Elections

Congressman Wiley Nickel On Reforming The Democrats’ Bitcoin Strategy

Published

4 months agoon

By

admin

On the main stage of Bitcoin 2024, Rep. Wiley Nickel (D-NC) shared that he’s working to have the Democrats shift to a more pro-Bitcoin and pro-crypto stance.

He told the audience at the event that he’d recently written a letter to the DNC signed by 28 Democrats, 14 of which are in Congress, advocating for a new approach to digital asset policy from the party and its presidential nominee.

Rep. Nickel explained that the new approach should include “pro-digital asset language in the party’s platform, selecting a vice presidential candidate sophisticated in digital asset policy, selecting a pro-innovation SEC chair, and engaging with the industry in a meaningful way.”

We followed up with Rep. Nickel in efforts to learn more about how he plans to get the Democrats on the Bitcoin bandwagon.

A transcript of our conversation, edited for length and clarity, follows below.

Frank Corva: What were your takeaways from the Bitcoin conference?

Rep. Wiley Nickel: I had a great time. I enjoyed speaking with folks involved with this issue at all levels and, most importantly, making the progressive case for crypto and why the work that we’re doing as Democrats in Congress is so important.

Keeping this in the bipartisan space was really my main focus in Nashville, and it’s what I’ve been working on in Congress. If this becomes a partisan political football — and Donald Trump, more than anyone, wants to politicize this issue — it’s going to set the industry back a decade in Congress.

DeFi and Bitcoin will continue regardless of who’s in power, but it’s really important that we get clear rules of the road, we have good regulation for the industry to protect consumers and to keep those jobs here and encourage innovation. That has been my focus in Congress, and I was glad I got to reiterate that in Nashville.

Corva: I think it is important for more middle-of-the-road Democrats like yourself to have a voice. Do you feel like there are more Democrats like you who do want to speak like this, who want to say they’ll keep Bitcoin and crypto jobs in the United States and that they want the US to be at the forefront of financial innovation?

Rep. Nickel: I do, because, frankly, we’re just right on the issue. Talking about financial inclusion is incredibly important. The current financial system just doesn’t work for everyone, and we have an incredibly promising solution here with crypto and Bitcoin that will help the folks I represent in a major way.

I think we’re seeing a new perspective on digital asset regulation emerging in the Democratic Party. Whether you love crypto or hate it, it’s here to stay. So, we have to protect consumers, foster innovation and bolster US competitiveness. Those are the big issues that matter in a public policy sense.

We’re working hard to build a coalition of like-minded Democrats across our party. We’ve succeeded in encouraging the Harris campaign to engage with industry, and I’m continuing to make the case for a reset.

The progress we made in the House of Representatives is undeniable: 71 Democrats joined with Republicans on FIT21, the digital asset market structure bill. Actions speak louder than words. The fact that I was able to get Nancy Pelosi and members of our House Democratic leadership on board with this bill says good things for keeping the future of Bitcoin in that bipartisan space.

Corva: That is an important and good reason for single issue voters or pro-crypto voters to consider voting for Democrats more if that’s their stance in these upcoming elections. Is there anything else that you want to say to pro-Bitcoin or pro-crypto voters to let them know that the Democrats do not want to be the party that stifles this innovation. Can these voters believe that things will be different than they have been over the course of the last three and a half years?

Rep. Nickel: Absolutely, and I thought it was important to author a letter to the DNC and to the Harris campaign, which I announced in Nashville from the stage. It’s a letter encouraging the DNC to include pro-digital asset language in the party’s platform, to appoint a pro-innovation SEC chair, and for the campaign to engage with industry experts. Those were some of the big points in the letter.

We’ve got 13 other House Democrats to join the letter, and a lot more support it. I wanted to put that out there so folks know that this is an important issue. You’ve got 20% of registered voters who own crypto, and there are well over a million single issue voters, so we need to continue to offer good public policy positions on the issue. I think we’re gonna see that from the Harris campaign in the coming weeks.

Corva: Looking back on the most practical level, what do you think the Democrats might have been able to do differently or better during the Biden administration?

Rep. Nickel: On the positive side, we have bitcoin and ether ETFs that the SEC approved, So, I can’t disagree with that. We worked in Congress hard to get the SEC to do that in a bipartisan way on the House Financial Services Committee, where I serve. I’m also on the Subcommittee on Digital Assets. We deal with this issue a lot in the House.

But Gary Gensler’s regulation by enforcement approach at the SEC has not served Kamala Harris’s interests or Joe Biden’s. Gary Gensler has taken the wrong approach, but he’s not the only voice in the Biden administration. There are a lot of other senior leaders who feel very differently. A lot of other regulators like Rostin Behnam at the CFTC have a different approach. So, we’ve got one regulator who is moving in the wrong direction, but it’s important for folks to know that he does not represent all Democrats.

Corva: Are Democratic senators and members of Congress learning about the positive use cases of Bitcoin? This includes financial inclusion; providing financial services to the unbanked, not only in the United States, but globally; cheap remittances; etc. Do you find that politicians are becoming more educated?

Rep. Nickel: Number one, it’s just about education. The folks that supported FIT21 on the Democratic side were the ones who were engaged, who were willing to take meetings and listen, understand and learn about this very new technology.

This is not the same place that we were four years ago, eight years ago or 12 years ago. To your point, you’re 100% right. You’ve got 1.4 billion people unbanked globally, and most of these people are part of marginalized communities. This hinders their financial management and deepens poverty and inequality. There is a very strong progressive case for how crypto can revolutionize financial inclusion, economic empowerment and offer new ways to build wealth outside of the traditional financial system.

Corva: Thinking beyond the borders of the United States, Bitcoin bestows property rights — something we have strong laws to protect here in the US — by default on people. This is powerful in places where people don’t have such rights. Will more progressives come out to acknowledge that this is important?

Rep. Nickel: I certainly hope so. That’s been my focus in Congress. We need to embrace new technology. You look back on the Internet and to think that you would have people in one political party opposing the Internet in the 90s, it’s just nuts to think about.

When you look back in a decade and the opposition to embracing Web3 in Congress — that position will not age well. The folks who oppose crypto on the Democrat side are just flat out wrong, and they’re not really looking at how we can strengthen this industry and protect consumers.

I spent most of the last year and a half talking about how our legislation in Congress will prevent the next FTX. That’s an important part for Americans to focus on.

I went on a CODEL (Congressional Delegation) with Patrick McHenry (R-NC), the Chair of the House of Financial Services Committee. We went to Singapore, Abu Dhabi, Tokyo to see mature crypto regulation, regulators and markets. One of the things they all said is they need the US to be part of the solution here. They need the United States to lead for the rest of the world.

This really is about democratizing finance. When we do that, we’re going to be able to uplift people all over the US when they are able to save money and transfer money. They’ll be able to do it much faster, with less red tape. Those are really good things if you’re talking about uplifting people in the US and around the globe with Bitcoin and other Web3 or blockchain technology.

Corva: One of the big things that Bitcoiners are worried about — and it’s something that both presidential candidates Trump and Kennedy have spoken directly to — is the idea of being able to hold your own private keys without any sort of AML/KYC requirements. Are Democrats in favor of everyone being able to hold their own keys in a non-custodial manner?

Rep. Nickel: In Congress, we’ve really focused on doing a few things before we get into the next level of stuff. It’s about regulating the industry, FIT21, the digital assets market structure bill and stablecoins. We’ve gotten sidetracked with SAB121 for custodial banking.

Those are the things that I think we need to tackle first, and then we get into the next layer of stuff, and I’m really hopeful we’re going to get those things done this Congress.

Corva: Two days after the Bitcoin conference, some of the bitcoin in custody of the US government moved addresses. Do you know where the government moved it to? Is the US government selling it? Have you heard anything about what’s going on?

Rep. Nickel: No, I haven’t.

Corva: Do you have any final thoughts you’d like to share?

Rep. Nickel: We’re just pushing hard for a reset with the Harris campaign on this issue. Trump certainly made his positions clear.

I’m just pushing to make sure that folks who own crypto — evenly split between parties — know this is an issue that matters for Democrats in the US Congress.

Source link

You may like

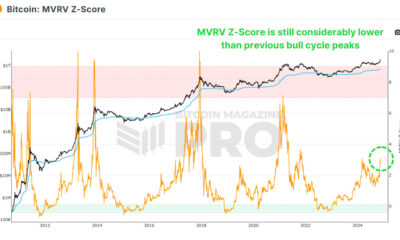

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Bitcoin crossed $77,000 on Friday, Nov. 8, setting a new all-time high for the second consecutive day.

Bitcoin (BTC) reached a new all time high of $77,020 roughly 48 hours after Donald Trump won the U.S. presidential election, along with the election of several pro-crypto policymakers to Congress. With a market cap of $1.5 trillion, Bitcoin now ranks as the world’s ninth most valuable asset, surpassing Mark Zuckerberg’s Meta.

BTC’s year-to-date growth has exceeded 118% with this recent surge. Over the past 30 days, Bitcoin has increased by nearly 25% as seasonal trends and halving-year data indicated bullish prospects. During the last two election cycles, Bitcoin has reached new highs and has not returned to pre-election levels.

Policy plans

For the first time, crypto money played a significant role in funding political action committees, leading experts and opinion leaders to anticipate progressive digital asset regulations from Washington. A BTC bill from Wyoming Senator Cynthia Lummis appears to be a frontrunner in what could become a new crypto policy landscape.

Like President-elect Donald Trump, Sen. Lummis pushed for a strategic national Bitcoin reserve and more. The proposal from Lummis would implement a BTC buying plan, piling on America’s existing 203,000 Bitcoin stockpile.

Lummis suggested acquiring 1,000,000 BTC over five years, which would cost the U.S. an estimated $77 billion if Bitcoin’s price remained constant over that period.

Bitcoin price

BTC ambassadors like Michael Saylor and the larger crypto community predict prices are going higher. Targets of $100,000 by year’s end, and $200,000 by 2025 have mentioned by investors and experts alike.

Investors already splurged $72 billion buying into Bitcoin via Wall Street exchange-traded funds. State like Detroit and Wyoming have announced some form of Bitcoin adoption. Marshalled interests between crypto titans did not disband following victory in the 2024 U.S. elections.

Crypto-focused super PAC Fairshake has raised over $78 million for the 2026 mid-terms. The organization disclosed donations from A16z crypto and Coinbase even before the Associated Press declared voting results.

I think @standwithcrypto did amazing work this election cycle to rate political candidates on crypto issues and apply pressure.

There’s still more work to do.

The largest cohort of U.S. politicians is still ranked undecided. pic.twitter.com/EuARsSAZs3

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) November 7, 2024

Source link

bull market

How Trump’s Promises Could Influence BTC $250k forecast

Published

2 weeks agoon

November 7, 2024By

admin

As analysts predict Bitcoin could reach $250K, how might Trump’s promises influence this potential? What should you be watching for in the coming months?

Trump triumphs

Donald Trump is back in the Oval Office, officially winning the 2024 U.S. presidential election as the 47th president. After a high-energy election night celebration at Mar-a-Lago with guests including Elon Musk and Robert F. Kennedy Jr., digital asset markets surged in response.

Bitcoin (BTC) rocketed past $75,000, reaching a fresh all-time high, while crypto-linked stocks like Coinbase and MicroStrategy saw strong after-hours gains.

For crypto supporters, Trump’ win signals more than just another GOP presidency, especially as he has made bold commitments to protect crypto, a notable departure from the past, when Trump’ stance on digital assets was anything but warm.

Moreover, with Trump’ Republican allies securing a Senate majority, the path is now open for the policies he hinted at throughout his campaign—policies that could reshape the future of crypto in both the U.S. and globally.

So, what promises has he made, and what should we expect from his term? Let’s find out.

Trump’s promises to the crypto industry

Bold vision for a national crypto stockpile

One of Trump’ biggest promises to the crypto world is to create what he calls a “strategic national crypto stockpile.” In simple terms, Trump aims to prevent the government from auctioning off seized Bitcoin, instead holding onto it as a national asset.

Trump believes that, just as countries hold reserves of gold or oil, the U.S. should secure a portion of Bitcoin to hedge against future financial uncertainties.

Currently, the U.S. government often auctions off Bitcoin seized from criminal cases, such as after the Bitfinex hack, but Trump has suggested putting a halt to these sales.

This promise is crucial, given that the U.S. Marshals Service has regularly auctioned Bitcoin holdings, sometimes causing temporary market dips. Earlier this year, Germany’s sale of hundreds of millions in seized Bitcoin led to similar price swings.

While Trump hasn’t provided a concrete plan for how this reserve would be managed, some view it as a step toward positioning the U.S. as a global crypto leader.

Creating a strategic Bitcoin reserve

One of Trump’ more intriguing promises is to establish a “strategic Bitcoin reserve” for the U.S. His idea is to retain Bitcoin seized from criminal activities, rather than auctioning it off, to gradually build a substantial national Bitcoin reserve.

This proposal gained further traction when Senator Cynthia Lummis introduced a bill to create a “Bitcoin strategic reserve,” aiming to accumulate one million BTC over five years as a hedge against the national debt.

If realized, this reserve could signal a shift in the U.S. approach to crypto, positioning Bitcoin as a strategic asset on par with gold or foreign currency reserves.

Promise to fire SEC Chair Gary Gensler “on day one”

Trump has also set his sights on the U.S. Securities and Exchange Commission, pledging to fire its current chair, Gary Gensler, on his first day in office.

Appointed by President Joe Biden, Gensler has led an aggressive crackdown on the crypto industry, initiating over 100 enforcement actions against crypto companies for alleged securities violations since he

Gensler’ stance — that much of the crypto industry falls under SEC jurisdiction — has sparked frustration among industry players, who argue they need clearer guidelines, not constant lawsuits.

However, Trump’ promise may not be as straightforward to execute. While the president can appoint the SEC chair, dismissing one requires valid grounds, like neglect or inefficiency, due to the SEC’ independent status.

Legal experts caution that firing Gensler “on day one” could prompt a lengthy review and may not happen as swiftly as Trump suggests.

Still, if Trump does manage to appoint a new SEC chair, it could mark a shift toward more crypto-friendly policies — though how much freedom the new leadership would truly have remains uncertain.

A national push for Bitcoin mining

Another bold promise from Trump is his call to ensure that all remaining Bitcoin is mined within the U.S. He envisions Bitcoin mining as “Made in the USA,” aiming to establish America as a global hub for the industry.

This vision was echoed during a private Mar-a-Lago meeting with key figures in U.S. crypto mining, including executives from major companies like Riot Platforms, Marathon Digital, and Core Scientific.

Trump’ goal aligns with his broader agenda of “energy dominance” for the U.S., believing that Bitcoin mining could boost energy production and decrease reliance on foreign energy sources.

However, the path to this goal is challenging. Bitcoin mining is decentralized by nature, relying on thousands of miners across the globe. Centralizing it within one country would contradict the decentralized ethos on which Bitcoin was built.

Moreover, about 90% of Bitcoin’ total supply has already been mined, leaving only a small yet symbolically significant portion — around 10% — that Trump hopes to bring under U.S. control.

Stopping the central bank digital currency development

Trump has also pledged to block any progress toward a central bank digital currency in the U.S. He made his stance clear: “There will never be a CBDC while I’m president”, citing that CBDCs pose a potential threat to financial privacy.

Unlike decentralized cryptocurrencies like Bitcoin, a CBDC would be fully controlled by the government, potentially allowing for extensive surveillance of citizens’ transactions.

Trump’ position aligns with other Republican leaders, such as Ron DeSantis, who recently signed a bill in Florida to limit CBDC use within the state.

Opposition to CBDCs is also building in Congress. Representative Tom Emmer introduced the CBDC Anti-Surveillance State Act, aiming to prevent the Federal Reserve from issuing a CBDC without congressional approval.

The right to self-custody

Trump has also pledged to enshrine self-custody rights for crypto users into federal law, reinforcing the principle that “not your keys, not your coins” should be protected by the U.S. government.

Self-custody allows crypto holders to manage their private keys independently, ensuring they fully control their digital assets without relying on third parties like exchanges.

This promise aligns with recent legislative efforts by Republican Senator Ted Budd, who introduced the Keep Your Coins Act in 2023. The bill aims to safeguard Americans’ ability to transact with self-hosted crypto wallets, making it harder for regulators to impose restrictions on self-custody.

However, the proposal has sparked debate. Critics argue that self-custody could enable bad actors to evade anti-money laundering regulations, a concern highlighted by Senator Elizabeth Warren’ 2022 Digital Asset Anti-Money Laundering Act, which advocates for tighter controls.

While the crypto community largely views self-custody as an essential right, questions remain about how such laws might affect the balance between personal freedom and regulatory oversight.

A crypto-friendly advisory council

One of Trump’ more structural promises is to establish a dedicated “crypto advisory council” to guide his administration’s approach to crypto policy.

The goal of this council would be to create clear, industry-friendly regulations that support crypto growth rather than stifle it.

As Trump puts it, he wants “the rules to be written by people who love your industry, not hate it,” ensuring that crypto policies reflect a deep understanding of the industry’s needs and challenges.

Many industry insiders have voiced concerns that current regulations lack clarity, making it difficult for companies to operate within legal boundaries.

However, setting up such a council presents its own challenges, such as ensuring a diversity of perspectives and maintaining unbiased oversight.

Commuting Ross Ulbricht’s sentence

In a more controversial promise, Trump has vowed to commute the sentence of Ross Ulbricht, founder of the Silk Road marketplace.

Ulbricht, a first-time nonviolent offender, received a double life sentence plus 40 years without parole—a punishment many view as excessively harsh. Silk Road, the darknet marketplace he created, facilitated the trade of illegal goods, from drugs to weapons, with Bitcoin as the primary currency.

Ulbricht’ case has become a rallying point within the crypto and libertarian communities, where advocates argue that his sentence was disproportionate to the nature of his crime.

Critics, however, contend that his involvement in Silk Road fueled illegal activities and harmed individuals, making any consideration of leniency a sensitive issue.

What to expect from Trump’s crypto term

Recent tweets from crypto analysts reflect a mood of optimism as Trump’ presidency begins.

Michaël van de Poppe, a prominent crypto analyst, describes the current state of crypto as the end of the “longest and heaviest Altcoin bear market.”

He suggests we’re on the brink of a new “Dot.com bubble in Crypto,” hinting that this cycle could “go way higher than we all expect.”

If this outlook proves accurate, Trump’ pro-crypto stance could pave the way for a strong market rebound, benefiting from a more supportive regulatory environment.

Meanwhile, technical analyst Gert van Lagen forecasts that Bitcoin is on its “final ascent,” with a target of $250,000 by February next year.

#Bitcoin – The Final Ascent

The Bull awakens, strong and clear,

Two-fifty K expected this year!

From shadows past, it’s set to soar,

With fortune close, and fate in store.In August the 10-2Y yield spread’s turned its tide,

A warning sign we can’t abide.

For history… pic.twitter.com/4UGeBEl7rE— Gert van Lagen (@GertvanLagen) November 6, 2024

He points to the recent reversal of the 10-2 yield curve — a classic precursor to recessions — as a sign that economic conditions could fuel a BTC rally.

For now, the industry watches to see if Trump’s bold promises can translate into action. If he delivers, the U.S. could emerge as a leader in crypto adoption, creating jobs and establishing financial alternatives that could leave a lasting mark on the entire crypto space.

Source link

Bitcoin

Trump victory creates over 11k new Bitcoin millionaires

Published

2 weeks agoon

November 7, 2024By

admin

Donald Trump’s 2024 election victory has created over 11,000 new Bitcoin millionaires.

According to data from Finbold, the number of Bitcoin wallets valued at $1 million or more rose to 132,842 on November 6, as Bitcoin prices increased by 7.8% in just 24 hours.

Last month, there were 121,061 Bitcoin addresses worth over $1 million. This figure has now grown by 11,487 wallets, indicating significant wealth gains among Bitcoin holders, per Finbold.

Let’s be absolutely clear, the anti-Bitcoin movement died last night. The USA will be the most pro-Bitcoin nation in the world. We will have a Bitcoin Strategic Reserve. We will enshrine a national law to defend Bitcoin Rights. 🇺🇸

— Dennis Porter (@Dennis_Porter_) November 6, 2024

At the time of writing, Bitcoin (BTC) has passed its all-time high and is currently trading at $75, 428.

Can Bitcoin go higher?

This spike follows a strong month for Bitcoin, which has risen 20% over the past 30 days. With Trump’s win and an overwhelming lead in the electoral college, Bitcoin saw renewed interest and broke past previous high prices.

Analysts suggest that Trump’s pro-crypto stance might lead to a supportive regulatory shift, potentially boosting market conditions. Technical analyst Gert van Lagen predicts Bitcoin could reach $250,000 by early next year.

Source link

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential