Bitcoin

Jamie Dimon from JPMorgan eyed by Trump for Treasury

Published

4 months agoon

By

admin

Will Trump’s potential choice of Jamie Dimon, a vocal critic of Bitcoin who said he’d close it down, mark the beginning of the end for cryptocurrency freedom in the U.S.?

Former U.S. President and current Republican nominee Donald Trump, a man known for his bold and often controversial decisions, recently dropped another bombshell.

In an interview with Bloomberg, conducted in late June and published on July 16, Trump revealed that he is considering JPMorgan CEO Jamie Dimon for a key position in his cabinet if he wins the upcoming election. The role in question? Secretary of the Treasury.

Now, here’s where it gets interesting. Jamie Dimon, a name synonymous with JPMorgan Chase, has been one of the harshest critics of Bitcoin (BTC) and crypto.

Over the years, Dimon has not minced words, calling Bitcoin a “fraud” and warning investors to stay away from the volatile crypto market.

However, in the same interview, Trump hinted that Dimon might have had a change of heart. He referenced a recent meeting in June where he met with Dimon, top executives, and Republican lawmakers, and Trump showed ‘a lot of respect’ for him.”

This isn’t the first time Dimon’s name has surfaced in connection with a high-profile government role. Back in 2016, during Trump’s first term, Dimon was offered a position in the Treasury but ultimately turned it down.

Fast forward to December 2023, and whispers of Dimon heading the Treasury resurfaced, with reports emerging of the possibility based on sources close to Trump’s campaign.

Let’s dive deeper into who Jamie Dimon is, his past remarks on crypto, and what his potential appointment could mean for the future of Bitcoin and the broader crypto market.

Meet Jamie Dimon

Jamie Dimon is a big name in the banking world, known for his no-nonsense approach and strong leadership. Born in 1956, Dimon graduated from Tufts University with a degree in psychology and economics and earned his MBA from Harvard Business School.

Dimon’s career started at American Express, where he worked under Sandy Weill. He then moved to Commercial Credit and later Citigroup, following Weill, where he played a crucial role in building one of the largest financial services companies in the world.

In 2004, he joined Bank One, which was later acquired by JPMorgan Chase. By 2006, Dimon became the CEO of JPMorgan Chase, leading it to become one of the most influential banks globally.

Dimon is known for his straightforward and sometimes controversial statements. In 2012, he downplayed a major trading loss, calling it a “tempest in a teapot,” which drew stark backlash.

He’s also a vocal critic of regulators and has often sparred with them over financial rules.

But, he is also one of the staunchest critics of crypto and has made several remarks over the years. He has called Bitcoin a “fraud” and warned investors against it, predicting its eventual downfall.

Despite this, rumors of him softening his view have emerged, particularly with Trump considering him for the Treasury.

Dimon and crypto: a complicated relationship

Dimon has never been shy about expressing his disdain for Bitcoin and crypto. His most recent and striking criticism came in April 2024 during an interview with Bloomberg TV, where he labeled Bitcoin a “fraud” and a “Ponzi scheme.”

Dimon stated, “Crypto, if you mean crypto like Bitcoin, I’ve always said it’s a fraud. If they think there is a currency, there’s no hope for it. It’s a Ponzi scheme, it is a public decentralized Ponzi scheme.”

Dimon’s negative stance on crypto was reiterated just a few months earlier, in December 2023, during a Senate hearing. When questioned by Massachusetts Senator Elizabeth Warren, Dimon didn’t hold back.

“I’ve always been deeply opposed to crypto, Bitcoin, etc.,” he declared, arguing that crypto primarily serves criminals, drug traffickers, money launderers, and those avoiding taxes. Dimon even went as far as to say, “If I was the government, I’d close it down.”

This stance isn’t new for Dimon. He has been vocal about his negative views on Bitcoin and other crypto since at least 2014. In an interview with CNBC in 2014, Dimon criticized Bitcoin as a terrible store of value, arguing that it could be easily replicated and lacked the legitimacy of government-backed currencies.

He said, “It’s a terrible store of value; it can be replicated over and over. It doesn’t have the standing of a government.”

Another one of his infamous critiques came in September 2017 when he labeled Bitcoin a “fraud” and compared it to the infamous Tulip Mania bubble of the 17th century.

Dimon said, “I’d fire them in a second,” referring to any JPMorgan trader caught trading Bitcoin. He reasoned this decision with, “For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.”

Interestingly, while Dimon has been a staunch opponent of Bitcoin, he has shown some support for the technology behind it — blockchain.

In October 2017, just days before JPMorgan launched its blockchain initiative for interbank payments, Dimon acknowledged the potential of blockchain technology.

“The blockchain is a good technology. We actually use it. It will be useful in a lot of different things. God bless the blockchain,” he said.

Despite his harsh words about crypto, Dimon admitted, “I could care less about Bitcoin. I don’t know why I said anything about it.”

So, what does Dimon’s potential role as Treasury Secretary mean for the crypto market, and might his views influence U.S. financial policy?

What lies ahead?

If Trump returns to power and appoints Dimon as Secretary of the Treasury, the future of crypto in the U.S. could face significant changes.

Dimon’s track record as a banker is impressive. Under his leadership, JPMorgan Chase not only survived the 2008 financial crisis but emerged stronger. His firm stance on regulatory compliance and financial stability has made him a respected figure in traditional finance.

However, this same mindset could spell trouble for the crypto industry. Dimon’s past remarks, labeling Bitcoin a “fraud” and a “Ponzi scheme,” suggest that he could push for stricter regulations and oversight, potentially curbing the freedom that crypto currently enjoys.

Interestingly, this could create a conflict within Trump’s administration. Trump has recently positioned himself as a pro-crypto advocate, aiming to attract a growing number of young crypto investors.

Whatever the case may be, politics is a long and strategic game where thoughts, actions, and beliefs can change in the blink of an eye, with underlying motives often driven by gain.

As the election fever heats up, we will likely see more such headlines in the coming days, and crypto will remain an important topic of discussion.

Source link

You may like

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Bitcoin

Senator Lummis wants to replenish Bitcoin reserves with gold

Published

2 hours agoon

November 24, 2024By

admin

Republican Senator Cynthia Lummis says converting gold reserves into Bitcoin could strengthen the U.S. government’s finances.

In an interview with CNBC, Lummis suggested that the Federal Reserve sell some of its gold reserves, which were valued at 1970s prices, and use the proceeds to buy Bitcoin (BTC).

See the clip below.

Lummis, known for her bullish support of cryptocurrency, believes that creating a strategic Bitcoin reserve could strengthen the dollar’s position as the world’s reserve currency and reduce the country’s debt burden.

She also suggested that Bitcoin, which is edging toward $100,000, could provide high returns.

Bitcoin can be considered a “gold standard digital asset” and creating a strategic reserve would be an essential step in its implementation, Lummis explained.

“We have reserves at our 12 Federal Reserve banks, including gold certificates that could be converted to current fair market value. They’re held at their 1970s value on the books. And then sell them into bitcoin, that way we wouldn’t have to use any new dollars in order to establish this reserve.”

Senator Cynthia Lummis

With the Trump administration’s growing interest in cryptocurrencies, Lummis said that legislation for digital assets could begin to be developed in the coming years.

How the Bitcoin reserve works

The creation of the Bitcoin Strategic Reserve Fund is a comprehensive initiative meant to strengthen financial stability and protect the nation’s assets.

Explained: 🇺🇸 The Strategic Bitcoin Reserve

Breaking down the BITCOIN act — the bill introduced by Senator @CynthiaMLummis

– Buy 1m BTC over five years

– HODL for 20 years

– Proof of Reserves

– Protect Bitcoin property rightsTL;DR: 🚀🚀🚀 pic.twitter.com/snnWP59FBc

— Julian Fahrer (@Julian__Fahrer) November 19, 2024

The Bitcoin Strategic Reserve will also act as a secure financial mechanism that allows the government and other agencies to use Bitcoin as a long-term asset.

The reserve will include a decentralized storage network. By creating a decentralized network of secure Bitcoin storage facilities, the U.S. can protect assets from centralized risks and vulnerabilities. Storage facilities will be distributed across different regions, reducing dependence on one location.

Bitcoin purchase program

The government will implement a Bitcoin purchase program, and it is planning to purchase 200,000 BTC per year for five years. The overall goal is to increase Bitcoin’s strategic reserve to 1 million BTC. Purchases will be made regularly to avoid sharp price fluctuations and ensure consistency.

All purchased Bitcoin will be held in the reserve for at least 20 years.

In addition, all Bitcoins currently stored in other government agencies will be transferred to the strategic reserve, which will allow for centralization and efficient asset management. States can voluntarily participate in this reserve by opening segregated accounts to deposit or withdraw their Bitcoin assets as needed.

The initiative will be supported because government agencies cannot confiscate or seize the rights to legally owned Bitcoin assets. This will provide confidence and incentives for Americans to store their Bitcoins independently.

Bitcoin reserves will not solve the U.S. national debt problem

Avik Roy, president of the non-profit think tank Foundation for Research on Equal Opportunity (FREOPP), doubts that creating a strategic reserve in Bitcoin will help the U.S. overcome the debt crisis.

Speaking at the North American Blockchain Summit 2024 in Dallas, Avik Roy said that Lummis’s plan will not help cover the national debt, which has already grown to $35 trillion.

“The Bitcoin reserve is good but does not solve the problem. You still have to actually do the budgetary reforms to get us out of this $2 trillion a year of federal deficits.”

Avik Roy, FREOPP president

According to Roy, even with a Bitcoin reserve, the U.S. would still have to implement budgetary reforms to get the country out of its $2 trillion federal deficit annually.

The political scientist noted that the BTC reserve could ease tensions in the bond market by making it feel like the U.S. is not going broke. Roy is also concerned that the U.S. could abandon its BTC reserves in the future, similar to what happened with gold in the 1970s.

The argument against Lummis

Bitcoin as a reserve asset points to several other challenges, with the biggest being volatility. Bitcoin’s price fluctuations make it a risky reserve asset compared to stable options like gold.

After all, Bitcoin has experienced several notable crashes throughout its history.

- In June 2011, when the Mt. Gox exchange was hacked. Bitcoin’s price dropped from $32 to $0.01 in a single day, a nearly 99.9% collapse.

- December 2017 to February 2018: After hitting a peak of nearly $20,000, Bitcoin lost over 56% of its value within months.

- March 2020: During the onset of the COVID-19 pandemic, Bitcoin’s price fell nearly 46% in less than a month, dropping from $10,300 to about $5,600.

- May 2021: Bitcoin dropped over 40% in two weeks, from $58,000 to $34,700.

- November 2022: Following the collapse of the FTX exchange, Bitcoin experienced a 14% dip in a short period

Bitcoin is also typically associated with illicit activities and discreet purchases, which raises concerns about integrating it into national financial systems. Critics say it could also enable countries like Russia to bypass international sanctions, undermine global financial stability and create geopolitical tensions.

Trump’s crypto advisory board to create promised reserve

A number of cryptocurrency companies, including Ripple, Kraken, and Circle, are seeking a seat on President Donald Trump‘s promised crypto advisory board, as Reuters reports. They are eager to participate in his plans to overhaul U.S. policy.

During his campaign at a Bitcoin conference in Nashville in July, Trump promised to create a new council as part of a pro-crypto administration. Trump’s team is discussing how to organize and staff the council and which companies should be included.

Potential members include venture capital firm Paradigm and the crypto arm of venture giant Andreessen Horowitz, known as a16z.

“It’s being fleshed out, but I anticipate the leading executives from America’s bitcoin and crypto firms to be represented.”

David Bailey, CEO of Bitcoin Magazine

According to sources, the team is expected to advise on digital asset policy, work with Congress on cryptocurrency legislation, create the Bitcoin reserve promised by Trump, and collaborate with agencies like the Securities and Exchange Commission, the Commodity Futures Trading Commission, and the Treasury Department. One source said law enforcement officials and former lawmakers may also be on the board.

Source link

Analyst

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Published

12 hours agoon

November 23, 2024By

admin

A crypto analyst who accurately forecasted the Bitcoin price increase to the $99,000 All-Time High (ATH) has just released a more detailed analysis of his prediction. The analyst shared a chart highlighting crucial technical indicators and price movements that suggest the cryptocurrency could be gearing up for an even higher ATH.

Analyst Projects $105,000 As The Next Price Target

Weslad, a TradingView analyst, has raised his Bitcoin price forecast, predicting the next upside target at $105,764 as the crypto market bull run gains momentum. The analyst reported that BTC has officially entered the bull market phase, characterized by explosive price increases and positive market sentiment.

Related Reading

His recent bullish prediction of the Bitcoin price is grounded on a key technical pattern known as the “Ascending Channel,” which indicates a bullish trend continuation. This chart pattern consists of two upward-sloping trend lines drawn parallel to each other, representing the resistance and support price levels, respectively.

Despite his optimistic outlook for the BTC price, Weslad has revealed that investors should anticipate a corrective move toward the immediate buy-back zone, which would provide an optimal entry point for opportunistic buyers. The analyst has also shared a detailed price chart that highlights the bullish ascending channel and key price levels that Bitcoin could reach in the short-term and long-term.

Overview Of The Analyst’s Bitcoin Price Chart Analysis

In his 4-hour Bitcoin chart, Weslad visualizes the cryptocurrency’s price action within an ascending channel, highlighting that the BTC is moving upwards within two trendlines. The analyst has provided a detailed roadmap for his $105,764 bullish target for the Bitcoin price.

Weslad highlighted the price range between $91,000 and $92,000 as an “important demand zone,” which acts as strong support where buyers are likely to step in if BTC slips any further. He also revealed that the price level at $94,327.99 has been identified as an ”immediate buy-back zone,” which also serves as an optimal entry point if BTC experiences any corrective pullback in its price.

Related Reading

The analyst has also highlighted $97,537 as the “immediate profit target,” suggesting that traders may consider locking in profits at this critical short-term price level. He has also pinpointed the “mid-term target” for the Bitcoin price, highlighting that the $100,334 mid-term level is important for investors holding longer positions.

Lastly, Weslad has highlighted $105,764 as the “projected final target” for Bitcoin, indicating that this may be the ultimate target for the present market cycle. For BTC to reach this bullish price target, it would require only a modest 6.83% increase from its current value. As of writing, the price of Bitcoin is trading at $99,072, marking a 12.73% increase over the past seven days, according to CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Bitcoin

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

Published

14 hours agoon

November 23, 2024By

admin

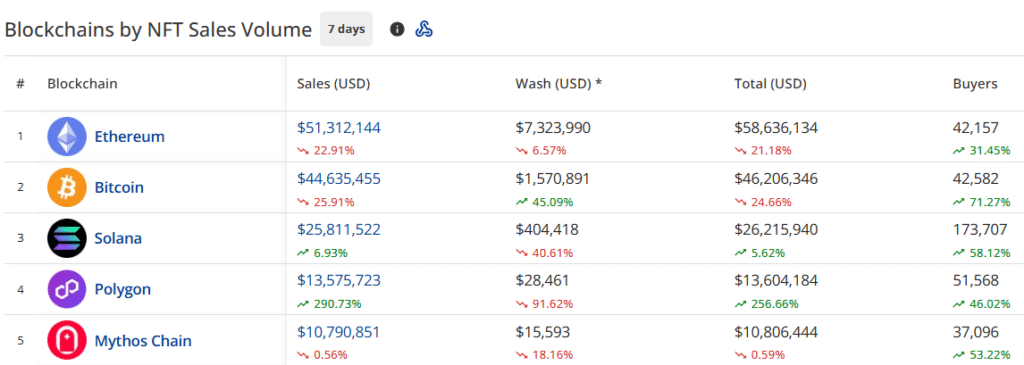

As Bitcoin surges toward the $100,000 mark, touching a new all-time high of $99,655.50, the non-fungible token (NFT) sales volume has shown a drop of 9.6% to $160.9 million.

The global cryptocurrency market capitalization has continued to surge, reaching $3.35 trillion from last week’s $3.03 trillion. This marks a 2% increase over the last day, with Bitcoin (BTC) currently trading at $98,620.

The last week’s NFT sales volume stood at $178.8 million. However, according to recent data from CryptoSlam, the NFT market has seen a pullback.

- NFT sales volume decreased to $160.9 million

- Ethereum (ETH) blockchain leads with $51.3 million in sales (23.07% decrease)

- Bitcoin follows with $44.6 million (25.67% decrease)

- NFT buyers surged by 52.93% to 450,512

- NFT sellers increased by 46.74% to 277,767

- NFT transactions slightly decreased by 1.26% to 1,606,261

Ethereum NFT sales decline by 23.07%

The Ethereum NFT blockchain sales volume fell to $51.3 million this week, marking a 23.07% decrease in the last seven days.

The number of NFT buyers on the Ethereum blockchain grew to 42,157, showing a 31.45% increase.

Bitcoin maintained its second position despite a 25.67% decrease in the last seven days.

According to the data, Bitcoin blockchain’s NFT volume stood at $44.63 million, with wash trading increasing by 46.05% to $1.57 million.

Solana (SOL) secured the third position with $25.8 million, showing resilience with a 6.83% increase during the last seven days.

Polygon (POL) jumped to fourth place with $13.5 million, displaying remarkable growth of 289.66% during the last seven days.

Mythos Chain (MYTH) took the fifth position with $10.7 million in sales, showing a marginal decline of 0.71%.

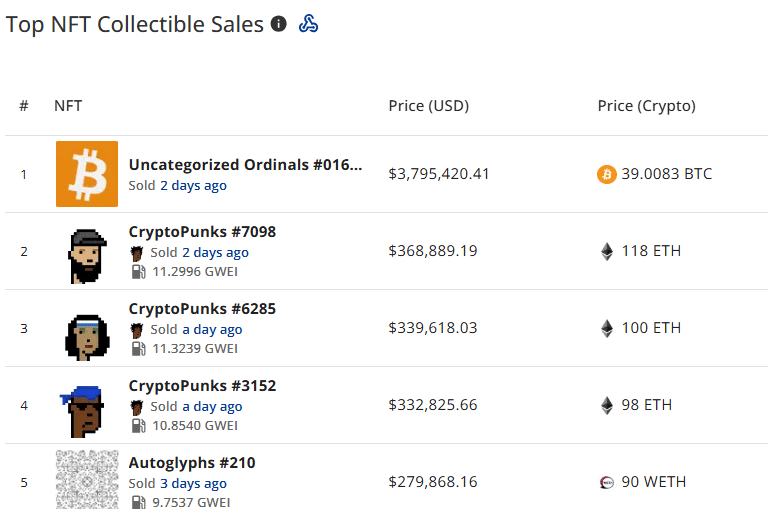

BRC-20 NFTs maintain market leadership

BRC-20 NFTs continue to lead with $16.6 million in sales volume, despite a 41.39% decrease.

MGGA Hat on Polygon secured second place with $10 million in sales, while CryptoPunks followed with $9.2 million, showing a 60.26% decrease.

The latest data shows that the following NFT collections topped the sales in the last week:

- Uncategorized Ordinals #016 sold for $3,795,420 (39.0083 BTC)

- CryptoPunks #7098 sold for $368,889 (118 ETH)

- CryptoPunks #6285 sold for $339,618 (100 ETH)

- CryptoPunks #3152 sold for $332,825 (98 ETH)

- Autoglyphs #210 sold for $279,868 (90 WETH)

Source link

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Dogecoin, Shiba Inu set the trend; this altcoin is ready to take the spotlight next

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Analyst Who Accurately Predicted Solana Price Rally Shares Next Target

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

SHIB Lead Shytoshi Kusama Hints At TREAT Token Launch

Trader Says Top-10 Altcoin To Vastly Outperform Bitcoin and Ethereum, Hit New Record High Quicker Than Expected

5 tokens to consider buying today

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential