Asia

Asia's First Inverse Bitcoin ETF to Launch Tomorrow in Hong Kong

Published

4 months agoon

By

admin

The Hong Kong Stock Exchange (HKEX) is poised to make history tomorrow with the launch of Asia’s first inverse Bitcoin exchange-traded fund (ETF).

JUST IN: 🇭🇰 Asia’s first inverse #Bitcoin ETF to go live tomorrow in Hong Kong. pic.twitter.com/HSV28BZd2l

— Bitcoin Magazine (@BitcoinMagazine) July 22, 2024

The CSOP Bitcoin Futures Daily (-1x) Inverse Product will begin trading on July 23rd. The ETF will invest in short positions on Bitcoin futures contracts traded on the Chicago Mercantile Exchange. This gives traders exposure to the daily inverse performance of the underlying Bitcoin futures index.

Traders can hedge risk or speculate on downward price moves by going short on Bitcoin futures. This new tool provides an alternative to shorting or buying put options on Bitcoin directly.

The inverse ETF is managed by CSOP Asset Management, with HSBC as the trustee. It charges a 1.99% annual fee and aims to attract $50-100 million in assets under management in 1-2 years.

The launch has generated buzz as a new way to trade Bitcoin volatility. While controversial to some, inverse Bitcoin ETFs are gaining traction globally. The ProShares Short Bitcoin ETF (BITI) in the U.S. has over $70 million under management.

The CSOP product will be the first of its kind in Asia, bringing inverse Bitcoin exposure to Hong Kong’s $5.4 trillion stock market. It represents another milestone for mainstream Bitcoin adoption in the region.

Source link

You may like

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

WHAT WE’RE READING: Blockspace Media

A recent Blockspace article deeply resonated with me as someone who’s lived in Asia and the West. It examined how Asia-based Bitcoiners are mostly profit maximalists, not philosophically driven Bitcoin maxis.

This rang true from my experience. When I meet Asian Bitcoiners, money and profit seem to be the primary motivators. Contrast that to Westerners, who often cite the cypherpunk, privacy, and political ideals behind Bitcoin.

Of course, this is a broad generalization. Many exceptions exist across both continents, but the general lens is that each side’s views on Bitcoin differ substantially.

Cultural and economic differences likely drive this divide. Western Bitcoiners are often born into prosperity with strong infrastructure. Money itself doesn’t captivate them, as it’s abundantly available. Thus, they have the luxury of prioritizing loftier Bitcoin goals like privacy, censorship resistance, and decentralization.

Meanwhile, many Asian Bitcoiners grew up poor, struggling for money amidst crumbling infrastructure. When they discover Bitcoin, it understandably represents financial opportunity above all else. After lacking money their whole lives, profits take precedence over philosophical concerns.

A prime example is the common maxi argument against altcoins – that they lose value against Bitcoin over time. This philosophical stance falls flat in Asia where people judge investments based on empirical results measured in fiat gains. If an altcoin generates a 20x fiat return, Asians won’t care that it dropped 98% against Bitcoin. Their profit-centric framework renders certain Western philosophical arguments ineffective.

You can see the results where Bitcoin maximalism thrives – predominantly in the West. Asia has practically no maxis comparatively. Again, incentives align. When your sole goal is profit maximization, altcoins and tokens become fair game.

That’s why we are seeing more Bitcoin season 2 projects emerging from Asia, which will continue to be the case.

This isn’t to say one mindset is superior. Both are integral to Bitcoin’s success. Asian business drive adoption at all costs, and provide the capitalist engine. Western idealism keeps the protocol ethos on track. Together they produce the checks and balances Bitcoin needs to thrive.

Observing Asia’s profit-first mentality versus the West’s ideological leanings provides insight into Bitcoin’s cultural landscape. Neither outlook is right or wrong per se. By understanding both mentalities, Bitcoin can synthesize the best of both worlds.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Asia

Bhutan’s Bitcoin Holdings Revealed: Kingdom Owns $780M in BTC from Mining

Published

2 months agoon

September 16, 2024By

admin

South Asian country Bhutan, a Buddhist kingdom on the Himalayas’ eastern edge, has been revealed as a major Bitcoin holder, owning 13,011 BTC worth around $780.49 million, according to a report by Arkham Intelligence. The public data company identified Bhutan’s Bitcoin addresses, marking the first time this information has been publicly shared.

“Bhutan is the 4th largest government with Bitcoin holdings on our platform, with over $750M in BTC,” Arkham stated on X. “Unlike most governments, Bhutan’s BTC does not come from law enforcement asset seizures, but from Bitcoin mining operations, which have ramped up dramatically since early 2023.”

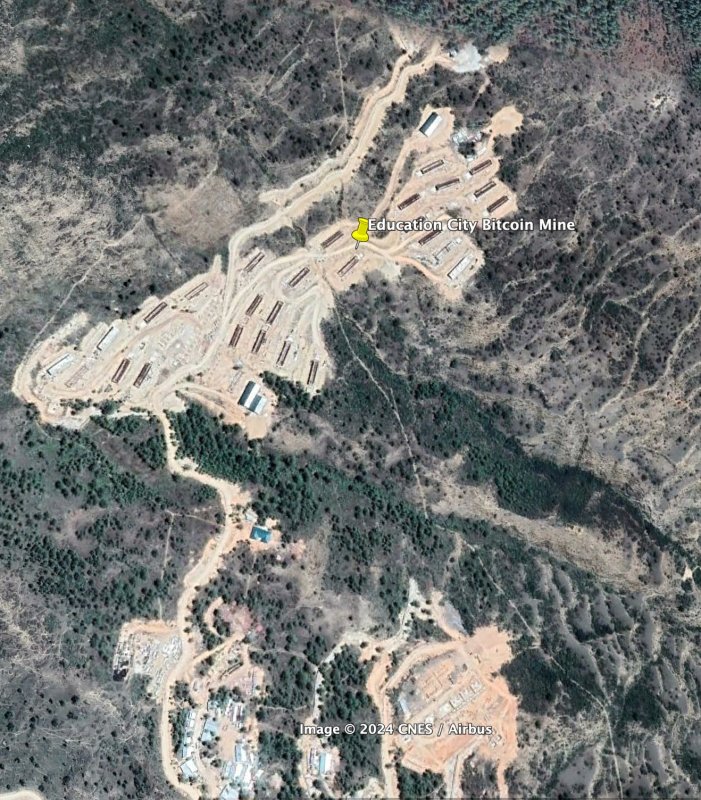

Bhutan’s Bitcoin mining activities are conducted by the Kingdom’s investment arm, Druk Holdings. According to Arkham, the country has constructed mining facilities at multiple sites, with the largest on the grounds of the defunct Education City project. Arkham further noted, “We were able to corroborate the timeline of on-chain mining activity with time-lapse satellite imagery of facility construction.”

In May of 2023, Bitdeer partnered with Druk Holding & Investments to develop the 100% carbon-free Bitcoin mining operation in Bhutan.

Earlier this year, a Bloomberg report revealed that Druk Holding & Investments and Bitdeer were expanding their mining capacity from 100 to 600 megawatts. Bhutan’s focus on eco-friendly mining is bolstered by its abundant hydropower resources, making it an ideal location for eco-friendly mining.

Source link

Asia

Hong Kong Spot Bitcoin ETFs Saw Highest Inflows in a Month

Published

3 months agoon

August 22, 2024By

admin

Hong Kong‘s spot Bitcoin ETFs saw their largest inflow of funds in over a month today, highlighting growing Asian interest in Bitcoin investment vehicles.

JUST IN: 🇭🇰 Hong Kong #Bitcoin ETFs saw $15 million in inflows today, the highest in a month.

Slowly and steadily 🙌 pic.twitter.com/Q83tjbS0ML

— Bitcoin Magazine (@BitcoinMagazine) August 22, 2024

The ChinaAMC Bitcoin ETF took in 274 Bitcoin worth around $15 million on August 22nd, its biggest single day of inflows since July 12th. The other two Hong Kong spot Bitcoin ETFs – Bosera Hashkey and Harvest saw no flows today.

Hong Kong approved its first three spot Bitcoin ETFs earlier this year, following the launch of similar products in the U.S. and Europe. The ETFs allow investors to be exposed to Bitcoin prices without having to handle the asset directly.

While Hong Kong’s Bitcoin ETF volumes pale compared to those in the U.S., inflows have been steadily climbing. The ChinaAMC Bitcoin ETF is the largest of the Hong Kong products, with over $141 million in net assets. Bosera Hashkey and Harvest Bitcoin ETFs have around $99 million and $30 million, respectively, under management.

The total assets under management across the three Hong Kong Spot Bitcoin ETFs is approximately 4,450 BTC worth around $270 million.

While still modest, the growing inflows indicate increasing bitcoin interest and adoption among Asian institutional investors. As Bitcoin matures into an established asset class, Asian and global investors are seeking regulated exposure through products like spot ETFs.

Source link

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential