ETF

Is the Eth ETF launch a “sell the news” scenario?

Published

4 months agoon

By

admin

Spot Ethereum Exchange-Traded Funds are set to debut on July 23, following the SEC’s rule change over two months ago.

According to a report by Kaiko, the initial inflows to these Exchange-Traded Funds (ETFs) will most likely affect Ethereum’s (ETH) price. However, whether the effect will be positive or negative is still up for grabs.

“The launch of the futures based ETH ETFs in the US late last year was met with underwhelming demand, said Will Cai, head of indices at Kaiko. “All eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation. Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

Several Ethereum ETFs from BlackRock, Fidelity, Bitwise, VanEck, 21Shares, Invesco, Franklin Templeton, and Grayscale are scheduled to start trading on July 23.

What are we expecting today for the Ethereum ETFs?

We expect them to begin trading tomorrow. That means we should see a bunch of filings on SEC site today that say the ETFs’ prospectuses have gone “effective”. Likely after or around market close. Here are the race entrants: pic.twitter.com/AkBxEjBRvv

— James Seyffart (@JSeyff) July 22, 2024

The influx of money could cause ETH to surge even though last year, futures-based ETH ETFs received a lukewarm reception. There is cautious optimism about spot ETFs’ asset accumulation and how it could reflect the price of ETH.

ETH prices briefly spiked in May following spot ETF approval but have since trended lower. At $3,500, ETH is facing a crucial supply wall.

Grayscale’s ETH ETF fees

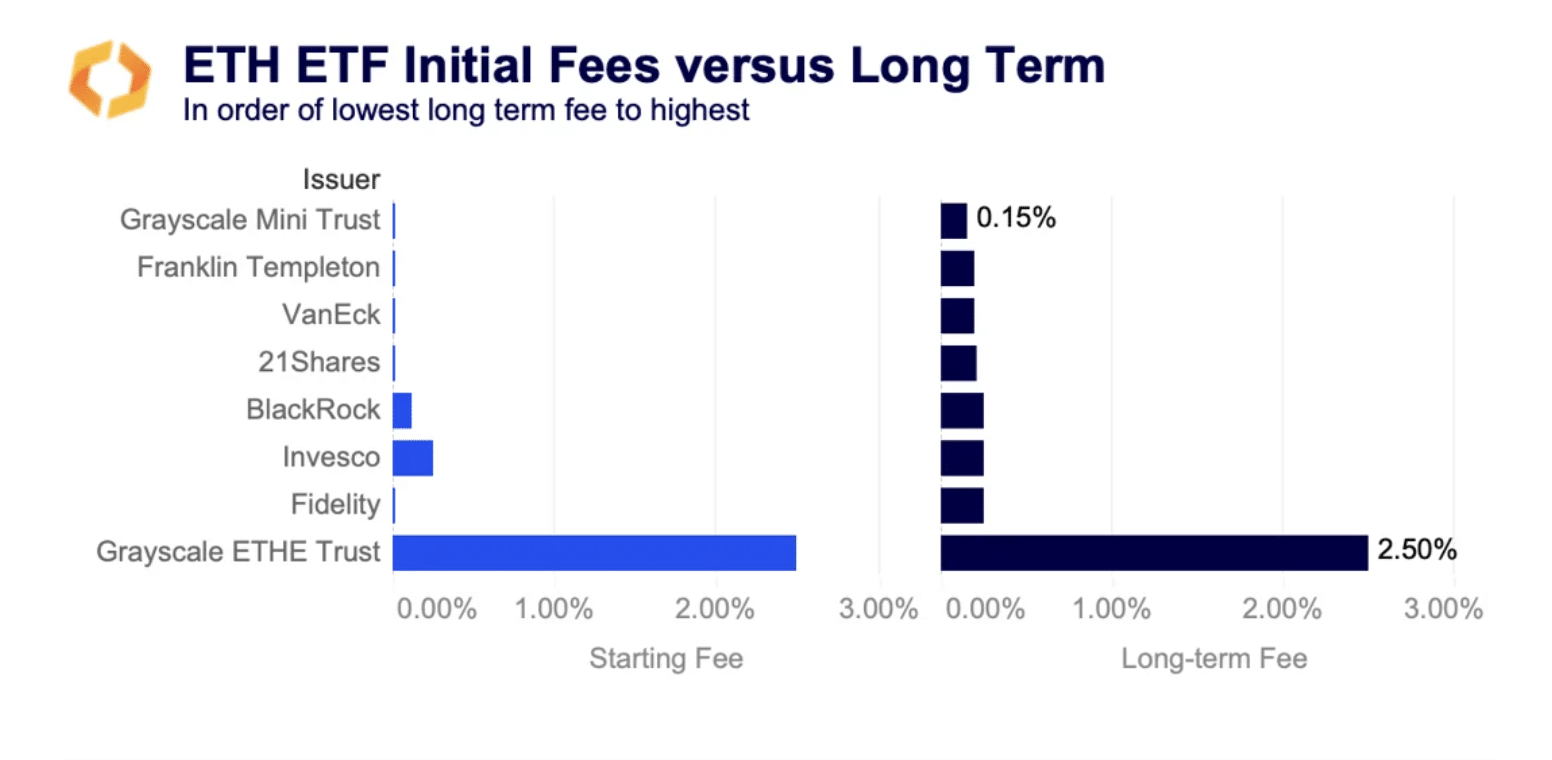

Grayscale, a prominent crypto player, plans to convert its ETHE trust into a spot ETF and introduce a mini trust seeded with $1 billion from the original fund. Grayscale’s ETHE fee will remain 2.5%, much higher than its competitors.

Most issuers will offer fee waivers to attract investors, with some waiving fees for six months to a year or until assets reach between $500 million and $2.5 billion. This fee war reflects the fierce competition in the ETF market, leading ARK Invest to exit the ETH ETF race.

This echoes Grayscale’s Bitcoin (BTC) ETF strategy, where they maintained high fees despite competitive pressures and sell-offs.

According to Kaiko, Grayscale’s decision to keep its fees high might lead to ETF outflows, leading to sell-off prices, similar to the post-conversion performance of its GBTC.

The ETHE discount to net asset value has recently narrowed, indicating traders’ interest in buying ETHE below par to redeem at net asset value post-conversion for profits.

ETH ETF volatility

Additionally, implied volatility for ETH has surged over the past few weeks due to a failed assassination attempt on Donald Trump and President Joe Biden’s announcement that he won’t run for president again. This reflects traders’ nervousness about the upcoming ETF launch.

According to Kaiko, contracts expiring in late July experienced a rise in volatility from 59% to 67%, indicating the market’s anticipation and potential price sensitivity to initial inflow numbers.

Source link

You may like

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

ETF

Get ready for new spot ETFs, hints President Nate Geraci

Published

2 days agoon

November 21, 2024By

admin

Nate Geraci, President of the ETF store, shared that major players are interested in new crypto index funds.

In a recent X post, Nate Geraci shared that established asset managers like Grayscale and Bitwise are open to new crypto index funds with a focus on Solana (SOL), Ripple (XRP) and Hedera (HBAR). This is a step in the right direction, as believed by the crypto community, as asset managers are beginning to look beyond just Bitcoin and Ethereum. Geraci noted that asset managers are looking to expand their portfolios to include other popular digital currencies in the exchange-traded funds market.

The move toward altcoin ETFs indicates a growing interest among institutional investors seeking more diverse exposure to cryptocurrencies. SOL has gained attention due to its scalability and lower transaction fees. VanEck recently filed a spot ETF to capitalize on its growing ecosystem.

In addition to crypto index fund uplistings from Grayscale & Bitwise, there are currently spot ETF filings for the following…

-SOL

-XRP

-HBARGuessing at least one issuer takes a flier on ADA or AVAX ETF as well.

— Nate Geraci (@NateGeraci) November 21, 2024

On the other hand, XRP has been in the headlines after attaining clarity regarding legality over its status as a security, which led to Bitwise asset management filing for an XRP spot ETF, showing their confidence in the prospect of the asset going long-term. Moreover, earlier this month, HBAR, powered by a robust distributed ledger, is one of the assets attracting ETF filing, in which Canary Capital submitted an S-1 registration statement, typically used during initial public offerings.

Geraci also surmised that issuers might soon begin filing for other well-known cryptocurrencies, such as Cardano (ADA) and Avalanche (AVAX). Both assets come with robust blockchain ecosystems. ADA emphasizes the security and scalability involved in its proof-of-stake consensus. At the same time, AVAX stands out for sub-second finality and a multi-chain architecture.

Still, as the need for crypto exposure increases and regulatory clarity improves, market participants remain optimistic that 2024 could witness a breakthrough for more altcoin ETFs.

Source link

Bitcoin

Franklin Templeton crypto index ETF delayed by SEC

Published

2 days agoon

November 20, 2024By

admin

Franklin Templeton, one of the crypto exchange-traded fund (ETF) issuers, has expressed interest in releasing the crypto index ETF, but the authorities are now delaying it.

The Securities and Exchange Commission (SEC) detained the deadline for approving the crypto index ETF by Franklin Templeton. According to the filing on Nov. 20, the authorities raised their concern about the sufficient time they needed to decide whether it would be accepted or declined.

“The Commission may designate if it finds such longer period to be appropriate and publishes its reasons for so finding or as to which the self-regulatory organization consents, the Commission shall either approve the proposed rule change, disapprove the proposed rule change, or institute proceedings to determine whether the proposed rule change should be disapproved,” SEC fillings.

On August. 17, based on their filing, Franklin proposed the crypto index ETF by holding Bitcoin (BTC) and Ethereum (ETH) with the ticker EZPZ. The proposed fund would allow the two most prominent crypto in the world under the same index with an unspecified ratio weighted by market capitalization.

If approved by the authorities, EZPZ would use the Coinbase custody and be listed on the Cboe BZX exchange. Franklin may add another crypto into the index but should gain approval from the SEC.

Franklin Templeton moves on crypto

Franklin Templeton, which is based in New York, is one of the most adaptable asset managers that allows investors to gain more exposure from the crypto price movement. Franklin created another crypto-related product after receiving the authority approval in January for Bitcoin spot ETF.

On October. 31, they tokenized money market funds into several blockchains, including Base, Arbitrum, Polygon, Avalanche, Aptos, and Stellar. The U.S. government money market fund (FOBXX) has $410 million in assets being tokenized into that blockchain.

Franklin also works with SBI Group in Japan to prepare for the possibility of accepting the crypto fund in the country, but this work’s development has not been published yet.

Source link

Bitcoin

Options on Bitcoin (BTC) Exchange-Traded Funds Marks Milestone, Despite Position Limits

Published

2 days agoon

November 20, 2024By

admin

Park explained on X that the exercisable risk, representing the total value of option contracts exercised or converted to actual shares, equates to less than 0.5% of IBIT’s outstanding shares. Meanwhile, the industry standard is closer to 7%, which would represent a comparative figure of 7%. To show how small the 0.5% figure is, bitcoin CME futures contracts are allowed to trade 2,000 contracts, which is the equivalent of 175,000 for IBIT.

Source link

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential