Partner Content

Experts tip Rollblock to lead but fear for exchange tokens like BNB, CRO

Published

4 months agoon

By

admin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Rollblock’s new crypto casino, set to grow massively, grabs attention as BNB and Cronos falter.

The crypto market is more unpredictable by the day. Exchange tokens like BNB and Cronos were expected to rally this quarter, but their performance has been disappointing. Now, all eyes are on Rollblock’s (RBLK) new crypto-based casino, which is set to grow 800x by the end of Q4.

BNB’s falling price could fuel bearish momentum

BNB (BNB) has seen a huge downturn recently, with the altcoin dropping by 9% during the past four days. According to Coinmarketcap, BNB is currently trading at $576.83. It is testing the crucial support level of $555, and if the price falls below this, then investors may face more short-term losses.

The bears are ready to take over BNB in the next quarter. For now, the only way to avoid this is if BNB manages to hold above its support.

Analysts unsure about Cronos’s future in volatile market

Cronos (CRO) hasn’t delivered the gains it promised. According to Coinmarketcap, Cronos is trading at $0.09085 after an intra-week decline of nearly 2%. Even if Cronos hits the $0.3 mark by the end of 2024, it is unlikely that the token will reach its all-time high any time soon.

The only thing that could save Cronos now is if the developers keep introducing innovative community-building initiatives. However, if Cronos fails to live up to its vision and stance, then the negative criticism could push the price down even further.

Rollblock tipped to become a top defi token

While exchange tokens like BNB and Cronos are showing little growth potential, Rollblock’s new crypto casino is making waves in the crypto world. Rollblock (RBLK) is a play-to-earn GambleFi token that integrates the best of centralized and decentralized gaming. If Rollblock can keep up the same momentum until the end of its presale stages, then experts are anticipating a massive 800x surge.

Rollblock’s strategy is to bring the fun back to gambling. By removing long KYC processes, Rollblock offers investors high levels of privacy and security. On Rollblock’s casino, players can sign up using their email or link their crypto wallet and dive into over 150 AI-powered games, including roulette, blackjack, and poker. No KYC checks are needed.

In the future, Rollblock will also add sports betting to their casino. This will give players an opportunity to place cryptocurrency bets on sports events like the NBA, NFL, Tennis, Golf, Formula 1, Boxing, and more.

Rollblock’s crypto casino is already live and generating revenue. Rollblock also offers a unique revenue-sharing incentive to token holders by distributing up to 30% of weekly casino gains to token holders. This is done through open market buybacks of Rollblock’s native RBLK token. After burning half of these tokens forever, the remaining are distributed to investors.

Rollblock’s tokenomics feature a fixed supply of just 1 billion RBLK tokens. This limited supply is the reason why analysts are forecasting that Rollblock’s value will see a massive surge once it hits the open market. Currently, in stage 4 of its presale, RBLK is trading at $0.0172. This price is expected to rise again in the next few weeks, with analysts expecting RBLK to pass $0.50.

To learn more about Rollblock, visit the website and its socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

You may like

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Partner Content

Crypto millionaires will be made by April 2025: 6 coins to hold

Published

3 hours agoon

November 23, 2024By

admin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto markets are heating up, and these 6 coins could make millionaires by April 2025.

Crypto markets are reaching unprecedented peaks, offering many opportunities for investors. As the market hits a feverish pace, the chance for substantial gains has never been greater. Astute investors are focusing on cryptocurrencies that could deliver significant returns by April 2025.

One standout is XYZVerse (XYZ), a meme coin seeking to unite sports fans worldwide. It merges meme culture with sports passion, aiming for remarkable growth through a community-driven ecosystem.

XYZVerse: The all-sports meme token

XYZVerse is the first all-sports meme coin designed to unite sports fans across football, basketball, MMA, and esports within a community-driven ecosystem. As the MVP of the XYZVerse, XYZ blends meme culture with the excitement of sports, offering investors a unique opportunity to tap into two thriving markets.

Drawing parallels to Polymarket’s $1 billion trading volume during the US presidential election, XYZVerse takes the concept further by combining the hype of meme coins with the appeal of sports betting. With millions of fans expected to join, the ecosystem’s expansion offers substantial opportunities for early investors to capitalize on its growth potential.

Currently in its presale at $0.000667, XYZ targets a listing price of $0.1, representing an ambitious 14,900% growth by its token generation event (TGE). XYZVerse aims to surpass previous standout performers like BOME’s 5,000% rise and WIF’s 1,000% rally, setting itself apart as a top contender in the meme coin space.

Supported by audited smart contracts, a vetted team, and upcoming CEX and DEX listings, XYZVerse positions itself as a strong investment. Its first-mover advantage in the sports-driven meme coin niche ensures that early participants could benefit significantly as the project gains momentum.

With the crypto market poised for euphoria in 2025, grabbing XYZ tokens could position investors for what could be one of the most exciting opportunities in the meme coin sector.

Interested investors can join XYZVerse through its presale.

XRP

XRP is a digital currency designed to enable fast, low-cost transactions worldwide. Built on the XRP Ledger, it was created by Jed McCaleb, Arthur Britto, and David Schwartz to move money as quickly as information.

XRP operates without a central authority, making transactions secure and irreversible while remaining accessible to anyone, even those without a bank account. When XRP launched, 100 billion coins were created, with 80 billion allocated to Ripple to support ecosystem development. Ripple uses XRP to improve liquidity and releases coins in a controlled manner.

In today’s market, XRP stands out for its speed and low transaction costs. Unlike Bitcoin, which often has higher fees and slower transaction times, XRP works with the existing financial system to facilitate seamless cross-border payments. The focus on bridging traditional finance and cryptocurrency positions XRP as a key player in the growing digital payments market.

Sui

Sui is a next-generation blockchain designed for security, scalability, and global adoption. It uses an object-centric data model, enabling efficient and flexible data handling. Built on the Move programming language, Sui prioritizes safety and solves common issues faced by other blockchains.

What sets Sui apart is its focus on user experience, offering innovations like zkLogin and sponsored transactions, which make blockchain applications easier to use. This user-friendly approach could help attract more participants to Web3.

In a market increasingly prioritizing user adoption, Sui’s accessibility and innovative design position it as a promising option for future growth.

Cardano

Cardano, powered by its native cryptocurrency ADA, is known for its flexibility, sustainability, and focus on smart contracts. Built for decentralized finance, token creation, and gaming, ADA rivals Ethereum as a platform for value storage, payments, and staking. Its environmentally friendly Ouroboros proof-of-stake mechanism minimizes energy consumption compared to proof-of-work systems.

Cardano’s unique two-layer system—one for transactions (Settlement Layer) and another for smart contracts (Computing Layer)—enhances scalability and speed, enabling it to potentially process up to a million transactions per second.

With its energy-efficient model and robust smart contract capabilities, Cardano aligns well with market trends favoring eco-friendly and scalable blockchain solutions.

Avalanche

Avalanche is a high-performance blockchain known for its eco-friendly approach, low fees, and lightning-fast transactions, capable of processing up to 4,500 transactions per second. Its standout feature, customizable subnets, allows users to create tailored blockchains.

Avalanche’s hybrid consensus mechanism combines Classical and Nakamoto principles, achieving transaction finality in less than two seconds. The Avalanche ecosystem is powered by AVAX, its native token used for transaction fees, staking, and custom blockchain creation.

With a focus on scalability, sustainability, and developer flexibility, Avalanche’s robust technology and unique features make it a compelling choice for businesses and developers, especially as environmental concerns grow in the crypto space.

Arbitrum

Arbitrum is a scaling solution for Ethereum, developed by Offchain Labs to enhance transaction speed, scalability, and privacy. Using optimistic rollups, Arbitrum bundles multiple transactions together, reducing costs and improving the efficiency of Ethereum-based smart contracts.

The ARB token plays a key role in the ecosystem, granting holders governance rights to shape the platform’s future. With an initial supply of 10 billion tokens and a low yearly inflation rate, ARB is designed for steady growth.

As demand for scalable blockchain solutions rises, Arbitrum’s ability to improve Ethereum’s performance makes it an attractive option for developers and investors alike.

Conclusion

XRP, SUI, ADA, AVAX are solid, but XYZ, as an all-sport meme coin targeting 20,000% growth by uniting sports fans, may be the standout in this bull run.

Learn more about XYZVersus on their website, Telegram, and X.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

Partner Content

Top crypto traders’ picks for explosive growth by 2025

Published

11 hours agoon

November 22, 2024By

admin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Top crypto traders highlight 3 coins with explosive growth potential for 2025.

Investing in the right cryptocurrency at the right time can lead to incredible returns. As the market evolves, certain coins stand out with promising futures. Experienced traders have pinpointed three digital currencies expected to experience significant growth by 2025.

CYBRO breaks $4 million: Multichain DeFi investment

CYBRO is taking the crypto community by storm, with its exclusive token presale surpassing $4 million. This innovative multichain DeFi platform offers investors unparalleled opportunities, enabling them to maximize earnings across multiple blockchains regardless of market conditions. The CYBRO project, powered by AI-driven solutions, aims to redefine what it means to be at the forefront of decentralized finance.

CYBRO tokens, available at a presale price of $0.04, present a rare investment opportunity, with experts forecasting an impressive 1200% potential return on investment. This advanced platform has already piqued the interest of prominent crypto whales and influencers, signaling strong market confidence.

Adding to the excitement, CYBRO has rolled out a referral program, providing 12% on direct referrals’ token purchases, along with additional rewards from second and third-level referrals. Weekly rewards are distributed in USDT, and those using a referral code earn double CYBRO points on their first deposit.

Interested investors can join the CYBRO presale and target gains up to 1200%

CYBRO points offer yet another incentive for investors, allowing holders to gain automatic entry into CYBRO’s weekly airdrop, with up to 1 million points available. These points can be accumulated by investing in CYBRO’s DeFi vaults, providing investors with earning potential beyond initial token value.

After the presale, CYBRO token holders are in for a range of exclusive benefits, from high staking rewards to cashback on purchases, exclusive airdrops, reduced trading and lending fees, and an insurance program to safeguard their investments.

With only 21% of the total tokens available for the presale and over 100 million already sold, the supply is quickly diminishing, making this an opportune moment for investors.

Jupiter is a swap aggregator driving liquidity across the Solana blockchain. By providing essential infrastructure, it improves the efficiency and accessibility of decentralized finance (DeFi) on the network.

Jupiter is expanding its offerings with advanced tools like limit orders, DCA/TWAP strategies, Bridge Comparator, and perpetuals trading, giving users diverse options for managing digital assets. These developments position Jupiter as a key player in Solana’s growing DeFi ecosystem, fostering its continued expansion and adoption.

OP: Powering decentralized governance on Optimism

The OP token serves as the backbone of Optimism Collective, an experiment in decentralized governance for the Optimism Layer 2 blockchain. Managed by the Optimism Foundation, the Collective oversees protocol updates, network configurations, and incentive programs within the ecosystem.

With 5.4% of OP’s total supply allocated for funding projects via governance, developers in the Ethereum ecosystem are encouraged to apply for grants, making Optimism a hub for innovation and community-driven growth.

Conclusion

While coins like JUP and OP show promise for growth by 2025, they may offer less immediate potential. CYBRO stands out as a technologically advanced DeFi platform offering investors unmatched opportunities to boost their earnings through AI-powered yield aggregation on the Blast blockchain.

With staking rewards, exclusive airdrops, and cashback on purchases, CYBRO delivers user experience with seamless deposits and withdrawals. CYBRO’s commitment to transparency, compliance, and quality has attracted significant interest from major investors and influencers, making it a promising project in the current market.

To learn more about CYBRO, visit their website, Twitter, Discord, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

Partner Content

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Published

1 day agoon

November 21, 2024By

admin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Polkadot (DOT) investor bets on CYBRO at $0.04, predicts a 30,000% rally by 2025.

A prominent investor who previously backed Polkadot (DOT) has highlighted a new cryptocurrency priced at $0.04, predicting it could experience a 30,000% increase by 2025. This potential surge might transform a modest $400 investment into an impressive $120,000.

CYBRO surpasses $4 Million in presale: Unlocking multichain DeFi possibilities

CYBRO has taken the crypto world by storm, reaching a $4 million milestone in its exclusive presale and drawing the attention of crypto whales. As a multichain DeFi platform, CYBRO is opening up opportunities for investors to maximize returns across different blockchains—whether the market is bullish or bearish.

With CYBRO tokens available at the presale rate of $0.04, experts are anticipating a potential ROI of up to 1200%. This project has already garnered interest from influential crypto figures and whales, reinforcing its promise.

Adding to the excitement, CYBRO recently introduced a lucrative referral program—offering 12% rewards from direct referrals, with an additional 3% from second-level and 2% from third-level referrals. These weekly rewards are paid in USDT, and new referees can enjoy double CYBRO points on their initial deposit with a referral code.

Interested investors can join CYBRO to unlock the potential for 1200% returns.

CYBRO also provides investors with exclusive points, offering more ways to benefit from this ecosystem. Holding points gives automatic eligibility for the CYBRO airdrop, with token allocations based on your points. Each week, up to 1 million points are up for grabs, which can be earned through strategic investments in CYBRO’s DeFi vaults.

CYBRO token holders also gain access to a range of perks, including staking rewards, exclusive airdrops, cashback on purchases, reduced fees on trading and lending, and a robust insurance mechanism—ensuring a secure and rewarding experience on the platform.

With only 21% of the total tokens available for this presale and over 100 million tokens already claimed, the supply is quickly decreasing.

Polkadot: Connecting blockchains with speed and scalability

Polkadot is a decentralized protocol and cryptocurrency. It enables secure communication between different blockchains. Value and data can be shared across networks like Ethereum and Bitcoin without intermediaries.

Polkadot uses parachains to boost speed and scalability. It processes more transactions than Bitcoin and Ethereum. The DOT token is used for governance and staking. Holders can participate in the network’s development and verify transactions. Polkadot was created by Gavin Wood, a co-founder of Ethereum. It is maintained by the Web3 Foundation. Polkadot aims to connect blockchains and make them more efficient.

Conclusion

While established coins like DOT may offer steady growth, their short-term potential is limited compared to emerging tokens. CYBRO presents a unique opportunity for investors to increase their earnings through its leverage of AI-powered yield aggregation on the Blast blockchain. Its additional features, including attractive staking rewards, exclusive airdrops, and cashback on purchases, enhance investor benefits.

With seamless deposits and withdrawals, the user experience is also elevated. CYBRO’s commitment to transparency, compliance, and quality set it apart in the DeFi space. The project has garnered significant interest from influential figures and large-scale investors, indicating strong confidence in its future performance.

To learn more about CYBRO, visit their website, Twitter, Discord, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

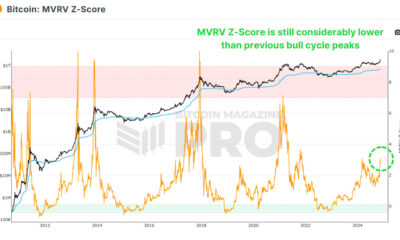

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential