679541931727359450

Published

2 months agoon

By

admin

You may like

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

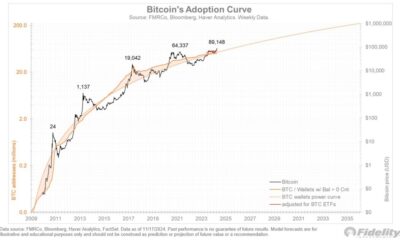

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Altcoins

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Published

2 hours agoon

November 26, 2024By

admin

A closely followed trader in the crypto space says there may be opportunities for select altcoins once Bitcoin (BTC) stabilizes.

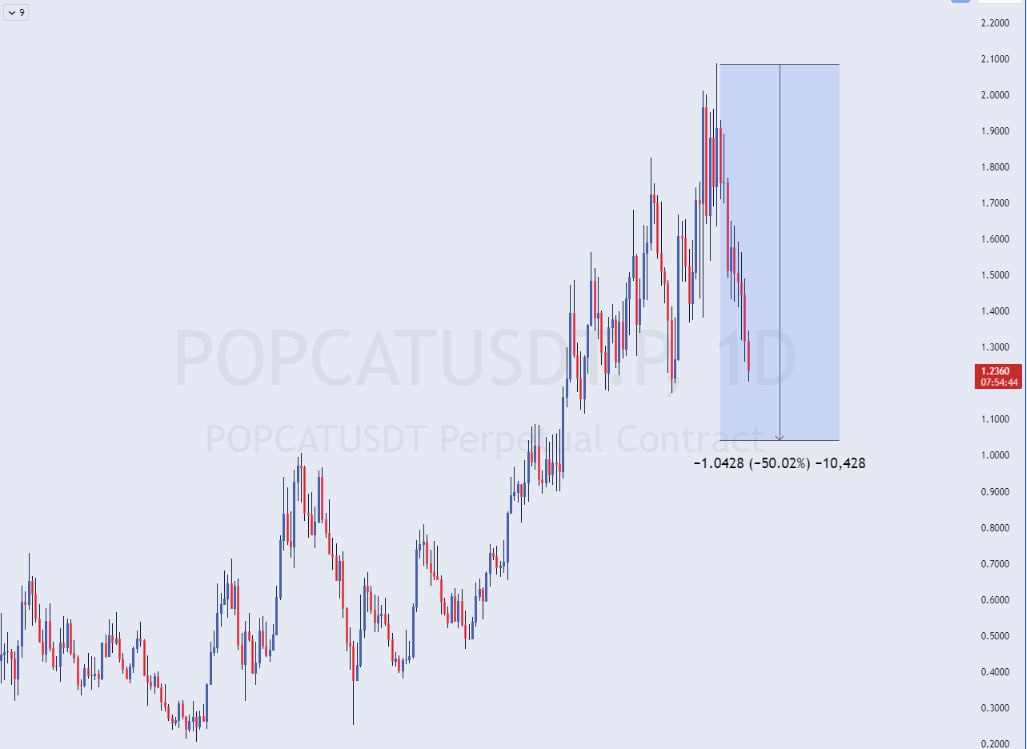

Pseudonymous analyst The Flow Horse tells his Telegram subscribers that the more liquid altcoins within the top 100 could present good entry points for bulls after their 50% dips.

The trader names cat-themed memecoin POPCAT as an example.

“Gentle reminder that alts probably can go a bit lower if Bitcoin does but after this type of mark up the 50% retracement level on liquid top 100 pairs is often a very good level to bid.

I would start creating filters and alerts for charts that are approaching their 50% retracement levels, Popcat is a good example.”

The Flow Horse also says that Celestia (TIA) and SEI are “good examples” of coins that are showing strength despite Bitcoin currently correcting and dragging much of the digital assets markets down with it.

The trader says it’s more than likely that BTC will consolidate under the $100,000 level, with some money flowing out of the risk curve into altcoins.

“Regardless of the near-term outcome, I think you can take one thing from BTC, no need to force anything here, BTC imo is more than likely going to take a little breather anyway before any real move above 100k.

Ideally, the market comes into agreement that we don’t have to worry about much lower prices, or that it doesn’t make sense to yet, and we can see some of the capital that does come out of Bitcoin go into alts.”

At time of writing, Bitcoin is trading at $94,201.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal/Vladimir Sazonov

Source link

Bitcoin Script

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Published

2 hours agoon

November 26, 2024By

admin

Everything built on top of Bitcoin that you are aware of today is because of the primitives that Bitcoin Script supports. What do I mean by primitives? The basic components of a programming language that you can use to build actual applications to do things. No programming language was ever designed specifically for a single application, i.e. to build one program. They are designed to support basic primitives, like mathematical operations to manipulate data, or creating basic data structures to store data in a certain way, or operations to iterate through data as you manipulate it.

Basic primitives are designed in such a way that developers can decide how to use them in order to create an actual application or program. The core design of the language doesn’t necessarily focus on what people will do with it, just that the primitives of the language can’t be combined in a way that will either 1) fail to accomplish what the developer is trying to accomplish without them understanding why, or 2) accomplish what the developer is trying to do in a way that is detrimental to the end user.

No one designs a programming language thinking from the outset “Oh, we want to enable developers to do A, B, and C, but completely prevent them from doing X, Y, and Z.” (For more technical readers here, what I’m referring to here is the goal of what the developer is building, not low level technical details like how primitives are combined).

Bitcoin Script is no different than other programming languages except in one respect, what it means for a certain combination of primitives to be detrimental to end users. Bitcoin has two properties that general computer applications don’t, the blockchain and what is executed on it must be fully verified by all users running a full node, and the entire progression of the system is secured by financial incentives that must remain in balance. Other than these extra considerations, Script is like any other programming language, it should include any primitives that allow developers to build useful things for users that cannot be combined in ways that are detrimental to users.

All of the conversations around softforks to add covenants (new primitives) have devolved, at least in the public square, to ridiculous demands of what they will be used for. That is both not a possible thing to do, and also not the important thing to focus on. What will be built with Script is tangential to the risks that need to be analyzed, how things built interact with the base layer is the major risk. What costs will it impose, and how can those be constrained? (This is a huge part of the Great Script Restoration proposal from Rusty). How can those costs on the base layer skew incentives? This is a big part of the risk of MEV.

These questions can be analyzed without focusing obsessively over every possible thing that can be built with a primitive. Primitives can be constrained at the base layer in terms of verification cost and complexity. Most importantly, in terms of incentives, what new primitives enable can be compared with things that are already possible to build today. If new primitives simply improve the trust model for end users of systems that can already be built that have an influence on the system incentives, without materially worsening the influence they have on those incentives, then there is no real new risk introduced.

These conversations need to start focusing on what really matters, new functionality versus end user harm. They have derailed almost completely, again in the public square, not technical circles, into arguments over whether end users should be allowed to do things or not. That is not the conversation that matters. What matters is providing valuable functionality to end users without creating detrimental consequences.

People need to focus on the primitives, and not the wild geese they hear in the distance.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Kraken

Kraken to close NFT marketplace by February 2025

Published

3 hours agoon

November 26, 2024By

admin

Kraken has announced the shutdown of its NFT marketplace to redirect resources toward new initiatives.

The marketplace will transition into withdrawal-only mode on November 27, 2024, and fully cease operations on February 27, 2025, according to an email from Kraken seen by crypto.news.

Kraken explained that the closure will allow the company to focus on undisclosed “new products and services.” Users are urged to withdraw their NFTs to self-custodial wallets or Kraken Wallets before the February deadline.

Kraken’s support team will assist users in the transition.

The downfall of NFTs

NFTs, or nonfungible tokens, are unique blockchain assets that verify ownership of digital or physical items. While they gained popularity during the crypto boom, the market has struggled to recover since the 2022 bear market.

Kraken’s NFT marketplace, launched in beta in November 2022, aimed to tap into the growing interest in NFTs at the time. However, market conditions and shifting priorities have led to the decision to wind down operations.

Source link

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

Ripple CLO Stuart Alderoty Challenges US SEC

Changpeng Zhao critiques meme coins, suggests projects should focus on utility

Expert Warns Of Upcoming 25% Drop, Timing And Trends Explained

Is Marathon Digital (MARA) a Better Bet Than MicroStrategy (MSTR) Stock Now?

Cardano eyes spot ETF entry as analyst foresees surge, Rollblock set to explode next

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential