Bitcoin

Front-Running the Institutions: Generating Bitcoin Alpha at Bitcoin 2024

Published

4 months agoon

By

admin

With Bitcoin 2024 fast approaching – July 25-27 in Nashville, TN – three enterprising fund managers are competing to win $1 million in seed capital in the Bitcoin Alpha Competition powered by Samara Alpha Management in partnership with Bitcoin Magazine Pro.

In a recent podcast, Bitcoin Magazine sat down with the Bitcoin Alpha Competition judges to discuss the state of the Bitcoin market and how individual investors are leveraging their agility to front-run larger capital allocators as Bitcoin moves into the age of institutional adoption.

Patrick Lowry, judge of the Bitcoin Alpha Competition and CEO of Samara Asset Group, believes that while Spot ETFs have been a resounding success, trillions of dollars of institutional capital have yet to seize the opportunity in “the best form of money humanity has ever conceived” largely due to both regulatory and organizational burden. This has left smaller organizations – family offices and individual investors – to seize the opportunity.

Remarking upon his experience at Deutsche Digital, one of Europe’s first Bitcoin ETP issuers, Lowry noted, “I can attest how difficult it is to become an asset manager. It is unbelievably difficult to start and found your own asset management firm. I can’t even tell you how many times I’ve had my nose bloodied by an ungodly amount of regulators and compliance officers”.

“So, one of the things I’ve always wanted to do is empower new-age managers, emerging asset managers, in this asset class that I have strong belief in. [Helping] them in a way that they’re not going to have to go through the same hurdles that I went through six, seven years ago.”

Joining Lowry as judges on the judges panel are Adil Abdulali, CIO of Samara Alpha Management, and Jack Elliot, CTO of Animus Technologies and winner of the inaugural Bitcoin Alpha Competition.

Abdulali, bringing his decades of experience in the hedge fund space, noted that Bitcoin – in comparison to traditional assets – offers a unique risk profile with its heightened volatility. This volatility, especially to the upside, reduces the need for leverage to generate returns. Abdulali believes obviating the need for leverage gives capital allocators a unique option in comparison to fixed-income arbitrage, saying:

“Any time you have an unleveraged strategy that also generates high returns, and there is a drawdown… you don’t have to liquidate. You can stay in the trade for as long as it takes… any kind of leverage strategy, no matter how safe you think it is, eventually will be susceptible to [margin being called].” This ostensibly offers a new way of managing investment risk and another tool in the toolkit when searching for a return.

While Bitcoin has certainly benefited from improved sentiment around Donald Trump’s positive comments on the asset of late, even these types of moves can present risks for fund managers. Jack Elliot, a CTO focused on optimizing his firm Animus’ artificial intelligence-based strategies, noted the importance of being flexible and resilient to tail risks when it comes to modeling and trading the Bitcoin market.

“It’s just acknowledging reality… this is a space that is extremely young and is developing extremely quickly and there are going to be a number of different factors that change the way the market behaves. And some of those are going to be step-function changes… and I think there are going to be a number of those in the future… For us, it’s about staying on the horse… it’s a fun problem because [modeling the market] is intractable.”

On July 25th, Lowry, Abdulali and Elliot will select the winner of $1 million in seed capital to enable an enterprising fund manager to scale their fund strategy, selecting from the following three finalists:

- Boreal.xyz

- L1 Yield

- Hill Valley Capital

The Bitcoin Alpha Competition is one of four total tracks in the larger Pitch Day at Bitcoin 2024, where top founders and projects across Open Source, Mining + Energy and Layer 2 + Scaling will present their vision to leading venture capitalists and audience members.

Bitcoin Magazine is owned by BTC Inc, which also owns and operates the world’s largest Bitcoin conference, The Bitcoin Conference.

Source link

You may like

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

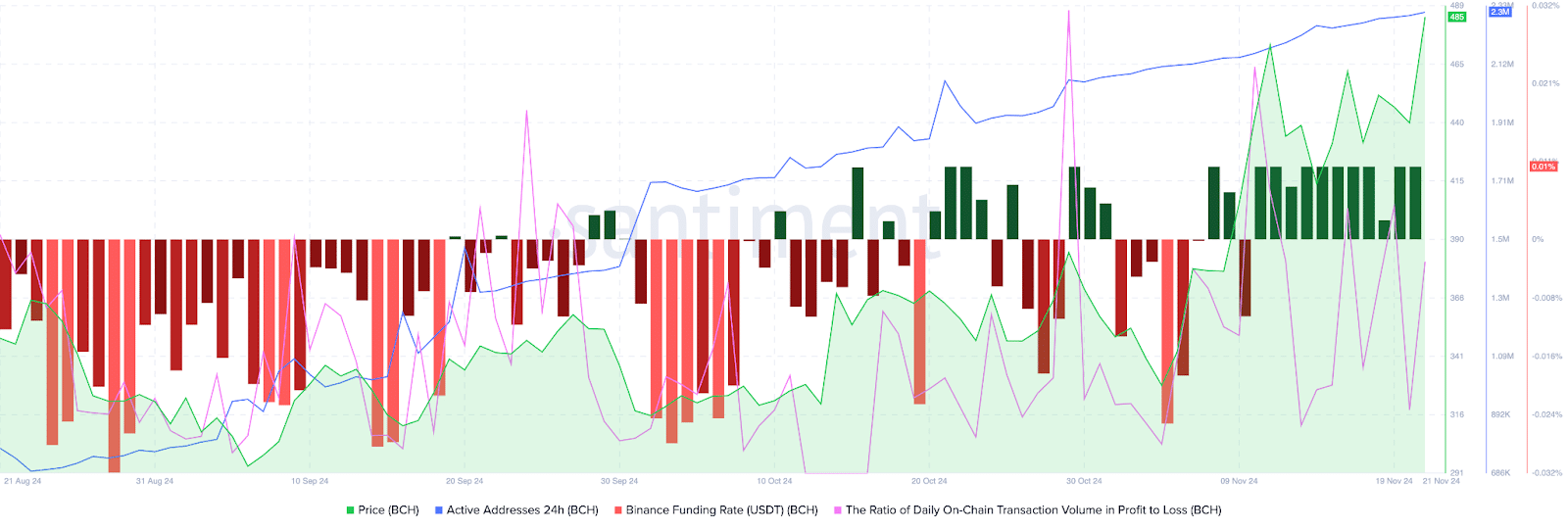

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

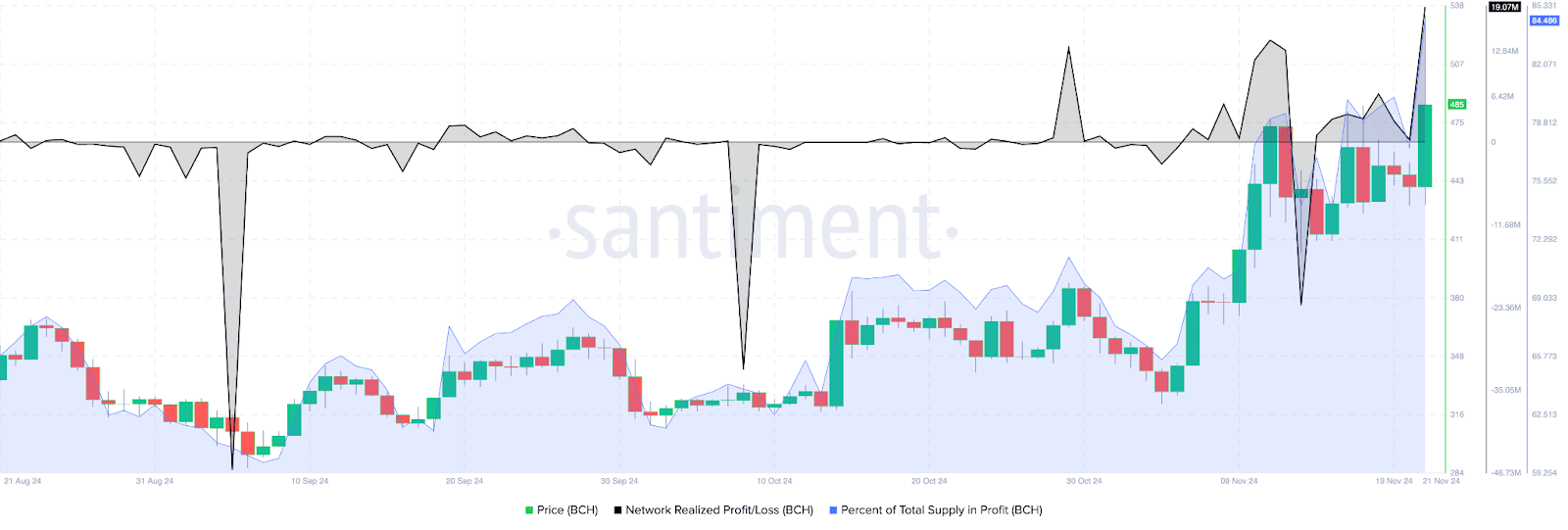

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

Derivatives traders are bullish on BCH

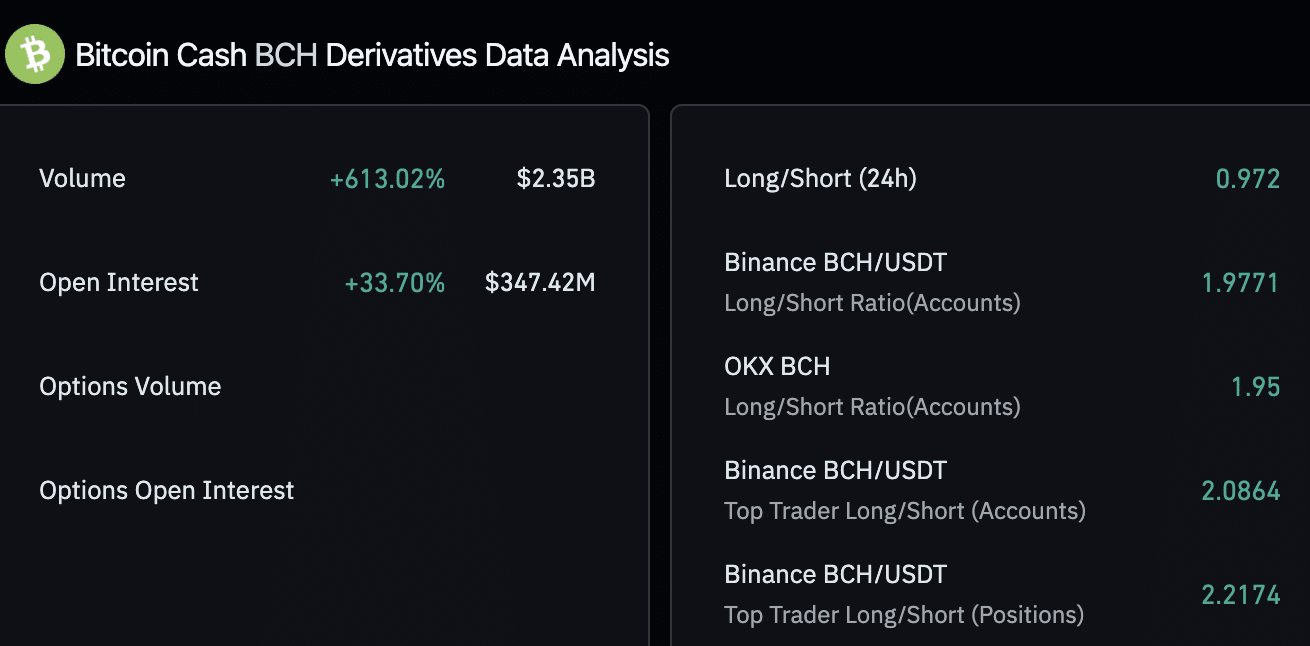

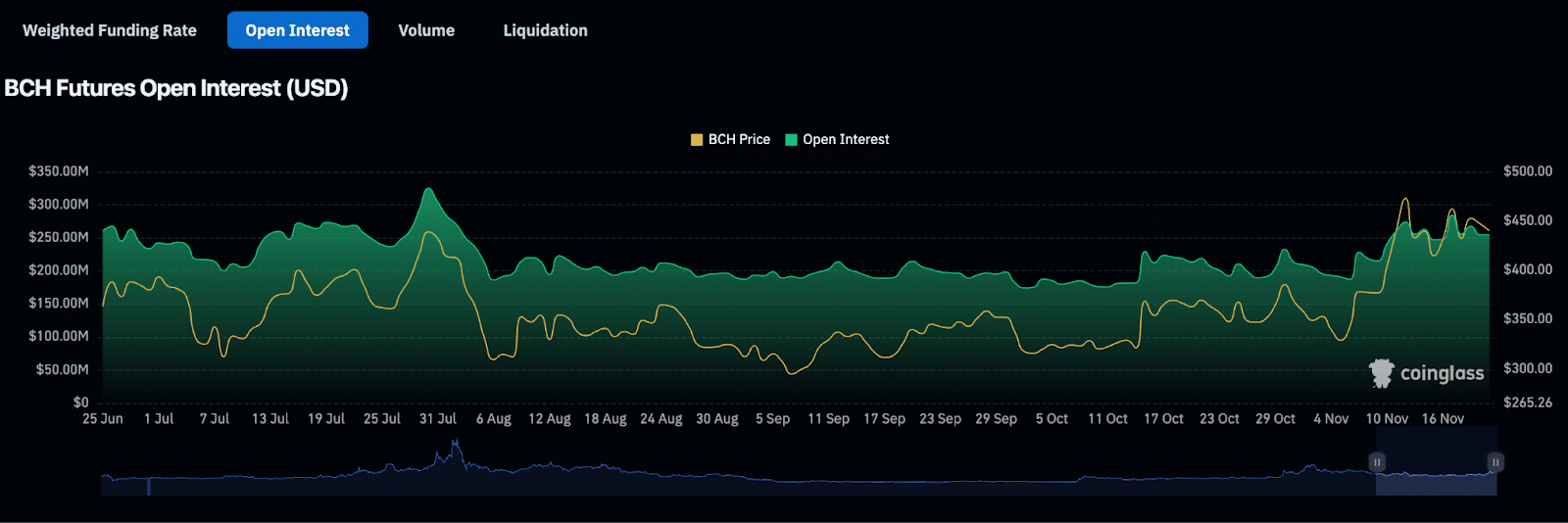

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

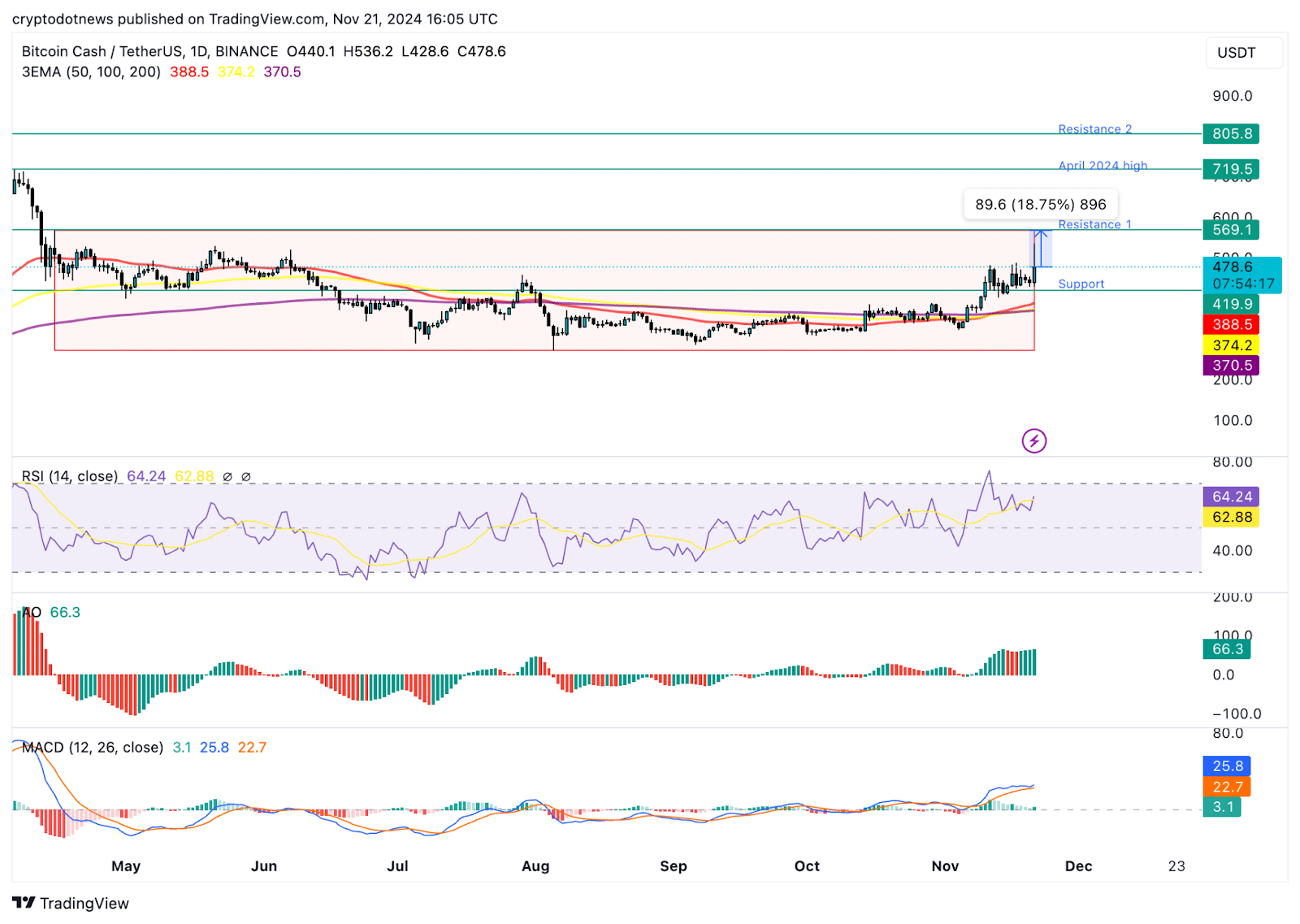

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitcoin

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Published

15 hours agoon

November 22, 2024By

adminBitcoin has shattered expectations once again, surging past the critical $93,257 level in a display of unstoppable momentum. This breakout has ignited fresh waves of bullish optimism across the crypto market, as traders and investors anticipate greater gains. With market sentiment shifting and key indicators aligning, could this be the spark for Bitcoin’s next major rally?

As optimism steadily increases in the market, the goal is to take a closer look at BTC’s impressive breakout above the $93,257 mark, analyze the positive sentiment driving its climb, and assess the potential for continued upward strength in the market.

Bullish Indicators: What’s Fueling BTC’s Uptrend?

Currently, on the 4-hour chart, BTC is sustaining its position after successfully surpassing the $93,257 mark while trading above the 100-day Simple Moving Average (SMA). By maintaining its position above this level and the 100-day SMA, BTC demonstrates resilience and capability for more price growth, targeting new highs.

An analysis of the 4-hour Relative Strength Index (RSI) shows a significant surge, climbing to 70% from its previous low of 56%, indicating strong bullish pressure for BTC. While this increase signals growing positive market sentiment, it raises concerns about the rally’s sustainability since a price correction could occur if profit-taking ensues.

Bitcoin is showing strong positive movement after breaking past the $93,257 level, supported by a rise above the 100-day SMA, reflecting sustained bullish strength and potential for continued upward movement. The fact that BTC is consistently above the 100-day SMA suggests a solid trend and that the bulls are eager to push prices higher, possibly leading to an extended growth if pressure continues to build.

Finally, the RSI on the daily chart is currently at 81%, well above the key 50% threshold, signaling a strong uptrend for Bitcoin. With the RSI at this level, it suggests that the upside pressure is likely to continue, which means that Bitcoin’s price could keep rising in the near term, as there are no signs of a reversal or decline.

What The $93,257 Breakout Signals For Bitcoin

The $93,257 breakout opens the door to a more optimistic future outlook for Bitcoin. This key resistance level has been decisively breached, suggesting that BTC may continue its upbeat momentum, potentially targeting higher price levels such as the $100,000 mark and beyond.

However, careful monitoring is essential for any signs of resistance or market corrections that could hinder its ascent. Should such a scenario occur, Bitcoin’s price could begin to drop toward the $93,257 mark. A break below this level might trigger further declines, possibly testing additional support levels in the process.

Source link

Bitcoin

Bitcoin Approaches $100K; Retail Investors Stay Steady

Published

16 hours agoon

November 22, 2024By

admin

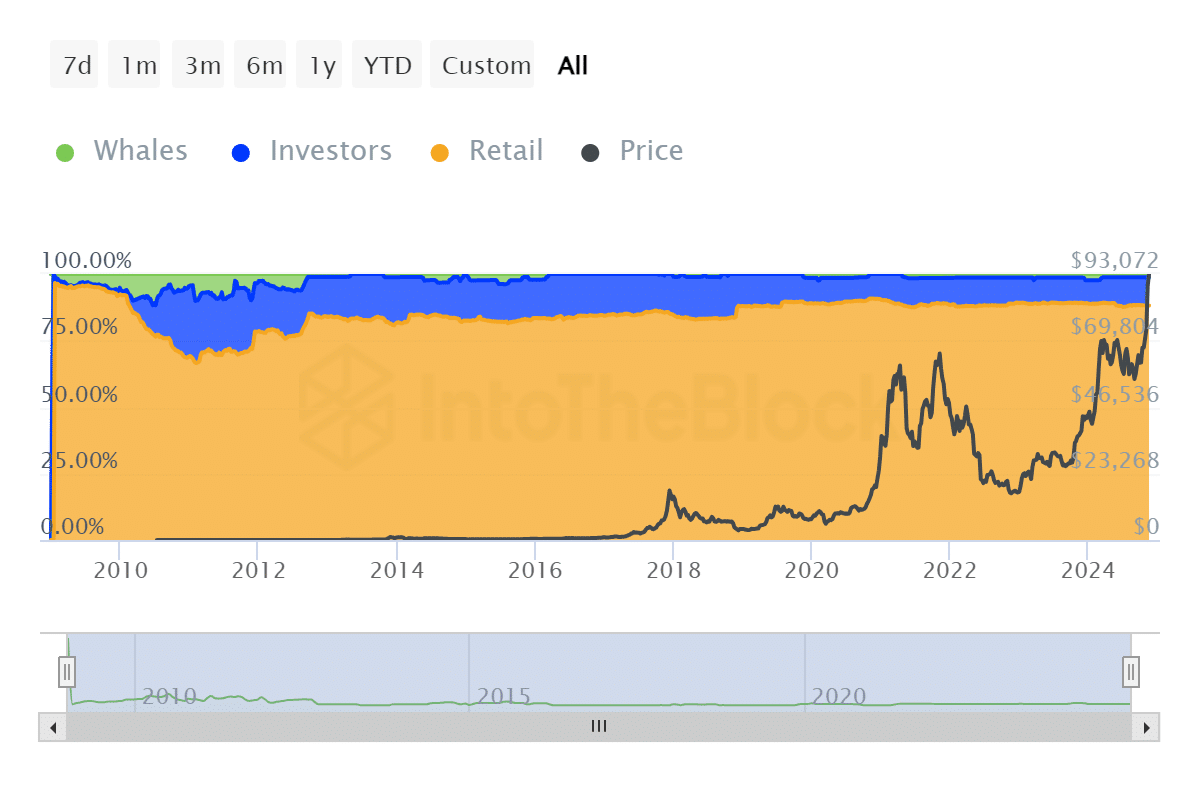

Bitcoin trades at $99,340.23, approaching the $100K mark as retail investors retain market dominance.

What is more interesting about this rally is the dominance of retail investors, who currently account for 88.07% of all Bitcoin (BTC) in circulation, according to The Block. Contrary to the recent claims that institutional investors are leaving retail investors behind in ownership of BTCs, the asset is still in the hands of retail investors, which underlines their stronghold in the market. This grassroots stronghold contrasts the much smaller shares held by whales at 1.26% and institutional investors at 10.68%.

Adding momentum to BTC, the historic debut of BlackRock’s BTC ETF options witnessed $1.9 billion in notional value traded on the first day. It is a landmark news because it signifies growing institutional interest in BTC, yet lowers entry barriers for everyday investors. But there’s still some way to go, says Jeff Park, Head of Alpha Strategies at Bitwise Invest, in his observations on X about the ETF’s potential to reshape access to BTC.

1/ Just as we expected, the market launched with a beautiful “volatility smile” quickly established by 945AM and for the rest of the day. In fact, the smile got even wider throughout the day, finishing with higher wings by EoD. pic.twitter.com/BHI09pORS4

— Jeff Park (@dgt10011) November 20, 2024

Bitcoin Breakdown:

How BTC ownership is distributed supports the overall trend of asset availability in the market. Companies such as Coinbase have substantial quantities of BTC, holding more than 2.25 million BTC. However, most of this is kept for their clients. Satoshi Nakamoto‘s wallet, which contains 96,8452 BTC, remains untouched as it played a role in creating the Genesis block.

Overall, funds and ETFs account for 1.09 million BTC, or about 5.2%, while governments such as the U.S. and China collectively hold around 2.5%.

Despite BTC witnessing price surges, the market is far from stable and often shows extreme volatility. For instance, on Nov. 21, the price of BTC dipped to $95,756.24, with trading volume reaching $98.40 billion. This volatility then reflects the vital role that retail investors play during price hikes, even as institutional investors become more active in the market.

Some argue that BTC is becoming more centralized, but the data does not back this claim. Financial products like ETFs are attractive to institutions, but they also make BTC more accessible to retail investors. BTC continues to align with Satoshi Nakamoto’s vision of a decentralized and democratized financial system. As BTC nears the $100,000 threshold, its open-and-shut conversation that BTC’s ownership remains essential.

Source link

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential