Bitcoin miners

Bitcoin Hashrate Hits All-Time High as Trump Vows to Boost Industry

Published

4 months agoon

By

admin

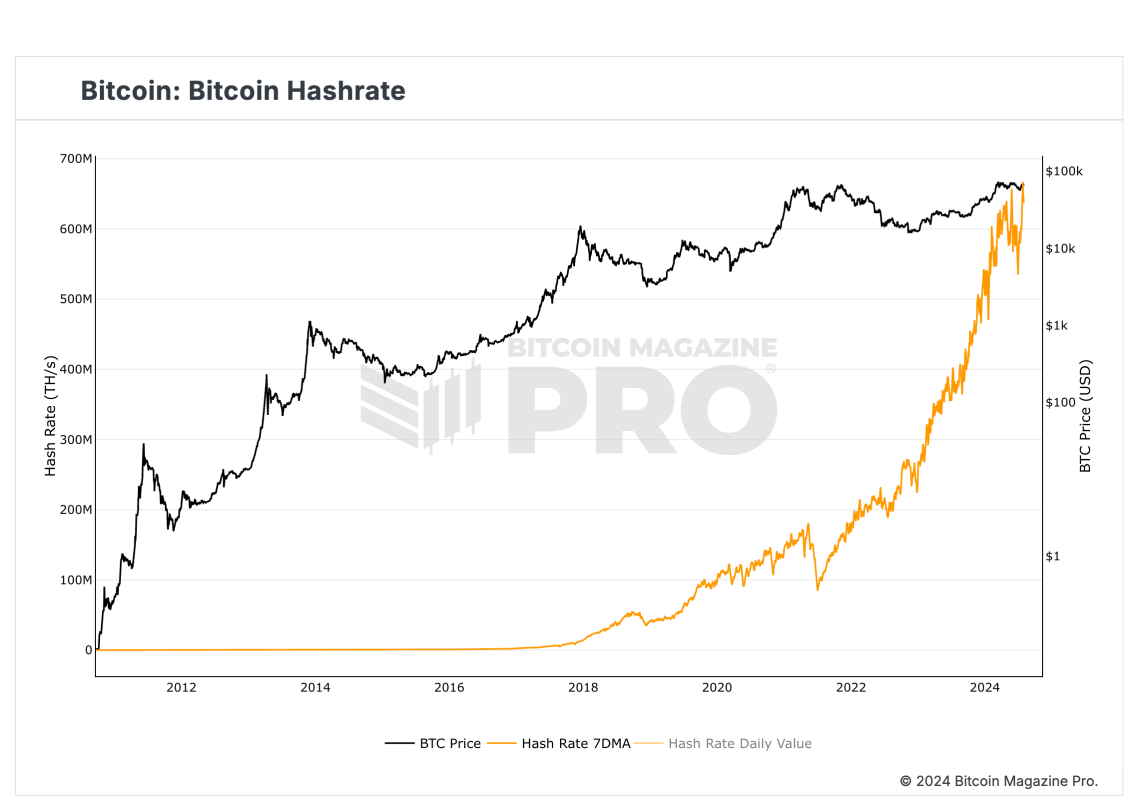

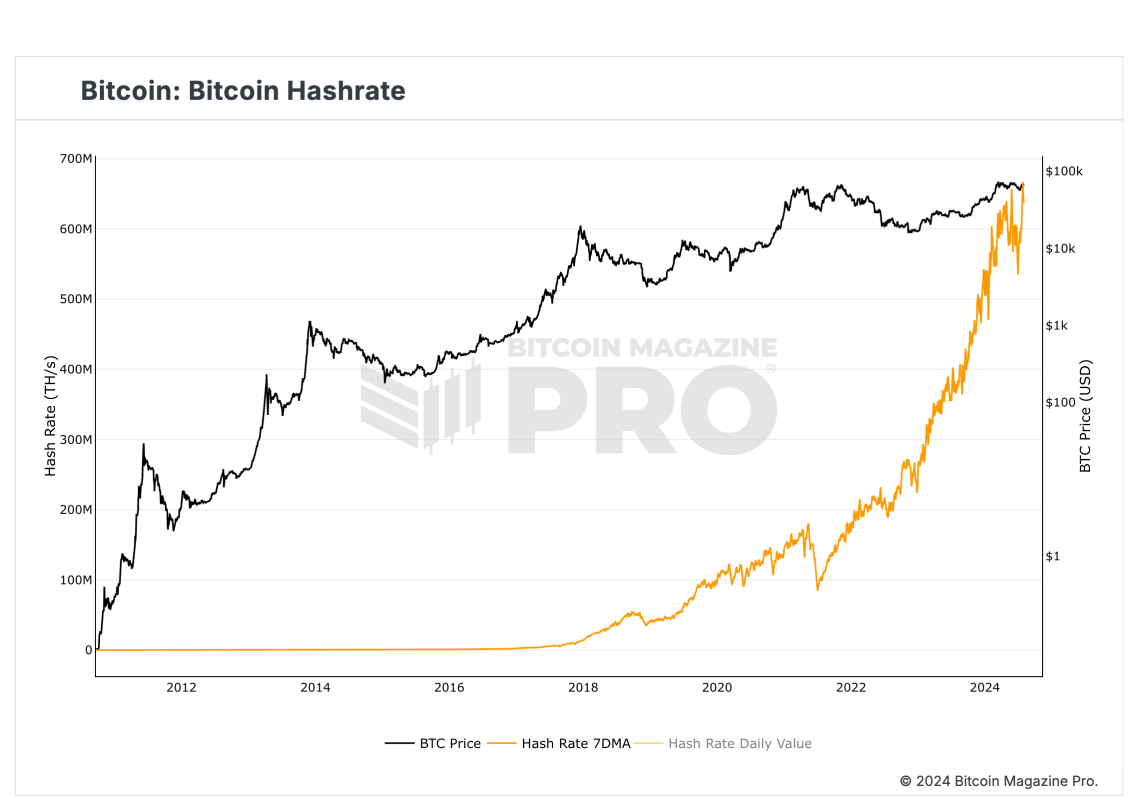

According to Bitcoin Magazine Pro, the 7-day average mining hash rate for Bitcoin has hit a new all-time high, surpassing 667 exahashes per second (EH/s) on July 26th during the Bitcoin 2024 conference. This tops the previous record of 657 EH/s set on May 26th.

This new all time high comes as Donald Trump announced his plans during the conference to support and boost the Bitcoin mining industry.

Major mining firms like Whatsminer and MicroBT are rolling out new powerful machines to capitalize on the hash rate boom. Whatsminer unveiled four new mining rigs and an upcoming solar mining container system. MicroBT introduced its M6XS+ miners, which can handle 190 to 450 terahash.

Riot Platforms also acquired Block Mining for $92.5 million to expand its hash rate and market reach. Miners are exploring AI integration and acquisition opportunities to navigate ongoing identity challenges.

The boost in miners’ revenue from Bitcoin’s rising price has cooled selling pressure and stabilized network activity. Outflows from miners remained under $10,000 per day in July compared to over $20,000 in March when BTC first hit $70,000.

Overall, Bitcoin’s climbing hashrate reflects a vote of confidence in its long-term viability. With major mining innovations and favourable politics boosting revenues, miners are aggressively expanding infrastructure to process transactions and secure the Bitcoin network.

Source link

You may like

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Bitaxe

Bitaxe And The Open-Source Bitcoin Mining Movement

Published

1 month agoon

October 23, 2024By

admin

Company Name: Bitaxe

Founders: Skot

Date Founded: Early 2023

Location of Headquarters: North Carolina + remote team

Amount of Bitcoin Held in Treasury: N/A

Number of Employees: ~12 regular contributors

Website: https://bitaxe.org/

Public or Private? Open-source project (not a company)

Bitaxe’s founder, who goes by the nym Skot, has taken his hobby of tinkering with electronics and not only transformed it into a full-time gig but has catalyzed thousands to follow his lead.

Harnessing his training as electrical engineer and his Bitcoin enthusiasm, Skot began deconstructing Bitmain’s Bitcoin mining machines approximately two years ago. After gaining a better understanding of how they work, he reverse engineered one, creating the blueprint for Bitaxe — the first ever open-source ASIC-based Bitcoin mining machine — in early 2023.

“It was just a technical challenge initially,” Skot told Bitcoin Magazine.

That technical challenge has transformed into something bigger than he ever could have imagined, though. Skot created a low-power and affordable Bitcoin miner that anyone can plug in at home without running up a huge energy bill, while his work also paved the way for others interested in open-source Bitcoin mining to begin contributing to Bitaxe and other open-source mining initiatives like it (and related to it).

“The project has morphed into something that’s bringing mining back to the open source fundamentals of Bitcoin itself,” Skot said.

“I’ve really become convinced that to be truly decentralized, which I think most people understand Bitcoin needs to be, all aspects of the development of Bitcoin needs to be open source,” he added.

“It needs to be open so that anyone who’s even remotely interested can get in.”

Skot’s Journey To Bitaxe

Years back, while taking liberal arts courses at a community college, Skot stumbled on an issue of Make Magazine, a publication that features tutorials for DIY electronics projects. A switch flipped inside of him as he perused the magazine.

He completed a degree as an electrical engineer and then co-founded a design consultancy for Internet of Things (IOT)-related products, which he ran for 10 years. Skot enjoyed the work, but admitted that the downside was that he was constantly working on other people’s ideas.

In 2011, a friend introduced him to Bitcoin at a party — showing him how to use bitcoin to buy drugs on the now defunct Silk Road. While he was intrigued, it wasn’t enough to get him to buy bitcoin (or drugs) at the time.

Two years later, Skot learned about Bitcoin mining, and, soon after, built his first Bitcoin miner.

“I actually built a FPGA Bitcoin miner,” recalled Skot. “FPGAs were the precursor to ASICs.”

FPGA miners were designed with open-source code, making it easy for Skot to figure out how to construct one.

While he lost all of the bitcoin that he mined in a pool hack, he didn’t become discouraged. In fact, he became more fascinated with this cross section of electronics and the permissionless nature of Bitcoin.

“When I was learning about it, I was like, ‘Well, okay, so these are the rules of how Bitcoin mining works, but who made these rules? Who enforces these rules?’” recounted Skot.

“Learning that no one is at the center of this and no one enforces these rules — or we all do — was mind-blowing. It’s a beautiful thing technically, and that intrigued me,” he added.

A few years later, he dove in deeper and developed the Bitaxe.

What is Bitaxe?

A Bitaxe is technically just open-source code that anyone can use to build a physical mining machine.

Skot has only built about a dozen Bitaxes himself, while thousands have been built and sold. Anyone can build and sell Bitaxe’s under its open-source license.

The circuit board for physical Bitaxes isn’t much bigger than a credit card, while the device’s fan protrudes out about 3 cm from the board. (There are different versions of Bitaxes that vary slightly in size.)

The machine runs on a 5 volt power source and connects to the internet over WiFi. Users interface with Bitaxes via their personal computer or phone. The devices use between 12 and 18 watts of electricity, which is comparable to an iPad charger.

Running a Bitaxe full-time should only increase users’ energy bill by a few dollars per month (this varies based on jurisdiction), and it costs less than what running a Bitcoin node costs to run.

The odds of finding a block with a Bitaxe are infinitesimally low (though, a Bitaxe did find a block this past July), but users can direct the hash power they produce with their Bitaxe to almost any mining pool for smaller payouts.

Ideally, Bitaxes are used to decentralize the hashrate, though this will, in the end, only lead to really meaningful decentralization if mining pool centralization decreases along with it.

“My hope is that by decentralizing the number of brains that are operating these things that enough people will make different decisions,” explained Skot. “If we can exponentially increase the number of different brains and all the crazy ways that they think, I think they will pick different pools.”

Bringing more of these brains in was part of Skot’s motivation creating Bitaxe (which I’ll touch on more in just a moment), while another part of his motivation was simply to bring a new kind of Bitcoin mining machine to market.

Bitaxe vs. Industrial Bitcoin Miners

Most Bitcoin mining equipment is built for the major players in the industry.

“99.9% of the Bitcoin mining hardware that’s out there is designed specifically for being used in an on-grid data center,” said Skot. “They’re all designed to be plugged into the grid and operate full power 24/7 on industrial power.”

Skot explained that while this is great for industrial miners who tend to point their hash power at the big mining pools, it does very little for the Bitcoin enthusiast who wants to contribute to the hashrate.

He also shared that ASIC chips aren’t currently sold independently of Bitmain miners and that it’s difficult to understand how the chips work, because the machines in which they operate are designed with closed-source code.

“We have essentially just one chip maker right now when it really comes down to it — that’s Bitmain,” said Skot.

“They’re really far ahead of the pack, but I don’t think that advantage they have is going to last forever. I think some of these other chip makers will come up,” he added.

While Skot is patiently waiting on the ASIC chip that Jack Dorsey’s Block is developing, which will be able to be used in any mining device, he continues to work on open-sourcing the Bitcoin mining stack so that it’s easier to compete on the ASIC market.

“Let’s open source as much of that stack as we can, because, like we saw with the internet, random people can do cool stuff in their garages that sometimes turns into a market standard,” said Skot.

And he should know, as he created a new standard in Bitcoin mining in his figurative garage with the Bitaxe just over a year and a half ago, which has led to many others following his lead.

“I’ve been doing it for about a year and a half, and it’s growing exponentially,” said Skot. “My goal is to keep up this exponential growth.”

The Open-Source Mining Movement

After receiving a grant from OpenSats early this year, Skot has been able to focus full-time on Bitaxe and the community that’s formed around the project.

“When I first started this, I met some random person on Bitcoin Talk who was like ‘I’m going to start a Discord group, and it’s going to be called Open Source Miners United — you should come check it out,’” explained Skot.

Start this Discord group the gentleman did, and it now has over 4,000 members, all of whom share ideas for how to further Bitaxe and the broader open-source mining movement. But Open Source Miners United (OSMU) has become even bigger than just a group in which people share ideas.

“It’s been set up so that anyone who wants to contribute to the Bitaxe project can do so, whether it’s a random person who wants to donate or the manufacturers of Bitaxe that contribute back to the project,” explained Skot.

“OSMU has this fund, this treasury now that’s growing because we’re selling lots of Bitaxes, and we provide small grants to other people working on open source mining,” he added.

Skot also shared that for every Bitaxe sold, approximately $5 is donated to OSMU, which helps to financially support both himself and OSMU grant recipients. (He stressed in a follow-up email that this practice is totally optional and that he is very appreciative of the manufacturers that choose to do this.)

The Future For Bitaxe and Open-Source Bitcoin Mining

The Bitaxe and open-source mining movement has taken on a life of its own, according to Skot. That is, Skot doesn’t necessarily feel that he’s at the center of it anymore — it’s become decentralized. And while he’s excited about the pace at which the movement is growing, he’s still grounded and mission-focused.

He hasn’t created a roadmap for what comes next for Bitaxe and the community he helped found, though he is quite sure of what the aim of his work is.

“I’ve been so intrigued and motivated to promote this idea that Bitcoin is fundamentally open source,” said Skot.

“This decentralized network needs to be developed in a decentralized way. We can’t have one without the other. So, I think this open-source part is so important,” he added.

“Bitcoin mining has somehow just totally forgotten about the open source ethos of Bitcoin and how important open-source development is. We’ve got to bring this back.”

Source link

24/7 Cryptocurrency News

Bitcoin Mining Stocks Will be Best BTC Proxy Bets If History Repeats

Published

3 months agoon

August 19, 2024By

admin

So far in 2024, the Bitcoin price has shown strength with most of the gains coming in the first quarter following the spot Bitcoin ETF launch. However, the Bitcoin mining stocks have given a laggard performance amid the BTC halving event putting significant pressure on the company’s revenues.

Bitcoin Mining Stocks Show Undervaluation

This year, some of the top BTC mining stocks such as Marathon Digital (NASDAQ: MARA), Riot Platforms (NASDAQ: RIOT), etc have been down 30-50% since the beginning of the year.

Crypto analytics platform ecoinometrics said that Bitcoin miner stocks had a terrible start to the year 2024, followed by a missed opportunity in Q1 following the spot Bitcoin ETF launch. During the second quarter, the BTC price has largely remained range-bound leaving the mining stocks struggling to gain momentum.

However, if history repeats, Bitcoin mining stocks can outperform BTC during the next bull run. In comparison to the previous cycles, several BTC mining stocks remain undervalued as of now.

The Bitcoin miners’ stocks have suffered a lot this year.

A terrible start to the year was followed by a missed opportunity during the Bitcoin ETFs rally in February and March. Since then, Bitcoin has been stuck in a range.

This is disappointing, considering that during… pic.twitter.com/3nJ3GoVbaf

— ecoinometrics (@ecoinometrics) August 18, 2024

“If you believe Bitcoin miners are likely to behave similarly during Bitcoin’s next parabolic phase, it’s reasonable to conclude that most of them are clearly undervalued,” noted ecoinometrics.

Top Bitcoin mining players have been consolidating their operations following the halving event in April, by buying new equipment and gearing up for future operations. Last week Marathon Digital purchased 4,144 Bitcoins through its $300 million in convertible notes.

In the past, several players have been betting on MicroStrategy stock as a proxy for Bitcoin. This also led to the launch of a leverage MicroStrategy ETF MSTX last week which saw strong trading volumes.

BTC Consolidation Ending Soon?

Over the weekend, the Bitcoin price attempted a breakout above $60,000 but failed to breach the crucial resistance. At press time, Bitcoin is trading 1.36% down at $58,549 with a market cap of $1.115 trillion.

Popular analyst Rekt Capital stated that Bitcoin is just 125 days from the halving event. Historically, the Bitcoin parabolic rally begins after 160 days from BTC halving. Thus, the BTC price breakout might come a month later by September end.

Bitcoin is ~125 days after the Halving

Bitcoin tends to breakout into the Parabolic Phase of the cycle some ~160 days after the Halving

If history repeats, Bitcoin could be just over a month away from breakout

That’s late September$BTC #Crypto #Bitcoin pic.twitter.com/iy7xmDjuso

— Rekt Capital (@rektcapital) August 18, 2024

Bhushan Akolkar

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: