BTC price

5 Altcoins To Watch as BTC Price Eyes $70K

Published

3 months agoon

By

admin

The BTC price surged 3.2% during the U.S trading session on Friday, nearly retesting the $60000 psychological level. A potential breakout from this resistance could accelerate the ongoing recovery and drive a rally to $70000. Here are five altcoins to watch amid a renewed bullish trend.

5 Altcoins Poised for Gains as BTC Price Eyes $70K

The BTC price daily chart shows a V-shaped reversal from $52500 to $59900— a 13.5% increase within two weeks. The bullish turnaround can be attributed to the market expecting a potential 50 BPS interest rate cut at the Sept. 18 FOMC meeting. If it happens, Bitcoin could chase $70000 and fuel bullish momentum in these below altcoins.

- XRP

- Cardano (ADA)

- Tron (TRX)

- Polygon (POL)

- Sui

Xrp (XRP)

XRP, the native cryptocurrency of the global payment solution company Ripple, witnessed a massive inflow on Thursday following Grayscale Investments’ relaunching of its XRP Trust. This development suggests growing institutional confidence in XRP and could potentially lead to the introduction of a new crypto exchange-traded trust (ETT) focused on XRP.

The XRP price currently trades at $0.57, registering a 7% jump in the last 48 hours. Consequently, the market cap was boosted to $32.18.

According to the santiment data, the XRP Whales wallet, holding 10 million to 1 billion coins, has shown steady accumulation since January 2022, carrying 6.94 billion XRPs. This indicates rising interest from large holders, bolsters a potential reversal and stable rally.

Cardano (ADA)

Coinciding with other altcoins, Cardano coin showcased a notable bounce from $0.31 to $0.359, accounting for 14.5% growth. If the bullish turnaround sustains, the ADA price could surge another 7% before challenging the overhead trendline intact since May 2024.

A potential breakout from this barrier will signal a change in market sentiment and accelerate the bullish momentum.

In September, the Cardano coin experienced a steady rise in large transaction volumes, currently at 19.37 billion ADA. The consistent increase in large transactions suggests that whales and institutional investors drive the accumulation.

TRON (TRX)

Defying the recovery momentum from fellow altcoins, the TRX price is down 2.1% today to currently trade at $0.148. Several analysts have marked this reversal as a temporary cool-off after the August rally following the launch of the Sunpump meme coin generator.

According to Intotheblock analytics, TRON has seen a significant rise in long-term holders over the past year. The number of long-term holder addresses increased by 237%, reaching nearly 90 million. This trend reflects growing confidence in TRON’s future as more investors opt to hold TRX for extended periods.

Polygon (POL)

Polygon’s native token, POL (formerly MATIC), surged nearly 15% today after Binance announced plans to integrate it into several key products, including Earn, Buy Crypto, Convert, Margin, and Futures.

By press time, the POL price had traded at $0.418 and maintained a market cap of $2.98 billion. The bullish momentum was further accentuated by a sudden spike in the 24-hour active addresses to 1400, according to Santiment data. This indicates a surge in user engagement and activity on the network following the recent migration from MATIC to POL.

Sui (SUI)

Like XRP, the SUI price recently garnered investors’ attention following the launch of Garyscale’s SUI Trust Fund. This new investment vehicle has sparked optimism for SUI’s future, as it opens up institutional access to the asset, increasing potential liquidity and market participation.

The SUI price reacted strongly bullish on Thursday’s announcement and surged around 11.35% to reclaim the $1 mark. According to DeFiLlama, the Total volume locked (TVL) in SUI surged past $700 Million, indicating the investors are actively locking their assets in SUI-based decentralized finance (DeFi) platforms, which could boost the liquidity and sustainability of the protocol.

If bullish momentum is precious, the SUI price could attempt $1.1, and resistance coincides close to an inverted head and shoulder neckline. For a detailed analysis, check the best altcoins to buy article.

Frequently Asked Questions (FAQs)

If BTC price breaks the $60K resistance and continues toward $70K, it could create a bullish market environment, driving increased demand for altcoins

Cardano saw a 14.5% price increase from $0.31 to $0.359, with rising large transaction volumes suggesting increased whale and institutional activity.

TRON’s long-term holders grew by 237%, reaching nearly 90 million addresses, signaling investor confidence in TRON’s long-term potential.

Sahil Mahadik

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

24/7 Cryptocurrency News

Veteran Trader Peter Brandt Predicts New Bitcoin Price Target

Published

1 day agoon

December 22, 2024By

admin

Bitcoin price has noted a strong recovery this weekend after a sharp decline recently falling below the $91K mark. Amid this, veteran trader Peter Brandt has reiterated his bullish outlook on the flagship crypto, indicating that the crypto could continue its rally ahead. In addition, other on-chain metrics also indicate a positive momentum for BTC ahead.

Peter Brandt Predicts Bitcoin Price Rally Ahead

The Bitcoin price, alongside the top altcoins, has witnessed a strong rally over the past few days, sparking market confidence. However, the flagship crypto has recently witnessed a sharp decline amid a broader crypto market crash this week. Despite that, BTC has recovered from its weekly lows on Saturday, indicating investors are reentering the market.

Amid this, veteran trader and top market expert Peter Brandt maintained a bullish outlook for BTC. In a recent analysis, Brandt said that the crypto is likely to hit $108,358 in the coming days, sparking optimism. However, he also warned over a potential decline to $76,614 citing the technical charts.

Besides, he also said that “this is not a prediction”, indicating the risks associated with the market. He said that these analyses only reflect the “possibilities, not probabilities, not certainties.” Besides, he has recently set a BTC price target of $125K, which has also gained notable market attention.

However, the market optimism is soaring towards the crypto market after Donald Trump’s election win in November. Now, as Trump’s inauguration on January 20 is approaching, the market sentiment is further bolstered by anticipation over the pro-crypto regulatory environment in the US.

What’s Next For BTC?

The discussions over the US BTC Strategic Reserve have fueled market sentiment recently. On the other hand, the recent robust inflow into US Spot Bitcoin ETF has also signaled a growing institutional interest in the crypto. However, the recent outflux this week into BlackRock Spot Bitcoin ETF and others has fueled concerns.

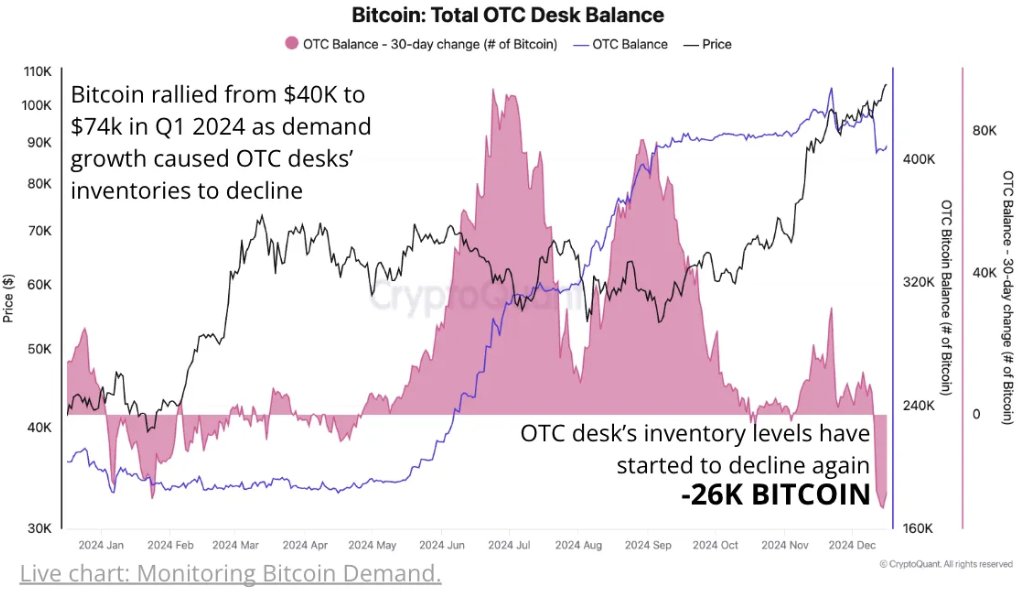

Despite that, the on-chain metrics indicate positive momentum ahead. For context, top analytics platform CryptoQuant said that “Bitcoin demand is surging.” CryptoQuant said that “OTC desks” are witnessing their largest monthly inventory decline this year, down 26K BTC. Considering that, the tightening market supply also indicates a bullish momentum ahead.

In addition, other market experts have also remained optimistic about the future trajectory of BTC. For context, Matrixport has cited key reasons recently that have sparked a rally in Bitcoin price and top altcoins like Solana, XRP, and DOGE. Besides, it also set a BTC price target of $160K for the crypto, boosting investors’ confidence.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Analyst

Here’s Why The Bitcoin Price Continues To Hold Steady Between $96,000 And $98,000

Published

3 days agoon

December 20, 2024By

adminThe Bitcoin price has dropped below the $100,000 psychological level and is now holding between the $96,000 and $98,000 range. Crypto analyst Ali Martinez provided insights into why Bitcoin could be holding well within this range.

Why The Bitcoin Price Is Holding Steady Between $96,000 And $98,000

In an X post, Ali Martinez noted that one of the most important support levels for the Bitcoin price is between $98,830 and $95,830, where 1.09 wallets bought over 1.16 million BTC. This explains why Bitcoin is holding steady between $96,000 and $98,000 as investors who bought between this level continue to provide huge support for the flagship crypto.

Related Reading

As Martinez suggested, it is important for these holders to continue to hold steady as a wave of sell-offs could send the Bitcoin price tumbling even below $90,000. The flagship crypto dropped below $100,000 following the Federal Reserve Jerome Powell’s recent speech, in which he hinted at a hawkish stance from the US Central Bank.

This sparked a massive wave of sell-offs, as a Hawkish Fed paints a bearish picture for risk assets like Bitcoin. However, despite the Bitcoin price drop below, most Bitcoin holders remain in profit, which is a positive for the flagship crypto. IntoTheBlock data shows that 86% of Bitcoin holders are in the money, 4% are out of the money, and 9% are at the money.

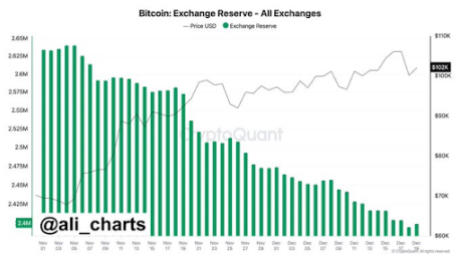

These Bitcoin holders still seem bullish on the leading crypto as they continue to accumulate more BTC. In an X post, Ali Martinez stated that so far in December, 74,052 BTC have been withdrawn from exchanges, and this trend doesn’t seem to be slowing down.

Traders Anticipate A Bullish Reversal

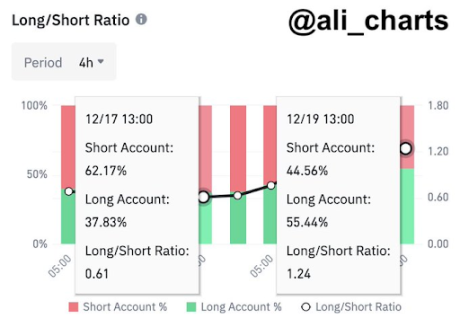

Ali Martinez suggested that crypto traders anticipate a bullish reversal for the Bitcoin price from its current level. This came as he revealed that traders on Binance nailed the top, with 62.17% shorting Bitcoin while it was trading at $108,000. Now, Martinez stated that sentiment has flipped, with 55.44% of these trading now longing dips below $96,000.

Related Reading

Meanwhile, it is crucial for the Bitcoin price to hold this $96,000, as Martinez warned that if BTC loses this support, it could drop below $90,000. The analyst stated that based on the Fibonacci level, if Bitcoin loses $96,000, the next point of focus becomes $90,000 and $85,000. Meanwhile, from a bullish perspective, crypto analyst Justin Bennett suggested that the $110,000 target is still in focus for the Bitcoin price.

At the time of writing, the Bitcoin price is trading at around $97,000, down over 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Bitcoin

US Bitcoin Reserve Could Push Price To $500,000: Expert

Published

5 days agoon

December 18, 2024By

admin

In an exclusive interview with Yahoo Finance, Matt Hougan, Chief Investment Officer at Bitwise Asset Management, shared his bullish outlook on Bitcoin, projecting significant price appreciation by the end of 2025. “We expect Bitcoin to be up above $200,000 by this time next year,” Hougan stated, attributing this forecast to three primary sources of demand: exchange-traded funds (ETFs), corporate investments, and governmental acquisitions.

Hougan elaborated, “There are ETFs that are vacuuming up Bitcoin, public companies like MicroStrategy are accumulating Bitcoin, and now we’re seeing discussions about governments investing in Bitcoin. It ultimately boils down to supply and demand—there’s too much demand and not enough supply, which drives the price higher.”

When probed about the sustainability of such demand, Hougan emphasized the gradual awakening of different investor segments to Bitcoin’s value proposition. “People just wake up to Bitcoin at different paces. We’ve seen retail investors engage first, followed by companies and financial advisors, and now institutions are recognizing that Bitcoin belongs in a diversified portfolio,” he explained.

Related Reading

“Bitcoin is now a global macro asset worth a few trillion dollars, and virtually every investor should have some exposure. We still have a large number of investors to go, which is why I believe we’re still early in this journey. We have many quarters to go,” he added.

How High Can Price Go If The US Buys Bitcoin?

A pivotal aspect of Hougan’s forecast hinges on the potential establishment of a US Strategic Bitcoin Reserve (SBR). Addressing this, Hougan remarked, “If we do get a Bitcoin strategic reserve where the government is buying Bitcoin, as proposed in Senator Lummis’ bill for the government to purchase a million Bitcoin, $200,000 Bitcoin is going to be looking quaint. You’re going to be looking at three four $500,000 Bitcoin. It’s just too big a story because governments all around the world would have to do it.”

Hougan admitted that he was first skeptical about Trump suggestions to establish a SBR. “But over the months, it hasn’t gone away in fact we continue to see leaders in the Trump Administration suggest that they’re open to it,” Hougan remarked. The Bitcoin CIO still thinks that the odds of the US government buying Bitcoin is less than 50%, but “it’s not zero,” he added. “If it happens or if we start to see it happening in other countries, you’re going to see a rip up in Bitcoin that will make 2024 look pretty docel in comparison.”

Related Reading

Hougan also highlighted the role of institutional platforms, specifically citing Coinbase as a potential major beneficiary in the evolving crypto landscape. “Coinbase is currently about half the size of Charles Schwab, and we believe it could surpass Schwab in brokerage size,” he noted.

“Coinbase hasn’t had major competitors bubbling up to challenge it; it’s sort of had a degree of regulatory capture, if you can believe it. As a result, it’s been able to sustain its high margins in brokerages and then layer on things like stablecoins. [..,.] It’ll also help if it gets into the S&P 500; you see institutions buying it broadly. I think it’s a really unique situation driven by the fact that there was so much regulatory uncertainty—it cleared the competitive fat path and now it’s going to reap those rewards and build a really, you know, maybe an unsalable position leading this industry in the US.”

Looking ahead to the broader market, Hougan anticipated an influx of crypto-related companies entering public markets. “We can expect firms like Kraken, Anchorage, and Chainalysis to go public, further normalizing the industry,” he stated. “This influx will lead to increased Wall Street coverage and institutional investment, setting the stage for a robust IPO window in 2025.”

Despite the optimistic outlook, Hougan acknowledged potential risks that could impede Bitcoin’s growth. “The biggest risk is that politicians don’t deliver on their promises—if we don’t achieve regulatory clarity or fail to establish a strategic reserve, the expected bull market might not materialize,” he cautioned. “Regulatory and political factors are crucial drivers for crypto in 2025, and any setbacks in these areas could pose significant challenges.”

At press time, Bitcoin traded at $104,212.

Featured image created with DALL.E, chart from TradingView.com

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: