Bitcoin

The implications of the Ethereum ETF and beyond

Published

5 months agoon

By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

After launching our own Ethereum exchange-traded funds in Hong Kong, we’ve experienced firsthand the unlock that comes with greater visibility among investors. We saw an immediate shift in the enthusiasm, tone, and tenor of our conversations with investors, both institutional and retail, who saw this moment as a shift in legitimacy for the asset class.

So, as Ethereum (ETH) ETFs start trading in one of the world’s largest markets this week, we see this as another milestone on the path to full integration of digital assets into traditional finance. This move paves the way for more diverse financial products, including cryptocurrency basket ETFs, ETFs with staking options, tokenized securities, and other financial innovations.

So, what will the real impact of expanded access to ETH as an investment class really be? Will we see ATHs in the coming months? How can we overcome Ethereum’s complexity as infrastructure compared to Bitcoin’s reputation as digital gold? Let’s explore these questions and how they may result in a more gradual adoption curve among investors.

The BTC effect

When spot Bitcoin (BTC) ETFs debuted, they saw over $25 billion traded in the first month. It’s unlikely that Ethereum ETFs will match this volume initially, considering Ethereum’s average 24-hour trading volume is currently at a 70% discount compared to Bitcoin. We expect spot Ethereum ETFs to trade between $15 billion and $20 billion in the first month.

Of course, it’s possible that the inflows will be larger than we expect. This would indicate a bullish sentiment that could drive momentum and give Ethereum a positive psychological push as an accepted asset class for investors of all kinds.

However, many investors will be comparing ETH directly to BTC—and that’s a major messaging challenge. If BTC is digital gold, then what is ETH? How do investors place it into their diversified portfolios? The success of the ETH ETF hinges on its marketing, which must focus on ETH as the utility layer for the crypto industry.

Potential for a price rally

By the end of this year, we forecast a price for Ethereum somewhere between $6,000 and $10,000. This price represents 1.6x to 2.5x its 52-week high. Our relatively bullish outlook on Ethereum is driven by rising demand from ETF introductions, increased interest in Ethereum-linked calls, and the growing adoption of ERC-20 tokens and the broader Ethereum ecosystem.

While initial ETF launches might push Ethereum higher, there could be short-term outflows from Grayscale’s Ethereum Trust, similar to what was observed with Bitcoin ETFs. Investors might shift funds to options with lower fees, impacting market sentiment temporarily.

The launch of an Ethereum ETF could trigger a modest price rally for ETH, driven by increased demand. This uptick might also positively affect other cryptocurrencies through a spillover effect. However, the macroeconomic environment will significantly influence the long-term trajectory of digital assets. Should bearish headwinds diminish and optimism grow with the advent of new funds, Ethereum could see greater price swings.

The sustainability of these gains will depend on external factors such as equity prices, interest rates, emerging sectors, and institutional adoption rates. There’s also the election year in the US, which injects a modicum of uncertainty into the medium-term appetite for risk assets like crypto.

Staking rewards: Retail vs institutional

One potential limitation of Ethereum ETFs is the absence of staking rewards, a significant incentive for holding Ethereum directly. Staking allows investors to earn rewards, making it attractive for those comfortable with self-custody. That could limit the appeal for crypto natives, who may not consider adding ETH to their brokerage accounts.

In contrast to retail investors, ETFs provide a regulated and convenient way for institutional investors to gain exposure to Ethereum without dealing with direct ownership. The strong institutional interest in ETH suggests a growing acceptance of ETFs as exposure instruments, even without staking yields. There is ongoing work with regulators to potentially introduce an ETH ETF with staking in the future, which could enhance market competitiveness.

Even so, staking is not a deal breaker. And income is not the main reason why many investors would want to add ETH ETFs to their portfolio. Rather, they’re looking for price appreciation and exposure to the digital asset vertical.

Institutional adoption

Institutional interest in Ethereum could differ from Bitcoin ETFs due to Ethereum’s potential as an infrastructure layer for decentralized applications across various sectors, including finance, supply chain, and technology. These sectors offer significant opportunities, making Ethereum attractive beyond just being a store of value like Bitcoin. And, as regulatory frameworks evolve and provide more clarity and certainty, institutions might find Ethereum a valuable addition for portfolio diversification.

Staking is a major attraction for institutional investors considering Ethereum ETFs. Institutional staking within crypto ETFs represents a sophisticated tool for yield generation, leveraging the inherent value of staked assets.

This could potentially outperform traditional fixed-income instruments by providing a consistent yield that buffers against market volatility. Incorporating staking into crypto ETFs potentially allows institutions to maximize asset utilization, capturing price appreciation and generating additional returns through staking rewards. This dual-purpose approach can optimize overall investment strategies and could stabilize fund performance in bearish markets.

Moreover, institutional participation in staking could enhance governance within the ecosystem, encouraging more robust regulatory guidelines from relevant authorities and creating a safer, more transparent environment that benefits everyone. This is most evident when it comes to liquidity, as institutions tend to provide more reliable support over time as they become more comfortable with an asset class prone to instability and volatility.

An upside catalyst

The approval of Ethereum ETFs promises to be a catalyst for market growth, attracting substantial capital inflows from investors preferring the regulated environment of traditional financial markets. As each new jurisdiction approves crypto-related financial products, it attracts new investors who were previously hesitant due to regulatory uncertainties, thus expanding the market.

More importantly, this exposure will add legitimacy to Ethereum in the eyes of the public, benefiting the broader digital asset ecosystem. We will see more people consider investments not only across other digital assets but also in the companies innovating in the broader blockchain ecosystem.

We see the potential for a rotation into utility, with investors considering projects that address real-world solutions and have the potential to disrupt industries on a global scale. We also could see a boost for defi, as financial products that bridge the gap between traditional finance and decentralized finance become more appealing as investors gain comfort with digital assets.

And, while initial trading volumes may not match Bitcoin ETFs, the long-term impact on Ethereum and the broader crypto ecosystem promises to be substantial, paving the way for greater awareness and innovation that enables the future of finance.

Vivien Wong

Vivien Wong leads the licensed asset management business at HashKey Capital, a global leader in digital assets and blockchain technologies. Vivien was instrumental in bringing the crypto spot ETFs to market in Hong Kong. Prior to HashKey Capital, she served as the General Manager of Huobi Asset Management in Asia. Vivien has also held various positions at Fosun Group and Deutsche Bank, where she focused on investment and research in new economy sectors, including AI, cloud computing, and healthcare. Vivien began her career at Barclays Global Investors. She earned an MBA from Warwick Business School and a bachelor’s degree from the University of Hong Kong.

Source link

You may like

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

Altcoins

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

Published

16 hours agoon

December 22, 2024By

admin

Bitwise CIO Matt Hougan says a wave of institutional interest in altcoins is coming next year, largely due to potential regulatory clarity and more exchange-traded funds (ETFs).

In a new interview with Bloomberg, Hougan says that institutional money is in the early stages of broadening out to other crypto assets besides just Bitcoin (BTC).

Hougan forecasts that 2025 will be the year that institutional investors will begin to incorporate more diversification in their crypto-investing strategies the same way they do in other asset classes like equities or bonds.

“You’re already seeing it broaden out actually. A lot of people were worried about the Ethereum ETFs for instance, which launched this summer and had tepid inflows.

But over the last month or so, you’ve seen billions of dollars flow into those products.

Again, the things that have happened in crypto in the past keep happening. Historically, most people enter crypto through Bitcoin, and then they discover Ethereum, and then they think about Solana. There’s no reason to assume that the institutions that came into Bitcoin won’t move on to other assets in the future.

In fact, I think in 2025, you’re going to see an explosion of interest in index space strategies that give diversified exposure to crypto. Of course, [that is] something we’ve been doing at Bitwise since 2017 when we pioneered that concept. I think 2025 is when that becomes a mainstream way to allocate to this space, the same way it is to stocks and bonds and real estate and everything else.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Julien Tromeur/Sensvector

Source link

Bitcoin

Microsoft says ‘no’ to Bitcoin, corporates say ‘bring it on’

Published

1 day agoon

December 22, 2024By

admin

Microsoft shareholders nixed a Bitcoin treasury idea, but other big-name companies disagree with this strategy. Here’s why.

Bitcoin (BTC) is often likened to “digital gold,” with its fixed supply of 21 million coins making it a potential hedge against currency devaluation and inflation.

And nowadays, Bitcoin’s unique characteristics make it an attractive addition to corporate treasuries. It can balance exposure to traditional assets like cash, stocks, and bonds.

Bitcoin is also one of the most liquid assets globally, and its historical performance has shown significant long-term value appreciation — it reached an all-time high of over $108,000 on Dec. 17.

But there’s no shortage of risks.

A board might avoid adopting a Bitcoin treasury due to the coin’s extreme price volatility, which can lead to substantial losses during downturns. Also, regulatory uncertainties pose potential threats as governments refine crypto policies. Additionally, liquidity challenges during market slumps can amplify price drops when offloading assets.

So it’s no wonder that, on Dec. 10, Microsoft’s board channeled the long-standing crypto skepticism of its co-founder, Bill Gates, and recommended ditching the proposa for a Bitcoin trasury. Gates himself has famously dismissed crypto as “100% based on greater fool theory” — ouch.

Bitcoin evangelist and MicroStrategy Chairman Michael Saylor was busy trying to woo Microsoft when he touted Bitcoin’s own meteoric returns and bragged about MicroStrategy’s stock soaring after their BTC splurge. His pitch? Bitcoin could boost Microsoft’s market cap while acting as a financial guardian angel.

Microsoft’s response? No, thanks.

Meanwhile, at least 10 other companies are embracing the MicroStrategy playbook.

Genius Group

Genius Group, an AI-powered education group, announced in November that it had completed the purchase of 110 Bitcoin for $10 million, at an average price of $90,932 per Bitcoin. The purchase made good on a promise to employ what it called a “Bitcoin-first” strategy where it planed to commit 90% or more of its current and future reserves to be held in Bitcoin, with an initial target of $120 million in Bitcoin.

Earlier this month, the company bolstered its Bitcoin treasury by acquiring 194 Bitcoin worth $18 million at an average price of $92,728 per Bitcoin.

Genius Group CEO Roger Hamilton credited Saylor’s Bitcoin treasury plan for the inspiration, adding that “more companies will see the benefits of establishing a Bitcoin treasury, and will be equipped with the clear steps to follow.”

Worksport

Worksport, a U.S.-based provider of pickup truck solutions, is adding cyptocurency to its corporate treasury strategy.

The Nasdaq-listed company announced on Dec. 5 that it would be adding Bitcoin (BTC) and XRP (XRP) to its treasury assets. This follows a resolution by the company’s board of directors, which approved an initial purchase of $5 million worth of BTC and XRP.

Worksport is committing 10% of its excess operational cash to this corporate pivot, it said in the announcement.

“Our upcoming adoption of Bitcoin (BTC) and XRP (Ripple) reflects our commitment to staying ahead of market trends while prioritizing operational efficiency and shareholder value. As we expand our product offerings and global reach, cryptocurrency has the potential to be a strong strategic complement,” Steven Rossi, chief executive officer of Worksport, said.

Amazon

Amazon shareholders, led by the National Center for Public Policy Research, are urging the Seattle-based company’s board to assess the potential benefits of adding Bitcoin to the company’s financial strategy.

The proposal, submitted on Dec. 6, aims to explore whether Bitcoin could protect and enhance shareholder value, especially amid persistent inflation and declining yields from traditional assets.

The National Center emphasizes Bitcoin’s robust performance—131% growth in the past year and 1,246% over five years—as evidence of its potential as an inflation hedge and a growth asset. The initiative also highlights concerns about the diminishing purchasing power of Amazon’s $88 billion cash reserves due to average inflation of 4.95% over the past four years.

This move represents a broader trend of shareholder proposals influencing corporate policies, leveraging shareholder rights to advocate for financial strategies that address economic risks and enhance long-term value.

MicroStrategy

Perhaps the most vocal of all Bitcoin fans is MicroStrategy’s Saylor who, as of this past week, increased the company’s total holdings to 439,000.

As a result, Saylor has officially strengthening MicroStrategy’s position as the top corporate BTC holder, considering it a long-term store of value.

Saylor, during an appearance on the Dec. 18 episode of the Open Interest show on Bloomberg Television, even voiced his willingness to advise President-elect Donald Trump on crafting a digital assets policy for the U.S.

But Saylor continues to draw scrutiny: Analyst Jacob King has labeled MicroStrategy’s Bitcoin-focused business model a “giant scam,” claiming it is unsustainable and destined for collapse.

MicroStrategy’s business model is a giant scam and relies on a reflexive loop: it issues debt or equity to buy BTC, which drives BTC’s price higher. This increases MSTR’s market cap, boosts its index weight, and attracts more sheep investors. With a higher valuation, it issues… pic.twitter.com/Owyi7mCHaO

— Jacob King (@JacobKinge) December 17, 2024

Marathon Digital Holdings

As one of the largest Bitcoin mining companies, Marathon owns 44,394 BTC. Its business model revolves entirely around mining and holding Bitcoin as part of its assets.

Back in July, the company confirmed it will adopt “a full HODL approach” towards its Bitcoin treasury policy, retaining all that it mines within its operations, in addition to its open market purchases.

“Adopting a full HODL strategy reflects our confidence in the long-term value of bitcoin,” CEO Fred Thiel stated. “We believe bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold bitcoin as a reserve asset.”

Tesla

Tesla initially bought $1.5 billion worth of Bitcoin in 2021 and currently holds 9,720 BTC. While the Elon Musk-led company remains a significant corporate holder.

BitcoinTreasuries data shows that Tesla is the fourth-largest holder of Bitcoin among U.S. public companies with crypto treasuries (MicroStrategy, MARA Holdings and Riot Platforms are believed to hold more).

In October, the electric vehicle company reportedly moved $765 million worth of Bitcoin to unidentified wallets.

Coinbase

The cryptocurrency exchange holds 9,480 BTC as part of its reserves, leveraging its position as a major player in the digital asset ecosystem.

The Brian Armstrong-led firm holds large amounts of Bitcoin as an exchange and converter. It’s also a trusted institution for custody services, and counts the Bitcoin ETF coterie of BlackRock, Grayscale, 21Shares, Invesco, Valkyrie, Wisdom Tree and Franklin Templeton among its clients.

Therefore, Coinbase has a Bitcoin treasury for itself and oversees others.

Hut 8 Mining Corp

On Thursday, crypto.news reported that Hut 8, a Bitcoin mining company, added 990 Bitcoin to its reserves.

The company spent roughly $100 million to increase its total holdings to 10,096 BTC. The reserve, now valued at over $1 billion, places Hut 8 among the largest corporate Bitcoin holders globally.

The company, under the guidance of CEO Asher Genoot, purchased the coins at an average price of $101,710, significantly higher than its cumulative acquisition cost of $24,484 per Bitcoin.

Block Inc.

The startup (formerly Square) holds 8,027 BTC as part of its strategy to integrate Bitcoin into mainstream finance.

The Jack Dorsey-founded company is so bullish on Bitcoin that, last month, it confirmed a company-wide pivot towards the cryptocurrency mining sector.

Block decided to dial down resources towards music streaming service TIDAL, and sunset TBD, a venture focusing on decentralizing the internet, to focus on expanding its presence in the Bitcoin mining sector.

Block acquired TIDAL in a 2021 acquisition for roughly $300 million. The platform has continued to struggle, with reports indicating workforce reductions and a $132.3 million impairment charge.

OneMedNet

OneMedNet Corp., as of Nov. 12, owns some 34 Bitcoins.

Off The Chain Capital, an investor in OneMedNet, was also inspired by Saylor, betting that Bitcoin isn’t just a hedge but a springboard for its healthcare data innovation.

Aaron Green, the company’s CEO, stated, “By continuing to invest a portion of our assets into Bitcoin, we aim to not only safeguard our financial stability but also fuel the ongoing development and innovation within our iRWD platform.”

Source link

Bitcoin

Why $99,800 Is An Important Resistance To Break

Published

1 day agoon

December 21, 2024By

admin

The Bitcoin price is approaching the $100,000 level again after experiencing significant declines these past weeks. A crypto analyst has pointed out that the critical resistance level at $99,800 is crucial for Bitcoin’s next move. If the pioneer cryptocurrency can break through this level, it could trigger a significant breakout, potentially propelling Bitcoin past the $100,000 mark.

Related Reading

Bitcoin Price Faces Resistance At $99,800

Prominent crypto analyst Ali Martinez has shared a chart showing an In/Out of the Money Around Price (IOMAP) analysis of the distribution of Bitcoin wallets based on their purchase price. According to the analyst, the Bitcoin price is facing extreme resistance between the $97,500 and $99,800 price levels as it tries to breach $100,000 again.

Martinez noted that around this price range, approximately 923,890 wallet addresses had purchased over 1.19 million BTC. This price zone acts as an important resistance level because many Bitcoin holders may look to sell and break even, potentially exerting selling pressure.

In the IOMAP chart shared by Martinez, the green dots that signal ‘In the Money’ represent price levels below the current Bitcoin price, where wallet holders are in profit because they bought BTC at a lower value. On the other hand, the red dots that represent ‘Out of the Money’ show price levels of Bitcoin’s present value, where wallet holders are at a loss because they bought BTC at a higher price.

Lastly, the white dot indicates ‘At the Money’ and represents the current price of Bitcoin at an average of $98,676, where some crypto wallets see neither profit nor loss.

Below Bitcoin’s current price, the chart shows strong buying zones, which could provide strong support if the pioneer cryptocurrency experiences a potential pullback. Martinez has forecasted that breaking through the critical resistance range between $97,500 and $99,800 would signal the start of a bullish rally for Bitcoin, potentially leading it to a new all-time high.

Currently, the Bitcoin price is trading at $98,652, steadily rising to return to previous highs above $100,000. To a new all-time high, Bitcoin will have to surge by over 7%, surpassing its present ATH above $104,000.

Related Reading

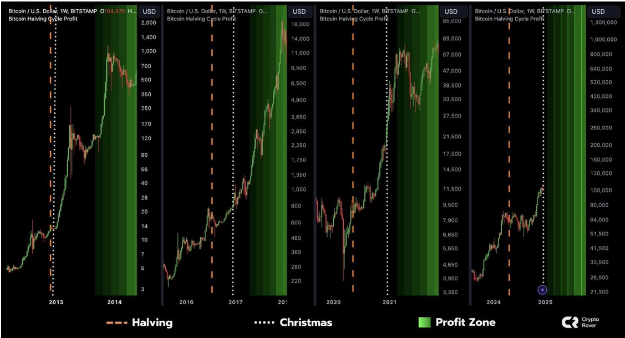

Bitcoin’s Biggest Gains To Come After Christmas

A popular crypto analyst identified as the ‘Crypto Rover’ has expressed optimism about Bitcoin’s near-term price potential this Q4. According to the analyst, Bitcoin has historically experienced its most significant gains right after Christmas during the halving years.

The analyst shared a price chart showing Bitcoin’s market performance during each halving cycle. In the 2012 halving year, Bitcoin started a significant price rally, which extended into the following year. The same bullish trend occurred in the next halving years in 2016 and 2020, with Bitcoin hitting exponential price highs.

Based on this historical trend, Crypto Rover projects that Bitcoin could witness a similar bullish surge before the end of 2024, with the rally potentially continuing into 2025.

Featured image from Bloomberg Images, chart from TradingView

Source link

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

Filecoin, Monero, and Lunex dominate smart investor portfolios

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

How Low Will Ethereum Price Go By The End of December?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential