bank

$512,900,000,000 in Unrealized Losses Hit US Banks As Number of ‘Problem Banks’ Rises To 66: FDIC

Published

3 months agoon

By

admin

The number of US banks with major issues is on the rise, according to the Federal Deposit Insurance Corporation (FDIC).

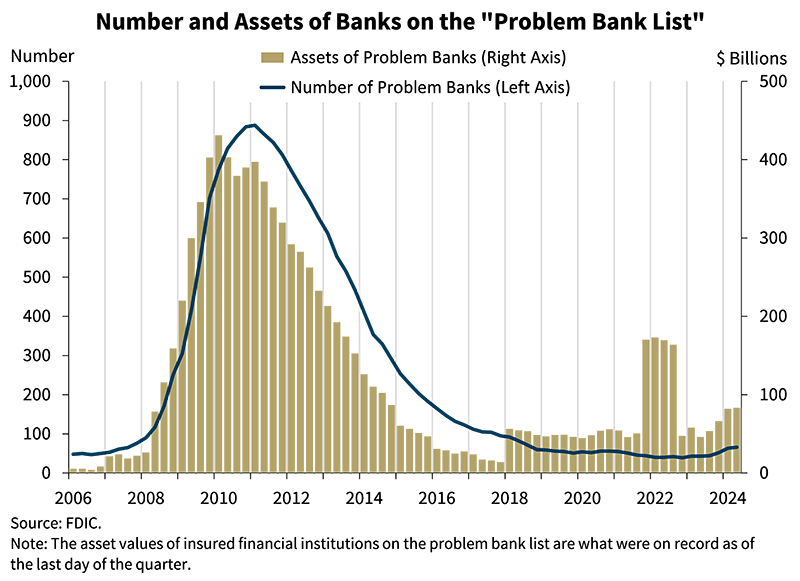

The agency’s Second Quarter 2024 Quarterly Banking Profile shows the number of lenders on its “Problem Bank List” rose quarter-on-quarter from 63 to 66.

It’s the fifth consecutive quarterly increase of banks rated 4 or 5 on the CAMELS ratings system since the second quarter of 2023.

A rating of 4 on the CAMELS system indicates a bank is suffering from financial, operational or managerial issues that could reasonably threaten viability if unresolved, while a rating of 5 indicates a bank is critically deficient and requires immediate remedial attention.

“The number of problem banks represent 1.5% of total banks, which is within the normal range for non-crisis periods of 1% to 2% of all banks. Total assets held by problem banks increased $1.3 billion to $83.4 billion.”

Meanwhile, US banks continue to saddle billions of dollars in unrealized losses on securities. The FDIC reports $512.9 billion in total unrealized losses in the second quarter, a 0.7% quarter-on-quarter decrease.

Says FDIC chairman Martin Gruenberg,

“Interest rates increased modestly in the second quarter, putting downward pressure on bond prices, but the resulting increase in unrealized losses was more than offset by the sale of bonds by several large banks that resulted in substantial realized losses.

This is the tenth straight quarter that the industry has reported unusually high unrealized losses since the Federal Reserve began to raise interest rates in first quarter 2022.”

The dangers of unrealized losses came into focus last year amid the collapse of Silicon Valley Bank, when concerns about the lender’s balance sheet triggered a bank run.

Today, Gruenberg says the US banking industry continues to demonstrate resilience, but risks remain.

“…The industry still faces significant downside risks from uncertainty in the economic outlook, market interest rates, and geopolitical events. These issues could cause credit quality, earnings, and liquidity challenges for the industry.

In addition, weakness in certain loan portfolios, particularly office properties, credit cards, and multifamily loans, continues to warrant monitoring. These issues, together with funding and margin pressures, will remain matters of ongoing supervisory attention by the FDIC.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

bank

JPMorgan Chase Refuses To Reimburse Customer After $7,000 Abruptly Drained From Bank Account: Report

Published

1 week agoon

December 14, 2024By

admin

A JPMorgan Chase customer says the bank has refused to reimburse him for more than a year after $7,000 was suddenly drained from his account.

Grant Holihan says he believes his Chase debit card information was skimmed at an ATM that he used in Queens, reports CBS New York.

Soon after he left the ATM, Chase alerted him to an illicit purchase in Las Vegas.

Holihan closed the account, but says new charges from the state of Pennsylvania poured in anyway, fully draining his life savings.

“It was four different Giant supermarkets in Pennsylvania, where [scammers] took out a little over seven grand in under an hour…

They still deny my claim, and it’s been over a year later, and I still haven’t seen my money.”

Holihan says he can prove he was in New York when the charges were made, but Chase says each purchase was fully authorized and verified.

“This customer’s claim was denied because the charges were authorized with their PIN and verified via phone call.”

Holihan says he’s simply looking for the bank to stand by him and do the right thing.

“It’s not even a thousandth of a percent. It’s nothing to them. To me, it was my entire life savings at the time.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

bank

$89,670,000,000 in Increasingly Risky Loans Flagged at JPMorgan Chase, Wells Fargo and Bank of America: Report

Published

3 weeks agoon

November 30, 2024By

admin

America’s biggest banks are reporting a rapid increase in the number of substandard, doubtful and potentially loss-making loans on their balance sheets, according to a new report.

The amount of money tied up in criticized loans, which show emerging signs of risk and weakness that could lead to defaults, just reached its highest level since 2020, reports S&P Global.

JPMorgan Chase has witnessed the largest year-over-year increase, with the number of criticized loans at the firm jumping 26.3%, reaching $26.01 billion at the end of Q3.

Meanwhile, Wells Fargo has recorded a 17.9% year-on-year increase in criticized loans, at $37.6 billion, while Bank of America recorded a 15.2% year-on-year increase, at $26.06 billion.

That brings the total amount of the criticized loans at the trio of banks to $89.67 billion since Q3 of 2023, reflecting a trend that’s playing out at banks across the board.

“Criticized loans at public US banks amounted to $279.98 billion, versus $240.37 billion at the end of 2023, and such loans at the 100 largest US public banks totaled $260.48 billion, versus $219.82 billion at 2023-end.”

Among tier-one banks with over $50 billion in total assets, four lenders recorded triple-digit increases in criticized loans.

Flagstar Financial recorded a 338.6% year-on-year increase in criticized loans while First Horizon, Valley National Bancorp and Webster Financial Corp witnessed 112.2%, 110.1% and 102.8% year-on-year increases in criticized loans.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

bank

Six US Banks Issue Urgent Debit Card Alerts, Forcing Mandatory Replacements for Many, After Third-Party Security Breach

Published

1 month agoon

November 16, 2024By

admin

Six US banks are reporting potential security breaches of debit cards, with several forcing affected customers to get replacements.

In new filings with the Massachusetts state government, Mainstreet Bank, Savers Bank, The Village Bank, Watertown Savings Bank, Webster Five Cents Savings Bank and Eagle Bank say some debit cards may have been compromised following a security breach of a merchant’s payment card platform.

A copy of a notice sent to Eagle Bank customers was recently posted on the government site, stating an unnamed Mastercard merchant allowed unauthorized access to account information.

A notice to customers at The Village Bank and a letter to customers at Savers Bank also pinpoint a merchant breach.

Says Savers Bank,

“We have been notified by MasterCard International of a suspected security breach of a merchant’s network, transactions that may have compromised some of Savers Bank’s debit card numbers.”

Affected customers at Eagle Bank and Savers Bank will receive new cards automatically.

Webster Five Cents Savings Bank offers fewer details on the source of the breach, but says it’s also issuing mandatory new debit cards.

Watertown Savings Bank is asking customers to be vigilant, issuing new cards upon request.

“The breach included the capture of some of your personal information, such as your name and card number…

…we do ask that you remain vigilant on monitoring your account activity for the next 12 to 24 months and report any unusual or suspicious activity immediately. If you prefer that we issue a new card please contact the bank.”

Mainstreet Bank says the breach occurred “June 28, 2023 through April 26, 2024” and involved personally identifiable or protected data.

“We have reason to believe that some of our customers may have had their card data compromised (which could include card names, numbers, and card expiration dates) in the incident.”

Mainstreet Bank is giving customers who would like to take extra precautions the option to receive a new card.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential