21 Million

94% of Bitcoin's Supply Has Now Been Issued

Published

4 months agoon

By

admin

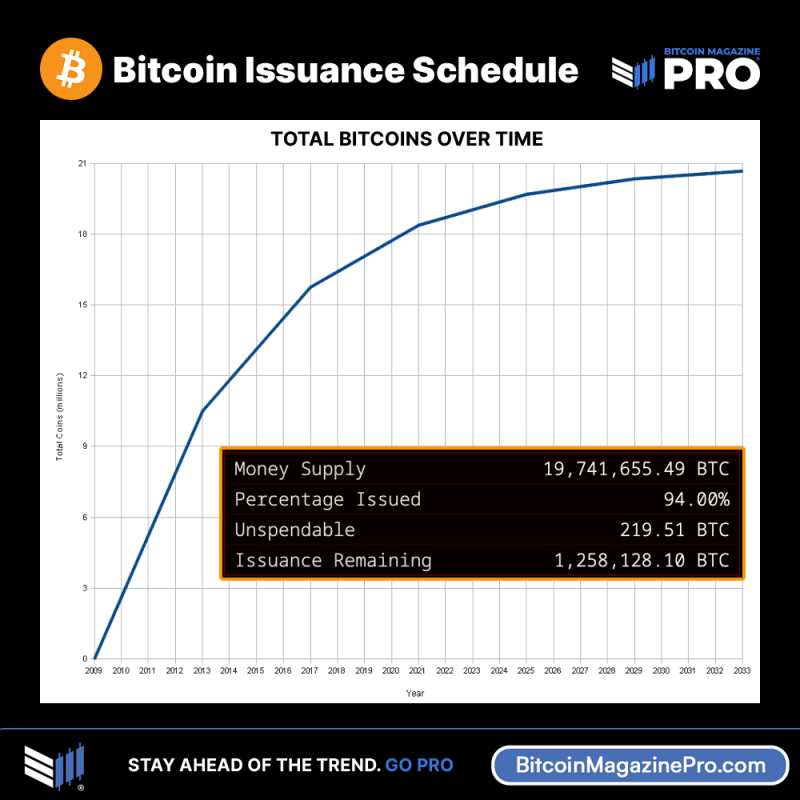

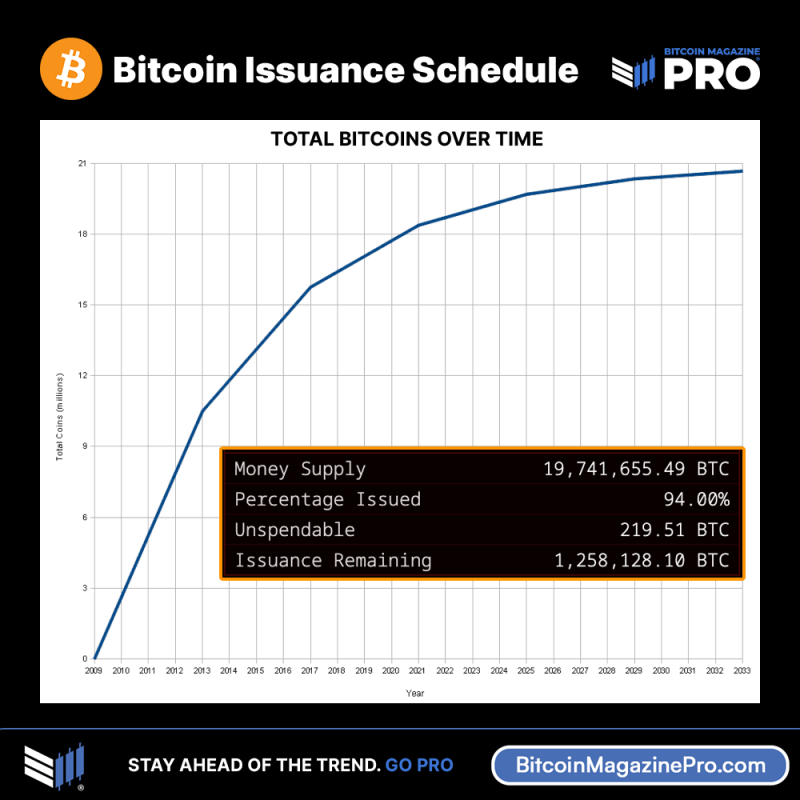

A milestone has been reached in Bitcoin’s supply schedule – 94% of the total Bitcoin supply has now been issued through mining. Out of a hard-capped total of 21 million BTC, over 19.74 million have been mined so far.

Bitcoin’s supply is issued through mining, where computers validate transactions and receive Bitcoin as a reward. The initial mining subsidy was 50 BTC per block, which halves every 210,000 blocks or roughly every 4 years.

This event called the Bitcoin halving, ensures a predictable, diminishing inflation rate as the supply grows. There have been three halvings, cutting the subsidy from 50 to 25 to 12.5 to the current 6.25 BTC.

The halvings combined with increasing difficulty and competition mean fewer and fewer new bitcoin enters circulation over time. Out of the maximum 21 million BTC, over 94% or 19,741,655 BTC have been mined since Bitcoin’s launch in 2009.

That leaves only around 1.26 million BTC to be issued. With the current 6.25 BTC block reward, the remaining supply will take over 100 more years to fully mint. Experts estimate 99.9% of all bitcoin will be mined by 2140, with miners mostly earning fees rather than subsidies by then.

This controlled supply schedule is a key aspect of Bitcoin’s value proposition. As the issuance slows and demand grows, Bitcoin is designed to become scarcer over time – an attractive attribute for investors facing unlimited fiat money printing and currency debasement.

Source link

You may like

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

Recently, BlackRock released an educational video explaining Bitcoin, which I thought was great—it’s amazing to see Bitcoin being discussed on such a massive platform. But, of course, Bitcoin X (Twitter) had a meltdown over one specific line in the video: “There is no guarantee that Bitcoin’s 21 million supply cap will not be changed.”

HealthRnager from Natural News claimed, “Bitcoin has become far too centralized, and now the wrong people largely control its algorithms. They are TELLING you in advance what they plan to do.”

Now, let me be clear: this is total nonsense. The controversy is overhyped, and the idea that BlackRock would—or even could—change bitcoin’s supply is laughable. The statement in their video is technically true, but it’s just a legal disclaimer. It doesn’t mean BlackRock is plotting to inflate bitcoin’s supply. And even if they were, they don’t have the power to pull it off.

Bitcoin’s 21 million cap is fundamental—it’s not up for debate. The entire Bitcoin ecosystem—miners, developers, and nodes—operates on this core principle. Without it, Bitcoin wouldn’t be Bitcoin. And while BlackRock is a financial giant and holds over 500,000 Bitcoin for its ETF, its influence over Bitcoin is practically nonexistent.

Bitcoin is a proof-of-work (PoW) system, not a proof-of-stake (PoS) system. It doesn’t matter how much bitcoin BlackRock owns; economic nodes hold the real power.

Let’s play devil’s advocate for a second. Say BlackRock tries to propose a protocol change to increase bitcoin’s supply. What happens? The vast network of nodes would simply reject it. Bitcoin’s history proves this. Remember Roger Ver and the Bitcoin Cash fork? He had significant influence and holdings, yet his version of bitcoin became irrelevant because the majority of economic actors didn’t follow him.

If Bitcoin could be controlled by a single entity like BlackRock, it would’ve failed a long time ago. The U.S. government, with its endless money printer, could easily acquire 10% of the supply if that’s all it took to control Bitcoin. But that’s not how Bitcoin works. Its decentralized nature ensures no single entity—no matter how powerful—can dictate its terms.

So, stop worrying about BlackRock “changing” Bitcoin. Their influence has hard limits. Even if they tried to push developers to change the protocol, nodes would reject it. Bitcoin’s decentralization is its greatest strength, and no one—not BlackRock, not Michael Saylor—can change that.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

Filecoin, Monero, and Lunex dominate smart investor portfolios

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

How Low Will Ethereum Price Go By The End of December?

Analyst says buying this altcoin at $0.15 could be as profitable as buying ETH at $0.66

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential