Crypto scam

Are users paying for the exchange’s failures?

Published

4 months agoon

By

admin

Is WazirX prioritizing its own survival over user security with the “socialized loss strategy,” and how does this impact the Indian crypto community?

On July 18, WazirX, India’s largest crypto exchange, faced a severe cyber attack. Hackers targeted one of their multisig wallets and made off with over $230 million worth of digital assets.

The attack saw the direct theft of 15,298 Ethereum (ETH), with the exploiter then swapping various tokens like Shiba Inu (SHIB), Polygon (MATIC), and Pepe Coin (PEPE) to gather a total of 59,097 ETH, impacting WazirX’s ability to maintain a 1:1 collateral with its assets.

Adding fuel to the fire, WazirX halted all trading activities as the prices on their platform crashed to levels far below those on other exchanges. Furthermore, WazirX has also frozen all withdrawals, both in crypto and INR, leaving customers unable to access their funds.

Given the scale of this incident, which affected 45% of user funds, the exchange’s trustworthiness, once boasted to over 15 million users, is now in serious doubt. To address this crisis, WazirX has proposed a controversial recovery plan.

On July 27, they announced a “socialized loss strategy,” aiming to distribute the losses among users to maintain platform stability. Under this plan, users will have immediate access to only 55% of their assets, while the remaining 45% will be locked in Tether-equivalent tokens.

This move, intended to prevent disproportionate impacts on any single group, has stirred stark backlash across social media. Many users feel betrayed by what they perceive as a blatant disregard for their assets’ security and integrity.

Let’s dive into the details and understand the public’s reaction to this contentious strategy.

Pick your poison, but you can’t cash out

WazirX’s controversial recovery plan, branded as the “socialized loss strategy,” has sparked heated debate among its users.

According to correspondence shared with affected users, the exchange presented a poll offering two options to recover their stolen funds.

“Option A” permits users to access 55% of their funds “for trading and deposits” but restricts withdrawals. This option also gives users priority in potential recovery proceeds.

On the other hand, “Option B” allows users to withdraw 55% of their assets “in a staggered manner,” but with a lower priority in the recovery queue.

In both scenarios, WazirX states that the remaining 45% of user assets will remain locked on the exchange as “USDT-equivalent tokens,” which would only be returned if the firm successfully recovers the stolen funds.

The value of the unlocked portfolio (55%) will be calculated based on average prices from CoinMarketCap and select global exchanges as of July 21, 2024, 8:30 PM IST.

Registered users received an email with detailed instructions and a link to select their preferred option. The deadline for responses is August 3, 2024, at 07:00 AM IST.

However, this poll is not legally binding upon the users or WazirX. The final decision will be made after considering the poll results, ongoing investigations, the platform’s liquidity, and any evolving circumstances, the platform announced on July 29.

Dear WazirX Tribe,

We appreciate your active participation in our recent poll from 27 July 2024. We want to clarify that this poll is a preliminary step to understand your opinions and is not legally binding upon the users or the WazirX platform.

We reassure you that this poll… pic.twitter.com/8BkbjhTCjM

— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) July 29, 2024

This plan has led to widespread outrage and skepticism. Many users perceive this strategy as a way for WazirX to avoid full responsibility for the losses.

Moreover, the restriction on withdrawals, coupled with the non-binding nature of the poll, leaves users feeling that their assets are still at critical risk.

WazirX’s recovery plan faces fierce backlash

The public backlash against WazirX’s controversial recovery plan has been swift and severe.

Sumit Gupta, the co-founder and CEO of CoinDCX, was among the first prominent figures to criticize the exchange’s handling of the situation.

He mentioned on X that the burden of losses should primarily fall on WazirX itself, using its own treasury and assets, rather than making customers bear a 45% loss.

Hate to be saying this, but the way @WazirXIndia is handling this entire situation isn’t community first and this IMO won’t go down well for them. This sadly is also hurting the other ecosystem participants.

The first contribution to losses should ALWAYS come from the Company…

— Sumit Gupta (CoinDCX) (@smtgpt) July 29, 2024

Gupta also pointed out that the poll options were framed to protect the business rather than its customers, calling the approach “utter nonsense.”

Brian Kuttikat, COO of KoinBX, expressed a similar sentiment in an exclusive conversation with crypto.news, citing WazirX’s strategy of “socializing losses” as highly controversial.

He acknowledged the intentions behind the approach but questioned its effectiveness in offsetting the losses faced by affected users.

Meanwhile, the call for justice has grown louder, with many users demanding strict intervention and criminal proceedings against WazirX and its head, Nischal Shetty.

One user shared a letter addressed to a DCP officer, insisting on a CBI inquiry to determine whether the incident was a hack or an insider job.

CBI inquiry is imperative to determine whether this #Wazirx incident was a hack or an insider job. If it turns out to be a hack, I may offer my support in the future. However, uncovering the truth is my priority. and I am committed to pursuing justice relentlessly, even if

1/2 pic.twitter.com/Qmh2GmNJym

— Justice for WazirX Users (@IndiasCrypto) July 28, 2024

Further critiques of WazirX’s approach poured in from various quarters.

Kashif Raza, another vocal critic, outlined several flaws in the proposed solution. Raza argued that the snapshot for asset valuation should have been taken before the hack, criticized the allocation and profit usage of WRX tokens, and questioned the fairness of penalizing users with non-stolen tokens.

WazirX Solution is Not Acceptable?

1) The snapshot should have been taken on or before 18th July 2024.

2) WRX foundations were allocated 30% of WRX tokens. The team and Foundation made some money on WRX tokens that can be paid off.

3) Why should the users with Non-Stolen… pic.twitter.com/fW5JkC7NO9

— Kashif Raza (@simplykashif) July 29, 2024

Raza also raised concerns about tax liabilities on top of user losses and demanded transparency regarding WazirX’s financials and profit usage to compensate victims.

The overarching sentiment is one of betrayal and frustration, with many questioning the fairness, legality, and transparency of the recovery plan.

In the face of this backlash, Nischal Shetty, the head of WazirX, mentioned that the poll presented to users was a preliminary step to understand their opinions and is not legally binding.

1. This poll is a preliminary step to understand your opinions.

2. This poll is not legally binding upon the users or WazirX

3. We will soon launch feedback form to collect more ideas

4. We are now looking into next steps based on all the feedback receivedThis is a major… https://t.co/tcdDjWzIYI

— Nischal (Shardeum) 🔼 (@NischalShetty) July 29, 2024

Shetty assured users that a feedback form would soon be launched to gather more ideas and that the team is considering all the feedback received to determine the next steps.

Take the taxes and stay quiet

India has emerged as a global leader in crypto adoption, topping Chainalysis’s Global Crypto Adoption Index in September 2023. However, this enthusiasm appears to be one-sided, with the government and regulators maintaining a conspicuous silence on the subject.

In the 2022 budget, the government introduced stringent income tax rules for crypto transfers, taxing any income earned from these transactions at a hefty 30%. No deductions are allowed, except for the cost of acquisition, and losses cannot be offset against other income or carried forward to future years.

The irony is palpable: while the government is quick to tax crypto gains, it offers no safety net when things go awry.

Meanwhile, the Reserve Bank of India (RBI) has also been silent, with the last notable statement coming from Deputy Governor Shri T. Rabi Sankar in February 2022.

In his speech, he mentioned crypto’s risks to the financial system, comparing them to speculative assets with no intrinsic value. He warned of the destabilizing effects they could have on monetary policy and financial stability.

This approach has created a precarious environment for investors. On one hand, they face high taxes and strict regulations; on the other, they receive no support or protection from the government during crises, such as the ongoing WazirX fiasco.

At this point, both WazirX and the government seem to have prioritized their own interests over those of individual investors. The lack of transparency and support from both parties has left investors feeling abandoned and betrayed.

As India continues to lead in crypto adoption, it is imperative for the government to engage more actively and constructively with the industry. Ignoring the issue is not a viable long-term strategy.

Source link

You may like

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Crypto scam

Crypto traders doxx 13 year-old-boy who rugged two pump.fun tokens

Published

2 days agoon

November 20, 2024By

admin

A 13-year-old boy got doxxed by crypto traders after pulling the rug on a pump.fun token he named Gen Z Quant. Traders doxxed his whole family and turned them into pump.fun tokens.

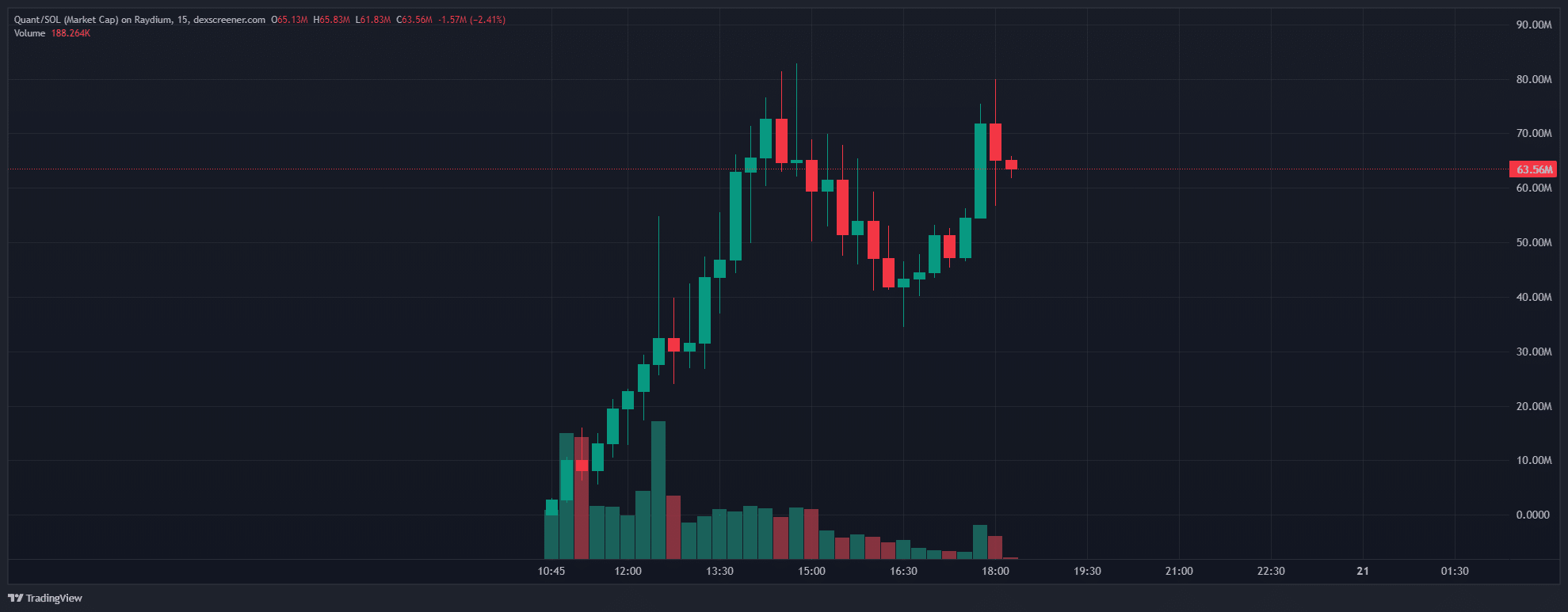

A 13-year-old boy has been caught in the middle of one of the most random rug-pulls the crypto community has ever witnessed. On Nov. 20, the unnamed boy launched a token on pump.fun under the ticker QUANT and watched as the price go up by 260% mere minutes after launching.

Not even an hour later, the boy dumps all his QUANT tokens, effectively pulling the rug from under traders who had bought the token minutes before. The boy made a profit of $30,000 by inflating the price and selling all his tokens.

As if that was not enough, he went online and flipped the middle finger at the traders who had been burned by QUANT’s rug-pull. He then went on to do the same thing by launching another token of the same name, which he later dumped for another $12,000 in profit.

Not long after, more experienced traders took over and brought the token’s market cap up to $70 million. The Gen Z Quant token he launched as an elaborate troll is currently trading at $0.05571 according to DEX Screener. It has soared to nearly 50% in the past six hours but is gradually going down hill by 13% in the past hour.

Although the boy has managed to turn his initial $30,000 token into a $2.4 million token, the crypto community was not going to let his misdemeanor slide.

Traders began doxxing the boy’s family and locating his school, tracking their social media accounts and complaining about the funds they lost thanks to the boy’s rug pull. Soon enough, developers began launching new pump.fun tokens named after the boy’s family members with their profile pictures revealed to accompany them.

Pump.fun tokens with the ticker QUANT DAD, QUANT SIS and QUANT MOM have already been circulating the markets, as well as tokens accompanied by a picture of the boy’s whole family and their pet dog with the ticker CABAL.

“Kid put his bloodline on the line,” one user pointed out.

“Then the community cto’d it to $135 million. He could’ve had 1.2 million. Then they doxxed his name, address and sschool. The community is roothless,” said a user on X.

One trader dubbed the boy “the future of finance,” while another reminded the community that this boy represents a messed up generation that has been “optimized to do that to people.”

Source link

Crypto scam

Scammers Decided Not to Operate in TON. Is this good?

Published

1 month agoon

October 23, 2024By

admin

Crypto scammers using malware to steal digital assets refused to attack TON users. However, things are not so clear-cut.

Scam Sniffer experts noted that the operators of a drainer popular among scammers rejected the TON network.

In a message published in an unspecified Telegram channel, the drainer creators announced its closure in the TON ecosystem. The main reason is the lack of crypto whales:

The malicious application’s developers are now moving to the Bitcoin blockchain, which will probably create many more opportunities for scammers to rob.

“What’s next? If you enjoyed draining on the TON network you will definitely live draining Bitcoins.”

One of the main reasons for the lack of whales is the vast number of airdrops on TON. They make fraud not the most profitable way to earn money: phishing schemes on The Open Network bring little profit, reducing scammers’ interest.

However, SlowMist founder Yu Xian said that such an assessment of whale activity in TON may need to be more complex. In his opinion, the drainer team may need to pay more attention to the potential of the TON blockchain.

“A phishing group on TON is ready to shut down, arguing that they believe TON has no whale players and is a small community. They have already turned to the Bitcoin ecosystem… Too realistic. Or maybe this gang isn’t smart enough.”

Yu Xian, SlowMist founder

How the TON blockchain became a new haven for scammers

TON has become one of the most successful stories of 2024, with the value of its token growing by more than 100% since the beginning of the year. In addition, integrating TON with the Telegram messenger, which has more than 900 million users, strengthened its position as a potential residence for the widespread distribution of cryptocurrency.

Scammers’ activity in TON arose against the backdrop of the rapid growth of the blockchain. Due to increased interest and investment in TON, fraudulent activity has gained momentum since at least November 2023.

The interest is mainly driven by the increasing popularity of mini-apps. They successfully exploited the popularity of projects such as Notcoin and Hamster Kombat. Typically, the attackers used the popularity of tap-to-earn games.

For example, Kaspersky Lab noted that scammers offered to earn Toncoin (TON) using bots and referral links. To make it easier to deceive users, the scammers recorded a video with instructions, created text manuals, and provided them with many explanatory screenshots.

Tonkeeper explained that the scammers rely on current trends in the ecosystem. For example, they created a token against the backdrop of the excitement caused by the launch of Hamster Kombat. Therefore, the names and tickers of fake tokens are often consonant with the names of popular projects.

“Usually, scammers create tokens before the official listing of the real coin. Check information about the token launch in official sources.”

Tonkeeper team

Experts from BlockAid also noted that attackers used leak tools previously used on the Ethereum and Solana platforms. In September, more than 300 malicious decentralized applications (dapps) were launched on TON, highlighting the growing threats.

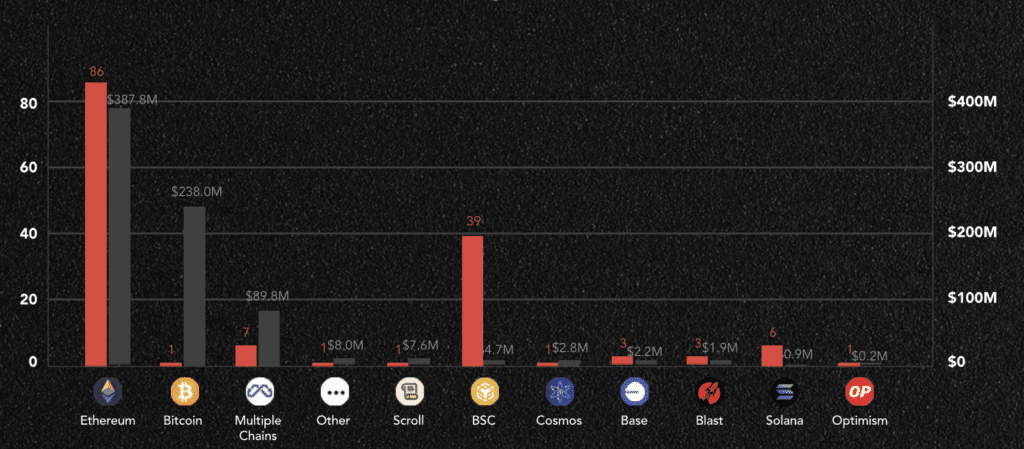

What is the most popular blockchain for fraud?

Despite the growing popularity of TON, the blockchain has yet to boast of popularity among fraudsters, according to data from the REKT Database.

Thus, Ethereum became the leader in phishing attacks last year, suffering losses of over $65 million, 91% of the total loss. Arbitrum also suffered losses of $5.2 million, while Bitcoin lost $768,000.

In terms of exploits, Ethereum was also the most affected blockchain in this category, with losses of $482.7 million, while Binance was the most vulnerable to exit scams, with a loss of $74.5 million.

Regarding attackers’ move to the Bitcoin blockchain, CertiK, another well-known company in the blockchain security field, emphasized that scammers are becoming increasingly interested in Bitcoin due to its high transaction volumes, large user base, and significant total value locked (TVL).

Phishing attacks on Bitcoin have increased significantly in recent months. One of the most notable incidents was the attack on a Bitcoin whale that resulted in $238 million in losses, further highlighting the growing risks in this area.

Source link

Crypto scam

Andrew Tate is Poison — Crypto Must Stand Up for Coffeezilla

Published

1 month agoon

October 22, 2024By

admin

Andrew Tate’s response to Coffeezilla shows he’s thin-skinned and doesn’t care about the people who have invested in his tokens.

On-chain sleuth Coffeezilla has become a thorn in the side of high-profile influencers shilling coins to their millions of fans.

One of his best-known scalps is Logan Paul, who was ripped to shreds over his embattled and now-abandoned project CryptoZoo.

Coffeezilla’s also gone toe-to-toe with the likes of Sam Bankman-Fried as he vies to uncover scams to his 3.77 million subscribers on YouTube.

But now, the investigator is facing an almighty backlash about a deep dive that hasn’t even been released yet — and it relates to a number of coins that have been endorsed by Andrew Tate.

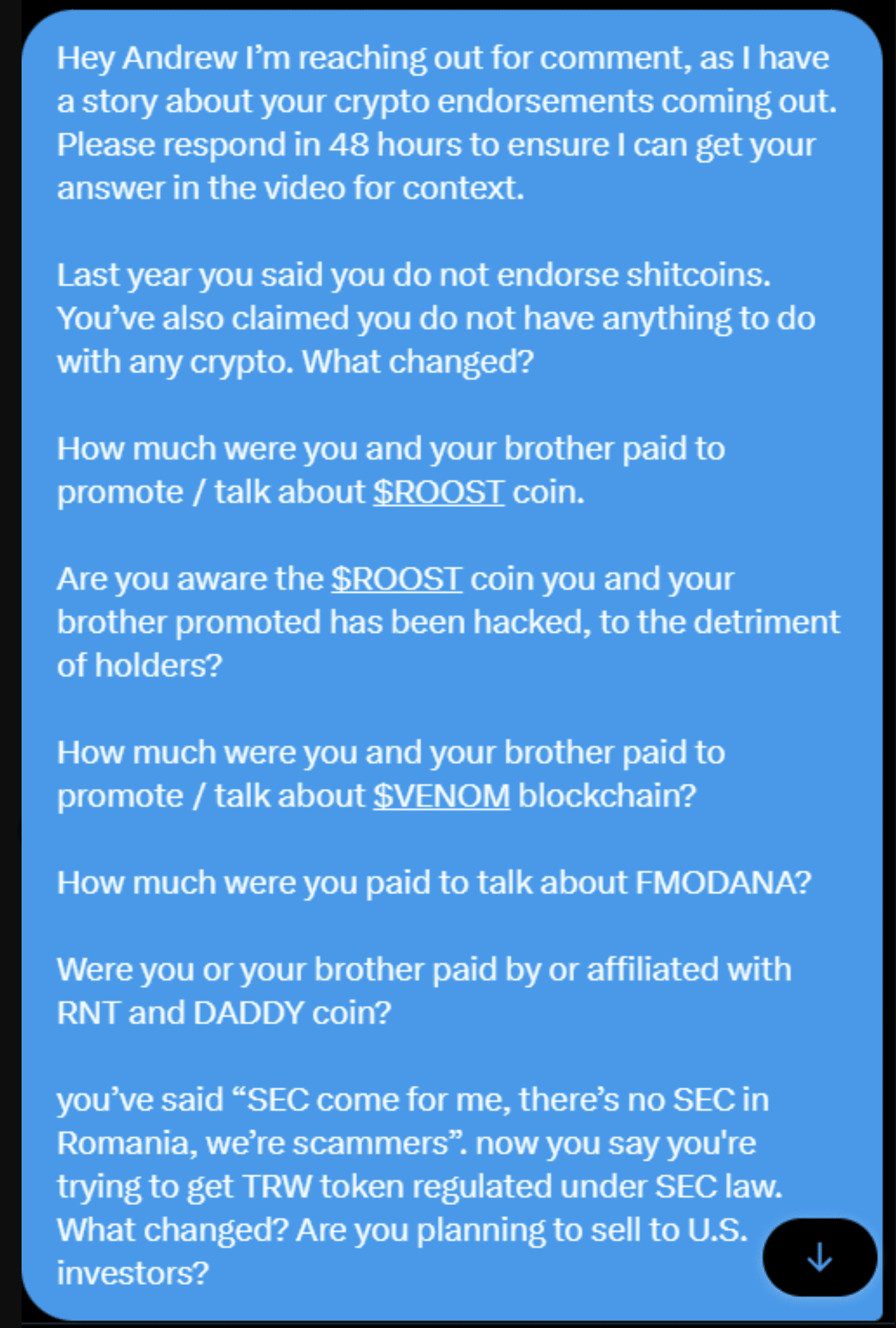

On Wednesday, Coffeezilla shared a DM that he had sent to Tate, asking whether he had been paid to promote cryptocurrencies, including ROOST and DADDY.

The message also pointed out that this is completely at odds with videos that Tate had released on X earlier this year, where he was topless and appeared to have substantially more hair.

I DO NOT ENDORSE SHITCOINS.

I’m not a scammer like every other “influencer”

I don’t need to rob my fans.

I DO NOT HAVE ANYTHING TO DO WITH ANY CRYPTO. pic.twitter.com/tlLQ8Iunz3

— Andrew Tate (@Cobratate) May 17, 2023

Coffeezilla is following a crucial journalistic principle known as the “right of reply.” If you’re going to make allegations against someone, they must have the ability to respond before publication.

But instead of answering the legitimate questions put forward — which would be of interest to his many acolytes — Tate chose to go down the homophobic route.

By the looks of things, this has now unleashed a huge can of worms. Coffeezilla shared a screenshot that shows how his inbox has been bombarded with slurs.

Why? Because Tate reposted an anonymous account that exposed Coffeezilla’s email address, with the misogynist telling his followers: “Email him and call him gay.”

Undeterred, the investigator has insisted that he still wants a reply to his questions — and it’s likely that, if the clock runs out, Coffeezilla’s video will go live anyway without a comment.

The YouTuber also posted a comical mash-up that showed Tate chomping on a cigar because it looks cool, declaring that he respected Coffeezilla, cutting to another clip where he says:

“Coffeezilla is a b****. I don’t give a f*** about your video, I don’t respect your journalism.”

Given how wide-eyed Tate is as he jabs his finger toward the camera, you could suggest that all of this scrutiny is bothering the sham entrepreneur more than he lets on.

What is Coffeezilla investigating?

Coffeezilla, who married his high school girlfriend in 2017, has so far remained tight-lipped about the nature of the allegations against Andrew Tate and his brother Tristan.

But it seems a core part of the focus in his upcoming investigation will surround the $DADDY token, which has fallen precipitously in value since launch and has never recovered.

An all-time high of $0.2925 was set in mid-June when CoinMarketCap started tracking the altcoin — and at the time of writing, it’s down by more than 48%.

Tate’s full rebuttal video is something of a parody — honestly, some of the lines in there are pure comedy, especially how they are delivered. He tells Coffeezilla:

“I guarantee I drink more coffee than you — meaning you’re a fraud to begin with. You’re doing this little breakdown, this investigation, you just emailed me in a homosexual tone.”

To be honest, I don’t even know where to start with this. You can’t have “Coffee” in your handle unless you prove you’ve got a higher caffeine tolerance than Andrew Tate? Daring to scrutinize a man who has more legal troubles than Lamborghinis reveals his sexual preference?

Even before knowing the exact nature of Coffeezilla’s investigation, we have an insight into how thin-skilled Andrew Tate really is — and ultimately, how little he cares for his community, as well as those who have invested in his tokens.

Tate’s toxic masculinity has preyed on the insecurities of disenfranchised young men around the world while his foray into crypto has dived into their wallets — creating a false illusion that they, too, will experience extreme wealth one day.

When you think about it, Tate’s branding and messaging are reminiscent of an era that most of the crypto world has been trying to move away from, when the ICO boom of 2017 was full of wild excesses along with never-ending images of fast cars and bundles of cash.

In this battle, the crypto community needs to rally behind Coffeezilla — a man who has taken great risks to expose bad actors in the space and stand up for those who have lost their life savings to some of the industry’s most audacious scams. He, among others, serves as crypto’s immune system, with every investigation slowly chiseling away at the sector’s “Wild West” image and deterring opportunistic thieves planning to swindle unsuspecting victims.

The crypto community needs to distance itself from narcissists like Tate, who use homophobia as a weapon to deflect against their own shortcomings. Coffeezilla’s sexual orientation has zero relevance to the work he performs, and it’s shameful to think otherwise. Digital assets won’t ever achieve mass adoption if the influencers within this space denigrate innocent people who are doing nothing wrong.

And last but not least, the crypto community needs to realize that Andrew Tate and his coins represent everything that this innovative sector is not: hateful, harmful and dishonest. Engaging with him only drags down the rest of the industry.

Crypto is all about the future. Tate’s worldview belongs to the past.

Source link

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential