24/7 Cryptocurrency News

Terra Classic Rejects Major Proposal; TFL Update To Boost LUNC Rally?

Published

4 months agoon

By

admin

The Terra Classic community has overwhelmingly rejected a proposal to create an independent community website, fueling market discussions. However, despite this setback, Terra Classic’s LUNC token saw a notable rally, gaining over 5%. This surge is likely attributed to recent positive developments surrounding Terraform Labs (TFL) and its Chapter 11 bankruptcy proceedings.

Terra Classic Community Rejects Key Proposal

The Terra Classic community has recently voted on a governance proposal to establish an independent website, modeled after Bitcoin.org. This proposed independent website was intended to integrate design processes and concept workshops, fostering a more cohesive community.

However, the Terra community’s proposal received minimal support. Only 4% of the votes were in favor, while over 21% voted against it. A significant 63% of the participants chose to veto the proposal, and 12% chose the “Abstain” option.

Meanwhile, the rejection of this proposal reflects the Terra Classic community’s reluctance to pursue this direction at this time. But despite the proposal failure, the price of Terra Classic (LUNC) experienced a surprising rally. The token’s value increased by about 5%, capturing market attention and demonstrating the resilience of the Terra ecosystem.

Also Read: Is Elon Musk Joining Donald Trump In Nashville Bitcoin Conference?

TFL Bankruptcy Update Boosts Price?

The recent rally in LUNC can be attributed to updates from Terraform Labs’ Chapter 11 bankruptcy proceedings. As reported by CoinGape Media earlier, a new court order has authorized the reopening of the shuttle bridge and a substantial 150 million LUNA burn. This development has sparked renewed interest and optimism within the Terra Classic community.

Meanwhile, the Terra community highlighted the importance of these updates. The reopening of the shuttle bridge allows for the movement of significant amounts of LUNC and USTC.

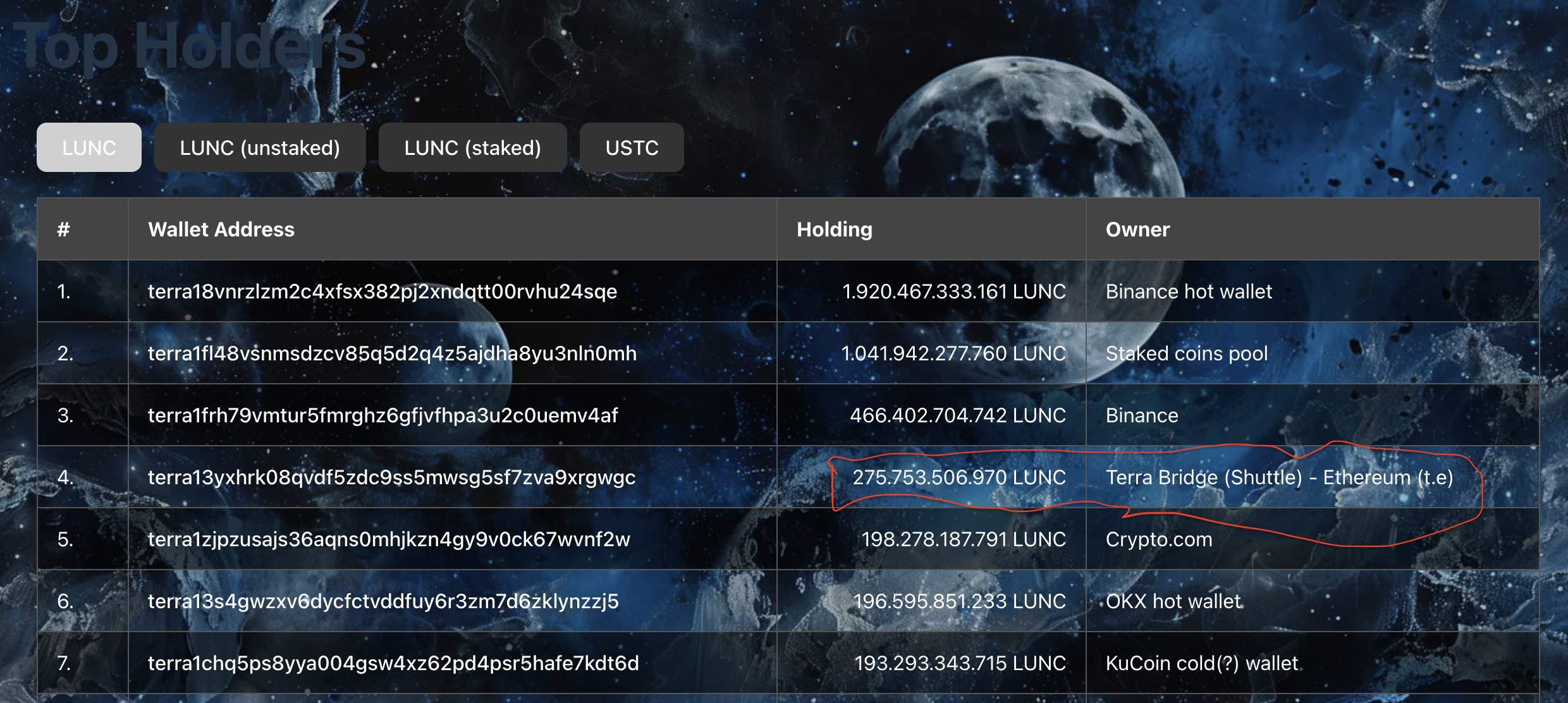

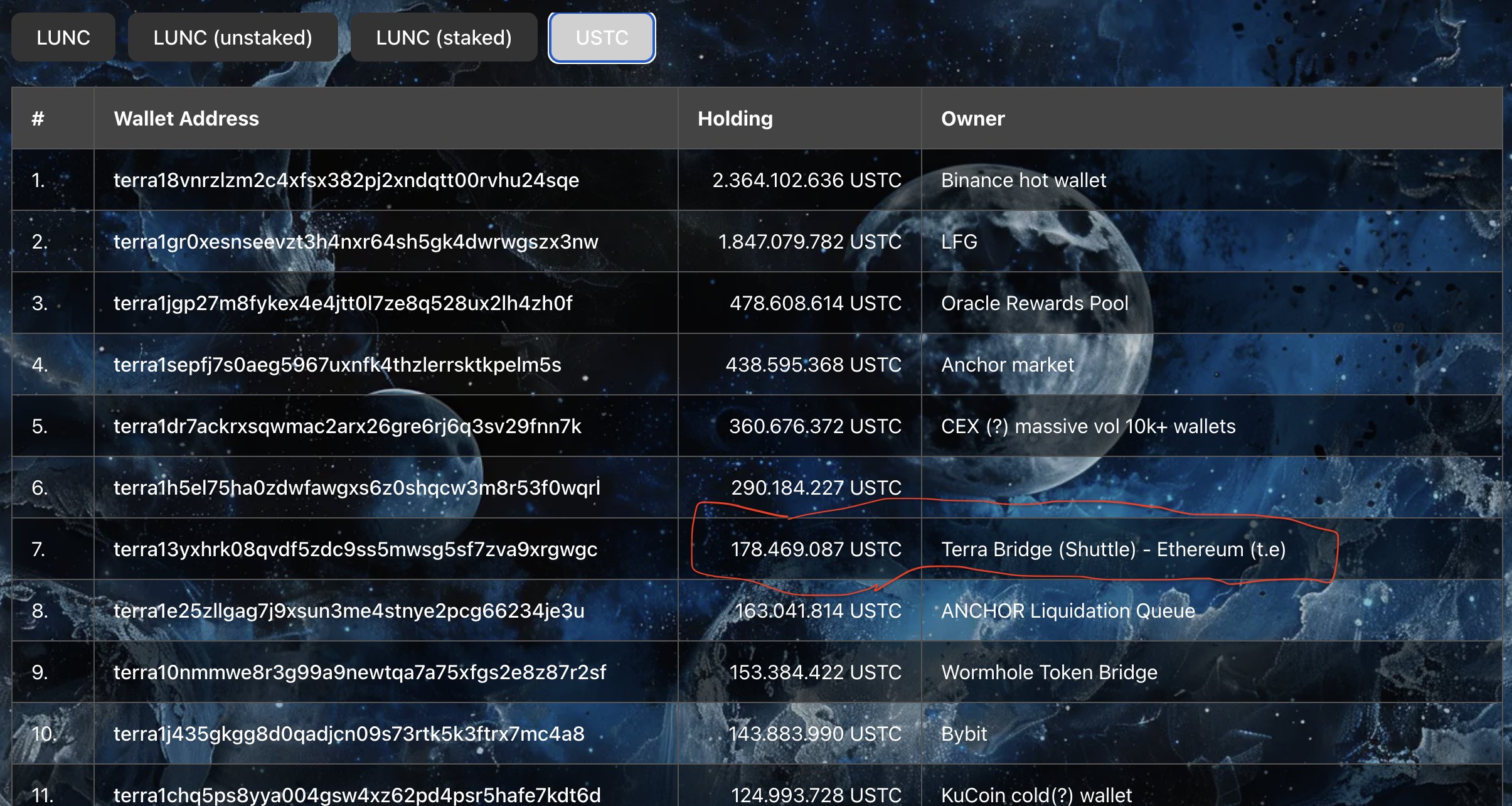

Specifically, the bridge contains 275.7 billion LUNC and 178.4 million USTC, according to data. Notably, the Terra Classic community plans to keep the bridge open for one month. If the funds are not withdrawn during this period, they will be burned, reducing the circulating supply.

This strategic move aims to bolster market confidence and support the long-term stability of the Terra ecosystem. Besides, additional wallets are also scheduled for burning, with detailed information expected by September 2024. This systematic approach to managing the token supply has been well-received by the community and investors alike.

As of writing, LUNC price was up 4.65% and exchanged hands at $0.00009108, while hitting a 24-hour high of $0.00009153. The token noted a surge of nearly 30% in the last seven days, reflecting the growing market interest.

On the other hand, USTC price was up about 4% to $0.02047. Furthermore, its one-day trading volume jumped about 60%, indicating significant trading activity.

Also Read: XRP Lawyer Targets Gary Gensler Amid SEC’s Latest Defeat

Rupam, a seasoned professional with 3 years in the financial market, has honed his skills as a meticulous research analyst and insightful journalist. He finds joy in exploring the dynamic nuances of the financial landscape. Currently working as a sub-editor at Coingape, Rupam’s expertise goes beyond conventional boundaries. His contributions encompass breaking stories, delving into AI-related developments, providing real-time crypto market updates, and presenting insightful economic news. Rupam’s journey is marked by a passion for unraveling the intricacies of finance and delivering impactful stories that resonate with a diverse audience.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

24/7 Cryptocurrency News

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Published

6 mins agoon

November 24, 2024By

admin

The crypto market enters a crucial week, with a flurry of key events like the US PCE inflation, FOMC Minutes, and Q3 GDP (first revision) data, among others, scheduled. In addition, the crypto market expiry has also fueled concerns among the market participants. For context, the investors are awaiting the impact of these events, as the broader market noted a massive rally in recent days.

US PCE Inflation & FOMC Minutes In Focus

The crypto market awaits a flurry of key economic events this week, including US PCE, FOMC, and others, with speculations soaring over the potential impact on asset prices. Notably, the week will start with Consumer confidence data and US FOMC for November scheduled on Tuesday, November 26. This would provide further cues on the Fed’s potential stance with their monetary policy plans, which usually affect the investors’ sentiment.

In addition, the minutes will also be closely watched, as recent reports showed that the US Federal Reserve said that it won’t be focusing on the 2% inflation target ahead. Besides, with Donald Trump’s election victory and Elon Musk’s focus on cutting Federal spending, investors will keep close track of the central bank’s minutes this week.

Following that, the market participants will await the US GDP figures for the third quarter. The first revision of the economic figure is scheduled for Wednesday, November 27, which will provide cues on the US economic health. This is also likely to impact the sentiment of the broader financial sector, let alone the crypto market.

Meanwhile, investors will be closely watching the inflation figures, especially after recent data indicates prices are soaring. The US PCE inflation, set for Wednesday, is expected to come in at 0.2% in October, unchanged from the previous month’s figure. On the other hand, the YoY PCE figure is expected to accelerate at 2.3%, as compared to 2.1% noted in the prior month.

In addition, the Core PCE inflation figures, which exclude the energy and food prices, are expected to show a 2.8% surge, up from the 2.7% noted in September. However, the monthly figure is expected to remain unchanged at 0.3%.

Will Crypto Expiry Impact The Ongoing Rally?

Bitcoin and other top altcoins have noted robust rallies recently, with optimism hovering in the market after Donald Trump’s election win. However, some market experts anticipate the upcoming crypto expiry to impact the market sentiment.

According to Deribit data, $9.13 billion in Bitcoin options is set to expire on November 29, with a put/call ratio of 0.80. The max pain price is $77,000. On the other hand, $1.24 billion Ethereum is also set to expire on the same date, with a put/call ratio of 0.77 and a max pain price of $2,800.

This crypto expiry, worth more than $10 billion, is likely to spark volatility in the market, impacting investors’ sentiments. In addition, many top experts including Peter Brandt hint towards a potential Bitcoin selloff ahead, while remaining optimistic about the crypto’s long-term trajectory.

Having said that, the market will keep close track of the US PCE inflation figures, FOMC minutes, and other macroeconomic events. In addition, the crypto expiry is also expected to impact the traders’ sentiment, especially amid the ongoing rally in the market.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ripple Provided The Blueprint To Defeat Gary Gensler

Published

6 hours agoon

November 23, 2024By

admin

Stuart Alderoty, the Chief Legal Officer of Ripple Labs Inc has spotlighted the firm’s role in fighting the crypto crackdown initiated by Gary Gensler as Chairman of the US Securities and Exchange Commission (SEC). With a legal battle spanning approximately four years, Alderoty send appreciation to the key stakeholders in the regulatory fight

The Unsung Heroes In Ripple Labs’ Legal Battle

In his post on X, Stuart Alderoty noted that though victory has a thousand fathers, some personalities played major roles. He spotlighted the company’s CEO, Brad Garlinghouse, as a leader who provided the courage the team needed to go on.

He also hinted at the role many in the firm’s legal department played as key in paving the way for the success achieved thus far. To the Ripple CLO, most of the core contributors in-house are nameless and do not seek “Twitter spotlight.”

Ultimately, he believes that Ripple provided the blueprint to “defeat Gary Gensler’s inexplicable war on crypto.” He reiterated that the team kept the door open long enough for the crypto industry to survive the regulatory crackdowns.

Victory has a thousand fathers, but make no mistake. The courage of Brad and Chris, and the resilience and expertise of Ripple Team Legal (most of whom are nameless and never sought the Twitter spotlight) paved the way. Ripple provided the blueprint to defeat Gary Gensler’s…

— Stuart Alderoty (@s_alderoty) November 23, 2024

Ultimately, he mentioned the role played by the XRP Army. Alderoty thanks the community for their faith and support in the project overall.

The Gary Gensler Defeat in Context

There are a number of interpretations to the defeat implied by the Ripple CLO. Beyond the undisputed verdict that XRP is not in itself a security, Gary Gensler’s resignation date is now set at January 20, 2025.

This resignation came following the Kamala Harris defeat by Donald Trump in the just-concluded US Presidential election.

As many industry leaders noted, the crypto voters played a role in determining the outcome of the election. Many supported Donald Trump drawing on his promises to end the war on crypto.

Thus far, the signs of change are visible with his appointments. He picked Tether advocate Howard Lutnick as Commerce Sec, Scott Bessent as Treasury Secretary with Gary Gensler’s replacement yet to be unveiled.

While the next steps in the XRP lawsuit appeal are well defined, it remains to be seen if the next US SEC Chairman will revoke the appeal in the Ripple Lawsuit. In all, the community has counted a win with Trump in charge.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Will Polkadot Price Continue To Rally Following 100% Surge?

Published

9 hours agoon

November 23, 2024By

admin

Polkadot price has had an exceptional surge, rising by over 100% within the last month. The cryptocurrency’s price has shifted from a lengthy downtrend channel and is therefore in the process of recovering. After this breakout, DOT returned to the $8 level which was a resistance turned support level in previous cycles. This level is important in maintaining the upward movement.

Polkadot Price Breaks $8 Resistance: Is a Rally to $10 Next?

Amid the current crypto rally, Polkadot price surged 111% over the past 30 days, marking an impressive recovery. This includes a 40% daily jump, bringing DOT back above $8. The market has experienced heightened trading activity and stronger bullish pressure, driving the recent upward momentum. At the time of writing, the $8 mark, which was a resistance level, is now a support zone.

On the monthly chart, Polkadot price is moving toward a key horizontal resistance level near $10, which also represents a critical psychological barrier. Historically, the $10 zone has acted as both support and resistance during various market cycles. Therefore, a successful breach could pave the way for a rally toward the $12.60 level.

Moreover, top technical indicators reveal a bullish outlook. The Relative Strength Index (RSI) has entered the overbought zone on the daily chart, reflecting increased buying pressure. This suggests that the market is favoring continued upward movement. However, traders remain cautious of a potential correction, as overbought conditions often precede short-term retracements.

Source: TradingView

Source: TradingView

Additionally, Polkadot (DOT) MACD indicator shows a strong bullish crossover, with the MACD line moving significantly above the signal line, indicating heightened bullish momentum. The rising histogram bars further confirm increasing buying pressure, suggesting that the uptrend could continue.

Will Price Reclaim the $10 Level?

According to experts, high volatility may lead to Polkadot reaching $10 if the upwards trends continue to prevail. The next important level of resistance is close to $9.91, breaking through which may open the way to further climb above $10. A rising Simple Moving Average (SMA) on the daily timeframe also backs DOT and the wider market sentiment.

Despite this rally, a bearish reversal could lead to a retest of the $6.57 support level, with stronger downward pressure driving the Polkadot price back to its critical floor of $5. More so, analyst Rekt Capital emphasized the importance of closing the month above $8.61 to sustain the crypto rally.

As of this writing, Polkadot price is at $8.53, having surged 35.65% in the last one day. Market capitalization is $13.14 billion, while the trading volume within 24 hours is $3.03 billion which is a 271% increase.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Dogecoin, Shiba Inu set the trend; this altcoin is ready to take the spotlight next

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Analyst Who Accurately Predicted Solana Price Rally Shares Next Target

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

SHIB Lead Shytoshi Kusama Hints At TREAT Token Launch

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: