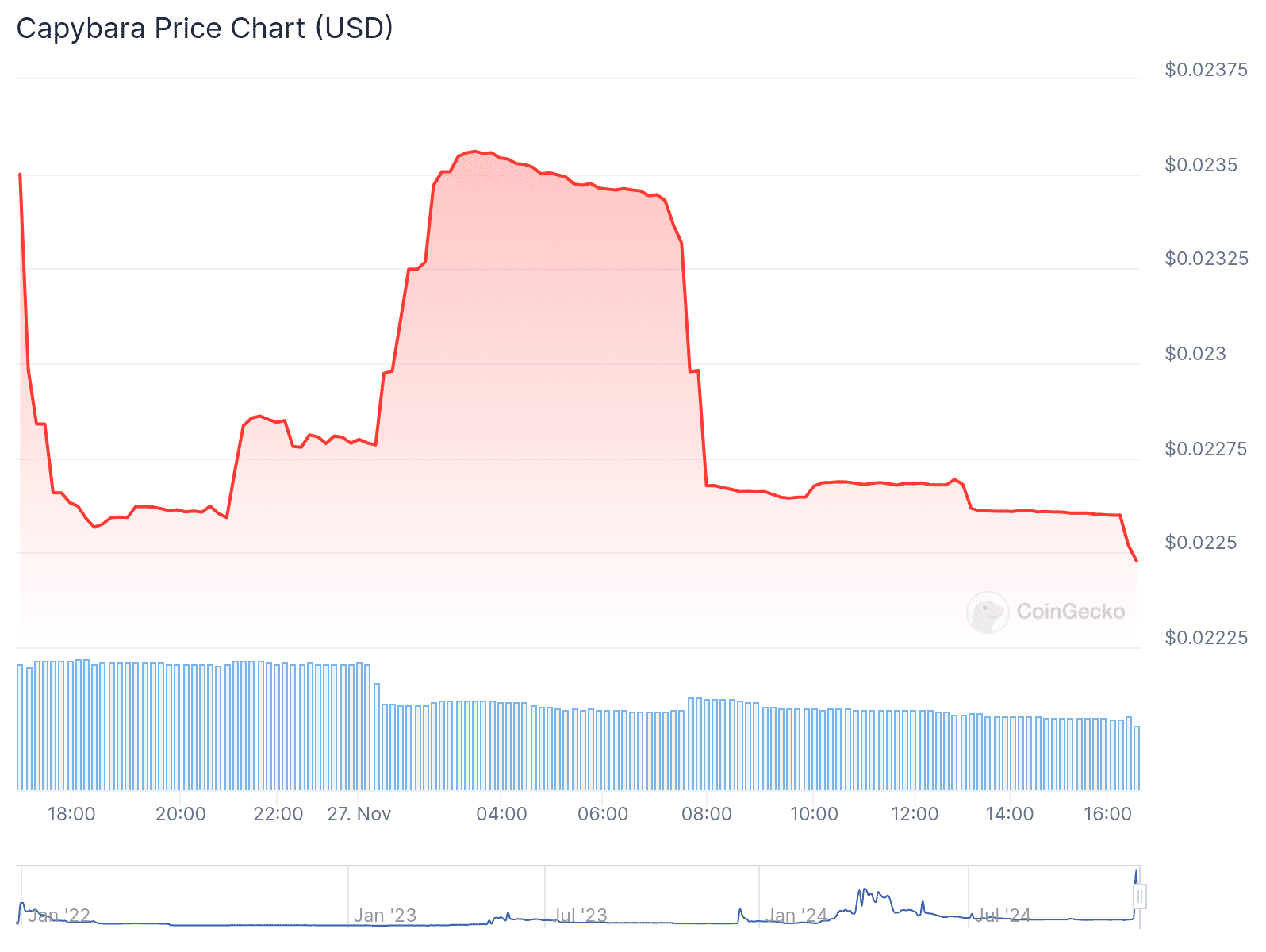

Capybara is down by nearly 30% in 24-hour trading

Published

1 day agoon

November 27, 2024By

admin

The Capybara token has gone down by 29.2% in the past 24-hours of trading, despite the Solana-powered token having soared through the week at 76%.

In the past day, the Capybara(CAPY) token has slid down by 29.2% according to data from crypto.news. The animal-themed token is currently trading hands at $0.002478.

Despite the downhill slope it is currently in, CAPY has been on an upward trend in the past seven days, with its price going up by nearly 80%. The Solana-based token has even seen a 121.87% in the past month, but it seems its rally has come to an end.

The token featuring the adorable South America-native rodent has had an experience quite similar to other animal-themed meme coins such as MOODENG(MOODENG). Just a few days ago on Nov. 22, CAPY went through a meteoric rise, reaching a new all-time-high of $0.0191521. But the token has since struggled to climb back up to its peak.

At the time of writing, the Capybara token’s trading volume stands at $4,538, decreasing by more than 50% compared to the previous day. Though, the token does not have a visible market cap, therefore it is nowhere near the cryptocurrency rankings. Not only that, CAPY also does not have any tokens on its circulating supply, despite its total supply amounting to 1 billion tokens.

On X, CAPY is being tweeted almost every minute along with other meme coins like CATI, HMSTR, DUCKS and DOGS. Most of these tweets seem to be automatically generated by bots using random accounts.

On the official website, Capybara World, the CAPY token is described as a community-driven token inspired by “the most peaceful animal in the world.” The Capybara token was launched in Dec. 2021, available for trading on Raydium and dexlab.

Over the years, the capybara has become one of the internet’s favorite animals. According to the South China Morning Post, there has been an influx of capybara content on various social media platforms like Instagram, TikTok and YouTube. The capybara is known for its laid-back and serene demeanor, becoming a symbol of peace and tranquility.

Source link

Doge price

Can Dogecoin Price Realistically Hit $4.20?

Published

1 day agoon

November 27, 2024By

admin

Cryptocurrencies stabilized a bit on Wednesday after slipping in the past two consecutive days. Dogecoin price rose slightly as traders anticipated Elon Musk’s DOGE success. One analyst predicted that the dog-themed coin would jump to $4.20 in the ongoing crypto bull run.

Analyst Predicts Dogecoin Price Could Hit $4.20

Dogecoin price has been in a strong uptrend in the past few weeks as it jumped by almost 500% between August 5 and November 23. This rally coincided with the broader uptrend in the crypto industry after Donald Trump won the election and appointed Elon Musk to lead the Department of Government Efficiency (DOGE).

In an X post, CEO, a popular crypto investor with over 511,000 followers, predicted that the DOGE price would jump to $4.20 in the ongoing cycle. If that was to happen, it would mean that the coin will rise by 976% from the current level. Such a move is possible in the crypto industry since DOGE has already risen by 160% in the past few days. If it happened, DOGE’s market cap would jump from the current $57 billion to over $613 billion.

For this to happen, cryptocurrencies need to be in a strong bull run, which would attract a sense of greed in the market. Also, Bitcoin, the biggest cryptocurrency in the market would need to continue its uptrend. In most periods, altcoins like Dogecoin thrive when Bitcoin is in a strong rally.

Other cryptocurrencies are highly bullish on the Dogecoin price. In a post, The Cryptomist noted that the coin was forming a falling wedge pattern. This pattern forms when an asset forms two descending and converging trendlines. It usually leads to a strong breakout when the wedge is about to converge.

DOGE Price Chart Points To Eventual Breakout

While talk of DOGE price surging to $4.2 is good, the most realistic situation is to first target the psychological point at $1.

The weekly chart shows that the value of DOGE has been in a long bullish trend as it jumped for six consecutive weeks. In most cases, assets tend to take a breather after such a long bull run.

It remains above the important resistance level at $0.2278, its highest point in March this year. Moving above that point invalidated a double-top pattern whose neckline was at $0.0836. The coin remains significantly higher than the 50-week and 200-week moving averages.

More Dogecoin price upside will be confirmed if it jumps above this month’s high at $0.4790. Such a move will raise the chances of it rising to its all-time high of $0.7393, which is about 87% above the current level.

This Dogecoon price prediction will become invalid if it drops below the key support at $0.2833, the 61.8% Fibonacci Retracement point. Such a move will raise the possibility of it dropping to $0.20.

Frequently Asked Questions (FAQs)

Yes, the coin can jump to $4.2 since everything in the crypto industry is possible. For example, Bitcoin has risen from below $1 in 2016 to near $100,000 today. DOGE needs to jump by less than 1,000% to get to $4.2.

For Dogecoin to hit $1, it first needs to rise above this month’s high of $0.4790. A move above that level will raise the possibility of it retesting its all-time high of $0.7393.

Dogecoin has a market cap of over $57 billion. A move to $1 would push its valuation to over $147 billion.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Swiss lawmakers to study Bitcoin for power grid upgrade

Bitcoin Could Reach up to $500,000 Within 24 Months, Says Cardano Founder Charles Hoskinson – Here’s Why

Why Is The Worldcoin Price Up 20% Today, Rally To Continue?

Bybit x Block Scholes report

How High Can Shiba Inu Price Climb If Bitcoin Hits $100,000?

Need Gift-Buying Advice for That Special Someone? Our AI SantaBot is Here to Help

These 3 meme coins are set to boom in 2025 without SHIB or DOGE

Pro Gamer Linked to $3.5M Meme Coin Scam: ZachXBT

Bitcoin Miners Near $40B Market Cap as Mining Difficulty Set for Fifth Straight Increase

Metaplanet aims to raise $62m from Stock Acquisition Rights to buy more Bitcoin

XLM Price Kickstarts Parabolic Rally to $1 After Recent Breakout

Here’s How To Talk About Bitcoin At The Thanksgiving Table

BitBasel + VESA

Metaplanet shares added to Amplify Transformational Data Sharing ETF

Ethena Price Shoots 20% Amid Heavy ENA Accumulation by Arthur Hayes

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: