Bitcoin

Render tops hottest small/mid-cap cryptos of 2024: report

Published

4 months agoon

By

admin

A CoinLedger report examined the top five most-bought small/mid-cap cryptocurrencies and the most sold digital assets this year.

2024 has ushered hundreds of billions of dollars into the cryptocurrency markets. Data shows that the digital asset industry has grown over 44% year-to-date (YTD) and has the potential to surpass the $3 trillion peak set in 2021.

A booming crypto market also means eager investors and traders hunting for profits in a fast-paced market. Big names like Bitcoin (BTC) and Ethereum (ETH) are ever the talk of the town, especially with Wall Street wading in under the ETF wrapper.

However, assets with small to mid-market caps have also garnered interest and claimed investor capital.

Based on data from over 500,000 crypto investors, CoinLedger researchers found that Render (RNDR), Fetch.ai (FET), Internet Computer (ICP), Injective (INJ), and Hedera (HBAR) are the top five most bought cryptocurrencies so far this year.

Render and Fetch.ai have surged 48% and 113% YTD, respectively. The tokens have likely piggybacked off interest around GPU giant Nvidia and artificial intelligence as investors look for web3 alternatives to traditional stakeholders. As of this writing, RNDR had a $2.5 billion market cap, while FET had a $3.6 billion valuation.

Most sold cryptocurrencies of 2024

Conversely, large-cap digital assets have seen incredible selling volume despite noticeable growth with these tokens. Bitcoin, Ethereum, Solana (SOL), Cardano (ADA), and Ripple (XRP) were named the five most sold virtual currencies in 2024.

“Unsurprisingly, this list comprises some of the biggest cryptocurrencies by market cap. The rally in the cryptocurrency market in early 2024 likely led many investors to take profits and sell some of their major holdings,” said CoinLedger researchers.

Specifically, Bitcoin achieved a new all-time high in March, and Ethereum has come close to previous highs. It’s not unusual for investors to book profits in these cases. For Solana, the SOL ecosystem has become the defacto memecoin chain and has seen billions in meme token traders. It’s possible that memecoin traders and meme swaps account for most of the SOL selloff.

Source link

You may like

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

$100

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Published

4 hours agoon

November 22, 2024By

admin

What an enormous day it has been today.

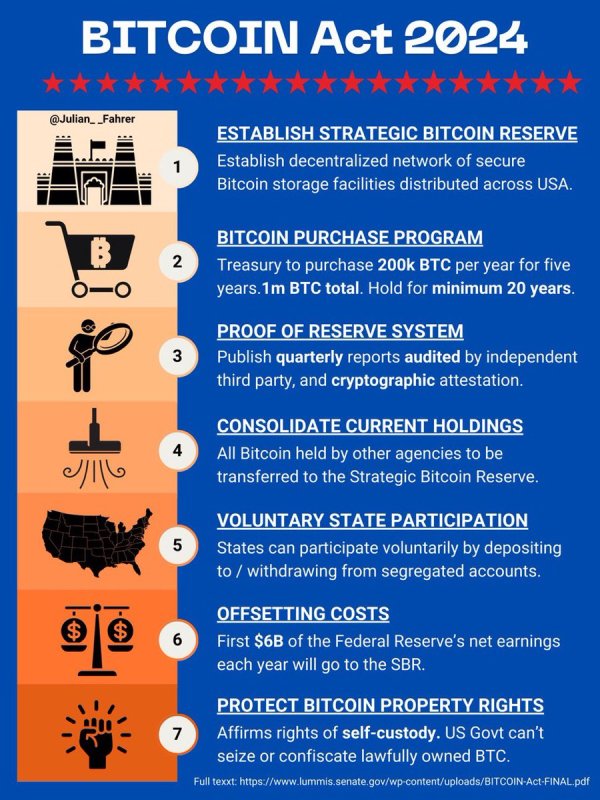

Gary Gensler officially announced that he is stepping down from his position as Chairman of the Securities and Exchange Commission (SEC), and minutes later, Reuters reported that Donald Trump’s “crypto council” is expected to “establish Trump’s promised bitcoin reserve.” A bitcoin reserve, that would see the United States purchase 200,000 bitcoin per year, for five years until it has bought 1,000,000 bitcoin.

Right after both of those, Bitcoin continued its upward momentum and broke $99,000, with $100,000 feeling like it can happen at any second now.

It is hard to contain my bullishness thinking about the United States purchasing 200,000 BTC per year. They essentially have to compete with everyone else in the world who is also accumulating bitcoin and attempting to front run them. There are only 21 million bitcoin and that is a LOT of demand.

To put this into context, so far this year the US spot bitcoin ETFs have accumulated a combined total of over 1 million BTC. At the time of launch the price was ~$44,000 and now bitcoin is practically at $100,000. And that’s all ETFs combined. Imagine what will happen when just one entity wants to buy a total of 1 million coins, having to compete with everyone else accumulating large amounts as well?

I mean MicroStrategy literally just completed another $3 BILLION raise to buy more bitcoin, and will continue raising until it purchases $42 billion more in bitcoin. The United States are most likely going to be purchasing their coins (if this legislation is officially signed into law) at very high prices. The demand is insane and only rising in the foreseeable future.

With two months left to go until Trump officially takes office, it remains to be seen if this bill becomes law, but at the moment things are looking really good. As Senator Cynthia Lummis stated, “This is our Louisiana Purchase moment!” and would be an absolutely historic moment for Bitcoin, Bitcoiners, and the future financial dominance of the United States of America.

This is the solution.

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

Published

12 hours agoon

November 21, 2024By

admin

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

24/7 Cryptocurrency News

Bitcoin Miner MARA Holdings Raises $1B To Buy More Bitcoin

Published

14 hours agoon

November 21, 2024By

admin

Bitcoin Miner MARA Holdings has raised approximately $1 billion through the sale of its convertible notes. The Bitcoin miner revealed that some of the proceeds from this sale would be used to buy more BTC, although they didn’t mention the exact amount.

Marathon Digital Raises $1B To Buy More Bitcoin

In a press release, the Bitcoin miner revealed that it had raised net proceeds of $980 million from its convertible notes sale after deducting the initial purchaser’s discounts and commissions but before the estimated offering expenses payable by the company.

This development is significant as MARA Holdings revealed that it will use some of the net proceeds to acquire additional BTC. It is worth mentioning that the Bitcoin miner already holds around 27,000 BTC and is the public company with the second-largest Bitcoin holdings.

This development comes as MARA also recently unveiled plans to raise $700m through convertible notes, which will mature in 2030. Meanwhile, the Bitcoin miner looks to be going head-to-head with MicroStrategy, which also recently upsized its private offering to $2.6 billion. The software company will use some of the proceeds to buy more BTC.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

Bitcoin Miner MARA Holdings Raises $1B To Buy More Bitcoin

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: