Markets

BlockFi Repayments to Its 100,000 Creditors Will Begin This Month

Published

4 months agoon

By

admin

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

Bankrupt crypto lender BlockFi will begin interim crypto distributions to creditors through Coinbase starting this month, the company wrote on Twitter and in a blog post.

“The distributions will be processed in batches in the coming months, and eligible clients will receive a notification to the BlockFi account email on file,” the company wrote on Wednesday. “Please note that non-US Clients are unable to receive funds at this time due to the regulatory requirements applicable to them.”

The news marks a significant step in BlockFi’s long journey since filing for Chapter 11 bankruptcy protection in November 2022 amid the collapse of crypto exchange FTX.

Founded in 2017 by Zac Prince and Flori Marquez, BlockFi quickly rose to prominence by offering high-yield interest accounts and crypto-backed loans. The company secured significant funding, including a $350 million Series D in March 2021 that valued it at $3 billion.

However, trouble began brewing in July 2021 when several U.S. states issued cease-and-desist orders against BlockFi, claiming its interest accounts were unregistered securities. In February 2022, the crypto lender settled with the SEC for $100 million over its lending product.

The killing blow came in November 2022, when FTX collapsed. BlockFi had substantial exposure to FTX and its trading arm, Alameda Research, with over $1.2 billion in assets tied up between them. When FTX and Alameda went under, BlockFi followed, citing liquidity issues. The lender filed for Chapter 11 bankruptcy on November 28, 2022, listing over 100,000 creditors.

In the ensuing proceedings, BlockFi executives largely blamed their woes on FTX and Alameda. The lender’s restructuring plan, which paves the way for creditor repayments, received 90% approval from voting creditors.

BlockFi emerged from bankruptcy in October 2023, nearly a year after filing. As part of its bankruptcy exit plan, BlockFi is now preparing to return customer funds, with distributions expected to start in early 2024.

According to BlockFi’s recent announcement, the company has partnered with Coinbase to facilitate the distribution of funds to creditors. The defunct crypto lender will begin processing withdrawals for wallet customers first, followed by distributions for BlockFi Interest Account (BIA) and loan customers.

The company estimates that BIA holders will recover anywhere from 39.4% to 100% of their funds, depending on the outcome of the FTX bankruptcy proceedings and the value of BlockFi’s equity in Robinhood.

As of July 2024, BlockFi customers are still awaiting the interim distributions announced by the company. Wallet customers have been able to withdraw funds, but BIA and loan customers have not yet received any repayments. The exact timing and amounts of these distributions remain uncertain, as they are tied to the complex legal proceedings surrounding FTX’s bankruptcy.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

Bitcoin Miner MARA Holdings Raises $1B To Buy More Bitcoin

Sui Network blockchain down for more than two hours

Analyst Says Six-Figure Bitcoin Price Incoming – But Warns One Factor Could Delay BTC Rally Till Next Year

Markets

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

Published

33 seconds agoon

November 21, 2024By

admin

Peak Bitcoin, hardly.

https://x.com/pete_rizzo_/

As I wrote in Forbes in 2021, the world is waking up to a new reality in regards to Bitcoin – the unlikely truth that Bitcoin’s programming has cyclical effects on its economy.

This has led to at least 4 distinct market cycles where Bitcoin has been branded a bubble, skeptics have rung their hands, and each time, Bitcoin recovers more or less 4 years later to set new all-time highs above its previously “sky-high” valuation.

I personally watched Bitcoin go from $50 to $1,300 in 2013. Then, from $1,000 to $20,000 in 2017, and I watched it go from $20,000 to $70,000 in 2021.

So, I’m just here to relate that, from my past experience, this market cycle is just heating up.

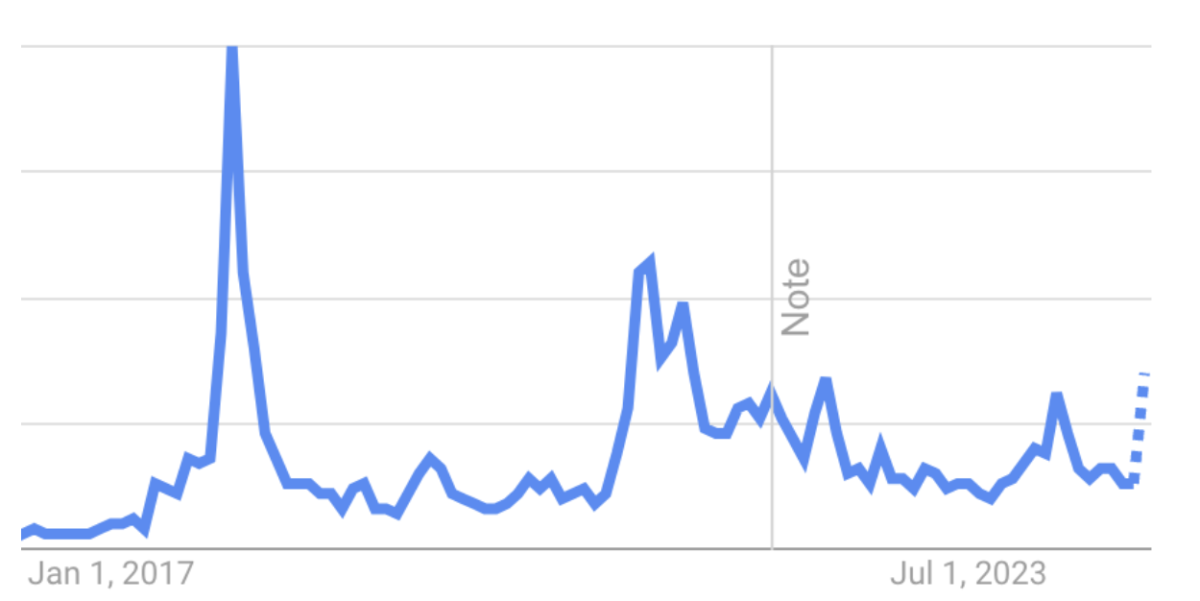

For those who have been in Bitcoin, there’s one tried-and-true and that’s Google Search. As long as I’ve been in Bitcoin, this has been the best indicator of the strength of the market.

Search is low, you’re probably in a bear market. Search heading back to all-time highs? This means new entrants are getting engaged, learning about Bitcoin, and becoming active buyers.

Remember, this is a habit change. Bitcoin HODLers are slowing shifting their assets to a wholly new economy. So, Google Trends search then, represents a snapshot of Bitcoin’s immigration. It shows how many new sovereign citizens are moving their money here.

And it’s something that all who are worried about whether bitcoin’s price topping out in 2024 should pay attention to.

Last year was the Bitcoin halving, and historically, the year following previous halvings has led to price appreciation. Maybe you’re tempted to think, “this time is different” – not me. I look at search and I see a chart that continues to accelerate into price discovery. Trust me when I say no one I know is selling bitcoin.

As shown above, buyer interest is accelerating, and these new buyers have to buy that Bitcoin from somewhere. Add nation states, US states, and a coming Trump administration set to ease the burden on the industry?

Well, I think the chart above says it all really.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Nears $96K, Continuing Wild ‘Trump Trade’ Rally

Published

12 hours agoon

November 21, 2024By

admin

BTC traded above $95,900 in early Asian hours, less than 6% from a landmark $100,000 figure that would push it above a $2 trillion market capitalization.

Source link

Bitcoin

Bitcoin Boosts MicroStrategy (MSTR) to Higher Trading Volume Than Tesla and Nvidia

Published

20 hours agoon

November 20, 2024By

admin

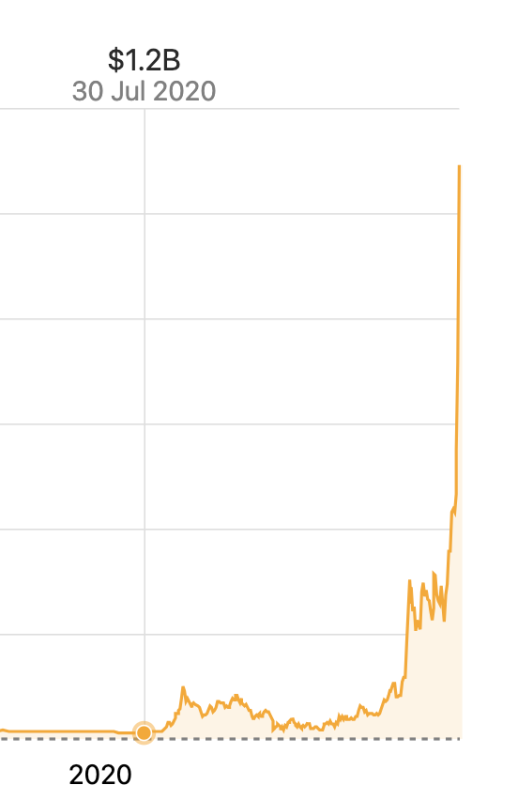

Today, MicroStrategy (MSTR) surpassed a $100 billion market cap to become the 93rd largest publicly-traded company in the U.S.

At the time of writing, MSTR has done more trading volume than both stock giants Tesla and Nvidia today, and has traditional stock traders like the Wall Street Bets community losing their minds.

Wow $MSTR is the most traded stock in America today.. to best $TSLA and $NVDA is crazy. It's been years since a stock has traded more than one of those two (it may have actually been $GME to last do it). It's also about double $SPY! Wild times.. pic.twitter.com/bUr8nycMX3

— Eric Balchunas (@EricBalchunas) November 20, 2024

This is absolutely mindblowing considering MicroStrategy was a mere $1 billion company when it first bought bitcoin for its treasury about four and a half years ago.

The big question I’m asking myself is, how and when does this end? Assuming MSTR continues to pump until the peak of this bull market, it’s anyone’s guess on how high MSTR may go.

But how hard will it crash in the bear market, considering it is essentially a leveraged trade on bitcoin? Dare I even suggest that this time may be different, and that the downside of the next bitcoin bear market won’t be as brutal as the 70%+ corrections we’re historically used to seeing?

Even with the spot bitcoin ETFs, and the notion that the US may lead the charge of nation states buying up mass amounts of bitcoin, I’m still not convinced that we don’t eventually see a massive downturn in bitcoin’s price. And I’m mentally preparing for a normal bitcoin bear market to commence after this bull market finishes sometime in the next year or so.

But back to MSTR — Michael Saylor has thus far proven that the Bitcoin for Corporations strategy works in stunning fashion. Public companies have been coming out of the woodwork this past week announcing that they’ve purchased bitcoin for their balance sheet or plan to do so, and it seems this trend will continue as the CEO of Rumble asked his X audience if he should add BTC to their balance sheet (almost 94% of his 42,522 voters voted “yes”).

Lets put this in a poll format…

Should Rumble add Bitcoin to its balance sheet?

— Chris Pavlovski (@chrispavlovski) November 19, 2024

Michael Saylor even offered to help explain how and why Rumble should adopt a corporate BTC strategy.

Institutional bitcoin adoption is here and it’s only going to grow for the foreseeable future. As companies figure out the logic behind adopting bitcoin as a strategic reserve asset, the number of publicly-traded companies that adopt this strategy is going to explode.

Companies that add bitcoin to their balance sheet will rise above most other companies — even top big tech giants — in terms of trading volume, as MicroStrategy has, until all companies add bitcoin to their balance sheet. I try to put myself in the shoes of a trader, with knowledge on Bitcoin and think to myself, “Why on earth would I buy any company’s stock if they don’t have bitcoin on their balance sheet?” I wouldn’t — it would be way too boring.

Putting BTC on the balance sheet helps create volatility, and therefore opportunity for stock traders, which is good for the traders, stock price, and company overall. If you are a publicly-traded company, it is a no brainer to adopt bitcoin as a treasury reserve asset.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

Bitcoin Miner MARA Holdings Raises $1B To Buy More Bitcoin

Sui Network blockchain down for more than two hours

Analyst Says Six-Figure Bitcoin Price Incoming – But Warns One Factor Could Delay BTC Rally Till Next Year

How Will BTC React to $3B Buying Spree?

ECB official calls for urgency on digital euro amid global CBDC race

The Story Behind a Crypto Trader Turning $378K into $35.2M

Justin Sun Goes Bananas: Snags Controversial “Comedian” Artwork for $6.4 Million

Get ready for new spot ETFs, hints President Nate Geraci

BTC Reaches $97K, Altcoins Gains

Bitcoin Nears $96K, Continuing Wild ‘Trump Trade’ Rally

Grayscale will begin trading Bitcoin ETF options

Elon Musk, Vivek Ramaswamy Outline Bold D.O.G.E US Workforce Plan: Details

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential