Culture

Bitcoin Is Cash For The Internet

Published

5 months agoon

By

admin

Bitcoin is much more than a typical online payment system. After all, we have plenty of those: PayPal, Venmo, and the like. Bitcoin and other privately used cryptocurrencies are cash for the internet.

Paper cash is an almost perfect way to pay someone. You don’t need an account. It doesn’t care who you are or what you’re buying. It’s a bearer instrument. I hand you a dollar. Now you have the dollar and I don’t. It’s instant and no one can interfere with the transaction. There is no trusting someone else to make sure the dollar gets to you. And best of all, it’s private. There is no record of that transaction whatsoever. It’s so private that there is an old joke in the cryptocurrency community: If cash were to be invented today, it would be illegal.

For all its benefits, however, paper cash is useless online. To pay someone over the internet, we have come to rely on a system of intermediaries to keep money moving. We put our money in a bank, direct that bank to send money to a company like PayPal, ask PayPal to send the money to another user’s PayPal account, they then finally have to withdraw from PayPal to a bank account from which they could choose to withdraw cash.

Every step in this process is recorded in detail by each involved company and ultimately reported to the government. And we have to rely on the companies to voluntarily execute our transaction, something which history has shown should not be taken for granted.

Unfortunately paper cash is dying as people opt for the convenience of tools like Venmo. Even face-to-face transactions for coffee that would have once been handled with paper cash are now intermediated, that is, recorded, reported, and executed under the rules set by corporations and the government.

The fact that commerce now flows through a relatively small set of intermediaries provides a convenient access point for authoritarians to place pressure needed to control what a populace can and can’t do. This risk might seem remote to those of us in stable democracies, but the reality is that states control financial systems and not all states uphold values of free expression and association.

Bitcoin and other cryptocurrencies offer a solution. They operate in a manner much more similar to cash. They are bearer instruments that can be used privately without an account. They are cash for the internet. And they break the control of intermediaries over our financial lives.

There are of course valid reasons why governments might want to monitor the flow of money and place restrictions on certain transactions. But we have increasingly seen a rise in governments succumbing to the temptation to weaponize their control of intermediaries to contain political dissent. This is the great flaw of regulation through intermediated finance.

When protests erupted in Belarus over a rigged election, the government swiftly cracked down, including through financial punishments. Protestors faced heavy fines, and employers were pressured to fire dissenting employees.

In response, the non-profit BYSOL, based in Belgium, provided financial aid to protestors. However, as the protests were deemed illegal, traditional financial intermediaries, complying with the law, seized protester funds and froze their accounts. Electronic transfers were monitored, and cash was confiscated at the border. BYSOL turned to Bitcoin, allowing protesters to receive funds in personal wallets and make small swaps with locals, evading this net of state mandated financial surveillance.

In Russia, Putin’s opposition was labeled an extremist group, making donations illegal. As in any country, financial intermediaries had no real choice but to comply with the law. These intermediaries had been effectively weaponized to police political activity. Alexei Navalny’s Anti Corruption Foundation turned to cryptocurrency, supercharged with the privacy enhancements provided by tools such as Wasabi Wallet, to survive. Russian citizens could continue putting money behind their opposition to Putin with this powerful new capability.

In Myanmar, the Junta implemented strict Know Your Customer rules and cracked down on physical cash, forcing all economic activities into a surveilled system prone to arbitrary account freezes. In Iran, new rules have been proposed to automatically deduct fines from the bank accounts of women who defy laws mandating a Hijab.

Even in the U.S., this issue could arise. The recent overturning of Roe v. Wade endangers abortion access. If funding abortion services becomes illegal, payment providers might be forced to comply with the law or provide evidence to law enforcement. Many abortion pill websites use services like PayPal and Stripe for payments, and if these services are cut off, cryptocurrency could become a crucial alternative. Similar financial threats to access exist for all hot-button issues. It’s hard to control people but it’s easy to control intermediaries.

Moving beyond direct legal control of intermediaries, it’s also important to consider another flaw in the intermediated financial system. These are private companies that have their own considerations and values. Many of them are publicly traded. This makes them susceptible to the whims of public opinion.

Why would a company like PayPal take on the reputational risk of processing payments to industries that some find unsavory, even if they are legal? There are endless cases of adult creators being kicked off platforms, or marijuana businesses, or outspoken political voices. At the end of the day, it’s a lot easier for them to just kick those people out so they can focus on their core business. If every company makes that same calculation those businesses are effectively killed even if they followed the rules.

Meanwhile cash, both paper and now cryptocurrency, are neutral systems that are immune from the whims of not only authoritarians, but the mob as well. Cryptocurrencies are cash for the internet. You don’t need an account, just a computer and internet access. They can’t have an opinion on what you’re doing. They don’t spy on you. And no one can interfere with your ability to transact with them. They are essential tools for protecting our ability to exist as free people in the digital era and are a check on authoritarianism made so much easier by a centrally intermediated internet.

This is a guest post by Neeraj Agrawal. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

The Islamic conceptualisation of finance is built around a set of core principles which give primacy to honesty, fairness and accountability in trade and transactions. As such, Islamic finance seeks uphold justice, transparency, and shared prosperity in economic systems. Arguably, fiat currency achieves the exact opposite of these principles, since it introduces uncertainty, speculation and inequities that punish the poor, who earn and spend fiat, and favours the rich who invest in assets that benefit from inflation. In this backdrop, Bitcoin emerges as a solution that aligns remarkably well with Islamic finance principles. This article explores why Bitcoin, with its decentralization, transparency, and scarcity, represents the most Islamic form of money, offering transformative potential for the Muslim world.

The foundational principles of Islamic finance include:

1. Prohibition of Riba (Usury):

Interest-based lending, where money generates money without productive activity, is strictly forbidden in Islam. Riba fosters exploitation, concentrates wealth, and undermines social equity.

2. Prohibition of Gharar (Uncertainty):

Transactions should be free from undue speculation or ambiguity. Clear terms and honest practices are paramount.

3. Asset-Backed Economy

Trade and transactions should involve tangible assets or productive activities. Wealth must be earned through legitimate means, not through gambling or speculative bubbles.

4. Risk Sharing

Islamic finance emphasizes equity-based partnerships where profit and loss are shared, ensuring mutual benefit and fairness in all financial dealings.

5. Justice and Equity:

Wealth distribution should serve societal needs, promoting fairness and reducing economic disparities.

One could very credibly argue that the current fiat-based monetary system flagrantly violates these tenets. Central banks set interest rates that underpin the entire fiat system, institutionalizing usury. Money created out of debt inherently generates unearned profits for lenders while indebting others, fostering exploitation and inequality. The fiat system disproportionately benefits those closest to the source of money creation (e.g., banks, governments) at the expense of ordinary people. This “Cantillon Effect” exacerbates wealth inequality, violating Islamic values of equity and justice.

Fiat currencies are prone to inflation and devaluation due to their unlimited supply. This creates uncertainty and speculative behaviour, further destabilizing economies and harming the most vulnerable. Unlike gold or tangible assets, fiat money is not backed by any physical commodity. It is merely a promise of value, eroding trust and violating Islam’s emphasis on tangible, asset-backed wealth. Centralized control of money by a few institutions undermines accountability, fosters corruption, and allows governments to manipulate currencies to serve political agendas, often to the detriment of their citizens. These systemic flaws have led to financial crises, inequality, and the erosion of societal trust.

Bitcoin, the world’s first decentralized digital currency, aligns closely with the ethical and economic teachings of Islam. Bitcoin operates without interest-based mechanisms. Its decentralized nature ensures that no central authority can create money out of thin air or profit unjustly through usury. Every Bitcoin transaction is recorded on an immutable public ledger, the blockchain. This ensures honesty and accountability, eliminating the uncertainty associated with opaque fiat systems.

Bitcoin’s supply is capped at 21 million coins, making it a deflationary asset. Its scarcity mirrors the attributes of gold, historically accepted as sound money in Islamic societies. Unlike fiat money, Bitcoin is not controlled by any government or institution. Its decentralized network empowers individuals and fosters equity, aligning with Islam’s emphasis on justice and fairness.

Bitcoin is not a speculative promise; it is earned through “proof-of-work,” which requires significant energy and computational effort. This tangible cost of production imbues it with intrinsic value, resonating with Islamic financial principles. Bitcoin allows anyone with an internet connection to participate in the global economy. This inclusivity aligns with Islam’s vision of reducing economic barriers and promoting universal access to financial resources. Through its adherence to these principles, Bitcoin offers a viable alternative to the exploitative fiat system, paving the way for a more just and equitable financial future.

Adopting Bitcoin on a wide scale could revolutionize the Muslim world, unlocking unprecedented economic opportunities. Many Muslim-majority countries suffer from chronic inflation, eroding the value of their fiat currencies and impoverishing their citizens. Bitcoin’s deflationary nature provides a hedge against inflation, preserving wealth over time. Millions of Muslims remain unbanked due to lack of access to traditional financial services. Bitcoin’s decentralized system allows individuals to store and transfer wealth securely without relying on banks, fostering economic empowerment. Muslim-majority countries are among the largest recipients of remittances. Bitcoin enables faster, cheaper, and more secure cross-border transactions, reducing reliance on costly intermediaries.

By decentralizing money creation and eliminating the privileges of central banks, Bitcoin ensures a fairer distribution of wealth, addressing economic disparities that plague many Islamic societies. Bitcoin’s transparent system facilitates the development of Shariah-compliant financial products and services, promoting ethical investment opportunities in line with Islamic values. Bitcoin enables nations to reduce their dependence on the US dollar and other foreign currencies, strengthening their economic sovereignty and resilience. By enabling trustless, borderless transactions, Bitcoin fosters trade within the global Muslim community, encouraging innovation and economic integration across nations.

Bitcoin is more than just a technological innovation; it is a financial system rooted in justice, transparency, and equity—values deeply embedded in Islamic teachings. As the Muslim world grapples with the challenges of fiat-based economies, Bitcoin offers a path toward economic independence, financial inclusion, and societal prosperity. By embracing Bitcoin, the Muslim world can align its financial systems with the timeless principles of Islam, paving the way for a fairer and more sustainable future.

This is a guest post by Ghaffar Hussain. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

2024 Election

Bitcoin is Neither Racist, Xenophobic, nor Misogynistic: A Response to Ideological Stereotyping

Published

4 weeks agoon

November 27, 2024By

admin

Just hours after the U.S. election results were announced, I received messages from friends filled with striking assumptions. Some congratulated me, mockingly saying, “Congrats, your side won for Bitcoin.” Others expressed disapproval with remarks like, “It’s pathetic!” and “I’m shocked that Americans just voted for Hitler.” One friend said, “You were lucky to find safety in the U.S. as a refugee under Biden’s administration. Refugees and asylum seekers will now face a harder time here, but, hey, it’s still good for your Bitcoin.” Many of these friends work in high-level corporate jobs or are university students.

As a Green Card holder, I was not eligible to vote, but I recognize their huge disappointment in seeing their preferred candidate lose. Their frustrations were directed at me because they know I support Bitcoin and work in the space. I understand that making me a scapegoat says less about me and more about their limited understanding of what Bitcoin’s value represents.

I’m aware that in this highly polarized political landscape, ideological stereotyping becomes evident—not only during election season but also in spaces where innovative thinking should be encouraged. A prime example of this ideological bias occurred during the Ohio State University commencement, where Chris Pan’s speech on Bitcoin was largely booed by students attending their graduation ceremony. I admire the courage it took to stand firm in front of over 60,000 people and continue his speech. My guess is that most of these graduating students have never experienced hyperinflation or grown up under authoritarian regimes, which likely triggered an “auto-reject”’ response to concepts beyond their personal experience.

I’ve encountered similar resistance in my own unfinished academic journey; during my time at Georgetown, I had several unproductive conversations with professors and students who viewed Bitcoin as a far-right tool. Once a professor told me, “Win, just because cryptocurrency (he didn’t use the term Bitcoin) helped you and your people in your home country doesn’t make it a great tool—most people end up getting scammed in America and many parts of the world. I urge you to learn more about it.” The power dynamics in academic settings often discourage open-minded discourse, which is why I eventually refrained from discussing Bitcoin with my professors.

I’ve learned to understand that freedom of expression is a core American value. Yet, I’ve observed that certain demographics or communities label anyone they disagree with as ‘racist.’ In more extreme cases, this reaction can escalate to using influence to have people fired, expelled from school, or subjected to coordinated cyberbullying. I’m not claiming that racism doesn’t exist in American society or elsewhere; I strongly believe both overt and subtle forms of racism still persist and are well alive today.

Although bias and inequality remain widespread, Bitcoin operates on entirely different principles. Bitcoin is borderless, leaderless, and accepting of any nationality or skin color all while without requiring any form of ID to participate. People in war-torn countries convert their savings into Bitcoin to cross borders safely, human rights defenders receive donations in Bitcoin, and women living under the Taliban get paid through the Bitcoin network.

Bitcoin is not racist because it is a tool of empowerment for anyone who is willing to participate. Bitcoin is not Xenophobic because it gives those forced to flee their homes the power to carry their hard-earned economic energy across borders and participate in another economy when every other option is closed. For activists, often branded as ‘criminals’ by authoritarian regimes, it supports them through frozen bank accounts and blocked resources. For women, enduring life under misogynistic rule, Bitcoin offers a rare chance for financial independence.

Going back to the U.S. election context, Bitcoin not only levels the playing field for people in the world’s most forgotten places and darkest corners, but it also opens new avenues for U.S. presidential candidates to engage with this growing community. President-elect Donald Trump has made bold promises regarding Bitcoin, signaling a favorable policy. In contrast, Democratic candidate Vice President Kamala Harris’s campaign reportedly declined to support the Bitcoin community. Grant McCarty, co-founder of the Bitcoin Policy Institute, stated, “Can confirm that the Harris campaign was offered MILLIONS of dollars from companies, PACs, and individuals who were looking for her to simply take meetings with key crypto stakeholders and put together a defined crypto policy plan. The campaign never took the industry seriously.” I believe this is something most people may be unaware of, and confirmation bias often leads to the assumption that all Bitcoin supporters back every policy of the other side, including potential drastic changes to America’s humanitarian commitments such as refugee resettlement and asylum programs, anti-trafficking and protection of vulnerable populations, and foreign aid and disaster relief.

Most people around the world lack a stable economic infrastructure or access to long-term mortgages; they live and earn with currencies more volatile than crypto gambling and, in some cases, holding their own fiat currency is as dangerous as casino chips, or worse.

The Fiat experiment has failed the global majority. I believe that Bitcoin and Bitcoin advocates deserve to be evaluated on their merits and work on global impact, rather than through the binary lens of political bias, misappropriated terms, or factually flawed yet socially accepted diminutive categorizing, which allows them to opt out of learning and evaluating assumptions.

This is a guest post by Win Ko Ko Aung. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Today’s modern Bitcoin exchanges have drastically improved access to Bitcoin ownership in 2024. Gone are the days of janky peer-to-peer (P2P) trade forums and questionably secure early exchanges like Mt Gox. Instead, a legion of Bitcoin on-ramps focused on superior security and user experience (UX) has made purchasing your first Bitcoin a breeze. Many of these services have even embarked on education-focused initiatives to encourage greater adoption during Bitcoin’s most recent bear market. In November 2023 Swan launched Welcome to Bitcoin, their free introductory 1 hour course about Bitcoin. In December 2023, Cash App released BREAD, a free, limited-edition magazine that uses design to tell stories and educate readers about Bitcoin in a relatable and accessible way.

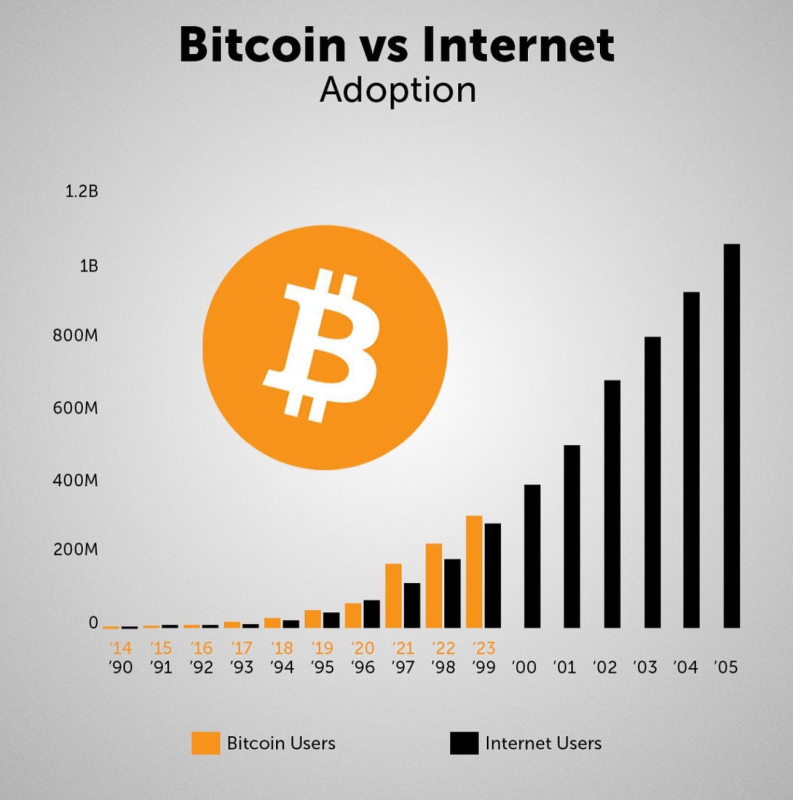

What these initiatives show is that Bitcoin adoption is approaching a turning point. These two major Bitcoin exchanges, along with the industry as a whole, are discovering that easy access to a smash buy button does not guarantee purchase. Numerous barriers to entry still exist for nocoiners, which provide significant constraints to understanding Bitcoin, and thus throttle Bitcoin’s growth and adoption. As we approach a steeper incline in Bitcoin’s bell curve, throwing novices into exchange apps without sufficient education and cultivation is no longer a strategy for success.

What once was a far simpler task of energizing early adopters and cypherpunks around Bitcoin’s clear value proposition, is evolving into a more complex and convoluted process of orange-pilling the early majority of future Bitcoin holders. This, we hope, will then lead to widespread Bitcoin mass adoption as society en masse chooses to store its time and energy in the best money ever created. For this hyperbitcoinization to occur, more people need to understand the intricacies of Bitcoin. This is easier said than done because Bitcoin still has an education problem:

- An Economist Intelligence Unit study reported that 51% of people said a lack of knowledge is the main barrier to Bitcoin ownership.

- A YouGov survey found that 98% of novices don’t understand basic Bitcoin concepts.

- A nationwide survey from the Yale Center discovered that 69% of young people find learning boring.

This research outlines the struggle of onboarding and educating the next generation of Bitcoiners, most notably younger generations who have been shown to possess a limited attention span of 8 seconds. For inspiration to help solve this problem, we can look at one of the most popular mobile games of all time… Pokémon GO.

Pokémon GO was and remains to be, a global phenomenon. This beloved app caught the attention of Gen-Z, millennials, and Gen-X alike, boasting record-breaking engagement stats:

- In 2016, the game peaked at 232 million active players.

- Pokémon GO has grossed over $6 billion in revenue.

- In 2024, 24% of 18–34-year-olds in the US are playing Pokémon GO, while 49% of 35–54 year-olds are playing.

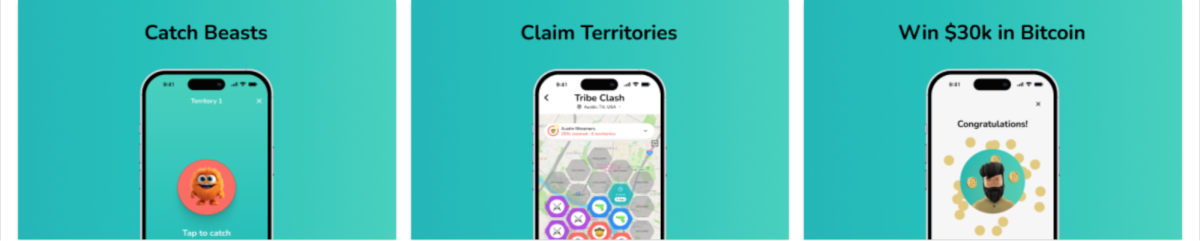

We at Jippi believe that the success of this award-winning game can illuminate the path forward for Bitcoin adoption. So we have set upon the electrifying task of building Tribe Clash–the world’s first Pokémon GO-inspired Bitcoin education game. The rules are simple, create or join a Tribe and battle for dominance over a city with your friends by catching a Bitcoin-themed Beast in every Territory.

Each week Jippi will release a new Territory to be claimed. A Tribe member will explore that Territory with their phone, where they will discover a Bitcoin Beast to catch. If they successfully answer all Bitcoin quiz questions correctly the fastest, they will then catch that beast. The Tribe with the most Territories and Bitcoin Beasts at the end of the game will win $30k worth of Bitcoin to be dispersed equally to each Tribe member.

Our vision is for Jippi to become the largest, most popular platform for beginners to gather, educate, and accumulate Bitcoin. We see Jippi as the most accessible on-ramp into the industry, where we can educate a whole new generation of Bitcoiners from novices to experts by lowering the barrier to entry.

You can support the development of Tribe Clash by contributing to our crowdfunding campaign on Timestamp. Timestamp enables investors of all backgrounds to support Bitcoin-only companies and make an impact. Our campaign is open to both the general public and accredited investors, so we would love for you to join us on this journey.

This is a guest post by Oliver Porter. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential