Bitcoin

What to expect from Bitcoin 2024

Published

4 months agoon

By

admin

The man who could be re-elected as president in November will be on stage at Bitcoin 2024, in a landmark moment for the world’s biggest cryptocurrency.

The Bitcoin 2024 conference is just around the corner, with thousands of devotees set to descend on Nashville to talk all things crypto.

There’s several things that look set to be different this year. For one, the event’s taking a break from Miami for a while, where the industry’s best and brightest had gathered in a cavernous convention center.

Sentiment surrounding BTC will also be much more upbeat. The world’s biggest cryptocurrency was trading at $26,832.21 on the first day of Bitcoin 2023 in May last year. It’s since accelerated by more than 140%.

The make-up of attendees has changed dramatically in recent years as adoption grows — moving away from a small number of nerds to a rich and diverse range of investors, entrepreneurs, developers and influencers.

January’s approval of exchange-traded funds based on Bitcoin’s spot price has had a seismic impact when it comes to institutional investors, meaning we could see a greater presence from Wall Street between July 25 and 27.

But the most headline-grabbing announcement of all is that Donald Trump, the Republican Party’s newly minted presidential nominee, will be taking to the stage in Tennessee — despite recently being the subject of an assassination attempt.

It’s hard to emphasize how much of a significant development this is for Bitcoin, and a reflection of how far this feisty, decentralized cryptocurrency has come in recent years.

Why? Because it cements how BTC has become an issue of national importance for voters — and part of the political discourse. Just a few years ago, it seemed fanciful that a U.S. presidential frontrunner would ever carve time out of a campaign schedule to attend.

It’ll be interesting to see whether Trump offers any insights into his legislative priorities for crypto — hints about what Bitcoiners could expect if he makes it back into the Oval Office. Any tangible announcements would have the potential to move markets in real-time.

That being said, it’s just as likely he’ll wheel out his usual criticisms of President Joe Biden, not to mention Gary Gensler’s record as chair of the Securities and Exchange Commission, and end up taking his speech wildly off topic by talking about something that has nothing to do with Bitcoin.

Reports have also suggested that the conference will double up as a fundraising drive — with Bitcoin Magazine CEO David Bailey hoping to raise $15 million in contributions to Trump’s campaign.

Speakers at the Bitcoin 2024 Conference in Nashville 🇺🇸

– Donald Trump

– Robert F. Kennedy Jr.

– Cathie Wood

– Michael Saylor

– Edward Snowden

– Vivek RamaswamyBULLISH! pic.twitter.com/ox1UBJQKsZ

— Bitcoin Magazine (@BitcoinMagazine) July 16, 2024

Trump isn’t going to be the only politician on stage either, far from it. Tennessee Senator Bill Hagerty is appearing on a panel exploring the policy outlook for Bitcoin in 2025, which could offer clues on how Congress plans to tackle legislation after the election. His colleague Marsha Blackburn will also be sharing a stage with one-time Republican presidential candidate Vivek Ramaswamy.

Beyond that, it’ll be a roll call of the usual faces that appear year after year. MicroStrategy’s executive chairman Michael Saylor is set to give a 30-minute keynote, fresh from his company snapping up 1% of the Bitcoin that will ever exist to hold in reserve. Cathie Wood’s another firm favorite of the crowd, as is Custodia Bank’s Caitlin Long.

As ever, there are also a few attendees that are bound to cause controversy. One of them is the British comedian Russell Brand, who has faced multiple accusations of sexual assault and inappropriate behavior from several women. He’s faced an investigation from police and has been questioned by detectives.

The fallout from reports of his conduct in the British press has been severe. Brand was dropped by his agent, who said they had been “horribly misled” by the fallen star. A nationwide comedy tour was canceled, while his YouTube stopped his page from receiving advertising income.

He’s now moved away to a lesser-known video-sharing site called Rumble, with his politics lurching even further to the right. Brand even made an appearance at the Republican National Convention in Milwaukee. While some Bitcoiners will welcome his appearance with open arms and rail against what they call “cancel culture,” you’ve got to wonder about the message this sends to women — many of whom will be in attendance.

Beyond the usual chin-scratching conversations about mining, banking, and regulation, there will probably be another glaring omission at Bitcoin 2024: the lack of a huge rabbit-out-of-the-hat announcement as seen when Nayib Bukele declared that El Salvador was embracing BTC as legal tender back in 2021.

Despite all of that, this is shaping up to be a news-making conference. Who knows, we could even see some TV networks take Trump’s speech live, potentially introducing Bitcoin to countless Americans in the process.

Source link

You may like

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Analyst

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Published

8 hours agoon

November 23, 2024By

admin

A crypto analyst who accurately forecasted the Bitcoin price increase to the $99,000 All-Time High (ATH) has just released a more detailed analysis of his prediction. The analyst shared a chart highlighting crucial technical indicators and price movements that suggest the cryptocurrency could be gearing up for an even higher ATH.

Analyst Projects $105,000 As The Next Price Target

Weslad, a TradingView analyst, has raised his Bitcoin price forecast, predicting the next upside target at $105,764 as the crypto market bull run gains momentum. The analyst reported that BTC has officially entered the bull market phase, characterized by explosive price increases and positive market sentiment.

Related Reading

His recent bullish prediction of the Bitcoin price is grounded on a key technical pattern known as the “Ascending Channel,” which indicates a bullish trend continuation. This chart pattern consists of two upward-sloping trend lines drawn parallel to each other, representing the resistance and support price levels, respectively.

Despite his optimistic outlook for the BTC price, Weslad has revealed that investors should anticipate a corrective move toward the immediate buy-back zone, which would provide an optimal entry point for opportunistic buyers. The analyst has also shared a detailed price chart that highlights the bullish ascending channel and key price levels that Bitcoin could reach in the short-term and long-term.

Overview Of The Analyst’s Bitcoin Price Chart Analysis

In his 4-hour Bitcoin chart, Weslad visualizes the cryptocurrency’s price action within an ascending channel, highlighting that the BTC is moving upwards within two trendlines. The analyst has provided a detailed roadmap for his $105,764 bullish target for the Bitcoin price.

Weslad highlighted the price range between $91,000 and $92,000 as an “important demand zone,” which acts as strong support where buyers are likely to step in if BTC slips any further. He also revealed that the price level at $94,327.99 has been identified as an ”immediate buy-back zone,” which also serves as an optimal entry point if BTC experiences any corrective pullback in its price.

Related Reading

The analyst has also highlighted $97,537 as the “immediate profit target,” suggesting that traders may consider locking in profits at this critical short-term price level. He has also pinpointed the “mid-term target” for the Bitcoin price, highlighting that the $100,334 mid-term level is important for investors holding longer positions.

Lastly, Weslad has highlighted $105,764 as the “projected final target” for Bitcoin, indicating that this may be the ultimate target for the present market cycle. For BTC to reach this bullish price target, it would require only a modest 6.83% increase from its current value. As of writing, the price of Bitcoin is trading at $99,072, marking a 12.73% increase over the past seven days, according to CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Bitcoin

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

Published

11 hours agoon

November 23, 2024By

admin

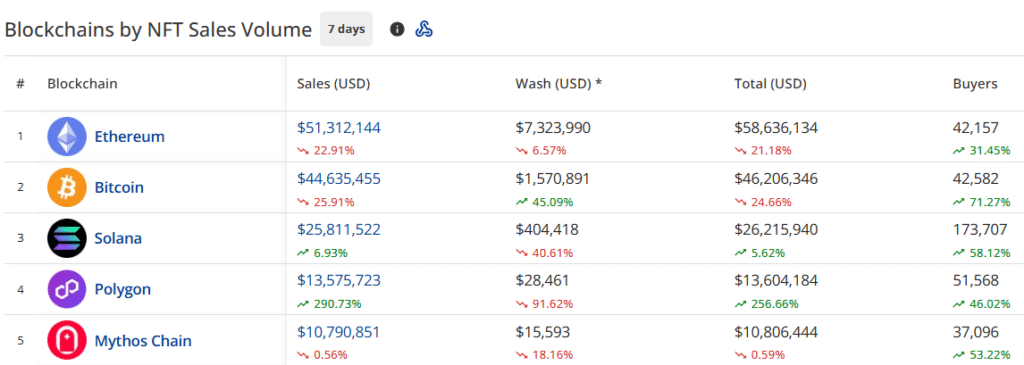

As Bitcoin surges toward the $100,000 mark, touching a new all-time high of $99,655.50, the non-fungible token (NFT) sales volume has shown a drop of 9.6% to $160.9 million.

The global cryptocurrency market capitalization has continued to surge, reaching $3.35 trillion from last week’s $3.03 trillion. This marks a 2% increase over the last day, with Bitcoin (BTC) currently trading at $98,620.

The last week’s NFT sales volume stood at $178.8 million. However, according to recent data from CryptoSlam, the NFT market has seen a pullback.

- NFT sales volume decreased to $160.9 million

- Ethereum (ETH) blockchain leads with $51.3 million in sales (23.07% decrease)

- Bitcoin follows with $44.6 million (25.67% decrease)

- NFT buyers surged by 52.93% to 450,512

- NFT sellers increased by 46.74% to 277,767

- NFT transactions slightly decreased by 1.26% to 1,606,261

Ethereum NFT sales decline by 23.07%

The Ethereum NFT blockchain sales volume fell to $51.3 million this week, marking a 23.07% decrease in the last seven days.

The number of NFT buyers on the Ethereum blockchain grew to 42,157, showing a 31.45% increase.

Bitcoin maintained its second position despite a 25.67% decrease in the last seven days.

According to the data, Bitcoin blockchain’s NFT volume stood at $44.63 million, with wash trading increasing by 46.05% to $1.57 million.

Solana (SOL) secured the third position with $25.8 million, showing resilience with a 6.83% increase during the last seven days.

Polygon (POL) jumped to fourth place with $13.5 million, displaying remarkable growth of 289.66% during the last seven days.

Mythos Chain (MYTH) took the fifth position with $10.7 million in sales, showing a marginal decline of 0.71%.

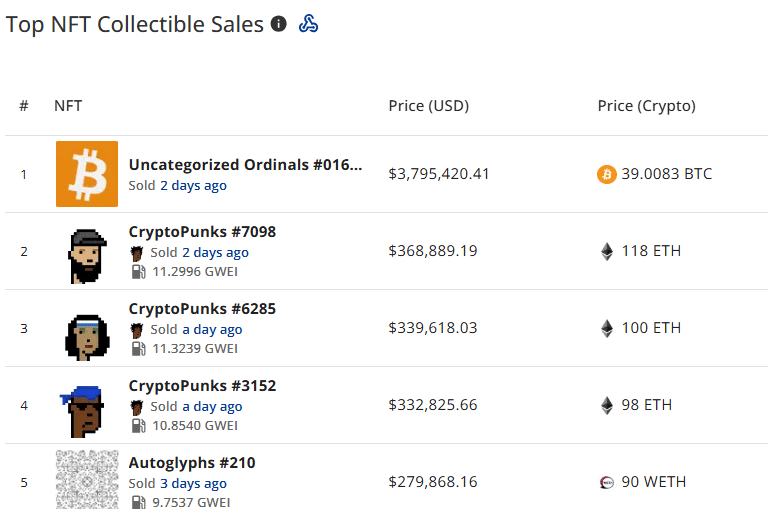

BRC-20 NFTs maintain market leadership

BRC-20 NFTs continue to lead with $16.6 million in sales volume, despite a 41.39% decrease.

MGGA Hat on Polygon secured second place with $10 million in sales, while CryptoPunks followed with $9.2 million, showing a 60.26% decrease.

The latest data shows that the following NFT collections topped the sales in the last week:

- Uncategorized Ordinals #016 sold for $3,795,420 (39.0083 BTC)

- CryptoPunks #7098 sold for $368,889 (118 ETH)

- CryptoPunks #6285 sold for $339,618 (100 ETH)

- CryptoPunks #3152 sold for $332,825 (98 ETH)

- Autoglyphs #210 sold for $279,868 (90 WETH)

Source link

Bitcoin

Trader Says Top-10 Altcoin To Vastly Outperform Bitcoin and Ethereum, Hit New Record High Quicker Than Expected

Published

13 hours agoon

November 23, 2024By

admin

A widely followed cryptocurrency analyst and trader is turning bullish on a large-cap altcoin that has more than doubled in price over the past two weeks.

The analyst pseudonymously known as Credible Crypto tells his 436,700 followers on the social media platform X that XRP is primed to reach a new all-time high a “lot quicker than most are expecting.”

“And I think it’s going to vastly outperform both Bitcoin and Ethereum from current levels while doing it.”

XRP is trading at $1.41 at time of writing, up by around 156% over the past two weeks.

Credible Crypto further says that XRP is on the cusp of entering the overbought zone of the Relative Strength Index (RSI) indicator on the monthly time frame. The RSI indicator, which is calibrated from 0 to 100, is used to determine overbought or oversold conditions, with levels between 70 to 100 indicating overbought conditions and levels between 0 to 30 indicating oversold conditions.

“This is bullish as f**k.

Contrary to popular belief, the higher RSI goes, the stronger the momentum is and the more bullish a coin is (absent bearish divergences) and like every other form of technical analysis the higher the time frame this is on, the more significant it is.

Next target is $2 and after that, we go for a new all-time high.”

According to the pseudonymous analyst, XRP also appears highly bullish in its Ethereum (ETH) pair and could be poised for triple-digit percentage gains against the second-largest crypto asset.

“XRP/ETH just reclaimed and retested a four-year-long range, with the first target being ~250% higher.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Dogecoin, Shiba Inu set the trend; this altcoin is ready to take the spotlight next

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Analyst Who Accurately Predicted Solana Price Rally Shares Next Target

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

SHIB Lead Shytoshi Kusama Hints At TREAT Token Launch

Trader Says Top-10 Altcoin To Vastly Outperform Bitcoin and Ethereum, Hit New Record High Quicker Than Expected

5 tokens to consider buying today

Terra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential