Feature

How is the Catizen related?

Published

4 months agoon

By

admin

The Telegram mini-game Catizen earned $16 million in in-game purchases and donated 1% to saving stray cats.

Telegram founder Pavel Durov said that Catizen earned $16 million from in-game purchases. They also donated 1% of this amount to save homeless cats.

According to Durov, within a few months, Catizen attracted more than 26 million users. In addition, its team has also developed tools to allow other developers to easily launch their projects based on The Open Network (TON) on Telegram.

“Catizen introduced millions of people to blockchain because it uses TON-based smart contracts for its in-game rewards.”

Pavel Durov, Telegram founder

Durov also noted that he is a dog lover. Therefore, he is looking forward to the developers of Catizen launching a game about his favorite pet, Dogizen.

Catizen gains popularity in the blockchain space

In early June, Catizen took first place in the App Battle competition of The Open League’s third season after winning the App Battle of The Open League’s second season.

“Congratulations to Catizen, Yescoin, SquidTG, Getgems, Fanton, TON Punks, and Tonano, who have won a combined reward of $500,000 in Season 3.”

The Open League team

The project’s achievements attracted the Binance Labs team, the venture capital division of the largest crypto exchange. They invested in Pluto Studio, the studio behind Catizen. The investment amount is not disclosed.

“Pluto Studio will use this new funding to fuel growth of the platform through supporting the development of the Catizen mini-app and game engine constructions, making it easier for more developers to join the Catizen ecosystem.”

Binance Labs team

What is known about Catizen

Catizen, a gaming bot on Telegram, immediately caught the attention of users, including those who actively use the TON blockchain. The Catizen community has grown to 25 million gamers, with approximately 1.5 million users constantly online.

The game takes place in a digital universe called Meowverse, which is entirely dedicated to cat themes. In this world, users can complete various tasks and receive valuable rewards.

In Catizen, gamers run a cat cafe where patrons pay to spend time with cats. When customers take a level 1 cat to play, players receive some in-game currency vKITTY.

Players also get unique IDs that provide access to the Launchpool and open up new opportunities within the game. Additionally, users actively participate in various events and competitions to earn airdrops through the play-to-airdrop mechanics.

According to the project team, the clicker’s native token, CATI, is planned to be launched and will also be available for staking. Players will receive 41% of the total CATI supply as an airdrop.

A new trend in the blockchain community

Tap-to-earn games have sparked significant growth in the TON ecosystem by offering simple game mechanics and tangible rewards. The mini-game boom on Telegram has accelerated the adoption of cryptocurrencies and set a new standard for integrating digital assets into social and gaming platforms.

Amid the growing popularity of mini-games on Telegram, Durov announced that the messenger will have a Mini Apps store and a built-in browser with web3 support by the end of the month.

According to the Telegram team, more than 500 million users interact with mini-apps monthly, purchasing goods and accessing services and games. The platform’s integration with the TON blockchain has led to a surge in the popularity of crypto-based games, especially after the success of Notcoin.

The popularity of Telegram has attracted scammers

Amid the growing popularity of Telegram, experts warned of an increase in the number of attacks. Thus, the Slow Mist platform reported an increase in the number of phishing attacks aimed at TON users.

Analysts say attackers distribute malicious links or bots in various Telegram channels. They most often do this under the guise of announcing an airdrop.

TON 生态的钓鱼开始多了,Telegram 生态过于自由的特点,许多钓鱼链接(或 bot 形式)通过消息群组方式传播,空投等诱骗方式来批量钓走用户 TON 钱包里的有关资产(包括 NFT,特别的如 Anonymous Telegram Numbers,类似手机号,许多人用于创建 Telegram 账号,这个被钓走,意味着对应的 Telegram…

— Cos(余弦)😶🌫️ (@evilcos) June 24, 2024

In addition to cryptocurrency, attackers steal anonymous numbers in the messenger, which are used to create additional accounts on Telegram. If the number is stolen, the user will completely lose control over the profile.

Should you pay attention to Catizen and other mini-games?

Games with tap-to-earn mechanics provide insight into cryptocurrency games’ potential. Their affordability and ease of use make them attractive to those interested in exploring the world of cryptocurrencies.

The rapid rise in popularity of mini-games like Catizen demonstrates the community’s interest in cryptocurrencies and provides an accessible entry point into the blockchain space for everyone.

Source link

You may like

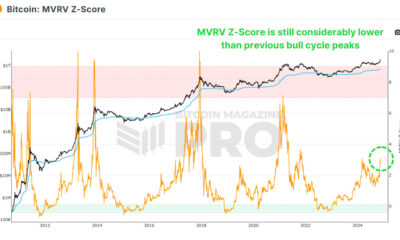

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Donald Trump

Over 250 Pro-Crypto Candidates Enter the US Congress

Published

1 week agoon

November 13, 2024By

admin

Preliminary results of the U.S. Congressional elections show that more than 250 candidates who support the digital asset sector have made it into the new legislature.

As FOX Business reports, the elections were held simultaneously with the presidential election, won by Donald Trump. Journalists note that representatives of the digital asset industry donated more than $200 million to pro-cryptocurrency candidates, which is a record amount.

Some crypto supporters could bypass experienced legislators who have been in Congress for many years. For example, in Ohio, Republican Bernie Moreno defeated Democrat Sherrod Brown, who had been in Congress for 18 years. In Pennsylvania, votes are still being counted in the standoff between Bitcoin (BTC) supporter Dave McCormick and Democrat Bob Casey.

Other pro-crypto winners include Jim Justice (West Virginia), Jim Banks (Indiana), Kirsten Gillibrand (New York), and Ted Cruz (Texas). Financial support from industry insiders also helped achieve success in Arizona, California, Colorado, Iowa, Michigan, and Virginia.

Experts point out that most of the latest members of Congress who support digital assets are Republicans, who traditionally advocate for the rapid integration of cryptocurrencies into the country’s financial system. Representatives of the crypto sector continue to discuss Trump’s victory, confident that his return to the White House could lead to a “golden age” for the industry.

The most vivid pro-crypto politicians: Who are they?

Bernie Moren

Republican Bernie Moreno has won in the Ohio Senate race, unseating incumbent Democrat Sherrod Brown. Moreno, a car dealer and blockchain entrepreneur, defeated Brown, who is critical of cryptocurrency and chairs the Senate Banking Committee.

Moreno, born in Bogota, Colombia, is a cryptocurrency advocate and a frequent speaker at industry conferences. In 2018, he co-founded ChampTitles, a company aimed at simplifying the process of obtaining car titles. He recently sold his stake in the company.

The political action committee (PAC) Fairshake has poured nearly $40 million into the campaign against Brown, an ally of the Securities and Exchange Commission (SEC) Chairman Gary Gensler, which has been vocal in its opposition to the crypto sector. Fairshake’s backers include Coinbase Global and Ripple Labs.

Moreno has also clashed with Elizabeth Warren, one of the Senate’s most prominent cryptocurrency opponents.

Forever politicians like Sherrod Brown and Joe Biden don’t understand the first thing about crypto and are totally unqualified to regulate it. They are obsessed with destroying crypto because they hate American innovation.

I’ll lead the fight to defend crypto in the US Senate. pic.twitter.com/yiZvv3OiGl

— Bernie Moreno (@berniemoreno) June 29, 2024

Coinbase CEO Brian Armstrong commented on Moreno’s victory and announced the creation of the most pro-crypto Congress in U.S. history:

“Welcome to America’s most pro-crypto Congress ever.”

Brian Armstrong, Coinbase CEO

Jim Justice

West Virginia Governor Jim Justice has successfully captured the Senate seat previously held by Democrat Joe Manchin.

Justice has received strong support from the pro-crypto super PAC Defend American Jobs, contributing $3 million to his campaign. Armstrong also backed the candidate with a $3,300 donation, praising his commitment to digital assets.

Justice, a former Democrat, switched parties in 2017 and has openly supported Donald Trump, calling him a close friend and pointing out the severe problems the country faces without his leadership. Justice has supported blockchain, artificial intelligence, and other cutting-edge technologies in line with Trump’s stance on cryptocurrency.

During his campaign, Justice campaigned against central bank digital currencies (CBDC) and emphasized the importance of precise regulation of cryptocurrencies. On his campaign website, he focused on creating a secure digital market to protect American investors and promote digital asset innovation and job creation.

🎉 We did it, West Virginia! Thank you for your incredible support! I’m honored to be your next U.S. Senator. Together, we will fight for our values and build a brighter future for our state and nation. pic.twitter.com/nursESIVKt

— Jim Justice (@JimJusticeWV) November 6, 2024

Ted Cruz

Longtime U.S. Senator Ted Cruz is a vocal supporter of cryptocurrencies. He has spoken out publicly in defense of the market. In 2021, he opposed a crypto tax as part of an infrastructure bill to raise about $28 billion over a decade. Cruz also proposed allowing merchants and businesses in Washington to accept crypto payments.

He is also against a digital dollar, emphasizing that U.S. digital currency policy should protect user privacy, maintain dollar dominance, and encourage innovation. Cruz points out that, unlike decentralized cryptocurrencies such as Bitcoin, a digital dollar could lead to control over citizens’ private transactions.

How crypto giants funded the U.S. elections?

The crypto industry actively funds the U.S. elections, donating over $200 million to various political committees, candidates, and organizations. This significant funding underscores the sector’s influence on the 2024 elections.

🚨NEW: With just one week out from Election Day, we’re getting some new #crypto election spending numbers. According to recent @FEC filings, the crypto industry has now donated well over $200 million to various PACs, candidates and political organizations. More to come on this.…

— Eleanor Terrett (@EleanorTerrett) October 29, 2024

Trump’s campaign has received support from prominent players in the crypto industry. Elon Musk, one of the world’s richest man, is a significant donor to Trump’s campaign and the sole donor to America PAC. From July to September, the committee spent $72 million to support Trump, underscoring its commitment to the Republican agenda.

Vice President Kamala Harris, meanwhile, has also received support from influential figures in the crypto industry. Ripple co-founder Chris Larsen led her donor list with a massive $11.7 million contribution. Other supporters have also focused on her, including tech investor Vinod Khosla with a $1 million donation and early Coinbase investor Reid Hoffman with a $250,000 contribution.

The rise of crypto donations became a significant factor in the 2024 presidential election, highlighting the industry’s interest in shaping regulation. These financial infusions could impact the candidates’ campaigns and crypto regulation policy moving forward as the election approaches, and both sides could benefit from the crypto industry’s support.

Source link

bull market

How Trump’s Promises Could Influence BTC $250k forecast

Published

2 weeks agoon

November 7, 2024By

admin

As analysts predict Bitcoin could reach $250K, how might Trump’s promises influence this potential? What should you be watching for in the coming months?

Trump triumphs

Donald Trump is back in the Oval Office, officially winning the 2024 U.S. presidential election as the 47th president. After a high-energy election night celebration at Mar-a-Lago with guests including Elon Musk and Robert F. Kennedy Jr., digital asset markets surged in response.

Bitcoin (BTC) rocketed past $75,000, reaching a fresh all-time high, while crypto-linked stocks like Coinbase and MicroStrategy saw strong after-hours gains.

For crypto supporters, Trump’ win signals more than just another GOP presidency, especially as he has made bold commitments to protect crypto, a notable departure from the past, when Trump’ stance on digital assets was anything but warm.

Moreover, with Trump’ Republican allies securing a Senate majority, the path is now open for the policies he hinted at throughout his campaign—policies that could reshape the future of crypto in both the U.S. and globally.

So, what promises has he made, and what should we expect from his term? Let’s find out.

Trump’s promises to the crypto industry

Bold vision for a national crypto stockpile

One of Trump’ biggest promises to the crypto world is to create what he calls a “strategic national crypto stockpile.” In simple terms, Trump aims to prevent the government from auctioning off seized Bitcoin, instead holding onto it as a national asset.

Trump believes that, just as countries hold reserves of gold or oil, the U.S. should secure a portion of Bitcoin to hedge against future financial uncertainties.

Currently, the U.S. government often auctions off Bitcoin seized from criminal cases, such as after the Bitfinex hack, but Trump has suggested putting a halt to these sales.

This promise is crucial, given that the U.S. Marshals Service has regularly auctioned Bitcoin holdings, sometimes causing temporary market dips. Earlier this year, Germany’s sale of hundreds of millions in seized Bitcoin led to similar price swings.

While Trump hasn’t provided a concrete plan for how this reserve would be managed, some view it as a step toward positioning the U.S. as a global crypto leader.

Creating a strategic Bitcoin reserve

One of Trump’ more intriguing promises is to establish a “strategic Bitcoin reserve” for the U.S. His idea is to retain Bitcoin seized from criminal activities, rather than auctioning it off, to gradually build a substantial national Bitcoin reserve.

This proposal gained further traction when Senator Cynthia Lummis introduced a bill to create a “Bitcoin strategic reserve,” aiming to accumulate one million BTC over five years as a hedge against the national debt.

If realized, this reserve could signal a shift in the U.S. approach to crypto, positioning Bitcoin as a strategic asset on par with gold or foreign currency reserves.

Promise to fire SEC Chair Gary Gensler “on day one”

Trump has also set his sights on the U.S. Securities and Exchange Commission, pledging to fire its current chair, Gary Gensler, on his first day in office.

Appointed by President Joe Biden, Gensler has led an aggressive crackdown on the crypto industry, initiating over 100 enforcement actions against crypto companies for alleged securities violations since he

Gensler’ stance — that much of the crypto industry falls under SEC jurisdiction — has sparked frustration among industry players, who argue they need clearer guidelines, not constant lawsuits.

However, Trump’ promise may not be as straightforward to execute. While the president can appoint the SEC chair, dismissing one requires valid grounds, like neglect or inefficiency, due to the SEC’ independent status.

Legal experts caution that firing Gensler “on day one” could prompt a lengthy review and may not happen as swiftly as Trump suggests.

Still, if Trump does manage to appoint a new SEC chair, it could mark a shift toward more crypto-friendly policies — though how much freedom the new leadership would truly have remains uncertain.

A national push for Bitcoin mining

Another bold promise from Trump is his call to ensure that all remaining Bitcoin is mined within the U.S. He envisions Bitcoin mining as “Made in the USA,” aiming to establish America as a global hub for the industry.

This vision was echoed during a private Mar-a-Lago meeting with key figures in U.S. crypto mining, including executives from major companies like Riot Platforms, Marathon Digital, and Core Scientific.

Trump’ goal aligns with his broader agenda of “energy dominance” for the U.S., believing that Bitcoin mining could boost energy production and decrease reliance on foreign energy sources.

However, the path to this goal is challenging. Bitcoin mining is decentralized by nature, relying on thousands of miners across the globe. Centralizing it within one country would contradict the decentralized ethos on which Bitcoin was built.

Moreover, about 90% of Bitcoin’ total supply has already been mined, leaving only a small yet symbolically significant portion — around 10% — that Trump hopes to bring under U.S. control.

Stopping the central bank digital currency development

Trump has also pledged to block any progress toward a central bank digital currency in the U.S. He made his stance clear: “There will never be a CBDC while I’m president”, citing that CBDCs pose a potential threat to financial privacy.

Unlike decentralized cryptocurrencies like Bitcoin, a CBDC would be fully controlled by the government, potentially allowing for extensive surveillance of citizens’ transactions.

Trump’ position aligns with other Republican leaders, such as Ron DeSantis, who recently signed a bill in Florida to limit CBDC use within the state.

Opposition to CBDCs is also building in Congress. Representative Tom Emmer introduced the CBDC Anti-Surveillance State Act, aiming to prevent the Federal Reserve from issuing a CBDC without congressional approval.

The right to self-custody

Trump has also pledged to enshrine self-custody rights for crypto users into federal law, reinforcing the principle that “not your keys, not your coins” should be protected by the U.S. government.

Self-custody allows crypto holders to manage their private keys independently, ensuring they fully control their digital assets without relying on third parties like exchanges.

This promise aligns with recent legislative efforts by Republican Senator Ted Budd, who introduced the Keep Your Coins Act in 2023. The bill aims to safeguard Americans’ ability to transact with self-hosted crypto wallets, making it harder for regulators to impose restrictions on self-custody.

However, the proposal has sparked debate. Critics argue that self-custody could enable bad actors to evade anti-money laundering regulations, a concern highlighted by Senator Elizabeth Warren’ 2022 Digital Asset Anti-Money Laundering Act, which advocates for tighter controls.

While the crypto community largely views self-custody as an essential right, questions remain about how such laws might affect the balance between personal freedom and regulatory oversight.

A crypto-friendly advisory council

One of Trump’ more structural promises is to establish a dedicated “crypto advisory council” to guide his administration’s approach to crypto policy.

The goal of this council would be to create clear, industry-friendly regulations that support crypto growth rather than stifle it.

As Trump puts it, he wants “the rules to be written by people who love your industry, not hate it,” ensuring that crypto policies reflect a deep understanding of the industry’s needs and challenges.

Many industry insiders have voiced concerns that current regulations lack clarity, making it difficult for companies to operate within legal boundaries.

However, setting up such a council presents its own challenges, such as ensuring a diversity of perspectives and maintaining unbiased oversight.

Commuting Ross Ulbricht’s sentence

In a more controversial promise, Trump has vowed to commute the sentence of Ross Ulbricht, founder of the Silk Road marketplace.

Ulbricht, a first-time nonviolent offender, received a double life sentence plus 40 years without parole—a punishment many view as excessively harsh. Silk Road, the darknet marketplace he created, facilitated the trade of illegal goods, from drugs to weapons, with Bitcoin as the primary currency.

Ulbricht’ case has become a rallying point within the crypto and libertarian communities, where advocates argue that his sentence was disproportionate to the nature of his crime.

Critics, however, contend that his involvement in Silk Road fueled illegal activities and harmed individuals, making any consideration of leniency a sensitive issue.

What to expect from Trump’s crypto term

Recent tweets from crypto analysts reflect a mood of optimism as Trump’ presidency begins.

Michaël van de Poppe, a prominent crypto analyst, describes the current state of crypto as the end of the “longest and heaviest Altcoin bear market.”

He suggests we’re on the brink of a new “Dot.com bubble in Crypto,” hinting that this cycle could “go way higher than we all expect.”

If this outlook proves accurate, Trump’ pro-crypto stance could pave the way for a strong market rebound, benefiting from a more supportive regulatory environment.

Meanwhile, technical analyst Gert van Lagen forecasts that Bitcoin is on its “final ascent,” with a target of $250,000 by February next year.

#Bitcoin – The Final Ascent

The Bull awakens, strong and clear,

Two-fifty K expected this year!

From shadows past, it’s set to soar,

With fortune close, and fate in store.In August the 10-2Y yield spread’s turned its tide,

A warning sign we can’t abide.

For history… pic.twitter.com/4UGeBEl7rE— Gert van Lagen (@GertvanLagen) November 6, 2024

He points to the recent reversal of the 10-2 yield curve — a classic precursor to recessions — as a sign that economic conditions could fuel a BTC rally.

For now, the industry watches to see if Trump’s bold promises can translate into action. If he delivers, the U.S. could emerge as a leader in crypto adoption, creating jobs and establishing financial alternatives that could leave a lasting mark on the entire crypto space.

Source link

Feature

Why is Ripple Betting Big on Harris and Shocking Everyone?

Published

4 weeks agoon

October 24, 2024By

admin

Ripple has thrown millions behind Kamala Harris. What’s the real agenda here? Is this about politics, or is Ripple gearing up for something bigger with XRP?

Ripple’s split personality hits

Ripple, the blockchain giant behind XRP, has always been in the spotlight for something or the other. Lately, though, it seems Ripple is stepping up its political game, especially with some eye-catching statements from its CEO, Brad Garlinghouse.

During the D.C. Fintech Week event, Garlinghouse gave a rare nod to Democratic presidential candidate Kamala Harris, praising her approach to digital assets. He even went as far as calling her stance on crypto “most constructive.”

Now, this raises some eyebrows, considering Ripple’s historical neutrality in U.S. elections and its rocky relationship with the U.S. regulators.

But Garlinghouse’s comments come at an interesting time—one where Ripple is eyeing the possibility of an XRP ETF and dealing with the aftershocks of its longstanding legal battle with the U.S. SEC under a Democratic administration.

So, why the shift towards Harris, and what could it mean for Ripple’s future? Let’s take a look at Ripple’s political donations, the company’s hopes for an XRP ETF, and the drama surrounding it all.

Ripple’s political pivot

Traditionally, Ripple hasn’t exactly been best friends with the Democratic Party, especially considering the $1.3 billion lawsuit it faced from the SEC under President Biden’s administration in 2020.

Yet, here we are in 2024, watching Ripple CEO and co-founder Chris Larsen make bold statements and donations supporting Democratic presidential candidate Harris.

Garlinghouse, while still maintaining Ripple’s neutral stance on the election, described Harris as “pro-technology” and praised her connections to Silicon Valley.

He even suggested that either a Harris or Trump win would benefit the crypto industry, a notable contrast to his harsh criticism of the current Biden-led administration’s approach.

But the real drama unfolded when Chris Larsen donated a whopping $10 million in XRP to Harris’ campaign, following an earlier donation of $1 million. This came after Trump had been heavily courting crypto supporters, making Larsen’s move even more surprising.

Nic Carter, a well-known crypto venture capitalist, expressed his confusion on Twitter, calling the donation “completely baffling.” After all, many in the industry see Trump as more of a crypto champion, given his vocal support for digital assets.

But Garlinghouse defended his co-founder’s decision, stating that Ripple encourages its employees to support whoever they believe is best for the country, reiterating that this is more about pro-crypto policies than political party loyalty.

I respect Chris’ (and everyone’s!) right to support whomever they think is best to lead the U.S.

We need to immediately change course from this administration’s misguided war on crypto.

Ripple will continue to engage with both Democrats and Republicans in the final days of…

— Brad Garlinghouse (@bgarlinghouse) October 21, 2024

He voiced that the upcoming 2024 election is crucial for the future of the crypto industry. Whether Harris or Trump wins, Garlinghouse believes either candidate would improve upon what he called the Biden administration’s “failed approach” to digital assets.

This has only added to the speculation about Ripple’s motives, as the company’s relationship with the SEC remains contentious.

Ripple’s relationship with Democrats, particularly the SEC, has been far from smooth. In 2020, the SEC hit Ripple with a hefty lawsuit, accusing the company of selling unregistered securities in the form of XRP.

This lawsuit, filed during Biden’s presidency, has been a dark cloud hanging over Ripple for years. Though Ripple scored a partial victory in July 2023 when a judge ruled that XRP sales to retail investors didn’t qualify as securities, the SEC didn’t back down.

In the latest verdict in August 2024, the regulator sought a massive $2 billion fine, only to be awarded a much smaller $125 million penalty. Ripple hailed this as a victory, but the SEC’s ongoing appeal continues to create uncertainty.

A strategy of survival?

Ripple’s recent political moves have been anything but ordinary. Just months ago, in June 2024, Ripple’s Chief Legal Officer, Stuart Alderoty, made headlines with a hefty $300,000 XRP donation to Trump’s presidential campaign.

Alderoty’s donation came at a time when Trump had shifted towards a pro-crypto stance, a change that likely influenced the Ripple CLO’s decision. After all, many believed that if Trump returned to the White House, he would replace Gensler with a more crypto-friendly SEC chair, potentially benefiting the crypto industry.

In fact, between April and June 2024, Trump’s fundraising efforts brought in over $118 million, with $4 million of that in cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and XRP.

High-profile donors such as Tyler and Cameron Winklevoss and BitGo CEO Mike Belshe have also backed Trump, further cementing the crypto industry’s alignment with the former president.

I just donated $1 million in bitcoin (15.47 BTC) to @realDonaldTrump and will be voting for him in November. Here’s why:

Over the past few years, the Biden Administration has openly declared war against crypto. It has weaponized multiple government agencies to bully, harass, and… pic.twitter.com/qOQSpmanBR

— Tyler Winklevoss (@tyler) June 20, 2024

Despite Ripple’s apparent split allegiances, the broader crypto industry has been heavily backing Trump. Recent data from AdImpact reveals that crypto companies have spent 62% more on ads for Republicans than Democrats this year.

Fairshake, a top-spending PAC, has poured $54.6 million into election ads supporting GOP candidates, compared to $33.7 million for Democrats.

Much of this spending is concentrated on key House races in states like New York, Nevada, and California. For instance, Southern California Republicans David Valadao and Michael Garcia, both in tight races, have received $1.3 million and $1 million, respectively, from crypto-backed PACs.

Ripple’s dual strategy reflects the uncertainty surrounding the 2024 U.S. presidential election and its impact on the crypto industry.

With political donations from crypto groups reaching $190 million for this election cycle, the stakes have never been higher. Whether it’s Trump or Harris in the Oval Office come 2025, Ripple seems determined to ensure that it has a seat at the table. But why?

Ripple eyes XRP ETF

On one hand, Larsen has been vocally supporting Harris. On the other hand, Alderoty donated to Trump’s campaign in June 2024. However, Ripple’s recent donations—both to Harris and Trump—could be a strategic maneuver at play.

Bitwise and Canary Capital have already filed for XRP ETFs, which, if greenlit, would allow investors to gain exposure to XRP through a stock exchange without holding the actual cryptocurrency.

Garlinghouse, speaking to Bloomberg recently, even called an XRP ETF “inevitable,” noting that there is growing demand from both retail and institutional investors to access this asset class. If the XRP ETF is approved, it could shift the arena for Ripple and its stakeholders.

For instance, spot Bitcoin ETFs have grown to command over $50 billion in assets under management, proving that institutional investors are eager to gain exposure to cryptocurrency without the complexities of direct ownership.

On the other hand, Ethereum ETFs, despite launching with great anticipation in July 2024, have amassed only about $7 billion in AUM — a much smaller figure compared to Bitcoin.

From Ripple’s perspective, the approval of an XRP ETF would be a huge win. Not only would it validate XRP as a legitimate financial asset, but it would also help resolve the lingering concerns that the SEC lawsuit has raised.

Hence, an ETF would allow Ripple to meet investor demand in a regulated, mainstream way, boosting confidence in XRP and potentially driving up its price and liquidity.

With the SEC’s current resistance, Ripple’s donations to both Harris and Trump might be a strategic hedge, positioning the company to benefit from either candidate’s favor and finally secure approval for their long-awaited XRP ETFs — no matter who wins the 2024 election.

Source link

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential