Bitcoin

TON Foundation announces trustless Bitcoin bridge

Published

4 months agoon

By

admin

Telegram-based TON unveiled new infrastructure to tap into Bitcoin’s blockchain and expand BTC’s utility.

Dubbed TON Teleport BTC, The Open Network (TON) Foundation announced the feature bridges Bitcoin (BTC) and unlocks greater operability for decentralized applications built on the Telegram-focused chain.

Although decentralized, most blockchains weren’t initially designed to communicate with each other. This phenomenon alienated standalone networks and created a divide with assets.

Networks like Ethereum (ETH) attempted to mitigate this issue by developing what is called the Ethereum Virtual Machine (EVM). This environment allowed anyone to build ETH-compatible tools and connect with Ethereum’s mainnet.

Bridges are another solution to the problem, allowing users and participants to ferry digital assets from one blockchain to another. TON Teleport BTC, as the name suggests, builds on this idea to improve liquidity and introduce crypto’s largest token to TON’s ecosystem.

According to the TON Foundation, the organization managing The Open Network, the bridge enables users to deploy BTC on native on-chain exchanges, lending platforms, and other popular defi platforms.

Want to unlock new potential for your Bitcoin ₿ on #TON? 👀

🔈 Introducing TON Teleport BTC, aiming to enhance Bitcoin utility on TON!

Dive into this thread to learn more 🧵⬇️ pic.twitter.com/M9gmUElvaJ

— TON 💎 (@ton_blockchain) July 17, 2024

The Open Network has grown exponentially this year with the rise of Telegram mini-games like Notcoin (NOT) and Hamster Kombat. Its native token ranks ninth among all digital assets, with a market cap of over $18 billion. In addition to directly accessing over 900 million global Telegram users, the blockchain reportedly reached 470,000 active wallets on Tuesday.

Source link

You may like

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin

Bitcoin Crashes Under $93,000: What’s Behind It?

Published

2 hours agoon

November 27, 2024By

admin

Bitcoin has observed a plunge under the $93,000 level during the past day. Here’s what the trend in an indicator suggests about what could be behind this downturn.

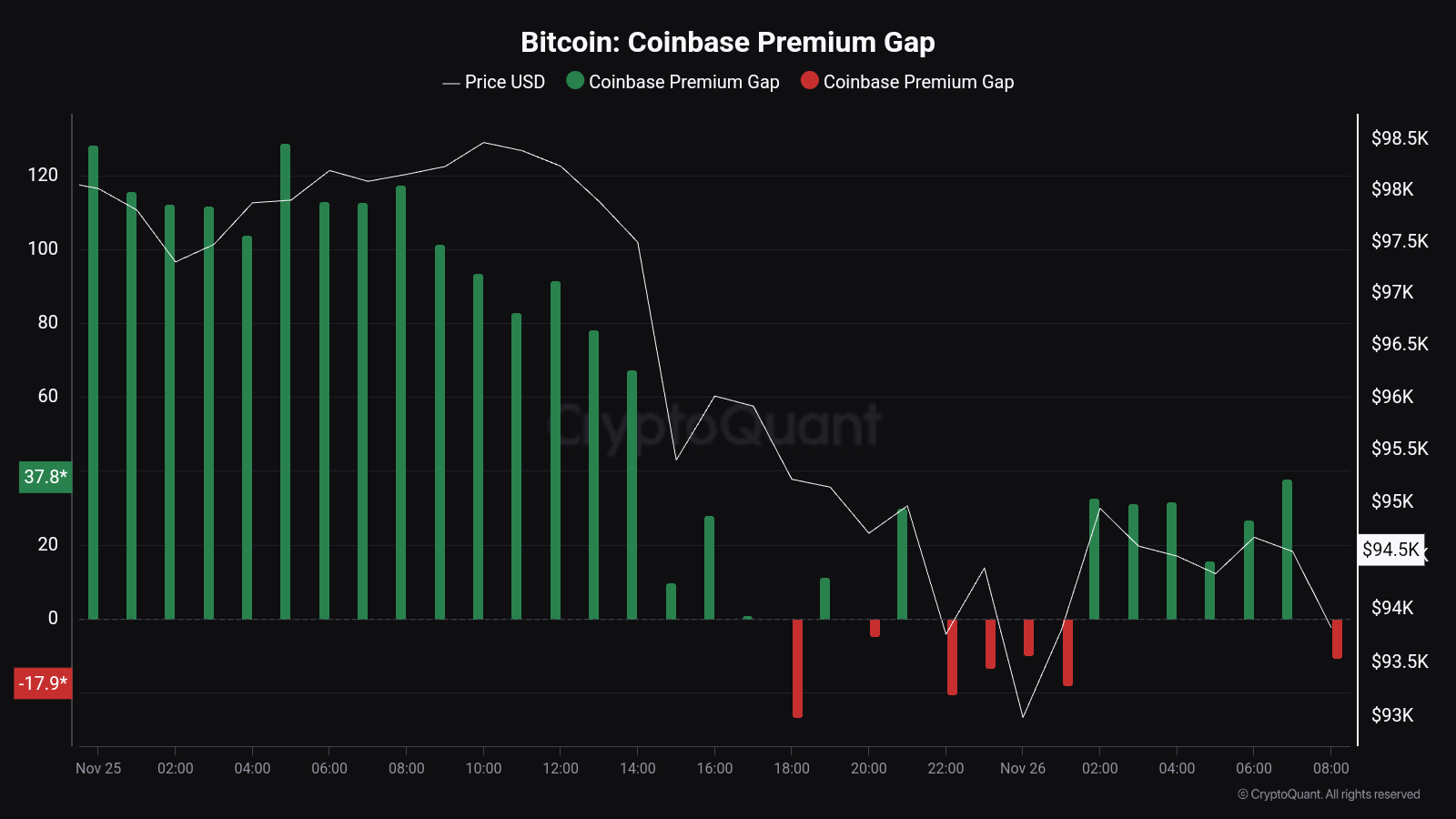

Bitcoin Coinbase Premium Gap Has Gone Cold

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the Coinbase Premium Gap has returned to neutral levels recently. The “Coinbase Premium Gap” here refers to an indicator that keeps track of the difference between the Bitcoin price listed on Coinbase (USD pair) and that on Binance (USDT pair).

This metric essentially tells us about how the buying or selling behaviours differ between the user bases of the two cryptocurrency exchanges. Coinbase’s main traffic is made up of American investors, especially large institutional entities, while Binance serves investors around the world.

When the Coinbase Premium Gap has a positive value, it means the US-based whales are participating in a higher amount of buying or a lower amount of selling than the Binance users, which is why the asset is more expensive on Coinbase. Similarly, it being negative implies a net higher buying pressure on Binance.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past couple of days:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap had been at notable positive levels earlier, but during the past day, its value has declined to the neutral zero mark.

According to Maartunn, the source of the positive premium was Microstrategy’s latest buying spree. Indeed, the cooldown in the indicator matches up with the timing of the completion of the $5.4 billion purchase by Michael Saylor’s firm. The significant accumulation from the company had helped the cryptocurrency maintain its recent highs, but with the buying pressure depleted, Bitcoin has retraced to price levels under $93,000.

BTC and the Coinbase Premium Gap have held a close relationship throughout 2024, so the metric could be to keep an eye on in the near future, as where it goes next may once again foreshadow the asset’s next destination. Naturally, a decline into the negative region could spell further bearish action for its price.

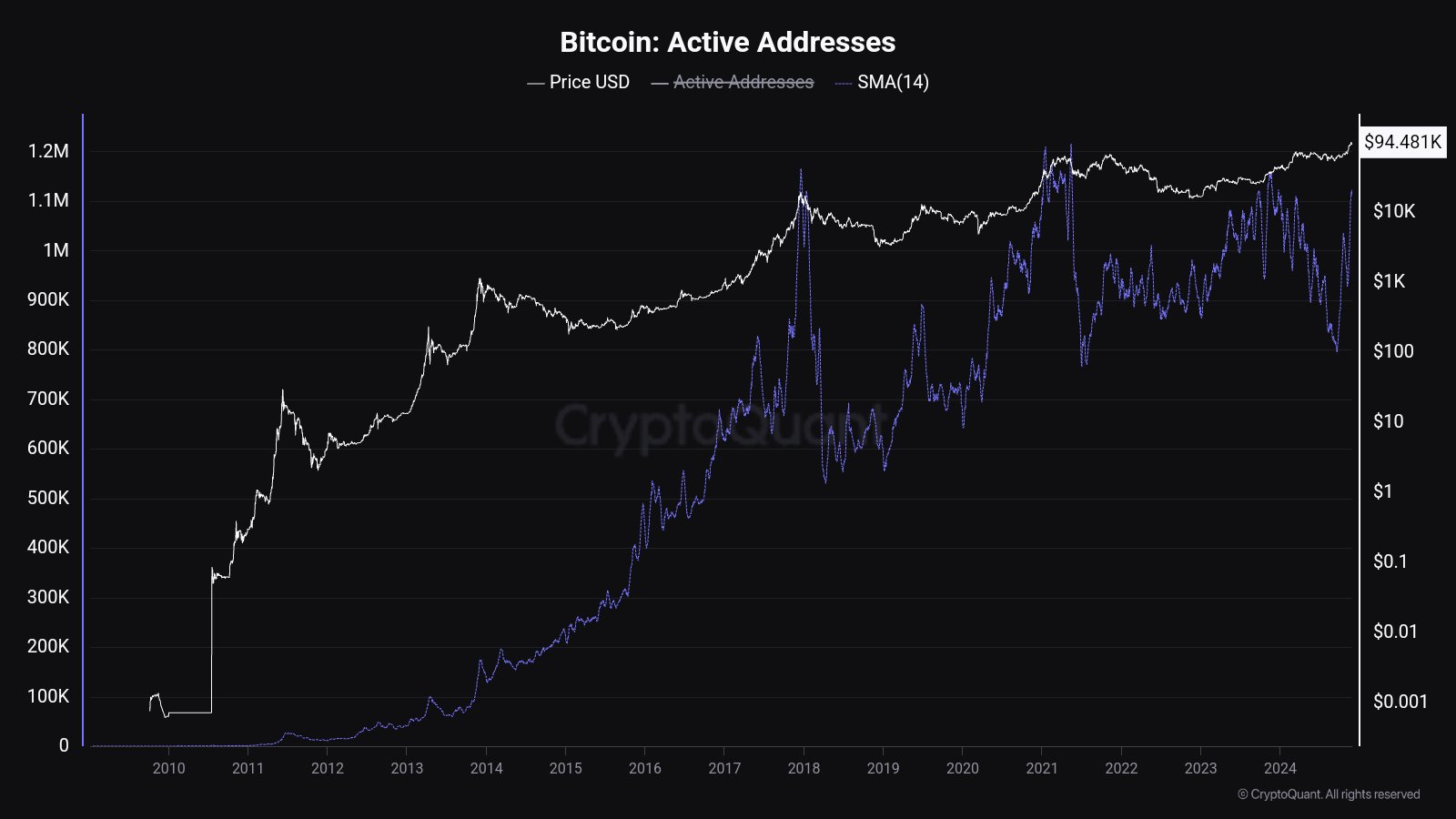

In some other news, the Bitcoin Active Addresses indicator has observed a sharp jump recently, as Maartunn has shared in another X post. This metric keeps track of the daily number of addresses that are participating in some kind of transaction activity on the network.

Below is the chart shared by the CryptoQuant analyst for the 14-day simple moving average (SMA) of the Active Addresses:

With this latest surge, the 14-day SMA of the Bitcoin Active Addresses has reached its highest point in eleven months. This suggests that a lot of activity has recently occurred on the network. Given that the asset has gone down in the past day, though, the most recent user interest has certainly not come for buying.

BTC Price

At the time of writing, Bitcoin is floating around $92,400, down almost 6% over the last 24 hours.

Source link

Bitcoin

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

Published

15 hours agoon

November 26, 2024By

admin

Bitcoin (BTC) has dropped 7.6% since it almost — but not quite — touched the psychological wall of $100,000 on Nov. 22.

That’s the biggest drop since Donald Trump won the U.S. presidential election, sparking a rally that sent the largest cryptocurrency by market capitalization soaring from a level of around $66,000 through its record high.

Even so, the slide isn’t out of the ordinary. In bull markets bitcoin typically tumbles as much as 20% or even 30%, so-called corrections that tend to flush out leverage in an overheated market.

A large part of the reason the bitcoin price didn’t get to $100,000 was the amount of profit-taking that took place. A record dollar value of $10.5 billion of profit-taking took place on Nov. 21, according to Glassnode data, the biggest day of profit-taking ever witnessed in bitcoin.

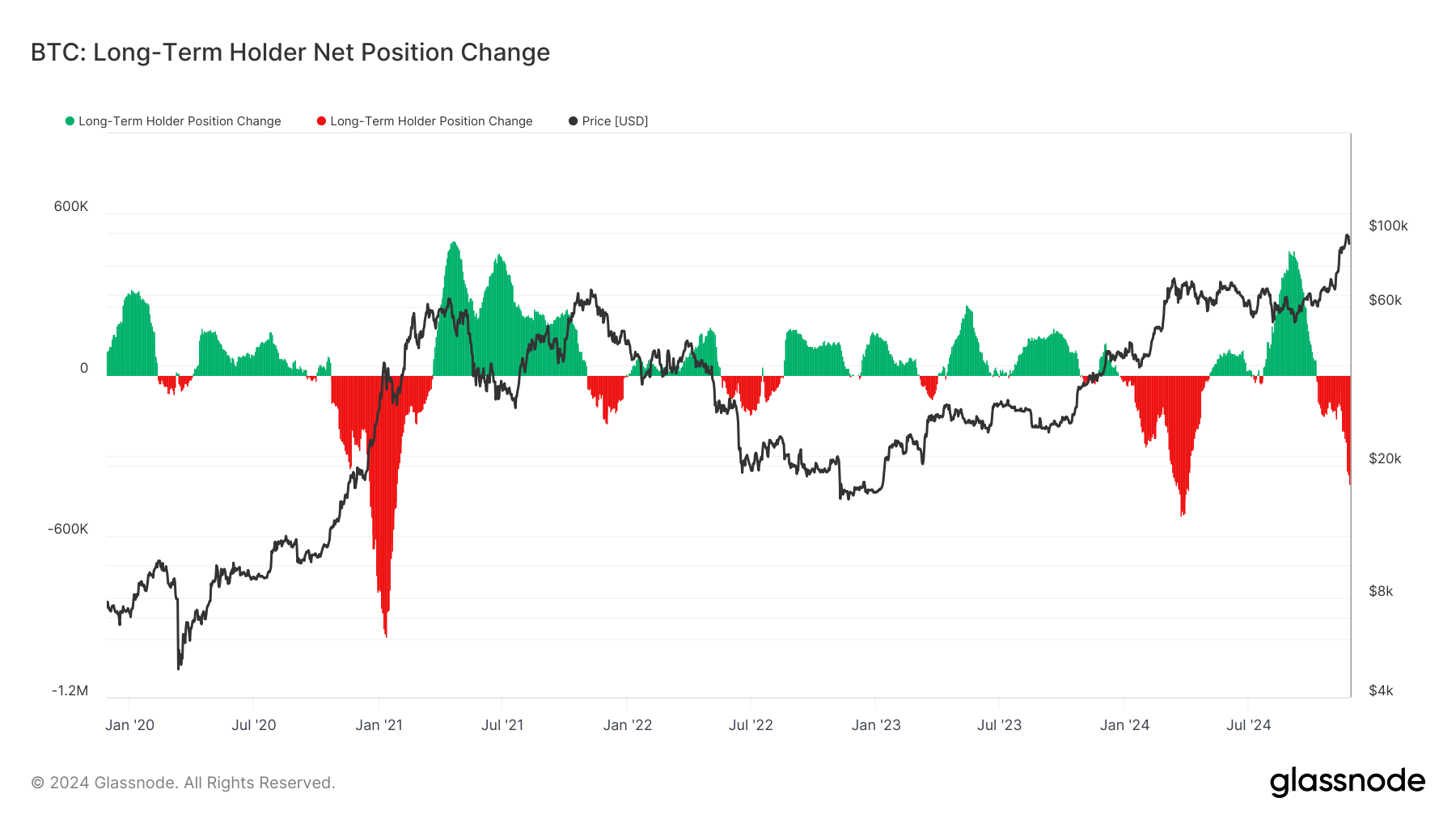

At the root of the action are the long-term holders (LTH), a group Glassnode defines as having held their bitcoin for more than 155 days. These investors are considered “smart money” because they tend to buy when the BTC price is depressed and sell in times of greed or euphoria.

From September to November 2024, these investors have sold 549,119 BTC, or about 3.85% of their holdings. Their sales, which started in October and have accelerated since, even outweighed buying from the likes of MicroStrategy (MSTR) and the U.S. spot-listed exchange-traded funds (ETFs).

How long is this selling pressure going to last?

What’s noticeable from patterns in previous bull markets in 2017, 2021 and early 2024, is that the percentage drop gets smaller each cycle.

In 2017, the percentage drop was 25.3%, in 2021 it reached 13.4% and earlier this year it was 6.51%. It’s currently 3.85%. If this rate of decline were to continue, that would see another 1.19% drop or 163,031 BTC, which would take the cohort’s supply to 13.54 million BTC.

Each time, the long-term investors’ supply makes higher lows and higher highs, so this would also be in line with the trend.

Source link

Bitcoin

Changpeng Zhao critiques meme coins, suggests projects should focus on utility

Published

18 hours agoon

November 26, 2024By

admin

Former Binance CEO Changpeng ‘Cz’ Zhao has criticized the growing trend of meme coins, suggesting that blockchain developers should focus on utility-driven projects.

In a Nov. 26 X post, Zhao wrote that meme coins are becoming “a little weird” and urged developers to focus on creating “real applications” that provide practical utility rather than prioritizing hype-driven projects.

CZ’s comments have reignited the debate around the meme coin hype, drawing attention to their lack of real-world value.

Meme coins largely rely on viral marketing and social media frenzy to generate short-lived investor interest. While they can deliver quick profits for some, they typically lack utility or tangible applications, leaving most holders with significant losses once the initial excitement fades.

CZ’s statement comes amidst the controversy around Solana-based meme coin deployer Pump.fun, where a livestream feature intended to boost engagement was exploited in disturbing ways, including threats of self-harm and inappropriate content.

One particularly troubling incident involved a user threatening to hang themselves if their token failed to reach a predetermined market cap. The situation escalated further when the individual later shared a video allegedly showing them acting on the threat.

Concerns over meme coins extend beyond their misuse on specific platforms. A CoinWire study reported that meme coins promoted through social media, particularly on X, tend to lose 90% or more of their value within three months.

Such trends undermine trust in the broader cryptocurrency industry, diverting attention from projects with genuine utility and innovation and fuelling skepticism among potential adopters and regulators about the sector’s long-term viability.

Other prominent figures in the industry have also criticized meme coins for their lack of utility and meaningful contribution to the crypto ecosystem. Ripple CEO Brad Garlinghouse has argued that tokens like Dogecoin fail to offer meaningful real-world applications.

Similarly, Ethereum co-founder Vitalik Buterin criticized the trend of celebrity-endorsed meme coins earlier this year.

In a June X post, Buterin stressed that financialization is only justified if it brings value to society and cited sectors such as healthcare and open-source software as examples of areas where blockchain can provide societal benefits.

Utility-driven blockchain initiatives form the foundation of the industry’s long-term viability.

Projects such as Axie Infinity, which enables players to earn income through gameplay, and AI-focused tokens like Fetch.ai, which powers autonomous machine-to-machine interactions, exemplify how blockchain technology can address real-world problems and revolutionize traditional industries.

According to CoinGecko data, the total market capitalization of meme coins has reached $120.27 billion, exceeding that of sectors like GameFi ($24.1 billion) and AI-focused tokens ($39 billion).

Source link

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential