ETF

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Published

5 months agoon

By

adminJul 23, 2024 14:49 UTC

| Updated:

Jul 23, 2024 at 14:49 UTC

By Clark

On-chain activity shows early ETH investors moving large funds to the Kraken exchange as the launch of Spot Ethereum ETFs approach. This bearish activity has sparked concerns for the ETH price ahead of Spot Ethereum ETFs hitting the market. Meanwhile, investors remain unwavering on ETFSwap (ETFS) presale as market activity shows continued purchases for early adopters.

Leveraging Spot Ethereum ETFs For Early Gains

Spotonchain reported two Genesis wallets moving 3,600 ETH tokens to the Kraken exchange. Genesis wallets, meaning that these wallets mostly acquired their Ethereum (ETH) in the ICO stage and are usually whale addresses. This move counteracts expected market trends, especially as insider sources say that the Spot Ethereum ETFs will launch on July 23.

According to Spotonchain, both wallets moved exactly 3631 ETH worth about $12.5 million to the US-based exchange Kraken. The first wallet, “0xbdb3,” accounts for moving 2,631 and had previously received most of its funds from another wallet, “0xAb0′, which is an early Ethereum (ETH) ICO participant. The participant has reportedly moved 17,886 ETH worth $65 million to centralized exchanges since June 8.

The second wallet, “0xAb0,” had reportedly moved 1000 ETH worth $3.46 million to Kraken, funds also received from another ICO participant ‘0x510’. This other ICO participant initially received 100,000 ETH tokens in 2015, but his holdings have been shaved down to 49,000, worth about $170 million as of this writing.

It’s surprising for crypto analysts that these sell-offs are happening amid the excitement for spot Ethereum ETFs. The ETH price is predicted to outperform Bitcoin (BTC) once spot Ethereum ETFs begin live trading, and confident investors continue to bet toward that sentiment. As of this writing, Ethereum (ETH) is trading at $3,402.15, which is almost a 10% increase over the past week following rumors discussing the launch of spot Ethereum ETFs.

Early Investors Target Life-Changing Profits On ETFSwap (ETFS) Presale

ETFSwap (ETFS) is a new Ethereum-based platform aiming to deliver the ETF market onchan via tokenized ETFs. This means investors can trade and invest in ETF assets directly from the blockchain platform. Compared to trading the assets directly on centralized markets, ETFSwap (ETFS) has more flexibility and other benefits.

Some of these include fast settlements, 24/7 trading, quick crypto-to-ETF swaps, staking, and lending opportunities. The new ETF trading platform operates as a bridge between centralized and decentralized market dynamics. Moreover, investors will be able to use ETFSwap (ETFS) without providing KYC information, eliminating a significant hindrance for investors who prefer to maintain anonymity.

Amid the progression of Spot Ethereum ETFs and the growing popularity of ETFs, ETFSwap (ETFS) emerges as a first-mover without any competition with a comparable offering. This puts early investors in a unique position for maximum gains towards launch and way beyond.

Furthermore, ETFSwap (ETFS) will facilitate advanced trading of ETFs and cryptocurrencies. The Ethereum-based platform will provide tools, real-time market data, market-making opportunities, and up to 50x leverage in future trading. Some significant tools early adopters have eyes on are the AI-powered ETF Screener and ETF Finder, which provide recommendations based on machine learning.

Reputable blockchain security firm SolidProof recently announced that the ETFSwap (ETFS) team had passed individual KYC verification, and the project ownership has been verified. This added credence has spurred the presale onto new heights, with the beta platform launch ahead.

Conclusion

Market analysts believe that the sell-off activity on Ethereum (ETH) does not have a negative effect on the altcoin. It’s simply a case of early investors taking profit, and this opportunity is available for investors who bet early on ETFSwap (ETFS) presale. Spot Ethereum ETFs are expected to be a massive success, and ETFSwap (ETFS) is poised to benefit heavily from the traction.

Secure your early entry on the ETFSwap (ETFS) presale now at $0.01831 before the price increases to $0.03846 in the next stage.

For more information about the ETFS Presale:

Clark

Head of the technology.

#Press Release

This is a paid press release. Btcwires does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any actions related to the company.

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Bitcoin

Metaplanet shares added to Amplify Transformational Data Sharing ETF

Published

4 weeks agoon

November 28, 2024By

admin

Metaplanet has been added to the the Amplify Transformational Data Sharing ETF or BLOK, a global index that invests in leading blockchain companies including SBI Holding, MicroStrategy and Nvidia.

On Nov. 28, the Japanese investment firm announced its inclusion into BLOK, joining a lineup of 53 companies that engage in the development and utilization of blockchain technology. The ETF features leading industry players including MicroStrategy, Robinhood, Nvidia, and SBI Holdings.

According to the press release, Metaplanet’s estimated starting weight on the BLOK will be around 2.9%. As of Nov. 29, the companies occupying to top spots on the Amplify Transformational Data Sharing ETF Blockchain leaderboard include Core Scientific, HUT 8, Coinbase, Galaxy Digital, MicroStrategy and Robinhood.

BLOK is managed by Amplify ETFs and leverages an active strategy to find and invest in companies that utilize blockchain technology in its daily operations, serving as a guide for investors looking for opportunities to inject capital into the blockchain sector.

BLOK holds more than $930 million in net assets, cementing itself as a widely followed ETF in the blockchain investment landscape.

CEO of Metaplanet, Simon Gerovich, shared the news on his X account. He stated that Metaplanet’s inclusion into the Amplify Transformational Data Sharing ETF further highlights the growing recognition of Metaplanet’s Bitcoin(BTC) acquisition strategy and the firm’s status as “Japan’s leading Bitcoin Treasury Company.”

Nicknamed “Asia’s MicroStrategy” by market proponents, Metaplanet has accumulated a Bitcoin trove of 1,142 BTC, worth $109.21 million at current market prices.

Excited to announce that Metaplanet has been added to its second major ETF, the Amplify Transformational Data Sharing ETF (“BLOK”). This inclusion highlights growing recognition of our leadership as Japan’s leading Bitcoin Treasury Company. BLOK holds a 4.4% stake in Metaplanet. https://t.co/9mgfCmUtGd pic.twitter.com/d8RgaVUowm

— Simon Gerovich (@gerovich) November 28, 2024

Metaplanet currently stands in 14th place, with the ticker 3350 JP, holding a current market value of $23.04 million.

Earlier this month, Metaplanet was included in CoinShares’ Blockchain Global Equity Index, also known as the BLOCK Index. The index tracks the performance of 45 companies that dabble in crypto and blockchain technology.

As previously reported by crypto.news on Oct. 23, Japan regulators are still reluctant to adopt spot crypto ETFs despite countries like the U.S. and Hong Kong already approving ETFs, according to Sumitomo Mitsui Trust Asset Management.

Source link

Bitcoin

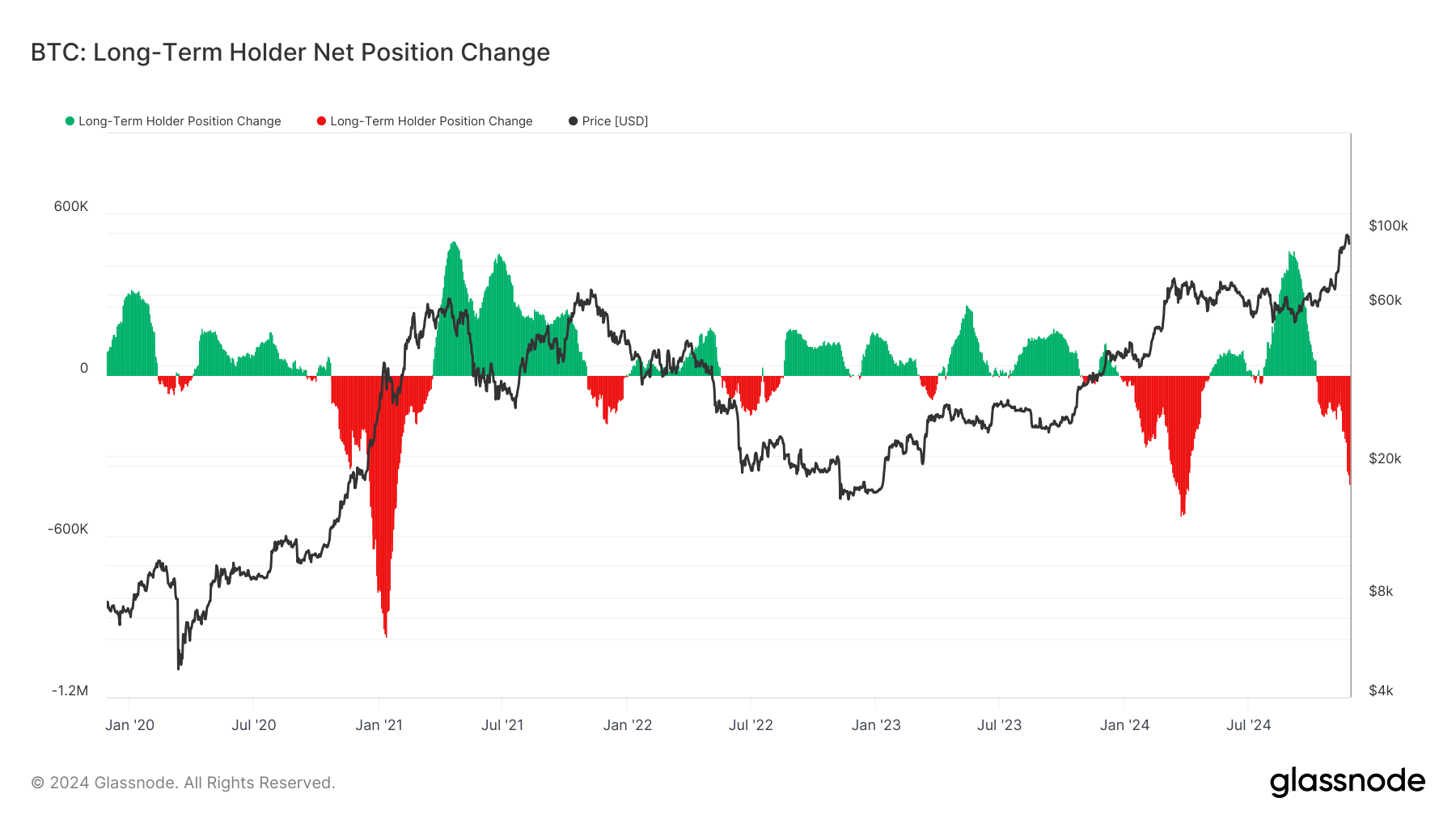

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

Published

4 weeks agoon

November 26, 2024By

admin

Bitcoin (BTC) has dropped 7.6% since it almost — but not quite — touched the psychological wall of $100,000 on Nov. 22.

That’s the biggest drop since Donald Trump won the U.S. presidential election, sparking a rally that sent the largest cryptocurrency by market capitalization soaring from a level of around $66,000 through its record high.

Even so, the slide isn’t out of the ordinary. In bull markets bitcoin typically tumbles as much as 20% or even 30%, so-called corrections that tend to flush out leverage in an overheated market.

A large part of the reason the bitcoin price didn’t get to $100,000 was the amount of profit-taking that took place. A record dollar value of $10.5 billion of profit-taking took place on Nov. 21, according to Glassnode data, the biggest day of profit-taking ever witnessed in bitcoin.

At the root of the action are the long-term holders (LTH), a group Glassnode defines as having held their bitcoin for more than 155 days. These investors are considered “smart money” because they tend to buy when the BTC price is depressed and sell in times of greed or euphoria.

From September to November 2024, these investors have sold 549,119 BTC, or about 3.85% of their holdings. Their sales, which started in October and have accelerated since, even outweighed buying from the likes of MicroStrategy (MSTR) and the U.S. spot-listed exchange-traded funds (ETFs).

How long is this selling pressure going to last?

What’s noticeable from patterns in previous bull markets in 2017, 2021 and early 2024, is that the percentage drop gets smaller each cycle.

In 2017, the percentage drop was 25.3%, in 2021 it reached 13.4% and earlier this year it was 6.51%. It’s currently 3.85%. If this rate of decline were to continue, that would see another 1.19% drop or 163,031 BTC, which would take the cohort’s supply to 13.54 million BTC.

Each time, the long-term investors’ supply makes higher lows and higher highs, so this would also be in line with the trend.

Source link

24/7 Cryptocurrency News

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Published

4 weeks agoon

November 26, 2024By

admin

Asset management firm Hashdex has made further progress toward launching a cryptocurrency-focused exchange-traded fund (ETF) in the United States. According to an announcement on Nov. 25, the company has submitted its second amended S-1 application with the U.S. Securities and Exchange Commission (SEC).

Hashdex Second Amendment for Nasdaq Crypto Index US ETF

Hashdex’s latest filing represents another step in its ongoing efforts to secure regulatory approval for the Nasdaq Crypto Index US ETF. The ETF aims to provide investors with exposure to a diversified portfolio of cryptocurrencies.

Initially, the fund will include Bitcoin (BTC) and Ether (ETH), the only two assets currently listed in the Nasdaq Crypto US Index. However, the filing noted that the portfolio could expand to include other digital currencies over time.

The amended filing comes after Hashdex’s initial S-1 application was modified in October when the SEC sought additional time to review the proposal. The SEC has historically been cautious in approving cryptocurrency-related products, and the amended filings demonstrate Hashdex’s ongoing compliance efforts to meet regulatory requirements. Despite the US SEC’s stance, firms have continued to file for Spot exchange-traded fund (ETF) like the latest one by WisdomTree for an XRP ETF.

Growing Interest in Crypto Index ETFs

Crypto index ETFs have emerged as a key area of focus for asset managers as demand for diversified investment products grows. Industry observers compare these ETFs to traditional index funds, such as those tracking the S&P 500, which provide investors with broad market exposure.

“Index ETFs are efficient for investors — just like how people buy the S&P 500 in an ETF. This will be the same in crypto,” said Katalin Tischhauser, head of investment research at Sygnum, a cryptocurrency-focused financial institution.

Hashdex is not alone in its pursuit of a cryptocurrency index ETF. Other asset managers, such as Franklin Templeton and Grayscale, are also seeking approval for similar products. The Franklin Crypto Index ETF would track the CF Institutional Digital Asset Index, which, like the Nasdaq Crypto US Index, currently focuses on Bitcoin and Ethereum. Grayscale’s Digital Large Cap Fund, which holds a basket of cryptocurrencies including Bitcoin, Ethereum, Solana (SOL), and XRP, has also applied for conversion to an ETF.

Potential Regulatory Changes and Market Implications

The regulatory landscape for cryptocurrency ETFs in the United States could shift significantly in the coming months. The SEC’s current Chair, Gary Gensler, has announced plans to step down on Jan. 20, 2025. This timeline coincides with the start of Donald Trump’s second presidential term. Trump, who has expressed a pro-crypto stance, has previously criticized Gensler’s strict approach to cryptocurrency regulation and promised reforms aimed at fostering growth in the sector.

Regulatory analysts suggest that the leadership transition at the SEC may impact the approval process for cryptocurrency-related financial products. Bloomberg ETF analyst James Seyffart stated that approval for index ETFs holding altcoins like XRP and Solana may depend on whether the SEC considers these smaller assets compliant with existing rules.

“Regulatory concerns about altcoins in index ETFs could be reduced if most of the allocation remains in Bitcoin and Ethereum,” Seyffart explained. He added that while there is optimism about these products, the ultimate decisions will likely hinge on the incoming SEC administration’s priorities and approach.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: