Bitcoin

Golf and Bitcoin: The Greatest Games

Published

5 months agoon

By

admin

“Golf is deceptively simple and endlessly complicated; it satisfies the soul and frustrates the intellect. It is at the same time rewarding and maddening – and it is without a doubt the greatest game mankind has ever invented.” – Arnold Palmer

This quote from one of golf’s greatest is reminiscent of the bitcoin journey in many ways. At first glance, these two inventions might seem entirely unrelated, but they share intriguing parallels. The principles of golf can offer valuable insights into bitcoin, and understanding bitcoin can shed light on the intricacies of golf.

In both pursuits, achieving a certain threshold of time and understanding is like gaining admission into an exclusive club. Until that point, it can be extremely frustrating and seemingly meaningless; and after, equally rewarding as it is maddening to be a part of. But whether it’s money or a game, both without a doubt are the greatest mankind has ever invented.

Most amateur golfers know how hard it is to play well consistently. It takes hard work, longevity, grit, and mental fortitude that can only be forged over years of dedication. For many, it is a lifelong journey. There is no substitute for hashing away on the driving range, ball after ball. The parallels to a personal bitcoin journey run deep. Success in golf and bitcoin is a product of a low time preference, proof of work, and minimizing mistakes.

A low time preference is essential

Golf is a hard journey. One that requires patience, discipline, and perseverance. Playing the game isn’t about the end destination, but the process along the way. That process has as much to teach us about ourselves as it can teach us the importance of looking out for our future selves.

Understanding the importance of bitcoin isn’t for the faint of heart. Learning what money is, what the problem with the money is today, and why bitcoin solves that problem takes time. But the fact that it’s hard is what makes it worth pursuing. After all, if it were easy, everyone would do it.

Worthwhile challenges come with obstacles, and this couldn’t be better represented in both bitcoin and golf. There are false peaks of understanding where good judgment lapses and hasty assumptions are made. There are snake oil salesmen offering shortcuts or “get rich quick” schemes along the way. And either way you spin it, ego is just another handicap.

Golf and bitcoin are incredibly humbling endeavors. Those who inevitably experience the pitfalls along the road learn that each is not about the end destination, and in fact, that they may never have one. But that journey can be incredibly rewarding in and of itself.

Once I understood bitcoin, the power I gained from using it as my primary form of savings trickled into other parts of my life. I suddenly became more interested in enhancing other parts of my life, like my health and my relationships with friends and family. I simply became happier, and generally, more optimistic toward the future. It’s a feeling that reminds me of a quote from Bobby Jones, one of the greatest golfers to ever play the game,

“The most important shot in golf is the next one.”

Golf is different from most other sports in that you can play it most of your life. Some sports are high-time preference in the sense that they are optimized for a short amount of time, typically a couple years, or even for a single game. Golfers know when they step onto the practice range or off the first tee that the goal isn’t to hit the longest drive or to shoot their best score. But instead, to get just a little better every time. The confidence gained from this approach is foundational to having the conviction necessary to not only survive, but thrive when the going gets tough…and it will get tough!

In Ben Hogan’s book, “Five Lessons,” a book I’d liken to “Mastering Bitcoin” but for the game of golf, he describes a shot that he hit on the 72 hole of a tournament in 1950 at the Merion Golf Club. The shot was a 5 iron from 200 yards away up a severe hill to a sloping green. The ball landed close enough to the pin to force a playoff and ultimately led him to winning the championship.

“I bring up this incident not for the pleasure of re-tasting the sweetness of a “big moment” but, rather, because I have discovered in many conversations that the view I take of this shot (and others like it) is markedly different from the view most spectators seem to have formed. They are inclined to glamorize the actual shot since it was hit in a pressureful situation. They tend to think of it as something unique in itself, something almost inspired, you might say, since the shot was just what the occasion called for. I don’t see it that way at all. I didn’t hit that shot then – that late afternoon at Merion. I’d been practicing that shot since I was twelve years old.”

Both golf and bitcoin reward individuals with a low time preference. Grasping and embracing this principle is essential for achieving better scores and greater enjoyment of the game. Faking a good golf swing is about as likely to happen as faking a bitcoin transaction, it simply cannot be done. This is why developing a strong golf game requires the same crucial element as sound money: proof of work.

There is no substitute for proof of work

The importance of proof of work in bitcoin, and in money generally, cannot be overstated. Money must be tied to the universal truth that nothing in this world is free. Success in golf is no different.

Becoming a professional golfer might be out of reach for most of us, but we can still adopt a low time preference approach to improving our skills. Whether you are aiming to go pro or just trying to break 90, consistent effort is essential. There’s no substitute for hitting hundreds or thousands of balls on the driving range, each swing aimed at perfecting your shot.

Developing a good golf game is like solving a puzzle. You must persist, swing by swing, making incremental adjustments until you find the solution—at least for that one swing or that one day. The challenge is that each new day brings different variables. You might be battling an injury, or the weather might create different playing conditions. These changes require slight tweaks to your game, and once again, you have to work through the puzzle.

Bitcoin mining is often described as solving a complex puzzle as well. Each block template is unique, and miners must tweak the nonce repeatedly until they discover the right input to hit the target. Doing so unlocks great rewards, but only if you can prove to the network you’ve expended the required work. This process links bitcoin’s ledger to real-world energy use, safeguarding its transaction history with an unforgeable costliness. The result of that work—a valid cryptographic hash below the difficulty target—can be easily verified by other players in the game. Achieving a low score for a round of golf is hard, but it’s easy for your playing partner to attest to your scorecard.

When you watch the average Saturday morning hacker, it’s clear that the level of work required to compete at the highest level hasn’t been met. The pros make it look easy, but achieving that level of skill requires significant investment over a long period. Winning a golf tournament involves a lot of hard work and a bit of luck, much like bitcoin mining.

Golf, like bitcoin, is a game that can only be mastered through proof of work. With a low time preference established and a massive amount of work invested, there’s another key concept to drive consistently lower golf scores: don’t make mistakes!

Don’t make mistakes

“Golf is a game of minimizing mistakes.” – Ben Hogan

Launch your drive somewhere in the fairway, hit your approach shot somewhere on the green, and get the ball in the hole in two putts…a successful par. Like shooting par on 18 holes, holding bitcoin is simple in concept but not easy in practice. Both require avoiding errors rather than achieving perfection. The key to success in bitcoin and golf is simple: don’t make mistakes.

Most golf fairways have a width between 25-65 yards. This means you do not have to hit a perfect shot to hit the fairway. In fact, you have a fairly wide range of shots that you can hit, and it would still put you in a sufficient spot to hit the green on the next shot. The same applies to a green. While it varies by course, the typical width of a putting green is around 25 yards. Again, this means you do not have to hit a perfect approach shot to hit the green. A wide range of shots will do. For both driving and approach shots, you do not need to hit the perfect shot. You simply need to not hit a bad shot.

Various elements can induce mistakes or mishaps on the golf course, such as wind, water, sand, rough, trees, and all sorts of other hazards. Success in any round of golf depends on a thoughtful approach. Course management and keeping your misses small, so that you can easily recover from them, are critical to achieving a low score. Perfection is not required, but fault tolerance is.

The same is true in your bitcoin journey. Hazards appear in the form of market volatility, adoption waves, and phishing attacks. Bitcoin “yield” products will tempt you to “overswing your driver” for a little bit of extra distance, and the trading gurus make going for the well-protected flag seem easy.

But your only job when it comes to holding bitcoin is to prevent yourself from making mistakes that cause you to lose it.

The foundation of your bitcoin course management is holding your own private keys in a fault-tolerant way and putting a succession plan in place. Avoid trying to time the market, trade bitcoin’s volatility, or search for a few extra points of yield. These are all near-certain ways to shank the proverbial BTC ball into the woods. You simply need to hold your bitcoin securely and keep your private keys private.

Final Thoughts

The parallels between golf and bitcoin offer valuable lessons for those embarking on either journey. They are each long-term pursuits that must be approached with a low time preference. The proof of work concept is central to both, emphasizing that consistent effort and dedication are the only paths to success. Finally, the importance of minimizing mistakes cannot be overstated in either domain. As you navigate your bitcoin journey, adopt the mindset of a seasoned golfer, and make sure you always play from the fairway.

P.S. If you are a golfer who loves bitcoin, join us for the inaugural Bitcoin Golf Championship on July 24th in Nashville!

https://bitcoingolfchampionship.com/

This is a guest post by Rocky Wold, Joe Burnett, and Trey Sellers. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

24/7 Cryptocurrency News

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Published

2 hours agoon

December 23, 2024By

admin

Rich Dad Poor Dad author Robert Kiyosaki has issued a stark warning while hinting towards an economic depression ahead. In a recent X post, the renowned author said that the global market crash has already started, as he predicted earlier, which indicates that the financial market might enter a “depression” phase. Notably, this comes as the crypto market records immense volatility, sparking concerns over what’s next for Bitcoin (BTC).

Robert Kiyosaki Hints At Economic Depression Ahead

Robert Kiyosaki, in a recent X post, has revealed a stark warning of a looming economic depression. The Rich Dad Poor Dad author warned that a global market crash has already begun, citing Europe, China, and the U.S. as regions facing significant downturns.

In his post, Kiyosaki urged caution, advising individuals to safeguard their finances and maintain their jobs. “Global crash has started. Europe, China, USA going down. Depression ahead?” he asked while emphasizing the enduring value of assets like gold, silver, and Bitcoin. He added, “For many people, crashes are the best times to get rich.”

This warning aligns with Kiyosaki’s earlier prediction of what he called the “biggest crash in history.” Earlier this month, he encouraged his followers to prepare for financial turmoil, stating, “Please be proactive and get rich… before the BOOMER’s go BUST.”

However, this recent comment from Robert Kiyosaki indicates his sustained confidence in BTC. As the crypto market faces heightened volatility, Bitcoin could emerge as a hedge against traditional market instability, he noted. Besides, it also indicates that the flagship crypto, alongside gold and silver, might continue to gain traction amid this economic turmoil.

What’s Next For BTC?

Bitcoin price today has continued its volatile trading, losing nearly 1.5% over the last 24 hours to $95,323. The crypto touched a high and low of $97,260 and $93,690 in the last 24 hours, showcasing the highly volatile scenario in the market.

In addition, the US Spot Bitcoin ETF also recorded significant outflow, with BlackRock Bitcoin ETF witnessing its largest outflux since its launch. This has weighed on the investors’ sentiment, sparking concerns over a waning institutional interest.

However, despite that, many experts remained confident on the asset’s future trajectory. For context, in a recent X post, Peter Brandt shared a new BTC price target, indicating his confidence in the digital asset.

On the other hand, institutions like Metaplanet have also continued to boost their BTC holdings. These moves indicates that the institutions, as well as many investors, are bullish towards the long-term potential of the crypto. Besides, as Robert Kiyosaki said, the recent dip also provides a buying opportunity to investors, which might further boost Bitcoin to its new ATH ahead.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Published

4 hours agoon

December 23, 2024By

admin

Tokyo-listed Metaplanet has purchased another 9.5 billion yen ($60.6 million) worth of Bitcoin, pushing its holdings to 1,761.98 BTC.

Metaplanet, a publicly traded Japanese company, has acquired 619.7 Bitcoin as part of its crypto treasury strategy, paying an average of 15,330,073 yen per (BTC), with a total investment of 9.5 billion yen.

According to the company’s latest financial disclosure, Metaplanet’s total Bitcoin holdings now stand at 1,761.98 BTC, with an average purchase price of 11,846,002 yen (~$75,628) per Bitcoin. The company has spent 20.872 billion yen in total on Bitcoin acquisitions, the document reads.

The latest purchase is the largest so far for the Tokyo-headquartered company and comes just days after Metaplanet issued its 5th Series of Ordinary Bonds via private placement with EVO FUND, raising 5 billion yen (approximately $32 million).

The proceeds from this issuance, as disclosed earlier, were allocated specifically for purchasing Bitcoin. These bonds, set to mature in June 2025, carry no interest and allow for early redemption under specific conditions.

Metaplanet buys dip

The company also shared updates on its BTC Yield, a metric used to measure the growth of Bitcoin holdings relative to fully diluted shares. From Oct. 1 to Dec. 23, Metaplanet’s BTC Yield surged to 309.82%, up from 41.7% in the previous quarter.

Bitcoin itself has seen strong performance this year, climbing 120% and outperforming assets like the Nasdaq 100 and S&P 500 indices. However, it has recently pulled back from its all-time high of $108,427, trading at $97,000 after the Federal Reserve indicated only two interest rate cuts in 2025.

Despite the retreat, on-chain metrics indicate that Bitcoin is still undervalued based on its Market Value to Realized Value (MVRV-Z) score, which stands at 2.84 — below the threshold of 3.7 that historically signals an asset is overvalued.

Source link

Altcoin Season

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Published

7 hours agoon

December 23, 2024By

admin

The creators of the crypto analytics firm Glassnode are warning that altcoins could lose all bullish momentum following last week’s market correction.

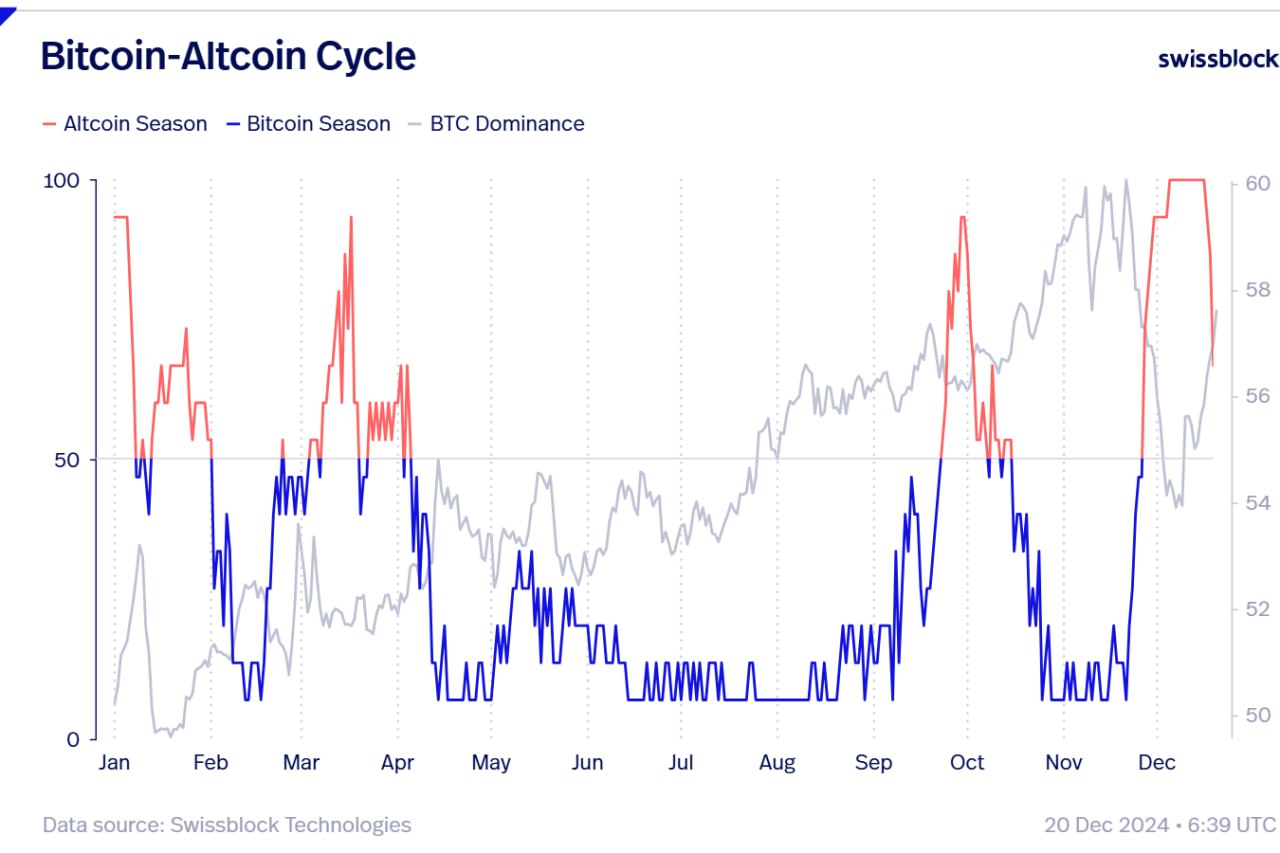

Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, tell their 63,400 followers that “altcoin season,” which they say began in late November, could come to an abrupt end after alts witnessed deep pullbacks over the last seven days.

According to the Glassnode co-founders, traders and investors will likely have a risk-off approach on altcoins unless Bitcoin recovers a key psychological price point.

“Is This the End of Altcoin Season?

Bitcoin dominance is surging after dipping below $100,000, while altcoins are losing critical supports. Dominance has risen and resumed its upward trend, signaling a stronger BTC environment.

If BTC stabilizes above $100,00, we might see a pump in altcoins now in accumulation zones. Until then, Bitcoin appears poised to lead, leaving altcoins lagging behind.”

The Bitcoin Dominance (BTC.D) chart tracks how much of the total crypto market cap belongs to BTC. In the current state of the market, a surging BTC.D suggests that altcoins are losing value faster than Bitcoin.

At time of writing, BTC.D is hovering at 59%.

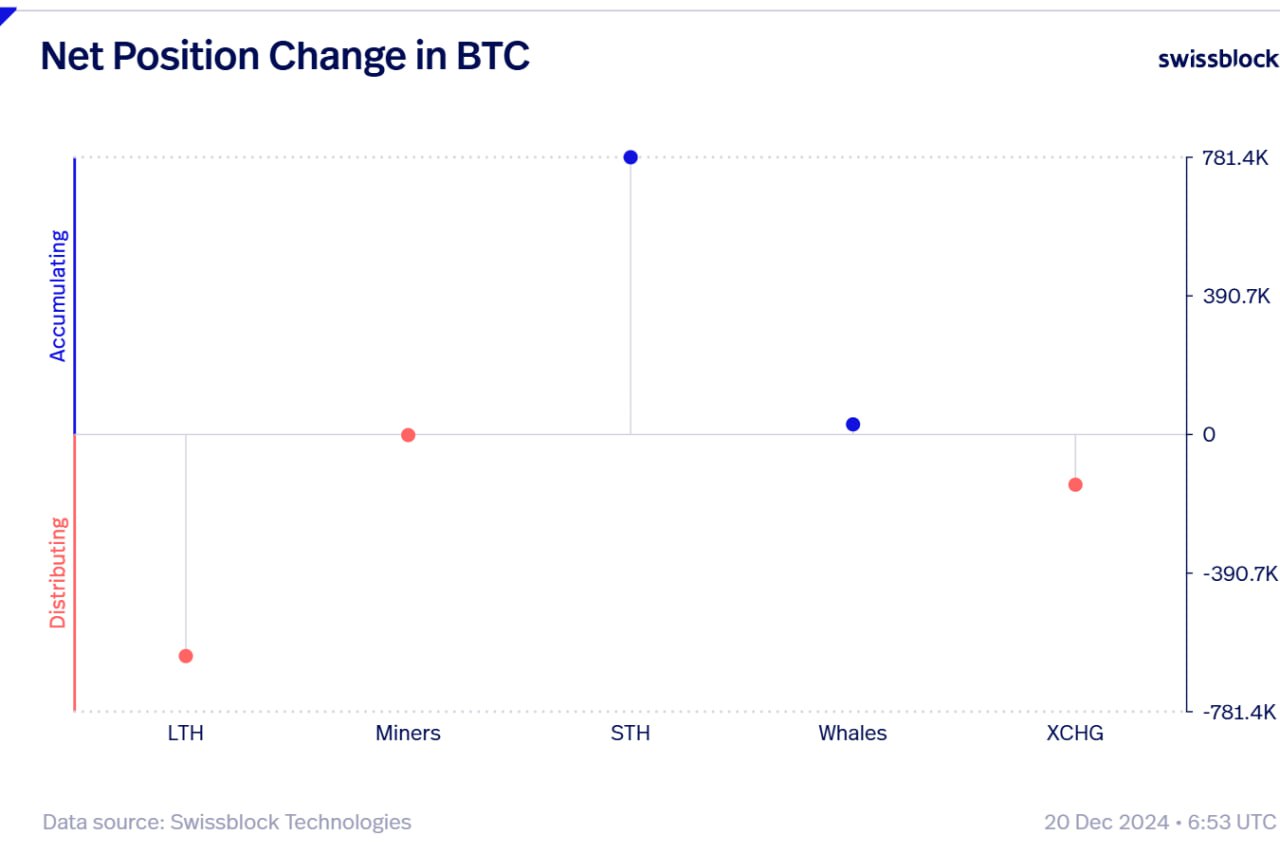

Looking at Bitcoin itself, the Glassnode executives say long-term Bitcoin holders are massively unloading their holdings as other investor cohorts pick up the slack.

“The Board Keeps Shifting.

As BTC continues flowing out of exchanges during this dip, long-term holders are exiting forcefully, while short-term holders step in without hesitation.

Whales quietly accumulate, miners remain neutral, and selling pressure has merely reshuffled the board.

New hands are absorbing the sales.”

At time of writing, Bitcoin is worth $97,246.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: