Aave

SATS, Aave, Monero, and ORDI soar over 10% after Bitcoin jumps 4%

Published

4 months agoon

By

admin

Altcoins SATS, Aave, Monero, and ORDI have all surged over 10% over the past day to rank as the top gainers in the crypto market, as Bitcoin, the leading cryptocurrency by market cap, jumped over 4% in the same timeframe.

SATS

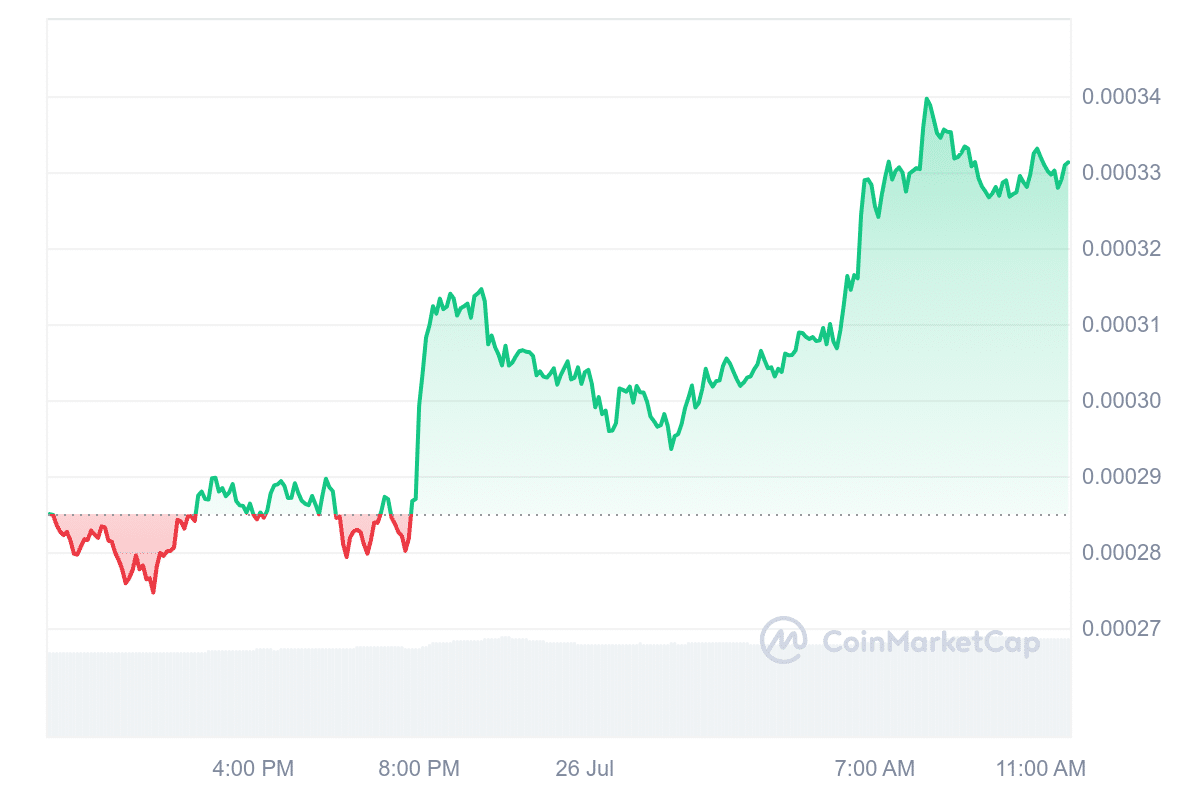

SATS (1000SATS) led the charge among the top gainers on July 26.

At the time of writing, the crypto asset was still up 18.5% in the last 24 hours, trading at $0.00033. SATS’s daily trading volume was also up 18.4%, hovering around $202.6 million.

The meme token’s market cap now stands at $695.6 million. However, the token’s value remains 64% below its all-time high of $0.00093, achieved on Dec. 26, 2023.

SATS is a BRC-20 token created to honor Satoshi Nakamoto, the pseudonymous inventor of Bitcoin. The name SATS refers to satoshi, the smallest unit of Bitcoin, equating to 0.00000001 BTC.

Developed by an anonymous team, SATS embodies a lighthearted approach within the cryptocurrency space, highlighting the cultural and historical importance of Bitcoin’s smallest unit.

Aave

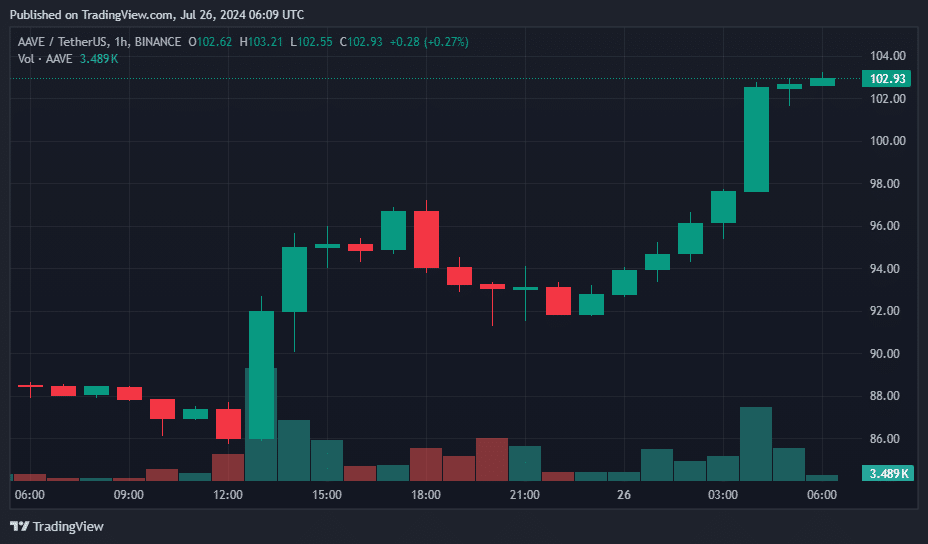

Aave (AAVE) saw a 10% increase in price over the past day, trading at $102.6 at press time. In the same time frame, the crypto asset’s daily trading volume hovered around $240.5 million.

Aave’s market cap is $1.52 billion, making it the 55th largest crypto asset. The token is still 84% below its all-time high of $666, reached on May 19, 2021.

Aave is a decentralized finance protocol enabling users to lend and borrow cryptocurrencies and real-world assets without relying on a centralized intermediary.

The platform has its own cryptocurrency, AAVE, which serves as its governance token. Holders of AAVE can vote on Aave’s development proposals and earn staking rewards by locking their tokens into the system. Additionally, Aave issues aTokens to lenders, allowing them to earn interest on their deposits.

Monero

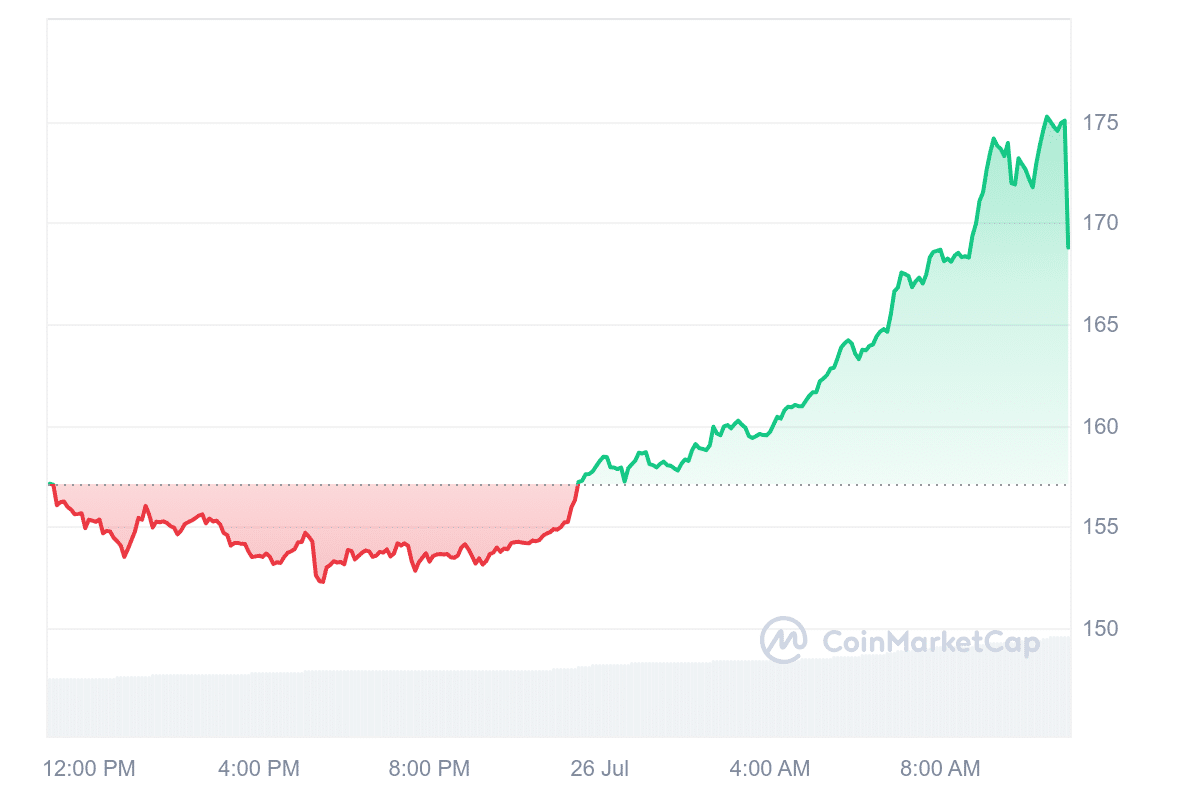

Monero (XMR), a privacy-focused peer-to-peer digital currency, was still up 8.5% in the last 24 hours and was trading at $168.7.

With a market cap of about $3.11 billion, Monero ranks 27th in global cryptocurrency rankings by market cap and has a daily trading volume of approximately $129.5 million at the time of publication.

Monero is a cryptocurrency that focuses on privacy and confidentiality. Unlike most cryptocurrencies that emphasize transparency and security, Monero upholds the principles of anonymity. This sets it apart from well-known transparent blockchains like Bitcoin and Ethereum.

Monero ensures user anonymity through technologies such as ring signatures, stealth addresses, and ring confidential transactions (RingCT). These features make every user on the Monero network anonymous by default, concealing information about the sender, receiver, and transaction amount.

ORDI

Ordi (ORDI) saw an 11.6% increase in price over the past day, trading at $38.5 at press time. In the same timeframe, the crypto asset recorded a trading volume of $165 million.

ORDI’s market cap is $809 million, making it the 83rd largest crypto asset. The token is still 60% below its all-time high of $96, reached on March 5, 2024.

ORDI is a meme coin on the Bitcoin network and the first BRC-20 token created using the Ordinals protocol.

The Ordinals protocol, developed by software engineer Casey Rodarmor, allows data like text, images, audio, and video to be directly inscribed on each satoshi, the smallest unit of Bitcoin. This technology has enabled new uses for non-fungible tokens (NFTs) and other tokens on the Bitcoin blockchain.

ORDI has a fixed supply of 21 million tokens and functions as a fungible and transferable asset within the BRC-20 ecosystem.

Bitcoin leads market recovery with 4% jump

The surge in these altcoins followed Bitcoin’s (BTC) 4.5% rise over the past day, reaching $66,968 on Friday, July 26. Bitcoin’s 24-hour low was $63,506, while its high was $67,338. The world’s oldest and most valuable cryptocurrency recovered from its losses, surpassing the $66,000 mark for the first time this week.

Other popular altcoins, including Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and Litecoin (LTC), experienced minor fluctuations in gains and losses. The overall Market Fear & Greed Index stood at 59 (Neutral) out of 100, according to CoinMarketCap data.

At the time of writing, the global crypto market cap was $2.39 trillion, reflecting a 24-hour increase of 3.41%.

Source link

You may like

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

24/7 Cryptocurrency News

US Government Makes First AAVE Transaction In 8 Months

Published

4 weeks agoon

October 24, 2024By

admin

The US government has ignited a selloff scare for AAVE after initiating its first transaction for the token in 8 months. According to data insights from Arkham Intelligence, the US Government transaction features a total of $5.4 million.

Is the US Government Earning With Aave?

Per the data shared, the funds were originally secured from the Bitfinex Hacker as marked by Arkham Intelligence. However, the exact transactions remains partly unclear considering the funds are paid out in USDC.

According to comments from the community, one explanation for this is that the US government locked up the funds on Aave. Based on this, it started earning interest as a liquidity provider on the Decentralized Finance (DeFi) lending platform.

This is a developing story, please check back for updates!!!

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Aave

AAVE Price Eyes $200 as Whale Buying Sphere Hits Key Fibonacci Support

Published

1 month agoon

October 13, 2024By

admin

AAVE price displays a modest downtick of 0.83% during Sunday’s low volatility trading. The pullback temporarily stalled the current recovery but allowed buyers to replenish the bullish momentum before the next leap. Amid the formation of a bullish reversal pattern, the recently recorded whale buying positions AAVE price for a sustained rally.

AAVE Price Targets $200 as Whale Buying Spree Aligns with Fibonacci Support

According to Lookonchain analytics, a crypto whale recently bought 31,173 AAVE tokens worth around $4.8 million and deposited them into Aave. Shortly after, the whale borrowed around 2.7M GHO stablecoin from the Aave protocol and swapped them for USDC.

These stablecoins were deposited into the Coinbase exchange to acquire more AAVE, projecting a bullish outlook for this smart money. The use of GHO, a stablecoin associated with Aave, further showcases confidence in the Aave ecosystem.

A whale is going long on $AAVE.

The whale bought 31,173 $AAVE($4.8M) 9 hours ago and deposited it into #Aave.

Then he borrowed 2.7M $GHO from #Aave and swapped it to $USDC.

And deposited the $USDC into #Coinbase to buy more $AAVE.

Address:https://t.co/s8cD7dHTb5 pic.twitter.com/WuVkTIbj38

— Lookonchain (@lookonchain) October 13, 2024

The supply distribution metric from Santiment indicates that large holders with wallet sizes between 1 million to 10 million AAVE initiated a buying spree in August. This accumulation has now reached 4.17 million AAVE, highlighting strong whale activity.

This trend suggests increasing confidence among large investors in AAVE’s price potential, possibly hinting at further upside momentum in the market.

![Aave [on Ethereum]](https://coingape.com/wp-content/uploads/2024/10/Aave-on-Ethereum-AAVE-17.22.17-13-Oct-2024.png)

![Aave [on Ethereum]](https://coingape.com/wp-content/uploads/2024/10/Aave-on-Ethereum-AAVE-17.22.17-13-Oct-2024.png)

AAVE Hint Major Reversal Pattern Breakout

Following the early October sell-off, the AAVE price managed to stabilize above $135 support since last week. This support is reinforced by both the 50-day exponential moving average and the 38.2% Fibonacci retracement level, providing a solid foundation for a potential price reversal.

The 38.2% FIB is typically seen as an ideal pullback zone for buyers to regain control after a period of exhausted bullish momentum. The recent reversal has uplifted asset 12% up to trade at $152.5 and formed a bullish reversal pattern called a double bottom.

The chart setup resembles a ‘W’ letter and indicates a renewed bullish momentum for a breakout opportunity. If the pattern holds true, the AAVE price rally could breach the $154.8 neckline and drive a post-breakout rally to $180, followed by $200.

Alternatively, if the AAVE buyers fail to sustain a neckline breakout, the sellers could revert the price lower and seek support at the $115 level.

Frequently Asked Questions (FAQs)

Recent whale buying has significantly boosted confidence in AAVE, with large holders accumulating 4.17 million AAVE. This activity, aligned with key Fibonacci support, is pushing the price toward the $200 target.

The 38.2% Fibonacci retracement level has provided a key pullback zone, allowing buyers to regain control and pushing AAVE’s price recovery

AAVE has formed a double bottom pattern on the daily chart, which suggests a bullish reversal

Sahil Mahadik

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Aave

AAVE Price Eyes $200 Push as Buyers Conclude Two-Year Accumulation

Published

2 months agoon

September 22, 2024By

admin

The AAVE price surged 3% during the Sunday training session, defying the low volatility momentum in the broader crypto market. This high-momentum rally pushed the asset to a peak of $162.5, a level not seen since May 2022. This movement indicates a significant breakout from the two-year accumulation phase, signaling the potential rally to $200.

AAVE Price Gears Up for $200 Surge After Two Years of Accumulation

Defying the ongoing consolidation trend in crypto markets, the AAVE price showcased a sustained recovery since July 2024 with new higher-high and higher-low formations in the daily chart. The bullish upswing uplifted the asset from $71 to $158, registering a growth of 123%. Consecutively, the market cap surged to $2.364 billion.

With an intraday gain of 5%, the AAVE price surged to $162.46 high, a level last recorded on May 5th, 2022. This upswing signals the end of a two-year accumulation trend, also highlighted by the founder of DefianceCapital, Arthur. According to his tweet, this breakout could signal a potential all-time high (ATH) reclaim, marking a significant moment in the ongoing DeFi resurgence.

$AAVE is trading at the highest level since May 2022 and seems to be breaking out from a 2 year consolidation pattern.

Expect ATH reclaim to further solidify DeFi Renaissance. pic.twitter.com/pn29UsBMes

— Arthur (@Arthur_0x) September 22, 2024

If the daily candle closes above $153, the buyers could drive a 25% upswing to challenge the $200 resistance, followed by an extended rally to $260.

A positive alignment between the daily Exponential moving average (20, 50, 100, and 200) indicates a high momentum in action.

According to Santiment data, the percentage of AAVE held by top addresses has steadily climbed to 55%. While a high value may signal centralization risk, it also indicates an accumulation trend among large holders and their confidence in future trends.

Moreover, the relatively low supply of AAVE on exchanges suggests reduced selling pressure, which is often a bullish signal, as fewer tokens are available for immediate sale.

On the contrary, if the AAVE price fails to sustain the $153 resistance breakout, the sellers could drive a bearish pullback to 20-or-50-day EMA.

Frequently Asked Questions (FAQs)

Yes, AAVE has broken out of a two-year accumulation phase, reaching a high of $162.5. If the price sustains above the key $153 resistance level, a potential 25% rally toward $200 is likely.

The postive alignment of the 20-50-100-and-200-day Exponential Moving Averages (EMAs) indicates strong bullish momentum

If AAVE price fails to sustain the $153 breakout, sellers could trigger a bearish pullback

Sahil Mahadik

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: